Ianadmin

Clariant Innovation Center Cornerstone Laid at Industriepark Höchst for 500 New Research Jobs

The cornerstone of the new 100-million-euro Clariant Innovation Center was officially laid during a ceremony today at the Industriepark Höchst in Frankfurt. Attending the event were Hessen State Finance Minister Thomas Schäfer; Clariant Executive Committee member Christian Kohlpaintner; and Ulrich Ott, Managing Director of the company’s operations in Germany. Over the next several months, the Swiss specialty chemicals corporation will build an innovative office and laboratory facility of roughly 36,000 square meters (approximately 387,000 square feet) on a site that will soon provide jobs for some 500 researchers. The concept for the building, which aims to offer an optimal working environment through its open architectural design, was developed by the Düsseldorf-based architectural firm of HPP.

“Innovation is the foundation of the future, both for individual companies and society as a whole,” said Christian Kohlpaintner, whose responsibilities at Clariant include Research and Development. “I hope that the bright and transparent rooms will not only be the birthplace for new ideas that flourish and grow, but also provide the environment for an inspiring exchange between our researchers and technicians, as well as with their partners in the fields of science and industry,” added Dr. Kohlpaintner. He also emphasized Clariant’s targeted research policy: “We want to develop products and procedures that yield sustainable benefits and represent true progress.” He underscored that a major focus in the future will be on megatrends, such as functional materials, energy efficiency and renewable raw materials.

Quoting scientist and statesman Benjamin Franklin, Dr. Thomas Schäfer stated: “Investing in knowledge still pays the highest return.” He said that the construction of a research and innovation center would benefit all parties involved: the company, whose future is visibly taking shape; the industry park, which will strengthen its reputation as knowledge and ideas factory; and the region and State of Hessen, which will gain from the new jobs for highly qualified professionals.

“Investments of this kind and magnitude also demonstrate the courage, determination and willingness to shape the future,” said Dr. Schäfer.

Clariant’s global research activities will, in the future, be centered in Höchst, Germany. “We have selected Höchst as the location because it already provides a maximum of research and development resources, including technical schools and institutions of higher education,” explained Dr. Ulrich Ott. “In addition, Frankfurt offers a number of infrastructure advantages, such as an attractive industry park, the proximity to various business partners and universities, as well as excellent connections to the transportation network.”

The building design by the HPP architectural firm of Düsseldorf, Germany, is based on an open concept for an office and laboratory building. This approach is meant to enhance chemical research and development of application-specific laboratories and technical marketing functions for different business units. In addition to Analytics, the new facility will be the location of the New Business Development and Intellectual Property Management units as well as the Patent department. An objective of bringing together different disciplines is to enhance Clariant’s R&D pipeline and further improve the company’s innovation capabilities.

The cornerstone also symbolizes this. Right next to it is a sealed stainless steel tube containing various legal and other documents – building certificate, construction permit, construction drawings and a local newspaper – as well as a three-dimensional model of the DEPAL molecule that was also driven into the ground. DEPAL is the acronym for diethyl phosphinic acid aluminum salt – the chemical name of Clariant’s successful flame retardant, which is the basis for the company’s Exolit® OP products. The molecule will remain visible to the visiting public under a glass panel in the floor of the building.

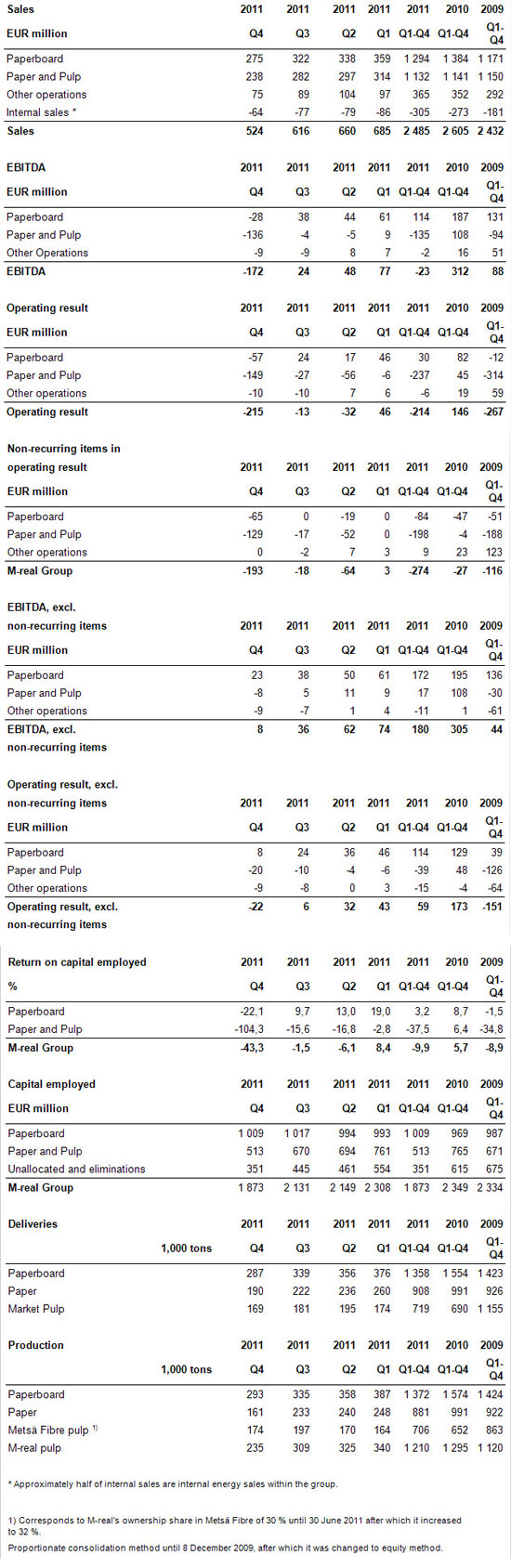

M-real Corporation Historical figures based on the new reporting structure

M-real Corporation, part of Metsä Group, announced on 19 January 2012 to renew its management and reporting structure to better reflect the company’s strategy and the focus on fresh forest fibre cartonboard. The company operates through two business areas that are also the company’s reporting segments from the first quarter of 2012 onwards:

- Paperboard

- Paper and Pulp

Paperboard business area includes the Kemi, Kyro, Simpele, Tako and Äänekoski board mills, Kyro wallpaper base machine and Joutseno BCTMP mill located in Finland as well as Gohrsmühle mill in Germany. Paper and Pulp business area includes Husum paper and pulp mill in Sweden, Alizay mill in France and Kaskinen BCTMP mill in Finland. As earlier announced M-real is planning to close the entire Alizay mill and the unprofitable operations at Gohrsmühle mill. The plans are expected to materialize in early 2012 that would improve the company’s profitability materially.

Accounting for the 32 percent ownership in Metsä Fibre (formerly Metsä-Botnia) will remain unchanged. The associated company result of Metsä Fibre will continue to be allocated to business segments based on their respective pulp consumption and is reported in EBITDA. Roughly two thirds of the result impact of Metsä Fibre ownership is expected to be included in the Paperboard business area and the rest in Paper and Pulp business area.

The historical figures based on the new business area structure are presented in the tables below. In addition to the above listed mills, the historical business area figures include also discontinued and divested operations.

M-REAL CORPORATION

MarquipWardUnited Showcasing Sheeters at Drupa 2012

Visit MarquipWardUnited at Drupa 2012, the international print and media fair May 3 – 16, 2012 in Düsseldorf, Germany.

MarquipWardUnited will demonstrate the TSKM Sheeter for “in-house” sheeting for paper and board with pioneering splicer technology and operator controls.

MarquipWardUnited will demonstrate the TSKM Sheeter for “in-house” sheeting for paper and board with pioneering splicer technology and operator controls.

MarquipWardUnited’s theme for Drupa 2012 is “We Innovate for Your Future.” Stop by to see how our sheeter solutions offer the most advanced technology and the broadest range in size, purpose and budget. You are invited to consult with MarquipWardUnited executives about new developments. Your feedback is valuable as it offers insight as to how MarquipWardUnited can support the industry even further. The company’s digital sheeting technology is one example of how MarquipWardUnited responded to industry needs. MarquipWardUnited currently has several machines designed specifically for digital sheeting, operating at speeds three times faster than conventional machines running the same sizes. Other digital related products are expected to launch in the near future.

Be one of the first to learn about MarquipWardUnited’s productivity, quality, performance and competitive advantage.

Drupa 2012 MarquipWardUnited highlights will include:

- The multi-capable TSKM sheeter with D2 splicer technology and advanced operator controls; demonstrations will be held at regular hours throughout the show.

- The opportunity for you to meet face-to-face with MarquipWardUnited leaders.

For further information on Drupa 2012 and MarquipWardUnited contact your local sales representative or email This email address is being protected from spambots. You need JavaScript enabled to view it..

Stora Enso successfully issues seven-year EUR 500 million Eurobond

Stora Enso has today issued a EUR 500 million seven-year bond under its EMTN (Euro Medium Term Note) programme. The new bond pays a fixed coupon of 5.5% and will mature in March 2019. The issue price was 99.824, equivalent to a yield of 5.531% and Euro Mid-swaps + 362.5 basis points. There are no financial covenants in the bond.

“We have a strong liquidity position and good access to various financing markets. We issued the bond and announced the tender offer for the Eurobond maturing in 2014 to take advantage of the good credit market conditions and extend our maturity profile,” says Jyrki Tammivuori, SVP, Group Treasurer.

Citigroup, Deutsche Bank, Goldman Sachs and SEB acted as Joint Bookrunners on the bond transaction and are acting as Dealer Managers on the tender offer. The new bond will be listed on the Luxembourg Stock Exchange. The proceeds of the offering will be used for general corporate purposes, including refinancing of the bond maturing in 2014.

Previous stock exchange release concerning Stora Enso’s seven-year Eurobond and tender offer for its Eurobond maturing in 2014 www.storaenso.com/press

- 29 February 2012: Stora Enso issues seven-year Eurobond and announces tender offer for its Eurobond maturing in 2014

Cascades Continues to Consolidate its Operations

Cascades Inc., a leader in the recovery and the manufacturing of green packaging and tissue paper products, continues to consolidate its operations and announces the permanent closure of Cascades Enviropac, located in Toronto.

Production at this unit, specialized in the manufacturing of Technicomb™ honeycomb packaging, intended primarily for the furniture packaging industry, will progressively be redirected towards the Cascades Enviropac Berthierville, Québec and the Grand Rapids, Michigan plants. Approximately 36 employees will be affected by this closure which will be effective on June 1, 2012.

"The decision to cease operations at the Toronto plant is due to a significant reduction in business volume. This decision was taken to secure the group's profitability and to improve its position as leader in the industrial packaging sector. Demand in the honeycomb packaging industry has been affected by challenging economic conditions over the past few years and it is imperative we adjust our operations based on this new economic environment. This initiative will enable us to maximize the operations at our mills of Grand Rapids and Berthierville, while continuing to offer a first-class product and service to our customers", stated Luc Langevin, President and Chief Operating Officer of Cascades Specialty Products Group.

Cascades has taken the necessary measures to help employees affected by this closure relocate to other manufacturing units and provide them with assistance in their search for work.

Domtar negotiates $3-billion, 15-year deal to supply paper to Appleton

Appleton and Domtar Corp. have reached a tentative agreement in which Domtar would supply Appleton with most of the uncoated base paper the company needs to produce its thermal, carbonless, and other specialty paper products. The historic 15-year supply deal is valued at more than $3 billion over the life of the agreement. Appleton is one of the world's leading specialty coaters, and while Domtar is the largest integrated manufacturer of uncoated paper in North America.

Integrated is the key word here.

Explaining the deal, Mark Richards, Appleton's chairman, president and chief executive officer, said that non-integrated paper mills, those not capable of producing pulp from logs or wood chips, are distinctly disadvantaged and no longer competitive. Worldwide demand for pulp has driven its market price to historic highs.

“Because we buy pulp on the open market, it costs Appleton considerably more to make base paper than it costs a producer like Domtar, which can supply its own pulp. Our proposed operational changes, as difficult as they may be for many of our employees in West Carrollton, are needed for our company to remain competitive," Richards said.

The proposed supply agreement would result in a reduction of approximately 330 jobs at the West Carrollton mill. Assuming the plan is finalized, approximately 100 employees would be retained to continue to operate the thermal paper coating facility. Employment and operations at Appleton's integrated pulp and paper mill in Roaring Spring, Pa., would be unaffected by the agreement.

The agreement is pending discussions with representatives of West Carrollton's Local 266 of the United Steelworkers.

The proposed supply agreement would reduce the company's exposure to unpredictable market costs for pulp and waste paper.

Domtar would gain significant and predictable volume for its base paper business driven by demand in Appleton's growing global thermal paper business.

John D. Williams, Domtar's president and chief executive officer, stated, “This proposed agreement provides us with an opportunity to repurpose and replace high volume communication paper capacity to specialty paper grades, while securing a growing business long-term."

Rayonier to Present at Raymond James 33rd Annual Institutional Investors Conference

Rayonier has announced that Paul Boynton, president and CEO, will present at the Raymond James 33rd Annual Institutional Investors Conference in Orlando on Wednesday, March 7, 2012, at 8:05 a.m. EST.

A live audio webcast of the presentation will be accessible at Rayonier’s website by clicking on http://www.rayonier.com and following the directions. Listeners should go to the link at least 15 minutes prior to the start of the presentation to download and install any necessary audio software.

A replay will be available on Rayonier’s website within 24 hours after the webcast.

Source: Rayonier

BASF increases prices for polymer dispersions and powders

Effective March 1, 2012, or as contracts allow, BASF will increase prices in Europe, Africa and Western Asia for polymer dispersions by 80 Euro per metric ton and redispersible powders by 140 Euro per metric ton. The price increase is necessary due to the significant rise in the cost of raw materials.

The products affected by the price increase are used as polymers for adhesives, fiberbonding , architectural coatings and construction chemicals.

About BASF

BASF is the world’s leading chemical company: The Chemical Company. Its portfolio ranges from chemicals, plastics, performance products and crop protection products to oil and gas. We combine economic success, social responsibility and environmental protection. Through science and innovation we enable our customers in almost all industries to meet the current and future needs of society. Our products and system solutions contribute to conserving resources, ensuring healthy food and nutrition and helping to improve the quality of life. We have summed up this contribution in our corporate purpose: We create chemistry for a sustainable future. BASF posted sales of about €73.5 billion in 2011 and had more than 111,000 employees as of the end of the year. BASF shares are traded on the stock exchanges in Frankfurt (BAS), London (BFA) and Zurich (AN). Further information on BASF is available on the Internet at www.basf.com .

Global sawlog prices fell in late 2011, especially in lumber export-oriented

Global sawlog prices fell in late 2011, especially in lumber export-oriented countries such as Western Canada, Finland, Sweden, Russia and New Zealand, reports the Wood Resource Quarterly

Weakening lumber markets in Asia and Europe reduced demand for sawlogs in many countries late last year. As a result, log prices in a number of the major lumber-producing countries in the world fell during the second half of 2011, according to the market report the Wood Resource Quarterly.

The full article can be found in the attached PDF file below.....

Over 325 delegates ALREADY registered for the Tissue World Conference. Join them now!

The Tissue World Americas conference meeting sessions on March 20-23 will likely be the largest ever held in Miami. In the past 3 weeks close to 200 new participants have registered, bringing the total to more than 325 tissue professionals already. And many more are planning to join.

The attraction is a great program of speakers covering a very timely combination of critical tissue topics:

- Sustainability and Environmental Challenges of Today and Tomorrow

- Dynamic Market Expansions, and Quality Upgrades, in both North and South America

- Fiber Supply Trends, Flows and Scenarios

- New Technology Giving Higher Quality and Efficiency on a Sustainable Footprint

- Yankee Dryer Operations aimed at optimum Reliability, Efficiency, and Sustainability

- . . . and Much More covering all aspects of the tissue business

There is something for everyone in Miami Beach at Tissue World Americas. You can simply attend one day, or several, or all four, depending on your areas of interest. To join the hundreds already registered, you can sign up now by clicking here.

Click here to see the list of conference participants ALREADY REGISTERED.

To learn more about the complete program of speakers, please read below.

Conference Theme:

Boosting Performance for Better Quality, Sustainability and Profitability

Main conference sessions – Wednesday to Friday

--------------------------------------------------------------------------------------------------------------------------------------------------

Wednesday March 21, 2012 (full day)

Session 1: Sustainability in the Tissue Business

Steps Toward the Sustainable Value Chain for Tomorrow

Suhas Apte, Global Vice President of Sustainability, Kimberly-Clark Corporation, USA

The historical sustainability focus of manufacturing companies, optimizing operational footprints and minimizing environmental impacts, is evolving to one of ensuring sustainability across their entire supply chain (from raw materials to shelf). Going forward, our scope needs to be expanded to consider our business’s value chain in a way that we become part of the solutions addressing the greater global challenges affecting us and our stakeholders. This will need to be demonstrated under the heightened transparency expected by our consumers and customers. We should expect that these trends will only be exacerbated in the World of 2050, inhabited by 9 billion consumers, where sustainable production and consumption is no longer nice to have but rather a requirement. This paper will outline steps companies can undertake to proactively address existing and emerging sustainability related global value chain challenges and opportunities.

Greenpeace: No Reason to be Afraid, Necessarily

Rolf Skar, Sr. Forest Campaigner, Greenpeace, USA

Indonesia's rainforests and carbon-rich peatlands are being destroyed to make disposable consumer products, including paper for glossy magazines, toilet paper and packaging. Greenpeace -- along with a growing list of NGOs -- is campaigning to find solutions to deforestation in Indonesia. We invite the tissue industry to join this effort, if not for the environmental and social values, for the sake of the bottom line. As consumers increasingly demonstrate an interest in sustainability, companies ignoring rainforest destruction in their supply chain do so at their own risk.

Making Sense of Environmental Certifications Programs

Suzanne Blanchet, President and CEO, Cascades Tissue, Canada

Abstract – To be announced

Where Environmental Groups and Big Brands Combine Forces

Corey Brinkema, President, Forest Stewardship Council (FSC), USA

The Forest Stewardship Council (FSC), the certification system that uniquely brings together companies and environmental scientists and activists, is in the midst of a remarkable marketplace expansion in North America. Having already attained a 5% share of the forest products market, both FSC demand and supply have exploded in the past 18 months. The tissue sector suddenly became more attuned to certification opportunities with the market leadership of Kimberly-Clark, and Clearwater Paper recently made FSC a reality for the retail grocery private label tissue. Where does it go from here? How much does the US consumer care? Where are the future sources of FSC certified fiber in the Americas? This paper will address these questions and share insights of recent US consumer research on responsible sourcing and purchasing of forest products.

Environmental Leadership in the Tissue Paper Sector – Beyond Forest Certification

Susan Rutherford, Sustainability Analyst, Ecologo, Canada

While public debate about the environmental impacts of paper production are focusing on the role of forestry certification, producing paper in a more sustainable manner requires attention to environmental and other impacts at all life cycle stages of the product; from land and resource management, to emissions associated with manufacture to end of life recyclability. This presentation will review the major life cycle impacts of the paper production sector, particularly in the manufacturing stage and identify some leadership practices resulting in environmentally preferable paper products. Practices covered will include design, sourcing recycled content, air, water and waste management practices and energy production and management both for on site production and purchased energy.

How Customers Can Leverage Your Sustainability

Don Lewis, President, SCA North America, USA

Building a strong sustainable profile has become a requirement for companies in today’s world. However, when customers leverage your reputation to build their own, you’ve become a value-added business partner and much more than a supplier. Don Lewis, president of SCA’s Americas operations, will discuss how SCA is adding value to customers through the company’s sustainability actions and programs. SCA is a global hygiene products and paper company with sustainability recognition that has placed it as one of the world’s most ethical companies by Ethisphere, on the Carbon Disclosure Leadership Index, FTSE4Good Index and the Dow Jones Sustainability Europe Index. With sales in 100 countries, SCA operates across North and Latin America with hygiene products such as tissue, incontinence and feminine care products and baby diapers. Sales for SCA in 2011 were $16 billion

Session 2: Market Developments and Fiber Supply

Market Developments and Trends in North and South America

Esko Uutela, Principal - Tissue, RISI, Germany

The North American tissue market is experiencing a new investment boom. The main driver seems to be the need for ultra and premium grade tissue, partly reflecting major retailers' target to upgrade their private label offerings closer to the main brands in quality, with a clear trend toward higher quality in the AfH sector as well. Market growth has flattened, particularly in terms of weight as the product light-weighting trend continues. Competition does not show any signs of lessening, and it is amazing to see how a growing number of small, independent converters have been able to forge ahead based on niche products, flexible service and sub-contracting orders from big players. Environmental certification and sustainability issues are also becoming increasingly important topics in the North American tissue business. In South America, tissue markets are in a very interesting expansion phase throughout the whole continent. The main focus is currently on Brazil, with the largest population and now also the highest tissue consumption in the region. In Brazil, the recent strong growth is benefitting from the increasing purchasing power in the inland and northeast regions. On the supply side, CMPC Tissue's recent aggressive expansion strategy has tightened competition further in Latin America, including the two largest markets Brazil and Mexico.

Fiber Supply – Where will Fiber for Tissue Making Come From?

Soile Kilpe, Director Global Consulting, Pöyry, USA

The tissue industry is the second largest consumer of market pulp, after printing and writing paper. Market bleached hardwood and softwood kraft pulp usage is clearly increasing in the at-home (consumer) tissue segment, driven by the new investments in Asia and Latin America. About 40% of all market pulp is bought by the top 5 tissue producers today, but with the steady investment activity in the low per capita regions, and increasing number of new entrants, this share will change as fragmentation rises. Integration with pulp production at tissue mills varies by region and certain at-home tissue suppliers have transitioned to using market pulp by closing down or selling their pulp assets. Moreover, captive pulp for tissue making has declined in North America, but with the fiber poor regions like Asia growing, there will be a comeback of this kind of a concept for securing fiber supply. Reduced availability and higher price of recycled fiber is expected to benefit market pulp suppliers in the future. However, the cyclical nature of the market pulp business will continue to be a challenge for tissue producers, as they have high sensitivity to raw material input cost swings. This presentation will explore key questions related to tissue product quality development, the impact of technology/recycled fiber, sustainability drivers and the potential

need for new pulp products for the ultra-quality category.

Session 3: Papermaking Developments

The Chattermark Project to Reduce Operational costs at ICT Iberica, ICT and BTG

World's First Tissue Machine with a Compact Wet End with Active Degassing, Aikawa Fiber Technology and LC Paper

Development Trends in Pressing for Tissue, Metso

Seamless Tissue Plant Concept Plus: Entry level Technology for Private Labels, Comer

New Pressing Technology for Higher Bulk and Dryness on Conventional Machines, Voith

Yankee Dryer System: Critical Asset Protection, Monitoring and Control, Nalco

New TAD Simulator provides Tissue Makers a Competitive Edge, Ashland

Towel Wet End Optimization: Utilizing Strength Additives and Functional Promoters, Kemira

--------------------------------------------------------------------------------------------------------------------------------------------------

Thursday March 22, 2012 (full day)

Session 4: Energy Reduction and Savings

Forecasting and Validation of Fossil Fuel and Steam Savings from Tissue Machine Heat Recovery, Thermal Energy and Kruger Products

Steam Energy Reduction in Tissue Drying Process, Andritz

Significant Energy Savings with Variable Speed Blowers in Tissue Paper Production, Runtech Systems

Making 100% High Pressure Steam with a new Post Combustor on Hood exhaust, Novimpianti

Biogas for the Yankee Hood, AMEC

Session 5: Converting, Packaging, Wrapping and Logistics

Colored Laminating Glues for Design Embossing, Kapp-Chemie

TCO: Total Cost of Ownership Analysis Spells Informed Investment, Futura

6 Different Products are just One Click Away, Gambini

Integrate to Innovate, The Next Steps in Packaging Efficiency, TMC

Compact Packaging of Tissue Paper, Optima

Overall Equipment Effectiveness: How Next Generation Automation Gives Real Improvements, Schneider Equipment

Conveying Lines: Optimizing Energy, Maintenance, Product Quality and Safety, Pulsar

New Concepts in Robotic Palletizing: Product Handling Methods, Multiple SKU Management and Flexibility, E80

New Robotic Bundler Combines Packaging and Palletizing Technology, W+D Langhammer

Reducing Costs and Improving Operations with Automatic Guided Vehicles, JBT Corp.

--------------------------------------------------------------------------------------------------------------------------------------------------

Friday March 23, 2012 (half day)

Session 6: Stock Prep

New Insights into the Application of High-yield Pulp in Tissue and Towel, Tembec/FP/Kruger

First Mill Experience with a new High Efficiency Compact Refiner, Metso

Compression Refining, Flexible Fibres and low Fines Content, Wageningen UR

Session 7: Auxiliary Topics in Tissue Making

Carbon Fiber Composite Materials for Tissue Rewinding Reel Spools, Double E

Improve Operator Safety and Reduce Downtime with Automatic Web Marking on a Tissue Line, Ryeco

Studies Reveal Unnecessary Fiber, Energy and Water Losses, Tecumseth Filtration

Guarding Operations - Engineering Safety for Tissue Converting Lines, SEACON

Recognized Standard Locations for Dust Concentration Testing, Brunnschweiler

Maintaining Optimum Performance of Tissue Machine Clothing, Dubois Chemicals