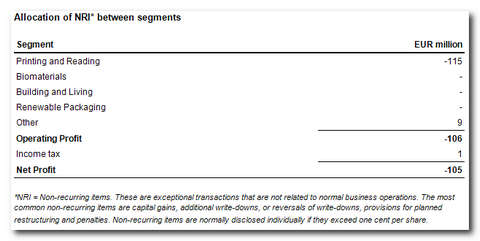

Stora Enso will record non-recurring items (NRI) with a negative net impact of approximately EUR 106 million on operating profit and a positive impact of approximately EUR 1 million on income tax in its second quarter 2014 results. The NRI will decrease earnings per share by EUR 0.13.

Stora Enso will record non-recurring items (NRI) with a negative net impact of approximately EUR 106 million on operating profit and a positive impact of approximately EUR 1 million on income tax in its second quarter 2014 results. The NRI will decrease earnings per share by EUR 0.13.

Corbehem Mill planned closure

The main item is a negative NRI in Printing and Reading of approximately EUR 81 million due to the planned permanent closure of the loss-making Corbehem Mill in France, including approximately EUR 7 million of non-cash write-down. The cost of the planned closure is based on the French legal requirements.

Since October 2012, Stora Enso has been actively searching for a solid new owner for Corbehem Mill offering a sustainable and long-term solution for the site and its employees. Despite significant efforts involving M&A and legal advisors and a dedicated project team, this search proved unsuccessful. The total operational EBITDA of the unit since the beginning of the process was a negative EUR 34 million.

The mill has been at standstill since January 2014. The employee representatives’ information and consultation process at the mill has now been completed. The social plan negotiated and concluded with the trade unions was validated by the French labour authorities on 10 June 2014. Under this social plan, Stora Enso will offer support to Corbehem Mill employees to alleviate the consequences of the redundancies related to the closure of the mill.

Other non-recurring items

- a negative NRI in Printing and Reading of approximately EUR 34 million due to fixed asset impairments and inventory write-downs related to the ongoing disposal of Uetersen Mill in Germany. The transaction will be delayed from the original target of mid-July due the regulatory approval process.

- a negative NRI in the segment Other of approximately EUR 9 million due to termination of an agreement in logistics operations.

- a positive NRI in the segment Other of approximately EUR 18 million due to land swap arrangements in the Group’s equity accounted investment Bergvik Skog.