Displaying items by tag: AkzoNobel

AkzoNobel tops global sustainability ranking

AkzoNobel has cemented its position as a global sustainability leader after being ranked in first place in the Chemicals supersector on the prestigious Dow Jones Sustainability World Indexes (DJSI)

Published today, the latest listing reveals that AkzoNobel achieved a total score of 93, improving on last year’s second place. The company has been ranked in the top three since 2007 (when AkzoNobel last topped the list).

"Our first place ranking and our consistent performance over the last years are clear evidence of how sustainability has been successfully integrated into our global operations," said Andre Veneman, Sustainability Director, who also acknowledged the contribution made by the company's employees around the world. "For us, business is sustainability and sustainability is business."

Regarded as one of the world's foremost sustainability indices, the DJSI World Index benchmarks the sustainability performance of leading companies based on environmental, social and economic performance, including forward-looking indicators.

AkzoNobel signs agreement to sell its shares in ICI Pakistan

AkzoNobel has reached an agreement to sell its 75.81 percent shareholding in ICI Pakistan Limited to the Yunus Brothers Group for $152.5 million (€124.4 million). The price represents a premium of 30 percent on the market price when the local stock exchange closed on Friday, July 27. The price is subject to adjustments for cash/debt as at the date competition clearance is obtained and for interest from that date until closing.

The transaction is expected to be completed towards the end of this year, once regulatory approvals have been obtained and the purchaser has completed a legally required tender offer for at least 50 percent of the shares in ICI Pakistan held by the other shareholders.

"We are pleased to have reached an agreement to sell our shares in ICI Pakistan," explained Keith Nichols, CFO AkzoNobel. "We are convinced that the Yunus Brothers Group is better suited to achieving its obvious potential, while the deal includes conditions to safeguard the terms and conditions of our dedicated employees there."

Commenting on the agreement, Sohail Tabba, Group Director at Yunus Brothers Group, said: "We are delighted with the agreement to acquire ICI Pakistan Limited. The Yunus Brothers Group is keen to further develop the business of the company, working closely with the existing management and employees."

The agreement follows the successfully completed restructuring of AkzoNobel's activities in Pakistan last month, which entailed the demerger of ICI Pakistan's paints and coatings businesses into the new listed company, AkzoNobel Pakistan Limited. The newly formed company is 75.81 percent owned by AkzoNobel and continues to focus on Decorative Paints, Performance Coatings and Specialty Chemicals.

ICI Pakistan Limited has been a subsidiary of AkzoNobel since 2008, when the company acquired Imperial Chemical Industries PLC. It is listed on the Karachi, Lahore and Islamabad Stock Exchanges. ICI Pakistan's business now comprises polyester fiber, soda ash, life sciences and chemicals.

The Yunus Brothers Group is a leading conglomerate in Pakistan with interest in the cement and textile industries, power and real estate. It had revenues of €775 million in 2011.

Alfa Laval wins a SEK 60 million unique energy efficiency order from AkzoNobel

Alfa Laval – a world leader in heat transfer, centrifugal separation and fluid handling – has won an order to supply a unique evaporation system to an AkzoNobel chemical plant in Germany. The order is worth approximately SEK 60 million and delivery is scheduled for 2013.

The Alfa Laval evaporation system which will concentrate caustic soda based on evaporation and condensation heat exchangers, will be installed in a plant in Germany. By combining the advantages of different types of heat exchangers it is, for the first time, feasible to concentrate caustic soda in a 4-effect evaporation system. The unique Alfa Laval design will enable energy savings of 25 percent compared to the best traditional designs

“One of our strengths is our wide range of heat exchangers and application knowledge covering different needs from various industries”, says Lars Renström, President and CEO of the Alfa Laval Group. “This time we have used our expertise to create a unique system that enables large energy savings. This order is a good example of our ability to optimize our customers’ processes.”

Did you know that… caustic soda needs to be concentrated from 32 to 50 percent – and then it is used as a chemical base in the manufacture of pulp and paper, textiles, drinking water, soaps and detergents?

AkzoNobel completes demerger of Pakistan activities

AkzoNobel has completed the restructuring of its activities in Pakistan by formally establishing AkzoNobel Pakistan Limited as a separate legal entity from ICI Pakistan. As previously announced, the split means that the company has started the formal sale process to divest its 75.81% shareholding in ICI Pakistan.

The new AkzoNobel Pakistan Limited business is focused on three core areas – Decorative Paints, Performance Coatings and Specialty Chemicals. An appropriate management and organizational structure is currently being finalized, with Jehanzeb Khan having been appointed as its CEO.

"Pakistan offers clear opportunities for the future and we are committed to realizing our growth ambitions through these more strategically focused activities," explained Leif Darner, AkzoNobel’s Executive Committee member responsible for the Middle East. "ICI Pakistan remains an attractive proposition with a number of strong businesses and we are confident that we will find a new owner better suited to achieving their obvious potential."

The coatings activities of ICI Pakistan were transferred to the newly-formed AkzoNobel Pakistan Limited through a legal process of demerger. ICI Pakistan’s business now comprises polyester fiber, soda ash, life sciences and chemicals.

AkzoNobel appoints Ton Büchner as new CEO

At the Annual General Meeting (AGM), shareholders of Akzo Nobel N.V. (AkzoNobel) approved the company’s 2011 financial statements and agreed that the 2011 financial year dividend would be €1.45 (2010: €1.40) per common share. An interim dividend of €0.33 was paid in November 2011, which means the final payment will be €1.12 per share.

The final dividend will be paid on May 24, 2012. Under the conditions to be published by the company and at the shareholder’s election, this dividend will be paid either in cash or in stock. The AkzoNobel shares will be traded ex-dividend on Euronext Amsterdam as of April 25, 2012. The record date is April 27, 2012.

Board of Management appointment and reappointments

Ton Büchner was appointed as member of the Board of Management by the shareholders and was duly appointed as CEO by the Supervisory Board. At the same time, Hans Wijers stepped down from his position as CEO and member of the Board of Management. The AGM thanked Mr. Wijers for his long and successful tenure at AkzoNobel, transforming the former conglomerate into the world’s largest coatings and specialty chemicals company.

Keith Nichols was reappointed to the Board of Management for another four-year term, and Leif Darner – who will reach the regular retirement age for Board of Management members in 2014 – was reappointed for a two-year term.

Rob Frohn stepped down from the Board of Management effective May 1, 2012. The AGM thanked Mr. Frohn for his extensive and successful 28-year career with AkzoNobel.

Supervisory Board appointments and reappointments

Dolf van den Brink and Peter Ellwood were reappointed to the Supervisory Board for further four-year terms. In addition, Sari Baldauf and Ben Verwaayen were appointed to the Supervisory Board for four-year terms.

Having reached the maximum 12-year tenure as member of the Supervisory Board, Virginia Bottomley stepped down. The AGM thanked Baroness Bottomley for her contributions to the company.

Amendments to the Articles of Association

The proposal to amend the Articles of Association to align them with changes in Dutch legislation was approved.

Further information about the amendments is available here.

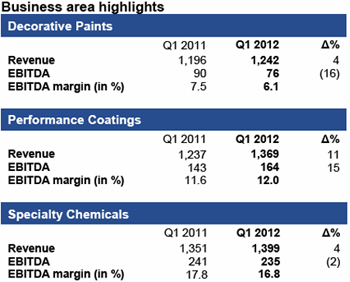

AkzoNobel publishes Q1 results

- Revenue up 6 percent to €3.97 billion, mainly driven by pricing actions

- EBITDA 3 percent lower at €423 million (2011: €437 million), as weaker end markets and cost inflation impacted results

- Net income from continuing operations €70 million (2011: €132 million), due to higher incidental charges

- Cash from operating activities was impacted by a one-time pension payment and seasonal build-up of operating working capital

- Adjusted EPS €0.63 (2011: €0.72)

- Performance improvement program on track

- Economic environment and certain raw materials remain principal sensitivities in 2012

Overall raw material prices remain a challenge. Looking forward, the company expects the higher oil and TiO2 prices on average to have an inflationary impact.

Cash from operating activities was impacted by a one-time pension payment and the seasonal build-up of operating working capital.

Decorative Paints achieved a revenue increase of 4 percent in the first quarter, primarily driven by margin management in weak markets. Lower volumes impacted EBITDA, particularly in North America which  benefited last year from a one-time positive customer load-in. Restructuring and cost reduction actions are underway in Europe and North America to offset weaker demand.

benefited last year from a one-time positive customer load-in. Restructuring and cost reduction actions are underway in Europe and North America to offset weaker demand.

In Performance Coatings, revenue increased 11 percent and EBITDA was up 15 percent compared with the previous year. Industrial Coatings – boosted by acquisition activity – achieved the strongest growth, followed by Marine and Protective Coatings. Although overall activity levels were flat, there was significant variability between individual segments.

Specialty Chemicals revenue was up 4 percent, mainly due to the Boxing Oleochemicals acquisition and a positive price/mix effect. EBITDA was 2 percent lower, reflecting different trading conditions in certain businesses.

CEO Hans Wijers

"We are continuing to focus on performance improvement. Our global margin management efforts are also proving successful as we continue to mitigate the adverse effects of higher raw material costs. However, our volumes were down slightly, reflecting the volatile nature of the economic conditions. Despite these challenges, we have solid fundamentals, renowned brands and a strong geographic spread. Furthermore, the ongoing performance improvement program shows that we are taking the right steps towards achieving our medium-term ambitions."

The 2012 Q1 report can be downloaded via the AkzoNobel Report iPad app or via the Quarterly Results page.

AkzoNobel invests €80 million to supply new Suzano pulp mill in Brazil

AkzoNobel is planning to invest €80 million in the construction of a new pulp Chemical Island facility in Brazil. The plant, operated by the company's Pulp and Paper Chemicals business, Eka Chemicals, will supply the Suzano Maranhão pulp mill. This is AkzoNobel's second largest investment in Brazil in the past 12 months and further expands Eka Chemicals' sustainability-focused Chemical Island concept.

"This 15-year agreement emphasizes the importance of high growth markets for AkzoNobel and will help drive the company's medium-term strategy of doubling revenue in Brazil to €1.5 billion," said Rob Frohn, AkzoNobel Executive Committee member responsible for Specialty Chemicals.

The investment will involve supplying, storing and handling all chemicals for the 1.5 million ton per year pulp mill, which is being constructed in Imperatriz, Maranhão, Brazil. The mill is expected to come on stream in the last quarter of 2013.

"We are very proud to have been awarded this project; it underlines the value our Chemical Island concept brings to our customers," said Pulp and Paper Chemicals General Manager Ruud Joosten. "The future demand for pulp and paper in Latin America and China is forecast to increase substantially over the next decade and these investments ensure that we are part of that growth."

Commenting on the agreement, Ernesto Pousada, COO at Suzano Papel e Celulose, said: "Eka Chemicals is a long and reliable partner to Suzano Papel e Celulose. Via this deal, we are ensuring our plant will use the latest and most sustainable chemicals available – something which has been key for us."

The new facility will expand AkzoNobel's well-established pulp and paper activities in Brazil. The business already successfully runs Chemical Islands, as well as other production units, on several customer sites. It also operates bleaching and paper chemical plants in Jacareí, Rio de Janeiro, Três Lagoas and Jundiaí.

AkzoNobel to take 100 percent control of Metlac Group

AkzoNobel plans to strengthen its position in packaging coatings by exercising the right to buy the remaining shares of Metlac, an Italian based packaging coatings producer. Financial details were not disclosed.

AkzoNobel currently is a shareholder in the Packaging Coatings Metlac Group. This position was inherited from the acquisition of ICI in 2008. The deal underlines the company’s strong commitment to supporting the coatings and inks market for metal packaging by securing the future of a well recognized supplier.

The combination of the two companies will bring value to its customers by leveraging the AkzoNobel global footprint and the product range of Metlac.

"This acquisition will reinforce our customer offering and links perfectly with the strategy to strengthen our positions in core markets", said Leif Darner, Executive Committee member responsible for Performance Coatings.

The completion of the transaction is subject to antitrust approval. The company expects to finalize the acquisition in Q2 2012.

AkzoNobel announces new bond

AkzoNobel announces new bond and launches tender offer to improve the company’s debt maturity profile

AkzoNobel announced today that the company intends to issue a €800m euro bond with a seven year maturity, at a coupon of 4%. The announcement of the bond was well received by the market with an order book exceeding €3 billion.

AkzoNobel has simultaneously announced a tender offer to re-purchase an estimated €600 million of its previously issued bonds, specifically bonds set to mature in January 2014 (7.75 percent, €1 billion) and March 2015 (7.25 percent, €975 million).

The new bond issue and purchase of existing bonds will improve the overall debt profile of AkzoNobel, further reducing future refinancing risk and improving its maturity profile.

The buyback of company bonds will result in an accounting loss, which will be determined at the end of the tender process. However, this loss will be off-set by the significantly reduced coupon on the new seven year bond.

The new bonds will be issued by Akzo Nobel NV and will be listed on the Luxembourg Stock Exchange. Settlement is scheduled for December 15, 2011, and the bonds will mature on December 17, 2018.

AkzoNobel is committed to maintaining a strong investment grade rating. Currently the company has a BBB+ rating with Standard & Poor’s and a Baa1 rating with Moody’s.

For more details on the tender offer, please refer to the announcement relating to the tender offer published by Akzo Nobel N.V. and Akzo Nobel Sweden Finance AB (publ) on the website of the Luxembourg Stock Exchange dated December 8, 2011.

Further details of the outcome of the tender offer will be announced when completed.

AkzoNobel secures €1.8 billion syndicated revolving credit facility

Akzo Nobel NV (AkzoNobel) signed a new, €1.8 billion five year multi-currency syndicated revolving credit facility to refinance its existing €1.5 billion facility.

The transaction – which has two, one-year extension options – was very well supported by the company's relationship banks during syndication, causing the facility to close oversubscribed.

The facility underpins the company's strong credit and liquidity profile, and is intended for general corporate purposes. AkzoNobel is rated Baa1 by Moody's and BBB+ by Standard & Poor's.