Displaying items by tag: Ashland Inc

Ashland Inc. and Clariant complete sale of ASK Chemicals joint venture to Rhône

Ashland Inc. (NYSE: ASH) and Clariant has announced they have completed the previously announced sale of their joint venture, ASK Chemicals GmbH headquartered in Hilden, Germany, to investment funds affiliated with Rhône, a London and New York-based private equity investment firm. The enterprise value of the transaction, before debt and assumed liabilities, amounts to €257 million. After adjusting for debt and assumed liabilities, total pre-tax proceeds to the sellers were €149 million, which includes €128 million in cash and a €21 million buyer note. Proceeds will be split evenly between Ashland and Clariant under terms of the 50/50 joint venture.

Ashland Inc. (NYSE: ASH) and Clariant has announced they have completed the previously announced sale of their joint venture, ASK Chemicals GmbH headquartered in Hilden, Germany, to investment funds affiliated with Rhône, a London and New York-based private equity investment firm. The enterprise value of the transaction, before debt and assumed liabilities, amounts to €257 million. After adjusting for debt and assumed liabilities, total pre-tax proceeds to the sellers were €149 million, which includes €128 million in cash and a €21 million buyer note. Proceeds will be split evenly between Ashland and Clariant under terms of the 50/50 joint venture.

With 1,800 employees in 25 countries, ASK Chemicals is a leading foundry chemicals manufacturer. Its portfolio encompasses an exceptionally broad and innovative range of foundry resources such as binders, coatings, feeders, filters and release agents, as well as metallurgical products including inoculants, inoculation wires and master alloys for iron casting. In 2013, ASK Chemicals generated annual revenues of €513 million.

Ashland Inc. announces CFO succession plan

Ashland Inc. (NYSE: ASH) has announced that Lamar M. Chambers, senior vice president and chief financial officer, will retire in July after 37 years of service to the company. The board of directors has elected J. Kevin Willis to succeed Chambers as senior vice president and chief financial officer, effective May 3, 2013.

Chambers has served as senior vice president and CFO since 2008. Prior to that, he spent four years as vice president and controller. He joined Ashland in 1976 as a staff auditor and later held a series of finance and operations leadership positions, both at the corporate and subsidiary levels, during his more than three decades of service to Ashland. In 2012, Chambers was named CFO of the Year by Chemical Week, a leading industry trade magazine.

Until his retirement on July 1, 2013, Chambers will remain on the management team as senior vice president and will continue to serve on Ashland's Executive Committee to help ensure a smooth transition.

"Lamar has played a pivotal role in Ashland's growth and transformation over the past decade," said James J. O'Brien, Ashland chairman and chief executive officer. "Under his leadership, Ashland's finance organization has established a reputation for performance, accountability and transparency during an incredibly busy period of acquisitions and divestitures. Lamar and I began our careers with Ashland just a few months apart, and through the years he has been a good friend and trusted partner, embodying the best of what Ashland stands for. We are grateful for his many significant contributions and wish Lamar and his family much happiness in the years ahead."

In his new role, Willis, 47, will be responsible for all worldwide financial functions and processes, including financial accounting and reporting, treasury and finance, insurance, business development, planning and analysis, investor relations, tax and internal audit activities. He also will serve as a member of Ashland's Executive Committee.

Since Ashland's acquisition of International Specialty Products (ISP) in August 2011, Willis has served as Ashland's vice president of finance, and controller for Ashland Specialty Ingredients, Ashland's largest and fastest-growing commercial unit. In that role, he has been responsible for the day-to-day management of the financial organization and processes within Specialty Ingredients. He also has served on the leadership team.

A native of Richmond, Ky., Willis joined Ashland in 1987 as an associate auditor. He served in various management positions of increasing responsibility, including leading teams on major projects in the business services, information technology, accounting and finance areas. Among the positions he previously held were treasurer and general auditor at Ashland. Earlier in his career, Willis spent nearly three years in The Netherlands helping lead Ashland's effort to standardize processes and implement accounting and other administrative shared services across European operations. He earned a bachelor's degree in accounting and an executive MBA from the Kellogg School of Management at Northwestern University.

"Kevin has played a critical role in the successful integration of ISP and the ongoing growth of Specialty Ingredients," O'Brien said. "Throughout his career, Kevin has displayed the leadership, critical thinking and vision that have been so vital to Ashland's transformation into a global specialty chemical company. We look forward to his contributions leading our worldwide finance team as we position Ashland for continued growth."

Ashland Inc. reports preliminary financial results for first quarter of fiscal 2013.

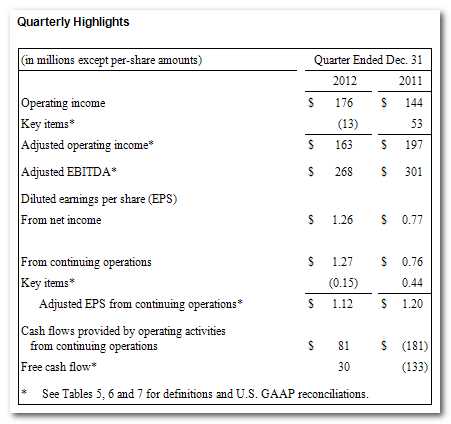

Ashland Inc. (NYSE: ASH), a global leader in specialty chemical solutions for consumer and industrial markets, today announced preliminary(1) financial results for the quarter ended December 31, 2012, the first quarter of its 2013 fiscal year.

Ashland reported income from continuing operations of $102 million, or $1.27 per diluted share, on sales of $1.9 billion. These results included three key items that together had a net favorable impact on continuing operations of $12 million, net of tax, or 15 cents per diluted share. The largest key item was a $13 million after-tax benefit related to a business interruption insurance settlement. Excluding the three key items, Ashland's adjusted income from continuing operations was $90 million, or $1.12 per diluted share, a decrease of 7 percent from the year-ago quarter.

Ashland reported income from continuing operations of $102 million, or $1.27 per diluted share, on sales of $1.9 billion. These results included three key items that together had a net favorable impact on continuing operations of $12 million, net of tax, or 15 cents per diluted share. The largest key item was a $13 million after-tax benefit related to a business interruption insurance settlement. Excluding the three key items, Ashland's adjusted income from continuing operations was $90 million, or $1.12 per diluted share, a decrease of 7 percent from the year-ago quarter.

For the year-ago quarter, Ashland reported income from continuing operations of $60 million, or 76 cents per diluted share, on sales of $1.9 billion. The year-ago results included two key items that had a combined negative effect of $35 million, net of tax, or 44 cents per diluted share. Excluding these items, adjusted income from continuing operations was $1.20 per diluted share. (Please refer to Table 5 of the accompanying financial statements for details of key items in both periods.)

For the remainder of this news release, financial results exclude the effect of key items in both the current and prior-year quarters. On this basis, Ashland's results as compared to the year-ago quarter were as follows:

· Sales were $1.9 billion; normalizing for currency, divestitures and joint ventures, sales were flat;

· Operating income decreased 17 percent to $163 million;

· Earnings before interest, taxes, depreciation and amortization (EBITDA) decreased 11 percent to $268 million; and

· EBITDA as a percent of sales declined 130 basis points to 14.3 percent.

"Our financial performance in the first quarter - which is Ashland's seasonally weakest period of the year - reflects soft demand in some key markets and regions. It also includes $31 million in losses on straight guar, primarily reflecting a discrete write-down of inventory to current market value," said James J. O'Brien, Ashland chairman and chief executive officer. "Without this loss, adjusted earnings per share would have increased 14 percent when compared to a year ago. Ashland Consumer Markets turned in a strong quarter, as higher margins led to a 34-percent increase in EBITDA compared to a year ago. In addition, we generated $30 million of free cash flow in the first quarter, a significant improvement compared to the year-ago quarter."

Business Segment Performance

In order to aid understanding of Ashland's ongoing business performance, the results of Ashland's business segments are described below on an adjusted basis and EBITDA, or adjusted EBITDA, is reconciled to operating income in Tables 7 and 8 of this news release.

Ashland Specialty Ingredients' sales totaled $622 million, a decline of 1 percent when compared to a year ago. EBITDA declined 28 percent, to $116 million, while EBITDA as a percent of sales was 18.6 percent, down 690 basis points versus the year-ago quarter. This year-over-year decline is primarily due to the aforementioned $31 million loss on straight guar, as well as weak demand, particularly in the month of December, in our coatings and construction product lines in emerging markets. Specialty Ingredients' pharmaceutical, hair and oral care, non-guar energy and specialties businesses all generated sales and gross profit increases versus the prior-year quarter.

Ashland Water Technologies' sales totaled $421 million in the December 2012 quarter, a decline of 6 percent from the year-ago quarter. Normalizing for currency effects and adjusting for divestitures, sales would have been flat. EBITDA was $34 million, a 15-percent decline from the year-ago quarter. EBITDA as a percent of sales was 8.1 percent, down 80 basis points. During the quarter, Water Technologies continued to face soft demand in several markets, most notably industrial water treatment. Under a new leader, Luis Fernandez-Moreno, the team is focused on revenue growth and cost structure efficiencies.

Ashland Performance Materials reported sales of $345 million, a 9-percent decrease from the December 2011 quarter. Normalizing for currency and adjusting for divestitures, sales would have been down 4 percent over the prior year. EBITDA declined 38 percent to $28 million, while EBITDA as a percent of sales declined 380 basis points to 8.1 percent, primarily due to lower margins on elastomers, which benefited in the year-ago quarter from declining raw material costs.

Ashland Consumer Markets reported strong results versus the year ago period, with higher earnings driven by lower raw-material costs and a 13-percent volume increase within the international business. While overall sales increased 1 percent, to $481 million, EBITDA rose 34 percent, to $75 million. EBITDA as a percent of sales was 15.6 percent, an increase of 380 basis points versus the year ago quarter.

After excluding the effects from key items, Ashland's effective tax rate for the December 2012 quarter was 24 percent. Ashland continues to expect the effective tax rate for the full 2013 fiscal year to be in the range of 26-28 percent.

Summary and Outlook

"While our first-quarter financial results did not meet our expectations, we believe the biggest issues affecting our performance have been addressed," O'Brien said. "The inventory issue with straight guar is now behind us, and we have taken action to significantly reduce the risks going forward. In addition, the weak volumes we saw within certain parts of our Specialty Ingredients business in December appear to have been short-term, as order patterns through the first four weeks of January have improved to more normalized levels."

"Looking ahead, our strategic focus has not changed. We remain committed to achieving our fiscal 2013 objectives, which should put us in a good position to attain our 2014 overall financial targets and generate significant value for our shareholders," he said.

Ashland Inc. names Luis Fernandez-Moreno as new president of Ashland Water Technologies

Ashland Inc. has announced that it has hired Luis Fernandez-Moreno to serve as vice president of the company and president of Ashland Water Technologies, the global leader in specialty papermaking chemicals and a commercial unit of Ashland. He reports to John Panichella, Ashland senior vice president and group operating officer.

Ashland Inc. has announced that it has hired Luis Fernandez-Moreno to serve as vice president of the company and president of Ashland Water Technologies, the global leader in specialty papermaking chemicals and a commercial unit of Ashland. He reports to John Panichella, Ashland senior vice president and group operating officer.

Fernandez-Moreno, 50, brings nearly 30 years of chemical industry leadership experience to this role. He most recently served as executive vice president of Arch Chemicals, Inc., where he was responsible for the wood protection and HTH water products businesses, with combined annual sales of approximately $900 million. Arch was acquired by Lonza Group Ltd., a leading supplier to the life sciences industry, in October 2011. Prior to that, Fernandez-Moreno served as business group vice president, Dow Coating Materials, a $3 billion unit that was formed after Dow Chemical Co. (NYSE: DOW) acquired Rohm & Haas Co. in 2009. He previously spent more than 25 years with Rohm & Haas in a series of leadership roles spanning across Europe, Latin America and the United States. The businesses he directed ranged from paint and coating materials to plastic additives and printing technologies.

"Luis is a talented leader with significant experience in driving profitable growth and execution across global business lines," said Panichella. "Throughout his career, Luis has proved adept at forging close relationships with customers, establishing clear strategic goals and holding his teams accountable for performance. We are pleased to have someone with his experience in the specialty chemical industry assume the leadership of Water Technologies and we are confident in his ability to position the business for future sales and earnings growth."

Fernandez-Moreno earned a Bachelor of Science degree in chemical engineering from Universidad Iberoamericana in Mexico City. He also completed the Wharton Management Program at The Wharton School at the University of Pennsylvania.

John Panichella elected group operating officer at Ashland Inc.

Ashland Inc. elects Janice Teal to board of directors

Ashland Inc. to host analyst day December 4 in New York City

Ashland Inc. (NYSE: ASH), a global leader in specialty chemical solutions for consumer and industrial markets, today announced it will hold an analyst day on Tuesday, December 4, 2012 in New York City. James J. O'Brien, chairman and chief executive officer, along with other members of the company's management team, will present an update on key business strategies and growth initiatives, with a focus on the Ashland Specialty Ingredients commercial unit. Topics will include long-term growth drivers, market trends, technical differentiation, and new product innovation.

Further event details will be posted on Ashland's investor website at http://investor.ashland.com closer to the date.

An audio webcast of the conference will be available live and can be accessed, along with supporting materials, through the Ashland website. A replay will be available within 24 hours of the live event and will be archived, along with supporting materials, on Ashland's website for 90 days. Supporting materials will be available for 12 months.

Ashland Inc. announces expiration of previously announced cash tender offer

Ashland Inc. has announced the expiration, as of midnight, New York City time, on August 2, 2012 (the Expiration Time), of its previously announced cash tender offer (the Tender Offer) to purchase for cash any and all of its outstanding $650 million aggregate principal amount of 9.125% Senior Notes due 2017 (2017 Notes). According to Global Bondholder Services Corporation, the Depositary for the Offer, approximately $572 million aggregate principal amount of the 2017 Notes had been validly tendered and not validly withdrawn before the Expiration Time, representing approximately 88% of the outstanding 2017 Notes.

Ashland Inc. also today announced the pricing of an offering of$500 million aggregate principal amount of its 4.750% Senior Notes due 2022 (2022 Notes). The 2022 Notes will be unsecured, unsubordinated obligations of Ashland and will mature onAugust 15, 2022.

Ashland intends to use the net proceeds of the 2022 Notes offering, together with available cash, to pay the consideration, accrued and unpaid interest and related fees and expenses in connection with the Tender Offer.

Settlement of the 2022 Notes offering and the Tender Offer is expected to occur on August 7, 2012, subject to customary closing conditions.

The 2022 Notes will be offered in the United States to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the Securities Act), and outside the United States pursuant to Regulation S under the Securities Act. The Notes have not been registered under the Securities Act and may not be offered or sold in the United States without registration or an applicable exemption from the registration requirements.

This press release shall not constitute an offer to sell, or a solicitation of an offer to buy, any security, including the 2022 Notes. No offer, solicitation, or sale will be made in any jurisdiction in which such an offer, solicitation, or sale would be unlawful.

Ashland Inc. announces offering of senior notes due 2022 as part of a refinancing of its 9.125% senior notes due 2017

Ashland Inc. third-quarter earnings webcast set for 9 a.m. EDT, July 26

Ashland Inc. has announced that it will conduct a live webcast with investors on Thursday, July 26, 2012, at 9 a.m. EDT to discuss preliminary financial results for the third quarter of fiscal 2012. The company's results will be issued earlier in the day.

In attendance at the presentation will be: James J. O'Brien, chairman and chief executive officer; Lamar M. Chambers, senior vice president and chief financial officer; John Panichella, president, Ashland Specialty Ingredients; and David A. Neuberger, director, Investor Relations.

The webcast, which will last approximately 60 minutes, will be accessible through the Investor Relations section of Ashland's website at http://investor.ashland.com, along with supporting materials. Following the live event, an archived version of the webcast and supporting materials will be available on the Ashland website for 12 months.