Displaying items by tag: Pöyry

ÅF Pöyry changes brand name to AFRY

Since 22 February 2019, ÅF and Pöyry have been one company, jointly operating in more than 100 countries. Today, 25 November 2019, we launch our new common brand, AFRY.

We have a long history. ÅF was founded in 1895 and Pöyry in 1958. Since our merger we have become the biggest company in our sector in the Nordic region, and a global actor with almost 17,000 employees with offices in 50 countries and projects in 100 countries, with an annual revenue of about SEK 20 billion. We are proud of our history, and look forward to our mutual journey onwards, with a strong focus on sustainable solutions. We bring the best from both ÅF and Pöyry into the new brand AFRY.

We have a long history. ÅF was founded in 1895 and Pöyry in 1958. Since our merger we have become the biggest company in our sector in the Nordic region, and a global actor with almost 17,000 employees with offices in 50 countries and projects in 100 countries, with an annual revenue of about SEK 20 billion. We are proud of our history, and look forward to our mutual journey onwards, with a strong focus on sustainable solutions. We bring the best from both ÅF and Pöyry into the new brand AFRY.

“Our focus on sustainability is strengthened and our position as a global company consolidated with the launch of AFRY. Given the exponential technological development we are facing, our services and solutions are more relevant than ever. In the last couple of years, we have experienced significant growth, and our revenue has doubled since 2015. I am happy to be a part of creating a common platform for the whole company, as well as proud of bringing our vibrant history into the future,” says Jonas Gustavsson, President and CEO at AFRY.

AFRY is a leading company within engineering, design and advisory services. We create solutions for the future together with our clients, which are mainly within the infrastructure, industry and energy sectors.

The need for sustainable solutions is greater than ever in times of increased globalisation, urbanisation, digitalisation and climate change. At AFRY we drive the transformation, and together with our clients, we are able to influence many parts of society through solutions that reduce our impact on the climate.

With a new common brand and offer, we strengthen our position in our core markets Sweden, Norway, Denmark, Finland and Switzerland, and grow internationally within, for example, the energy and process industries. Attracting the most skilled people is a core issue for the company, and we wish to remain one of the most attractive employers for engineers, researchers, designers and advisors.

The legal name of the company will remain ÅF Pöyry AB. The new brand AFRY is a combination of the letters in ÅF and Pöyry: AF+RY.

AFRY is an international engineering, design and advisory company. We support our clients to progress in sustainability and digitalisation. We are 17,000 devoted experts within the fields of infrastructure, industry and energy, operating across the world to create sustainable solutions for future generations.

Making Future.

Parents of the revolution: why we must start planning for the coming digital age today

Don’t work harder; work smarter.

This old adage is taking on new significance as digitalisation transforms our economies. Today, we stand at the precipice of a global productivity revolution and the watchword of this will be: “work smarter.”

Yet, while this transformation will free us from a great deal of wasted time, it will also require us to change the energy industry. In the future, we will all be required to learn new skills and change the way we work – quite fundamentally – to adapt to this emerging reality.

Yet, while this transformation will free us from a great deal of wasted time, it will also require us to change the energy industry. In the future, we will all be required to learn new skills and change the way we work – quite fundamentally – to adapt to this emerging reality.

This requires workforces to change their cultures and mindsets, while also learning new ways of working. This is no small task. Yet it is vital, because those who succeed will find themselves at a competitive advantage.

Digital applications in energy have the potential to transform the sector, by delivering greater efficiency throughout the entire supply chain, by revolutionising companies’ relationships with their customers, and by unlocking the potential for deep decarbonisation through automating flexibility to match production patterns of renewable energy. The earliest digital breakthroughs are in predictive asset maintenance, improved forecasting and real-time monitoring, and digital tools that aim to attract and retain customers. Drones and UAVs for remote inspections, as well as process mining and text mining are also helping to improve efficiency. Digital twins allow ‘what-if’ and predictive analysis to be performed on virtual representations of physical assets. Artificial intelligence is unlocking value almost everywhere it is applied.

So, while this revolution will be full of opportunity, we must ask ourselves some tough questions: What does the future look like? How do companies ensure they have the right structure and skills to lead this change? And what does the company of the future look like?

Skilling up

While still a nascent technology, predictive asset maintenance is becoming one of the more mature digital technologies in the energy sector – and it tells us important things about the changes to come. Today, predictive maintenance is at the cutting edge, but tomorrow it will be part of a much bigger system. We are still at the cusp of what the Industrial Internet of Things (IIoT) can do.

The guiding star for all “industry 4.0” technologies will be data. The data that these IIoT sensors gather will enable companies to identify and resolve problems remotely, allow engineers to deploy their time more efficiently and, eventually, machine learning might help plants automate simple engineering jobs. It will also allow plant owners to gain insights into their own operations and identify how assets can be used more productively. Energy companies are still only at an early stage in exploiting digital technologies and data streams, such as machine learning applied to rich data sources.

However, this future is not yet here. To reach this point, we need better access to clean, accessible data streams and we need to better identify where to focus our efforts. We also need to get around practical barriers like the interoperability of these sensors. Although the limits are expanding fast, constraints on processing power, data storage and algorithms mean that the 80:20 rule still applies to data analytics. It is these practical considerations that led Pöyry to co-develop Krti 4.0, a machine learning predictive maintenance framework that works across different kinds of sensors. It begins with prioritisation using Pöyry’s RAMS (Reliability, Availability, Maintainability, Safety) methodology, to assess and prioritise the most relevant potential causes of failure. This RAMS approach distinguishes Krti 4.0 from less discerning systems; allowing Pöyry’s engineering experience to direct the system to focus on the most important data.

Tomorrow’s barriers will be the evolving relationship between humans and machines: we must learn when to trust machine decisions, how to monitor and when to take back control, and how to augment machine learning with humans’ experience and knowledge from beyond the data. For policymakers, it may also require changes to the way with think about regulation, as the lines blur between utilities and tech companies.

Adapting for change

Yet for all of this, the biggest barrier will be ourselves. Today’s engineers have learned their trade in the last few decades, yet the skills required of them will change in the coming ones. In an interconnected, data-driven world; engineers will find they are required to be software and hardware engineers, and even drone operators, as much as they are required to be power engineers. Knowledge and information will be treated as a precious company resource and will be managed and maintained.

This will require cultural transformation. Companies that adopt a forward-looking and nimble posture will steal a march over companies that are slower to adapt. The Silicon Valley “move fast and break things” mentality might seem anathema to engineers who have grown up in a world of careful design and planning, but just as tech start-ups are currently challenging the status quo in the transport and retail industries, they will challenge engineering too.

Another challenge is to develop digital solutions within a strategic plan, so that data sources are carefully consolidated and synergies are fully exploited.

Finally, in this fast-paced world, companies that do get first mover advantage must not rest on their laurels, lest the advanced technology of today become the legacy system of tomorrow.

The coming revolutions

All of this means those of us who are working in the energy sector can no longer consider ourselves discrete from technology experts. We must understand both worlds. Companies and their people must now start planning to become digital-first. This is about weaving digital into the fabric of what we do – not simply as something that is bolted on.

What’s more is that this revolution is happening hand in hand with another one – decarbonisation. This will be complemented by the digital one. It will be digital technologies that facilitate decentralised generation, load balancing and demand-response. Traders are already using AI based forecasting and algorithmic trading to help them get ahead of their competition in energy markets, and digital tools are being used to help companies attract and retain customers.

It is this final element which makes the revolution inevitable. The energy industry simply will not continue as it is. As we’ve learned by speaking to clients through our own digital readiness service, change is often unsettling – even for those who understand it best – but it is happening, whether we like it or not.

If you haven’t started the journey to a digital future yet – start today.

Stephen Woodhouse is Chief Digital Officer at Pöyry.

Skills gap provides foreign-born engineers with route into Swedish labour market

Sweden needs more engineers: over recent years, ÅF has worked actively to recruit newly immigrated and foreign-born engineers through standard recruitment channels as well as via the company’s own investment, New Immigrated Engineers.

Since 2016, 150 people have started work at ÅF within the framework of the initiative.

For the past three years, ÅF has offered hands-on coaching to foreign-born engineers and matched their skills with those sought by the company. Over the course of those three years, ÅF’s investment in New Immigrated Engineers has succeeded in attracting 150 new employees, almost half of them women.

In 2018 alone, ÅF recruited 53 newly arrived engineers. Of these, 16 were women, equating to 30% of recruitments, which is in line with ÅF’s goal for the proportion of women in the workforce.

- ÅF and the industry in general sees a continued high demand for engineers and we will need to take advantage of all available competences if we are to meet future needs and the social challenges we are currently facing. The pace of change is high and our strategic investment in newly immigrated and foreign-born engineers is crucial if we are to continue to be a leader in sustainable solutions.

- ÅF and the industry in general sees a continued high demand for engineers and we will need to take advantage of all available competences if we are to meet future needs and the social challenges we are currently facing. The pace of change is high and our strategic investment in newly immigrated and foreign-born engineers is crucial if we are to continue to be a leader in sustainable solutions.

Jonas Gustavsson, President and CEO.

At the start of the programme, those admitted were primarily newly immigrated engineers. Today, recruitment has been widened to include foreign-born long-term residents of Sweden who had difficulty establishing themselves in the Swedish labour market, overseas students and those recruited directly from abroad. In addition to addressing the skills gap, developing ÅF as a business and reflecting the needs of ÅF’s clients are also vital aspects of the project.

Since Amir Nazari took up the post of Diversity Coach in 2016, tasked with attracting and recruiting more engineers, the company’s recruitment of newly immigrated and foreign-born employees has gained momentum. In spring 2018, Sofia Klingberg joined as ÅF’s second Diversity Coach with responsibility for driving the project in the west and south of Sweden and together they will be developing and scaling up recruitment activities.

About ÅF Pöyry

ÅF Pöyry is a leading company within engineering, design and advisory services. We create sustainable solutions for the next generation through talented people and technology. We are more than 16,000 devoted experts within the fields of infrastructure, industry and energy operating across the globe to bring value to our customers and the society.

Making Future.

IT Emperor’s New Clothes and other stories about Cyber Security in Industry

Introduction - Cyber security is not a new topic, but it is increasingly a central factor in modern risk management in the industrial sector. Nevertheless, it is not just about management of risk but also a matter of personal responsibility. Production related threats, such as production losses, impaired quality or delivery delays, are no longer the only risks. Management and privacy of data is equally important in any responsible and modern production environment. This has to be supported by well-organized management standards and frameworks that can deal with the ever evolving threat of cyber threats.

This paper discusses how modern industry is threatened by cyber threats and outlines new EU directives and guiding standards that will incentivise and help businesses adapt.

The current state of cyber threats in the industrial sector

When considering cyber security in the industrial sector, the challenges are traditionally associated with personal IT, office automation, business management and ERP (Enterprise Resource Planning). The largest share of incidents is unintentional, caused by an individual’s lack of knowledge. This obvious flaw can be amended by increasing your workforce’s cyber awareness with a sufficient training program, which covers the basics of email phishing, malicious attachments and e-fraud.

The benefits of increased digitalization or automation in the industrial sector are well known. What is less well known is how Industrial Control Systems (ICS) can be become a target for cyber attacks. Recent cyber-attacks are using malwares to disrupt or take control of critical infrastructure like electrical substations. It is also not just infrastructure; there are also reports that hackers are also attacking safety systems (1). The growing number of these incidents underlines the fact that ICS are increasingly being targeted for cyber-attacks

The industrial sector, especially process plants (food, chemicals, forest products etc.) are vulnerable to cyber-attacks from known and unknown sources. Successful cyber-attacks can lead to loss of production, unplanned downtime (production quality waste), disturbances to cash-to-order processes and the supply chain. The impact is not just limited to production processes. Building technology, such as climate control systems, remotely controlled access control systems and surveillance networks can be surprisingly vulnerable. Damage to these technology can also damage production indirectly or even have a catastrophic impact on the local environment or community. For example, an attack on heating, ventilation, and air conditioning (HVAC) systems in a hospital or laboratory could directly impact people’s health. Understanding how digitalization can impact peoples’ well-being needs to be understood, managed and protected accordingly. The journey starts by assessing critical parts of infrastructure and building technology.

When assessing industrial processes it is vital to:

- Be aware of, and understand, potential cyber incidents

- Assess and identify “my risks and how they are handled”

- Understand the time and effort required to recover back to production following a cyber attack

- Build and increase your resilience

Too often, there are no clear plans. Back-ups are not tested and even smaller disturbances can easily cause chaotic recovery situations. This highlights why cyber threats have to be a standard element of your general risk management strategy in the industrial sector.

About upcoming changes in cyber security directives – “what’s in it for me?”

In 1995, the European Union introduced the “Data Protection Directive” (Directive 95/46/EC) to regulate the processing of personal data to meet privacy and human rights laws. However from May 25th 2018, new directives will come into force. The “General Data Protection Regulation” (GDPR) will supersede previous directives. The aim of GDPR is to protect EU citizens from privacy and data breaches, including heavy penalties for violations. Within this new directive there are measures that look to protect industrial operations (2). These include:

- The authorities must be notified within 72hrs of first becoming aware of a cyber-security breach. This applies not only to the production unit, but also its customers, suppliers and other stakeholders.

- Anyone, whose data is managed by a data controller (e.g. registered customer data), can, at any time, free of charge, get a confirmation related to the data use.

- Data controllers have to erase personal data once it has lost its original purpose, is no longer relevant or a data subject withdraws consent.

- Data protection must be included at the start of designing systems, rather than an addition. It must be of the highest standard and protect the privacy of any data subject

- Establishment and appointment of a Data Protection Officer (DPO)

What is apparent with these new measures is the level of increased transparency for data processing, attempted cyber-attacks or breaches. There is going to be no hiding place if errors occur which can be detrimental to a company’s reputation. Therefore just having a traditional IT manager role will no longer suffice. These new challenges mean it is necessary to appoint a Chief Information Security Officer (CISO).

Trustworthiness

Increased digitalization in production means there is greater interaction between different systems which are controlled or monitored through computer-based algorithms. Wireless sensor networks, measuring something in a given environment and transmitting that to a central unit (e.g. automatic pilot avionics systems), are typical applications in this area. This is all combined with human interaction. All these moving parts create the cyber physical systems (CPS). The CPS needs to be incorporated into risk management practices (3).

Trustworthiness is an integral part in the CPS concept, with aspects of security, privacy, safety, reliability and resilience. Trustworthiness must be a basic requirement of any modern industrial site and a prerequisite to sustainable, advanced manufacturing and the digital business environment. From a risk management perspective, combining GDPR and trustworthiness can be conducted by doing the following:

- CPS may include physical, analogue and cyber components. Engineers must determine how to evaluate the impact of their choices in terms of multi-level trade-off metrics

- Security, operational and reputational risk

- Safety, error rates (is there a possibility that data can be used against the processor?)

- Reliability, failure rates

- Privacy, unwanted disclosure rates

- Resilience, recovery rates

Resilience planning is done to mitigate against an attack and help with recovery. Data recovery following a security breach should be planned with a clearly defined process. Ideally this should be practiced as well. In many cases, clear data backup routines can be the difference between a quick recovery and a total catastrophe. The key is how quickly this can be done to mitigate damages (e.g. production losses).

Turning theories into practice

ISO Standard 27001 is a commonly known and widely employed standard for management of information security and defines its related risks. This standard has traditionally been considered more as an IT management standard, but in environments with increasing digitalization, it cannot be relied upon anymore in modern production facilities. ISA99/IEC62443 emphasizes the industrial control systems on four different layers (General, Policies and Procedures, System and Component). Furthermore the ISA99/IEC62443 represents a more advanced approach to industrial cyber security, specifically addressing the cyber security to control systems perspective. (4)

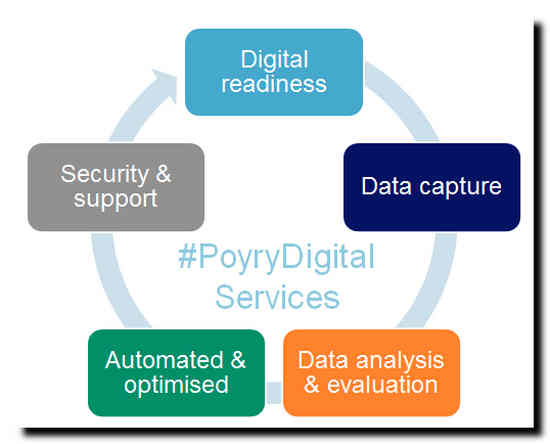

With a jungle of standards, guidelines and frameworks; selecting the right one for your business and industrial set-up is critical. Only once you have selected the most relevant ones can you establish the foundation of your ICS cyber security. Equally important is the ability to maintain and evolve your cyber security. Pöyry has developed a simple approach to do this as illustrated in the flow chart below.

Asset management and cyber security

Processing or production industries are typically very asset intensive businesses. From the owner’s perspective, there is a huge amount of uncertainty and risk that is considered in the future production portfolio and business environment. They have to consider important external factors such as the global economy, demand/supply changes, raw material pricing, employee restrictions, politics etc. Modern asset management includes a number of challenging questions, such as:

- How to maintain assets to and still meet all set operational, sustainability and business targets?

- What is the annual investment demand needed to meet any of the targets?

- Should we replace or rebuild?

- How can we mitigate any asset-related risks associated with unclear future market scenarios?

As you can see there is a huge amount that owner has to contemplate and manage. But it is vital that cyber security is given equal consideration. Therefore any asset management plan must include CPS. For example, equipment generation upgrades cannot only include hardware refurbishment or modernization. It has to include cyber security ICS (e.g. data privacy). Typically business managers tend to focus on reducing costs and time efficiencies. Meanwhile, procurement practices in processing focus more on direct assets costs, with maintenance and operational expenses being secondary. Too often cyber-security drops down the agenda. However, failing to build in cybersecurity at the investment phase means that your new modern plant will in fact be old and inefficient from day one.

Summary

It is no longer sufficient to just deliver efficiencies or advanced sustainability. The integration of digitalization in industrial operations is dramatically exposing industrial processes to unknown cyber security risks. Traditional asset management alone cannot ensure your safety. However, all these challenges can be managed, but it requires a systematic approach, while continuously improving and updating. A suitable framework for everyone’s own business must be chosen, but being well planned is not enough if the plans are not enabled. That makes the difference. One might rephrase this fact in a following way: “Cyber security is a journey, not a destination!”

Lind, T.1, Talsi, J.2

1) Tom Lind, Vice President, Technology and New Solutions, Industry Business Group, FINLAND (Corresponding author)

2) Jonni Talsi, Chief Engineer, Cyber Security, Energy Business Group, SWITZERLAND

Acknowledgements

The authors wish to thank the valuable support by Mr. Petri Kankkunen for valuable comments to the contents of this article.

References

https://ics-cert.kaspersky.com/wp-content/uploads/sites/6/2017/10/KL-ICS-CERT-H1-2017-report-en.pdf

https://www.eugdpr.org/key-changes.html

http://nvlpubs.nist.gov/nistpubs/SpecialPublications/NIST.SP.1500-201.pdf

https://en.wikipedia.org/wiki/Cyber_security_standards

http://www.poyry.com/cybersecurity

Pöyry ramps up its investment in digitalisation to increase client value and appoints digital transformation team

Pöyry is ramping up its investment in digitalisation with the establishment of its #PoyryDigital transformation team. The international management consulting and engineering company earlier this year announced #PoyryDigital, the umbrella name for its digital solutions, which has already resulted in 17 new digital services, ranging from 'Smart Water' to 'Pöyry Innovation Link': www.poyry.com/digital.

Pöyry is ramping up its investment in digitalisation with the establishment of its #PoyryDigital transformation team. The international management consulting and engineering company earlier this year announced #PoyryDigital, the umbrella name for its digital solutions, which has already resulted in 17 new digital services, ranging from 'Smart Water' to 'Pöyry Innovation Link': www.poyry.com/digital.

Leading the team, Stephen Woodhouse, Director, Management Consulting Business Group and global energy markets expert and has been appointed as Chief Digital Officer. Stephen, together with the #PoyryDigital team, will help deliver added value to our clients by stimulating, incubating and connecting the many exciting digital developments taking place across Pöyry.

"Digitalisation is a hugely disruptive force and is transforming our clients' businesses across the energy, industry and infrastructure sectors," says Martin à Porta, President and CEO, Pöyry PLC. I want Pöyry to offer its clients the most digitally advanced solutions on the market and this is why we are putting digital at the heart of what we do. Stephen and the #PoyryDigital team will help accelerate the many innovative digital developments being pioneered by our team of 5500 talented intrapreneurs."

"Pöyry is transforming its business culture to become one of the most digitally-advanced consulting and engineering companies in the world," says Stephen Woodhouse. In my experience clients are increasingly looking for digital expertise integrated with deep insight and engineering know-how. Our experts are helping clients to transform their operations by taking advantage of IOT, Industry 4.0, big data and AI to increase efficiency, safety and performance. We are engaging our own intrapreneurs, our partners and clients in a digital dialogue to help solve our clients' needs."

Additional information:

Martin à Porta

President & CEO, Pöyry PLC

+41 44 355 5525

Stephen Woodhouse

Chief Digital Officer, Pöyry

+44 7970 572444

Did You Know? Pöyry announced 17 new #PoyryDigital services in 2017: www.poyry.com/digital.

About Pöyry

Pöyry is an international consulting and engineering company. We deliver smart solutions across power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry's net sales in 2016 were EUR 530 million. The company's shares are quoted on Nasdaq Helsinki (POY1V). Approximately 5500 experts. 40 countries. 130 offices.

The hidden value on pulp and paper operations - Gabriel Sousa, Principal, Pöyry Management Consulting

The hidden value on operation execution for the pulp and paper industry – How big is it and why does it matter?

Pulp and paper companies are facing continuous pressure on their profitability as the markets get more competitive. Our experience tells us that there is a lot of money left on the table that is related solely to the intrinsic operational capability. Capturing this hidden value can make the difference between success and failure.

The main pillars for business success

There are plenty of business management theories that describe why some businesses are successful and others aren’t, but from our point of view, the success of any business relies on three main pillars: strategy, assets and execution.

Clearly, getting the business strategy right is paramount, as it will define the organisation’s direction and development. The basis of this strategy should be defining which products and services provide the most added value, and which geographies offer the best opportunities. This can then be supported by M&A, organic growth or other decisions.

The second pillar of any strategy is the organisation’s assets; in other words the physical equipment in which the products are manufactured. The type of technology, its technical age (new investments versus upgrades) and the level of automation will define the potential competitive edge that the company will have within the industry.

The final element of success is the way the people and organisation execute its strategy with the available assets. For this, adequate operational capability is needed to achieve target profitability in the prevailing market context.

The “asset quality” myth in the pulp and paper industry

In a capital intensive industry like pulp and paper, there is a tendency to believe that asset quality (technology, age and maintenance) is the main determinant factor of operational performance. If everything else is constant, then asset quality determines the competitiveness potential, but assets are just the hardware in an industry that has historically overlooked operational execution. Many pulp and paper mills have old assets but strong operating performance, while others have newer assets but trail on overall efficiency.

In a highly competitive industry, it is the companies that learn how to maximise the value of their assets, regardless of their age, that will achieve a competitive advantage. This can only be achieved with excellent operating practices that focus on process stability, optimisation and continuous improvement. Our experience shows that, by failing to optimise their processes, many organisations are effectively leaving money on the table. Capturing this hidden value is ever more important for the pulp and paper industry due to challenging market conditions, and can be the difference between success and failure.

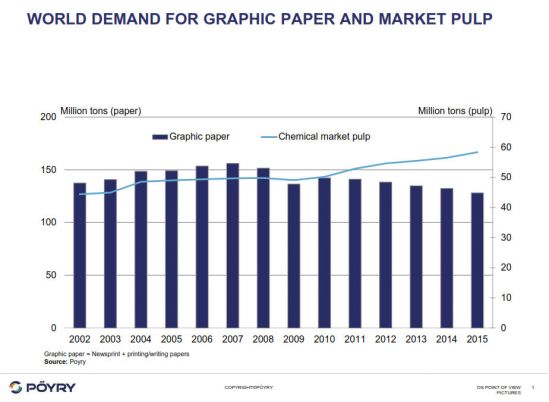

The pulp and paper sector - a mature and maturing industry

The pulp and paper sector is a mature industry that has very different segments and geographic realities. On the paper side, sales of industrial and hygienic grade papers are still growing globally, but graphic paper sales are declining due to the developed markets sunset. On the pulp side, emergent markets in Latin America have gained the upper hand due to several competitive advantages, related to lower cost base. In fact, this geographic shift from mature, fibre-rich western markets towards emergent markets has been the industry’s guiding force in the 2 decades. In turn, this has led to a gradual shift away from vertically integrated pulp and paper operations, towards a market pulp and recovered paper-driven industry. Also, the decline of non-wood supply in China and the tissue move into virgin fibre have supported virgin pulp markets.

The main result of this shift is that the developed markets will continue to mature, with some segments declining as a result. This will put additional pressure on existing pulp and paper players in Europe and North America, where improving the overall operating performance is now essential.

The tides are more favourable in emerging markets, but investment cycles prove that these markets are also maturing. With this, more focus needs to be given to the operational efficiency of current assets, rather than looking at new investments. The issues are common regardless of geography and the position on the investment cycle.

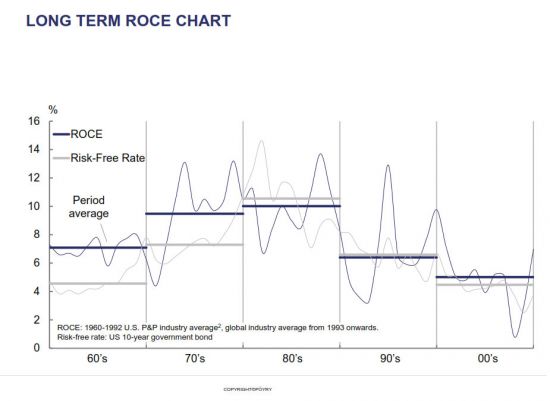

Pulp and Paper Industry has become a global competitive arena with ever tighter margins

Key market drivers are putting pressure on overall industry profitability

In recent years, pulp and paper producers have endured challenging conditions, resulting in unsatisfactory profitability. Although profitability varies from segment to segment, generally speaking this poor performance has been driven by poor capacity utilisation, declining demand, a low level of supplier concentration, poor sales prices and unfavourable exchange rates. The markets are complex, and the drivers vary from one industry sector to another and over time.

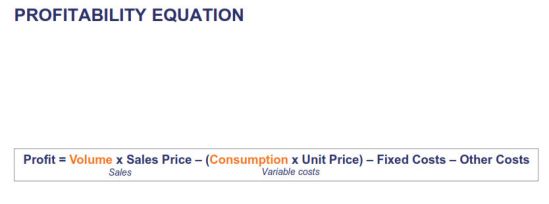

Profit margins are influenced by a number of factors but typically market forces cannot be controlled by companies. This means improving sales and reducing overall costs is necessary in a highly competitive environment.

The pulp and paper industry has evolved into a highly competitive global arena where producers have positioned themselves on the lowest cost position possible while capturing relevant market shares.

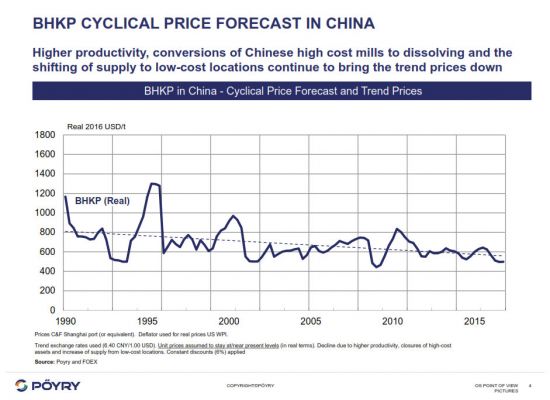

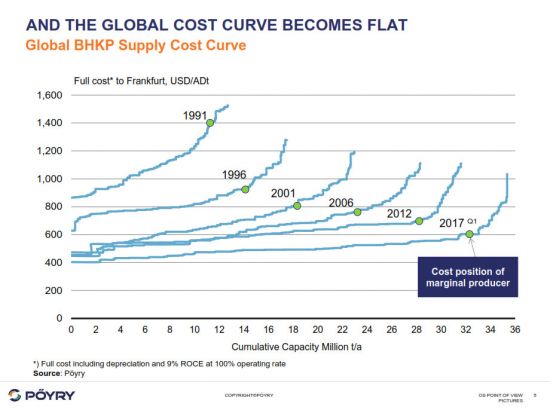

To illustrate this, the recent additional BHKP capacity responding to higher demand has positioned the new producers at the lower cost end. Production costs have declined as a result of highly-competitive raw material prices, growing economies of scale and declining transport costs, in turn forcing high- costs producers out of the market. As a consequence, the flattening BHKP market pulp supply curve increases competition for profitability, punishes inefficient producers and exposes players to price fluctuations.

In this context, companies have low degrees of freedom to affect the Sales Price Profitability Lever as this is fundamentally the result of market balance. To compensate for this reduced profitability that affects most of the pulp and paper grades, companies have looked at rationalising their production costs to keep profitability at acceptable levels. This might include consolidating the business, streamlining operations and reducing their overheads (including their number of FTEs). However cost- cutting can only do a limited amount for increasing profitability.

By necessity the next step must be improving operational efficiency, which is the lever that the company can actively control. Ultimately, this can positively impact production volumes or raw materials and utilities consumption, which has direct effect on the profit equation, regardless of market conditions.

Focus on what you can control - Execution Gap

Main internal levers for operations performance

Improving operational performance and efficiency is not straightforward. Plenty of companies find themselves unable to achieve significant improvements even though they expend significant resources on it. While continuous improvement initiatives have been a part of business culture for a long time, the pulp and paper sector has always been somewhat conservative in making it a common management practice.

When companies do apply continuous improvement initiatives, they often find they do not have the right operational capability to develop and implement effective and consistent performance improvement initiatives and harvest visible results.

Operations performance can be determined by the quality of three main factors: assets and process, people and organisation, and management systems.

- 1. Assets and processes – this is the way physical assets are run and optimised to create value, while minimising losses through improved stability. It is related to the design of manufacturing and business process, as well as to the subsequent ability to technically improve the business and physical proc

- 2. People and organisation – this is the way people organise, think, perform and conduct themselves in the workplace, both individually and collectively. It is related to the organisational structure, as well as people’s skillsets that can support the goals of an effective continuous improvement culture.

- 3. Management systems – this is the formal structure, processes and systems through which human and organisational resources are aligned to achieve shared go It can include elements such as process variable tool monitoring, KPI reporting, shift reports, action planning systems and standard operating procedures. These systems should be geared towards effective continuous improvement.

These levers can be used in a number of different ways to improve operations, but they all aim to change operating methods and procedures together with the use of modern technology in operational control. Several companies have applied different methods such as Lean Six Sigma, Lean Management, TPS, Kaizen and Deming’s Circle – PDCA. But, understanding the technical challenges of the pulp and paper industry when applying continuous improvement tools is key, as out of- context implementation can actually do more harm than good.

Having recognised this, Pöyry has developed a methodology that incorporates the best of different continuous improvement techniques, while bringing industry savvy experts that can understand the specific needs of pulp and paper mills and speak their language. Pöyry’s ExGapTM methodology is based on sound analytics and process insights into operations, supply chain and organisation.

Execution Gap – how much value are we leaving on the table?

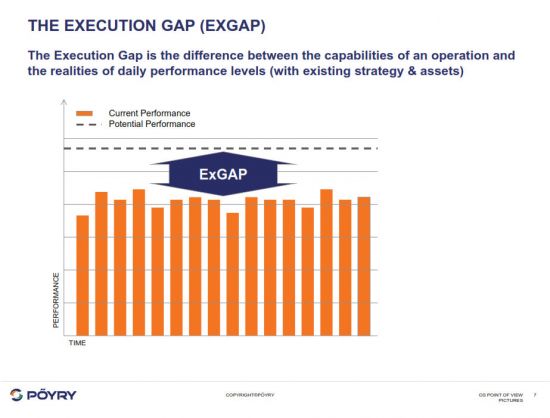

Fundamental to Pöyry’s ExGapTM methodology is qualifying and quantifying the Execution Gap (ExGap) of an operation. This can be defined as the difference between current performance and potential performance. It is the money that companies are leaving on the table by not being able to perform to their full potential with their current assets. This is a simple but powerful concept that is the first step on the long path towards sustainable performance improvement. Though a simple concept, the ExGap contains a powerful message:

- It is usually significant – all industries, all market conditions

- It is within our control

• It will never be captured until it is specifically identified and quantified

The first step towards establishing and quantifying the ExGap is undertaking a mill diagnostic. This entails a full management process and system diagnostic, together with a technical process diagnostic, combining both management and technical perspectives. The diagnostic focuses mostly on non-capex areas of opportunity, as most of the improvement can come from better process monitoring and control. This highlights how most process improvement is unrelated to asset investment. Nonetheless, in selected circumstances, rapid return investments can also be identified to accelerate the ExGap closure.

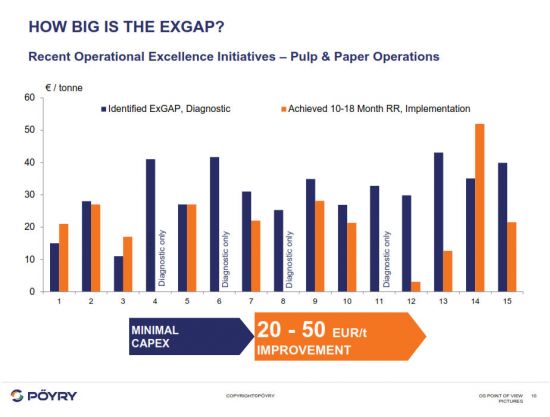

Typically, for the pulp and paper industry the ExGap on operations can reach between 20-50EUR/t of improvement opportunity. Roughly 55% is attributed to increased production (if it can be valued) and 45% is related to variable cost savings. This is a sizeable gap that has a high impact on the bottom-line and can make the difference between a company’s success and failure.

The Pulp and Paper players are facing common challenges preventing them of capturing the full value of their operations

Case Study - Taking operational improvements to the next level

- The client was a recycled graphic paper producer with modern assets who had already executed several improvement initiatives. Their goal was to improve production efficiency and stability. In addition to the technical issues in both paper machines and recycled plant, the mill had structural problems related to its management systems, hindering its performance.

- Pöyry’s team stepped in to conduct an ExGapTM diagnostic with detailed data analysis and technical interviews during a two week site visit. The team identified 20EUR/t of lost productivity in production areas OEE, raw materials and energy consumption. The low performance was clearly attributable to more than mere asset quality: for example, management systems for the production monitoring and control were inadequate. Other typical organisational shortcomings included management of departmental silos, as well as lack of diligent planning, action and accountability.

- The diagnostic phase was crucial to guide the next step on the performance improvement process. Next, Pöyry’s team and the client started to jointly bridge the execution gap, based on the first phase findings. The 12-month implementation project that followed included several changes in management and technical improvement initiatives. These were geared towards developing management system methods and tools for consistency of behaviour, actions and, ultimately, performance and results.

- Importantly, performance transparency was also established. This included visual means and regular reports, clear and manageable targets, as well as improved communication/information sharing through meetings at the mill and within department levels. Emphasis was put on diligence and actions were taken against negligent or unintentionally faulty work. Ultimately, motivation and team mentality improved due to increased accountability.

- By the end of the project, the mill achieved an annualized improvement level of about 4 MEUR on all aspects of the operation. The performance continued to rise further following the establishment of high performance culture. The main achievements included the following: 1) Technical downtime reduced by almost 50% on main PM’s; 2) Increased speed machine by 3%; 3) Break frequency was almost halved on one machine and stabilised on the second machine even with higher speeds; 4) Power consumption reduction of about 10%t; 5) Steam consumption reduction of about 10%.

What are the main challenges that industry faces in operations?

The root of an organisation’s ExGap lies in the three above-mentioned components of operations management – management systems, assets and process, and people and organisation. Issues and challenges that contribute to a company’s ExGap include:

Process variance and inconsistent results – inefficient use of assets together with lack of optimisation and limited standard operating procedures can lead to excessive process variability. Process variability leads to lower efficiencies and higher production costs.

Non-systematic management processes – incomplete or inconsistent management systems are a common cause of poor performance. This can be reflected in poor and incomplete management and process metrics, excessive and unfocused reporting, poor meeting and action structures, informal action planning, or the lack of a formal continuous improvement system. It’s typical to see different departments on the same mill using a different management process and tools.

Poor equipment availability due to sub-optimal maintenance practice – The ineffectiveness of maintenance function is more of an issue than the maintenance costs. Incomplete business processes and lack of management systems tend to generate low visibility and accountability of maintenance results, which reflects on poor equipment availability.

Lack of specific operational and industry skills – as a result of low industry profitability, investment in assets and people has been reduced. This results in a shortage of management and technical skills, which is exacerbated by an ageing workforce.

Obsolete instrumentation and automation – to maintain steady and stable processes, having the correct and most reliable measurements is essential. It is not possible to control a complex process of high inertia with infrequent lab measurements. At the same time, manually operated operations are fallible and prone to variability. Systems obsolescence is becoming a common issue in the pulp and paper industry.

Organisation silos and data overload – mill departments tend to be organised in silos where data and information doesn’t flow across borders. Holistic mill optimisation is thus more difficult. On top of this, pulp and paper mills are overloaded with too much data, and have insufficient time and tools to extract any valuable information or insights.

This is not a comprehensive breakdown of all the challenges the industry is facing, which varies between companies, segments and geographies. Rather, the challenges outlined above are consistently found across the pulp and paper industry and are the main causes of low operational performance.

What are the requirements to improve on operations?

Improving mill operations and achieving performance gains is not straightforward; different companies will have different levels of readiness for the long and sometimes difficult journey required. Ultimately, continuous improvement processes are about fundamental changes to a company’s culture.

There are two phases within Pöyry’s ExGapTM principles that drive continuous improvement processes: firstly, the diagnostic phase and secondly, the implementation phase.

The diagnostic phase is an intensive audit of the company’s operations, with the objective of identifying and quantifying the extent of the opportunities for improvement (ExGap), while also revealing clues about the causes of underperformance. This is a fundamental step, which any improvement initiative should start with. Typically, this can be developed within 1-2 months of intensive work, depending on the areas involved and the complexity of operation.

After diagnosing the state of operations, the next phase involves the implementation of new methods and practices that can help close the ExGapTM. This should be based on a 10-18 month initiative, in which all levels of the organisation are involved. Systematic processes are developed with a clear management structure that helps to unlock the operation’s true potential. At the same time, the development of people is promoted alongside efforts to change company culture. The result is a new approach and new system that is focused on continuous improvement.

In our experience, applying operational excellence methodologies is not enough to achieve tangible results in improving operations in the pulp and paper industry. It must be accompanied by deep technical knowledge of the industry and extensive technological expertise in order to challenge and change deep-rooted operating methods. The path to improvement can be both long and challenging, and companies must fully commit and dedicate all required resources to these initiatives. However, the reward is on the horizon and can be tangible.

Concluding – why all of this matters?

Given the cut-throat competition in the pulp and paper sector, it is imperative that producers extract the most out of their assets. There is typically a great deal of value hidden within underperforming operations. This money is left on the table by companies that are not able to capitalise the best of their operations.

These improvements should be a priority, as they are entirely within a company’s control. Companies can’t control market forces, so focusing on what they can control is essential, and can be the difference between survival and failure. Based on our experience, the potential benefits on production, maintenance and supply chain can yield savings as much as 20-50EUR/t. It is time for pulp and paper companies to claim back this hidden value – the ExGapTM.

Pöyry manages investor partnership process that results in Spinnova and Fibria joining forces

Innovative start-up company and leading eucalyptus pulp producer connected for new high-value bio-based products

Fibria, the leading producer of eucalyptus pulp, and Spinnova, a Finnish start-up developing wood to fabrics technology, recently announced that Fibria is to acquire 18% of Spinnova and partner in the development, production and marketing of new materials using Spinnova's technologies. The two companies were brought together in a partnership search process managed by Pöyry. This is an example of Pöyry's choice to work closely with the startup scene from bio to digital. Pöyry has also a long-standing relationship with Fibria through many project assignments.

Pöyry's role in Spinnova's partnership development assignment was to help find the right industrial partner for the company, the assignment including potential partner analysis, partner relationship development, negotiations and contractual advisory. At the end of the process, Spinnova and Fibria came together for new opportunities in technology development, testing and piloting in pre-commercial scale of new high-value products.

Pöyry's role in Spinnova's partnership development assignment was to help find the right industrial partner for the company, the assignment including potential partner analysis, partner relationship development, negotiations and contractual advisory. At the end of the process, Spinnova and Fibria came together for new opportunities in technology development, testing and piloting in pre-commercial scale of new high-value products.

In such a process, being able to support a startup necessitates a trusted position among global forest cluster companies from biomass to end users, extensive market understanding and knowledge of innovative technologies, all of which Pöyry has put much effort into developing.

Spinnova develops low-cost and environmentally sustainable technologies for making fabrics. The technologies use wood fibers to produce filaments and yarns that can replace cotton, viscose and other raw materials in both woven and nonwoven applications. Fibria is a Brazilian forestry company and the world's leading producer of eucalyptus pulp from planted forests.

"The new partnership with Fibria will help Spinnova grow our business faster and significantly enhance our global competitiveness. We value highly this win-win partnership with a lot of strategic level synergies and a shared vision. It was great to work with the Pöyry team. They are real professionals and their help was invaluable during the partnership search process," said Janne Poranen, CEO and founder of Spinnova.

"We are active in the start-up scene and continuously looking for new technologies and companies especially in bioindustries, energy and the digital space. Our global network and strong relationships with major forest cluster companies enable us to find the right partners for different needs and connect start-ups and investors for mutual benefits. We are the trusted partner to our clients and support them with our market and technical understanding covering the whole value chain from raw materials to end markets," said Petri Vasara, Vice President Management Consulting, Pöyry.

About Pöyry

Pöyry is an international consulting and engineering company that delivers smart solutions across power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry's net sales in 2016 were EUR 530 million. The company's shares are quoted on Nasdaq Helsinki (POY1V). Approximately, Poyry has 5500 experts. 40 countries. 130 offices.

Pöyry and Betulium sign co-operation agreement to unlock full value chain benefits for clients in bio-based businesses

Pöyry and Betulium have signed a Letter of Intent (LOI) for co-operation that will enable both companies to serve their clients better in bio-based businesses. Pöyry and Betulium share common objectives in bioindustry: together they have the know-how and experience which can be used especially in the field of nanocellulose for composites, plastics and similar materials as well as for wood-based nanocellulose and material testing in both the forest and chemical industries.

Betulium Oy is a Finnish clean-tech company established in 2013. Betulium provides renewable, biodegradable, and high-performance water-based cellulose materials to replace or supplement synthetic organic polymers in a vast number of industrial applications. Betulium runs a pilot plant producing material on an industrial scale in Espoo, Finland. Nanocellulose can be used in the manufacture of paper, feeds, foods, cosmetics and pharmaceuticals.

Betulium Oy is a Finnish clean-tech company established in 2013. Betulium provides renewable, biodegradable, and high-performance water-based cellulose materials to replace or supplement synthetic organic polymers in a vast number of industrial applications. Betulium runs a pilot plant producing material on an industrial scale in Espoo, Finland. Nanocellulose can be used in the manufacture of paper, feeds, foods, cosmetics and pharmaceuticals.

Pöyry has a proven track record in process engineering excellence in the chemicals and biorefining sectors and knows the complex bioindustry value chain, megatrends, drivers and business partners. Pöyry's highly-skilled experts can help clients to identify value added opportunities and commercialise bioproducts with engineering solutions that maximise profitability, sustainability and health, safety and environmental (HSE) aspects.

"Our services in bio-based solutions cover the whole project life cycle from identifying opportunities through market studies and developing the business idea to the design and start-up of industrial scale production plants. This co-operation initiative will benefit both parties but especially our clients who can make use of the whole value chain advantages reached from one source, enabling smoother and more efficient R&D operations," says Nicholas Oksanen, Executive Vice President of Pöyry's Industry Business Group.

Did you know? Pöyry has been delivering bioindustry solutions for 60 years.

http://www.poyry.com/services/smart-solutions/bioindustry

About Poyry

Pöyry is an international consulting and engineering company that delivers smart solutions across power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry's net sales in 2016 were EUR 530 million. The company's shares are quoted on Nasdaq Helsinki (POY1V). Approximately, Poyry has 5500 experts. 40 countries. 130 offices.

Iran unchained: new opportunities for forest products trade?

Over a year has gone by since the IAEA (International Atomic Energy Agency) verified Tehran’s compliance with the nuclear agreement, and many of the economic sanctions against Iran were removed. During that time, the country’s relative isolation from international markets, especially those in the West, has led the country to establish an independent economy. While Iran has been successful in becoming self-sufficient, its open doors to much of the world has now put a spotlight on areas for investment where growth has faltered since the sanctions.

One of these untapped markets is Iran’s forest products – an area showing significant growth potential. Considering Iran’s raw material balances and demand prospects for forest products, probably the most obvious business opportunities for international players can be found in the wood raw material supply.

Forest Resources

Iran is located in the mid-latitude belt of arid and semi-arid regions of the earth. Consequently, Iran is sparsely forested with only some 7 million hectares of forest covering less than 5% of the nation’s land area. Most of Iran’s forests are found in the North in a region called the Hyrcanian forests and is the primary wood production region in the country accounting for about 30% (2.1 million hectares) of the country’s forest area. About 15% of the Hyrcanian forests are protected from harvesting. The main species of the Hyrcanian forests are hardwoods, including beech, hornbeam, maple, oak, alder, elm, ash and ironwood and a few softwoods including cypress, juniper and yew.

Iran is located in the mid-latitude belt of arid and semi-arid regions of the earth. Consequently, Iran is sparsely forested with only some 7 million hectares of forest covering less than 5% of the nation’s land area. Most of Iran’s forests are found in the North in a region called the Hyrcanian forests and is the primary wood production region in the country accounting for about 30% (2.1 million hectares) of the country’s forest area. About 15% of the Hyrcanian forests are protected from harvesting. The main species of the Hyrcanian forests are hardwoods, including beech, hornbeam, maple, oak, alder, elm, ash and ironwood and a few softwoods including cypress, juniper and yew.

The second most important forest area is located to the west, accounting for about 40% of the Iranian forest area and comprising mainly oak. However, Zagros is not suitable for industrial production because much of the area has been converted to grazing but has been found suitable for forest plantations. The last major forest area is called Mangrove forests in the south and is protected from harvesting.

Growing Wood Products and Paper Market

At present, there are hardly any sawmills left due to the shortage of sawlog-sized wood and the shortage of adequate water resources is a major constraint to plantation development. The Iran Government is not placing any serious emphasis on securing domestic wood supply – instead, the industry’s sentiment is that the state encourages wood imports instead of domestic supply.

The development of wood-based panels industry has been quite divergent despite the fact that it shares upstream challenges similar to the sawmilling sector. The market size is not monumental, but the potential for growth is significant. The increasing demand for modern furniture, built-in-fitments and other home-furnishing products will keep the Iranian wood-based panels market in a growth track well into the future. Panel exporters will likely maintain their presence in the country, but in particular, suppliers of modern panel production lines will likely activate in the future, as Iranian companies will invest in new technologies in an attempt to become more competitive.

Reliable data on industry output and product demand for Iran’s pulp and paper market is lacking considerably. However, most Iranian paper industry players share the view of a growing domestic market. But they face many of the same challenges as the wood raw material industry; a costly and limited supply of wood or fiber; a need to modernize mill assets and the threat of strong international competition. Potential foreign investors should see the opportunity in those challenges; it opens doors for foreign capital and investment in a market with high demand and little production.

Several factors including the modernization of society and retail trade, along with the rise of the middle class will eventually lead to the rise of packaging industry in Iran. The packaging industry is seeking ways to modernize existing assets and invest in new production lines – including primary paperboard production and packaging converting through final products packaging. Historically, Chinese suppliers have been the main beneficiaries of the rise of the packaging machinery market in Iran. With the lift of the sanctions however, Iran is also looking for high quality machinery from regions outside China, eyeing markets that have been banned in recent years.

Another sector that has the potential for profitability for Western investors is the Iranian tissue and hygiene sector which up until now has been dominated by domestic suppliers, and one Turkish group, in the absence of strong international players. The industry has invested somewhat ahead of demand in the anticipation of rapidly growing market. In terms of per capita consumption, Iran is lagging far behind the large Middle East countries as well as its global peers of the same income level, but is quickly catching up with them in terms of demand level.

Dawn of a New Economic Era?

The oil embargo and other economic sanctions have been the key reasons behind Iran’s flimsy economy during the current decade. However, the sanctions may have helped the country cope with the commodities slump by forcing it to diversify its economy. Iran is the third largest economy in the MENA region after Turkey and Saudi Arabia. It has the second largest population of the region after Egypt with an estimated 82.8 million people in 2016. Compared to most MENA countries, Iran is in a relatively good position in terms of oil dependency, thanks to the Government’s efforts to reduce dependency on oil and gas by focusing on expanding other sources of revenue.

Because of the sanctions and its relative isolation from the rest of the industrial world, Iran has had to make itself independent from the rest of the world. As a result, Iran has fostered a strong workforce – the country’s vast population is young, urbanized and highly educated and the country has an established manufactured commodities market. The opportunity for strong growth in key markets along with a reliable domestic workforce makes Tehran and other thriving metropolises attractive destinations for foreign businesses and set the stage for future investment post sanctions.

While many sanctions banning trade and finance remain in place due to concerns over Iran’s human rights record and military programs, the overseas business community should not lose perspective on the growing opportunities in the country. Iran has taken crucial steps to mend business relations with the West. It privatized its industrial sector and gives investment incentives for foreign capital. Most national and EU-level restrictions were eliminated after January 2016 and several European companies have taken advantage of this situation. These include European Airbus, Italy’s state rail company, the French car maker Renault and the Danish pharmaceutical company Novo Nordisk to name a few. Further, a number of Asian firms are already making steady inroads to the Iranian markets.

China intends to fully exploit the potential for cooperation with Iran, predominately in infrastructural projects and manufacturing. China’s Silk Road Strategy provides the framework and encourages Chinese companies to increase their involvement in the opening Iranian market. This would be a reason good enough for the European businesses to take a closer look at hiding opportunities in one of the most stable Middle East markets at the moment.

Accessing the Market

Iran offers one of the few forest products markets that are showing significant growth potential which, owing to the country’s vast population base, can turn out considerable in terms of both volume and value. It is therefore recommended and meaningful for business developers and marketing managers to investigate the country’s existing and emerging opportunities.

Access to relevant market information is necessary for companies that want to discover trading and investment opportunities in Iran. The to-do list should include collection of market data and finding the right local partners in the country, as well as checking global compliance/sanctions lists to ensure that business is conducted by the book. All things considered, businesses need to understand the nature and extent of the current (remaining) restrictions and be prepared for possible challenges.

The Iranian wood processing, paper and packaging industry is currently modernizing its asset base. Investments that are enhancing cost competitiveness and product quality will be on the front burner, thus providing business opportunities for machinery and equipment vendors in Europe and Asia. New opportunities for packaging and converting firms will open up as FMCG companies have paved their way onto the market and started to form local and international partnerships in order to develop their offering in the country.

How is M&A activity shaping the European tissue industry?

Pirkko Petäjä, Principal at Pöyry Management Consulting, and Mikko Helin, Senior Consultant

Since 2000, the European tissue volume has grown from 5.7 million tons to almost 8.5 million tons. A clear trend connected to this growth has been consolidation of the largest players.

Consolidation is a clear trend in the European tissue industry

The large producers have been growing through sizeable acquisitions, as well as by organic growth. The most active acquirers have been SCA, Sofidel and WEPA, while all of the mentioned, and in addition ICTTronchetti, have also been active builders of new capacity. The capacity share of the three largest players has grown from approximately 40% to 50%.

The large producers have been growing through sizeable acquisitions, as well as by organic growth. The most active acquirers have been SCA, Sofidel and WEPA, while all of the mentioned, and in addition ICTTronchetti, have also been active builders of new capacity. The capacity share of the three largest players has grown from approximately 40% to 50%.

The business environment is better in a consolidated market. The impact of consolidation is also reflected in the performance of individual companies; after the consolidation steps in Europe, SCA’s tissue business experienced evidently higher and more stable margins. While large companies have been becoming even larger, there has been a continuous stream of new entrants to the tissue business, as barriers to entry are relatively low. The Eastern European industry especially is still fairly fragmented, and consolidation could significantly improve this business environment.

European tissue M&A over the last 15 years

The leading European tissue companies have targeted major strategic acquisitions, such as SCA’s acquisition of P&G and G-P, Sofidel’s acquisition of LPC and WEPA’s of Kartogroup. These deals have resulted in significant synergy benefits and positively impacted the business environment. There is, however, a limited number of opportunities for large acquisitions. Finding one buyer for all, or the majority of, assets has become difficult. This has led K-C to actively divest its less profitable units and locations, where it does not have ‘number 1 brand position’. Since 2000, K-C has divested some 300,000 t/a tissue capacity as individual mills to different buyers.

In the same time period, most of the largest companies in the industry have made a clear transformation through acquisitions. SCA, the clear leader in the M&A activity, has more than doubled its size in the last 15 years. Sofidel first expanded throughout Europe with new mills, and then through acquisitions. Sofidel has grown into a million ton company, and has recently started to expand outside of Europe. WEPA made one of the biggest leaps by first acquiring Kartogroup, and more recently through active organic growth and complementary smaller acquisitions. Kimberly Clark has been a clear exception - its capacity in Europe has reduced over 30%. Metsä Tissue has been stagnant. The last acquisition they made was ten years ago, and the company’s organic growth has been cautious, mainly replacing outdated capacity. Companies on the smaller end of this spectrum have grown steadily and have doubled their capacity since 2000. Lucart has made acquisitions and built mills in France and Italy, and Carrara in Italy.

Recent M&A ac tivities focused on small companies and individuals mills

In the last five years, since SCA’s G-P acquisition in 2012, European tissue acquisitions have been relatively small. Deals have included re-arrangements related to the aftermath of the G-P exit: Sofidel’s completion of its portfolio through purchase of selected targets, and WEPA’s strategic acquisitions in the UK and France, and divestment of two Italian mills. In addition, recent deals have involved acquisitions of individual single mills, or small companies, where the buyer is often a private equity fund and in many cases, the seller is K-C.

In some cases, there is distinct strategic benefit to the smaller deals. These are often concentrated to the CEE, currently a ‘hot’ area in European tissue. The Paloma deal, whereby the Slovenian company finally ended up with the Slovakian SHP, is one step towards Eastern European consolidation. Also, the Abris Capital acquisition of the Romanian Pehart Tec forms a future platform for further consolidation. In the Iberian Peninsula, strategic investments include Cominter acquiring Cellulosas de Hernani, and Portucel acquiring AMS. The acquisition by Portucel (now the Navigator Company) of AMS-Paper in Portugal anticipates a future significant move into the tissue sector. Other strategic acquisitions include purchase of independent converters or independent converters acquiring base paper mills.

Industrial buyers complement their portfolios with acquisitions and target stronger position, consolidation and synergy benefits. Financial investors have become more interested in tissue acquisitions than before. In many cases, there is a clear strategic intent behind these deals as well.

Characteristics of organic growth and new builds

A large share of the new tissue capacity in Europe has been built by larger companies that have renewed their assets or grown organically.

- Tronchetti has built 350,000 t/a new capacity in the last some fifteen years

- SCA has closed down 180,000 t/a obsolete capacity and built 275,000 t/a new

- Sofidel has grown outside Italian markets with 250,000 t/a new capacity WEPA has soon built 190,000 t/a new capacity, speeding up in the last few years

New capacity has also been built by small and medium size established players and by newcomers. The Iberian Peninsula specifically has seen many investments (AMS, Suavecel, Paper Prime, Renova) and more capacity increases are planned. Eastern Europe has also seen an increase of new investments. Part of these has been made by established large groups such as SCA and ICT. Russian companies such as Syassky and Syktyvkar Tissue Group have also grown to sizable players in a relatively short time. Pehart Tec investments have been supported by the new owner, Abris Capital.

There are various players adding single width machines to replace old capacity, or just to grow or start producing tissue. Only the largest industrial companies have added double width machines.

New Generation of Tissue Entry

Tissue capacity increase is not only by expansion of existing producers but there is versatile motivation for new entrants. This can be push or decline of their current businesses - for example, smaller pulp mills losing competitiveness and integrating to tissue or graphic paper sites, looking for new opportunity due to their declining market. There are also cost benefits for this type of entry in terms of both manufacturing and investment costs. For a newcomer the entry is often much easier to an existing site.

Entry into the tissue market often starts from converting. When capacity is high enough for a paper machine, many independent converters start to consider their own paper production. Margins are normally higher for an integrated player as the concept has many cost benefits, while the producer is also stronger and less vulnerable with its own base paper. Consequently, adding base paper production is attractive to sizable independent tissue converters.

Investors are currently active in the tissue sector making base paper additions possible, and enabling consolidation moves. Therefore, even investors can be considered a new entrant group.

Large family companies and financial owners increasing their share of the industry

In the 1990s large multinational paper or hygiene companies accounted for a large share of tissue companies in Europe. Family companies were small and more locally based. A significant share of tissue companies were private, local single mill companies. The number of large listed and multinational companies has reduced from those days. Current major ones include SCA, K-C and Metsä Group (Metsä Tissue). The exit of North American companies from Europe has reduced the presence of multinationals and non-European companies significantly.

Family-owned companies have grown significantly, spreading across and even outside of European regions. New family companies have also become more visible. In addition, the industry has seen the reincarnation of family companies, such as Carrara Group carrying the family name of former Cartoinvest owners and the independent converter Leicester Tissue Company owned by the Tejani family (former owner of LPC).

Financial owners are also becoming more common in tissue, especially in growth areas such as Iberia and Eastern Europe. Local funds have been common participants in smaller deals, while large international funds have always shown interest when anything significant has been for sale, as now related to the recent split of SCA into two companies.

There are investors behind several tissue companies, either full or partial. In addition, there are various small privately or even state owned companies. For many small companies the ownership structure is not known.

The European top 100 tissue base paper producers’ capacity is broken down into different ownership categories. Family and private companies account for approximately 40% of capacity. Listed, large, and often multinational companies are the second biggest group.

Investor ownership of tissue base paper producers accounts for approximately 7% of ownerships. This analysis does not include independent converters, which are mostly private companies, but can also be owned by investor funds (e.g. Accrol Paper). Minority ownerships, such as the case of Syktyvkar Tissue Group (30% Venture Investments & Yield Management), are also excluded from this estimate. Considering all of this, it is fair to say that some 10% of the European tissue business is in the hands of financial owners. There are no large groups involved in this type of ownership at the moment, although in Eastern Europe this kind of players are developing.