Displaying items by tag: Pöyry

Nanocellulose: The next big thing in bioeconomy?

While nanocellulose was discovered already in the late 1970s, it was only in the last ten years that a rise of patent applications related to nanocellulose occurred. As promising as the nanocellulose materials do sound, we are still waiting to see their concrete applications expand to mass production.

Nanocellulose is nano-structured material derived from cellulose fiber. Depending on the nanocellulose type, it typically measures between 2-50 nm in width and 100-5 000 nm in length, which compares to 80 000 nm of human hair width and 0.3 nm of a gold atom’s width. Nanocellulose has numerous beneficial qualities, including light weight as well as high strength and absorbency, which means it can improve the functionality and cost-effectiveness of various materials and products. Nanocellulose is completely renewable which gives it an advantage over fossil fuel based raw materials.

A variety of applications across industries

The potential applications for nanocellulose are numerous, including the paper and board, composites, food, cosmetic and pharmaceutical as well as electronics industries.

Probably the first application for bacterial nanocellulose, one of the main categories of nanocellulose, was developed back in 1989 when Sony made a limited set of 2,000 units of headphones. Sony apparently tried every conventional material for forming diaphragms but found nothing which would yield the 'broad, deep sound of a room speaker system' and eventually discovered "bio-cellulose”. The price for the headphones was a staggering 2,499.95 US dollars. Since then, due to its high purity, bacterial nanocellulose has been used in applications such as wound dressings, face masks and artificial blood vessels. It is produced synthetically from low molecular weight sugars such as glucose by using acetic acid bacteria.

Nanocrystalline cellulose (NCC or CNC), another type of nanocellulose, is produced by strong acid hydrolysis and is already being manufactured in a demo production plant in Canada by CelluForce. However, actual high volume applications are still missing. So far it has been tested in oil drilling applications and used in adhesives. As far as composite use, the problem is how to utilize the full strength potential of the crystals as they easily behave like a filler.

Nanofibrillated cellulose (NFC), the third main category, is produced by mechanical fibrillation and can be used in industrial and food applications as a rheology modifier. It has also potential for use as a barrier material in food packaging as it has better oxygen barrier properties than polyethylene for example. Wood-derived ingredients, such as xylitol (E967), microcrystalline cellulose (E460), cellulose powder (E460) and carboxymethylcellulose (E466) have been used as food additives already for decades. However, food additive or novel food legislation does not – at least yet – cover nanofibrillated cellulose. It seems likely though that nanofibrillated cellulose will be added to E460.

The packaging industry is driving ecological and lighter packaging material, favoring low grammage coated boards. With nanofibrillated cellulose, the basis weight of board material can be reduced without compromising the required strength properties. The result is light weight products that consume less raw materials, which, in turn, increases revenue and creates smaller ecological footprint. For this reason, nanofibrillated cellulose is already being produced in industrial scale and has found its way into a high volume application in the liquid packaging board industry.

Building a solid business case

The above means that the best option is to produce nanofibrillated cellulose at the same site where it is used. For example in the board application, this integration provides clear advantage in quality and in energy efficiency.

A large scale production of bacterial nanocellulose would require high volumes of sugars, nutrients and fermentation tanks. In addition, production capability is also very low, at 0.4 g/l/h. The solution could lie in genetically-altered algae that would be entirely self-sustaining. They could produce their own food from sunlight and water, and absorb carbon dioxide from the atmosphere.

Nanocelluloses are generally considered expensive and challenging to produce. High energy consumption and complicated chemistry create a hindrance for entry to market, added to the competition from already existing products. This means that it would be crucial to create completely new applications or significant added value compared to existing rivals. In addition, current low oil prices can have a negative effect on novel products that might not be able to compete in the same price league.

The key is to identify the applications where currently available products can be out-performed by nanocellulose. In the optimal case, nanocellulose would solve a problem where existing products have failed. This would also require that customers understand the potential of nanocellulose and create a market-pull for the product.

In the end, it all comes down to bringing together the right specialists with extensive knowhow and tuned mindset for solving these obstacles.

Did you know?

Pöyry is involved in nanocellulose business through its Pöyry µCellTM process concept for producing nanocellulose reinforced packaging board. We also provide market entry and business development strategies, technical concept studies and market analyses.

Pöyry at Lignofuels 2017: Mastering the whole value chain a prerequisite for profitable bioproduct business

Advanced biofuels and biomaterials have been high on industrial companies’ agendas for several years. Investments in R&D, pilot projects and development initiatives have also generated some commercial scale production, but a lot of potential is still untapped.

Nicholas Oksanen, President of Pöyry’s Industry Business Group, recently gave a presentation at the Lignofuels 2017 Conference in Helsinki, Finland, about advanced biofuels and materials and a European market overview. In his presentation, Oksanen noted that woody biomass is gaining interest as a feedstock for biofuels while its use is still rather limited.

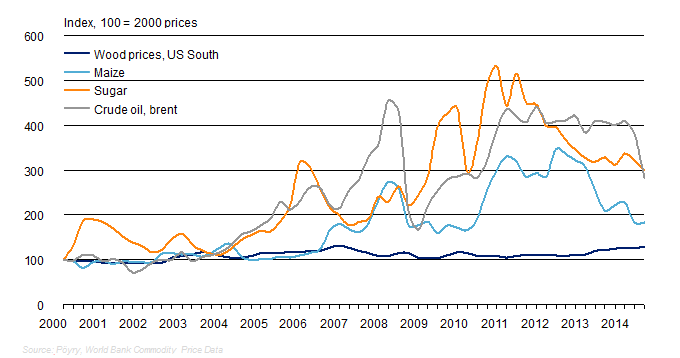

The benefit of advanced, or 2nd generation feedstocks (lignocellulosic feedstocks, non-food crops, industrial waste and residues), is that they are more sustainable compared to 1st generation, food or feed based feedstocks such as corn, sugarcane, soybean oil or rapeseed oil. Secondly, compared to crude oil, sugar and maize, the price level of wood has remained stable through the 2000s and 2010s while the prices of the alternative feedstocks have experienced great fluctuation. Also, by using harvesting and side-stream residues as biofuel and materials feedstock instead of burning them for energy, companies are able to maximise added value.

Woody biomass is gaining interest as feedstock for bioproducts

source: Pöyry

“Biobased products also present new product opportunities for industry players. For example lignin, nanocellulose, hemicelluloce or tall oil open new business potential for bioenergy, biofuels and biochemical sectors and the packaging industry,” Oksanen said. “The EU’s ‘Renewable Energy Directive’, which prioritises waste and residues, has also increased the industry’s interest in 2nd generation feedstocks.”

Bioproduct opportunities for Pulp & Paper companies

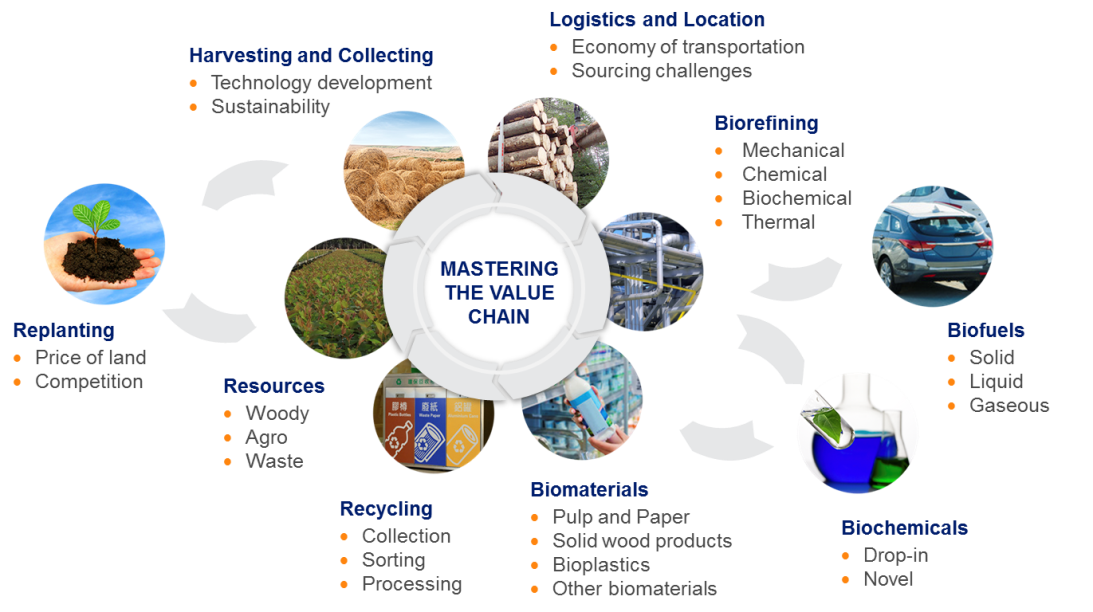

source: Pöyry

While the opportunities are lucrative, there are challenges that have slowed down larger scale bioproduct investments. At the moment, one of the major challenges is caused by political uncertainty and the direction of the EU legislation, imposing a market risk for companies. Also, country-based biofuel policy mechanisms would require harmonisation. With the exception of wood, advanced feedstock sourcing and the supply chain is still immature and requires further development before it can be relied on.

“For companies, the main focus is to find a valid business case in which the feedstock price plays a big role. However, it is crucial to master the whole value chain from feedstock to markets to ensure profitable business and investment,” Oksanen summarises.

source: Pöyry

About Pöyry

Pöyry is an international consulting and engineering company. We deliver smart solutions across power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry's net sales in 2016 were EUR 530 million. The company's shares are quoted on Nasdaq Helsinki (POY1V). Approximately 5500 experts. 40 countries. 130 offices.

Tall Oil: Unlocking opportunities for pulp mills in the bioeconomy

Thanks to renewable energy regulations, the demand for tall oil is increasing. The by-product of the kraft pulping process industry can improve the efficiency of a pulp mill and be sold as a commercial product to processing industries.

The EU’s ‘Renewable Energy Directive’ requires all EU countries to ensure that at least 10% of their transport fuels come from renewable sources by 2020. The EU is also planning even more ambitious targets for greenhouse gas emission reductions to fulfill its pledges towards the Paris Agreement of which decarbonisation of the transport sector is a cornerstone.

This regulatory nudge has increased interest in tall oil as a biofuel feedstock.However,this emerging demand for the raw material competes with the use for more traditional tall oil derivatives, such as resin and fatty acids produced in distilleries. Whilst the price for crude tall oil has been slowly increasing to around 400-500 EUR/t, due to biodiesel competition and increase of the distillates product prices, the regulatory pull increases the competitiveness of tall oil as a biofuel feedstock from a biofuel manufacturer’s perspective.

What is tall oil?

Tall oil is a commercially important by-product of softwood (i.e. pine or spruce) from pulp production. It is produced by first separating ‘tall oil soap’ from the ‘black liquor’ that is formed in the pulping process. The tall oil soap can then be reacted with acid to product ‘crude tall oil’.

Pulp mills burn the black liquor to generate heat and electricity. As soap removes some capacity of burning the black liquor and hinders the operation of the evaporation plant , it makes sense for the mills to separate the soap from black liquor.

Besides producing tall oil of the separated soap, soap can alternatively be sold or burned for additional electric power but this is often not so profitable.

So in addition to bringing income to the mill as a commercial product (even more than selling the soap as such), separating tall oil from soap improves the overall efficiency and operations of the mill as primary processes are not compromised.

Capacity expansion potential

As the price of crude tall oil increases, coupled with more modern techniques for extracting this raw material at existing softwood pulp mills, it is becoming more and more lucrative for pulp producers.

As the price of crude tall oil increases, coupled with more modern techniques for extracting this raw material at existing softwood pulp mills, it is becoming more and more lucrative for pulp producers.

The key factors impacting the profitability of tall oil production are:

- the local market environment and demand

- the scale of pulp production

When the softwood pulp production capacity is roughly 100,000 tons per year or more, tall oil separation for commercial purposes is usually more profitable than the alternative use of soap.

Currently, there are an estimated 40 softwood pulp mills globally that could utilise tall oil separation based on their annual pulp production capacity but are yet to capitalise on the opportunity. In Northern and Central Europe, tall oil separation is already quite common but the biggest untapped potential with current pulp production assets lies in the US.

Tall oil business case

Investment in a new tall oil plant is a feasible option both for mills with too small or outdated tall oil plants as well as for mills without an existing plant. For mills that sell tall oil soap and do not have a tall oil acidulation plant, the investment payback time is usually between 1-3 years.

In case the mill burns the soap in the recovery boiler, commercial benefits are further improved by the fact that the mill can increase pulp production when recovery boiler capacity can be utilised for black liquor combustion instead of soap burning. If a too small or outdated tall oil plant is renewed with the aim of increasing tall oil production by 25%, the investment payback time varies between 2-5 years.

Based on pulp production growth forecasts up to 2030, an additional 300,000 tons p/a of crude tall oil could enter the market. These capacity expansions would help supply the growing demand for crude tall oil and would mark significant growth opportunities for tall oil applications.

Did you know?

Pöyry provides complete, value adding service offering to pulp mills, from developing raw material sourcing strategies and conducting market research and business case analysis to delivering HDS® (Hydro Dynamic Separator) tall oil plants and providing operational support and performance improvement. Over the past 30 years, we have delivered more than a third of the world’s tall oil plants and helped several mills to design or improve their soap and tall oil separation processes in order to increase profitability and efficiency to drive growth.

Jarno Peltonen Director, Pulp Technology, Industry Business Group, Pöyry A new Pöyry Point of View explores how e-commerce is creating unique opportunities for containerboard mills and converters.

The article, ‘The Delivery Economy: When boxes fly', outlines how the continual increase in delivery based, convenience shopping is making companies consider every ounce and pound of their packaging, as they seek to drive down shipping costs. Some well-known companies are taking this a step further; Amazon, Google and UPS are working on unmanned drone delivery systems where reduced size and weight of packaging will be even more vital. These developments are driving the emergence of lightweight containerboard in the delivery economy.

Soile Kilpi, Director at Pöyry Management Consulting North America states, "If you are a mill or a converter that provides the paper and board for packaging who is cutting precious ounces from the corrugated container, you could have a lot to gain from these new opportunities – however futuristic they may currently seem.”

Soile Kilpi, Director at Pöyry Management Consulting North America states, "If you are a mill or a converter that provides the paper and board for packaging who is cutting precious ounces from the corrugated container, you could have a lot to gain from these new opportunities – however futuristic they may currently seem.”

The article argues that the delivery economy provides multiple business development paths for a corrugated manufacturer in addition to drone delivery. The Point of View contains numerous best practice examples, highlighting real case studies to illustrate these points.

Kilpi continues, "Mega trends support the idea that the delivery economy is here to stay. The convenience of the delivery economy is supported by increasing urbanisation and household trends. Efforts for more sustainable solutions, whether done to reduce costs through lighter and less packaging or for environmental stewardship, are not going away.”

America’s population may be aging, but older generations are also getting tech savvy and embracing e-commerce. Millennials have practically lived their whole adult lives with e-commerce and have formed shopping habits around its existence. With this in mind, corrugated manufacturers must embrace all the new possibilities this presents.

Download the report

The Delivery Economy: When Boxes Fly Point of View report

About Pöyry

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2015 were EUR 575 million and the company's shares are quoted on Nasdaq Helsinki (Pöyry PLC: POY1V).

World Fibre Outlook 2030: Global consumption of papermaking fibre and specialty pulps has grown by 125% since 1980

The new global pulp market study “World Fibre Outlook up to 2030” by Pöyry Management Consulting details how global consumption of papermaking fibre and specialty pulps has grown from 185 million tonnes in 1980 to 416 million tonnes in 2014 – representing a growth of 125%.

The new global pulp market study “World Fibre Outlook up to 2030” by Pöyry Management Consulting details how global consumption of papermaking fibre and specialty pulps has grown from 185 million tonnes in 1980 to 416 million tonnes in 2014 – representing a growth of 125%.

The past 35 years have witnessed major changes in the paper industry’s fibre furnish. The recovered paper industry has seen a 28% increase in its share of the market, with global consumption levelling at 233 million tonnes in 2014. During the same period, the share of wood pulp has declined by 27% with global consumption amounting to 167 million tonnes in 2014.

According to the Pöyry study which looks at ten geographic regions and ten product areas including papermaking and specialty fibre grades, global demand for paper and paperboard is forecast to grow by 1.0%/a in the long term, from about 400 million tonnes in 2014 to 467 million tonnes by 2030. This growth is driven by the emerging markets with Asia accounting for 95% of global incremental paper and paperboard consumption during 2014-2030.

The global papermaking fibre market is facing profound changes with China’s economy starting to slow down and uncertainty growing in other parts of the world. The study by Pöyry provides insights into this increasingly turbulent market and notes that with paper market slow-down, coupled with the combination of several new pulp lines coming on stream at close intervals to each other, the global pulp industry is facing a real risk of value destruction.

Pöyry forecast that maintaining equilibrium despite the evolving new large-scale supply will be one of the key challenges for the pulp industry towards the 2020s. The report highlights that there is a strong need for restructuring within the global pulp industry and supply/demand balances will inevitably then be restored over time.

The study proposes that investments made ahead of demand in low cost areas will inevitably lead to exits of higher cost suppliers. Meanwhile, over-capacity in the lower sections of the supply curve will result in declining equilibrium prices and lowered producer surplus, thus affecting all players in the market.

The “World Fibre Outlook up to 2030” study provides a strategic platform and essential business information for all business participants, including pulp and paper companies, chemicals, machinery and related suppliers, investors, financiers, institutions, pulp traders, logistics companies and other interest groups.

Link to order form:

http://www.poyry.com/sites/default/files/wfo_up_to_2030_brochure_web.pdf

Pöyry awarded detailed engineering assignment for Kruger's paper machine rebuild project in Quebec

Kruger Trois-Rivières L.P. has awarded Pöyry (Montreal) Inc. detailed engineering services assignment for the rebuild of the Trois-Rivières No. 10 newsprint machine into a state-of-the-art lightweight and high-strength recycled linerboard production facility. The assignment covers the recycled old corrugated container plant (OCC), paper machine inter-connections, balance-of-plant, upgrade engineering to the mill control systems, extensive migration engineering of the existing control system, and engineering for dismantling of replaced systems.

Kruger Trois-Rivières L.P. has awarded Pöyry (Montreal) Inc. detailed engineering services assignment for the rebuild of the Trois-Rivières No. 10 newsprint machine into a state-of-the-art lightweight and high-strength recycled linerboard production facility. The assignment covers the recycled old corrugated container plant (OCC), paper machine inter-connections, balance-of-plant, upgrade engineering to the mill control systems, extensive migration engineering of the existing control system, and engineering for dismantling of replaced systems.

Kruger is a leading paper producer in North America. The Trois-Rivières project is one of their most important capital expenditures in recent years. The modernisation project includes the installation of a modern OCC production facility and a comprehensive rebuild of the existing PM 10 newsprint machine to a high-quality and high-performance lightweight linerboard machine. Pöyry's assignment includes services for the installation of a new starch system, chemical systems, heat recovery and modifications to the existing stock approach system.

During the 20-month conversion project, the existing newsprint machine will be extensively modernised to incorporate advanced containerboard manufacturing technology. The new production line will produce 360,000 metric tons per year of lightweight and high-strength linerboard using 100% recycled corrugated containerbaord as raw material.

"Thanks to Pöyry's proven track record, we trust that this production line rebuild will be highly successful and that PM10 will rank among the very best lightweight and high-strength containerboard production lines in North America," says Christian Lemay, Project Manager at Kruger Trois-Rivières L.P.

"The assignment is an important continuation for this key client relationship, and previous studies carried out by Pöyry will be a significant reference strengthening Pöyry's strong position as a leading engineering consultant for pulp & paper industry in the North American market," says Vilho Salovaara, President of Pöyry's Regional Operations North America.

The value of the order is not disclosed. The order was recognised within the Regional Operations order stock in Q4/2015.

Additional information by:

Vilho Salovaara

President, Regional Operations North America

Tel: +1 514 341 3221

Robert Baril

Senior Project Manager

Tel.: +1 514 341 3221

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2014 were EUR 571 million and the company's shares are quoted on Nasdaq Helsinki (Pöyry PLC: POY1V).

$670 billion global packaging industry set for continued growth fuelled by innovation

Pöyry and Stora Enso detail packaging trends at annual Investors Breakfast in London

Executives from Pöyry Management Consulting and Stora Enso detailed the drivers behind a buoyant packaging market that is due to see growth across all materials.

Pöyry Management Consulting selected the Future of Packaging theme for its annual Investors Breakfast held at Stationers’ Hall in London. The packaging sector has enjoyed stable growth for the past two decades, has proven to be largely recession proof, enjoys an optimistic outlook for the years ahead and generates attractive returns on private equity investment.

Pöyry Management Consulting selected the Future of Packaging theme for its annual Investors Breakfast held at Stationers’ Hall in London. The packaging sector has enjoyed stable growth for the past two decades, has proven to be largely recession proof, enjoys an optimistic outlook for the years ahead and generates attractive returns on private equity investment.

Jarkko Sairanen, President at Pöyry Management Consulting, said, “Packaging is a $670 billion market and we are seeing positive growth across all packaging materials – this makes it a very exciting and dynamic industry at the moment. This truly global industry is performing well globally – and very well in the Asia Pacific region in particular due to the link between demand and population growth. The other drivers of this vast industry are interlinked and complex but include retail structures and competition, consumer behavior, materials and technology, cost, sustainability and regulation. It is a pleasure to bring together investors and industry figures at our event to discuss these issues in depth.”

Special industry guest Jari Latvanen, Executive Vice President, Head of Consumer Board at Stora Enso, delivered a presentation informed by his FMCG background and understanding of consumer purchasing behavior and trends. He identified the consumers as the key driver for both growth and change, and linked the brand owners and Stora Enso responses to the observed consumer behavior.

Latvanen said, “The future is now. At Stora Enso we believe that everything that’s made with fossil-based material today can be made from a tree tomorrow. There are some exciting innovations taking place in this area such as micro fibrillated cellulose (MFC). With MFC, you can make high-quality packaging that is lighter and more durable from less raw materials. You’ll get more for less, without compromising on quality.

“The demand for more paperboard packaging from consumers is also clear and this technology helps us to do more to match it. We work across the value chain to understand consumers who are increasingly conscious of what goes into their food and how that is packaged and delivered. Brands can no longer ignore this. We need a 360 degree view of the product.”

Sairanen was joined by fellow Pöyry consultants David Powlson and Outi Juntti who added additional perspectives on the forces shaping the future of packaging such as sustainability, and the need for packaging producers to continuously maintain the balance between cost, quality and functionality as well introduce cutting –edge technologies such as RFID.

Managing Director of Pöyry Capital, Cele Moncayo-Quiros analysed packaging as an asset class and covered the financial responses from the public and private equity markets to the growth of packaging. On the private equity side, he explained how some packaging companies were being broken up for IPOs and divestitures and that these investments were generating returns in the range of 30-70% for the private equity funds. Pitfalls of packaging investments and observed M&A packaging mega trends were also outlined.

About Pöyry

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2014 were EUR 571 million and the company's shares are quoted on NASDAQ OMX Helsinki (Pöyry PLC: POY1V).

Website: www.poyry.com

Pöyry awarded two engineering services assignments for BillerudKorsnäs, Sweden

BillerudKorsnäs has awarded Pöyry with two engineering services assignments in Sweden. One for a new board machine project in their production site in Gruvön; and the other for the machine glazed (MG) paper machine relocation project from Tervasaari in Finland to Skärblacka in Sweden.

BillerudKorsnäs has awarded Pöyry with two engineering services assignments in Sweden. One for a new board machine project in their production site in Gruvön; and the other for the machine glazed (MG) paper machine relocation project from Tervasaari in Finland to Skärblacka in Sweden.

BillerudKorsnäs is a leading supplier of renewable fibre-based packaging materials and solutions, and one of the world leaders in liquid packaging board and other virgin fibre cartonboard. Driven by global megatrends, the demand for these types of board is increasing. BillerudKorsnäs is investigating the possibility of installing a new board machine at the production unit in Gruvön. The machine would become one of the most cost efficient in the world with a capacity of approximately 500 000 t/a of liquid packaging board, cartonboard, food service board and white kraftliner. Pöyry has been awarded pre-project engineering services to develop the investment plan into a viable technical concept.

Simultaneously, BillerudKorsnäs is launching a separate investigation into potential further structural change and growth in specific kraft paper segments. The investigation includes exploring the possibility of moving and integrating the MG paper machine in Tervasaari, Finland, to pulp production at Skärblacka, Sweden. The investigation will also look at investment in further value adding surface treatment capacity at the existing MG paper production in Skärblacka. If implemented, the investments would strengthen Skärblacka's position as one of the world's most efficient production units for white MG papers while also opening up opportunities in attractive market segments within medical papers, food packaging and release liners. Pöyry's assignment covers pre-project engineering services for the machine relocation.

"These projects are evidence of our successful operation model where global competence and local presence are combined. We are executing this project with experts from Sweden and Finland to ensure the best result for the client. We are proud to be the selected partner of BillerudKorsnäs with these strategically important development opportunity investigations. These assignments further strengthen Pöyry's position as the world's leading pulp and paper engineering consultancy.", says Johan Ehrnrooth, Pöyry's Vice President, Pulp & Paper Europe.

The values of the orders are not disclosed. The orders will be recognised within the Industry Business Group order stock in Q4/2015.

PÖYRY PLC

Additional information by:

Johan Ehrnrooth

Vice President, Pulp & Paper Europe

Tel: +358 10 33 22294

Stefan Nyström

Managing Director, Pöyry Sweden

Tel: +358 40 733 6145

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2014 were EUR 571 million and the company's shares are quoted on NASDAQ OMX Helsinki (Pöyry PLC: POY1V).

Pöyry awarded EPC assignment for tall oil plant at Metsä Group's bioproduct mill

Metsä Fibre has awarded Pöyry with an EPC agreement to deliver a tall oil plant for a bioproduct mill being built in Äänekoski, Finland. The assignment covers the total delivery of a tall oil plant, consisting of the design, procurement and delivery of main and auxiliary equipment. The approximately two-year project has started in October 2015.

Metsä Fibre has awarded Pöyry with an EPC agreement to deliver a tall oil plant for a bioproduct mill being built in Äänekoski, Finland. The assignment covers the total delivery of a tall oil plant, consisting of the design, procurement and delivery of main and auxiliary equipment. The approximately two-year project has started in October 2015.

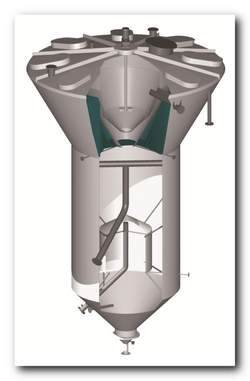

The tall oil plant is the largest single-line plant delivered by Pöyry, with a capacity of 10 t/h of tall oil. The plant is based on Pöyry's patented HDS® technology. Pöyry has delivered more than 20 plants based on the same technology in Europe, China, the United States and Canada, with two projects currently in progress in Finland. The plant combines high yields and usability with low operating costs. It produces a high-quality crude tall oil which, after processing, can be used in various applications.

"The crude tall oil is an important product in the bioproduct mill. We have good experiences of HDS® technology in other Metsä Fibre mills and we believe that we can maximise the tall oil production in a cost effective way with the solution chosen," says Timo Merikallio, director of the bioproduct mill project. Metsä Fibre is a part of the Metsä Group.

"We are proud that Metsä Fibre selected Pöyry as the tall oil plant supplier for its next-generation bioproduct mill. This shows the trust in Pöyry's ability to tailor its technology according to customers' requirements," says Ilkka Heikkilä, regional director of Pöyry's Energy business group in Finland.

The value of the assignment will not be disclosed. The order will be recognised within the Energy business group's order stock for Q4 in 2015.

Additional information from:

Ilkka Heikkilä

Regional director, Energy business group, Finland

Tel. +358 1033 24268

Anja Silvennoinen

President, Energy business group

Tel. +358 1033 49018

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2014 were EUR 571 million and the company's shares are quoted on NASDAQ OMX Helsinki (Pöyry PLC: POY1V).

Pöyry awarded EPCM services assignment by Suominen for a new wetlaid production line in USA

Suominen has awarded Pöyry (Appleton) LLC with the EPCM services assignment for the installation of a new wetlaid production line to be located in its Bethune plant, South Carolina, USA. The project includes the installation of a new wetlaid line as well as associated process, electrical and automation systems.

Suominen has awarded Pöyry (Appleton) LLC with the EPCM services assignment for the installation of a new wetlaid production line to be located in its Bethune plant, South Carolina, USA. The project includes the installation of a new wetlaid line as well as associated process, electrical and automation systems.

The investment is expected to create at least 25 jobs at the Suominen Bethune plant and the new line is anticipated to be installed in the second half of 2016.

"To achieve the targeted substantial growth, we seek to increase both our sales volumes and the share of products with higher value-added in our portfolio. Therefore, the new production line will focus on supplying nonwovens with higher added value for, among others, household and industrial wiping as well as flushable applications" says Nina Kopola, President & CEO of Suominen Corporation.

"This is an important new project reference in the wiping and hygienic applications and a continuation of a key client relationship for Pöyry" says Vilho Salovaara, President of Pöyry's Regional Operations North America.

The value of the order is not disclosed. The order will be recognised within the Regional Operations Business Line order stock in Q3/2015.

Additional information by:

Michael Hooyman

Managing Director, Pöyry (Appleton) LLC, Regional Operations North America

Tel: +1 920 954 2374

Vilho Salovaara

President, Regional Operations North America

Tel: +1 438 824 3157

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2014 were EUR 571 million and the company's shares are quoted on NASDAQ OMX Helsinki (Pöyry PLC: POY1V).