Displaying items by tag: Smithers Pira

Four technologies poised to disrupt the specialty paper market

In its latest research Smithers Pira has identified four novel technologies that are set to increase capacity and enable new product opportunities for manufacturers of specialty papers across the next five years.

The new Smithers Pira market report – The Future of Speciality Papers to 2022 – provides a comprehensive overview of this important sector of the paper industry. It incorporates both higher volume applications, like flexible packaging and label stocks, and more niche segments like electrical insulation, filtration, and security papers.

Smithers Pira analyses the different fortunes to chart how global consumption of speciality papers in 2017 has reached 24.16 million tonnes. Steady growth will continue through the end of the decade at 2.2% per year to push this figure to 26.98 million tonnes in 2022.

US perspective

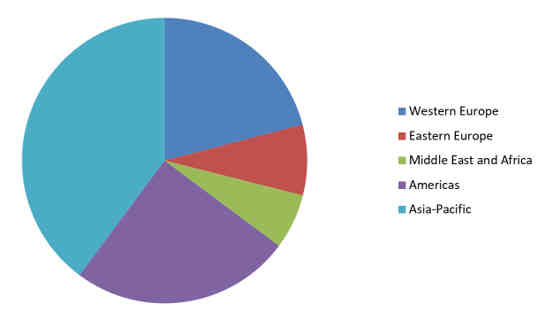

Unsurprisingly the US dominates specialty paper demand in the Western hemisphere. In 2017 US market share for the Americas is 64% (by volume); or just over 16% of global demand. Expansion in the US, will continue across the next five years, but at a slower rate to less mature markets in the region, principally Brazil. Across the next five years the US will also be displaced by China as the world’s single largest national market for specialty papers.

Regional market shares for specialty papers (by tonnage, 2017) Source: Smithers Pira

The plummet in printing and writing paper demand linked to the emergence of the Internet began in the US, and it continues to reshape the papermaking landscape. Speciality papers have become attractive for stranded assets that are new and can be economically refocused – filtration and battery insulator papers in particular are showing good resilience in the face of the broader industry competition with polymer alternatives.

Simultaneously the paper industry continues its consolidation trend, which is carrying over into the speciality business.

Disruptive technologies

As a diverse, high-value sector, the specialty papers market provides a strong forum for the initial deployment of technical innovations, to open new market applications and realise production efficiencies.

Smithers research has identified four key developments that will help underpin future growth in specialty papers both in the North America and further afield across 2017-2022.

- Foam forming

- Precision control on large format machines

- Industry 4.0

Foam forming

First developed in the 1970s, foam forming is a papermaking process that can produce nonwoven-type materials on paper machines with excellent formation uniformity, bulk and porosity. Critically successful commercialisation will allow paper machines to produce nonwovens substitutes at lower costs than the current slow airlaid or wetlaid nonwoven production platforms.

Foam forming is a multi-phase fluid system structured by the presence of gas bubbles separated by thin liquid films. The bubbles impart increased sheet bulk and porosity to the paper.

As the process has undergone a series of recent technical refinements, new systems employing foam forming are now entering commercial production for specialty paper types. A key focus is maintaining sheet strength while not compromising the enhanced paper bulk; one process is employing cellulose nanofibrils (CNF) to give a reported 16-19% improvement in tensile strength.

The first product to come from the 21st-Century foam forming development is Paptic’s extensible paper bag stock which offers a more environmentally friendly substitute for plastic.

Precision in papermaking

State-of-the-art precision technology developed for the commodity grades will steadily find a wider use on speciality machines too. These platforms offer multiple benefits with reduced product variation, resulting in tighter specifications with less waste from changeovers, rejected lots, or over-designed products that use excess fibre to cover poor variability and reproducibility.

In practice this means lighter paper grades from high-precision machines can compete with the same performance as heavier-weight papers from less precise machines. Simultaneously, superior coater designs are facilitating quick changes of coating formulations between grades with little time or material waste.

Improved product quality and costs will allow increased penetration of speciality paper grades into new applications and markets. However, a more disruptive impact will be the implementation of precision technology on faster and wider papermaking machines allowing them to compete in the speciality spaces that have hitherto relied on slower, labour-intensive papermaking.

Industry 4.0

Running in parallel to greater precision, paper making is also adapting its systems to enable greater automation and data exchange. Across all manufacturing sectors this has been dubbed Industry 4.0.

While computers have been used on paper machines since the 1960s, new systems are integrating technical processes, quality systems and supply chain management in automated harmonised systems that reduce cost and will allow larger production lines to behave like small and nimble producers of the past. In combination with new on-line sensors for real-time monitoring of product attributes these will enable owners of larger and wider machines to deliver the precision required in many specialty grades.

A fine example of this trend is the evolution of headboxes with online CD basis-weight profiling. The headbox slice is kept as straight as possible, but the excess weight in a small area is corrected by injecting water in narrow segments to displace just the excess fibre. This is finally a robust control system for headbox fibre weight distribution. It matches the precision of the new high-resolution sheet scanner systems, correcting fibre weight differences in the cross direction of the tissue sheet.

Stretchable papers

Initially developed in Europe by Gruppo di X, and beta tested with Innventia in Sweden, the capacity to develop stretchable papers is now a commercial reality via a licensing deal with BillerudKorsnäs in Europe. The mould paper produced using Gruppo di X’s trademarked Papermorphosis process relies on mechanical treatment to achieve a base sheet with 20% stretchability in the machine direction and 16% in the cross direction.

Stretchable papers are a new concept intended to replace plastics with natural paper webs, aligning with brand desires for a more sustainable persona, especially for single-use packaging. They can be supplied in reels that can be printed, coated and otherwise processed on traditional converting lines previously used for polymers. The key end products include tray-format packaging and pharmaceutical blisters for stiffness and advertising, paper cups and other liquid containers, and decorative foils for furniture.

The full impact of these technologies is analysed and other important market development is examined in detail and quantified in the Smithers Pira report The Future of Speciality Papers to 2022– click here for more information.

Smithers Pira forecasts nonwovens as fastest growth area for fluff pulp over the next ten years

Global fluff pulp consumption in 2017 is 5.8 million air-dried and has value of $4.6 billion according to the latest exclusive research from Smithers Pira.

Smithers’ in-depth market analysis shows how this demand will increase by 3.7% per year to reach 7.0 million air-dried tonnes in 2022. Value growth will be slower, and yield a market value of $5.3 billion by the end of the study period, with a series of emergent opportunities for fluff pulp suppliers and users fueling worldwide expansion.

Historically, the hygiene segment - diapers/nappies, feminine hygiene pads, and adult incontinence products – has consumed the majority of the fluff pulp globally, and driven overall growth 2012, hygiene end uses accounted for 90.3% of world fluff consumption By 2022, though, these end uses will consume only 89.5% of the world fluff pulp; a small drop in market share, but an indicator of longer-term trends that have been place for Several years.

Historically, the hygiene segment - diapers/nappies, feminine hygiene pads, and adult incontinence products – has consumed the majority of the fluff pulp globally, and driven overall growth 2012, hygiene end uses accounted for 90.3% of world fluff consumption By 2022, though, these end uses will consume only 89.5% of the world fluff pulp; a small drop in market share, but an indicator of longer-term trends that have been place for Several years.

Volume growth in hygiene will follow the market average, but the fastest expanding end-use application will be nonwovens, where consumption for the next 5 years is forecast to increase at 5.5% per year.

‘These new markets will evolve alongside developments in the supply of fluff pulp’. Phil Mango, author of the Smithers report, says: ‘The trend in fluff pulp production is expansion in South America and North America, while Europe has concentrated on modifying pure fluff-producing mills to biorefineries. A biorefinery uses biomass as the input, and produces a wide variety of products and energy. In the fluff pulp biorefinery, wood is input and chemicals, pulp, and even energy are produced. This is not only more sustainable as a process, but improves the profitability of the mill, especially one with marginal profitability.’

Geographically, the fluff pulp is relatively mature in North America and Western Europe, meaning these regions will have the lowest growth rates for fluff pulp. While Asia, South America, and Eastern Europe will increase relative market share.

The competitive landscape for fluff pulp is dominated by large pulp and paper companies headquartered in North America. This is due mainly to the presence of the most optimal wood species for fluff pulp in North America. The three largest fluff pulp producers are International Paper, Georgia-Pacific, and Domtar. These three producers account for about 4.9 million air dried tonnes, or 80% of all fluff pulp production in 2017.

The short growing seasons in northern Europe and Asia, and sub-optimal soil and climate conditions in most of southern Asia, have reduced the potential of these regions. Infrastructure issues in South America and Russia continue to retard progress in these regions.

Rapid technology changes drive growth in speciality papers market, reaching almost 27 million tonnes in 2022

The speciality paper industry is changing as fast as the markets are moving. New machinery and technology is entering the markets, as the commodity printing and writing market went through rapid decline and now is slowly shrinking in the developed countries. This will tend to disrupt the speciality paper makers, as new technology will enable faster and wider machines to effectively and economically produce more technical speciality grades.

![]() Smithers Pira’s latest report ’The Future of Speciality Paper to 2022’ projects the global market for speciality papers in 2017 to be 24.16 million tonnes, and forecasts it to reach 26.98 million tonnes in 2022. This represents a CAGR of 2.2% in the five-year period from 2017 to 2022.

Smithers Pira’s latest report ’The Future of Speciality Paper to 2022’ projects the global market for speciality papers in 2017 to be 24.16 million tonnes, and forecasts it to reach 26.98 million tonnes in 2022. This represents a CAGR of 2.2% in the five-year period from 2017 to 2022.

‘The regulatory environment continues to be complicated, driving changes in materials for health, safety and sustainability’, says Bruce W Janda, author of the report.

‘Speciality papers enjoy many opportunities for new product development to create new demand. Replacement of plastics with sustainable paper-based materials is a large opportunity. Disruptive technologies are coming into the market to support plastics replacement’.

Speciality papers have become even more important because commodity grades used for graphic communications, such as newsprint, freesheet and coated printing papers, have declined abruptly over the past ten years in Western Europe and North America. Recent trends suggest that this may also be starting to happen in more recently developed markets such as China. This trend is expected to continue and spread to the other regional markets as digitalisation of communications continues. As the global graphic commodity papermaking universe contracts, speciality paper grades are becoming one of the forces for growth in the industry, along with tissue and packaging.

Several key common features of speciality papers are noteworthy. They tend to be higher added-value products owing to their unique characteristics. These features often allow speciality producers to charge a premium. Consequently, they are perceived to lead to a better financial performance for the manufacturer. Speciality papers are also seen as useful product portfolio extenders for risk spread over several markets. Often the introduction of speciality papers arises from the availability of, or need to make use of, small-scale output machinery that would otherwise be shut down. The premium charged on the added value allows a producer to work machinery that would otherwise be too costly when making large-scale commodity products, where price competition tends to be fierce.

This landmark report quantifies and segments the specialty paper market globally across 14 major countries and identifies opportunities and threats facing suppliers.

This market report was based on an in-depth combination of primary and secondary research. Primary research included telephone interviews used to generate an up-to-date and accurate picture of the market and to gather information on the specialty papers market that is not available from published sources. Secondary research was based on extensive literature analysis of published data and trends collected from leading players.

With expert insight The Future of Speciality Papers to 2022 [http://www.smitherspira.com/industry-market-reports/paper/specialty-paper/the-future-of-specialty-papers-to-2022] provides a vital strategic planning tool for pulp and paper manufacturers, converters, and equipment manufacturers of specialty papers.

About Smithers Pira

Smithers Pira is the worldwide authority on packaging, paper and print industry supply chains. Established in 1930, Smithers Pira provides strategic and technical consulting, testing, intelligence and events to help clients gain market insights, identify opportunities, evaluate product performance and manage compliance. For more information please visit www.smitherspira.com

Smithers Pira forecasts steady growth for liquid paperboard demand 2017-2022

There will be steady increases in demand for liquid paperboard materials across the next five years according to the latest in-depth industry study from Smithers Pira.

![]() Exclusive data published in The Future of Liquid Paperboard to 2022, shows production of liquid packaging board (LPB) and food/cupstock (FCS) boards combined passed the 7 million tonne mark in 2015. This has grown by over 3% annually on average since 2012. Reaching 7.2 million tonnes in 2016, this segment of the packaging market was worth $9.5 billion to the paper mills.

Exclusive data published in The Future of Liquid Paperboard to 2022, shows production of liquid packaging board (LPB) and food/cupstock (FCS) boards combined passed the 7 million tonne mark in 2015. This has grown by over 3% annually on average since 2012. Reaching 7.2 million tonnes in 2016, this segment of the packaging market was worth $9.5 billion to the paper mills.

Through to 2022, demand for LPB will accelerate significantly at 4.5% per year, driving a total market value of $4.69 billion in 2017 to reach $5.83 billion in 2022. The Smithers study segments this market and provides extensive value and volume figures by board type, end-use application, regional geographic and key national markets.

Production of liquid paperboard materials is highly concentrated; especially liquid packaging board, which is produced in only ten countries around the world. Consumption of converted board products is spread across all global regions; however, in contrast to some other packaging segments, three-quarters of all converted LPB is still used in the Americas and Europe, with Asia holding only a moderate 17% market share in 2016.

Demand for liquid paperboard is heavily dependent on a few segments, although there is scope to expand into new areas. In 2016, more than 70% of LPB consumption occurred in the dairy industry, with juice packaging accounting for a further 20% plus. Smithers Pira tracks how evolution in these core segments and new evolving end-use applications will impact the market across the next five years.

Stephen Harrod, author of the report, says: ‘Consumption of dairy products has slowed in Western Europe but Eastern Europe has enjoyed rapid growth in demand, sustaining volume demand for liquid paperboard. Globally, however, the industry is seeing growing competition from ‘alt-milk’ products, such as nut-based ‘milks’. However, these products may actually stimulate demand for LPB, as they open up new niche markets. LPB consumption will be maintained over the medium term, assisted by the healthy eating trend, together with growing consumption patterns in the emerging markets.’

In spite of increasing competition from other alternative beverages, including ready-to-drink (RTD) tea and coffee, energy drinks and the like – especially amongst younger consumers – demand for LPB in the dairy industry will see continued good growth, with nearly 400,000 tonnes of additional LPB materials needed to meet demand growth between 2017 and 2022.

An overall trend across the packaging industry is to minimise the environmental impact of packaging, which is stimulating both technical innovations and new business models across the value chain. This interest includes consumers, brand owners, converters and regulators and spans a number of different means to realise the goal of furthering the use of sustainable, recyclable and compostable packaging into the mainstream.

Marketing to more environmentally aware consumers will increasingly be an important differentiator for packaging suppliers and FMCG brand owners in the future. This is driving the development of more sustainable LBP products such as Tetra Pak’s Tetra Rex Bio-based, Tetra Brik Aseptic 1000 Edge with Bio-based LightCap 30, and the Tetra Top carton bottle, as well as the Combidome low-acid carton bottle from SIG Combibloc and Elopak’s Pure-Pak Sense Aseptic carton.

This latest Smithers Pira report The Future of Liquid Paperboard to 2022, analysing the key drivers of demand for the various liquid paperboard products. The liquid paperboard market includes food service products made from food and cupstock board (FCS) and liquid packaging board (LPB) materials used in various packaging applications. The major end-use markets for liquid packaging board are quantified and segmented, with discussion of the key trends affecting demand for the end-use products as well as the consumption of liquid packaging board in these markets

About Smithers Pira

Smithers Pira is the worldwide authority on packaging, paper and print industry supply chains. Established in 1930, Smithers Pira provides strategic and technical consulting, testing, intelligence and events to help clients gain market insights, identify opportunities, evaluate product performance and manage compliance. For more information please visit www.smitherspira.com

Packaging industry continues to demand new solutions from functional and barrier coating suppliers

Global demand for functional and barrier coatings in paper and paperboard applications, is forecast to grow by 4.9% year-on-year to $5.18 billion by 2022.

Exclusive data from the new Smithers Pira report – The Future of Functional and Barrier Coatings for Paper and Board to 2022 [http://www.smitherspira.com/industry-market-reports/paper/paper-packaging/the-future-of-functional-and-barrier-coatings] determines that future growth will be driven by a resurgent global outlook and the greater penetration of into transition economies. The Asia-Pacific market will represent over 54% of worldwide functional and barrier coatings use by 2022, up from 46% in 2012, with Japan the only major economy in the region expected to have a reduced demand. China leads the way with 34.2% of world consumption.

![]() Peter A. Signoretti, author of the report, comments: “There are many demands from the market that require a growing number of substantial advances in technology, leading to greater innovation at numerous levels. Market demands for more sustainable packaging are increasing, as are regulatory requirements that are forcing companies to consider new alternatives.

Peter A. Signoretti, author of the report, comments: “There are many demands from the market that require a growing number of substantial advances in technology, leading to greater innovation at numerous levels. Market demands for more sustainable packaging are increasing, as are regulatory requirements that are forcing companies to consider new alternatives.

“The rate of technology change continues to challenge the industry, and the packaging industry continues to demand new solutions from functional and barrier coating suppliers. When implementing new and innovative technologies suppliers will be required to stay relevant to the market.”

The food and beverage market will continue to dominate demand for paper and paperboard packaging, and the need for functional and barrier properties. Aseptic packaging continues to expand the use of aluminium foil as a barrier coating for paperboard packaging, while water-based, other high-barrier coatings and biopolymers are expected to make inroads into more traditional petroleum-based wax and plastic laminate paperboard products for fresh food bakery, frozen food and takeaway applications. Novel water-based alternative solutions to silicone in baked goods markets and safer solutions to replace fluorochemicals will continue to be active.

Cost will continue to drive the market to search for innovative approaches to replace fibre content. The use of micro-fibrillated cellulose and functional coatings will reduce the amount of fibre needed, while maintaining package strength and integrity. Paper and paperboard laminations will be looked at harder for these types of applications. Paper converters are under pressure from consumer brands to reduce waste,

emissions, volatile chemicals and any hazardous processes. This is putting pressure on packaging companies to provide products with safer and more sustainable functional and barrier coating options.

The ever-growing e-commerce market will also play a role in future growth, and functional and barrier coating technology will be expected to provide the properties needed to ship more products directly to shoppers worldwide. Food products in particular will need insulating, and lower cost and sustainable products are being sought to replace non-sustainable materials like expanded polystyrene, wax, polyethylene, and polyvinylidene chloride (PVdC). The potentially expanded use of drone delivery will also require tougher and innovative packaging alternatives.

The Future of Functional and Barrier Coatings for Paper and Board to 2022 [http://www.smitherspira.com/industry-market-reports/paper/paper-packaging/the-future-of-functional-and-barrier-coatings] is based on a combination of in-depth primary and secondary research. Primary research included refinement of Smithers Pira’s databases on paper and board packaging throughout the world and interviews targeting key decision makers.

This exclusive content was contextualized and integrated and integrated with secondary research drawn from third-party databases and historical data – including official statistics, trade associations, trade directories, market reports, journals, websites, and industry contacts – and detailed analyses of economic data.

Smithers Pira is the worldwide authority on packaging, paper and print industry supply chains. Established in 1930, Smithers Pira provides strategic and technical consulting, testing, intelligence and events to help clients gain market insights, identify opportunities, evaluate product performance and manage compliance. For more information please visit www.smitherspira.com

Get exposure to over 6,000 pigment and TiO2 decision makers by sponsoring or exhibiting at Pigments and TiO2 2017

Sponsoring or exhibiting at the co-located Pigment and Colour Science Forum and TiO2 World Summit 2017 is the perfect opportunity to raise your profile, put yourself ahead of the competition and get unprecedented access to key decision makers.

By sponsoring or exhibiting at these globally renowned events, you'll be able to reach an audience of 6,000 plus through inclusion in pre-conference marketing messages AND meet face-to-face with over 300 pigment and TiO2 decision makers at the conferences themselves.

Both conferences are dedicated to bringing together key members of the pigments and colourants sector and the titanium dioxide supply chain to discuss the latest global projects, applications, technologies, processes, investment perspectives and much more.

Companies including BASF and Schlenk have already confirmed their sponsorship packages so there's no time to lose!

Download the sponsorship and exhibition guide to find out more, or contact Cherrie Keene today on +44 (0) 1372 802255 or This email address is being protected from spambots. You need JavaScript enabled to view it. to discuss your bespoke package.

Smithers Pira: Paper Industry Professionals to Gather at Specialty Papers Europe Conference in Cologne, Germany 3-5 April 2017

Over 150 key industry experts from the paper industry will assemble in Cologne, Germany from 3 – 5 April 2017 to attend Smithers Pira’s Specialty Papers Europe (http://www.specialtypaperconference.com/europe).

With the global market for specialty papers expected to increase at an annual rate of 1.8% over the period of 2015-2020, more than 150 key industry professionals from across the supply chain are expected to gather at this year’s Specialty Papers Europe to hear the latest updates on advancements and trends affecting the industry and to exchange their knowledge and ideas.

“Specialty Papers conference always provides excellent insight into the near and future paper market. We find it especially helpful when considering medium to long term direction for our development program.”

Alicia B Richards, AquaSol Corporation

By attending Specialty Papers Europe, delegates will learn what is happening within the paper industry, gain updates on the latest policy issues, hear from high-level speakers and learn about new technologies and innovations, whilst having the opportunity to build network relationships, expand their business opportunities and meet leading personalities in the industry. Attendees to the conference will include brand owners, raw material suppliers, converters, machinery/equipment suppliers, graphic designers and packaging designers from within the specialty papers industry.

With 20 expert speakers set to provide high-level insight and advice, this year’s conference will focus on specific topics related to the specialty paper manufacturing and paper supply industry including Innovation in Packaging, Barrier Developments, Coatings, Digital Printing, Innovations and New Technologies and more.

Sessions include:

- Alexey Vishtal, Nestlé, Packaging sustainability and a role of fibre-based packaging in it

- Dr. Fikri E. Alemdaroglu, Daikin Chemical Europe, Fluorine or no fluorine – a comparative analysis of barrier chemicals for grease proof paper

- Anna Jonhed, BillerudKorsnäs, New fiber based products for a sustainable future

- Mark Crable, Crable Engineering, Colour is a key attribute of specialty papers and must be properly managed

- Jan Duffhues, Mars Europe, How paper can deliver added value to consumer packaging

- Plus many more

This year’s conference promises to provide an unparalled learning and networking opportunity for anyone from within the paper industry and SNP Inc who attended a past edition of the conference labelled it as “A highly-targeted interesting conference with exceptional networking opportunities”.

Exclusive to 2017 - Delegates to Specialty Papers 2017 will also have the opportunity to sign up to an exclusive tour at Zanders paper mill taking place the day before the conference on Monday 3rd April. During the tour, delegates will see the Zanders paper mill including the high quality specialty papers and boards facilities. The accompanying presentation will focus on the continuous change in the international paper industry and how the “old lady” Zanders managed to return to success with new structures, products and services.

For more information on Specialty Papers Europe 2017, visit http://www.specialtypaperconference.com/europe

About Smithers Pira

Smithers Pira is the worldwide authority on the packaging, paper and print industry supply chains. They provide world-leading expertise and market intelligence, and offer a range of testing services supported by comprehensive facilities in the UK and US. With over 80 years’ technical and scientific experience Smithers Pira help clients around the world with their business and testing requirements.

Growth in consumer markets is driving the sack and kraft paper market to $80 billion by 2021

Steady growth in consumer markets will buoy the sack and kraft paper industry to produce growth of around 3% per annum for 2016–2021 – according to the latest exclusive data from Smithers Pira. This will push global market value to $80 billion in 2021, up from $66 billion in 2016.

Smithers Pira’s new report – The Future of Sack and Kraft Paper to 2021 [http://www.smitherspira.com/industry-market-reports/paper/paper-packaging/the-future-of-sack-and-kraft-paper] – identifies how expansion is being driven by numerous factors – like the demand for higher quality graphics, which is pressuring papermakers to develop innovative solutions to provide suitable and appropriate printing surfaces. This includes the evolution of digital printing technology for the sack and kraft segment which is creating opportunities for converters and challenges for papermakers.

Report author Stephen Harrod notes that environmental concerns are also helping transform this industry. He says: “Adoption of sustainability practices has been fairly widespread throughout much of the kraft and sack paper industry and many suppliers now sport a plethora of environmental certificates in various forms. As environmental pressures become ever greater, it is possible that kraft and sack paper manufacturers may start to develop entire product ranges marketed on a sustainability platform.

Report author Stephen Harrod notes that environmental concerns are also helping transform this industry. He says: “Adoption of sustainability practices has been fairly widespread throughout much of the kraft and sack paper industry and many suppliers now sport a plethora of environmental certificates in various forms. As environmental pressures become ever greater, it is possible that kraft and sack paper manufacturers may start to develop entire product ranges marketed on a sustainability platform.

“In addition to sourcing from sustainably-managed forests, some kraft paper producers have also made attempts to increase the amount of recycled material used in the manufacture of their products.”

Operating in parallel pressure to reduce costs is leading to technological advances that now enable much lighter weights of paper to achieve the same results. Grammages are declining significantly in some cases from 55gsm to as low as 20gsm. This shift to lighter weights increases the importance of sheet uniformity, bulk and thickness, absorbency, opacity, dimensional stability, surface finish, printability – as well as reducing volume offtake for raw material suppliers.

The reduction in volume caused by downgauging is, however, mitigated by the trend to smaller pack sizes, as smaller packs tend to use more material to hold the same contents. This trend also increases the demand for other consumables – such as inks and adhesives – adding more value to the sack and kraft segment for packaging converters. This evolution is being driven by demographic changes worldwide, where there is a general increase in single parent families and smaller family units. Such downsizing is also being supported by health and safety concerns, with many 50 kg industrial packs being reduced to 25 kg content weights for this reason.

The Future of Sack and Kraft Paper to 2021 [http://www.smitherspira.com/industry-market-reports/paper/paper-packaging/the-future-of-sack-and-kraft-paper] is based on an in-depth combination of primary and secondary research. Primary research included telephone interviews used to generate an up-to-date and accurate picture of the market and to gather information on the sack and kraft paper segments that is not available from published sources. Secondary research was based on extensive literature analysis of published data and trends collected from leading companies worldwide. The report provides a unique depth of information and analysis.

Smithers Pira is the worldwide authority on packaging, paper and print industry supply chains. Established in 1930, Smithers Pira provides strategic and technical consulting, testing, intelligence and events to help clients gain market insights, identify opportunities, evaluate product performance and manage compliance. For more information please visit www.smitherspira.com

Environmental trends and diverging product performance drive innovation in tissue production, according to Smithers Pira

Smithers Pira publishes a new report entitled, The Future of Tissue Manufacturing to 2021, which provides an in-depth, long-term assessment of the rapidly evolving tissue manufacturing processes.

Operating environment trends and diverging product performance levels will push alternative manufacturing technologies. Tissue manufacturers occupying economy segments compete primarily on price. This requires increased focus on productivity and cost control. Premium level product performance will drive increased adoption of structured sheet technologies supported by chemicals and fibres.

Operating environment trends and diverging product performance levels will push alternative manufacturing technologies. Tissue manufacturers occupying economy segments compete primarily on price. This requires increased focus on productivity and cost control. Premium level product performance will drive increased adoption of structured sheet technologies supported by chemicals and fibres.

Changes are well underway as the standardisation of crescent former configurations and sizes have allowed machines to be built in auto assembly line fashion in workshops at much lower costs than the traditional engineered custom machines. Steel Yankee assembly is rapidly joining this disruptive approach to machinery sourcing.

“Product focus is moving toward a two level strategy with economy and premium performance products.” states Bruce W. Janda, author of the report.

“Middle of the road products will increasingly be left behind.”

Recycled fibre for tissue making will see shortages as tissue demand grows and the supply of recyclable papers decreases in the electronic media conversion. This will have a disruptive effect, particularly in North America over the period to 2021. Tree-free tissue products are poised to take off in North America and this period will show if consumers will respond with interest. Sustainable pulping where fibre is a by-product of non-fossil energy or feedstock production is moving forward in Northern Europe.

Tissue manufacturing is growing in allregions, albeit at distinctly different rates. The two undeveloped tissue markets remain Africa (excluding South Africa) and India. These are unlikely to change the market balance in the next five years. Improved hot air hand dryers will continue to take business away from paper hand towels with substitution rates above 30% expected in Western Europe and North America by the end of this period.

The operating environment for tissue manufacturers will increasingly be constrained by uncertain water and energy access and costs. Sustainability measures will become a greater factor as consumer and government requirements increase. The growth of non-wood fibre sources has opened up new possibilities for simplified and sustainable pulping processes. New approaches to dry strength additives show potential to increase tissue softness and productivity. Enzyme applications for fibre modification and process management will offer potential sustainable improvements to tissue manufacturing.

The Future of Tissue Manufacturing to 2021 focuses on the market and manufacturing processes for hygienic tissue and towel products made from natural cellulosic fibre, along with packaging and other applications of tissue paper.Trends in manufacturing processes, cutting-edge machinery developments, fibre technologies, and tissue end-use are examined both on a globaland regional basis. Additionally new product trends, the current operating environment, and technology developments are assessed for potential disruptive changes to tissue manufacturing.

The Future of Tissue Manufacturing to 2021 is available for £4,200. For more information, please contact:

Europe/Asia

Stephen Hill / This email address is being protected from spambots. You need JavaScript enabled to view it.

+44(0)1372 802025

North/South America:

Josh Rabb / This email address is being protected from spambots. You need JavaScript enabled to view it.

330-762-7441 ext. 1206

Smithers Pira is the worldwide authority on packaging, paper and print industry supply chains. Established in 1930, Smithers Pira provides strategic and technical consulting, testing, intelligence and events to help clients gain market insights, identify opportunities, evaluate product performance and manage compliance. For more information please visit www.smitherspira.com

Smithers Pira announces expert speakers for Drupa 2016

Smithers Pira, the worldwide authority on the packaging, paper and print industry supply chains, has announced that two of its industry experts are to present at Drupa 2016.

Dominic Cakebread, renowned expert in global packaging, will explore prospects for printing within the packaging market. Driven on the one hand by brand owners’ increasing demands for greater differentiation, personalisation and a more engaging relationship with consumers, and on the other hand by the increasing availability of new and disruptive technologies, the printing requirements for the global packaging industry are expected to undergo major change over the next decade, with ever higher quality and faster digital printing expected to take share from traditional printing methods. Dominic will examine the main opportunities and barriers to growth and how the printing industry can best meet the future demands of the global packaging sector.

Sean Smyth, who has spent over 25 years as a consultant in the print industry, will analyse disruptive trends in functional and industrial printing in a talk that focuses on the rapidly emerging use of printing-for-profit in novel areas outside the traditional graphics and packaging arenas. Inkjet is being adopted strongly in many areas of functional printing – promotional items, glass, electronics, décor, and 3D. Additive manufacturing is being studied in pure and applied research labs in universities, and at large companies, with new fluids and techniques being brought to market. Sean will outline the findings of Smithers Pira research into the sector, presenting highlights from the recently published market report The Future of Functional and Industrial Print to 2020.

Sean Smyth, who has spent over 25 years as a consultant in the print industry, will analyse disruptive trends in functional and industrial printing in a talk that focuses on the rapidly emerging use of printing-for-profit in novel areas outside the traditional graphics and packaging arenas. Inkjet is being adopted strongly in many areas of functional printing – promotional items, glass, electronics, décor, and 3D. Additive manufacturing is being studied in pure and applied research labs in universities, and at large companies, with new fluids and techniques being brought to market. Sean will outline the findings of Smithers Pira research into the sector, presenting highlights from the recently published market report The Future of Functional and Industrial Print to 2020.

About Smithers Pira

Smithers Pira is the worldwide authority on the packaging, paper and print industry supply chains. Providing world-leading expertise and market intelligence, the company offers a range of testing services supported by comprehensive facilities in the UK and US.

The company’s market reports provide an independent and expert view of emerging markets, technologies and factors which will affect the packaging, paper and print industries. Each report contains a qualitative and quantitative five-year market forecast, including a comprehensive analysis of customers and providers to each market.

Smithers Pira also provides bespoke consultancy services, helping companies to solve a specific business need. Its specialist research team can assist with market sizing and forecasting, market segmentation, market entry studies, and surveys, enabling businesses to identify new profitable opportunities and niche markets, understand unmet needs, and benchmark against competitors.

Meet Smithers Pira on Stand 5B03, May 31–June 10, 2016