Displaying items by tag: Verso Paper Corp

Verso Paper Corp. Reports Second Quarter 2012 Results

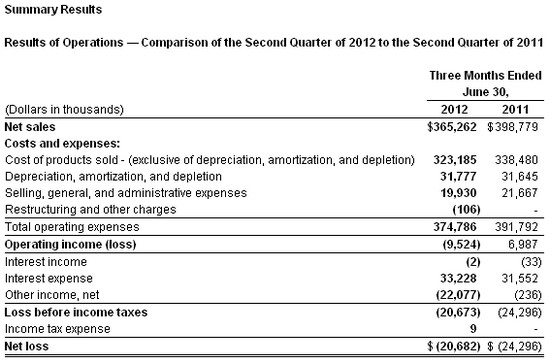

Verso Paper Corp. has reported financial results for the second quarter and six months ended June 30, 2012. Results for the quarters ended June 30, 2012 and 2011 include:

- EBITDA of $44.4 million in the second quarter of 2012 compared to $38.8 million in the second quarter of 2011, and Adjusted EBITDA before pro forma effects of profitability program of $23.5 million in the second quarter of 2012, compared to $43.6 million in the second quarter of 2011. (Note: EBITDA and Adjusted EBITDA are non-GAAP financial measures and are defined and reconciled to net income later in this release).

- Net loss of $20.7 million in the second quarter of 2012, or $0.39 per diluted share, compared to a net loss of $24.3 million, or $0.46 per diluted share in the second quarter of 2011.

- Operating loss of $9.5 million in the second quarter of 2012 compared to operating income of $7.0 million in the second quarter of 2011.

- Net sales of $365.3 million in the second quarter of 2012 compared to $398.8 million in the second quarter of 2011.

Overview

Verso's net sales for the second quarter of 2012 decreased $33.5 million, or 8.4%, reflecting a 5.5% decrease in the average sales price for all of our products combined with a 3.1% decline in total sales volume, which was driven by the shutdown of three paper machines late last year. Verso's gross margin was 11.5% for the second quarter of 2012 compared to 15.1% for the second quarter of 2011, reflecting the higher average sales prices during 2011.

Verso reported a net loss of $20.7 million in the second quarter of 2012, or $0.39 per diluted share, which included $22.4 million of net benefits from special items, or $0.42 per diluted share, primarily due to debt refinancing. Verso had a net loss of $24.3 million, or $0.46 per diluted share, in the second quarter of 2011, which included $3.7 million of charges from special items, or $0.07 per diluted share.

"Demand in the coated industry continued to be challenged during the second quarter of 2012 which resulted in a delay in the announced price increases during the quarter. This was primarily a result of the drop-off in advertising spending and slowdowns in the commercial print area which are impacted by the sluggish GDP growth. However, our coated groundwood and coated freesheet volumes were relatively flat with last year's levels and we did a good job of managing our pricing relative to overall market demand. Adjusted EBITDA was comparable to the first quarter of this year and slightly better if you exclude the over $5.0 million impact related to scheduled maintenance outages we took during the second quarter," said David Paterson, President and Chief Executive Officer of Verso.

"Our company was further challenged during the quarter by the fire and explosion at our Sartell Mill that resulted in the tragic loss of one of our employees and injuries to four others. As we announced last week, we have made the decision not to restart the Sartell Mill and will begin to evaluate options relative to the future of the site.

"We anticipate that coated groundwood prices will gain positive momentum throughout the third quarter and coated freesheet prices to be stable as we move into the busier second half of the year. Overall, volumes will be similar to last year's levels after giving consideration to the Sartell Mill closure. We expect operating costs to benefit from the continuation of our cost reduction initiatives and input prices are expected to remain fairly flat versus the second quarter. The U.S. coated groundwood market should be relatively in balance for the remainder of the year as a result of recent capacity reductions including the recently announced closure of our Sartell Mill."

Net Sales. Net sales for the second quarter of 2012 decreased 8.4%, to $365.3 million from $398.8 million in the second quarter of 2011, reflecting a 5.5% decrease in the average sales price for all of our products, led by a quarter-over-quarter decline in the price of pulp, although it was up on a sequential-quarter basis. Additionally, total sales volume was down 3.1% compared to the second quarter of 2011, which was driven by the shutdown of three paper machines late last year.

Net sales for our coated papers segment decreased 11.1% in the second quarter of 2012 to $285.0 million from $320.7 million for the same period in 2011, due to a 7.8% decrease in paper sales volume, which was driven by the shutdown of three paper machines late last year, combined with a 3.7% decrease in the average paper sales price per ton.

Net sales for our market pulp segment were $36.2 million in both the second quarter of 2012 and 2011. The average sales price per ton decreased 11.9% while sales volume increased 13.7% compared to the second quarter of 2011.

Net sales for our other segment increased 5.0% to $44.1 million in the second quarter of 2012 from $41.9 million in the second quarter of 2011. The improvement in 2012 was due to a 12.7% increase in sales volume, reflecting the continued development of new paper product offerings for our customers. The average sales price per ton decreased 6.8%.

Cost of sales. Cost of sales, including depreciation, amortization, and depletion, was $355.0 million in the second quarter of 2012 compared to $370.1 million in 2011. Our gross margin, excluding depreciation, amortization, and depletion, was 11.5% for the second quarter of 2012 compared to 15.1% for the second quarter of 2011, reflecting higher average sales prices during 2011. Depreciation, amortization, and depletion expenses were $31.8 million for the second quarter of 2012 compared to $31.6 million for the second quarter of 2011.

Selling, general, and administrative. Selling, general, and administrative expenses were $19.9 million in the second quarter of 2012 compared to $21.7 million for the same period in 2011.

Interest expense. Interest expense for the second quarter of 2012 was $33.3 million compared to $31.6 million for the same period in 2011.

Other income, net. Other income, net for the second quarter of 2012 was a gain of $22.1 million compared to a gain of $0.2 million for the second quarter of 2011. Included in the results for the second quarter of 2012 were gains of $21.8 million related to the early retirement of debt in connection with debt refinancing.

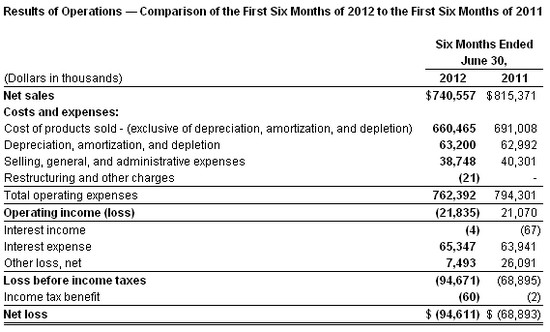

Net Sales. Net sales for the six months ended June 30, 2012, decreased 9.2% to $740.6 million from $815.4 million for the six months ended June 30, 2011, reflecting a 5.7% decrease in total sales volume, which was driven by the shutdown of three paper machines late last year. Additionally, the average sales price for all of our products decreased 3.7%, led by a decline in the price of pulp.

Net sales for our coated papers segment decreased 12.5% to $588.2 million for the six months ended June 30, 2012, from $672.4 million for the six months ended June 30, 2011. This change reflects an 11.0% decrease in paper sales volume, which was driven by the shutdown of three paper machines late last year, combined with a 1.8% decrease in the average coated paper sales price per ton compared to the same period last year.

Net sales for our market pulp segment decreased 3.9% to $69.1 million for the six months ended June 30, 2012, from $71.9 million for the same period in 2011. This decrease was due to a 13.3% decline in the average sales price per ton while sales volume increased 10.8% compared to the six months ended June 30, 2011.

Net sales for our other segment increased 17.1% to $83.3 million for the six months ended June 30, 2012, from $71.1 million for the six months ended June 30, 2011. The improvement in 2012 is due to a 21.5% increase in sales volume, reflecting the continued development of new paper product offerings for our customers. The average sales price per ton decreased 3.6% compared to the six months ended June 30, 2011.

Cost of sales. Cost of sales, including depreciation, amortization, and depletion, were $723.7 million for the six months ended June 30, 2012, compared to $754.0 million for the same period last year. Our gross margin, excluding depreciation, amortization, and depletion, was 10.8% for the six months ended June 30, 2012, compared to 15.3% for the six months ended June 30, 2011, reflecting higher average sales prices during 2011. Depreciation, amortization, and depletion expenses were $63.2 million for the six months ended June 30, 2012, compared to $63.0 million for the six months endedJune 30, 2011.

Selling, general, and administrative. Selling, general, and administrative expenses were $38.7 million for the six months ended June 30, 2012, compared to $40.3 million for the same period in 2011.

Interest expense. Interest expense for the six months ended June 30, 2012, was $65.4 million compared to $64.0 million for the same period in 2011.

Other loss, net. Other loss, net for the six months ended June 30, 2012, was a net loss of $7.5 million compared to a net loss of $26.1 million for the six months ended June 30, 2011. Included in the results for 2012 and 2011 were losses of $8.2 million and $26.1 million, respectively, related to the early retirement of debt in connection with debt refinancing.

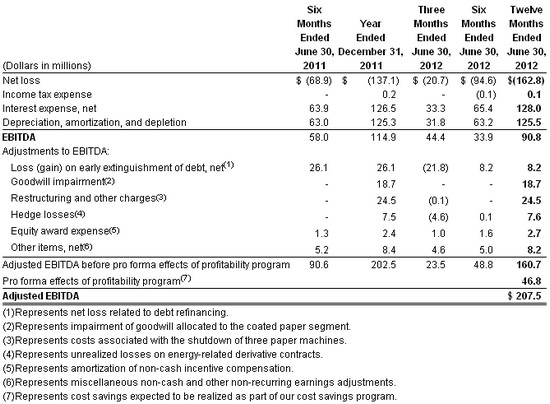

Reconciliation of Net Income to Adjusted EBITDA

The agreements governing our debt contain financial and other restrictive covenants that limit our ability to take certain actions, such as incurring additional debt or making acquisitions. Although we do not expect to violate any of the provisions in the agreements governing our outstanding indebtedness, these covenants can result in limiting our long-term growth prospects by hindering our ability to incur future indebtedness or grow through acquisitions.

EBITDA consists of earnings before interest, taxes, depreciation, and amortization. EBITDA is a measure commonly used in our industry, and we present EBITDA to enhance your understanding of our operating performance. We use EBITDA as a way of evaluating our performance relative to that of our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets among otherwise comparable companies. Adjusted EBITDA is EBITDA further adjusted to exclude unusual items and other pro forma adjustments permitted in calculating covenant compliance in the indentures governing our debt securities to test the permissibility of certain types of transactions. Adjusted EBITDA is modified to align the mark-to-market impact of derivative contracts used to economically hedge a portion of future natural gas purchases with the period in which the contracts settle and is modified to reflect the amount of net cost savings projected to be realized as a result of specified activities taken during the preceding 12-month period. We believe that the supplemental adjustments applied in calculating Adjusted EBITDA are reasonable and appropriate to provide additional information to investors. We also believe that Adjusted EBITDA is a useful liquidity measurement tool for assessing our ability to meet our future debt service, capital expenditures, and working capital requirements.

However, EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDA or Adjusted EBITDA as an alternative to operating or net income, determined in accordance with U.S. GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as an indicator of our cash flows or as a measure of liquidity. The following table reconciles net loss to EBITDA and Adjusted EBITDA for the periods presented.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Permanent Shutdown of Sartell Mill

Verso Paper Corp. has announced that after conducting a comprehensive assessment, Verso has made the difficult decision not to reopen its paper mill in Sartell, Minnesota. Verso's decision is based on the  length of time that it would take to rebuild the mill structures and systems that were destroyed in the Memorial Day fire and explosion, and the marketplace challenges that would present.

length of time that it would take to rebuild the mill structures and systems that were destroyed in the Memorial Day fire and explosion, and the marketplace challenges that would present.

The permanent closure of the Sartell Mill will reduce Verso's annual coated groundwood capacity by 180,000 tons or approximately 20 percent, and will eliminate approximately 35,000 tons of annual supercalendered paper capacity.

The permanent closure of the Sartell Mill will reduce Verso's annual coated groundwood capacity by 180,000 tons or approximately 20 percent, and will eliminate approximately 35,000 tons of annual supercalendered paper capacity.

Verso President and CEO David Paterson met with state and local officials earlier today to deliver the news in person. "After a thorough review of the many factors involved following the Memorial Day tragedy, we have made the very difficult decision not to reopen the Sartell Mill," Paterson said. "The mill has not been competitive for a number of years and, despite our employees' dedicated efforts since the December 2011 shutdown of two of the facility's three paper machines, our assessment indicates that it is impossible for the mill to achieve a competitive position in today's marketplace, especially after a setback of this magnitude and duration. We will work closely with local and state officials to develop options for the future use of the mill site."

"We know that the decision to permanently close the mill will have a significant impact on many people across this region, especially our Sartell Mill employees and their families," said Verso Senior Vice President for Manufacturing and Energy Lyle Fellows. "We continue to work with affected employees to help them access the resources needed to identify alternative employment opportunities."

Verso has been working with Sartell Mill customers to make necessary production transitions since the mill was idled by the Memorial Day fire and explosion. "Even in the face of sudden and challenging circumstances, our customers knew they could depend on Verso to deliver high-quality paper products and exceptional customer service," said Verso Senior Vice President of Sales, Marketing and Product Development Mike Weinhold. "Our team has worked hard to make needed shifts in production and we are meeting our customers' needs at Verso's other mills."

The mill closure will result in an aggregate pre-tax charge to earnings of approximately $114 million, which is expected to occur primarily in the third quarter of 2012. This includes approximately $19 million for severance and benefit costs; approximately $81 million in non-cash charges primarily related to the impairment of property, plant and equipment; and approximately $14 million related to other costs. The severance and other shutdown costs require the outlay of cash, which is expected to occur primarily in the third quarter of 2012. Settlement negotiations regarding this loss claim with our insurance carrier are continuing and we expect resolution in the coming months.

Costs associated with shutdown activities are based on currently available information and reflect management's best estimates; accordingly, actual cash costs and non-cash charges and their timing may differ from the projections stated above.

"The Sartell Mill has a long and proud history, and we thank all of our employees, the community and the many local and state officials who have partnered with us over the years," said Sartell Mill Manager Matt Archambeau. "It's impossible to put into words how much your support has meant to our company."

Source: Verso Paper Corp.

Forward-Looking Statements

In this press release, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "project," "plan," "estimate," "intend," and similar expressions. Forward-looking statements are based on currently available business, economic, financial, and other information and reflect management's current beliefs, expectations, and views with respect to future developments and their potential effects on Verso. Actual results could vary materially depending on risks and uncertainties that may affect Verso and its business. For a discussion of such risks and uncertainties, please refer to Verso's filings with the Securities and Exchange Commission. Verso assumes no obligation to update any forward-looking statement made in this press release to reflect subsequent events or circumstances or actual outcomes.

Verso to Report Second Quarter Results and Host Conference Call on August 9

Verso Paper Corp. (NYSE: VRS) has announced that it will report its financial results for the second quarter ended June 30, 2012, in a news release before the market opens on Thursday, August 9, 2012. Also on August 9, management will host a conference call at9 a.m. Eastern Daylight Time to discuss the second quarter results.

The news release and second quarter results will be available on Verso's website at www.versopaper.com/investorrelations by navigating to the Financial Information page.

Analysts and investors may participate in the live conference call by dialing 719-325-4858 or, within the United States and Canada only, 877-741-4245, access code 1039434. To register, please dial in 10 minutes before the conference call begins. The conference call and presentation materials can be accessed on Verso's website at www.versopaper.com/investorrelations by navigating to the Events page, or at http://investor.versopaper.com/eventdetail.cfm?EventID=115362.

A telephonic replay of the call can be accessed at 719-457-0820 or, within the United States and Canada only, 888-203-1112, access code 1039434. This replay will be available starting at 12 p.m. Eastern Daylight Time on Thursday, August 9, 2012, and will remain available for 14 days.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Discussions with Holders of First-Lien Notes of NewPage Corporation

Verso Paper Corp. has announced that it has held discussions with certain holders of the 11.375% first-lien senior secured notes of NewPage Corporation in an effort to achieve a potential business combination involving Verso and NewPage as part of a consensual plan of reorganization in NewPage's Chapter 11 bankruptcy proceedings.

The terms of Verso's proposed transaction would provide NewPage's first-lien noteholders with $1.425 billion of value, consisting of $1.075 billion of new Verso first-lien notes, $150 million of Verso common stock, and $200 million of cash. In addition, the proposed transaction would include a 100% recovery in cash to repay NewPage's debtor-in-possession financing, a 100% recovery in cash for the allowed priority and administrative claims in the bankruptcy proceedings, a to-be-determined amount of Verso common stock for the holders of NewPage's second-lien notes, and a to-be-determined recovery for NewPage's unsecured creditors. To facilitate the transaction, a $200 million cash equity investment in Verso was contemplated. The proposed transaction would be subject to customary conditions, including the satisfactory completion of due diligence and the completion of antitrust review.

Verso believes that a combination with NewPage would create a stronger business in the global coated and supercalendered paper industry because of the material cost savings that would be achieved. Verso also believes that a combination with NewPage would provide a compelling option for a restructuring in that it would afford NewPage's first-lien noteholders a very attractive recovery, while at the same time treating fairly the other NewPage constituencies, including its employees, other creditor classes, and customers. Despite these advantages, Verso has been disappointed with the lack of progress in advancing its discussions with the first-lien noteholders. Verso continues to believe that its proposed transaction is the most sensible.

The terms of Verso's proposal to NewPage's first-lien noteholders regarding the proposed transaction are included in the June 18, 2012 discussion materials attached as an exhibit to the current report on Form 8-K that Verso is filing with the Securities and Exchange Commission. Verso provided advance notice to NewPage of its presentation to the first-lien noteholders and delivered its presentation to the first-lien noteholders for discussion purposes only. Verso also is including a withdrawn May 30, 2012 term sheet previously presented to the first-lien noteholders as an exhibit to the current report on Form 8-K. This May 30 term sheet was superseded in its entirety by the term sheet included in the June 18, 2012 presentation, which was revised to reflect NewPage's updated earnings and cash balance. This press release is not a solicitation to any party to accept or support any Chapter 11 plan of reorganization.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Grant Program to Increase Certified Forest Acreage near Its Paper Mills

Verso Paper Corp. has launched the Verso Forest Certification Grant Program, an initiative aimed at increasing certified fiber and certified acreage on lands near the company's four paper mills. The program will provide start-up funding to encourage and assist landowners, consulting foresters and other stakeholders in developing innovative new projects that will help expand and maintain certification in Verso's wood procurement zones.

"Verso's Forest Certification Grant Program helps us meet two important sustainability commitments," says Verso Senior Vice President for Manufacturing and Energy Lyle Fellows. "By encouraging expanded forest certification, we're advancing responsible management practices that keep U.S. forests vibrant and healthy. We're also helping to increase the available supply of certified fiber which, in turn, allows us to keep our pledge to provide paper products that help our customers meet their own sustainability objectives," he says.

"Verso already uses a high percentage of fiber that's certified to credible forest management certification standards — about 70 percent, but the availability of certified fiber in the United States remains limited with only about 28 percent of privately owned U.S. land certified," explains Verso Senior Vice President for Sales, Marketing and Product Development Mike Weinhold. "With customer demand for certified paper products increasing significantly, it's vital that we do all we can to make sure the supply of certified fiber keeps pace."

The Forest Certification Grant Program builds on Verso's track record of successful forest certification expansion initiatives. In 2011, the company completed a two-year group certification project in partnership with several of its customers and other stakeholders that resulted in an additional 1.4 million certified acres in Maine. In 2009 and 2010, a Verso grant to the Trust to Conserve Northeast Forestlands resulted in 160,000 additional certified acres across six Northeast states. Verso regularly encourages certification through collaboration with state forestry associations and certification organizations, and through its relationships with private landowners.

Source: Verso Paper Corp.

Verso Paper Corp. Comments on Explosion and Fire at Sartell Mill

Verso Paper Corp. has announced that it has completed a preliminary assessment of the damage resulting from the recent explosion and fire at its paper mill in Sartell, Minnesota. The incident at the Sartell mill on May 28, 2012, which claimed the life of one Verso employee and injured four others, caused substantial damage to the mill's paper warehouse and important infrastructure including the electrical system. While a visual inspection of the mill's paper machine indicates that it was not damaged, the operability of the paper machine has not yet been confirmed. Based on the preliminary damage assessment, Verso has concluded that a period of several months would be required to complete the necessary repairs to the mill. Verso intends to continue the damage assessment and will make a decision on the mill's future once the assessment is completed.

Verso has determined that over 5,000 tons of finished paper and work-in-process inventory were destroyed by the explosion and fire at the Sartell mill. Verso is working closely with its customers to provide alternative paper supplies in an effort to meet their needs in a timely manner. "Verso is appreciative of the cooperation and flexibility that our customers have demonstrated as we work together to resolve the production, supply and logistical issues resulting from this unfortunate, unforeseen event," said Mike Weinhold, Verso's Senior Vice President of Sales, Marketing and Product Development.

"The tragic loss of our employee, Jon Maus, makes this an especially difficult time for Verso and our employees," said Dave Paterson, Verso's President and Chief Executive Officer. "Our collective thoughts and prayers continue for Jon's wife Lucy, their children, and the rest of the Maus family." Verso also continues to offer counseling services for all employees affected by the Sartell incident.

Parallel with the damage assessment, Verso has begun an investigation into the origin and cause of the explosion and fire at the Sartell mill. "Our top priority is to determine why this unfortunate event happened and to make sure that nothing like it ever happens again," said Paterson. The Sartell mill has consistently achieved "Star" status in the Voluntary Protection Program sponsored by the federal Occupational Safety and Health Administration, which recognizes employers and employees who have demonstrated exemplary achievement in the prevention and control of occupational safety and health hazards.

The State Fire Marshal Division of the Minnesota Department of Public Safety, the Minnesota Occupational Safety and Health Administration, and Verso's insurer also are investigating the explosion and fire at the Sartell mill. Verso is voluntarily and fully cooperating with these investigations.

Verso is grateful for the tremendous assistance provided by many organizations and individuals in response to the Sartell incident. "We want to thank everyone — including the mill's first responders, fire departments, law enforcement agencies, emergency response organizations, emergency relief agencies, governmental officials, and concerned businesses and citizens — for their outpouring of support for Verso and the Sartell mill," said Lyle Fellows, Verso's Senior Vice President of Manufacturing and Energy.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Amendments to Exchange Offers and Consent Solicitations

Verso Paper Corp. has announced that it has amended certain terms of the previously announced exchange offers and consent solicitations of two of its subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (together, the "Issuers"), with respect to their second priority senior secured floating rate notes due 2014 (the "Old Secured Floating Rate Notes") and with respect to their 11⅜% senior subordinated notes due 2016 (the "Old Subordinated Notes").

Among other things, the amendments to both exchange offers and consent solicitations included the following changes with respect to certain covenants relating to the new series of 11.75% secured notes due 2019 (the "New Notes") to be issued in the exchange offers: (a) revising the definition of "Existing Fixed Rate Second-Lien Notes" to include certain refinancings or exchanges of these notes, (b) revising the indebtedness covenant by imposing certain additional requirements therein relating to the refunding or refinancing of the Issuers' existing second-lien notes; and (c) revising the restricted payments covenant to impose additional restrictions on the ability of the Issuers to refinance existing second-lien notes and make certain other restricted payments. The amended covenant terms are set forth in more detail in supplements, dated as of May 7, 2012, to each of the Issuers' confidential offering memorandums and consent solicitation statements relating to the exchange offers.

Tendered Old Subordinated Notes may be withdrawn before the withdrawal deadline of 5:00 p.m., New York City time, on May 8, 2012. Tendered Old Secured Floating Rate Notes may no longer be withdrawn, except to the extent that the Issuers are required by law to provide additional withdrawal rights.

Except as set forth herein, in the supplements dated as of April 25, 2012, and May 7, 2012, to the Issuers' confidential offering memorandum and consent solicitation statement dated as of March 28, 2012, and the related consent and letter of transmittal (collectively, the "Old Secured Floating Rate Notes Exchange Offer Documents") and in Verso's news release issued on April 11, 2012, the complete terms and conditions of the exchange offer and consent solicitation for the Old Secured Floating Rate Notes remain the same as set forth in the Old Secured Floating Rate Notes Exchange Offer Documents, copies of which were previously distributed to eligible holders of the Old Secured Floating Rate Notes.

Except as set forth herein and in the supplement dated as of May 7, 2012, to the Issuers' confidential offering memorandum and consent solicitation statement dated as of April 25, 2012, and the related consent and letter of transmittal (collectively, the "Old Subordinated Notes Exchange Offer Documents"), the complete terms and conditions of the exchange offer and consent solicitation for the Old Subordinated Notes remain the same as set forth in the Old Subordinated Notes Exchange Offer Documents, copies of which were previously distributed to eligible holders of the Old Subordinated Notes.

If any of the conditions to the exchange offer and consent solicitation for the Old Secured Floating Rate Notes is not satisfied, the Issuers may terminate the exchange offer and consent solicitation and return tendered Old Secured Floating Rate Notes not previously accepted. The Issuers have the right to waive any of the conditions with respect to the Old Secured Floating Rate Notes. In addition, the Issuers have the right, in their sole discretion, to terminate the exchange offer and consent solicitation at any time, subject to applicable law.

If any of the conditions to the exchange offer and consent solicitation for the Old Subordinated Notes is not satisfied, the Issuers may terminate the exchange offer and consent solicitation and return tendered Old Subordinated Notes not previously accepted. The Issuers have the right to waive any of the conditions with respect to the Old Subordinated Notes. In addition, the Issuers have the right, in their sole discretion, to terminate the exchange offer and consent solicitation at any time, subject to applicable law.

General

This announcement shall not constitute an offer to purchase or a solicitation of an offer to sell any securities. The complete terms and conditions of the exchange offer for the Old Subordinated Notes are set forth in the Old Subordinated Notes Exchange Offer Documents that have been sent to eligible holders of the Old Subordinated Notes, as amended to the extent described in this news release. The exchange offer and consent solicitation for the Old Subordinated Notes is being made only through, and subject to the terms and conditions set forth in, the Old Subordinated Notes Exchange Offer Documents and related materials. The complete terms and conditions of the exchange offer and consent solicitation for the Old Secured Floating Rate Notes are set forth in the Old Secured Floating Rate Notes Exchange Offer Documents that were sent to eligible holders of the Old Secured Floating Rate Notes, as amended to the extent described in this news release and in the news releases dated as of April 11, 2012, and April 25, 2012. The exchange offer and consent solicitation for the Old Secured Floating Rate Notes is being made only through, and subject to the terms and conditions set forth in, the Old Secured Floating Rate Notes Exchange Offer Documents (as amended to the extent described in this news release) and related materials.

The New Notes are being offered in the U.S. only to (1) qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the "Securities Act") and (2) "accredited investors" as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act, and outsidethe United States only to non-U.S. investors pursuant to Regulation S. The New Notes will not initially be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from registration requirements or in a transaction that is not subject to the registration requirements of the Securities Act or any state securities laws.

Global Bondholder Services Corporation is acting as the Information Agent for the exchange offers. Requests for the Old Subordinated Notes Exchange Offer Documents or the Old Secured Floating Rate Notes Exchange Offer Documents from eligible holders may be directed to Global Bondholder Services Corporation at (212) 430-3774 (for brokers and banks) or (866) 470-3700 (for all others).

Neither the Issuers' boards of directors nor any other person makes any recommendation as to whether holders of Old Subordinated Notes or Old Secured Floating Rate Notes should exchange such notes, and no one has been authorized to make such a recommendation. Eligible holders of Old Subordinated Notes or Old Secured Floating Rate Notes must make their own decisions as to whether to exchange their notes, and if they decide to do so, the principal amount of the notes to exchange. Eligible holders of Old Subordinated Notes or Old Secured Floating Rate Notes should read carefully the exchange offer documents described above and related materials before any decision is made with respect to the exchange offer and consent solicitation.

Source: Verso Paper Corp.

Verso Paper Corp. Reports 2011 Sustainability Progress in "Count on Verso"

Verso Paper Corp. has announced the publication of its 2011 Sustainability Report titled "Count on Verso." The report details Verso's progress against its commitment to respect a sustainable balance among environmental, social and economic needs.

"The title of our 2011 report reflects Verso's belief that our company's sustainability commitment carries with it a responsibility to deliver a high level of certainty to everyone we interact with, even in these uncertain times," explains Verso President and CEO Mike Jackson. "Our corporate strategy and disciplined approach to executing it assure our customers and other stakeholders that they can count on Verso to do what we say we will do when it comes to our business, our people and our planet."

2011 Sustainability Report Highlights

- Our excellent safety performance continued in 2011 with a total incidence rate (TIR) of 1.58 and a world-class lost workday incidence rate (LWIR) of 0.20. We believe that zero injuries is achievable and continue to strive toward that goal.

- Our 2011 energy initiatives moved us nearly half the way toward keeping our 2009 Save Energy Now LEADER pledge to reduce energy per unit of production 25 percent by 2019.

- We completed a $45 million renewable energy project at our Quinnesec Mill in Michigan that will deliver 28 megawatts of green energy, an amount equivalent to the electricity used by 21,000 households annually.

- Sixty percent of the energy generated by Verso in 2011 came from renewable, greenhouse gas-neutral biomass.

- 70 percent of the wood fiber Verso used was third-party certified to a credible forest management certification standard and all four Verso mills maintained compliance with the Programme for the Endorsement of Forest Certification (PEFC™ - PwC-PEFC-319) and Forest Stewardship Council™ (FSC® License Code FSC®-C019085) chain of custody standards.

- We increased our sale of chain-of-custody certified papers to 33% of total sales, up from 26% in 2010.

- The company completed an innovative, two-year pilot project with several customers and other stakeholders that added 1.4 million certified acres in Maine, an increase of 20 percent.

- Each of Verso's four mills applied for and received ISO 14001:2004 recertification after successfully completing an independent audit of its environmental management system.

- Verso once again had a near perfect environmental compliance record with only one notice of violation. Cited issues were corrected immediately and no fines were assessed.

- Verso's combined employee and company United Way contributions totaled more than $300,000, a 3 percent increase over 2010.

For more information, download a full copy of the Verso 2011 Sustainability Report from the company's website at www.versopaper.com/sustainability.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Retirement of CEO

Verso Paper Corp. have announced that Michael A. Jackson will retire as the President and Chief Executive Officer and a director of Verso and that David J. Paterson has been elected by Verso's board of directors to serve in such roles, with both events to occur effective as of May 14, 2012.

Scott Kleinman, Verso's Chairman of the Board, said, "Verso truly has been fortunate to have Mike Jackson as our CEO during the past five years. Mike has established a solid culture and strategic foundation at Verso since we became an independent entity in 2006. Under Mike's direction, Verso has improved and refined our core product portfolio, developed and marketed a series of specialty products, and formulated and begun executing a forward-looking renewable energy strategy. Verso is on sound footing thanks to Mike's steady leadership. On behalf of the entire Verso team — our employees, board of directors, and stockholders — I want to thank Mike for his distinguished service and tremendous contributions to Verso."

Kleinman continued, "Going forward, we are pleased and honored that Dave Paterson will become Verso's new CEO. Dave brings to Verso a wealth of experience garnered during his many years of service as an executive with AbitibiBowater Inc., Bowater Incorporated, and Georgia-Pacific Corporation. Dave is an outstanding leader, a respected and knowledgeable businessman, and absolutely the right person to lead Verso in the next phase of its business life."

Dave Paterson added, "I am pleased to be appointed as CEO and am excited about the opportunities ahead for Verso. Verso has a strategic focus, exceptional people, and a nimble management approach that should bode well for the future. I am truly excited to be joining the Verso team."

Mike Jackson concluded, "It has been an honor and privilege for me to serve as Verso's CEO during the past several years. I have so much appreciation for the incredible work and indomitable spirit of our employees. I am confident that this will be a seamless CEO transition and that Dave Paterson is well prepared to continue the evolution and execution of Verso's strategies."

Mr. Jackson will continue to serve as the President and Chief Executive Officer and a director of Verso through Verso's first quarter earnings call on May 14, 2012, after which Mr. Paterson's appointment to these positions will become effective. Mr. Paterson will serve as a Class II director of Verso with an initial term expiring at our 2013 annual meeting of stockholders.

Mr. Paterson, age 57, served as President and Chief Executive Officer and a director of AbitibiBowater Inc. (now doing business as Resolute Forest Products), a leading global producer of newsprint, coated and specialty papers, market pulp and wood products, from 2007 to 2011. He was Chairman, President and Chief Executive Officer of Bowater Incorporated during 2007 and President and Chief Executive Officer of Bowater Incorporated from 2006 to 2007. From 1987 to 2006, Mr. Paterson worked in various executive and sales and marketing positions for Georgia-Pacific Corporation, a leading global manufacturer of tissue, packaging, paper, building products and related chemicals, including most recently as Executive Vice President of the Building Products division from 2003 to 2006, Executive Vice President of the Pulp and Paperboard division from 2001 to 2003, President of the Paper and Bleached Board division in 2001, and Senior Vice President of the Communication Papers division from 2000 to 2001.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Amendments to Exchange Offer

Verso Paper Corp. has announced that it has amended certain terms of its previously announced exchange offer and consent solicitation of two of its subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (together, the "Issuers"), with respect to their second priority senior secured floating rate notes due 2014 (the "Old Notes").

Initially, only those holders that validly tendered their Old Notes prior to the previously scheduled early tender date of 5:00 p.m., New York City time, on April 10, 2012, were entitled to receive the total consideration of $1,000 in principal amount of new 9.75% Secured Notes due 2019 (the "New Notes") per$1,000 in principal amount of Old Notes tendered, which includes an early tender payment of $50 per $1,000 in principal amount of Old Notes tendered (the "Total Consideration"). The Issuers have now determined that all holders that validly tender their Old Notes prior to 11:59 p.m., New York City time, onApril 24, 2012, which is the expiration date of the exchange offer and consent solicitation, will be entitled to receive the Total Consideration. Tendered Old Notes may no longer be withdrawn, except to the extent that the Issuers are required by law to provide additional withdrawal rights.

In addition, the Issuers are amending the terms of the exchange offer and consent solicitation by waiving the condition requiring receipt of tenders (and associated consents) from holders of more than 50% of the outstanding Old Notes.

Except as set forth herein, the complete terms and conditions of the exchange offer and consent solicitation for the Old Notes remain the same as set forth and detailed in the Issuers' confidential offering memorandum and consent solicitation statement dated as of March 28, 2012, and the related consent and letter of transmittal (the "Exchange Offer Documents"), copies of which were previously distributed to eligible holders of the Old Notes.

Except as set forth herein, all of the other conditions set forth in the Exchange Offer Documents remain unchanged. If any of the conditions is not satisfied, the Issuers may terminate the exchange offer and consent solicitation and return tendered Old Notes not previously accepted. The Issuers have the right to waive any of the foregoing conditions with respect to the Old Notes. In addition, the Issuers have the right, in their sole discretion, to terminate the exchange offer and consent solicitation at any time, subject to applicable law.

This announcement shall not constitute an offer to purchase or a solicitation of an offer to sell any securities. The complete terms and conditions of the exchange offer and consent solicitation are set forth in the Exchange Offer Documents that were sent to eligible holders of the Old Notes, as amended to the extent described in this news release. The exchange offer and consent solicitation is being made only through, and subject to the terms and conditions set forth in, the Exchange Offer Documents (as amended to the extent described in this news release) and related materials.

The New Notes are being offered in the U.S. only to (1) qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933 (the "Securities Act") and (2) "accredited investors" as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act, and outside the United Statesonly to non-U.S. investors pursuant to Regulation S. The New Notes will not initially be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from registration requirements or in a transaction that is not subject to the registration requirements of the Securities Act or any state securities laws.

Global Bondholder Services Corporation is acting as the Information Agent for the exchange offer and consent solicitation. Requests for the Exchange Offer Documents may be directed to Global Bondholder Services Corporation at (212) 430-3774 (for brokers and banks) or (866) 470-3700 (for all others).

Neither the Issuers' boards of directors nor any other person makes any recommendation as to whether holders of Old Notes should tender their Old Notes, and no one has been authorized to make such a recommendation. Holders of Old Notes must make their own decisions as to whether to tender their Old Notes, and if they decide to do so, the principal amount of the Old Notes to tender. Holders of the Old Notes should read carefully the Exchange Offer Documents and related materials before any decision is made with respect to the exchange offer and consent solicitation.

Source: Verso Paper Corp.