Displaying items by tag: clariant

Clariant with clear strategic targets up to 2015

The Swiss specialty chemicals company Clariant will continue to consistently implement its profitable growth strategy during the next three years, as announced by CEO Hariolf Kottmann and CFO Patrick Jany at this year's Capital Markets & Media Day in Munich, Germany. The goal is, amongst others, to increase the company's EBITDA margin from 13.2% in 2011 to above 17% in 2015 and to achieve a return on invested capital (ROIC) that is above peer group average. Clariant will in future generate more than 70% of its sales with core non-cyclical business units.

In order to achieve these goals, considerable progress has to be made in all four strategic directions. Within the existing Business Units, a further profitability increase is planned through Performance Management and Functional Excellence measures. Successful innovations will generate new growth opportunities, as demonstrated already today by new products such as Exolit®, a successful flame retardant, or Life Power®, a high-performance battery material. In addition, increased market shares in emerging markets such as China, India and Brazil will further boost profitable growth.

An active portfolio management will play an important role on the path to a sustainably profitable company. As already announced with the publication of the 2011 full year results, the company will sustainably increase the quality and performance of its product portfolio. In this context, Clariant is evaluating strategic options for the Business Units Textile Chemicals, Paper Specialties, and Emulsions, Detergents & Intermediates. These options are planned to be implemented during the next 18 months.

CEO Hariolf Kottmann: "We will implement these portfolio management measures with the same speed and determination as that of our activities in the restructuring phase. They are an important pre-requisite for reaching our targets by 2015. At that point, a newly aligned Clariant will be even more profitable and will generate more than 70% of its sales from non-cyclical business units. The acquisition of Süd-Chemie marked a first milestone in this process. We will continue this success story in the next years."

The acquisition of Süd-Chemie was an important first step for Clariant. Already in 2011 the former Süd-Chemie businesses contributed significantly to the company's results. Until end 2013, an additional EBITDA improvement of CHF 90-115 million is expected from synergies resulting from the integration. The transaction will be accretive in 2013, i.e. in the second year after the acquisition. In addition, the transaction was fully refinanced within less than twelve months.

Clariant showcases “Sustainability meets Performance” paper solutions at Zellcheming 2012

Clariant presents the paper industry with an extended portfolio of functional and optical performance-enhancers and process chemicals focused on cost-optimization, environmental benefits and high-performance at Zellcheming Expo 2012 (June 26-28, 2012, Wiesbaden, Germany).

Clariant presents the paper industry with an extended portfolio of functional and optical performance-enhancers and process chemicals focused on cost-optimization, environmental benefits and high-performance at Zellcheming Expo 2012 (June 26-28, 2012, Wiesbaden, Germany).

The specialty chemicals expert will showcase recent additions to its ranges, following Clariant’s acquisition of Süd-Chemie, and trusted innovations that together reflect its commitment to support efforts by customers to improve the sustainability of their own products and manufacturing processes.

Clariant’s “Sustainabilty meets Performance” products deliver energy savings, productivity improvements and high quality finished paper materials. They simplify production and reduce machine maintenance requirements for better efficiency at the paper machine; offer no-compromise coloration and surface effects; and give Papermakers the opportunity to integrate more environmentally-compatible process materials into their operations.

Selected highlights from Clariant’s paper ranges on-show at Booth 318 (Hall 3) will include:

Leucophor® XL is a novel nuanced optical brightening agent for surfaces which makes white purer and less red cast, providing paper with high and highest grades of white at less OBA-content and accordingly less cost. The innovation is an excellent combination of cost-optimization and performance.

Cartaspers® PSM and Cartaspers® SCH reduce stickies and pitch on sieves and felts by passivation and thereby increase running time. At the same time exposure of both factory staff and the environment to volatile organic compounds is reduced. Both Cartaspers PSM and SCH are FDA compliant and fulfill the criteria for NORDIC SWAN and EU Eco-label (EU Flower).

Pitchbent® is a complementary additive to prevent impurities from raw materials and the build-up of secondary substances in the water re-circulating in papermaking machines. Through passivation it achieves a clear reduction in glue deposits on machine parts and machine cloth.

Printosil® supports the production of multi-purpose paper primarily without the use of binders. The mineral coating creates an even surface at low coating weight. Paper made with Printosil is suitable for all printing processes, and prevents quality issues for optimal production speed and output.

“Clariant’s innovative paper solutions address the industry’s need for cost-savings and increased use of recycled fiber, while also achieving the high-performance paper strengths, color shades or the brilliant whites end-users expect. We are looking forward to presenting our extended portfolio for the first time at the Zellcheming Expo,” comments Helmut Wagner, Head of Clariant’s Business Unit Paper Specialties.

For more information on Clariant’s “Sustainability meets Performance” paper industry solutions visit Clariant at Booth 318 during Zellcheming Expo 2012.

Clariant delivers resilient performance

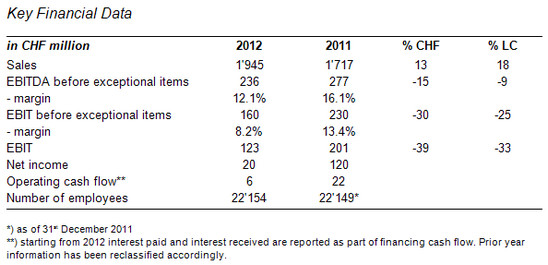

Clariant, a world leader in specialty chemicals, today announced first quarter sales of CHF 1.945 billion, compared to CHF 1.717 billion in the previous-year period. Sales grew 18% in local currencies and 13% in Swiss francs, mainly driven by the acquisition of Süd-Chemie. On a like-for-like basis, sales declined 2% in local currencies year-on-year.

§ First quarter sales up 18% in local currencies and 13% in CHF, driven by acquisitions

§ EBITDA margin before exceptional items at 12.1%, compared to 16.1% in the previous-year period, reflecting the expected soft start to 2012, with lower demand compared to the high basis of the previous year

§ Continuing growth in non-cyclical businesses while cyclical and structurally challenged businesses faced similar trading conditions to Q4 2011, improving towards the end of the quarter

§ Outlook for 2012 confirmed: Clariant expects further sales growth in local currencies and sustained profitability in 2012 as the global economy is expected to strengthen progressively in the course of the year.

CEO Hariolf Kottmann commented: "As expected, Clariant had a soft start into the year as the global economy stabilized. While the non-cyclical parts of the portfolio continued to perform well, the more cyclical businesses faced ongoing challenges in the current uncertain environment, especially in Europe. This is reflected in lower margins for the Group compared to an extraordinarily strong quarter one year ago. Going forward, we anticipate a gradual improvement in business conditions throughout the remainder of the year, which combined with further efficiency gains, will lead to an improved performance in the second half-year."

The first quarter was a continuation of the trend seen in the fourth quarter of 2011. Sequentially, Catalysis & Energy weakened as it entered its low season while the seasonally strong businesses like de-icing and refinery had a weak performance due to unfavorable weather conditions. This was compensated by a solid growth in the non-cyclical Business Units and a pick-up in demand, particularly in Masterbatches, towards the end of the quarter.

In a year-on-year comparison, however, the quarter was weaker due to economic headwinds, an unfavorable currency development and the absence of restocking activities. In this environment, ongoing robust demand was observed in the non-cyclical Additives, Catalysis & Energy, Functional Materials, Industrial & Consumer Specialties, and Oil & Mining Services Business Units, contributing around 50% to total sales and 60% to EBITDA.

Oil & Mining Services achieved the highest growth with local currency sales up in the 20 percent range. Sales in the other non-cyclical BUs grew more moderately. Due to a mild winter in North America and a cold but dry winter in Europe, the seasonal de-icing and refinery businesses recorded low demand. Although seasonally weaker compared to the third and fourth quarter, Catalysis & Energy achieved a very strong order intake above previous years in the first three months, confirming ongoing strength in this business. Business activity in the mature BUs Textile Chemicals, Paper Specialties, Leather Services, and Emulsions Detergents & Intermediates remained subdued. All regions showed double-digit growth in local currencies with the exception of Europe which was heavily impacted by the euro crisis, mainly in Southern areas.

The double-digit increase in sales was the result of a 14% volume increase and 4% higher sales prices year-on-year. On a comparable basis, i.e. excluding acquisitions, volumes were 6% lower, reflecting both weaker demand in some Business Units and a deliberate loss of less profitable businesses. Compared to the first quarter 2011, the negative effect from currency movements softened somewhat but still impacted the top-line by 5%.

The gross margin decreased to 28.2% from 29.8% in the previous-year period but significantly increased from the comparable underlying 26.0% recorded in the fourth quarter of 2011. This development reflects the declining demand year-on-year, resulting in lower capacity utilization mainly in Masterbatches and Pigments. The recovery from Q4 2011 underlines the slightly improving business conditions compared to the final quarter of last year. Compared to the previous-year quarter, sales prices increased 4% and raw material costs 2%, therefore positively contributing to the gross margin of the Group. Sequentially, raw material costs were marginally lower while prices remained flat.

EBITDA before exceptional items decreased to CHF 236 million (margin 12.1%) from CHF 277 million (margin 16.1%) a year ago. The decline in profitability is explained by a lower gross margin, higher SG&A costs, the usual seasonal weakness of the catalysts business, and a high comparable base one year-ago. The operating profit (EBIT) before exceptional items fell to CHF 160 million (margin 8.2%) from CHF 230 million (margin 13.4%), again reflecting the aforementioned factors and the higher depreciation and amortization for the former Süd-Chemie businesses. Restructuring and impairment costs of CHF 41 million versus CHF 29 million were mainly related to the integration of Süd-Chemie and additional projects related with sustainable cost reductions. Net income was CHF 20 million compared to CHF 120 million one year ago.

After the extreme volatility in 2011, foreign exchange markets are starting to level out; however, there was still a slightly negative impact of currency movements on EBITDA and EBIT, which were therefore lower at CHF -5 million and CHF -2 million respectively.

Cash flow from operating activities of CHF 6 million was below to last year's CHF 22 million as inventories have been increased in some Business Units in anticipation of progressively higher demand going into the second quarter. As a percentage of sales, net working capital reached 20.6%.

Net debt remained basically constant at CHF 1.754 billion compared to CHF 1.740 billion at year-end 2011. This resulted in a gearing (net debt divided by equity) of 59% at quarter-end.

Outlook 2012

Clariant confirms its outlook for 2012 with the publication of its full-year figures. Raw material costs are expected to rise in the mid-single-digit range while exchange rates should remain stable compared to the beginning of the year. In its base case scenario, Clariant expects that after a weak start to 2012, the global economy will strengthen progressively in the course of the year. Therefore, results for the first half-year are expected to be lower compared to the high base of the first half of 2011, with an improvement in the second half-year 2012. For full-year 2012, Clariant expects further sales growth in local currencies and sustained profitability.

Clariant AG shareholders approve all agenda items

The Annual General Meeting of Clariant AG, a world leader in specialty chemicals, took place on 27 March 2012 in Basel and approved all agenda items. It was attended by 560 shareholders or proxies, representing 132`215`758 shares or 44.7% of Clariant's total share capital.

The AGM approved the annual report and annual accounts for 2011 with 99.9 percent of votes, discharged the corporate bodies of the company with 98.1 percent of votes, and voted for the allocation of the available net profit to the free reserves with 99.8 percent. With 76.8 percent of votes, it also approved on a consultative basis the company's compensation policy.

With 99.7 percent of votes, the General Meeting followed the Board of Director's proposal to repay the par value of CHF 0.30 per registered share, instead of distributing an ordinary dividend. The share capital will therefore be reduced as well as the par value of each registered share by CHF 0.30 to CHF 3.70.

With 65.6 percent of votes, shareholders also waived the restriction of the voting rights limit of

10 percent of the share capital for each shareholder.

Rudolf Wehrli succeeded Jürg Witmer as Chairman of the Board of Directors, as both Witmer and Klaus Jenny retired from the Board.

PricewaterhouseCoopers AG was re-elected as auditors for the financial year 2012.

In his outlook, CEO Hariolf Kottmann confirmed the already announced expectations for 2012. An accurate forecast for 2012 is difficult to make, given the current level of economic uncertainty. In its base case scenario, Clariant expects that, after a weak start to 2012, the global economy will progressively strengthen in the course of the year. Therefore, results for the first half-year are expected to be lower compared to the high base of the first half of 2011, with an improvement in the second half-year 2012. For full-year 2012, Clariant expects further sales growth in local currencies and sustained profitability.

Clariant Innovation Center Cornerstone Laid at Industriepark Höchst for 500 New Research Jobs

The cornerstone of the new 100-million-euro Clariant Innovation Center was officially laid during a ceremony today at the Industriepark Höchst in Frankfurt. Attending the event were Hessen State Finance Minister Thomas Schäfer; Clariant Executive Committee member Christian Kohlpaintner; and Ulrich Ott, Managing Director of the company’s operations in Germany. Over the next several months, the Swiss specialty chemicals corporation will build an innovative office and laboratory facility of roughly 36,000 square meters (approximately 387,000 square feet) on a site that will soon provide jobs for some 500 researchers. The concept for the building, which aims to offer an optimal working environment through its open architectural design, was developed by the Düsseldorf-based architectural firm of HPP.

“Innovation is the foundation of the future, both for individual companies and society as a whole,” said Christian Kohlpaintner, whose responsibilities at Clariant include Research and Development. “I hope that the bright and transparent rooms will not only be the birthplace for new ideas that flourish and grow, but also provide the environment for an inspiring exchange between our researchers and technicians, as well as with their partners in the fields of science and industry,” added Dr. Kohlpaintner. He also emphasized Clariant’s targeted research policy: “We want to develop products and procedures that yield sustainable benefits and represent true progress.” He underscored that a major focus in the future will be on megatrends, such as functional materials, energy efficiency and renewable raw materials.

Quoting scientist and statesman Benjamin Franklin, Dr. Thomas Schäfer stated: “Investing in knowledge still pays the highest return.” He said that the construction of a research and innovation center would benefit all parties involved: the company, whose future is visibly taking shape; the industry park, which will strengthen its reputation as knowledge and ideas factory; and the region and State of Hessen, which will gain from the new jobs for highly qualified professionals.

“Investments of this kind and magnitude also demonstrate the courage, determination and willingness to shape the future,” said Dr. Schäfer.

Clariant’s global research activities will, in the future, be centered in Höchst, Germany. “We have selected Höchst as the location because it already provides a maximum of research and development resources, including technical schools and institutions of higher education,” explained Dr. Ulrich Ott. “In addition, Frankfurt offers a number of infrastructure advantages, such as an attractive industry park, the proximity to various business partners and universities, as well as excellent connections to the transportation network.”

The building design by the HPP architectural firm of Düsseldorf, Germany, is based on an open concept for an office and laboratory building. This approach is meant to enhance chemical research and development of application-specific laboratories and technical marketing functions for different business units. In addition to Analytics, the new facility will be the location of the New Business Development and Intellectual Property Management units as well as the Patent department. An objective of bringing together different disciplines is to enhance Clariant’s R&D pipeline and further improve the company’s innovation capabilities.

The cornerstone also symbolizes this. Right next to it is a sealed stainless steel tube containing various legal and other documents – building certificate, construction permit, construction drawings and a local newspaper – as well as a three-dimensional model of the DEPAL molecule that was also driven into the ground. DEPAL is the acronym for diethyl phosphinic acid aluminum salt – the chemical name of Clariant’s successful flame retardant, which is the basis for the company’s Exolit® OP products. The molecule will remain visible to the visiting public under a glass panel in the floor of the building.

Clariant improves profitability, reinstates dividend

Clariant, a world leader in specialty chemicals, today announced full-year 2011 sales of CHF 7.370 billion, compared to CHF 7.120 billion in 2010. Sales grew 16% in local currencies and 4% in Swiss francs. The lower growth in Swiss francs was a result of the significant appreciation of the Swiss franc against most major currencies on a year-on-year basis.

Due to the acquisition of Süd-Chemie and the strength of the Business Unit Catalysis & Energy in the third and fourth quarters, sales were higher in the second half-year than in the first six months, despite a significant slowdown in some businesses towards year-end. In addition to Catalysis & Energy, which had another record-year, the non-cyclical Business Units Additives, Functional Materials, Industrial & Consumer Specialties, and Oil & Mining Services contributed significantly to the sales increase in 2011. Those non-cyclical businesses account for more than 50% of Group sales. In contrast, the cyclical Business Units Pigments and Masterbatches suffered from a slow-down in industrial production that started at the beginning of the second half-year and resulted in destocking activities along the value chain. All regions grew at a double-digit rate in local currencies.

The double-digit increase in sales was driven by year-on-year sales price increases of 7% and by acquisitions, which contributed 14% to sales growth. Volumes were 5% lower, reflecting the lower demand in the second half-year and the deliberate loss of sales that did not meet Clariant's profitability targets.

The gross margin decreased to 26.7% from 27.9% in full-year 2010. Lower volumes, negative currency effects, and a one-time charge were the main drivers of the slightly lower margin, and were only partly offset by successful sales price management. Excluding the one-time charge of CHF 54 million as a result of the sale of Süd-Chemie inventories revalued to fair value less costs to sell, the gross margin was 27.4%. Despite the global economic slow-down, commodity prices remained at high levels. Raw material costs increased 14% compared to the previous year. Sales price increases of 7% fully compensated the higher raw material costs, leading to a slightly positive contribution to the gross margin.

EBITDA before exceptional items increased to CHF 975 million (margin 13.2%) from CHF 901 million (margin 12.7%) a year ago. A strong fourth quarter in Catalysis & Energy and a diminishing negative impact from currencies toward the end of the year pushed the margin higher. The operating profit (EBIT) before exceptional items rose to CHF 717 million (margin 9.7%) compared to CHF 696 million (margin 9.8%) in 2010. Lower restructuring costs led to an improvement in net income to CHF 251 million from CHF 191 million despite higher tax expenses.

The extreme volatility in the foreign exchange markets weighed on Clariant's profitability in 2011. Both EBITDA and EBIT before exceptional items were negatively impacted by approx. CHF 190 million (EBITDA), corresponding to a 0.9 percentage-point margin, respectively approx. CHF 170 million (EBIT), corresponding to a 1.0 percentage-point margin.

Cash flow from operations of CHF 206 million was below last year's CHF 642 million, which to a large extent had been obtained from the reduction in net working capital, but significantly above the CHF 21 million reported at the end of the third quarter 2011. As a percentage of annualized sales, net working capital reached 19.6%, below the targeted

20% of sales.

The acquisition of Süd-Chemie led to an increase in net debt to CHF 1.740 billion compared to CHF 126 million at year-end 2010. Net debt has been reduced from 1.812 billion at the end of the third quarter, leading to a gearing (net debt divided by equity) of 58% at year-end 2011. The cash position was strong with CHF 1.199 billion in cash and cash equivalents on 31 December 2011. The extension of the maturity profile has been successfully addressed with the issuance of bonds totaling CHF 300 million in the Swiss francs market since May 2011 and another EUR 365 million in certificates of indebtedness with terms of three years and four and a half years. After the reporting period, another EUR 500 million with maturity in 2017 have been raised in the Eurobond market.

Clariant Q4 2011 Performance

Clariant reported 21% sales growth in local currencies in the fourth quarter. In Swiss francs, sales were 13% higher, at CHF 1.918 billion compared to CHF 1.700 billion a year ago. Sales prices increased 9% year-on-year, while volumes were 12% lower and raw material costs rose 10%. Sequentially, sales prices rose slightly while raw material costs fell 1%. Catalysis & Energy had an excellent quarter, leading the good performance of the non-cyclical businesses. Masterbatches and Pigments were negatively affected by the softening demand from the plastics industry and the related destocking activities. The structurally challenged mature businesses Textile Chemicals, Leather Services, and Paper Specialties continued to suffer from the poor business conditions in their respective end-markets. Organic sales growth in North and Latin America was double-digit, while sales in Asia/Pacific decreased. Europe suffered from the debt crisis, with a double-digit decrease in sales. Including acquisitions, all regions showed double-digit sales growth.

The gross margin was lower year-on-year, at 23.8% compared to 26.0% in the previous-year period. This was exclusively due to a one-time charge of CHF 43 million as a result of the sale of Süd-Chemie inventories revalued to fair value less costs to sell. Excluding this charge, the gross margin reached the level of the previous-year quarter. The EBITDA margin before exceptional items climbed to 12.6% from 10.0% in the fourth quarter of 2010, driven by lower costs and helped by one-time effects, contributing 0.8 percentage points to the EBITDA margin. The operating income (EBIT) before exceptional items increased to CHF 165 million (margin 8.6%) from CHF 120 million (margin 7.1%).

Operating cash flow picked-up significantly compared to the first nine months (CHF 21 million) and rose to CHF 185 million, but was below the exceptionally high CHF 277 million of the previous year, which had been the result of the reduction of net working capital.

Süd-Chemie meets high expectations, smooth integration ongoing

The two new Süd-Chemie Business Units - Catalysis & Energy and Functional Materials - have performed above target in the first eight months of consolidation. Catalysis & Energy reported an EBITDA before exceptionals of CHF 107 million (margin 21.8%), and Functional Materials CHF 59 million (margin 12.9%). Catalysis & Energy showed the expected strong development in the third and especially the fourth quarter.

After the extraordinary General Meeting held by Süd-Chemie AG on 22 November 2011, the transfer of all shares held by minority shareholders to Clariant was approved. The squeeze-out became effective 1 December 2011, with Süd-Chemie now being 100% owned by Clariant and organized according to the Clariant operating model.

The integration is progressing as planned with all project teams fully operational. Based on current insights and integration experience, the anticipated EUR 75-95 million EBITDA improvements by year-end 2013 are confirmed.

Outlook 2012

Clariant will continue to systematically implement the next steps in its transformation process with a focus on the integration of Süd-Chemie, on completing the restructuring measures initiated in 2009-2010, and on portfolio management. In this context, Clariant is evaluating strategic options for the Business Units Textile Chemicals, Paper Specialties, and Emulsions, Detergents & Intermediates, with the goal of realization in the mid- to long-term.

An accurate forecast for 2012 is difficult given the current level of economic uncertainty. Raw material costs are expected to rise in the mid-single-digit range while exchange rates should remain stable compared to the beginning of the year. In its base case scenario, Clariant expects that after a weak start to 2012, the global economy will progressively strengthen in the course of the year. Therefore, results for the first half-year are expected to be lower compared to the high base of the first half of 2011, with an improvement in the second half-year 2012. For full-year 2012, Clariant expects further sales growth in local currencies and sustained profitability.

In the last three years, the restructuring program as well as portfolio management measures have brought Clariant's operating performance to a sustainably higher level. The Board of Directors will therefore propose to the AGM a payout of CHF 0.30 per share through a reduction of the nominal value of the shares to CHF 3.70 from CHF 4.00.

Clariant Full Year 2011 Results - Press Conference

CLARIANT 2011 FULL YEAR RESULTS PRESS CONFERENCE - Wednesday 15 FEBRUARY 2012 - 09.00 CET

Clariant will be presenting its 2011 Full Year Results on 15 February, 2012

Location:

SIX Swiss Exchange

ConventionPoint

Selnaustrasse 30

CH-8021 Zürich

www.conventionpoint.ch

Please register with Jennifer Burri (This email address is being protected from spambots. You need JavaScript enabled to view it.) - by latest Wednesday February 8, 2011, if you want to attend the full year results presentation in person.

You will also have the opportunity to join the media conference via a live webcast at the following location:

http://gaia.world-television.com/clariant/20120215/mc/extern/trunc

Or by dialing in via phone line by using one of the following numbers:

+41 (0) 91 610 56 00 (Europe)

+44 (0) 203 059 58 62 (UK)

+1 866 291 41 66 (USA - Toll-Free)

Questions may be raised via the webcast or via the e-mail address: This email address is being protected from spambots. You need JavaScript enabled to view it..

In order to enable us to start on time we ask all participants to dial in 5 - 10 minutes before the conference is scheduled to start.

An audio plug-in capability will be made available during the press conference.

Please note that the press release along with other supporting material will be issued and posted on www.clariant.com at 07.00 CET on February 15.

Clariant successfully issues EUR 500 million Eurobond

The fixed rate notes with a minimum denomination of EUR 100,000 and a final coupon of 5 ⅝ % p.a. are maturing on January 24, 2017. The orderbook was significantly oversubscribed on the back of strong investor demand. Clariant has applied for listing of the notes with the London Stock Exchange. BNP Paribas, Citigroup and UniCredit acted as Joint Book Runners on this transaction.

The proceeds are to be used for general corporate purposes so optimizing Clariant's debt maturity profile. After two CHF-Bond issuances (total of CHF 300 million) in May and July 2011 and the placement of a total of four German Certificates of Indebtedness (total of EUR 390 million) in October 2011 including an increase in early January 2012, this bond issuance is the third successful financing step in the debt capital markets over the last nine months.

Clariant is named Pigment Supplier of the Year

Sitivesp, the Union of Paints & Coatings producers of the State of São Paulo, has named Clariant “Supplier of the Year” in the Pigment category of its annual award scheme. This is the 17th time, in the 20 year history of the award, that Clariant has been chosen as the best Pigment supplier.

Promoted by the Union's Raw Materials Department, the Sitivesp Supplier of the Year Award highlights the work done by companies that promote continuous improvements in the products and services offered to the paint and coatings market. “Clariant continuously invests in research and innovation, in the improvement of its processes and the development of environmentally friendly products, with the objective of providing clients with the optimum solutions for their needs. This recognition proves that we are on the right path, from the stand point of quality and customer service,” states Pieter Hermens, Clariant’s Head of Business Unit Pigments to Latin America.

The selection process included votes from all Sitivesp associated companies. In all there are 75 companies, which together make up 70% of the Brazilian paint and coatings market. In the secret and voluntary vote, the members took into consideration factors such as relationship between company and supplier, pre- and post-sale service quality, timely delivery, commercial policy, process, product quality and technological innovation.

For Clariant, the award is even more significant because it is based on Top of Mind Awareness (TOMA), in which Sitivesp members freely name the best companies in different categories. “The Clariant team includes experienced professionals who have been serving the paint market for many years, which contributes to our deep understanding of client needs, and strengthens our relationships and partnerships," states Luis Carlos Peres, Pigment Sales Coordinator at Clariant.

Clariant strengthens Asian presence

The Swiss-based specialty chemicals company Clariant announces the opening of its new Regional Headquarters for South East Asia & Pacific and its new Global Textile Chemicals headquarters, both located in Singapore. Today Clariant is also celebrating the inauguration of its newly built ethoxylation plant and application laboratory in Guangdong, China. “Expanding Clariant’s business in the fast-growing Asian region is an important pillar in our profitable growth strategy and a strong commitment to serving our customers and markets,” comments CEO Hariolf Kottmann.

- New Singapore Headquarters for South East Asia & Pacific

- New Textile Chemicals Headquarters and application lab

- First Asian Clariant ethoxylation plant in Dayabay, China

New Regional Headquarters for South East Asia & Pacific Region

Clariant’s new regional hub is the first headquarters to be shared by Clariant and Süd-Chemie. The current 200 employees based at the Singapore location will support customers in the South East Asia and Pacific regions. In the last five years, Clariant’s sales in the Asia Pacific region have grown from 17% to around 22%. At the same time investment reached over CHF 200 million in China alone. Clariant’s acquisition of Süd-Chemie will add significantly to this growth. Süd-Chemie achieved 31.5% of its sales in Asia and the Middle East in 2010, standing at EUR 385 million. A third of its employees are located in this region.

New Global Textile Chemicals BU Headquarters

The South East Asia & Pacific Headquarters will also serve as the headquarters for Clariant’s Textile Chemicals Business Unit. In 2010 the textile business generated sales of CHF 821 million. With more than 60% of global textile production based in the Asia Pacific region, Clariant already generates 43% of its textile chemicals sales from Asia. With its relocation from Switzerland now complete, the new headquarters will accommodate the entire senior Textile Chemicals BU management team. The Business Unit has also set up its global textile application team at the new location, including a state of the art laboratory.

First Asia ethoxylation plant of Clariant in China

Clariant’s completion of its global ethoxylation footprint with a first site in Asia marks another significant investment in the country by its Industrial and Consumer Specialties (ICS) Business Unit.

The new 80,000 square meter Dayabay plant situated in the South East of Guangdong Province is the business unit’s largest plant in Asia Pacific. The plant has an initial capacity close to 50,000 tons per annum for the manufacture of surfactants. Additionally, it is equipped with an autoclave laboratory to allow fast product development and customization of products to local demands.