Kemira Oyj's Interim Report January-March 2012: Stable revenue and sales margin offset by higher fixed costs

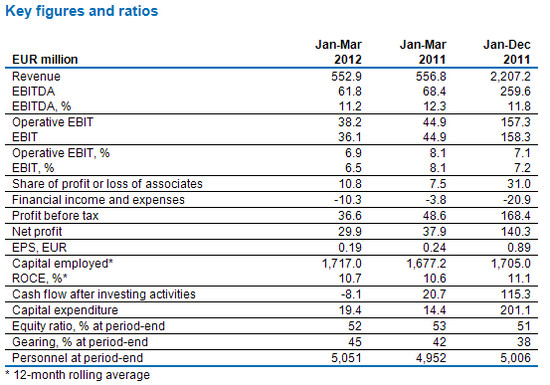

- Revenue remained stable at EUR 552.9 million (556.8).

- Operative EBIT decreased 15% to EUR 38.2 million (44.9) with a margin of 6.9% (8.1%) mainly due to higher fixed costs.

- Earnings per share decreased 21% to EUR 0.19 (0.24) mainly due to changes in fair values of electricity derivatives.

- Kemira outlook for 2012 is revised from the 2011 year-end report. Kemira expects revenue and operative EBIT in 2012 to be approximately at the same level than in 2011.

Kemira's President and CEO Wolfgang Büchele:

"Kemira's revenue and operative EBIT improved at the beginning of the year compared to the challenging fourth quarter of 2011. Compared to the first quarter of 2011, Kemira was able to compensate the lower sales volumes and higher raw material prices with the sales price increases. However, our fixed costs increased in all segments and resulted in a decrease in the operative EBIT.

Kemira will continue to focus on the water and more specifically on the water quality and quantity management. This is a unique aspect in the chemical industry. Now we are focusing on the following priorities:

First of all, we have to get into an accelerated mode in order to reach our EBIT financial target of 10% by improving our internal efficiency. This will be achieved by reducing the complexity of our business while growing profitably at the same time.

Secondly, as the fastest growth of water related business will be in Asia and South America, we have to substantially strengthen our position there.

Lastly, we need to sharpen our strategy and to make it more tangible for everyone.

I assumed the position of CEO on April 1, 2012 but already prior to that I have spent time meeting Kemira employees. What impressed me most was the energy and enthusiasm of our people. As one Kemira, we will together leverage our market potential and create value for the company and its stakeholders.

In the near term, uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products. Kemira expects revenue and operative EBIT in 2012 to be approximately at the same level than in 2011. This guidance assumes that no major macroeconomic disruption and/or further substantial increase in oil price would occur."

Definitions of key figures are available at www.kemira.com > Investors > Financial information. Comparative 2011 figures are provided in parentheses for some financial results, where appropriate. Operating profit, excluding non-recurring items, is referred to as Operative EBIT. Operating profit is referred to as EBIT.

Outlook (revised)

Kemira's vision is to be a leading water chemistry company. Kemira will continue to focus on improving profitability and reinforcing positive cash flow. The company will also continue to invest in order to secure the future growth in the water business.

Kemira's financial targets remain as communicated in connection with the Capital Markets Day in September 2010. The company's medium term financial targets are:

- revenue growth in mature markets > 3% per year, and in emerging markets > 7% per year

- EBIT, % of revenue > 10%

- positive cash flow after investments and dividends

- gearing level < 60%.

The basis for growth is the expanding water chemicals markets and Kemira's strong know-how in the water quality and quantity management. Increasing water shortage, tightening legislation and customers' needs to increase operational efficiency create opportunities for Kemira to develop new water applications for both current and new customers. Investment in research and development is a central part of Kemira's strategy. The focus of Kemira's research and development activities is on the development and commercialization of the new innovative technologies for Kemira's customers globally and locally.

In the near term, an uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products in the customer industries. In 2012, Kemira expects the revenue and operative EBIT to be approximately at the same level than in 2011. This guidance assumes that no major macroeconomic disruption and/or further substantial increase in oil price would occur.