Sappi Limited results for the year and fourth quarter ended September 2014. Debt below US$2 billion; full year EBITDA excluding special items increase by 25% on strong fourth quarter

Sappi Limited results for the year and fourth quarter ended September 2014. Debt below US$2 billion; full year EBITDA excluding special items increase by 25% on strong fourth quarter

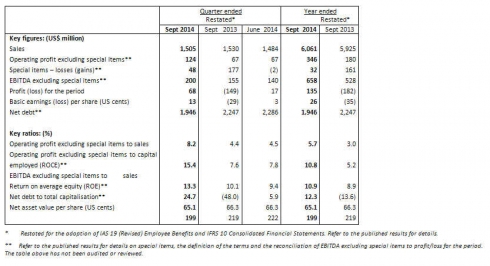

Highlights for the Year

- Strategy delivers strong earnings growth

- EBITDA excluding special items US$658 million (up 25% year-on-year)

- EPS excluding special items 22 US cents (restated 2013 loss per share 4 US cents)

- Net debt US$1,946 million, down US$300 million year-on-year

Highlights for the Quarter

- EBITDA excluding special items US$200 million (up 29% year-on-year)

- EPS excluding special items 12 US cents (restated Q4 2013 1 US cent)

- US$288 million cash generation in the quarter (restated Q4 2013 US$111 million)

Commenting on the key financial highlights of the quarterly and year-end results, Sappi Chief Executive Officer Steve Binnie said:

“We made significant strides in the execution of our strategy this past year. Notable achievements were reduction of net debt, improved performance of our European and Southern African paper businesses and delivery of substantially increased dissolving wood pulp volumes into a growing and high margin market. Additionally, we disposed of Nijmegen Mill in order to reduce costs, and sold our Usutu forests which were surplus to requirements, to assist with reducing net debt. The North American business had a challenging year; however, we can already see advancement in that business and expect further improvement in the year ahead.

The first full year of operation for our expanded Specialised Cellulose operations as well as reduced capex expenditure following the completion of the dissolving wood pulp projects, allowed for a focus on cash generation and debt reduction. The group’s EBITDA excluding special items for the full year increased by 25% over the prior year.

The group continued the strong progress made throughout 2014 and delivered a 29% rise in EBITDA excluding special items compared with the equivalent quarter last year. It is pleasing to note that all three regions improved from the prior quarter. Cost reductions across the group and higher selling prices in some markets contributed to the growth. Volumes continued to decline in the graphic paper markets, but at a slower rate than experienced in recent years.

“The European business saw an encouraging improvement in margin in this seasonally better quarter, achieving an EBITDA excluding special items margin of more than 10% for the first time since 2012.

“In North America, market conditions were extremely competitive throughout the year and we experienced significant downward pressure on pricing. During this seasonally stronger quarter, operating profit excluding special items recovered compared with the prior quarter, which included the impact of outages. The result was slightly below that of the equivalent quarter last year due to lower paper prices and higher input costs, particularly for wood. Prices for coated woodfree web increased during the quarter, but have yet to match prior year price levels. The release paper business was once again impacted by weak Chinese demand, only partially offset by stronger sales to the rest of the world.

“Overall, this has been a good year for the Southern African business, with an expanded Specialised Cellulose business and the restructured paper business consistently delivering enhanced margins. The performance of the Southern African business improved compared to the equivalent quarter last year due to increased sales volumes for dissolving wood pulp, as well as higher average prices for paper and paper packaging.

“The Specialised Cellulose business had another solid quarter, with increased sales volumes and a weaker Rand/Dollar exchange rate offsetting the lower average dollar dissolving wood pulp prices compared to both the prior quarter and prior year. Strong shipment volumes contributed towards an EBITDA excluding special items of US$77 million.

“Based on current market conditions, we believe that EBITDA excluding special items in the 2015 financial year will be broadly similar to that of 2014. The expected improvement in the underlying operational performance of the paper businesses will be offset by lower US Dollar dissolving wood pulp pricing and the impact of the projects at Gratkorn and Somerset.

“The first quarter result will be negatively impacted by the Gratkorn PM11 upgrade project, resulting in three weeks of downtime for the paper machine. The results will be further impacted by the extended annual maintenance outage and the finalisation of the natural gas conversion project at Somerset Mill in the US.

“We therefore expect the group EBITDA excluding special items in the first quarter to be similar to that achieved in the equivalent quarter last year, despite the improved underlying performance of the overall business.”

click image to resize

The year and quarter under review

Operating profit excluding special items for the year was US$346 million compared to US$180 million in the prior year. Special items amounted to a charge of US$32 million, comprised mainly of net restructuring charges and loss on disposal of assets across our businesses. This was partially offset by plantation fair value pricing gains of US$18 million.

Special items for the quarter were a net charge of US$48 million. Included in the special items was a provision for retrenchments and restructuring costs in our European paper business. These charges were offset by a deferred tax asset of US$53 million in North America which was recognised due to the non-taxability of bio-fuel tax credits received in fiscal 2009 and 2010.

Earnings per share for the quarter were 13 US cents (including a gain of 1 US cent in respect of special items), compared with a loss of 29 US cents (including a charge of 30 US cents in respect of special items) in the restated equivalent quarter last year.

Net cash generated for the full financial year was US$243 million compared to utilisation of US$247 million last year. This significant turnaround was due to the improved operating cash generation, excellent working capital management, reduced capital expenditure and the receipt of proceeds of ZAR1 billion from the sale of the Usutu forests.

Net debt at financial year-end decreased to US$1,946 million as a result of the increased cash generated, and was within our target to end the year below US$2 billion. At the end of September 2014, we had liquidity comprising US$528 million of cash in addition to undrawn committed revolving credit facilities of €350 million and ZAR1 billion in Europe and South Africa respectively. In October 2014, we utilised cash resources to redeem US$27 million (ZAR300 million) of our US$67 million (ZAR750 million) public bonds due April 2015.

Outlook

Markets will remain challenging, both for graphic paper, where demand is expected to continue to decline, and for dissolving wood pulp due to current pricing pressures. In the dissolving wood pulp market, demand remains robust. US Dollar prices have weakened post the financial year due to pressure from lower cotton prices and the continued oversupply of dissolving wood pulp and viscose staple fibre production capacity. Cloquet Mill will likely take advantage of its ability to swing between dissolving pulp and hardwood paper pulp production to optimise margins for the US business. Volumes with key dissolving wood pulp customers will not be impacted by any such optimisation. We will continue to focus on cost management in order to maintain our current margins for the overall Specialised Cellulose business.

Currency movements affect margins in our European and Southern African businesses, having both transactional and translational impacts. A weaker Rand and Euro in relation to the US dollar both support local and export pricing for these businesses, historically offsetting any input cost impact of the weaker currency.

Capital expenditure in 2015 is expected to be in line with that of 2014, and focussed largely on the investments at our Kirkniemi and Gratkorn Mills.

We are considering utilising our increased cash reserves to repay and refinance a portion of our debt in order to lower future costs. We typically experience a cash outflow in our first fiscal quarter and this will lead to an increase in net debt as at the end of December 2014. Nevertheless, we expect to reduce our net debt further over the course of the year and reduce our financial leverage towards our target of two times net debt to EBITDA.