Figures in brackets, unless otherwise stated, refer to the comparison period, i.e. the same period of the previous year. Automation has been consolidated into Valmet's financials since April 1, 2015, when the acquisition of Automation was completed.

April-June 2015: Strong start for Automation - Valmet's EBITA more than doubled

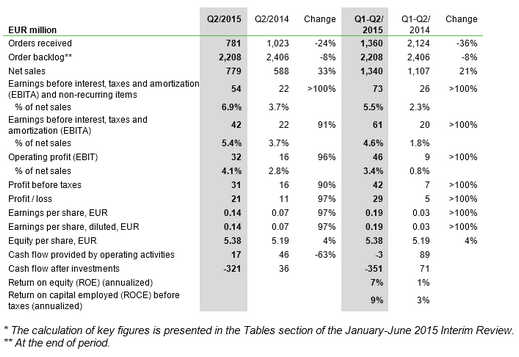

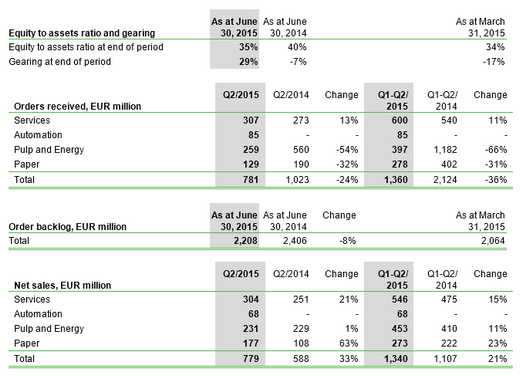

- Orders received decreased to EUR 781 million (EUR 1,023 million).

- Orders received increased in the Services business line and decreased in the Pulp and Energy, and Paper business lines.

- Net sales increased to EUR 779 million (EUR 588 million).

- Net sales increased in the Paper, and Services business lines and remained at the previous year's level in the Pulp and Energy business line.

- Automation contributed to net sales by EUR 68 million.

- Earnings before interest, taxes and amortization (EBITA) and non-recurring items were EUR 54 million (EUR 22 million), and the corresponding EBITA margin was 6.9 percent (3.7%).

- Profitability improved due to the higher level of net sales, improved gross profit, and the acquisition of Automation.

- Earnings per share were EUR 0.14 (EUR 0.07).

- Non-recurring items amounted to EUR -12 million (EUR 0 million), of which costs related to acquisition of Automation amounted to approximately EUR 10 million.

- Cash flow provided by operating activities was EUR 17 million (EUR 46 million).

January-June 2015: EBITA more than doubled - continued good development in Services

- Orders received decreased to EUR 1,360 million (EUR 2,124 million).

- Orders received increased in the Services business line and declined from the high levels in H1/2014 in the Pulp and Energy, and Paper business lines.

- Net sales increased to EUR 1,340 million (EUR 1,107 million).

- Net sales increased in Services, Pulp and Energy, and Paper business lines.

- Automation contributed to net sales by EUR 68 million.

- Earnings before interest, taxes and amortization (EBITA) and non-recurring items were EUR 73 million (EUR 26 million), and the corresponding EBITA margin was 5.5 percent (2.3%).

- Profitability improved due to the higher level of net sales, improved gross profit, and the acquisition of Automation.

- Earnings per share were EUR 0.19 (EUR 0.03).

- Non-recurring items amounted to EUR -12 million (EUR -6 million), of which costs related to acquisition of Automation amounted to approximately EUR 10 million.

- Cash flow provided by operating activities was EUR -3 million (EUR 89 million).

Valmet reiterates its guidance for 2015

Valmet is reiterating its guidance presented on February 6, 2015 in which Valmet estimates that, including the acquisition of Process Automation Systems, net sales in 2015 will increase in comparison with 2014 (EUR 2,473 million) and EBITA before non-recurring items in 2015 will increase in comparison with 2014 (EUR 106 million).

Short-term outlook

General economic outlook

Global growth is projected at 3.3 percent in 2015, marginally lower than in 2014, with a gradual pickup in advanced economies and a slowdown in emerging market and developing economies. In 2016, growth is expected to strengthen to 3.8 percent. The distribution of risks to global economic activity is still tilted to the downside. Near-term risks include increased financial market volatility and disruptive asset price shifts, while lower potential output. (International Monetary Fund, July 9, 2015)

Short-term market outlook

Valmet is reiterating its short-term market outlook presented on April 29, 2015. Valmet estimates that activity in pulp, and board and paper markets will remain on a good level. The activity in the services, tissue, and automation markets is estimated to remain satisfactory. The activity in the energy markets is expected to remain weak.

President and CEO Pasi Laine: Together with Automation, Valmet becomes a stronger company

When the acquisition of Process Automation Systems was completed on April 1, 2015, Valmet got its fourth business line, called Automation. Our customers appreciate that we have reunited the automation expertise with paper, pulp, and power plant technology and process know-how, within the same company. This change has energized and motivated our employees too.

Automation had a strong start as a part of Valmet, and over time I believe that we can achieve even greater benefits through good internal cooperation. With an integrated sales process, harmonized project execution, wider offering and enhanced product development, we will be able to serve our customers even better than before. All in all, Valmet will become a stronger company.

Valmet's performance in the second quarter of 2015 was solid: net sales increased, profitability improved and the EBITA margin reached our targeted range. Good development continued in the Services business line. Additionally we are continuing our focus on cost control and successful project execution.

In addition to expanding Valmet's offering, the automation business somewhat decreases cyclicality of Valmet's businesses. On annual level the automation business is typically fairly stable, thus increasing the stability and visibility of Valmet's business.

Key figures*

Valmet is the leading global developer and supplier of technologies, automation and services for the pulp, paper and energy industries. Valmet's vision is to become the global champion in serving its customers.

Valmet's services cover everything from maintenance outsourcing to mill and plant improvements and spare parts. The strong technology offering includes pulp mills, tissue, board and paper production lines, as well as power plants for bio-energy production. Valmet's advanced automation solutions range from single measurements to mill wide turnkey automation projects.

Valmet's net sales in 2014 were approximately EUR 2.5 billion. Our 12,000 professionals around the world work close to our customers and are committed to moving our customers' performance forward - every day. Valmet's head office is in Espoo, Finland and its shares are listed on the NASDAQ OMX Helsinki Ltd.

Valmet's Interim Review January 1 - June 30, 2015