Displaying items by tag: Kemira

Pro-Gest awards Kemira with a start-up contract at a green field board machine in Mantova, Italy

Kemira has been awarded a start-up contract at Pro-Gest Mantova in Italy, the only green field containerboard machine in Europe in recent years. Kemira will supply the start-up with all water treatment and wet end chemistries in line with its Total Chemistry Management (TCM) concept. The contract is signed for three years. The start-up of the machine is scheduled for the second half of 2017, and the production capacity will be 550,000 tons of high-quality lightweight recycled board.

"Kemira is proud to have the opportunity to participate in the new Pro-Gest Mantova board machine start-up", says Kimmo Strengell, Marketing Manager, Strength Products, Export Manager, Kemira Pulp & Paper EMEA. "Our TCM model makes chemistry management carefree in all different phases of the mill lifecycle – from start-ups and conversions to day-to-day operations. With our expertise, service capability and broad portfolio of board making chemistries, we are able to support Pro-Gest in reaching the desired quality and productivity targets of the new board grade.”

"Kemira is proud to have the opportunity to participate in the new Pro-Gest Mantova board machine start-up", says Kimmo Strengell, Marketing Manager, Strength Products, Export Manager, Kemira Pulp & Paper EMEA. "Our TCM model makes chemistry management carefree in all different phases of the mill lifecycle – from start-ups and conversions to day-to-day operations. With our expertise, service capability and broad portfolio of board making chemistries, we are able to support Pro-Gest in reaching the desired quality and productivity targets of the new board grade.”

“We are convinced that Kemira is the most capable partner for Pro-Gest to handle the chemistry on the board machine during the start-up period”, says Francesco Zago, General Manager and shareholder of Pro-Gest. “The whole team is very excited about the close cooperation in this high capacity and high quality board machine start-up.”

Pro-Gest is Italy’s leading vertically integrated producer of packaging in corrugated board, active in all fields, from the collection of raw materials to packaging production. It operates in 8 Italian regions with 22 production sites, employing over 1,100 people. In 2016 Pro-Gest generated a consolidated annual turnover of EUR 435 million.

Kemira is a global chemicals company serving customers in water-intensive industries. We provide expertise, application know-how and chemicals that improve our customers' product quality, process and resource efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment. In 2016, Kemira had annual revenue of around EUR 2.4 billion and 4,800 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd. www.kemira.com

Kemira increases prices of polymer products in Europe

Kemira, a global chemicals company serving customers in water intensive industries, announces price increase for its polymer product line across all European countries.

Kemira, a global chemicals company serving customers in water intensive industries, announces price increase for its polymer product line across all European countries.

The price increase is necessary due to overall significant cost increase and global tight supply of many key raw materials across our entire polymer product line:

- Increases in price of major raw materials for polymer manufacturing

- Several building block chemicals on shortage due to force majeure of chemical plants, low stock situations, and unplanned maintenance / outages

- Increased cost of sea freight due to supply reduction and reduction of available shipping routes

- Fluctuating currencies and exchange rates, as well as changes in trade conditions

The adjustment will be effective immediately or as customer contracts allow. The increase will be an average of 4-8 %.

For more information:

Olli Turunen

Vice President, Investor Relations Kemira Oyj

Tel. +358 10 862 1255

This email address is being protected from spambots. You need JavaScript enabled to view it.

Kemira is a global chemicals company serving customers in water-intensive industries. We provide expertise, application know-how and chemicals that improve our customers' product quality, process and resource efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment. In 2016, Kemira had annual revenue of around EUR 2.4 billion and 4,800 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd.

www.kemira.com

Kemira - Tissue World Milan 2017

Strong, soft and sustainable tissue

Kemira will participate in Tissue World Milan 2017, the world's largest trade show for the tissue industry, with a booth and a technical conference paper. The paper is titled "Wet strength resins to provide economic and environmental benefits", and it will focus on presenting high efficiency wet strength resins that generate target wet tensile at a 5-25% lower dosage compared to the market resins. The WSR efficiency can be further improved by using novel synthetic functional promoters. The paper and industrial case studies are presented by Vladimir Grigoriev, Sr. Manager, Business & Application Development.

In case you want to create strong, soft and sustainable tissue, please stop by to discuss with Kemira experts at our booth no. E500! Welcome, see you in Milan!

Kemira increases prices of Pulp & Paper FennoSize AKD chemicals in EMEA

Kemira announces a price increase for its Pulp & Paper FennoSize AKD product line in EMEA. The adjustment will be effective immediately or as customer contracts allow.

The price increase of the AKD sizing chemicals will be approximately 5-10%, depending on the specific formulations and can differ in selected geographies. This adjustment is necessary due to significant raw material costs increases.

The price increase of the AKD sizing chemicals will be approximately 5-10%, depending on the specific formulations and can differ in selected geographies. This adjustment is necessary due to significant raw material costs increases.

More information:

Harri Eronen

VP, Sales &Technical Service, Pulp & Paper, EMEA

Tel. +491718028790

This email address is being protected from spambots. You need JavaScript enabled to view it.

Janne Silonsaari

Director, Marketing & Product Management, Pulp & Paper, EMEA,

Tel. +358504099264

This email address is being protected from spambots. You need JavaScript enabled to view it.

Kemira is a global chemicals company serving customers in water-intensive industries. We provide expertise, application know-how and chemicals that improve our customers’ product quality, process and resource efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment. In 2015, Kemira had annual revenue of EUR 2.4 billion and around 4,700 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd.

Kemira invests in expansion of ASA capacity in Nanjing, China

Kemira will make a multi-million euro investment in the production line expansion of sizing agent (ASA) at its Nanjing site in China. Sizing agents are used for improving water-resistance in middle to high end paper and in packaging board. This investment in the most modern ASA production facility globally and the only major ASA production unit in APAC, will expand Kemira’s ASA production capacity substantially. The new capacity is expected to be available from December 2017 onwards.

“Kemira is the leading producer and supplier of sizing agents (ASA) in the Asia-Pacific (APAC) market. In order to further strengthen our leading position we are expanding our production in Nanjing for the future growth. The Asian pulp and paper market is growing around 3% in a year in total and even faster for consumer board. This is linked to the increased living standards and the growth of online shopping. There are also new investments of printing and writing paper machines in China, India and the rest of South East Asia. ASA is an important product in our TCM (Total Chemistry Management) strategy and we see growth opportunities all over the Asia-Pacific to provide cutting edge ASA technology and replace older sizing technologies” says Nichlas Kavander, Head of regional business unit, Pulp & Paper, APAC.

“Kemira is the leading producer and supplier of sizing agents (ASA) in the Asia-Pacific (APAC) market. In order to further strengthen our leading position we are expanding our production in Nanjing for the future growth. The Asian pulp and paper market is growing around 3% in a year in total and even faster for consumer board. This is linked to the increased living standards and the growth of online shopping. There are also new investments of printing and writing paper machines in China, India and the rest of South East Asia. ASA is an important product in our TCM (Total Chemistry Management) strategy and we see growth opportunities all over the Asia-Pacific to provide cutting edge ASA technology and replace older sizing technologies” says Nichlas Kavander, Head of regional business unit, Pulp & Paper, APAC.

“Integration of additional capacity is expected to be smooth as the production technology is well proven over the past 3 years at our Nanjing site. It is safe, reliable and robust. In addition, we are already preparing for the next generation ASA-technology to further increase performance and sustainability to our sizing customers” says Hanspeter Enzmann, Head of manufacturing, APAC.

The Nanjing site is located in the Nanjing Chemical Industry Park, Jiangsu Province. It provides a wide range of functional and process chemicals for water-intensive industries such as the pulp and paper industry. The total estimated annual capacity at the site is approximately 100,000 tons. Nanjing site is equipped with cutting-edge facilities offering the highest quality, featuring a high degree of automation and use of sophisticated IT-systems in the production process. The site operations are supported by Kemira’s global expert teams with strong R&D capabilities, the Asia-Pacific R&D Center in Shanghai and local laboratories. The site conforms to the highest EHS (environment, health and safety) standards in the industry, striving to be the leader in the sustainable development of China’s chemical industry.

For more information, please contact

Kemira Oyj

Nichlas Kavander, Head of Regional Business Unit, Pulp & Paper, APAC

Tel. +86 1852 1319 966

Tero Huovinen, Senior Vice President, Communications & Corporate Responsibility

Tel. +358 10 862 1980

Kemira is a global chemicals company serving customers in water-intensive industries. We provide expertise, application know-how and chemicals that improve our customers’ product quality, process and resource efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment. In 2015, Kemira had annual revenue of EUR 2.4 billion and around 4,700 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd.

Kemira increases prices of pulp & paper process chemicals in APAC

Kemira announces price increase for its pulp & paper process chemical product line in APAC. The adjustment will be effective January 9, 2017 or as customer contracts allow.

The price increase of polymers, surface sizes, coating chemicals and dispersants will be approximately 5-10%, depending on the specific customer segment and applications, and can differ for specific product types in selected geographies. This adjustment is necessary due to overall increased production and raw material costs.

The price increase of polymers, surface sizes, coating chemicals and dispersants will be approximately 5-10%, depending on the specific customer segment and applications, and can differ for specific product types in selected geographies. This adjustment is necessary due to overall increased production and raw material costs.

More information:

Nichlas Kavander

SVP, Pulp & Paper APAC

Tel. +86 185 2131 9966

This email address is being protected from spambots. You need JavaScript enabled to view it.

Ross Howat

VP, Sales & Technical Service, Pulp & Paper, APAC

Tel. +86 185 2101 3311

This email address is being protected from spambots. You need JavaScript enabled to view it.

Kemira is a global chemicals company serving customers in water intensive industries. We provide expertise, application know-how and chemicals that improve our customers‘ product quality, process and resource efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment. In 2015, Kemira had annual revenue of EUR 2.4 billion and around 4,700 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd.

Kemira increases prices of polymer products in Europe

Kemira, a global chemicals company serving customers in water intensive industries, announces price increase for its polymer product line across all European countries. The adjustment will be effective January 1, 2017 or as customer contracts allow.

Kemira, a global chemicals company serving customers in water intensive industries, announces price increase for its polymer product line across all European countries. The adjustment will be effective January 1, 2017 or as customer contracts allow.

The increase will be an average of 5%, depending on the specific customer segment and applications, and can differ for specific product types in selected geographies. This adjustment is necessary due to overall increased production and supply costs.

Kemira announces price increase for AKD wax in APAC

Kemira will implement a price increase of up to 15 % for selected AKD (alkyl ketene dimer) wax based sizing products in APAC. The adjustment will be immediately implemented or as the existing AKD wax contracts allow. The price adjustment is a result of increased costs within the AKD-wax supply chain. AKD-wax is the main raw material for AKD-sizing products.

Kemira will implement a price increase of up to 15 % for selected AKD (alkyl ketene dimer) wax based sizing products in APAC. The adjustment will be immediately implemented or as the existing AKD wax contracts allow. The price adjustment is a result of increased costs within the AKD-wax supply chain. AKD-wax is the main raw material for AKD-sizing products.

For more information, please contact:

Ross Howat

VP, Sales & Technical Service, Pulp & Paper, APAC

Tel. +86 185 2101 3311 This email address is being protected from spambots. You need JavaScript enabled to view it.

KD Lin

Director, Sales, Pulp & Paper, Greater China

Tel. +86 139 1783 9307 This email address is being protected from spambots. You need JavaScript enabled to view it.

Kemira is a global chemicals company serving customers in water intensive industries. We provide expertise, application know-how and chemicals that improve our customers‘ product quality, process and resource efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment. In 2015, Kemira had annual revenue of EUR 2.4 billion and around 4,700 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd. www.kemira.com

Kemira shortlisted in the EU Sustainable Energy Awards

Kemira's site in Helsingborg, Sweden has been shortlisted in the EU Sustainable Energy Awards 2016 for industrial symbiosis that facilitates sharing recovered energy from industrial processes.

Kemira's site in Helsingborg, Sweden has been shortlisted in the EU Sustainable Energy Awards 2016 for industrial symbiosis that facilitates sharing recovered energy from industrial processes.

Kemira's site in Helsingborg operates under the name of Industry Park of Sweden (IPOS). The business idea of IPOS is industrial symbiosis, which means that all businesses based in the industry park cooperate in order to achieve resource efficiency, reduce costs and to minimize their environmental impact. The site currently hosts around 20 different companies within chemical and food industry, logistics and service. All companies within the park collaborate around energy, material, utilities, logistics, infrastructure and services.

An important part of the industrial symbiosis is sharing of the recovered energy from Kemira's own processes. Today, 600 GWh of energy is recovered every year to replace the consumption of primary fuels not only for Kemira but also for the companies within IPOS and Helsingborg City. This recovered energy is the base load of the district heating network in Helsingborg, accounting for 1/3 of the total yearly heat demand.

As Kemira's recovered energy is produced by exothermal reactions and by heat recovery from product flows it does not generate any CO2 emissions. If the corresponding volume of energy were to be produced by for example natural gas, yearly emissions would be 120 000 tons CO2 per year.

"Our aim has been to create added value and to reduce costs and environmental impact by innovative cooperation", says Lennart Albertsson , Director, Pulp & Paper, Kemira Helsingborg.

The EU Sustainable Energy Awards recognize outstanding innovation in energy efficiency and renewables. Around 200 submissions for the 2016 Awards have been evaluated, and the nominees have been chosen from a shortlist of the year's most successful projects for clean, secure and efficient energy in three categories: Consumers, Businesses and Public sector. Three winners among nine nominees will be unveiled on 14 June as part of the 2016 EU Sustainable Energy Week (EUSEW) in Brussels.

For more information, please contact

Kemira Oyj

Lennart Albertsson, Director, Pulp & Paper, Helsingborg

Tel. +46 4217 1467

Tero Huovinen, SVP, Communications & Corporate Responsibility

Tel. +358 10 862 1980

Kemira is a global chemicals company serving customers in water-intensive industries. We provide expertise, application know-how and chemicals that improve our customers' water, energy and raw material efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment. In 2015, Kemira had annual revenue of EUR 2.4 billion and around 4,700 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd.

www.kemira.com

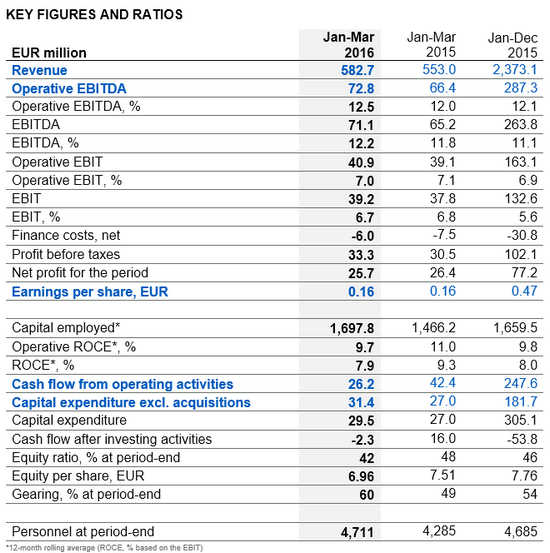

Kemira Oyj's Interim Report January-March 2016: Revenue and operative EBITDA growth continued

This is a summary of the January - March 2016 Interim report. The complete January - March 2016 Interim report with tables is attached to this release and available at www.kemira.com/investors.

This is a summary of the January - March 2016 Interim report. The complete January - March 2016 Interim report with tables is attached to this release and available at www.kemira.com/investors.

- Revenue increased 5% to EUR 582.7 million (553.0) mainly due to the acquisition of AkzoNobel's paper chemicals business. Revenue in local currencies, excluding acquisitions and divestments, decreased 2%.

- Operative EBITDA increased 10% to EUR 72.8 million (66.4) with a margin of 12.5% (12.0%).

- Earnings per share were EUR 0.16 (0.16).

- Outlook (unchanged): Kemira continues to focus on profitable growth. Kemira expects its revenue and operative EBITDA to increase in 2016 compared to 2015.

Kemira's President and CEO Jari Rosendal:

"The year started according to our expectations. The Pulp & Paper segment had a strong first quarter with revenue growth and improvement in profitability. The Municipal & Industrial segment maintained its volume growth, and the Oil & Mining segment took actions to mitigate the challenging market environment while maintaining focus on the long-term opportunities. In January-March the Group's revenue increased 5% and operative EBITDA 10%, and resulted an improved EBITDA margin of 12.5%.

In the Pulp & Paper segment, revenue in local currencies, excluding acquisitions and divestments, increased 3%. We had a very good growth in APAC and South America. The operative EBITDA margin of the segment improved for the fourth consecutive quarter to 13%. Strong demand for pulp continues and therefore the timing is excellent for the new sodium chlorate plant in Brazil, which successfully started up in March 2016. In addition, we announced in March the investment in the additional sodium chlorate capacity in Finland, which is expected to be operational during the fourth quarter of 2017.

The Oil & Mining segment continued to face a challenging market in the U.S. shale operations. However, the segment was able to improve its operative EBITDA margin from 5% to 9% compared to the fourth quarter of 2015, which is a good achievement in this market. We have taken actions to protect our existing business and have maintained discipline in cost management. We continue to invest in new applications and promising growth areas, such as Chemical Enhanced Oil Recovery.

In the Municipal & Industrial segment, the volume growth continued at 3%, while sales prices declined leading to a 1% revenue growth in local currencies, excluding acquisitions and divestments. We are overcoming the temporary cost increase in North America, which was due to the disruption caused by a closure of a supplier's site in the fourth quarter of 2015. The operative EBITDA margin improved sequentially and was almost 13%.

We continue to grow and focus on improved profitability through operational improvements, leveraging growth, and capturing synergies. After the first quarter, Kemira is on track to increase its revenue and operative EBITDA in 2016."

KEY FIGURES AND RATIOS

Definitions of key figures are available at www.kemira.com > Investors > Financial information. Comparative 2015 figures are provided in parentheses for some financial results, where appropriate. Operative EBITDA, operative EBIT and operative ROCE do not include non-recurring items.

FINANCIAL TARGETS 2017 AND OUTLOOK for 2016 (unchanged)

Kemira will continue to focus on improving its profitability and cash flow. The company will also continue to invest in order to secure future growth to serve selected water-intensive industries.

The company's financial targets for 2017 are:

- Revenue EUR 2.7 billion

- Operative EBITDA-% of revenue 15%

- Gearing level <60%.

The basis for growth is the expanding market for chemicals and Kemira's expertise that helps customers in water-intensive industries to increase their water, energy and raw material efficiency. The need to increase operational efficiency in our customer industries creates opportunities for Kemira to develop new products and services for both current and new customers. Research and Development is a critical enabler of growth for Kemira, providing differentiation capabilities in its relevant markets.

Outlook for 2016

Kemira continues to focus on profitable growth. Kemira expects its revenue and operative EBITDA to increase in 2016 compared to 2015.

Kemira expects its capital expenditure, excluding acquisitions, to be around EUR 200 million in 2016.

Kemira is a global chemicals company serving customers in water-intensive industries. We provide expertise, application know-how and chemicals that improve our customers' water, energy and raw material efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment. In 2015, Kemira had annual revenue of EUR 2.4 billion and around 4,700 employees. Kemira shares are listed on the Nasdaq Helsinki Ltd.

www.kemira.com

Kemira Q1 2016 Interim Report