Displaying items by tag: Wausau Paper

Wausau Paper and Starboard Reach Agreement - Two New Independent Directors to Join Wausau Board

Wausau Paper (NYSE:WPP) has announced it has reached an agreement with Starboard Value LP and its affiliates regarding the composition of the company’s Board of Directors. Under the terms of the agreement, Wausau has agreed to nominate two new directors recommended by Starboard, Mr. John S. Kvocka and Mr. George P. Murphy, neither of whom is employed by or affiliated with Wausau or Starboard. The nominations will be included in the company’s 2013 proxy statement and submitted for stockholder approval at the company's 2013 Annual Meeting.

In connection with the nominations, Starboard, which beneficially owns approximately 14.8% of the outstanding shares of Wausau’s common stock, has agreed to vote all of its shares in favor of each of the Board's nominees at the 2013 Annual Meeting. A total of four director nominees will stand for election at the 2013 Annual Meeting, including the two Starboard recommended candidates. If all nominees are elected, the Wausau Board will be expanded to nine directors, comprised of seven independent directors, Thomas J. Howatt, Non-Executive Chairman of the Board and Henry C. Newell, Wausau’s President and Chief Executive Officer. The Board is presently comprised of eight members. Mr. Dennis Kuester, having attained the mandatory age of retirement, will not stand for election at the company’s 2013 Annual Meeting.

“We are pleased to have reached this agreement with Starboard,” said Hank Newell, President and Chief Executive Officer of Wausau Paper. “Wausau Paper is well positioned to capitalize on the investments we have made in the tissue business and we look forward to working productively with our new Board members, John Kvocka and George Murphy, with a shared commitment to enhancing stockholder value. We are confident that their significant industry experience will be an asset to Wausau.”

Jeff Smith, CEO of Starboard, stated, “We are pleased to have worked constructively with management and the Board of Wausau and are confident that the addition of John Kvocka and George Murphy will bring a fresh perspective to the Board and serve the best interests of Wausau and its stockholders. We look forward to enhanced value for the benefit of all stockholders.”

The complete agreement between Wausau Paper and Starboard will be included as an exhibit to the company's Current Report on Form 8-K which will be filed with the Securities and Exchange Commission ("SEC"). Further details regarding the 2013 Annual Meeting will be included in the company's definitive proxy materials, which will be filed with the SEC.

Wausau Paper Announces Closure of Brainerd, Minnesota, Mill

Wausau Paper has announced the closure of the Company’s technical specialty paper mill in Brainerd, Minnesota, to occur early in the second quarter of 2013. The closure will affect approximately 130 employees.

Wausau Paper has announced the closure of the Company’s technical specialty paper mill in Brainerd, Minnesota, to occur early in the second quarter of 2013. The closure will affect approximately 130 employees.

Pre-tax closure charges are estimated to be $47 million, with non-cash charges, primarily related to the write-down of long-lived assets, accounting for approximately $44 million of the total. First quarter, pre-tax closure charges of approximately $36 million are expected with the remaining charges occurring over the balance of 2013. After considering income tax liabilities and the anticipated reduction in working capital, the cash impact of the closure is expected to be neutral on a cumulative basis.

The Company recently announced its intent to strategically reposition the company to focus on its Tissue business. A range of alternatives for the divestiture of the technical specialty business have been explored. It has become clear that Brainerd will not contribute to those alternatives and the closure will significantly improve the continuing Paper segment operating results.

Hank Newell, president and CEO commented on the closure, “A number of factors, including our accelerated exit from the print business, protracted global economic weakness and recent competitive paper capacity additions in Asia have impacted the viability of the Brainerd operations and created operational losses from the mill that were unsustainable. Our employees and the community of Brainerd have done all we have asked in our efforts to create a long-term viable operation and we thank them for their support.”

Wausau Board of Directors Responds to Starboard Letters

![]() Wausau Paper (NYSE:WPP) has announced that it was in receipt of the letter sent yesterday by Starboard Value LP (“Starboard”), as well as a letter sent on January 11, 2013, which indicated Starboard’s intent to nominate three candidates to the Company’s Board of Directors.

Wausau Paper (NYSE:WPP) has announced that it was in receipt of the letter sent yesterday by Starboard Value LP (“Starboard”), as well as a letter sent on January 11, 2013, which indicated Starboard’s intent to nominate three candidates to the Company’s Board of Directors.

The Company announced that its Board of Directors has sent a response to Starboard’s letters, the text of which follows:

January 15, 2013

Mr. Jeffrey C. Smith

Managing Member

Starboard Value LP

830 Third Avenue, 3rd Floor

New York, NY 10022

Dear Mr. Smith:

We were disturbed by your letter and public statements regarding the recent discussions with you about the strategy and governance of Wausau Paper. Your public description of the sequence of private events is inaccurate in many respects. In particular, our announcement on Friday regarding the exploration of alternatives for the Paper Segment and focus on Tissue Business was a unanimous Board decision that resulted from months of discussion and careful consideration by the Board of Directors with the assistance of independent financial advisors. Contrary to your accusation, this important strategic decision was not made in reaction to your letter of Friday morning.

The Wausau Paper Board of Directors is comprised of highly professional, experienced and ethical individuals who are committed to serving the best interests of all Wausau Papershareholders. We, including the two members nominated last year by Starboard, have been pursuing a wide range of actions to better position Wausau Paper for the future and to deliver the highest long-term value to our shareholders. These actions cannot be completed overnight, and, in fact, this Board began evaluating operational strategies to better position Wausau for the future long before Starboard became a shareholder of Wausau Paper. The steps taken, as set forth below, have positioned us to issue the most recent announcement regarding our intent to focus on our Tissue business:

- Added four new Board members since 2007

- Closed certain mills in the Northeast in 2009

- Closed Appleton converting facility in 2009

- Announced Tissue Expansion Plan in 2011

- Sold Timberland assets in 2011

- Appointed new Chairman in 2012

- Appointed new CEO and CFO during 2012

- Retained financial advisor in early 2012 to assist with the exploration of strategic alternatives for the Paper segment

- Sold premium Print and Color brands to Neenah Paper in 2012

- Closed Brokaw mill in 2012

Clearly, we are a Board committed to taking actions that benefit our shareholders. We have offered to sign a non-disclosure agreement with you in the past so that you could be better informed about our strategy and processes, but you have declined our offer. Yet, you continue to make assertions about the conduct and commitment of this Board, including members nominated by you, without any basis in fact.

Mr. Smith, for months you indicated your genuine interest in working together privately with us to reach an agreement. A few days ago you represented to our Chairman that we were “very close” to an agreement. These statements make your recent actions even more surprising. Understand that our focus is on serving the best interests of all Wausau Papershareholders and we will continue to take actions consistent with that focus. In that regard, we look forward to continuing our discussions with you and our other shareholders.

Sincerely,

Thomas J. Howatt, Chairman

Henry C. Newell, Chief Executive Officer

Michael C. Burandt

Londa J. Dewey

Gary W. Freels

Charles E. Hodges

G. Watts Humphrey, Jr.

Dennis J. Kuester

Source: Wausau Paper

Wausau Paper to Narrow Focus to Tissue Business

![]() Wausau Paper (NYSE:WPP) has announced that it commenced a process last year to identify strategic alternatives for its Paper Segment that will position the Company to focus its management efforts on continuing the growth of its highly successful tissue business.

Wausau Paper (NYSE:WPP) has announced that it commenced a process last year to identify strategic alternatives for its Paper Segment that will position the Company to focus its management efforts on continuing the growth of its highly successful tissue business.

In early 2012 the Company exited its legacy Print & Color business and narrowed the focus of its Paper Segment to specialty products with leading domestic and global positions in food, industrial and tape markets. Since that time the Company retained financial advisors to assist the Company’s board of directors in the evaluation of alternatives for the remainder of the Paper Segment.

The Company recently began the start-up phase of a $220 million tissue capacity investment at its Harrodsburg, Kentucky site. The project will accelerate growth of its Tissue Segment and further establish its “green leadership” position in away-from-home tissue markets through improved product performance and the introduction of new-to-the-market premium recycled products.

“Our Tissue Segment has demonstrated strong profitability and exceptional growth over the last decade,” stated Hank Newell, president & CEO. “We believe our shareholders’ interests will be best served through a singular focus on successfully marketing the capacity and capability of our new tissue machine and sustaining the historically strong growth and profit performance of our tissue business.”

The Company cannot provide assurance of the timing, terms or completion of a transaction related to the strategic alternatives for the Paper Segment.

Source: Wausau Paper

Wausau Paper Announces Third-Quarter Results

Wausau Paper (NYSE:WPP) has reported that:

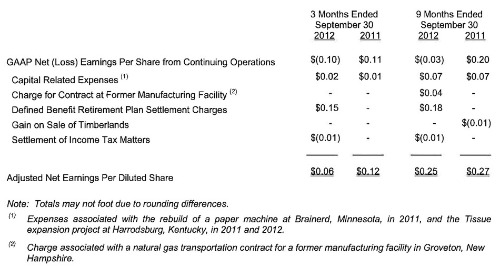

- Excluding special items, third-quarter adjusted net earnings from continuing operations were $0.06 per diluted share, compared to adjusted net earnings of $0.12 per diluted share during the same period last year.

- Net earnings from continuing operations, excluding special items, for the nine months ended September 30, 2012 and 2011, were $0.25 per diluted share and $0.27 per diluted share, respectively.

During 2012, the Company completed the sale of its premium Print & Color brands, inventory and select equipment, and the permanent closure and sale of its Brokaw, Wisconsin, manufacturing site. The Company began reporting the operations of the Brokawmanufacturing facility and related closure activities as a discontinued operation as of March 31, 2012, in the condensed consolidated balance sheet. Additionally, the discontinued operation is separately presented from continuing operations for all periods presented in the condensed consolidated statements of operations. All results discussed below exclude the discontinued operation unless otherwise indicated.

Third-quarter net loss from continuing operations was $5.2 million, or $0.10 per share compared to net earnings of $5.4 million, or $0.11 per diluted share a year ago. On a year-over-year basis, consolidated net sales decreased five percent to $202 million with shipments measured in tons decreasing three percent. Year-to-date, the Company reported a net loss from continuing operations of $1.5 million, or $0.03 per share, compared with net earnings of $10.0 million, or $0.20 per diluted share in the comparable 2011 period. For the nine months ended September 30, consolidated net sales increased two percent to $631 million as shipments increased four percent.

On an adjusted basis, third-quarter results included after-tax expenses of $7.6 million, or$0.15 per diluted share related to settlement charges on certain defined benefit pension plans and $1.2 million, or $0.02 per diluted share for capital-related expense for the Tissue expansion project. Prior-year third-quarter results included after-tax capital-related expenses of $0.4 million, or $0.01 per diluted share for the Tissue expansion project.

For the first nine months of 2012, adjusted net earnings from continuing operations were$12.3 million, or $0.25 per diluted share, compared with prior-year adjusted net earnings of$13.2 million, or $0.27 per diluted share. Although these comparisons are non-GAAP measures, the Company believes that the presentation of adjusted net earnings from continuing operations provides a useful analysis of ongoing operating trends. Adjusted earnings for the three and nine-month periods are reconciled to GAAP earnings below.

Click image to enlarge

Including discontinued operations, net of tax, third-quarter net loss was $5.3 million, or $0.11per share, compared to net earnings of $5.2 million, or $0.10 per diluted share, for the same period last year. Current-quarter and prior-year results included earnings from continuing operations before income taxes offset by income tax expense and a net loss from discontinued operations of $0.2 million, or $0.00 per share.

For the nine months ended September 30, 2012, including discontinued operations, net of tax, net earnings were $3.1 million, or $0.06 per diluted share, compared to net earnings of $7.0 million, or $0.14 per diluted share, for the same period last year. Net earnings in the current year included earnings from continuing operations before income taxes offset by income tax expense and net earnings from discontinued operations of $4.6 million, or $0.09 per diluted share. Net earnings in the prior year included earnings from continuing operations before income taxes, offset by income tax expense, and a net loss from discontinued operations of$3.0 million, or $0.06 per share.

Henry C. Newell, president and CEO, commenting on the Company’s continued progress against strategic initiatives, said, “Our Tissue expansion is on track as three to four percent case shipment growth continues to drive improving operating margins, now approaching 13 percent. The second half is proving to be a challenge for our Paper segment, as we see slowing demand in industrial and tape markets at a time when we are commercializing new technical capacity at our Brainerd, Minnesota, facility. Despite these pressures, technical volumes are up six percent this year and specifically, tape sector volume is up 14 percent, the result of new customer business and new product introductions.

“The successful exit of our Print franchise has resulted in an exceptionally well positioned balance sheet as we continue to commercialize technical capacity on our Brainerd asset and complete the installation, start-up and commercialization of the new towel and tissue machine at Harrodsburg, Kentucky. We expect to report continued progress over the coming quarters against the long-term growth targets and timelines we’ve outlined this year.”

TISSUE SEGMENT

The Tissue segment’s third-quarter operating profit of $7.5 million included pre-tax expense of $1.9 million related to the expansion activity. This result compared favorably to prior-year operating profit of $7.0 million, including $0.7 million in expansion-related pre-tax expense.

PAPER SEGMENT

During 2012, the Company completed the sale of this segment’s premium Print & Color brands, inventory and select equipment, and ceased papermaking and converting operations at its former primary Print & Color manufacturing site in Brokaw. In the third quarter, we sold the mill site to an unrelated third party. Results of operations related to the former Brokawmanufacturing facility are reported as discontinued operations and for the third quarter and the same period last year included, net-of-tax, a loss of $0.2 million from operations.

From continuing operations, the Paper segment reported a third-quarter operating loss of $7.9 million versus an operating profit of $5.9 million for the same period in 2011. The 2012 third-quarter operating loss included pre-tax expense of $7.7 million related to a settlement charge on a certain defined benefit pension plan associated with our former Jay, Maine, facility. The operating results reflect the impact of transitioning capacity to technical grades, including extensive trialing activity at our Brainerd papermaking operations and the pace of working capital liquidation as a result of the premium Print & Color sale and Brokaw closure activity.

In a release issued October 1, the Company set forth full-year guidance for adjusted net earnings from continuing operations of $0.28-$0.30 per diluted share compared to prior-year adjusted net earnings of $0.33 per diluted share.

Click here to download the full release and tables

Wausau Paper lowers 2012 EPS Guidance; Tissue Segment expansion remains on track

![]() Wausau Paper has said that the Paper segment earnings in both the third and fourth quarter will be impacted by lower profitability at its Brainerd, Minnesota, facility, as well as recent further weakening demand in its economically sensitive industrial product categories.

Wausau Paper has said that the Paper segment earnings in both the third and fourth quarter will be impacted by lower profitability at its Brainerd, Minnesota, facility, as well as recent further weakening demand in its economically sensitive industrial product categories.

Henry C. Newell, president and chief executive officer, stated, “We made the choice to accelerate the conversion of the Brainerd mill to technical paper grades as part of our strategy to divest the print franchise. While the pace of the transition resulted in above- target cash generation, the compressed time period added complexity to the ability to position the additional capacity creating higher-than-expected margin pressure, increased product development costs and reduced operating efficiencies. Weakness in industrial end-use market demand has exacerbated the impact. With few signs of a general economic recovery, we now expect pressure on Paper segment profitability through year end.

“The Company’s Tissue segment continues to demonstrate strong operational performance, driven in part by above-market case shipment growth of 3 to 4 percent. Our expansion program, including product development activities, remains on schedule, with initial start-up of the new paper machine in Harrodsburg, Kentucky, expected in the fourth quarter. Additionally, our balance sheet is strong due to above-forecast cash generation and working capital reductions in our Paper segment.”

Mr. Newell continued, “In the near-term, Paper segment profitability challenges will significantly affect second-half adjusted earnings. Consequently, we are reducing our full-year adjusted earnings guidance to $0.28 to $0.30 per share, and anticipate mid- single digit adjusted earnings per share in both the third and fourth quarters.” The Company’s previous guidance was for full-year adjusted net earnings in the $0.39 to

$0.41 per share range versus prior-year adjusted net earnings of $0.33 per share.

The Company is scheduled to release third-quarter earnings after the market close on Monday, October 29. A call to discuss results will be held at 11:00 a.m. ET Tuesday, October 30. Interested parties may access the webcast of this call from the Investor section of the Company’s website at: www.wausaupaper.com

Wausau Paper Unveils Line of Recycled PCW Release Liners

Wausau Paper (NYSE:WPP) is proud to announce the launch of Eco Select RT™, a new to the world product family of innovative and sustainable release liner products, utilizing recycled post-consumer waste (PCW) and Forest Stewardship Council (FSC) certified fiber. Wausau Paper is a leading provider of specialty papers to the release liner industry with a long history of innovation to meet the needs of the market.

"Our integrated manufacturing model allows us to combine our proprietary papermaking expertise and coating technologies in the same facility. This allows us to create unique solutions to meet customer needs with unparalleled speed to market. Eco Select RT™ will enable our customers to provide an environmentally sustainable solution while providing the superior performing products they have come to expect from Wausau Paper", said Sheila Widule, Strategic Marketing Manager.

Our Eco Select RT™ line fulfills an unmet need driven by the growing trend of environmentally conscience laminators and end-users. This new product family is consistent with our vision to be a leading provider of paper-based, environmentally sensitive brands and solutions to the markets we serve, driven through a model of collaborative innovation" said Jon Bast, Vice President Sales & Marketing.

Wausau Paper Coated Products Achieves ISO 9001:2008 Certification

Wausau Paper, a leading provider of release liner products, is pleased to announce the certification of its coated products Manufacturing and Distribution Quality Management (MDQM) System to ISO 9001:2008. The certification assures that the Company’s coated products MDQM System complies with the performance standards set forth by the International Standards Organization (ISO), a group that sets rigorous quality and management standards for business worldwide.

“Driven by our commitment to continual improvement and to consistently produce products which meet or exceed customer expectations, we chose to pursue ISO certification utilizing BSI as our certifying body,” said Sheila Widule, strategic marketing manager. “Meeting the ever-growing customer demand for the highest level of quality is vital to the future success of our coated products business.” Widule further commented, “This certification is the end result of the intense effort by multi-functional groups within our Company dedicated to improving workflow and advancing our processes to ensure consistent top-quality products for our customers. Our decision to become ISO 9001:2008 certified is just another demonstration of our commitment to achieve total customer satisfaction.”

To further explore release liner solutions from Wausau Paper, visit www.wausaupaper.com.

Wausau Paper and Starboard Reach Agreement

Wausau Paper has announced it has reached an agreement with Starboard Value LP and its affiliates regarding the composition of the Company’s Board of Directors. Under the terms of the agreement, Wausau has agreed to nominate two new directors recommended by Starboard, Mr. Michael Burandt and Mr. Charles Hodges, neither of whom is employed by or affiliated with Wausau or Starboard. The nominations will be included in the Company’s 2012 proxy statement and submitted for stockholder approval at the Company's 2012 Annual Meeting. In addition, the company has also agreed to form a newly-created committee of the Board. The committee will be made up of four individuals including Mr. Burandt and Mr. Hodges. The committee will advise the Board with respect to operations of, and investments and capital spending in, the Company’s business.

In connection with the nominations, Starboard, which beneficially owns approximately 9.7% of the outstanding shares of Wausau’s common stock, has agreed to vote all of its shares in favor of each of the Board's nominees at the 2012 Annual Meeting. A total of four director nominees will stand for election at the 2012 Annual Meeting, including the two Starboard recommended candidates. If all nominees are elected, the Wausau Board will be expanded to eight directors, comprised of six independent directors, Thomas J. Howatt, Non-Executive Chairman of the Board and Henry C. Newell, Wausau’s President and Chief Executive Officer. The Board is presently comprised of six members.

“We are pleased to have reached an agreement with Starboard, one of our largest shareholders,” said Hank Newell, President and Chief Executive Officer of Wausau Paper. “We are delighted to nominate and support Michael Burandt and Charles Hodges for election to Wausau’s Board. We are confident that their significant industry experience will be an asset to Wausau, and we look forward to working productively with the new members of the Board with a shared commitment to enhancing stockholder value.”

Jeff Smith, CEO of Starboard, stated, “We are pleased to have worked constructively with management and the Board of Wausau and are confident that the addition of Michael Burandtand Charles Hodges will bring a fresh perspective to the Board and serve the best interests of Wausau and its stockholders. We look forward to enhanced value for the benefit of all stockholders.”

The complete agreement between Wausau Paper and Starboard will be included as an exhibit to the Company's Current Report on Form 8-K which will be filed with the Securities and Exchange Commission ("SEC"). Further details regarding the 2012 Annual Meeting will be included in the Company's definitive proxy materials, which will be filed with the SEC.

Source: Wausau Paper

Wausau Paper Announces Senior Appointments

Wausau Paper has announced the appointment of Matthew L. Urmanski to the position of Senior Vice President - Tissue and Michael R. Wildenberg to the position of Senior Vice President - Tissue Strategy effective March 1, 2012.

Mr. Urmanski, 39, joined Wausau Paper in 2000 and has most recently served as Vice President - Administration for the Tissue segment responsible for Tissue strategy, finance and supply chain operations. Matt has played an instrumental role in the development of our Tissue growth strategy and the building of our Tissue operating team.

Mr. Wildenberg joined Wausau Paper in 1981 and has served as Senior Vice President for our Tissue segment since 2009. Mike plans to retire in July and will work with the Tissue leadership team to insure a smooth transition.

Source: Wausau Paper