Displaying items by tag: Xerium Technologies

Xerium Technologies Unveils Next-Generation SMART Roll Cover Technology

Xerium Technologies, Inc. (NYSE:XRM) a leading global manufacturer of specially engineered textiles and roll covers used in the production of paper, paperboard, building products, nonwovens, and specific industrial processes, has announced full commercial availability of SMART®5.0 Technology. SMART 5.0 is another significant advancement in the total cost management of paper machines.Xerium is the global market share leader in intelligent nip technology.

Xerium Technologies, Inc. (NYSE:XRM) a leading global manufacturer of specially engineered textiles and roll covers used in the production of paper, paperboard, building products, nonwovens, and specific industrial processes, has announced full commercial availability of SMART®5.0 Technology. SMART 5.0 is another significant advancement in the total cost management of paper machines.Xerium is the global market share leader in intelligent nip technology.

SMART 5.0 provides papermakers with unprecedented real-time nip analysis including : 1) three-dimensional measurement and display of machine direction nip width, 2) advanced capability for shoe press nips, and, 3) enhanced connectivity software to connect directly to mill DCS and PI machine control systems.

Roll covers are critical to the quality and cost of paper as it is produced. Xerium introduced SMART roll cover products in 2008 as the industry's first real-time electronic roll cover. Since then the company has implemented the product line globally and includes it as an available value-add feature of all roll cover types – rubber, polyurethane and composite. With over two hundred worldwide references, the company believes that it offers the most advanced and reliable intelligent nip roll cover products on more applications than all other competitors combined. SMART roll covers are a proven tool for optimizing total cost of production and quality of the papermaker’s product.

Harold Bevis, Xerium’s President and CEO said, "SMART 5.0 is a significant next step in real-time electronic roll covers. The nip is modeled and displayed graphically in 3D so that machine operators can dial in their machines to get maximum results. The data feeds are straight-forward to integrate into overall machine controls. We are well underway with our machine integration approaches. This is a productivity advancement worth looking into."

Source: Xerium Technologies, Inc

Xerium Technologies Wins Cascades’ 2012 Sustainable Supplier Award

Cascades (TSX: CAS) released yesterday the name of the winner of the fourth edition of the Sustainable Supplier Award, a contest that aims to recognize best business practices in sustainable development among its suppliers. Created by the company's Corporate Procurement Department, this award enables Cascades to publicly acknowledge the efforts of its suppliers that have had positive repercussions on its products, processes or manufacturing methods. The projects undertaken were also assessed on their environmental, societal and economic impacts. This year, although many projects caught the attention of the jury, Xerium was the winner.

Cascades (TSX: CAS) released yesterday the name of the winner of the fourth edition of the Sustainable Supplier Award, a contest that aims to recognize best business practices in sustainable development among its suppliers. Created by the company's Corporate Procurement Department, this award enables Cascades to publicly acknowledge the efforts of its suppliers that have had positive repercussions on its products, processes or manufacturing methods. The projects undertaken were also assessed on their environmental, societal and economic impacts. This year, although many projects caught the attention of the jury, Xerium was the winner.

About Xerium Technologies

Xerium Technologies, with its Weavexx and Stowe divisions, have been working in the pulp and paper industry since the mid-1800s. The company is a leader in paper machine clothing and roll technology. In particular, it provides forming fabrics, press felts, dryer felts, roll covers and spreader rolls. The manufacturing of these products focuses on the reduction of total costs, the improvement of sheet quality and overall machine efficiency. The long standing business partnership between Cascades and Xerium has led them to integrate state-of-the-art rolls and fabrics in many Cascades Tissue Group plants in North America (Candiac, Eau Claire, Kingsey Falls, Mechanics, Memphis, Ransom, Rockingham, Scarborough, Whitby). Integrated projects on fourteen machines have helped increase efficiency of operations. This optimization has generated significant savings in costs as well as a reduction in the consumption of water and energy in the targeted plants. Xerium distinguished itself by providing a file that was exemplary, supported by figures and highlighting the positive environmental and economic repercussions of its project.

Harold Bevis, President and Chief Executive Officer of Xerium, thanked Cascades for this unique recognition: "I see this prize as one of the best incentives for encouraging suppliers like us to engage in a sustainable development approach with its clients. For the coming years, Xerium intends to continue developing paper machine clothing and rolls technology for the purpose of improving the performance of its clients.”

Suppliers play a major role in the value chain of a manufacturing company like Cascades. The Sustainable Supplier Award is a prime example of the importance that Cascades attaches to good relations. According to Alain Lemaire, President and Chief Executive Officer of Cascades, “if year after year we succeed in distinguishing ourselves and in bringing to market top quality products, it is partly thanks to our suppliers who bring us concrete solutions and that help us improve ourselves”.

The prize was awarded during the annual meeting of Cascades' plant managers in North America, in front of more than one hundred people. It was deemed the most appropriate time by Cascades because it made it possible to highlight the accomplishments of some plants as well as make known the supplier that is being honored and its expertise in other units of the company.

Xerium Technologies Announces Another Step In Its Restructuring

Xerium Technologies, Inc., a leading global manufacturer of clothing and roll covers used primarily in the paper production process, is announcing today the closing of 2 more of its manufacturing plants, the further reduction of headcount in Europe and the movement of polyurethane roll casting equipment to China. Within the last year, the company has initiated the closing of 4 manufacturing operations, installed new machines in low cost countries, and lowered its SG&A costs. The company is in the beginning stages of a multi-year repositioning of its cost structure and asset base to better mirror its served markets.

Xerium has commenced negotiations to close its paper machine clothing facility in Zizurkil,Spain with its employees’ representatives and is closing its spreader roll facility in Charlotte, North Carolina. The company expects permanent annualized cost savings of $3.2 million from these actions.

“These closures, while difficult on the affected people and communities, are reflective of Xerium’s need to restructure its cost profile and to better align its asset base with natural market sizes”, said Harold Bevis, Xerium’s President and Chief Executive Officer. “These actions demonstrate our management team’s resolve to take immediate and continuous steps to get Xerium back on track to deliver increased Adjusted EBITDA and shareholder value.”

The measures announced today are additive to previously announced cost restructuring actions. Those previously announced actions are expected to result in annual savings of$13.8 million, bringing the cost-takeout total to $17.0 million. These cumulative actions include:

- Reduction of selling costs in Europe via termination of sales agency agreements

- Closure of clothing production operation in Argentina

- Closure of roll covering plant in France

- Reduction of base costs in Europe via headcount reduction

- Closure of clothing plant in Spain

- Closure of roll covering plant in North Carolina

- Redeployment and expansion of capabilities and capacity in China and Mexico

“The company is just getting underway with its multi-year repositioning and expects significant additional cost restructuring actions in the future. There is a pace to these repositioning actions as they are complicated and are all being funded from the company’s natural cash flow”, said Harold Bevis.

Source: Xerium Technologies, Inc.

Xerium Technologies Continues European Cost Reductions

Xerium Technologies, Inc. (NYSE:XRM), a leading global manufacturer of clothing and roll covers used primarily in the paper production process, has announced that it has initiated consultation proceedings with the works council at its Huyck Wangner forming fabric facility in Reutlingen, Germany regarding a proposal to eliminate a significant number of positions in an effort to continue to address the Company’s cost structure. Due to the nature of the proceedings with the local works council, the Company is not able to provide an estimate of the anticipated restructuring expenses or costs savings at this time.

Commenting on the action, Harold Bevis, the Company’s President and Chief Executive Officer said, “This is an important element of the Company’s plan to rightsize our cost structure. Despite these anticipated workforce reductions, Huyck Wangner will continue to timely fulfill customer requirements and will maintain its leadership in producing high quality forming fabrics.”

Source: Xerium Technologies, Inc.

Xerium Technologies announces the appointment of a new Chairman and a new CEO

Xerium Technologies, Inc, a leading global manufacturer of industrial textiles and roll covers used primarily in the paper production process, has announced the appointment of Mr. Harold C. Bevis, as the company’s new Chief Executive Officer, President and Director. Mr. Bevis has been CEO, President and Director of Pliant Corporation and Jordan Telecommunication Products, and has held executive positions with Emerson Electric and General Cable Corporation. He is a 1983 graduate of Iowa State University receiving an Industrial Engineering degree and earned his MBA from Columbia University in 1988.

Coincident with the appointment of Mr. Bevis, Mr. James F. Wilson, currently Xerium’s Lead Director, has been appointed the company’s Chairman of the Board. Mr. Wilson joined the Xerium Board of Directors in June 2010 and has served on the Compensation and Nominating committees since that time. Mr. Wilson is a principal at Carl Marks Management Company, LLC, an investment firm which is a significant shareholder of Xerium stock. As a consequence of the separation of the Chairman and CEO roles, the Board of Directors will no longer have a Lead Director.

As previously announced in December 2011, Stephen R. Light Xerium’s Chairman, Chief Executive Officer and President resigned from his executive and board positions coincident with the appointment of Mr. Bevis and Mr. Wilson. Mr. Light will remain a non-executive employee of the company to facilitate the executive transition until his retirement in February 2013. The company wishes to thank Mr. Light for his leadership and contributions during a time of significant change and progress for Xerium.

In connection with his appointment, Mr. Bevis was awarded 204,208 restricted stock units and options to purchase 781,701 shares of Xerium’s common stock. These awards were made in accordance with the employment inducement award exemption provided by Section 303A.08 of the New York Stock Exchange Listed Company Manual and were therefore not awarded under Xerium’s stockholder approved equity plan. The restricted stock units vest annually in one-third increments, beginning on the second anniversary of the August 15, 2012 grant date. Vested restricted stock units will result in the delivery to Mr. Bevis of one share of Xerium’s common stock per vested unit. The options will vest annually in one-third increments, beginning on the second anniversary of the August 15, 2012 grant date, have a 10-year term and an exercise price of $4.00 per share, the August 15, 2012 closing price of Xerium’s common stock on the New York Stock Exchange.

Source: Xerium Technologies, Inc.

Xerium Technologies Reports Second Quarter Results

Profitability Improves over First Quarter

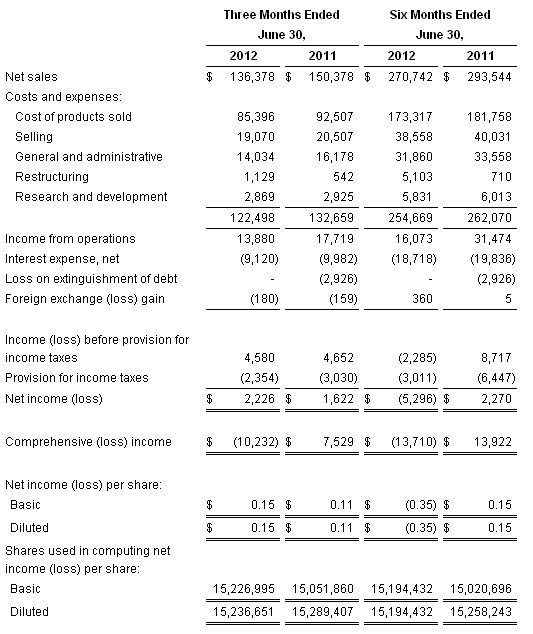

Xerium Technologies, Inc. (NYSE: XRM), a leading global manufacturer of industrial textiles and roll covers used primarily in the paper production process, announced today the results of its operations for the quarter ended June 30, 2012. Net sales increased 1.5% from the quarter ended March 31, 2012, yet decreased 9.3% from the quarter ended June 30, 2011. On a year to date basis, net sales decreased 7.8% from the six months ended June 30, 2011. Net income per diluted share improved to $0.15 for the quarter ended June 30, 2012 from ($0.50) for the quarter ended March 31, 2012 and$0.11 for the quarter ended June 30, 2011. On a year to date basis, net income per diluted share decreased to a loss of ($0.35) for the six months ended June 30, 2012 from income of $0.15 for the six months ended June 30, 2011.

“Xerium’s second quarter 2012 over first quarter 2012 performance improvement is the result of our continuous focus on operational improvements, our customers’ accelerating adoption of our better performing and higher margin new products, and reduced trade working capital in every region,” said Stephen R. Light, Chief Executive Officer and Chairman. “ While our European business remains soft as the paper industry there is impacted by the region’s ongoing economic crisis, we enjoyed good growth in North America and Asia. 'Vision 2015,' Xerium’s three year strategic realignment of our manufacturing footprint, announced on July 2, 2012, is off to a good start. We expect 'Vision 2015' will restore our historical margins by reducing unnecessary fixed costs and aligning our global capacity with customer demand.”

RESTRUCTURING

As previously reported, on July 2, 2012, we announced a voluntary redundancy program at our press felt facility in Buenos Aires, Argentina in connection with the relocation of our Huyck Wangner press felt capacity and initiated consultation proceedings with our works' council at our rolls cover facility in Meyzieu, Franceregarding a proposal to cease operations there. In Argentina, the production of press felts and fiber cement felts will be transferred to our facilities in Brazil and the roll cover production of our facility in France will be assumed by our rolls facilities in Germany and Italy. The actions are expected to commence in the third quarter of 2012 and be completed over the next several months. As the redundancy program has just been initiated, the proceedings with the works’ council have just begun and there has been no formal evaluation of the affected assets, at this time, we are in the process of analyzing our estimate of the restructuring charges and asset impairments, if any, related to these redundancy programs.

CREDIT FACILITY AMENDMENT

To facilitate the above restructuring activities, on June 28, 2012, we entered into an amendment to our senior secured credit facility. Among other revisions to the credit facility, the amendment allows for additional add backs to Adjusted EBITDA annually through 2015 up to the lesser of $15.0 million or the unused portion of our allowed annual capital expenditure limit; increases the maximum leverage ratios between September of 2012 and December of 2013; amends the definition of the leverage ratio to reduce debt by unrestricted surplus cash held by the Company and increases the interest rate on the term loans by 0.75% annually for eighteen months.

SECOND QUARTER FINANCIAL HIGHLIGHTS

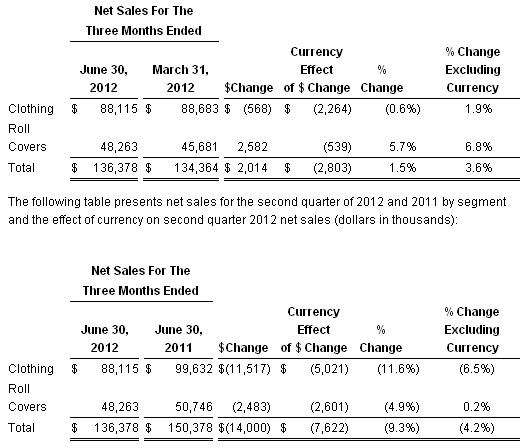

- Net sales for the second quarter of 2012 were $136.4 million, a 1.5% increase compared to the first quarter of 2012. Excluding unfavorable currency effects of$2.8 million, second quarter 2012 net sales increased 3.6% from the first quarter of 2012, with an increase of 1.9% in the clothing segment and an increase of 6.8% in the roll covers segment. Net sales decreased 9.3% from net sales for the second quarter of 2011 of $150.4 million. Excluding unfavorable currency effects of 5.1%, second quarter 2012 net sales decreased 4.2% from the second quarter of 2011, with a decrease of 6.5% in the clothing segment, primarily as a result of the reduced European market demand, and an increase of 0.2% in the roll covers segment. See “Segment Information” and “Non-GAAP Financial Measures” below for further discussion.

- Gross profit increased by 9.8% to $51.0 million for the second quarter of 2012 from $46.4 million for the first quarter of 2012, yet decreased 11.9% from $57.9 million for the second quarter of 2011. In the second quarter of 2012, gross margins increased to 37.4% from 34.6% in the first quarter of 2012. The increase was due to improved product mix, partially as a result of an unusually high level of low margin steel core sales in the first quarter of 2012 and improved labor efficiencies. These increases were offset by currency exchange rate differences and unfavorable factory absorption driven by continued progress in reducing inventory levels. Gross margins declined from 38.5% in the second quarter of 2011 largely as a result of the reduction of inventory reserves in the prior year. Excluding this non-recurring item, gross margins were relatively flat compared to the second quarter of 2011, as unfavorable absorption of production costs and unfavorable regional mix related to the reduced European market demand were partially offset by favorable currency effects and improved material and labor cost efficiencies.

- The Company’s operating expenses (selling, general and administrative, restructuring and research and development expenses) of $37.1 million for the second quarter of 2012 decreased by $3.1 million, or 7.7%, from operating expenses of $40.2 million in the second quarter of 2011. The decrease in operating expenses during the second quarter of 2012 is primarily the result of favorable currency effects of $2.5 million, a decrease of $1.6 million in management incentive compensation and the reversal of a $1.0 million contingent liability that was favorably resolved. Partially offsetting these items was an increase in general and administrative expenses due to the reversal in 2011 of $1.1 million in value added tax in Brazil and $0.6 million related to incremental CEO transition costs in 2012.

- Interest expense improved 9.0% to $9.1 million in the second quarter of 2012 from $10.0 million in the second quarter of 2011. This decline in interest expense reflects lower current interest rates and debt balances and favorable currency effects, net of higher deferred financing cost amortization in the second quarter of 2012. The decrease in interest rates and the increase in deferred financing cost amortization are a result of the refinancing in May 2011. Cash interest expense, or interest expense less amortization of deferred financing costs, decreased by 12.5% in the second quarter of 2012 to $8.4 millioncompared to $9.6 million in the second quarter of 2011.

- Income tax expense declined to $2.4 million in the second quarter of 2012 from $3.0 million in the second quarter of 2011. This reduction was primarily attributable to the geographic mix of earnings in the second quarter of 2012 as compared to the second quarter of 2011. Our overall effective tax rate for the periods presented reflects the fact that we have losses in certain jurisdictions where we receive no tax benefit.

- Net income for the second quarter of 2012 improved to $2.2 million or $0.15 per diluted share, compared to net loss of ($7.5) million or ($0.50) per diluted share for the first quarter of 2012 and net income of $1.6 million or $0.11 per diluted share for the second quarter of 2011.

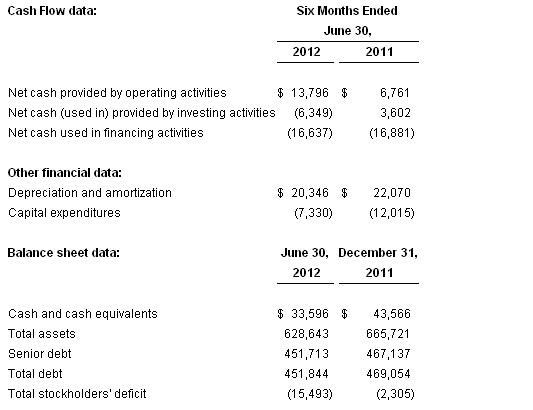

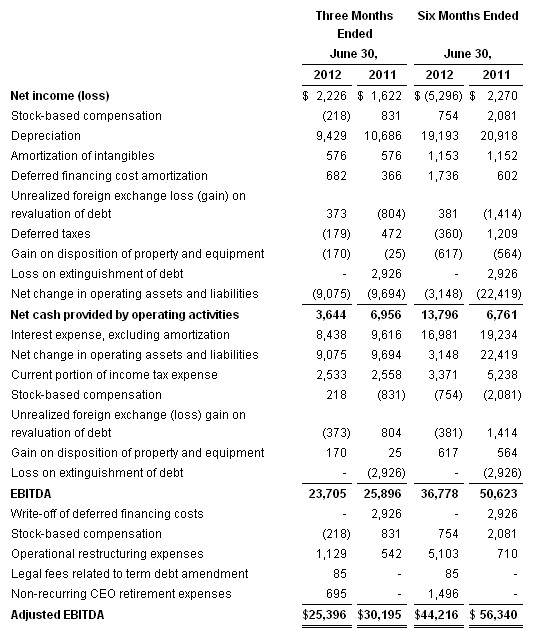

- Adjusted EBITDA (as defined by the Company’s credit facility) of $25.4 million increased $6.6 million in the current quarter from $18.8 million in the first quarter of 2012, yet decreased $4.8 million from $30.2 million in the second quarter of 2011. See “Non-GAAP Financial Measures” below for further discussion.

- Cash at June 30, 2012 was $33.6 million, compared to $43.6 million at December 31, 2011. The decrease in the cash balances from December 31, 2011 is primarily due to $14.9 million in payments on long-term debt, capital expenditures of $7.3 million, $1.8 million in payments relating to the credit facility amendment and unfavorable currency effects of $0.8 million. These decreases were partially offset by cash provided by operating activities of $13.8 millionand proceeds from the disposition of property of $1.0 million.

- Total debt at June 30, 2012 was $451.8 million, compared to $469.1 million at December 31, 2011. The decrease of $17.3 million from December 31. 2011 is primarily due to net debt payments of $14.9 million in 2012 and favorable currency effects of $2.4 million.

- Capital expenditures for the six months ended June 30, 2012 were $7.3 million, consisting of $2.1 million in growth capex and $5.2 million in maintenance capex. In the same period in 2011, we reported $12.0 million of capital spending, consisting of $4.6 million in growth capex and $7.4 million of maintenance capex. We are currently targeting total capital expenditure commitments for 2012 at approximately $30 million, while actual cash spent on capital expenditures may be somewhat less due to the timing of the equipment installations.

SEGMENT INFORMATION

The following table presents net sales for the first and second quarter of 2012 by segment and the effect of currency on second quarter 2012 net sales (dollars in thousands):

CONFERENCE CALL

The Company plans to hold a conference call on the following morning:

| Date: | Tuesday, August 7, 2012 | ||||

| Start Time: | 9:00 a.m. Eastern Time | ||||

| Domestic Dial-In: | +1-866-831-6247 | ||||

| International Dial-In: | +1-617-213-8856 | ||||

| Passcode: | 73944707 | ||||

| Webcast & Slide Presentation: |

To participate on the call, please dial in at least 10 minutes prior to the scheduled start. A live audio webcast and replay of the call, in addition to a slide presentation, may be found in the investor relations section of the company’s website at www.xerium.com.

NON-GAAP FINANCIAL MEASURES

This press release includes measures of performance that differ from the Company’s financial results as reported under generally accepted accounting principles (“GAAP”). The Company uses supplementary non-GAAP measures, including EBITDA, Adjusted EBITDA and currency effects on Net Sales to assist in evaluating its liquidity and financial performance. EBITDA and Adjusted EBITDA are specifically used in evaluating the ability to service indebtedness and to fund ongoing capital expenditures. The Company’s credit facility includes covenants based upon Adjusted EBITDA. If Adjusted EBITDA declines below certain levels, the Company could go into default under its credit facility or be required to prepay the credit facility. Neither Adjusted EBITDA nor EBITDA should be considered in isolation or as a substitute for income (loss) or cash flows from operations (as determined in accordance with GAAP).

For additional information regarding non-GAAP financial measures and a reconciliation of such measures to the most comparable financial measures under GAAP, please see “Segment Information” above and our Selected Financial Data below. In addition, the information in this press release should be read in conjunction with the corresponding exhibits, financial statements and footnotes contained in our documents to be filed with the Securities and Exchange Commission.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements involving risks and uncertainties, both known and unknown, that may cause actual results to differ materially from those indicated. These risks and uncertainties include the following items: (1) a sustained downturn in the paper industry, compounded by uncertainty in global economic conditions, particularly those stemming from Europe, could adversely affect our revenues and profitability; (2) our financial results could be adversely affected by fluctuations in interest rates and currency exchange rates, for instance a marked decline in the value of the Euro relative to the U.S. Dollar stemming from the European sovereign debt crisis; (3) market improvement in our industry may occur more slowly than we anticipate, may stall or may not occur at all; (4) variations in demand for our products, including our new products, could negatively affect our revenues and profitability; (5) our manufacturing facilities may be required to quickly increase or decrease production, which could negatively affect our production facilities, customer order lead time, product quality, labor relations or gross profits; (6) our plans to develop and market new products, enhance operational efficiencies, and reduce costs may not be successful; and (7) the other risks and uncertainties discussed elsewhere in this press release, our Form 10-K for the year ended December 31, 2011 filed on March 14, 2012 and our other SEC filings. If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement in this press release reflects our current views with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise. As discussed above, we are subject to substantial risks and uncertainties related to current economic conditions, and we encourage investors to refer to our SEC filings for additional information. Copies of these filings are available from the SEC and in the investor relations section of our website at www.xerium.com.

Selected Financial Data Follows

|

Xerium Technologies, Inc. |

||||||||||||||||

|

Condensed Consolidated Statements of Operations and Comprehensive (Loss) Income |

||||||||||||||||

|

(dollars in thousands, except per share data) |

| Condensed Consolidated Selected Financial Data | |||||||

| (in thousands) |

EBITDA and Adjusted EBITDA Non-GAAP Measures

Non-GAAP Financial Measures

We use EBITDA and Adjusted EBITDA (as defined in our credit facility) as supplementary non-GAAP liquidity measures to assist us in evaluating our liquidity and financial performance, specifically our ability to service indebtedness and to fund ongoing capital expenditures. The credit facility includes covenants based on Adjusted EBITDA. If our Adjusted EBITDA declines below certain levels, we may violate the covenants resulting in a default condition under the credit facility or be required to prepay the credit facility. Neither EBITDA nor Adjusted EBITDA should be considered in isolation or as a substitute for income (loss) or cash flows from operations (as determined in accordance with GAAP).

EBITDA is defined as net income (loss) before interest expense, income tax provision (benefit) and depreciation (including non-cash impairment charges) and amortization.

“Adjusted EBITDA”, under our credit facility means, with respect to any period, the total of (A) the consolidated net income for such period, plus (B) without duplication, to the extent that any of the following were deducted in computing such consolidated net income for such period: (i) provision for taxes based on income or profits, including, without limitation, federal, state, provincial, franchise and similar taxes, including any penalties and interest relating to any tax examinations, (ii) consolidated interest expense, (iii) consolidated depreciation and amortization expense, (iv) reserves for inventory in connection with plant closures, (v) consolidated operational restructuring costs, (vi) noncash charges or gains resulting from the application of purchase accounting, including push-down accounting, (vii) non-cash expenses resulting from the granting of common stock, stock options, restricted stock or restricted stock unit awards under equity compensation programs solely with respect to common stock, and cash expenses for compensation mandatorily applied to purchase common stock, (viii) non-cash items relating to a change in or adoption of accounting policies, (ix) non-cash expenses relating to pension or benefit arrangements, (x) expenses incurred as a result of the repurchase, redemption or retention of common stock earned under equity compensation programs solely in order to make withholding tax payments, (xi) amortization or write-offs of deferred financing costs, (xii) any non-cash losses resulting from mark to market hedging obligations (to the extent the cash impact resulting from such loss has not been realized in such period) and (xiii) other non-cash losses or charges (excluding, however, any non-cash loss or charge which represents an accrual of, or a reserve for, a cash disbursement in a future period), minus (C) without duplication, to the extent any of the following were included in computing consolidated net income for such period, (i) non-cash gains with respect to the items described in clauses (vi), (vii), (ix), (xi), (xii) and (xiii) (other than, in the case of clause (xiii), any such gain to the extent that it represents a reversal of an accrual of, or reserve for, a cash disbursement in a future period) of clause (B) above and (ii) provisions for tax benefits based on income or profits. Notwithstanding the foregoing, Adjusted EBITDA, as defined in the credit facility and calculated below, may not be comparable to similarly titled measurements used by other companies.

Consolidated net income is defined as net income (loss) determined on a consolidated basis in accordance with GAAP; provided, however, that the following, without duplication, shall be excluded in determining consolidated net income: (i) any net after-tax extraordinary or non-recurring gains, losses or expenses (less all fees and expenses relating thereto), (ii) the cumulative effect of changes in accounting principles, (iii) any fees and expenses incurred during such period in connection with the issuance or repayment of indebtedness, any refinancing transaction or amendment or modification of any debt instrument, in each case, as permitted under the credit facility and (iv) any gains resulting from the returned surplus assets of any pension plan.

The following table provides reconciliation from net income (loss) and operating cash flows, which are the most directly comparable GAAP financial measures, to EBITDA and Adjusted EBITDA. Please also see our exhibits to be filed with our current report on Form 8K, which should be read in conjunction with this release.

Source: Xerium Technologies, Inc.

Xerium Technologies Receives Continued Listing Standards Notice from the NYSE

Xerium Technologies, Inc., a leading global manufacturer of clothing and roll covers used primarily in the paper production process, today announced that on August 2, 2012, it received notification from the New York Stock Exchange (NYSE) that it was not in compliance with a NYSE standard for continued listing of the Company's common stock on the exchange. Specifically, the Company is considered below the continued listing criteria by the NYSE because the Company's average total market capitalization over a consecutive 30 trading day period has been less than $50 million and its most recently reported stockholders' equity was less than $50 million.

Under NYSE rules, the Company has 45 days from the date of the notice to submit a plan to the NYSE to demonstrate its ability to achieve compliance with the market capitalization listing standards within 18 months of receiving the notice. The Company intends to submit such a plan and has notified the NYSE that it intends to cure the deficiency within the prescribed timeframe. During this cure period, the Company's shares will continue to be listed and traded on the NYSE, subject to the Company's compliance with other NYSE continued listing standards.

The Company's business operations, credit agreement and Securities and Exchange Commission reporting requirements are unaffected by this notice.

Source: Xerium Technologies, Inc.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements involving risks and uncertainties, both known and unknown, that may cause actual results to differ materially from those indicated. These risks and uncertainties include the following items: (1) our financial results could be adversely affected by fluctuations in interest rates and currency exchange rates, for instance a marked decline in the value of the Euro relative to the U.S. Dollar stemming from the European sovereign debt crisis; (2) a sustained downturn in the paper industry, compounded by uncertainty in global economic conditions, could adversely affect our revenues and profitability; (3) market improvement in our industry may occur more slowly than we anticipate, may stall or may not occur at all; (4) variations in demand for our products, including our new products, could negatively affect our revenues and profitability; (5) our manufacturing facilities may be required to quickly increase or decrease production, which could negatively affect our production facilities, customer order lead time, product quality, labor relations or gross profits; (6) our plans to develop and market new products, enhance operational efficiencies, and reduce costs may not be successful; and (7) the other risks and uncertainties discussed elsewhere in this press release, our Form 10-K for the year endedDecember 31, 2011 filed on March 14, 2012 and our other SEC filings. If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement in this press release reflects our current views with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise. As discussed above, we are subject to substantial risks and uncertainties related to current economic conditions, and we encourage investors to refer to our SEC filings for additional information. Copies of these filings are available from the SEC and in the investor relations section of our website at www.xerium.com.

Xerium Technologies Schedules Second Quarter 2012 Conference Call

Xerium Technologies, Inc., a leading global manufacturer of industrial textiles and rolls used primarily in the paper production process, today announced that it plans to release financial results for the second quarter 2012, ending June 30, 2012, after the close of regular market trading on Monday, August 6, 2012.

The company plans to hold a conference call on the following morning:

| Date: | Tuesday, August 7, 2012 | |

| Start Time: | 9:00 a.m. Eastern Time | |

| Domestic Dial-In: | +1-866-831-6247 | |

| International Dial-In: | +1-617-213-8856 | |

| Passcode: | 73944707 | |

| Webcast & Slide Presentation: | ||

To participate on the call, please dial in at least 10 minutes prior to the scheduled start. A live audio webcast and replay of the call, in addition to a slide presentation, may be found in the investor relations section of the company's website at http://www.xerium.com.

Source: Xerium Technologies, Inc.

Xerium Technologies Announces Appointment of Industry Veteran to Board

Xerium Technologies, Inc., a leading global manufacturer of clothing and roll covers used primarily in the paper production process, today announced that it has appointed to its Board of Directors Roger A. Bailey, a veteran of the pulp and paper industry and currently President, Power Products, North Americafor ABB, Inc.

"During my years with Xerium, I have come to know Roger as one of the most well-respected leaders in the paper industry," said Stephen R. Light, the Company's Chairman, President and Chief Executive Officer. "As the former Group Vice President of ABB's Pulp and Paper Business Unit, he was successful in growing the business during a time of declining paper volume and in restructuring the ABB footprint towards growth-oriented markets. His experience will be invaluable to Xerium particularly as we continue to implement our recently announced strategic plan 'Vision 2015.'"

Source: Xerium Technologies, Inc.

******

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements involving risks and uncertainties, both known and unknown, that may cause actual results to differ materially from those indicated. These risks and uncertainties include the following items: (1) our financial results could be adversely affected by fluctuations in interest rates and currency exchange rates, for instance a marked decline in the value of the Euro relative to the U.S. Dollar stemming from the European sovereign debt crisis; (2) a sustained downturn in the paper industry, compounded by uncertainty in global economic conditions, could adversely affect our revenues and profitability; (3) market improvement in our industry may occur more slowly than we anticipate, may stall or may not occur at all; (4) variations in demand for our products, including our new products, could negatively affect our revenues and profitability; (5) our manufacturing facilities may be required to quickly increase or decrease production, which could negatively affect our production facilities, customer order lead time, product quality, labor relations or gross margin; (6) our plans to develop and market new products, enhance operational efficiencies, and reduce costs may not be successful; and (7) the other risks and uncertainties discussed elsewhere in this press release, our Form 10-K for the year endedDecember 31, 2011 filed on March 14, 2012 and our other SEC filings. If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement in this press release reflects our current views with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise. As discussed above, we are subject to substantial risks and uncertainties related to current economic conditions, and we encourage investors to refer to our SEC filings for additional information. Copies of these filings are available from the SEC and in the investor relations section of our website at www.xerium.com.

Xerium Technologies Announces Operational Realignments in Argentina and France

Xerium Technologies, Inc. a leading global manufacturer of clothing and roll covers used primarily in the paper production process, today announced a voluntary redundancy program at its press felt facility in Buenos Aires, Argentina in connection with the relocation of its Huyck.Wangner press felt capacity and initiated consultation proceedings with its works’ council at its rolls cover facility in Meyzieu,France regarding a proposal to cease operations there. In Argentina, the production of press felts and fiber cement felts would be transferred to the Company’s facilities in Brazil and the roll cover production of its facility in France would be transferred to the Company’s rolls facilities in Germany and Italy. The actions are expected to be completed over the next several months.

Commenting on the action, Stephen R. Light, the Company’s Chairman, President and Chief Executive Officer said, “Any action of this nature is taken only after much deliberation. This action helps align our rolls and press felt capacity with current and future market demands. With these actions, Xerium will maintain its leadership position in the global paper industry with state of the art facilities strategically located in North and South America, Europe and Asia.”

Although the final costs will not be known until the actions are complete, the Company estimates it will incur approximately $10.1 million in restructuring charges, including $2.8 million of non-cash impairment charges, beginning in the third quarter of 2012 through the planned completion of shutdown activities in the fourth quarter of 2012. The Company estimates it will make approximately $5.8 million in net cash payments related to various personnel, facility and capital expenditure costs associated with these plans, which are net of proceeds on the sale of certain assets. The Company estimates these actions will result in future annual pre-tax savings of $2.6 million.

Source: Xerium Technologies, Inc.