Do you really have quantitative data on your development and innovation portfolio, or are you just making decisions based on qualitative opinions? There is a way to make innovation evaluation more accurate with Modern Portfolio Theory application.

Do you really have quantitative data on your development and innovation portfolio, or are you just making decisions based on qualitative opinions? There is a way to make innovation evaluation more accurate with Modern Portfolio Theory application.

Check out our approach presentation.

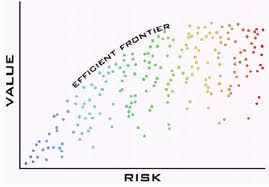

MPT has been recently criticized for its inability to understand actual market situations in investment field. As this criticism is well justified in investment banking, it has no relevance in innovation portfolio management. This is based on the nature of collecting data for the model as well as the natural predictability of future development. The approach is very suitable to companies’ innovation evaluation work when various predictions of the future need to be justified for improved decision making .

The answer to the R&D evaluation challenge is three fold. First we need to evaluate the used processes and adjust them to meet the data collection criteria. Second we need to collect all qualitative data into tools that enable variation of input. And third, we need to perform a portfolio analysis based on the data from multiple projects.