Displaying items by tag: Gardner Denver Nash

Significantly improved efficiency: The new 900 series from Hoffman & Lamson

With the "900" series, Hoffman & Lamson launchesa significantlyimproved, multistage centrifugal blower to the market. Design optimizations result in an increase in efficiency of upto 8 %.

The new "900" series wasdeveloped for optimum performance withdirectly coupled motors. Optimizations in the housing and theimpellers result in an increase in efficiency of up to 8 %,and thereforesignificant energy savings. Compared to other models, it is possibleto operate the blower without a gearbox, which considerably reduces the noise emissions of a system.

The maximum compression pressure is 1.5 bar g. The "900" series is offered in 3 sizeswith which a volume flow rate between 8,000 and 67,000 m³/h can be achieved. A large numberof design optionsare possible here: Special coatings, alternative materials, oil and grease lubrication, special gaskets, coupling options and different drives. The multistagecentrifugal blowerdefined in this way is then manufacturedfor the individual application and according to the specified requirements.

The brands Hoffman®andLamson®stand for the world's leading manufacturer of multistagecentrifugal blowers. The blowers from Hoffman & Lamson are the ideal solution whenprocesses require a uniform pressure, pulsation-free flow and oil- free operation. This property is extremelyimportant for manyprocesses in a broad range of industries, e.g. for the ventilation, extraction,conveying of gases and fine dust or in drying processes.

About the company:

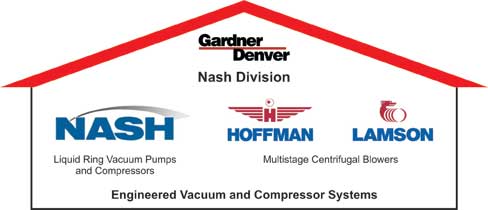

The NashDivision is part ofthe „EnergyGroup“ of Gardner Denver,Inc. Originating from nash_elmo Industries,the company is the world's leading manufacturer of liquid ringvacuum pumps, compressors and engineered systems. The brand ofNASH has over 100 years of experiencein manufacturing of liquid ring vacuumpumps andcompressors, the HOFFMAN & LAMSON brand is a manufacturer of multistagecentrifugal blowers. All three brands have a strong focus on Engineered Vacuum and Compressor Systems. Furthermore, the brand of Oberdorfer Pumps is part of the NashDivision. All brands have awide product portfolio and customers allover the world. Our Vacuum and compressorsystems have reliably operated fordecades in the oil & gas industry, chemical process industry, filter applications, pulp & paperproduction, electric power plants, refineries, wastewater treatment, generalprocess industries and many more applications. Professionalservice is available to keeppumps and systems running efficiently for decades.

Nash Division extends its portfolio

Gardner Denver has restructured the activities within its Engineered Products Group: Effective January 01, 2013, the CF (Multistage Centrifugal Blowers) organization of Gardner Denver, encompassing the Hoffman and Lamson brands, become part of the Gardner Denver Nash division.

NASH has over 100 years of experience in manufacturing of liquid ring vacuum pumps and compressors and the CF group is a strong manufacturer of HOFFMAN & LAMSON multistage centrifugal blowers. All three brands have a strong focus on Engineered Vacuum and Compressor Systems. They have a wide product portfolio and customers all over the world.

Vacuum and compressor systems made by Nash and Hoffman & Lamson have reliably operated for decades in the chemical process industry, filter applications, pulp & paper production, electric power plants, refineries, wastewater treatment, general process industries and many more applications.

This new organization will realize significant synergies within the Nash division, especially in the engineering and supply of vacuum and compressor systems. Combined sales channels and know-how will enable us to provide better communication and further improve all processes with our partners and customers.

For business partners in EMEA, this means that the Nash sales organization will be the contact partner for all issues regarding CF Blowers. All CF inquires will continue to be handled by the experienced technical sales support team of Hoffman & Lamson.

Both Lamson (founded in 1880) and Hoffman (founded in 1905) have strong roots in the USA and a strong market position in many wastewater treatment applications. After being acquired by Gardner Denver (Lamson in 1996 and Hoffman in 2001), the two brands were merged, further improving their

market position.

Nash originated from nash_elmo which was acquired by Gardner Denver in 2004. The company is the inventor of the liquid ring pump, with patent certificates issued in Germany and the USA in 1903 and 1905 respectively.

Michael M. Larsen Named President and CEO of Gardner Denver

Gardner Denver, Inc. (NYSE: GDI) has announced that its board of directors has unanimously appointed Michael M. Larsen as President and Chief Executive Officer, effective immediately. Mr. Larsen had served as Vice President and Chief Financial Officer of Gardner Denver since 2010 and as Interim Chief Executive Officer since July 2012.

Mr. Larsen was also appointed to the Gardner Denver board of directors, effective immediately. Mr. Larsen was appointed to the class of directors whose term of office expires at the 2015 Annual Meeting of Shareholders. With the addition of Mr. Larsen, Gardner Denver's board now consists of nine directors, eight of whom are independent.

"After a thorough search, we are pleased to announce Michael's appointment as President and CEO on a permanent basis," said Diane Schumacher, independent Chairperson of the Board. "This appointment reflects the unanimous recognition by our board of the importance of Michael's numerous contributions, including serving as Interim CEO since July and as CFO since 2010. Michael has been intimately involved in developing and executing Gardner Denver's strategy for profitable growth and has led Gardner Denver's strong performance in a challenging environment. Under his leadership, Gardner Denver has improved productivity and reduced structural costs and remains focused on these efforts as evidenced by the recently announced restructuring of the Company's European operations. Michael's knowledge of our company and industry will be a valuable asset as we continue to execute on our strategy and work to enhance value for all Gardner Denver shareholders."

Ms. Schumacher continued, "The Gardner Denver board, together with its management team and the Company's financial advisor, continue to explore strategic alternatives for the Company, including enhancing the Company's existing strategic plan or a possible sale or merger of the Company. The board remains committed to this process, and we intend to thoughtfully and carefully evaluate options available to the Company in order to enhance shareholder value."

The Company stated that no decision has been made and that there can be no assurance that the board's exploration of strategic alternatives will result in any transaction being entered into or consummated. Gardner Denver does not intend to discuss or disclose developments with respect to this process until the board has approved a definitive course of action.

Mr. Larsen will continue to fulfill the role of Chief Financial Officer while a search is conducted and until a successor is named.

Gardner Denver Announces European Restructuring Initiative

Gardner Denver has announced a restructuring initiative to optimize its global manufacturing footprint, reduce costs and expand margins. These initiatives, which focus primarily on its European Industrial Products Group, will consolidate manufacturing facilities and reduce associated staffing levels to increase operational efficiency and provide additional resources to invest in profitable growth. In connection with today's announcement, the Company also confirmed its prior earnings guidance for full-year 2012.

Gardner Denver expects to begin implementing its restructuring plan over the next several months and intends to conclude these initiatives by the end of 2015.

In total, these initiatives are expected to generate annualized, pre-tax cost savings of $35-$40 million by 2016, with $10-$15 million expected to be achieved in 2013.

"Gardner Denver has a solid track record of margin expansion and execution supported by the principles of the Gardner Denver Way," said Michael M. Larsen, Gardner Denver Interim Chief Executive Officer and Chief Financial Officer. "Today, we are announcing a series of strategic actions and plans designed to ensure that our company remains financially well-positioned and appropriately structured for profitable, long-term growth in our Industrial Products Group in Europe."

"After extensive analysis and consideration, we believe these restructuring initiatives will enhance the Company's prospects for growth and value creation, while ensuring that our businesses continue to meet and exceed the needs of customers every day. We further recognize that this will have a personal impact on people who have been dedicated to the mission of Gardner Denver. We recognize their contributions to the achievements of our business, and are committed to treating them fairly and with respect throughout this process," said Larsen.

The company noted that it expects to record cumulative, pre-tax restructuring charges related to the restructuring plan, consisting primarily of severance benefits and other integration costs, in the range of $85-$100 million which will be fully realized by 2015, with $35-$45 million expected to be incurred in 2013.

Gardner Denver CEO Resigns, Board Appoints Michael M. Larsen Interim CEO

The board of directors of Gardner Denver, Inc. has announced that Barry L. Pennypacker has resigned as president, chief executive officer and director. Michael M. Larsen, vice president and chief financial officer, has been named interim CEO, effective immediately. Diane Schumacher, who served in a variety of senior management and legal roles during her career with Cooper Industries, will continue to serve as board chairperson and will actively assist Mr. Larsen during the transition period.

Mr. Larsen oversees all company financial matters, including mergers and acquisitions, and will retain his CFO responsibilities during the interim period. Having served as vice president and chief financial officer since 2010, Mr. Larsen has played a key role in defining and driving Gardner Denver's growth strategy, focused on a transformation into a leading industrial company. Under Mr. Larsen's leadership as CFO, the company delivered record financial results in 2011. Gardner Denver expects second quarter 2012 results to be in line with previously stated guidance.

"We thank Barry for his service to the company and wish him well in his new endeavors," said Diane Schumacher. "Gardner Denver is a strong company and we have a strong transitional leadership plan, which includes the return of T. Duane Morgan to lead the Engineered Products Group. As we move forward, we are very pleased to have a leader with Michael M. Larsen's credentials as interim CEO."

"I am proud of the progress and results we achieved in my years with the company, which is well positioned for a strong future. Gardner Denver has a talented leadership team supported by a dedicated and customer-focused workforce. I wish them only the best," said Barry L. Pennypacker.

"It's an honor to be selected for this role and I accept with the clear goal of continuing to move the company forward by executing Gardner Denver's lean strategy for profitable growth," said Michael M. Larsen, interim chief executive officer and chief financial officer.

Prior to joining Gardner Denver, Mr. Larsen served as chief financial officer for General Electric Water & Process Technologies, a global organization with revenues of approximately $2 billion and 7,500 employees. His previous experience includes more than 15 years with General Electric Company, where he served in a variety of financial leadership roles in GE Plastics, GE Industrial, GE Energy Services and GE Power & Water. He joined GE's European Healthcare organization in Paris, France in 1995 and served on GE's Corporate Audit staff for six years.

The nominating and corporate governance committee of the board of directors will oversee the search for the next CEO.

The company plans to release second quarter results on Thursday, July 19, 2012 after the market close followed by a conference call on July 20, 2012 at 8:30 a.m. ET. Additional detail on the conference call can be found on the investors section of the company's website (www.GardnerDenver.com).

SOURCE: Gardner Denver, Inc.

Gardner Denver Announces Key Leadership Changes

Gardner Denver, Inc. has announced the appointment of Brian L. Cunkelman, age 43, as Vice President, Gardner Denver, Inc. and President, Industrial Products Group (IPG), effective immediately.

Mr. Cunkelman joined Gardner Denver in 2010 as Vice President, IPG Americas, and was promoted in 2011 to his current role as Vice President and General Manager for Emco Wheaton, a division of Gardner Denver, headquartered in Germany. In his new role, Mr. Cunkelman will remain based in Europe, which represents a substantial portion of IPG's global operations.

Previously, Mr. Cunkelman was Vice President of the Engineering Solutions business unit for Dell Corporation, and spent more than 17 years with Wabtec Corporation in a variety of operational and business leadership roles of increasing responsibility. These roles included Product Development, Operations Management, International Business Development, and Aftermarket Development. Brian holds a Bachelor of Science degree in Mechanical Engineering from Brown University and has extensive experience in implementing Lean principles.

"I am very pleased to announce Brian's promotion to the President of the Industrial Products Group," said Barry L. Pennypacker, Gardner Denver's President and Chief Executive Officer. "Brian has a proven track record of generating strong results in previous businesses and his recent experience managing the IPG Americas business makes him a great fit for this role as we continue to execute on our five point growth strategy. Brian's in-depth knowledge of the Gardner Denver Way will enable us to continue to drive innovation and velocity throughout the global IPG enterprise."

Concurrently, Gardner Denver, Inc. today announced the retirement of T. Duane Morgan, age 62, effective May 1, 2012. Mr. Morgan is currently Vice President, Gardner Denver, Inc. and President, Engineered Products Group (EPG). He joined the Company as Vice President and General Manager of the Gardner Denver Fluid Transfer Division in 2005.

"I thank Duane for his strong leadership over the past seven years," said Mr. Pennypacker. "Duane has made tremendous contributions to organic growth and margin expansion within the EPG business. In addition, Duane has helped us prepare and build a strong bench of talented leaders, which will allow for a smooth transition with regards to his planned retirement."

With Mr. Morgan's retirement, the General Managers for Gardner Denver's Petroleum and Industrial Pumps, Thomas, and Nash divisions in EPG will report directly to Mr. Pennypacker.

Gardner Denver Announces New Independent Auditor

Gardner Denver, Inc has announced that the Company's Audit and Finance Committee of the Board of Directors (the "Audit Committee") has appointed Ernst & Young LLP ("E&Y") as Gardner Denver's new independent registered public accounting firm for the fiscal year ending December 31, 2012, replacing KPMG LLP ("KPMG") following the completion of the audit for the fiscal year ending December 31, 2011.

"We have enjoyed a very positive relationship with KPMG and are grateful for the excellent work they have performed for Gardner Denver since 2002," stated Michael M. Larsen, Vice President and Chief Financial Officer of Gardner Denver. "The selection of E&Y followed a rigorous, competitive proposal process conducted by the Audit Committee, in which several firms including KPMG were invited to participate. E&Y emerged during this process as the best fit for Gardner Denver's long-term needs."

KPMG has confirmed that the change in auditor was not related to any disagreements about accounting principles or practices, financial statements disclosure or auditing scope or procedure between the Company and KPMG. In conjunction with this change, Gardner Denver filed a Form 8-K with the Securities and Exchange Commission today. This filing can be accessed from the Investor section on the Company's website (www.gardnerdenver.com).

John D. Craig Joins Gardner Denver, Inc. Board of Directors

Gardner Denver, Inc. has announced that its Board of Directors appointed Mr. John D. Craig to serve as an independent director of the company, effective November 2011 concurrent with the retirement of Mr. Frank J. Hansen. Barry L. Pennypacker, Gardner Denver's President and Chief Executive Officer, stated, "We are very pleased to have John join the Board of Directors. He brings a wealth of leadership and management expertise that has been accumulated during his distinguished career and his operational principles mirror those of the Gardner Denver Way."

Mr. Craig is the Chairman of the Board of Directors, President and Chief Executive Officer of EnerSys, a publicly held manufacturer of industrial batteries and associated stored energy solutions and services. Mr. Craig joined EnerSys' predecessor company, Yuasa, Inc., in 1994 and has held a series of senior management positions of increasing responsibility, including President and Chief Operating Officer, a position he held from 1998 to 2000 when he was promoted to his current position. Mr. Craig earned his Bachelor's degree from Western Michigan University and a Master's Degree in Electronics Engineering Technology from Arizona State University.

Gardner Denver Delivers Record Results

Gardner Denver, Inc. has announced the second quarter 2011 results that established quarterly records for orders, revenues, operating income and DEPS. In addition, backlog at June 30, 2011 was $681.7 million, an all-time high. Revenues and operating income were $610.7 million and $99.2 million, respectively. Operating income improved 75% compared to the three-month period of the prior year, increasing to $99.2 million from $56.6 million in 2010. Operating income as a percentage of revenues was 16.2% in the second quarter of 2011, up 360 basis points compared to 12.6% in last year's second quarter. The increase in operating income was largely driven by incremental profitability on the revenue growth, favorable product mix and the benefits of operational improvements previously implemented. For the second quarter of 2011, net income and DEPS attributable to Gardner Denver were $67.1 million and $1.27, respectively. The three-month period ended June 30, 2011 included expenses for profit improvement initiatives and other items totaling $5.2 million, or $0.08 DEPS.

CEO's Comments

"Gardner Denver had an outstanding second quarter with strong, broad based organic growth across our diverse portfolio of businesses and significant margin expansion," said Barry L. Pennypacker, Gardner Denver's President and Chief Executive Officer. "As evidenced by the record breaking orders, revenue and DEPS achieved in the second quarter, we continue to progress on our strategic priorities and improve operational execution supported by the Gardner Denver Way. Both of the Company's reportable segments delivered strong operational performance in the quarter, resulting in operating margins expanding by 360 basis points compared to the prior year. The Industrial Products Group (IPG) improved margins sequentially for the ninth consecutive quarter and continued to benefit from healthy organic growth in North America and Asia Pacific. The Engineered Products Group (EPG) benefited from broad strength across the portfolio and especially strong demand for petroleum pumps and related aftermarket parts and services."

Mr. Pennypacker continued, "Cash provided by operating activities was more than $66 million in the second quarter, a 63% improvement compared to the same period of 2010. In addition, we invested $13.0 million in capital expenditures in the second quarter of 2011, with a sustained focus on operational improvements and increased production output to meet customer demand. The Company expects capital expenditures to total approximately $50 to $55 million in 2011. Our focus on cash generation and disciplined capital allocation remains a top priority for 2011. The acquisition pipeline is strong, and we continue to selectively evaluate appropriate opportunities as they become available."

Outlook

"Our backlog for EPG remains at record levels, yielding a very positive outlook for the remainder of 2011. Demand for well servicing pumps and aftermarket fluid ends continues to grow sharply as shale activity increases and we are investing in additional capacity to meet these growing needs. Further, the demand for engineered packages and OEM compressors remains strong," commented Mr. Pennypacker.

"For the remainder of 2011, we expect continued revenue growth in IPG as a result of healthy demand in our core end markets as well as strong growth in emerging markets such as China. We anticipate that global capacity utilization will remain steady in 2011, resulting in sustained levels of manufacturing spending and investment in customer plants. We remain optimistic that this steady growth will drive demand for IPG's compressors, blowers and vacuum products as well as opportunities for replacement parts and services."

Mr. Pennypacker stated, "Based on this outlook, our existing backlog and productivity improvement plans, we are projecting third quarter 2011 DEPS to be in a range of $1.27 to $1.32 and are raising our full-year 2011 DEPS range to $5.05 to $5.15. This projection includes profit improvement costs and other items totaling $0.03 per diluted share for the third quarter of 2011 and $0.15 per diluted share for the full-year 2011. Third quarter 2011 DEPS, as adjusted for the impact of profit improvement costs and other items ("Adjusted DEPS"), are expected to be in a range of $1.30 to $1.35. The midpoint of the Adjusted DEPS range for the third quarter of 2011 ($1.33) represents a 51% increase over the same period of 2010. Full-year 2011 Adjusted DEPS are expected to be in a range of $5.20 to $5.30. The midpoint of the updated Adjusted DEPS range for the full-year 2011 ($5.25) represents a 55% increase over 2010 results and a 13% increase from the full-year 2011 guidance issued in April. The effective tax rate assumed in the DEPS guidance for 2011 is unchanged at 28%."

Engineered Products Group (EPG)

EPG orders and revenues increased 43% and 56%, respectively, for the three months ended June 30, 2011, compared to the same period of 2010, reflecting sustained, strong demand for drilling and well servicing pumps and engineered packages. In the second quarter of 2011, favorable changes in foreign currency exchange rates increased orders and revenues for EPG by 5% and 6%, respectively. The ILMVAC acquisition, completed in the third quarter of 2010, increased both orders and revenues by 2%. Organically, EPG generated order and revenue growth of 36% and 48%, respectively, in the second quarter of 2011, compared to the prior year period.

Segment operating income(1), as reported under generally accepted accounting principles in the U.S. ("GAAP"), for EPG for the three months ended June 30, 2011 was $64.8 million and segment operating margin(1) was 22.9%, compared to $36.4 million and 20.1%, respectively, in the same period of 2010. Operating Income, as adjusted to exclude the net impact of expenses incurred for profit improvement initiatives and other items ("Adjusted Operating Income"), for EPG for the second quarter of 2011 was $65.9 million and segment Adjusted Operating Income as a percentage of revenues was 23.3%. Adjusted Operating Income for EPG in the second quarter of 2010 was $35.2 million, or 19.5% of revenues. The improvement in Adjusted Operating Income for this segment was primarily attributable to incremental profitability on revenue growth, favorable product mix and cost reductions. See the "Selected Financial Data Schedule" and the "Reconciliation of Operating Income and DEPS to Adjusted Operating Income and Adjusted DEPS" at the end of this press release.

Industrial Products Group (IPG)

Orders and revenues for IPG increased 15% and 22%, respectively, in the second quarter, compared to the same period of 2010, reflecting on-going improvement in demand for OEM products, compressors and aftermarket parts and services. In the second quarter of 2011, favorable changes in foreign currency exchange rates increased orders and revenues for the Industrial Products segment by 9%. Organically, IPG generated order and revenue growth of 6% and 13%, respectively, in the second quarter of 2011, compared to the prior year period.

Segment operating income(1) and segment operating margin(1), as reported under GAAP, for the Industrial Products segment for the three months ended June 30, 2011 were $34.3 million and 10.5%, respectively, compared to $20.2 million and 7.5% of revenues for the three months ended June 30, 2010. Adjusted Operating Income for IPG in the second quarter of 2011 was $38.5 million and Adjusted Operating Income as a percentage of revenues was 11.7%. By comparison, Adjusted Operating Income for IPG was $23.2 million, or 8.6% of revenues, in the three-month period of 2010. The improvement in Adjusted Operating Income for this segment was primarily attributable to incremental profit on revenue growth and cost reductions. See the "Selected Financial Data Schedule" and the "Reconciliation of Operating Income and DEPS to Adjusted Operating Income and Adjusted DEPS" at the end of this press release.

Gardner Denver Consolidated Results

Adjusted Operating income, which excludes the net impact of expenses incurred for profit improvement initiatives and other items ($5.2 million), for the three-month period ended June 30, 2011 was $104.4 million, compared to $58.4 million in the prior year period. Adjusted Operating Income as a percentage of revenues improved to 17.1% from 13.0% in the second quarter of 2010. Adjusted DEPS for the three-month period ended June 30, 2011, were $1.35, compared to $0.73 in the three-month period of 2010. Adjusted Operating Income, on a consolidated and segment basis, and Adjusted DEPS are both financial measures that are not in accordance with GAAP. See "Reconciliation of Operating Income and DEPS to Adjusted Operating Income and Adjusted DEPS" at the end of this press release. Gardner Denver believes the non-GAAP financial measures of Adjusted Operating Income and Adjusted DEPS provide important supplemental information to both management and investors regarding financial and business trends used in assessing its results of operations. Gardner Denver believes excluding the specified items from operating income and DEPS provides a more meaningful comparison to the corresponding reported periods and internal budgets and forecasts, assists investors in performing analysis that is consistent with financial models developed by investors and research analysts, provides management with a more relevant measurement of operating performance and is more useful in assessing management performance.

Forward-Looking Information

This press release contains forward-looking statements that involve risks and uncertainties. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "could," "should," "anticipate," "expect," "believe," "will," "project," "lead," or the negative thereof or variations thereon or similar terminology. The actual future performance of the Company could differ materially from such statements. Factors that could cause or contribute to such differences include, but are not limited to: changing economic conditions; pricing of the Company's products and other competitive market pressures; the costs and availability of raw materials; fluctuations in foreign currency exchange rates and energy prices; risks associated with the Company's current and future litigation; and the other risks detailed from time to time in the Company's SEC filings, including but not limited to, its Annual Report on Form 10-K for the fiscal year ending December 31, 2010, and its subsequent quarterly reports on Form 10-Q for the 2011 fiscal year. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company does not undertake, and hereby disclaims, any duty to update these forward-looking statements, although its situation and circumstances may change in the future.

Comparisons of the financial results for the three and six-month periods ended June 30, 2011 and 2010 follow.

Gardner Denver will broadcast a conference call to discuss results for the second quarter of 2011 on Friday, July 22, 2011 at 9:30 a.m. Eastern Time through a live webcast. This free webcast will be available in listen-only mode and can be accessed, for up to ninety days following the call, through the Investor Center on the Gardner Denver website at www.GardnerDenver.com or through Thomson StreetEvents at www.earnings.com.

Gardner Denver, Inc. Appoints President, Industrial Products Group

Gardner Denver, Inc. has announced the appointment of Christopher R. Celtruda as Vice President, Gardner Denver, Inc. and President, Industrial Products Group effective April 26, 2011. Mr. Celtruda will be based in Gardner Denver's global headquarters in Wayne, PA. Prior to joining Gardner Denver, Mr. Celtruda was employed by CIRCOR International, Inc. as Group Vice President for the global Aerospace Products Group. CIRCOR provides valves and other highly engineered products and subsystems that provide flow management for the aerospace, energy and industrial markets. Mr. Celtruda was instrumental in promoting growth within the CIRCOR Aerospace franchise via acquisition and investment in both new product development and operational excellence. Prior to joining CIRCOR, Mr. Celtruda spent more than 12 years with Honeywell and the former Allied Signal in a variety of operational and business leadership roles within the aerospace group. These roles included Director of the Engine Systems Integrated Supply Chain, General Manager for the Engine Fuel Control business and additional business leadership roles in Factory Repositioning, New Product Development and Product Management. Mr. Celtruda began his career with the General Dynamics Corporation and is a Six Sigma Black Belt. He holds a Bachelor of Science degree in Mechanical Engineering from the University of Maine and an M.B.A. from the W.P. Carey School of Business at the Arizona State University. "I am very pleased that Chris has decided to join Gardner Denver," said Barry L. Pennypacker, Gardner Denver's President and Chief Executive Officer. "He brings a breadth of operational leadership experience that has been accumulated during his career at Honeywell and CIRCOR and inherits a strong leadership team that has made significant improvements to the Industrial Products Group over the past three years. The outstanding experience and new perspective that Chris brings, when combined with the existing leadership at IPG, will continue to drive operational excellence through the Gardner Denver Way: accelerating organic growth; expanding our aftermarket revenues; increasing operating margins; and leading the industry in innovative products." "I am excited about the opportunity to join Gardner Denver and to build upon the strong legacy of innovation and operational excellence," said Mr. Celtruda. "I am looking forward to immersing myself in the Industrial Products Group value stream and connecting with the global team to build customer relationships and drive plans for future growth." SOURCE: Gardner Denver, Inc.