Displaying items by tag: Verso Paper Corp

Verso Stevens Point Mill Earns 2015 Green Masters Award for Sustainability Initiatives and Performance

Verso Corporation (OTCQB: VRSZ), a leading supplier of printing papers, specialty papers and pulp, have just announced that its mill in Stevens Point, Wisconsin, has earned a 2015 Green Masters Award for the second year in a row. Verso is among an exclusive group of leading companies in Wisconsin that was recognized by the Wisconsin Sustainable Business Council for significant and ongoing sustainability practices.

Verso Corporation (OTCQB: VRSZ), a leading supplier of printing papers, specialty papers and pulp, have just announced that its mill in Stevens Point, Wisconsin, has earned a 2015 Green Masters Award for the second year in a row. Verso is among an exclusive group of leading companies in Wisconsin that was recognized by the Wisconsin Sustainable Business Council for significant and ongoing sustainability practices.

"Sustainability is one of Verso's founding principles and is integral to the decisions we make across our business every day," said Becky Burris, Verso Vice President of Environmental, Health, Safety and Sustainability. "As we seek to reduce our environmental footprint, we challenge ourselves and our suppliers to find new and better ways to use resources more efficiently and further reduce air emissions, water discharges and waste. We are very proud to be recognized by the Green Masters Program for our sustainability initiatives at the Stevens Point Mill."

The Stevens Point Mill was judged in a competitive process on a comprehensive range of key sustainability areas, including energy, water, waste management, emissions and transportation, as well as educational and community outreach. The Green Masters Award designation is the highest tier attainable in this competitive process and is only made available to Green Masters Program participants scoring in the top 20 percent of all program participants, based on points awarded for sustainability practices in these key sustainability areas.

The Stevens Point Mill produces specialty papers for food, beverage and consumer goods applications. The mill works within stringent operational standards, constantly striving to improve internal processes, and has invested in continuous improvement methodology that has led to a number of successful sustainability projects. "Our overarching sustainability goal is continuous performance improvement in everything we do," said Stevens Point Mill Manager Craig Helgeson. "The Stevens Point Mill continues to make noteworthy progress in sustainably manufacturing and delivering high quality specialty papers. It is rewarding to be recognized alongside other companies in Wisconsin who are sustainability leaders."

Notable accomplishments for the Stevens Point Mill in 2015:

- Carbon Emissions Reduction: Two-year reduction of 8.8 percent in carbon emissions produced per ton of paper manufactured

- Water Usage Reduction: Two-year reduction of nearly 19 percent of total water usage per ton of paper manufactured

- Total Energy Usage Reduction: Nearly 4 percent reduction in energy usage over prior year per ton of paper manufactured

- Transportation Sustainability: Over 86 percent of shipments utilize the U.S. Environmental Protection Agency's SmartWay™ transportation partners

The 2015 Green Masters Award was presented to Verso today at the 8th Annual Wisconsin Sustainable Business Council Conference at the University of Wisconsin-Oshkosh in Oshkosh, Wisconsin.

About the Green Masters Program

The Green Masters Program is an objective, points-based recognition program that enables Wisconsin institutions of all sizes and from any sector to join a group of like-minded companies that are "on the road to sustainability." Developed by the Wisconsin Sustainable Business Council, in conjunction with the University of Wisconsin, the Green Masters Program helps to recognize Wisconsin's sustainability leaders and encourage continuous improvement. Nearly 200 Wisconsin Businesses are participating in the program, and only the top 20 percent achieve the highest "Green Master" designation.

About Verso

Verso Corporation is the turn-to company for those looking to successfully navigate the complexities of paper sourcing and performance. The leading North American producer of printing and specialty papers and pulp, Verso provides insightful solutions that help drive improved customer efficiency, productivity, brand awareness and business results. Verso's long-standing reputation for quality and reliability is directly tied to our vision to be a company with passion that is respected and trusted by all. Verso's passion is rooted in ethical business practices that demand safe workplaces for our employees and sustainable wood sourcing for our products. This passion, combined with our flexible manufacturing capabilities and an unmatched commitment to product performance, delivery and service, make Verso a preferred choice among commercial printers, paper merchants and brokers, converters, publishers and other end users. For more information, visit us online at versoco.com.

Verso Releases New PAPER@WORK(TM) Brief

Verso Corporation (OTCQB: VRSZ), a leading supplier of printing papers, specialty papers and pulp, today released Flexible Packaging: Anatomy of a Special(ty) Relationship, the fifth installment in its popular PAPER@WORK™ series. This brief explores Verso's 40-year-plus relationship with American Packaging Corporation (APC) and examines keys to success in the flexible packaging market.

Verso Corporation (OTCQB: VRSZ), a leading supplier of printing papers, specialty papers and pulp, today released Flexible Packaging: Anatomy of a Special(ty) Relationship, the fifth installment in its popular PAPER@WORK™ series. This brief explores Verso's 40-year-plus relationship with American Packaging Corporation (APC) and examines keys to success in the flexible packaging market.

In consumer packaging, brand is everything and paper is a brand builder. Companies in this highly competitive realm know print consistency is critical to building and maintaining their brands. That signature red -- or blue or yellow or metallic gold -- has to be the same each and every time, across each and every product and package. This is why printing surface is so important and why a strong, collaborative supplier relationship is crucial to success.

"This new brief delves into the successful Verso-APC relationship," says Jason Handel, Verso Group Vice President of Specialty, Pulp and Product Development, "but also touches on what makes any customer-supplier relationship work, that is, a mutual understanding of goals and what it takes to achieve them together as a team."

"APC is a trusted provider in the packaging industry and it is very important for us to have a collaborative relationship with all of our suppliers," says Jeff Huber, APC Director of Corporate Purchasing. "Working with Verso on this PAPER@WORK™ brief highlights our shared values of quality, innovation and commitment."

PAPER@WORK™ is an ongoing series of briefings from Verso Corporation which details a spectrum of important topics impacting the world of specialty papers.

Please visit www.versoco.com/specialtypapers or email This email address is being protected from spambots. You need JavaScript enabled to view it. to request a copy of this free PAPER@WORK™ brief.

About Verso

Verso Corporation is the turn-to company for those looking to successfully navigate the complexities of paper sourcing and performance. The leading North American producer of printing and specialty papers and pulp, Verso provides insightful solutions that help drive improved customer efficiency, productivity, brand awareness and business results. Verso's long-standing reputation for quality and reliability is directly tied to our vision to be a company with passion that is respected and trusted by all. Verso's passion is rooted in ethical business practices that demand safe workplaces for our employees and sustainable wood sourcing for our products. This passion, combined with our flexible manufacturing capabilities and an unmatched commitment to product performance, delivery and service, make Verso a preferred choice among commercial printers, paper merchants and brokers, converters, publishers and other end users. For more information, visit us online at versoco.com.

About American Packaging Corporation

American Packaging Corporation is an ISO 9001:2008 certified company specializing in the manufacture of flexible packaging laminations for a variety of specialty markets. The company has three process focused facilities: Rotogravure Printing and Laminating, Flexographic Printing and Laminating, and Engineered Laminations and Coatings. The company is privately-held and has been serving the packaging industry for over 100 years. ampkcorp.com.

Verso Announces Plans for Major Reductions in Coated Paper and Pulp Production Capacity

Actions at Androscoggin and Wickliffe Mills Will Reduce Production Capacity by 430,000 Tons of Coated Paper and 130,000 Tons of Dried Market Pulp

Verso Corporation has announced that it plans to make major reductions in its coated paper and pulp production capacity by shutting down the No. 1 pulp dryer and No. 2 paper machine at its Androscoggin Mill in Jay, Maine, and indefinitely idling its mill in Wickliffe, Kentucky. Together, these actions will reduce Verso's production capacity by 430,000 tons of coated paper and 130,000 tons of dried market pulp. Verso intends to implement these capacity reductions beginning in the fourth quarter of 2015.

Verso Corporation has announced that it plans to make major reductions in its coated paper and pulp production capacity by shutting down the No. 1 pulp dryer and No. 2 paper machine at its Androscoggin Mill in Jay, Maine, and indefinitely idling its mill in Wickliffe, Kentucky. Together, these actions will reduce Verso's production capacity by 430,000 tons of coated paper and 130,000 tons of dried market pulp. Verso intends to implement these capacity reductions beginning in the fourth quarter of 2015.

Verso's decision to reduce its production capacity was driven by several factors. North American coated paper demand is in secular decline, down 4.7% in the first half of 2015, following declines of 3.4% and 4.3% in 2014 and 2013, respectively, according to the Pulp and Paper Products Council. The effects on U.S. producers have been made significantly worse by a change in the net trade balance due to the strengthening of the U.S. dollar relative to foreign currencies, which has resulted in increased foreign imports from Asia, Europe and Canada and decreased U.S. exports. In addition, high operating costs in Maine, especially high energy costs and local property taxes, were contributing factors.

"One of Verso's founding principles is to do what's right for the company as a whole," said Verso President and CEO David J. Paterson. "This includes maintaining a balance between Verso's supply of products and our customers' demand for them. Remaining true to this principle, and after a comprehensive review of our assets, inventory and demand forecasts, Verso has decided to make significant reductions in our coated paper and pulp production capacity at our Androscoggin and Wickliffe mills."

The shutdown of the No. 1 pulp dryer and the No. 2 paper machine at the Androscoggin Mill will reduce Verso's production capacity by 150,000 tons of coated paper and 100,000 tons of dried market pulp. In addition, to help mitigate the high energy and other operating costs in Maine and to make the Androscoggin Mill more competitive in the future, Verso will optimize the mill's pulp, power and recovery assets. The optimization efforts are expected to take place in the fourth quarter of 2015 and the first quarter of 2016.

The Wickliffe Mill has one machine with the capacity to produce 280,000 tons of coated paper and 30,000 tons of dried market pulp.

Verso anticipates that the capacity reductions and optimization of the Androscoggin Mill will result in the permanent elimination of approximately 300 jobs. Verso expects that the indefinite idling of the Wickliffe Mill will result in the layoff of approximately 310 employees.

"Decisions to reduce production capacity are never easy," Paterson stated. "They are especially difficult for the employees and their families who are directly affected by these actions. Verso is committed to treating all of our impacted employees with fairness, dignity and respect and to communicating openly and honestly with each individual about how this decision will affect him or her. Our Human Resources team will begin meeting with our affected employees immediately."

"Our customers are always top-of-mind as we implement these types of strategic decisions, and we want to assure them that Verso remains steadfastly committed to delivering the high-quality products and services they have come to expect from us," said Michael A. Weinhold, Verso Senior Vice President of Sales, Marketing and Product Development. "Verso's manufacturing system is extremely flexible. Most of the affected paper grades are already qualified to be manufactured on other Verso paper machines, and we are working diligently to qualify the remaining paper grades for production on other Verso paper machines. Our Sales leadership will begin contacting all of our affected customers immediately. Our aim is to ensure that all customer needs are seamlessly met."

About Verso

Verso Corporation is the turn-to company for those looking to successfully navigate the complexities of paper sourcing and performance. The leading North American producer of printing and specialty papers and pulp, Verso provides insightful solutions that help drive improved customer efficiency, productivity, brand awareness and business results. Verso's long-standing reputation for quality and reliability is directly tied to our vision to be a company with passion that is respected and trusted by all. Verso's passion is rooted in ethical business practices that demand safe workplaces for our employees and sustainable wood sourcing for our products. This passion, combined with our flexible manufacturing capabilities and an unmatched commitment to product performance, delivery and service, make Verso a preferred choice among commercial printers, paper merchants and brokers, converters, publishers and other end users. For more information, visit us online at versoco.com.

Verso Settles With U.S. Department of Justice Regarding Pending Acquisition of NewPage

Settlement Enables Completion of Acquisition in Early January 2015

Verso Paper Corp. (NYSE: VRS), a leading North American producer of printing and specialty papers and pulp, has announced that it has reached a settlement with the United States Department of Justice that will permit Verso to proceed with its acquisition of NewPage Holdings Inc. The transaction, valued at approximately $1.4 billion, originally was announced on January 6, 2014. Upon the completion of the NewPage acquisition, Verso will have approximately $3.5 billion in annual sales and approximately 5,800 employees in eight mills across six states.

As part of the settlement process, the United States today filed a civil antitrust lawsuit in the U.S. District Court for the District of Columbia alleging that Verso's proposed acquisition of NewPage would violate the antitrust laws. At the same time, the United States filed a proposed settlement that, if approved by the court, will resolve the lawsuit and enable the transaction to proceed. The transaction remains subject to customary closing conditions.

The proposed settlement requires the divestiture of NewPage's paper mills in Biron, Wisconsin, and Rumford, Maine, as previously announced on October 30, 2014. The proposed settlement will be published in the Federal Register and will be subject to public comment, as required by the Antitrust Procedures and Penalties Act (known as the Tunney Act).

Verso expects to complete the NewPage acquisition in early January 2015. NewPage is expected to complete the divestiture of the Biron and Rumford mills to a subsidiary of Catalyst Paper Corporation in connection with Verso's acquisition of NewPage.

"The combination of Verso and NewPage will create a stronger, more stable company that will be better positioned to serve our customers and compete in a competitive global marketplace," said David J. Paterson, Verso's president and chief executive officer. "We are pleased that we were able to address the concerns of the Justice Department while preserving the benefits of the transaction for our stockholders and customers."

"Although this transaction has been among the most challenging and complex, the resulting combination will create value for all of our constituents, particularly our shareholders," said Mark Angelson, the chairman of NewPage. "We would not have come this far without critical input from the Justice Department and the advisors, key shareholders and directors of both companies."

Following the completion of the NewPage acquisition, Verso's existing senior leadership team will continue to lead the combined company.

About Verso

Verso Paper Corp. is a leading North American producer of coated papers, including coated groundwood and coated freesheet, and specialty products. Verso is headquartered in Memphis, Tennessee, and owns and operates two paper mills located in Maine and Michigan. Verso's paper products are used primarily in media and marketing applications, including magazines, catalogs and commercial printing applications such as high-end advertising brochures, annual reports and direct-mail advertising. Additional information about Verso is available on its website at www.versopaper.com .

Forward-Looking Statements

In this press release, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "project," "plan," "estimate," "intend" and other similar expressions. Forward-looking statements are based on currently available business, economic, financial and other information and reflect management's current beliefs, expectations and views with respect to future developments and their potential effects on Verso. Actual results could vary materially depending on risks and uncertainties that may affect Verso and its business. For a discussion of such risks and uncertainties, please refer to Verso's filings with the Securities and Exchange Commission. Verso assumes no obligation to update any forward-looking statement made in this press release to reflect subsequent events or circumstances or actual outcomes.

Contact

Verso Paper Corp.

Robert P. Mundy

Senior Vice President and Chief Financial Officer

001-901-369-4128

Email Contact

www.versopaper.com

Source: Verso Paper Corp.

Verso Announces Closure of Bucksport, Maine Paper Mill

Verso Paper Corp. (NYSE: VRS) has announced plans to close its paper mill in Bucksport, Maine. The closure of the mill is expected to occur in the fourth quarter of 2014. The mill closure will reduce Verso's coated groundwood paper production capacity by approximately 350,000 tons and its specialty paper production capacity by approximately 55,000 tons.

Verso Paper Corp. (NYSE: VRS) has announced plans to close its paper mill in Bucksport, Maine. The closure of the mill is expected to occur in the fourth quarter of 2014. The mill closure will reduce Verso's coated groundwood paper production capacity by approximately 350,000 tons and its specialty paper production capacity by approximately 55,000 tons.

"The Bucksport mill unfortunately has not been profitable for a number of years, in spite of our employees' dedicated efforts to make it so. Our assessment indicates that it is impossible for the mill to achieve profitability in today's marketplace," said Verso President and Chief Executive Officer, Dave Paterson.

"This decision is especially difficult because of the significant impact that the closure of the Bucksport mill will have on many people across the region, especially our long-serving and hard-working employees and their families," said Verso Senior Vice President of Manufacturing and Energy, Lyle Fellows.

Verso is committed to helping the Bucksport mill employees who will be affected by the closure. Verso will work closely with union officials and salaried employees concerning severance benefits and other assistance. Verso also will work with local and state officials to help the affected employees access resources to identify alternative employment opportunities.

Verso will work with its customers to find the best long-term solutions for their product needs after the closure of the Bucksport mill. "Our desire in this process is to minimize disruption to our customers' businesses to the extent possible. Even in the face of reduced production capacity, our customers know that they can depend on Verso to deliver high-quality paper products and exceptional customer service," said Verso Senior Vice President of Sales, Marketing and Product Development, Mike Weinhold.

Verso estimates that the closure of the Bucksport mill will result in pre-tax cash severance and other shutdown charges of approximately $35-45 million to be recorded in 2014 and 2015. The estimated cash charges consist of approximately $30-35 million in severance costs and approximately $5-10 million in other shutdown costs. Verso currently is analyzing options for the disposition of mill assets and thus does not have sufficient information to estimate the pre-tax noncash asset impairment and accelerated depreciation charges at this time. Verso expects that the noncash charges will be recognized in 2014.

"The Bucksport mill has a long and proud history. We thank all of our employees, the surrounding communities, and the many local and state officials who have partnered with us over the years," said Bucksport Mill Manager, Dennis Castonguay. "It's difficult to put into words how much your support has meant to us."

About Verso Paper Corp.

Verso Paper Corp. is a leading North American producer of coated papers, including coated groundwood and coated freesheet, and specialty products. Verso is headquartered in Memphis, Tennessee, and owns three paper mills located in Maine and Michigan. Verso's paper products are used primarily in media and marketing applications, including magazines, catalogs and commercial printing applications such as high-end advertising brochures, annual reports and direct-mail advertising. Additional information about Verso is available on its website at www.versopaper.com.

Forward-Looking Statements

In this press release, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "project," "plan," "estimate," "intend" and other similar expressions. Forward-looking statements are based on currently available business, economic, financial and other information and reflect management's current beliefs, expectations and views with respect to future developments and their potential effects on Verso. Actual results could vary materially depending on risks and uncertainties that may affect Verso and its business. For a discussion of such risks and uncertainties, please refer to Verso's filings with the Securities and Exchange Commission. Verso assumes no obligation to update any forward-looking statement made in this press release to reflect subsequent events or circumstances or actual outcomes.

Contact

Verso Paper Corp.

Robert P. Mundy

Senior Vice President and Chief Financial Officer

901-369-4128

Email Contact

www.versopaper.com

Source: Verso Paper Corp.

Verso Paper Corp. Awards Verso Forest Certification Grant to PalletOne of Maine

Verso Paper C orp. (NYSE:VRS) has announced that PalletOne of Maine has been selected to receive a Verso Forest Certification Grant. The grant will enable PalletOne to seek independent Forest Stewardship Council™ (FSC®) Chain of Custody (COC) certification for its pallet mill operation in Livermore Falls, Maine.

PalletOne already purchases a portion of its wood supply from FSC-certified forests in New England and sells residual wood chips to Verso's paper mill in nearby Jay, Maine. Achieving COC certification will allow PalletOne to increase the amount of FSC-certified material available to Verso and ultimately to Verso's paper customers who prefer FSC-certified products. In addition to the grant, Verso will provide technical expertise to assist in the certification process.

"Verso has a long history of promoting sustainability by supporting a variety of certification initiatives within our wood supply chain," said Verso Fiber Supply Manager Jim Contino. "We launched the Verso Forest Certification Grant program last year to increase certified fiber available to our mills, and the PalletOne project is well suited to our criteria. PalletOne is a trusted and long-term chip supplier to Verso's Androscoggin Mill and we are pleased to award this grant as part of our ongoing effort to increase the availability of certified fiber in the marketplace."

"We could not complete this certification without Verso's funding and technical expertise," said PalletOne Vice President Donnie Isaacson. "We are pleased to preserve FSC credits through our sawmill that create value for Verso's paper customers while developing COC certification within our organization."

Source:

Verso Paper Corp. Reports Third Quarter 2012 Results

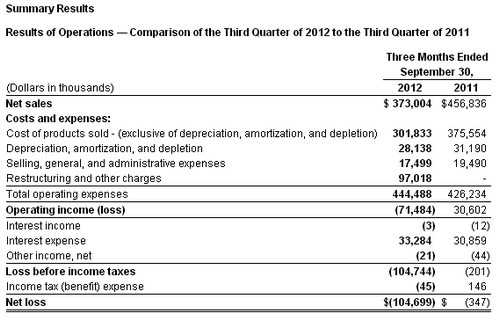

Verso's net sales for the third quarter of 2012 decreased $83.8 million, or 18.4%, compared to the third quarter of 2011, reflecting a 14.9% decline in total sales volume, which was driven by the closure of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year, as well as a 4.0% decrease in the average sales price per ton for all of our products. Verso's gross margin was 19.1% for the third quarter of 2012 compared to 17.8% for the third quarter of 2011.

Verso reported a net loss of $104.7 million in the third quarter of 2012, or $1.98 per diluted share, which included $92.7 million of net charges from special items, or $1.75 per diluted share, primarily due to restructuring charges related to the closure of the Sartell mill in the third quarter of this year. Verso had a net loss of $0.3 million, or $0.01 per diluted share, in the third quarter of 2011, which included $1.1 million of charges from special items, or $0.02 per diluted share.

"We experienced our typical seasonal pick-up in demand during the third quarter in both coated freesheet and coated groundwood shipments. Industry operating rates were strong even though we continue to see a year over year drop-off in advertising spending which is impacted by the sluggish GDP growth. As we anticipated, coated groundwood pricing moved higher during the quarter and coated freesheet pricing was stable. Adjusted EBITDA of $50.2 million was about double what we recorded in the second quarter of this year driven by the stronger volumes, higher prices and improvements in our manufacturing costs resulting from our cost improvement programs and having the second quarter scheduled maintenance outages behind us," said David Paterson, President and Chief Executive Officer of Verso.

"During the quarter, we made the difficult decision not to restart the Sartell Mill and are well into evaluating the options relative to the decommissioning of the site and marketing the properties and assets for eventual sale.

"Looking ahead, we anticipate that coated groundwood prices will continue to move up during the fourth quarter and coated freesheet pricing to remain relatively stable. Coated volumes will move slightly lower than the seasonally stronger third quarter, but we do not anticipate a significant drop-off. We'll finish the year at very good inventory levels with coated groundwood inventory fairly tight. Operating costs and input prices should remain flat to down slightly, although we do have a scheduled maintenance outage at our Quinnesec Mill during the quarter. Finally, we are excited about the start-up of ourBucksport Renewable Energy Project during the quarter which will complete the last of the initiatives included in the first phase of our energy strategy that you've heard us talk a lot about."

Net Sales. Net sales for the third quarter of 2012 decreased 18.4%, to $373.0 million from $456.8 million in the third quarter of 2011, led by a quarter-over-quarter decline in the price of pulp. Additionally, total sales volume was down 14.9% compared to the third quarter of 2011, which was driven by the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year, as well as a 4.0% decrease in the average sales price per ton for all of our products.

Net sales for our coated papers segment decreased 19.7% in the third quarter of 2012 to $300.9 million from $374.5 million for the same period in 2011, due to a 17.4% decrease in paper sales volume, which was driven by the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. The average sales price per ton of coated paper decreased 2.8% compared to the same period last year.

Net sales for our market pulp segment decreased 13.1% in the third quarter of 2012 to $35.1 million from $40.4 million for the same period in 2011. The average sales price per ton decreased 11.0% while sales volume decreased 2.3% compared to the third quarter of 2011.

Net sales for our other segment decreased 11.7% to $37.0 million in the third quarter of 2012 from $41.9 million in the third quarter of 2011. This decrease was due to an 11.5% decrease in sales volume, while the sales price per ton remained flat.

Cost of sales. Cost of sales, including depreciation, amortization, and depletion, was $329.9 million in the third quarter of 2012 compared to $406.7 million in 2011, reflecting realized cost reduction from the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. Our gross margin, excluding depreciation, amortization, and depletion, was 19.1% for the third quarter of 2012 compared to 17.8% for the third quarter of 2011. Depreciation, amortization, and depletion expenses were $28.1 million for the third quarter of 2012 compared to $31.2 million for the third quarter of 2011.

Selling, general, and administrative. Selling, general, and administrative expenses were $17.6 million in the third quarter of 2012 compared to $19.5 million for the same period in 2011, primarily driven by a decrease in personnel costs.

Restructuring and other charges. Restructuring and other charges for the third quarter of 2012 was $97.0 million, and consisted primarily of fixed asset and other impairment charges of $75.8 million and severance and benefit costs of $16.3 million related to the closure of the Sartell mill.

Interest expense. Interest expense for the third quarter of 2012 was $33.2 million compared to $30.8 million for the same period in 2011.

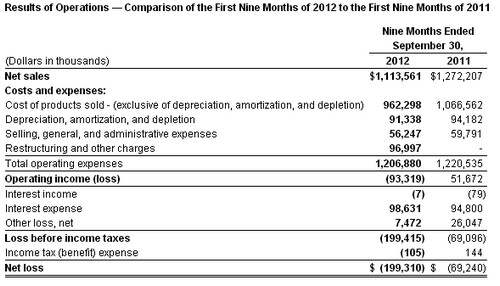

Net Sales. Net sales for the nine months ended September 30, 2012, decreased 12.5% to $1,113.6 million from $1,272.2 million for the nine months ended September 30, 2011, reflecting an 8.9% decrease in total sales volume, which was driven by the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. Additionally, the average sales price for all of our products decreased 3.8%, led by a decline in the price of pulp.

Net sales for our coated papers segment decreased 15.1% to $889.1 million for the nine months ended September 30, 2012, from $1,046.9 million for the nine months ended September 30, 2011. This change reflects a 13.2% decrease in paper sales volume, which was driven by the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. The average sales price per ton of coated paper decreased 2.1% compared to the same period last year.

Net sales for our market pulp segment decreased 7.2% to $104.2 million for the nine months ended September 30, 2012, from $112.3 million for the same period in 2011. This decrease was due to a 12.5% decline in the average sales price per ton while sales volume increased 6.0% compared to the nine months ended September 30, 2011.

Net sales for our other segment increased 6.4% to $120.3 million for the nine months ended September 30, 2012, from $113.0 million for the nine months ended September 30, 2011. The improvement in 2012 is due to a 9.2% increase in sales volume, reflecting the continued development of new paper product offerings for our customers. The average sales price per ton decreased 2.5% compared to the nine months ended September 30, 2011.

Cost of sales. Cost of sales, including depreciation, amortization, and depletion, were $1,053.6 million for the nine months ended September 30, 2012, compared to $1,160.7 million for the same period last year, reflecting realized cost reduction from the shutdown of three paper machines late last year and the closure of the Sartell mill in the third quarter of this year. Our gross margin, excluding depreciation, amortization, and depletion, was 13.6% for the nine months ended September 30, 2012, compared to 16.2% for the nine months ended September 30, 2011, reflecting higher average sales prices during 2011. Depreciation, amortization, and depletion expenses were $91.3 million for the nine months ended September 30, 2012, compared to $94.2 million for the nine months ended September 30, 2011.

Selling, general, and administrative. Selling, general, and administrative expenses were $56.3 million for the nine months ended September 30, 2012, compared to $59.8 million for the same period in 2011, primarily driven by a decrease in personnel costs and other fees.

Restructuring and other charges. Restructuring and other charges for the nine months ended September 30, 2012 was $97.0 million, and consisted primarily of fixed asset and other impairment charges of $75.8 million and severance and benefit costs of $16.3 million related to the closure of the Sartell mill.

Interest expense. Interest expense for the nine months ended September 30, 2012, was $98.6 million compared to $94.8 million for the same period in 2011.

Other loss, net. Other loss, net for the nine months ended September 30, 2012, was a net loss of $7.5 million compared to a net loss of $26.1 million for the nine months ended September 30, 2011. Included in the results for 2012 and 2011 were losses of $8.2 million and $26.1 million, respectively, related to the early retirement of debt in connection with debt refinancing.

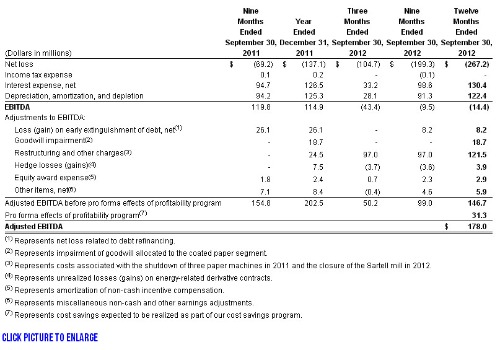

Reconciliation of Net Income to Adjusted EBITDA

The agreements governing our debt contain financial and other restrictive covenants that limit our ability to take certain actions, such as incurring additional debt or making acquisitions. Although we do not expect to violate any of the provisions in the agreements governing our outstanding indebtedness, these covenants can result in limiting our long-term growth prospects by hindering our ability to incur future indebtedness or grow through acquisitions.

EBITDA consists of earnings before interest, taxes, depreciation, and amortization. EBITDA is a measure commonly used in our industry, and we present EBITDA to enhance your understanding of our operating performance. We use EBITDA as a way of evaluating our performance relative to that of our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets among otherwise comparable companies. Adjusted EBITDA is EBITDA further adjusted to eliminate the impact of certain items that we do not consider to be indicative of the performance of our ongoing operations and other pro forma adjustments permitted in calculating covenant compliance in the indentures governing our debt securities to test the permissibility of certain types of transactions. Adjusted EBITDA is modified to align the mark-to-market impact of derivative contracts used to economically hedge a portion of future natural gas purchases with the period in which the contracts settle and is modified to reflect the amount of net cost savings projected to be realized as a result of specified activities taken during the preceding 12-month period. You are encouraged to evaluate each adjustment and to consider whether the adjustment is appropriate. In addition, in evaluating adjusted EBITDA, you should be aware that in the future, we may incur expenses similar to the adjustments included in the presentation of adjusted EBITDA. We believe that the supplemental adjustments applied in calculating Adjusted EBITDA are reasonable and appropriate to provide additional information to investors. We also believe that Adjusted EBITDA is a useful liquidity measurement tool for assessing our ability to meet our future debt service, capital expenditures, and working capital requirements.

However, EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDA or Adjusted EBITDA as an alternative to operating or net income, determined in accordance with U.S. GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as an indicator of our cash flows or as a measure of liquidity. The following table reconciles net loss to EBITDA and Adjusted EBITDA for the periods presented.

Forward-Looking Statements

In this press release, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "project," "plan," "estimate," "intend," and similar expressions. Forward-looking statements are based on currently available business, economic, financial, and other information and reflect management's current beliefs, expectations, and views with respect to future developments and their potential effects on Verso. Actual results could vary materially depending on risks and uncertainties that may affect Verso and its business. For a discussion of such risks and uncertainties, please refer to Verso's filings with the Securities and Exchange Commission. Verso assumes no obligation to update any forward-looking statement made in this press release to reflect subsequent events or circumstances or actual outcomes.

Source: Verso Paper Corp.

Verso Paper Corp. Awards First Verso Forest Certification Grant

Verso Paper Corp. (NYSE:VRS) has announced that Sustainable Resources Institute (SRI) Inc. will be the first recipient of a Verso Forest Certification Grant. The two-year grant will enable SRI to target the owners of small, private non-industrial properties (2,400 acres or less) in Michigan and help them achieve certification at an affordable cost. Third-party certification to credible forest management standards advances responsible management practices that keep U.S. forests vibrant and healthy. SRI's first-year goal to certify an additional 15,000 acres has the potential to add up to 35,000 tons of certified fiber in the marketplace. "We launched the Verso Forest Certification Grant program to increase certified fiber and certified acreage on lands near Verso's three paper mills," said Verso Senior Vice President of Manufacturing and Energy Lyle Fellows. "SRI's grant proposal demonstrated not only a solid plan to help us advance this goal, but also strong partnerships with the Michigan Master Logger Certification program, the Michigan Association of Timbermen and others that provide a strong foundation for success." "The start-up funds provided by the Verso Forest Certification Grant will help us reach out to landowners who already have responsible forest management plans and offer them a more accessible path to affordable certification," said SRI Executive Director Don Peterson. "We're anxious to get underway and are committed to seeking additional funding from other sources to make sure we're able to continue the terrific certification opportunities that Verso's initial two-year funding provides." Anyone interested in learning more about the Verso Forest Certification Grant Program or in obtaining a grant application may contact:

Greg Barrows (This email address is being protected from spambots. You need JavaScript enabled to view it.)

Verso Paper Corp. Bucksport Mill

P.O. Box 1200

2 River Road

Bucksport, ME 04417

Source:

Verso Introduces Aspect™ SCK Release Papers

Verso Paper Corp. introduces Aspect™ SCK Release Papers, an exciting addition to its Aspect™ line of label and release papers. Now comprised of cut and stack labels, pressure sensitive face sheets and SCK release liners, Verso's Aspect™ Label and Release Papers deliver the aesthetics, strength and performance required for quality and efficient label production.

"Our premium SCK Release Liner is a high performing, extremely efficient and cost effective liner, allowing lower silicone coat weight and reduced adhesive usage due to better, more consistent profiles," says Mike Weinhold, Verso's Senior Vice President of Sales, Marketing and Product Development. "With a perfect balance between desired optical properties, performance requirements and cost effectiveness, our Aspect™ SCK Release Liner is sure to become the industry standard."

Aspect™ SCK Release Liner has high strength, superb apparent density, low dirt count and opacity, exceptional die-cutting performance, excellent cure and holdout and smooth surface characteristics.

Verso's Aspect™ Label and Release Papers product line will be produced on the No. 4 paper machine at Verso's mill in Androscoggin, Maine. "Androscoggin's No. 4 paper machine is a well-positioned asset, with relative machine scale and an integrated pulp supply," Weinhold explains. "Androscoggin, like all of our mills, has a strong manufacturing focus on producing consistent, quality products, and our Aspect™ line of label and release papers is no exception. We understand our customers want a product and a supplier they can rely on, and Verso delivers on both of those needs," he says.

Source: Verso Paper Corp.

Verso Paper Corp. Announces That It Has Ended Discussions With NewPage Corporation

In this press release, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "project," "plan," "estimate," "intend" and similar expressions. Forward-looking statements are based on currently available business, economic, financial and other information and reflect management's current beliefs, expectations and views with respect to future developments and their potential effects on Verso. Actual results could vary materially depending on risks and uncertainties that may affect Verso and its business. For a discussion of such risks and uncertainties, please refer to Verso's filings with the Securities and Exchange Commission. Verso assumes no obligation to update any forward-looking statement made in this press release to reflect subsequent events or circumstances or actual outcomes.

Source: Verso Paper Corp.