Displaying items by tag: Verso Paper Corp

Verso Paper Corp. Announces Completion of Tender Offer

Verso Paper Corp. (NYSE: VRS) has announced the completion of the tender offer (the "Tender Offer") of two of its subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (together, the "Issuers") to purchase any and all of the Issuers' outstanding 11.5% senior secured notes due 2014 (the "Notes").

The Tender Offer expired at 11:59 p.m., New York City time, on April 3, 2012 (the "Expiration Date"). As previously announced, the Issuers received tenders from the holders of $270,573,000 aggregate principal amount of the Notes prior to the early tender payment deadline of March 20, 2012, at 5:00 p.m.,New York City time (the "Early Tender Date"), which represented approximately 85.9% of the outstanding Notes. On March 21, 2012, the Issuers accepted for early payment, and paid for, the Notes tendered prior to the Early Tender Date. After the Early Tender Date and prior to the Expiration Date, the Issuers received no additional tenders. The tenders for all Notes received by the Issuers prior to the Expiration Date represented approximately 85.9% of the outstanding Notes. The Issuers intend to redeem the Notes that remain outstanding after completion of the Tender Offer at the applicable redemption price, plus accrued and unpaid interest, on April 30, 2012.

Citigroup Global Markets Inc., Barclays Capital Inc., Credit Suisse Securities (USA) LLC and Goldman, Sachs & Co. acted as the Dealer Managers for the Tender Offer.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Exchange Offer for Outstanding Debt and Related Consent Solicitation

Verso Paper Corp. have announced that two of its wholly owned subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (collectively, the "Issuers"), have launched an offer to issue up to $180.2 million aggregate principal amount of a new series of 9.75% secured notes due 2019 (the "New Notes") in exchange for any and all of the Issuers' outstanding $180.2 million aggregate principal amount of senior secured floating-rate notes due 2014 (the "Old Notes").

Simultaneously, the Issuers commenced a solicitation of consents from the holders of the Old Notes to waivers of, and proposed amendments to, certain covenants in the indenture pursuant to which the Old Notes were issued (the "Proposed Amendments"), and, separately, to authorize release from the liens and security interests in the collateral securing the Old Notes (the "Collateral Release"). Holders who tender their Old Notes into the exchange offer will be deemed to have given their consents to both the Proposed Amendments and the Collateral Release with respect to those tendered Old Notes.

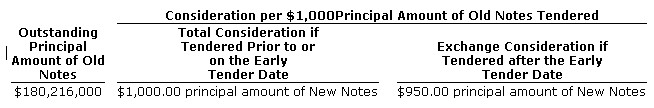

The Old Notes and other information relating to the exchange offer and consent solicitation are set forth in the table below.

The exchange offer and consent solicitation and the effectiveness of any supplemental indenture entered into pursuant to the exchange offer and consent solicitation are conditioned on the tenders and associated consents by holders of more than 50% of the Old Notes.Each holder who validly tenders its Old Notes prior to 5:00 p.m., New York City time, on April 10, 2012 (as may be extended, the "Early Tender Date") will receive, if such Old Notes are accepted for purchase pursuant to the exchange offer, the total consideration of $1,000.00 principal amount of New Notes per $1,000.00 principal amount of Old Notes tendered, which includes an early tender payment of $50.00 per $1,000.00 principal amount of Old Notes tendered. Each Holder who does not validly tender its Old Notes prior to the Early Tender Date will only receive $950.00 principal amount of New Notes for each $1,000.00 of Old Notes tendered and accepted and will not be entitled to receive the $50.00 early tender payment.

The Issuers intend to enter into a supplemental indenture to effectuate the Proposed Amendments promptly after the receipt of the requisite consents for the Proposed Amendments. To the extent requisite consents for the Collateral Release have also been received, such supplemental indenture will also include the Collateral Release. To the extent that the requisite consents for the Collateral Release have not been obtained at the time such supplemental indenture is executed, such supplemental indenture will not include provisions effecting the Collateral Release, but if such requisite consents for the Collateral Release are later obtained, the Issuers will execute another supplemental indenture providing for the Collateral Release promptly after receipt of the requisite consents for the Collateral Release. Each of the foregoing supplemental indentures will be effective immediately upon execution thereof, but the provisions thereof will not be operative until all of the Old Notes that have been tendered prior to the date of such supplemental indenture have been accepted for payment and paid for in accordance with the terms of the exchange offer and consent solicitation.

The exchange offer and consent solicitation will expire at 11:59 p.m., New York City time, on April 24, 2012, unless extended or earlier terminated (the "Expiration Date"). Tendered Old Notes may be validly withdrawn prior to the earlier of (a) the date the Issuers receive the requisite consents and execute the supplemental indenture providing for the Proposed Amendments and (b) 5:00 p.m., New York City time, on April 10, 2012, unless extended (such time and date described in (a) or (b), as the same may be extended, the "Withdrawal Deadline"). Tendered Old Notes may not be validly withdrawn subsequent to the Withdrawal Deadline. Prior to the Withdrawal Deadline, if a holder withdraws its tendered Old Notes, such holder will be deemed to have revoked its consents to both the Proposed Amendments and the Collateral Release and may not deliver consents without re-tendering its Old Notes. After the Withdrawal Deadline, consents to the Proposed Amendments may be validly revoked prior to the execution of the supplemental indenture giving effect to the Proposed Amendments. While tendered Old Notes may not be withdrawn subsequent to the Withdrawal Deadline, if the supplemental indenture giving effect to the Proposed Amendments (but not the Collateral Release) has been executed, consents to the Collateral Release may be validly revoked (but neither the relevant Old Notes may be withdrawn nor the consents to the Proposed Amendments may be revoked) until the execution of the supplemental indenture giving effect to the Collateral Release.

Subject to the terms and conditions described below, payment of the exchange offer consideration will occur promptly after the Expiration Date. Such payment is currently expected to occur on or about April 25, 2012, unless the Expiration Date is extended or the exchange offer is earlier terminated. In addition, at any time after the Early Tender Date but prior to the Expiration Date, and subject to the terms and conditions described below, the Issuers may accept for exchange Old Notes validly tendered on or prior to such time and exchange such notes for the exchange consideration promptly thereafter.

The Issuers may terminate or withdraw the exchange offer and consent solicitation at any time and for any reason, including if certain conditions described in the Exchange Offer Documents (defined below) are not satisfied, subject to applicable law.

This announcement shall not constitute an offer to purchase or a solicitation of an offer to sell any securities. The complete terms and conditions of the exchange offer are set forth in a confidential offering memorandum and consent solicitation statement, dated March 28, 2012 and the related consent and letter of transmittal (the "Exchange Offer Documents") that are being sent to eligible holders of the Old Notes. The exchange offer and consent solicitation are being made only through, and subject to the terms and conditions set forth in, the Exchange Offer Documents and related materials.

The New Notes are being offered in the U.S. only to (1) qualified institutional buyers in reliance on Rule 144A under the Securities Act and (2) "accredited investors" as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act, and outside the United States only to non-U.S. investors pursuant to Regulation S. The New Notes will not initially be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from registration requirements or in a transaction that is not subject to the registration requirements of the Securities Act or any state securities laws.

Global Bondholder Services Corporation will act as the Information Agent for the exchange offer. Requests for the Exchange Offer Documents from eligible holders may be directed to Global Bondholder Services Corporation at (212) 430-3774 (for brokers and banks) or (866) 470-3700 (for all others).

Neither the Issuers' boards of directors nor any other person makes any recommendation as to whether holders of Old Notes should exchange their Old Notes, and no one has been authorized to make such a recommendation. Eligible holders of Old Notes must make their own decisions as to whether to exchange their Old Notes, and if they decide to do so, the principal amount of the Old Notes to exchange. Eligible holders of Old Notes should read carefully the Exchange Offer Documents and related materials before any decision is made with respect to the exchange offer and consent solicitation.

Source: Verso Paper Corp.

Verso's Continued Listing Plan Accepted by NYSE

Verso Paper Corp. has announced that the New York Stock Exchange has accepted the company's plan for continued listing on the NYSE. As a result, Verso's common stock will continue to be listed on the NYSE, subject to quarterly reviews by the NYSE to monitor the company's progress against the plan.

The NYSE earlier notified Verso on December 21, 2011, that the company had fallen below the NYSE's continued listing standard requiring that it maintain an average market capitalization of at least $75 million over a consecutive 30 trading-day period. With the NYSE's acceptance of the plan, Verso has 18 months from the original notification date in which to comply with the average market capitalization standard, subject to its compliance with the NYSE's other continued listing requirements.

Verso will continue to work proactively with the NYSE to maintain the listing of its common stock during the compliance period. "The NYSE's acceptance of our plan reaffirms our belief that Verso's strategic direction and fundamental operating principles are sound. We look forward to executing our business plan and increasing our share price and market capitalization," commented Mike Jackson, Verso's President and Chief Executive Officer.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Preliminary Results of Tender Offer for Certain Outstanding Debt

Verso Paper Corp. has announced that, pursuant to the previously announced tender offer of its subsidiary, Verso Paper Holdings LLC ("Verso Holdings"), Verso Holdingsreceived tenders from the holders of $270,573,000 aggregate principal amount of the 11½% senior secured notes due 2014 issued by it and Verso Paper Inc. (the "Notes") prior to the early tender payment deadline on March 20, 2012, at 5:00 p.m., New York City time (the "Early Tender Date"). The tenders for the Notes received by Verso Holdings prior to the Early Tender Date represent approximately 85.9% of the outstanding Notes.

The complete terms and conditions of the tender offer for the Notes are detailed in Verso Holdings' Offer to Purchase dated March 7, 2012, and the related Letter of Transmittal (the "Tender Offer Documents"). Verso Holdingscurrently expects to accept for payment, subject to conditions set forth in the Tender Offer Documents, all of the Notes validly tendered prior to the Early Tender Date on Wednesday, March 21, 2012.

Each holder who validly tendered its Notes prior to the Early Tender Date will receive, if such Notes are accepted for purchase pursuant to the tender offer, the total consideration of $1,055.00 per $1,000 principal amount of Notes tendered, which consists of $1,025.00 as the tender offer consideration and $30.00 as an early tender payment. In addition, accrued interest up to, but not including, the applicable payment date of the Notes will be paid in cash on all validly tendered and accepted Notes.

The tender offer is scheduled to expire at 11:59 p.m., New York City time, on April 3, 2012, unless extended or earlier terminated (the "Expiration Date"). Because the Early Tender Date has passed, tendered Notes may no longer be withdrawn at any time, except to the extent that Verso Holdings is required by law to provide additional withdrawal rights. Holders who validly tender their Notes after the Early Tender Date will receive only the tender offer consideration and will not be entitled to receive an early tender payment if such Notes are accepted for purchase pursuant to the tender offer.

All the conditions set forth in the Tender Offer Documents remain unchanged. If any of the conditions is not satisfied, Verso Holdings may terminate the tender offer and return tendered Notes not previously accepted. Verso Holdings has the right to waive any of the foregoing conditions with respect to the Notes. In addition, Verso Holdings has the right, in its sole discretion, to terminate the tender offer at any time, subject to applicable law.

This announcement shall not constitute an offer to purchase or a solicitation of an offer to sell any securities. The tender offer is being made only through, and subject to the terms and conditions set forth in, the Tender Offer Documents and related materials.

Credit Suisse Securities (USA) LLC, Citigroup Global Markets Inc., Barclays Capital Inc. and Goldman, Sachs & Co. are acting as the Dealer Managers for the tender offer. Questions regarding the tender offer may be directed to Credit Suisse Securities (USA) LLC, Attn: Liability Management Group at (800) 820-1653 (toll-free) or at (212) 325-5912 (collect); to Citigroup Global Markets Inc., Attn: Liability Management Group at (800) 558-3745 (toll-free) or at (212) 723-6106 (collect); to Barclays Capital Inc., Attn: Liability Management Group at (800) 438-3242 (toll-free) or at (212) 528-7581 (collect); or to Goldman, Sachs & Co., Attn: Liability Management Group at (800) 828-3182 (toll-free) or at (212) 902-5183 (collect).

Global Bondholder Services Corporation is acting as the Information Agent for the tender offer. Requests for the Tender Offer Documents may be directed to Global Bondholder Services Corporation at (212) 430-3774 (for brokers and banks) or (866) 807-2200 (for all others).

Neither Verso Holdings' board of directors nor any other person makes any recommendation as to whether holders of Notes should tender their Notes, and no one has been authorized to make such a recommendation. Holders of Notes must make their own decisions as to whether to tender their Notes, and if they decide to do so, the principal amount of the Notes to tender. Holders of the Notes should read carefully the Tender Offer Documents and related materials before any decision is made with respect to the tender offer.

Verso Paper Corp. Announces Proposed $345 Million Debt Offering

Verso Paper Corp. has announced that its subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (the "Issuers"), propose to issue $345 million aggregate principal amount of senior secured notes due 2019 (the "Notes") in a private offering that is exempt from the registration requirements of the Securities Act of 1933, as amended (the "Securities Act"). The Notes will be guaranteed by certain domestic subsidiaries of Verso.

Verso also announced today that it has received commitments from lenders for a new $150 million asset-based revolving loan facility and a new $50 million first-priority revolving facility. These commitments would be utilized in lieu of Verso's previously announced $100.0 million of commitments for an accounts receivable securitization facility and approximately $55.0 million of commitments to provide a new and/or extended revolving facility under Verso Holdings' existing senior secured revolving credit facility.

Verso intends to enter into the new credit facilities as soon as practicable following the completion of the Notes offering and upon satisfaction of customary conditions. While Verso has received commitments from lenders for the proposed new credit facilities, there can be no assurance that Verso will enter into such facilities. The new credit facilities will replace Verso's existing $200 million revolving credit facility which matures on August 1, 2012.

Verso's subsidiaries that intend to issue and guarantee the Notes are the same entities that issued and guaranteed Verso's existing senior secured notes. The Notes will be secured by first priority security interests in the "Notes Priority Collateral" (which generally includes most fixed assets of the Issuers and the guarantors) and by second priority security interests in the "ABL Priority Collateral" (which generally includes most inventory and accounts receivable of the Issuers and the guarantors), in each case subject to certain permitted liens and as described in the offering circular relating to the Notes.

Verso intends to use the net proceeds from the offering of Notes to (1) pay the consideration for the cash tender offer for Verso's outstanding 11½% senior secured notes due 2014 (the "Existing Senior Secured Notes"), (2) redeem any remaining Existing Senior Secured Notes, following the expiration of the cash tender offer, at the applicable redemption price plus accrued and unpaid interest, and (3) pay certain related transaction costs and expenses. The proposed offering of the Notes is subject to market and other conditions and may not occur as described or at all.

The Notes are being offered only to qualified institutional buyers in reliance on Rule 144A under the Securities Act, and outside the United States only to non-U.S. investors pursuant to Regulation S. The Notes will not initially be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from registration requirements or in a transaction that is not subject to the registration requirements of the Securities Act or any state securities laws.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any security and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offering, solicitation or sale would be unlawful.

Source: Verso Paper Corp.

Verso Paper Corp. Prelim Results for 4th Quarter and Year End

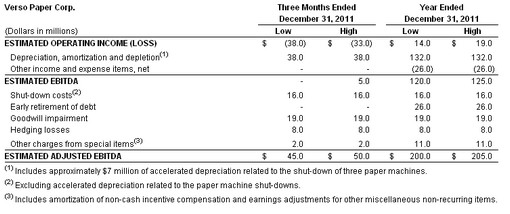

- For the three-month period ended December 31, 2011, we expect Adjusted EBITDA to be within the range of $45 million to $50 million, and for the year ended December 31, 2011, we expect Adjusted EBITDA to be within the range of $200 million to $205 million.

- Adjusted EBITDA for the three-month period ended December 31, 2011, excludes charges from special items of approximately $45 million primarily related to the shut-down of three paper machines, goodwill impairment, and hedging transactions. Adjusted EBITDA for the year ended December 31, 2011, excludes charges from special items of approximately $80 million primarily related to net losses on debt refinancing, the shut-down of three paper machines, goodwill impairment, and hedging transactions.

- For the three-month period ended December 31, 2011, we expect operating income before items to be within the range of $14 million to $19 million. Including approximately $52 million of charges primarily related to the paper machine shut-downs, goodwill impairment and hedging transactions we expect operating losses within the range of $38 million to $33 million for the quarter. For the year ended December 31, 2011, we expect operating income before items to be within the range of $74 million to $79 million. Including approximately $60 million of charges primarily related to the paper machine shut-downs, goodwill impairment and hedging transactions we expect operating income within the range of $14 million to $19 million for 2011.

- Cash and total debt at December 31, 2011 were approximately $95 million and $1.2 billion, respectively. At December 31, 2011, our existing $200 million revolving credit facility had no amounts outstanding, approximately $41 million in letters of credit issued, and approximately $159 million available for future borrowing.

- Capital expenditures for the three-month period ended December 31, 2011, are expected to be approximately $23 million.

Verso intends to release its financial results for the fourth quarter and the year ended December 31, 2011, in a news release to be issued before the market opens on Wednesday, March 7, 2012. Management will host a conference call at 9 a.m. (Eastern Time) on Wednesday, March 7, 2012, to discuss the fourth quarter and year-end results. Analysts and investors may participate in the live conference call by dialing 719-325-4795 or, within the U.S. and Canada only, 877-591-4959, access code 5749765. To register, please dial in 10 minutes before the conference call begins. The conference call and presentation materials will be made available on Verso's website at www.versopaper.com/investorrelations by navigating to the Events page, or at http://investor.versopaper.com/eventdetail.cfm?EventID=108162. The earnings release and Verso's annual report on Form 10-K for the year ended December 31, 2011, will be made available on Verso's website at www.versopaper.com/investorrelations by navigating to the Financial Information page. A telephonic replay of the conference will be accessible at 719-457-0820 or, within the U.S. and Canada only, 888-203-1112, access code 5749765. This replay will be available starting on March 7, 2012, at 12:00 p.m. (Eastern Time) and will remain available for 14 days.

Reconciliation of Estimated Operating Income to Estimated Adjusted EBITDA

The agreements governing our debt contain financial and other restrictive covenants that limit our ability to take certain actions, such as incurring additional debt or making acquisitions. Although we do not expect to violate any of the provisions in the agreements governing our outstanding indebtedness, these covenants can result in limiting our long-term growth prospects by hindering our ability to incur future indebtedness or grow through acquisitions.

EBITDA consists of earnings before interest, taxes, depreciation, and amortization. EBITDA is a measure commonly used in our industry, and we present EBITDA to enhance your understanding of our operating performance. We use EBITDA as one criterion for evaluating our performance relative to that of our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets among otherwise comparable companies. Adjusted EBITDA is EBITDA further adjusted to exclude unusual items and other pro forma adjustments permitted in calculating covenant compliance in the indentures governing our notes to test the permissibility of certain types of transactions. We believe that the inclusion of the supplemental adjustments applied in calculating Adjusted EBITDA are reasonable and appropriate in providing additional information to investors to demonstrate our compliance with our financial covenants. We also believe that Adjusted EBITDA is a useful liquidity measurement tool for assessing our ability to meet our future debt service, capital expenditures, and working capital requirements.

However, EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDA or Adjusted EBITDA as an alternative to operating or net income, determined in accordance with U.S. GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as an indicator of our cash flows or as a measure of liquidity.

The following table reconciles estimated operating income (loss) to estimated EBITDA and estimated Adjusted EBITDA for the periods presented.

Source: Verso Paper Corp.

Verso Paper Completes $45 Mil Renewable Energy Project

Verso Paper Corp. has announced that the company has completed a $45 million renewable energy project at its pulp and paper mill in Quinnesec, Michigan. The project includes design upgrades to the mill's existing combination boiler (which burns biomass from waste wood sources), a new biomass handling system, and a new turbine generator. The project is delivering 28 megawatts of additional green energy for consumption within the mill, which is equivalent to the amount of electricity consumed by 18,000 homes in a year.

"The completion of the Quinnesec renewable energy project is a milestone in the implementation of Verso's long-term energy strategy," said Verso President and CEO Mike Jackson. "Besides delivering annual energy savings, the project helps Verso deliver on our commitment to increase our use of renewable biofuel and thereby reduce our carbon footprint."

The boiler upgrades enable the mill to use renewable, carbon-neutral, wood-based biofuel for more than 95 percent of its on-site electricity generation. The new biomass handling system expands the mill's capabilities for processing residual wood such as tree tops, limbs and bark. Verso ensures that the expanded harvesting of this logging residue meets forest sustainability standards. The mill's boilers also will continue to burn black liquor, a byproduct of the wood pulping process.

"In addition to reducing our carbon footprint, these improvements will improve boiler combustion and efficiency and will markedly reduce the mill's reliance on electricity produced from fossil fuels," said Verso Vice President of Energy and Technology Mark Daniel.

Verso began ordering major components for the project in May 2010, construction was begun in October 2010, and the project was completed with the commissioning of the new turbine earlier this month.

Source: Verso Paper Corp.

Verso Addresses NYSE Listing Standard

Verso Paper Corp. has announced that the New York Stock Exchange has notified the company that it has fallen below the NYSE's continued listing standard relating to market capitalization. The NYSE requires that Verso's average market capitalization over a consecutive 30 trading-day period be at least $75 million. As of December 21, 2011, the date of the NYSE notice, Verso's 30 trading-day average market capitalization was approximately $66.6 million.

Mike Jackson, President and Chief Executive Officer of Verso, commented, "We do not believe that Verso's current stock price is indicative of the strong operating performance of the company. Verso has ample liquidity and is well positioned to fund its operations and anticipated growth."

Under the applicable NYSE rules, Verso has 45 days from receipt of the NYSE notice to submit a plan to demonstrate its ability to achieve compliance with the market capitalization standard within 18 months. Verso intends to respond to the NYSE in a timely manner. In the meantime, Verso's common stock will continue to be traded on the NYSE, subject to the company's compliance with other NYSE continued listing requirements.

Verso Paper Corp. Partnership for More Certified Acres in Maine - an Impressive Success

Verso Paper Corp. has announced that their participation in a groundbreaking partnership involving Time Inc., Hearst Enterprises, National Geographic Society, the Sustainable Forestry Initiative® (SFI®), and another forest products company has led to 790,000 acres of additional forest lands being certified to the SFI Standard in Maine. The partnership was an extension of an earlier project in 2010 that led to 620,000 acres certified to the SFI Standard — bringing the total of additional lands certified to the SFI Standard over the two year period to 1.4 million acres.

"This is a huge accomplishment," said Craig Liska, Vice President of Sustainability for Verso. "This two-year effort not only resulted in a 20% increase in the amount of certified forestland in Maine but also demonstrated the success of this new SFI group certification process in Maine which we hope will encourage more forest land owners to also seek certification. We believe that forest certification can have a substantial role in encouraging responsible forest management practices and we're pleased to have been able to work together with SFI and an elite group of customers that share similar values in this topic."

"Verso is very excited about the success of this latest partnership and embraces our responsibility to support healthy, viable forests as a renewable resource for generations to come," Mr. Liska continued.

Source: Verso Paper Corp.

Verso Paper Corp. Reports Third Quarter 2011 Results

Verso Paper Corp. (NYSE: VRS) has reported financial results for the third quarter and nine months ended September 30, 2011. Results for the periods ended September 30, 2011 and 2010 include:

- Operating income increased 136% to $30.6 million in the third quarter of 2011 from $12.9 million in the third quarter of 2010.

- Net sales were $456.8 million in the third quarter of 2011 compared to $432.9 million in the third quarter of 2010.

- Adjusted EBITDA before pro forma effects of profitability program was $64.2 million in the third quarter of 2011, compared to $46.0 million in the third quarter of 2010. (Note: EBITDA and Adjusted EBITDA are non-GAAP financial measures and are defined and reconciled to net income later in this release).

- Net income before items was $0.8 million in the third quarter of 2011, or $0.01 per diluted share, compared to a net loss before items of $18.6 million, or $0.35 per diluted share in the third quarter of 2010.

Overview

Verso's net sales for the third quarter of 2011 increased $23.9 million, or 5.5%, compared to the third quarter of 2010, reflecting an 8.0% increase in the average sales price for all of our products while sales volume decreased 2.3% compared to last year's third quarter. Verso's gross margin was 17.8% for the third quarter of 2011 compared to 14.1% for the same period in 2010.

"Our third quarter results improved significantly from the third quarter of 2010. In spite of some demand challenges with specific product categories and the cost pressures of raw materials, Verso recognized a solid quarter. Pricing improved significantly as compared to the prior-year period and slightly on a sequential quarter basis. Our operations, as we projected in our second quarter earnings call, continued to improve in the area of material usage," said Mike Jackson, President and Chief Executive Officer of Verso.

"Our major energy projects continue to advance on our projected timeline, and we expect to start up our energy project at our Quinnesec mill in late November, which will continue to improve our cost position at our largest freesheet facility.

"As many of you know, on October 11, 2011, we announced some capacity closures that are in the best interest of our long-term performance and support our strategy of both lowering our costs and balancing supply with demand.

"Finally, we continue to recognize a correlation between operational performance and safety results. During the quarter, our total incident rate was 0.8, which is a world-class performance. I wish to recognize all of our employees who continue to contribute to this outstanding achievement."

Verso reported a net loss of $0.3 million in the third quarter of 2011, or $0.01 per diluted share, which included $1.1 million of charges from special items, or $0.02 per diluted share. Verso had a net loss of $19.2 million, or $0.36 per diluted share, in the third quarter of 2010, which included $0.6 million of charges from special items, or $0.01 per diluted share.

Verso reported a net loss of $69.2 million, or $1.32 per share, for the first nine months of 2011, which included $31.3 million of charges from special items, or $0.60 per diluted share, primarily due to $26.1 million in pre-tax net losses related to our debt refinancing in the first quarter of 2011. Verso reported a net loss of $117.1 million, or $2.23 per share, for the first nine months of 2010, which included $3.7 million of charges from special items, or $0.07 per diluted share, primarily due to costs associated with new product development.