Displaying items by tag: verso

Verso Settles With U.S. Department of Justice Regarding Pending Acquisition of NewPage

Settlement Enables Completion of Acquisition in Early January 2015

Verso Paper Corp. (NYSE: VRS), a leading North American producer of printing and specialty papers and pulp, has announced that it has reached a settlement with the United States Department of Justice that will permit Verso to proceed with its acquisition of NewPage Holdings Inc. The transaction, valued at approximately $1.4 billion, originally was announced on January 6, 2014. Upon the completion of the NewPage acquisition, Verso will have approximately $3.5 billion in annual sales and approximately 5,800 employees in eight mills across six states.

As part of the settlement process, the United States today filed a civil antitrust lawsuit in the U.S. District Court for the District of Columbia alleging that Verso's proposed acquisition of NewPage would violate the antitrust laws. At the same time, the United States filed a proposed settlement that, if approved by the court, will resolve the lawsuit and enable the transaction to proceed. The transaction remains subject to customary closing conditions.

The proposed settlement requires the divestiture of NewPage's paper mills in Biron, Wisconsin, and Rumford, Maine, as previously announced on October 30, 2014. The proposed settlement will be published in the Federal Register and will be subject to public comment, as required by the Antitrust Procedures and Penalties Act (known as the Tunney Act).

Verso expects to complete the NewPage acquisition in early January 2015. NewPage is expected to complete the divestiture of the Biron and Rumford mills to a subsidiary of Catalyst Paper Corporation in connection with Verso's acquisition of NewPage.

"The combination of Verso and NewPage will create a stronger, more stable company that will be better positioned to serve our customers and compete in a competitive global marketplace," said David J. Paterson, Verso's president and chief executive officer. "We are pleased that we were able to address the concerns of the Justice Department while preserving the benefits of the transaction for our stockholders and customers."

"Although this transaction has been among the most challenging and complex, the resulting combination will create value for all of our constituents, particularly our shareholders," said Mark Angelson, the chairman of NewPage. "We would not have come this far without critical input from the Justice Department and the advisors, key shareholders and directors of both companies."

Following the completion of the NewPage acquisition, Verso's existing senior leadership team will continue to lead the combined company.

About Verso

Verso Paper Corp. is a leading North American producer of coated papers, including coated groundwood and coated freesheet, and specialty products. Verso is headquartered in Memphis, Tennessee, and owns and operates two paper mills located in Maine and Michigan. Verso's paper products are used primarily in media and marketing applications, including magazines, catalogs and commercial printing applications such as high-end advertising brochures, annual reports and direct-mail advertising. Additional information about Verso is available on its website at www.versopaper.com .

Forward-Looking Statements

In this press release, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "project," "plan," "estimate," "intend" and other similar expressions. Forward-looking statements are based on currently available business, economic, financial and other information and reflect management's current beliefs, expectations and views with respect to future developments and their potential effects on Verso. Actual results could vary materially depending on risks and uncertainties that may affect Verso and its business. For a discussion of such risks and uncertainties, please refer to Verso's filings with the Securities and Exchange Commission. Verso assumes no obligation to update any forward-looking statement made in this press release to reflect subsequent events or circumstances or actual outcomes.

Contact

Verso Paper Corp.

Robert P. Mundy

Senior Vice President and Chief Financial Officer

001-901-369-4128

Email Contact

www.versopaper.com

Source: Verso Paper Corp.

Verso Announces Closure of Bucksport, Maine Paper Mill

Verso Paper Corp. (NYSE: VRS) has announced plans to close its paper mill in Bucksport, Maine. The closure of the mill is expected to occur in the fourth quarter of 2014. The mill closure will reduce Verso's coated groundwood paper production capacity by approximately 350,000 tons and its specialty paper production capacity by approximately 55,000 tons.

Verso Paper Corp. (NYSE: VRS) has announced plans to close its paper mill in Bucksport, Maine. The closure of the mill is expected to occur in the fourth quarter of 2014. The mill closure will reduce Verso's coated groundwood paper production capacity by approximately 350,000 tons and its specialty paper production capacity by approximately 55,000 tons.

"The Bucksport mill unfortunately has not been profitable for a number of years, in spite of our employees' dedicated efforts to make it so. Our assessment indicates that it is impossible for the mill to achieve profitability in today's marketplace," said Verso President and Chief Executive Officer, Dave Paterson.

"This decision is especially difficult because of the significant impact that the closure of the Bucksport mill will have on many people across the region, especially our long-serving and hard-working employees and their families," said Verso Senior Vice President of Manufacturing and Energy, Lyle Fellows.

Verso is committed to helping the Bucksport mill employees who will be affected by the closure. Verso will work closely with union officials and salaried employees concerning severance benefits and other assistance. Verso also will work with local and state officials to help the affected employees access resources to identify alternative employment opportunities.

Verso will work with its customers to find the best long-term solutions for their product needs after the closure of the Bucksport mill. "Our desire in this process is to minimize disruption to our customers' businesses to the extent possible. Even in the face of reduced production capacity, our customers know that they can depend on Verso to deliver high-quality paper products and exceptional customer service," said Verso Senior Vice President of Sales, Marketing and Product Development, Mike Weinhold.

Verso estimates that the closure of the Bucksport mill will result in pre-tax cash severance and other shutdown charges of approximately $35-45 million to be recorded in 2014 and 2015. The estimated cash charges consist of approximately $30-35 million in severance costs and approximately $5-10 million in other shutdown costs. Verso currently is analyzing options for the disposition of mill assets and thus does not have sufficient information to estimate the pre-tax noncash asset impairment and accelerated depreciation charges at this time. Verso expects that the noncash charges will be recognized in 2014.

"The Bucksport mill has a long and proud history. We thank all of our employees, the surrounding communities, and the many local and state officials who have partnered with us over the years," said Bucksport Mill Manager, Dennis Castonguay. "It's difficult to put into words how much your support has meant to us."

About Verso Paper Corp.

Verso Paper Corp. is a leading North American producer of coated papers, including coated groundwood and coated freesheet, and specialty products. Verso is headquartered in Memphis, Tennessee, and owns three paper mills located in Maine and Michigan. Verso's paper products are used primarily in media and marketing applications, including magazines, catalogs and commercial printing applications such as high-end advertising brochures, annual reports and direct-mail advertising. Additional information about Verso is available on its website at www.versopaper.com.

Forward-Looking Statements

In this press release, all statements that are not purely historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by the words "believe," "expect," "anticipate," "project," "plan," "estimate," "intend" and other similar expressions. Forward-looking statements are based on currently available business, economic, financial and other information and reflect management's current beliefs, expectations and views with respect to future developments and their potential effects on Verso. Actual results could vary materially depending on risks and uncertainties that may affect Verso and its business. For a discussion of such risks and uncertainties, please refer to Verso's filings with the Securities and Exchange Commission. Verso assumes no obligation to update any forward-looking statement made in this press release to reflect subsequent events or circumstances or actual outcomes.

Contact

Verso Paper Corp.

Robert P. Mundy

Senior Vice President and Chief Financial Officer

901-369-4128

Email Contact

www.versopaper.com

Source: Verso Paper Corp.

Verso to Locate Ohio Operations Center in Miamisburg Following Completion of Pending Newpage Acquisition

Verso Paper Corp. (NYSE: VRS), a leading North American producer of coated papers, has announced plans to consolidate its existing West Chester office and the NewPage Miamisburg office into a single Ohio Operations Center. The Ohio Operations Center will be located in the existing Miamisburg facility shortly following the completion of Verso's pending acquisition of NewPage expected later this year. Verso's corporate headquarters will remain in Memphis, Tenn.

Verso Paper Corp. (NYSE: VRS), a leading North American producer of coated papers, has announced plans to consolidate its existing West Chester office and the NewPage Miamisburg office into a single Ohio Operations Center. The Ohio Operations Center will be located in the existing Miamisburg facility shortly following the completion of Verso's pending acquisition of NewPage expected later this year. Verso's corporate headquarters will remain in Memphis, Tenn.

Verso's West Chester office currently houses about 55 employees in customer-facing and Information Technology functions. "We're committed to presenting a single face to our customers on Day 1," said Mike Weinhold, Verso's senior vice president of Sales, Marketing and Product Development. "Quickly co-locating our teams will help ensure we deliver on our promise of a seamless transition for customers."

The NewPage Miamisburg office is located at 8540 Gander Creek Drive, about 20 miles north of West Chester. "While we understand this will be an adjustment for our West Chester employees, we plan to do our best to minimize the potential disruption that such a move entails," Verso's Vice President of Human Resources Kenny Sawyer said. "We conducted a thoughtful and rigorous analysis of our options for a single Ohio Operations Center. Ultimately, our decision was based on a combination of financial, logistical and employee considerations that led us to select Miamisburg as the best option."

Source: Verso Paper Corp.

Verso Introduces Aspect™ SCK Release Papers

Verso Paper Corp. introduces Aspect™ SCK Release Papers, an exciting addition to its Aspect™ line of label and release papers. Now comprised of cut and stack labels, pressure sensitive face sheets and SCK release liners, Verso's Aspect™ Label and Release Papers deliver the aesthetics, strength and performance required for quality and efficient label production.

"Our premium SCK Release Liner is a high performing, extremely efficient and cost effective liner, allowing lower silicone coat weight and reduced adhesive usage due to better, more consistent profiles," says Mike Weinhold, Verso's Senior Vice President of Sales, Marketing and Product Development. "With a perfect balance between desired optical properties, performance requirements and cost effectiveness, our Aspect™ SCK Release Liner is sure to become the industry standard."

Aspect™ SCK Release Liner has high strength, superb apparent density, low dirt count and opacity, exceptional die-cutting performance, excellent cure and holdout and smooth surface characteristics.

Verso's Aspect™ Label and Release Papers product line will be produced on the No. 4 paper machine at Verso's mill in Androscoggin, Maine. "Androscoggin's No. 4 paper machine is a well-positioned asset, with relative machine scale and an integrated pulp supply," Weinhold explains. "Androscoggin, like all of our mills, has a strong manufacturing focus on producing consistent, quality products, and our Aspect™ line of label and release papers is no exception. We understand our customers want a product and a supplier they can rely on, and Verso delivers on both of those needs," he says.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Exchange Offer for Outstanding Debt and Related Consent Solicitation

Verso Paper Corp. have announced that two of its wholly owned subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (collectively, the "Issuers"), have launched an offer to issue up to $180.2 million aggregate principal amount of a new series of 9.75% secured notes due 2019 (the "New Notes") in exchange for any and all of the Issuers' outstanding $180.2 million aggregate principal amount of senior secured floating-rate notes due 2014 (the "Old Notes").

Simultaneously, the Issuers commenced a solicitation of consents from the holders of the Old Notes to waivers of, and proposed amendments to, certain covenants in the indenture pursuant to which the Old Notes were issued (the "Proposed Amendments"), and, separately, to authorize release from the liens and security interests in the collateral securing the Old Notes (the "Collateral Release"). Holders who tender their Old Notes into the exchange offer will be deemed to have given their consents to both the Proposed Amendments and the Collateral Release with respect to those tendered Old Notes.

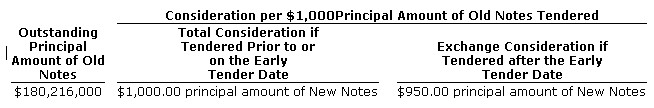

The Old Notes and other information relating to the exchange offer and consent solicitation are set forth in the table below.

The exchange offer and consent solicitation and the effectiveness of any supplemental indenture entered into pursuant to the exchange offer and consent solicitation are conditioned on the tenders and associated consents by holders of more than 50% of the Old Notes.Each holder who validly tenders its Old Notes prior to 5:00 p.m., New York City time, on April 10, 2012 (as may be extended, the "Early Tender Date") will receive, if such Old Notes are accepted for purchase pursuant to the exchange offer, the total consideration of $1,000.00 principal amount of New Notes per $1,000.00 principal amount of Old Notes tendered, which includes an early tender payment of $50.00 per $1,000.00 principal amount of Old Notes tendered. Each Holder who does not validly tender its Old Notes prior to the Early Tender Date will only receive $950.00 principal amount of New Notes for each $1,000.00 of Old Notes tendered and accepted and will not be entitled to receive the $50.00 early tender payment.

The Issuers intend to enter into a supplemental indenture to effectuate the Proposed Amendments promptly after the receipt of the requisite consents for the Proposed Amendments. To the extent requisite consents for the Collateral Release have also been received, such supplemental indenture will also include the Collateral Release. To the extent that the requisite consents for the Collateral Release have not been obtained at the time such supplemental indenture is executed, such supplemental indenture will not include provisions effecting the Collateral Release, but if such requisite consents for the Collateral Release are later obtained, the Issuers will execute another supplemental indenture providing for the Collateral Release promptly after receipt of the requisite consents for the Collateral Release. Each of the foregoing supplemental indentures will be effective immediately upon execution thereof, but the provisions thereof will not be operative until all of the Old Notes that have been tendered prior to the date of such supplemental indenture have been accepted for payment and paid for in accordance with the terms of the exchange offer and consent solicitation.

The exchange offer and consent solicitation will expire at 11:59 p.m., New York City time, on April 24, 2012, unless extended or earlier terminated (the "Expiration Date"). Tendered Old Notes may be validly withdrawn prior to the earlier of (a) the date the Issuers receive the requisite consents and execute the supplemental indenture providing for the Proposed Amendments and (b) 5:00 p.m., New York City time, on April 10, 2012, unless extended (such time and date described in (a) or (b), as the same may be extended, the "Withdrawal Deadline"). Tendered Old Notes may not be validly withdrawn subsequent to the Withdrawal Deadline. Prior to the Withdrawal Deadline, if a holder withdraws its tendered Old Notes, such holder will be deemed to have revoked its consents to both the Proposed Amendments and the Collateral Release and may not deliver consents without re-tendering its Old Notes. After the Withdrawal Deadline, consents to the Proposed Amendments may be validly revoked prior to the execution of the supplemental indenture giving effect to the Proposed Amendments. While tendered Old Notes may not be withdrawn subsequent to the Withdrawal Deadline, if the supplemental indenture giving effect to the Proposed Amendments (but not the Collateral Release) has been executed, consents to the Collateral Release may be validly revoked (but neither the relevant Old Notes may be withdrawn nor the consents to the Proposed Amendments may be revoked) until the execution of the supplemental indenture giving effect to the Collateral Release.

Subject to the terms and conditions described below, payment of the exchange offer consideration will occur promptly after the Expiration Date. Such payment is currently expected to occur on or about April 25, 2012, unless the Expiration Date is extended or the exchange offer is earlier terminated. In addition, at any time after the Early Tender Date but prior to the Expiration Date, and subject to the terms and conditions described below, the Issuers may accept for exchange Old Notes validly tendered on or prior to such time and exchange such notes for the exchange consideration promptly thereafter.

The Issuers may terminate or withdraw the exchange offer and consent solicitation at any time and for any reason, including if certain conditions described in the Exchange Offer Documents (defined below) are not satisfied, subject to applicable law.

This announcement shall not constitute an offer to purchase or a solicitation of an offer to sell any securities. The complete terms and conditions of the exchange offer are set forth in a confidential offering memorandum and consent solicitation statement, dated March 28, 2012 and the related consent and letter of transmittal (the "Exchange Offer Documents") that are being sent to eligible holders of the Old Notes. The exchange offer and consent solicitation are being made only through, and subject to the terms and conditions set forth in, the Exchange Offer Documents and related materials.

The New Notes are being offered in the U.S. only to (1) qualified institutional buyers in reliance on Rule 144A under the Securities Act and (2) "accredited investors" as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act, and outside the United States only to non-U.S. investors pursuant to Regulation S. The New Notes will not initially be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from registration requirements or in a transaction that is not subject to the registration requirements of the Securities Act or any state securities laws.

Global Bondholder Services Corporation will act as the Information Agent for the exchange offer. Requests for the Exchange Offer Documents from eligible holders may be directed to Global Bondholder Services Corporation at (212) 430-3774 (for brokers and banks) or (866) 470-3700 (for all others).

Neither the Issuers' boards of directors nor any other person makes any recommendation as to whether holders of Old Notes should exchange their Old Notes, and no one has been authorized to make such a recommendation. Eligible holders of Old Notes must make their own decisions as to whether to exchange their Old Notes, and if they decide to do so, the principal amount of the Old Notes to exchange. Eligible holders of Old Notes should read carefully the Exchange Offer Documents and related materials before any decision is made with respect to the exchange offer and consent solicitation.

Source: Verso Paper Corp.

Verso Paper Corp. Prelim Results for 4th Quarter and Year End

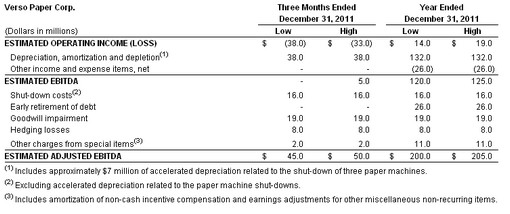

- For the three-month period ended December 31, 2011, we expect Adjusted EBITDA to be within the range of $45 million to $50 million, and for the year ended December 31, 2011, we expect Adjusted EBITDA to be within the range of $200 million to $205 million.

- Adjusted EBITDA for the three-month period ended December 31, 2011, excludes charges from special items of approximately $45 million primarily related to the shut-down of three paper machines, goodwill impairment, and hedging transactions. Adjusted EBITDA for the year ended December 31, 2011, excludes charges from special items of approximately $80 million primarily related to net losses on debt refinancing, the shut-down of three paper machines, goodwill impairment, and hedging transactions.

- For the three-month period ended December 31, 2011, we expect operating income before items to be within the range of $14 million to $19 million. Including approximately $52 million of charges primarily related to the paper machine shut-downs, goodwill impairment and hedging transactions we expect operating losses within the range of $38 million to $33 million for the quarter. For the year ended December 31, 2011, we expect operating income before items to be within the range of $74 million to $79 million. Including approximately $60 million of charges primarily related to the paper machine shut-downs, goodwill impairment and hedging transactions we expect operating income within the range of $14 million to $19 million for 2011.

- Cash and total debt at December 31, 2011 were approximately $95 million and $1.2 billion, respectively. At December 31, 2011, our existing $200 million revolving credit facility had no amounts outstanding, approximately $41 million in letters of credit issued, and approximately $159 million available for future borrowing.

- Capital expenditures for the three-month period ended December 31, 2011, are expected to be approximately $23 million.

Verso intends to release its financial results for the fourth quarter and the year ended December 31, 2011, in a news release to be issued before the market opens on Wednesday, March 7, 2012. Management will host a conference call at 9 a.m. (Eastern Time) on Wednesday, March 7, 2012, to discuss the fourth quarter and year-end results. Analysts and investors may participate in the live conference call by dialing 719-325-4795 or, within the U.S. and Canada only, 877-591-4959, access code 5749765. To register, please dial in 10 minutes before the conference call begins. The conference call and presentation materials will be made available on Verso's website at www.versopaper.com/investorrelations by navigating to the Events page, or at http://investor.versopaper.com/eventdetail.cfm?EventID=108162. The earnings release and Verso's annual report on Form 10-K for the year ended December 31, 2011, will be made available on Verso's website at www.versopaper.com/investorrelations by navigating to the Financial Information page. A telephonic replay of the conference will be accessible at 719-457-0820 or, within the U.S. and Canada only, 888-203-1112, access code 5749765. This replay will be available starting on March 7, 2012, at 12:00 p.m. (Eastern Time) and will remain available for 14 days.

Reconciliation of Estimated Operating Income to Estimated Adjusted EBITDA

The agreements governing our debt contain financial and other restrictive covenants that limit our ability to take certain actions, such as incurring additional debt or making acquisitions. Although we do not expect to violate any of the provisions in the agreements governing our outstanding indebtedness, these covenants can result in limiting our long-term growth prospects by hindering our ability to incur future indebtedness or grow through acquisitions.

EBITDA consists of earnings before interest, taxes, depreciation, and amortization. EBITDA is a measure commonly used in our industry, and we present EBITDA to enhance your understanding of our operating performance. We use EBITDA as one criterion for evaluating our performance relative to that of our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets among otherwise comparable companies. Adjusted EBITDA is EBITDA further adjusted to exclude unusual items and other pro forma adjustments permitted in calculating covenant compliance in the indentures governing our notes to test the permissibility of certain types of transactions. We believe that the inclusion of the supplemental adjustments applied in calculating Adjusted EBITDA are reasonable and appropriate in providing additional information to investors to demonstrate our compliance with our financial covenants. We also believe that Adjusted EBITDA is a useful liquidity measurement tool for assessing our ability to meet our future debt service, capital expenditures, and working capital requirements.

However, EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDA or Adjusted EBITDA as an alternative to operating or net income, determined in accordance with U.S. GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as an indicator of our cash flows or as a measure of liquidity.

The following table reconciles estimated operating income (loss) to estimated EBITDA and estimated Adjusted EBITDA for the periods presented.

Source: Verso Paper Corp.

Verso Paper Corp. Announces Permanent Shutdown of Three Paper Machines

Verso Paper Corp. has announced that it will permanently reduce its annual production capacity by 193,000 tons. This will be accomplished by the permanent shutdown of the No. 2 coated groundwood paper machine at its mill in Bucksport, Maine, effective October 23 and two supercalendered (SC) paper machines at its mill in Sartell, Minnesota, effective December 14.

The shutdown of the No. 2 paper machine at the Bucksport Mill will reduce Verso's annual coated groundwood capacity by 90,000 tons or approximately 10 percent. With an annual capacity after the shutdown of 925,000 tons, Verso will remain the second largest producer of coated groundwood paper in North America. The Bucksport Mill's workforce will be reduced by approximately 125 employees.

The shutdown of the No. 1 and No. 2 paper machines at the Sartell Mill will eliminate approximately 103,000 tons annually of SCA and SCB paper capacity. The Sartell Mill's workforce will be reduced by approximately 175 employees.

"While improved from the recent lows of 2009, demand for coated groundwood papers continues to face headwinds," said Verso President and CEO Mike Jackson. "The cost structure of the No. 2 paper machine at Bucksport, continuously rising input costs and these headwinds resulted in this decision to permanently reduce our coated groundwood capacity. This is consistent with our continuing commitment to match supply with customer demand. The demand for supercalendered papers remains fairly stable in the marketplace; however, despite our employees' diligent efforts, the cost structure of the two SC machines to be shut down at the Sartell Mill remains unfavorable.

"The decision to permanently reduce production at Bucksport and Sartell was difficult and we are mindful of the impact it will have on the affected employees and their families," Jackson added. "I want to express my sincere gratitude to the affected employees for their years of service to Verso, and to recognize all Bucksport and Sartell employees for their hard work and continued focus on safety in the workplace."

"Verso remains committed to customer service and delivery of high-quality paper products, and we will work closely with our customers to make the necessary transitions as seamlessly as possible," said Mike Weinhold, Verso Senior Vice President of Sales, Marketing and Product Development.

The paper machine shutdowns will result in an aggregate pre-tax charge to earnings of approximately $22 million, which is expected to occur primarily in the fourth quarter of 2011. This includes approximately $13 million for severance and benefit costs; approximately $7 million in non-cash charges related to the accelerated depreciation of property and equipment over a reduced remaining useful life and the write-off of related spare parts; and approximately $2 million related to other costs. The severance and other shutdown costs require the outlay of cash, which is expected to occur primarily in the fourth quarter of 2011.

Costs associated with shutdown activities are based on currently available information and reflect management's best estimates; accordingly, actual cash costs and non-cash charges and their timing may differ from the projections stated above.

Source: Verso Paper Corp.

Verso Paper Holdings LLC and Verso Paper Inc. Announce Extension of Exchange Offer for their 8.75% Second Priority Senior Secured Notes Due 2019

Verso Paper Corp. has announced that its indirect subsidiaries, Verso Paper Holdings LLC and Verso Paper Inc. (collectively, the "Issuers"), have extended the time and date of the expiration of their offer (the "Exchange Offer") to exchange up to $396,000,000 aggregate principal amount of the Issuers' 8.75% Second Priority Senior Secured Notes due 2019 that have been registered under the Securities Act of 1933 (the "Exchange Notes") for a like principal amount of the Issuers' outstanding 8.75% Second Priority Senior Secured Notes due 2019 (the "Old Notes") to 5:00 p.m., New York City time, on Thursday, August 4, 2011 (the "Expiration Date"), unless further extended. The Exchange Offer had been scheduled to expire at 5:00 p.m., New York City time, on Monday, August 1, 2011.

The terms of the Exchange Notes to be issued in the Exchange Offer are substantially identical to those of the Old Notes, except that the Exchange Notes are freely tradable by persons other than affiliates. Except for the new Expiration Date, all other terms, provisions and conditions of the exchange offer that are described in the Issuers' Registration Statement on Form S-4 declared effective by the Securities and Exchange Commission on June 30, 2011, will remain in full force and effect.

As of 5:00 p.m., New York City time, on August 1, 2011, the Issuers have been advised that holders of $395,248,000 aggregate principal amount of the Old Notes have tendered their Old Notes for exchange. The amount tendered represents approximately 99.8% of the outstanding Old Notes. Tendered Old Notes may be withdrawn at any time prior to the Expiration Date.

This press release is not an offer to exchange Exchange Notes for Old Notes, which the Issuers are making only through a prospectus. Copies of the prospectus and related documents may be obtained from Wilmington Trust Company, the exchange agent for the Exchange Offer, c/o Wilmington Trust Company, Corporate Capital Markets, 1100 North Market Street, Wilmington, Delaware 19890-1615.

Verso to Report Second Quarter Results and Host Conference Call on August 11

Verso Paper Corp. has announced that it will report its financial results for the second quarter ended June 30, 2011, in a news release before the market opens on Thursday, August 11, 2011. Management will host a conference call at 9:00 a.m. Eastern Time on Thursday, August 11, 2011, to discuss the second quarter results.

This release and the second quarter results will be made available on Verso's website at www.versopaper.com/investorrelations by navigating to the Financial Information page.

Analysts and investors may participate in the live conference call by dialing 719-457-2705 or, within the U.S. and Canada only, 888-481-2845, access code 4576177. To register, please dial in 10 minutes before the conference call begins. The conference call and presentation materials can be accessed on Verso's website at www.versopaper.com/investorrelations by navigating to the Events page, or at http://investor.versopaper.com/eventdetail.cfm?eventid=99890.

A telephonic replay of the call can be accessed at 719-457-0820 or, within the U.S. and Canada only, 888-203-1112, access code 4576177. This replay will be available starting at 12:00 p.m. Eastern Time on Thursday, August 11, 2011, and will remain available for 14 days.

Verso Paper Corp. Continues Efforts toward Increased Certified Forest Acreage in Maine

Verso Paper Corp. has announced its participation in a partnership with Time Inc., Hearst Enterprises, National Geographic, the Sustainable Forestry Initiative® (SFI®), and other forest products companies in Maine to promote sustainable forest management principles and initiatives.

"Verso and its partners are to be congratulated for building on the Maine pilot to expand the partnership and increase the amount of lands certified to the SFI Standard," said SFI President and CEO, Kathy Abusow. This partnership is an extension of a pilot project completed last year in Maine that provided support to private landowners by creating a more cost effective certification process and offering resources to support responsible forest management practices. Last year's pilot project resulted in an additional 620,000 acres certified to the SFI and the American Tree Farm System® standards in Maine, an 8.3% increase. This year's partnership effort will use the experience learned from the pilot project and involve a new group of landowners who recognized the value in the improved and thorough process that came out of last year's pilot. This new partnership effort is expected to result in over 600,000 additional acres becoming certified under the SFI Standard. Importantly, the project will meet the needs of small and medium-sized landowners by further validating a more cost effective certification process and providing resources to support forest management best practices.

"Verso has strategically taken a leadership role over the years to promote forest certification by developing partnerships and providing support to a variety of stakeholders with similar values," said Craig Liska, Vice President of Sustainability for Verso. Last year's pilot project and this year's extension have resulted in a growing number of landowners showing interest in this improved certification process. Verso believes the increased awareness and understanding of the value this new certification process offers will prompt others to join the effort and promote further growth of the program in Maine and other states.

"Verso is very excited about this latest partnership and looks forward to seeing the increase in certified acreage in Maine along with the sustainable forest management practices that accompany this certification effort," continued Mr. Liska. "As a manufacturer and marketer of paper products, Verso recognizes and embraces our responsibility to support healthy, viable forests as a renewable resource for generations to come."