Ianadmin

Buckeye Announces a New Board Member

PMP Successfully Starts Up Intelli-Tissue™ 1500 in Yuen Foong Yu in China

In July of 2011, PMP received an order for (2) new Intelli-TissueTM 1500 machines from Yuen Foong Yu located in Yangzhou, China. It is our pleasure to announce that the 1st of these machines, PM #5 was brought online on the 8th of August at 5:25pm. Mr. Ming-Fa Tang, the mill spokesman, commented “It was the fastest assembly and start-up in the history of the YFY Corporation”. The YFY and PMP team was very proud of this accomplishment and based on the overall satisfaction of their cooperation, look forward to potential future projects. Overall, this is the 2nd Intelli-Tissue™ 1500 machine installed by YFY with the 1st machine starting up in 2008 in Beijing, China.

YFY is a Corporation that is comprised of (3) Business Units. The Household Products Business Unit has (3) major brands of tissue paper: Mayflower, Tender and Delight. Their production lines cover paper products such as toilet paper, tissue paper, facial tissues, paper towels and napkins. The unit is also responsible for producing cosmetic products such as bio facial masks for leading brands in the country.

PMP supplied (2) 2.8m wide crescent former Intelli-TissueTM 1500 machines with a maximum operating speed of 1,600 mpm and a capacity of 75 tpd for PM #5 and PM#6 in Yangzhou. The machines are designed as an Eco-Tissue machines which maximizes quality and minimizes media consumption. They are able to produce virgin fiber based tissue with a basis weight range of 13 – 31.3 gsm for conversion into facial tissue, bath tissue and kitchen towels. The scope of supply covered stock preparation, the tissue machine (Intelli-Jet VTM Headbox, Intelli-FormerTM Crescent Former, Intelli-PressTM, 16’ Yankee Dryer with a high efficiency steam hood and Intelli-ReelTM) and auxiliary systems such as mechanical drives, lubrication system, steam & condensate system and dust removal.

Stora Enso and Neste Oil to end their biodiesel project

Voith has upgraded the world’s biggest board machine

After a Voith rebuild, APP’s BM 6 in Xiaogang, China, went back into operation at the beginning of 2012. The goal of the rebuild was to speed up the BM 6 to 1,100 m/min. At this speed range no other multi-ply board machine has ever produced top quality art board products, as now APP does in Xiaogang. APP and Voith have crossed the 4,000 t/24 h production mark and the production speed of 1,100 m/min. This is a new benchmark in the board making history.

The rebuild was a big challenge for the teams of APP and Voith because of the limited shutdown time of eight days. During this short period Voith has modified the wire, press and dryer sections to fulfill APP’s requirements. In the wire section the newly developed suction forming boards were installed to reduce stock jumping at such high speeds.

In the press section a new water doctor and save all pans were installed before and after the first shoe press nip. This modification is reducing the rewetting of the board at such high speeds.

The most complex rebuild activity was done in the dryer section. Voith has changed the concept of the existing steam and condensate system of the pre dryer section. In connection to this the Turbo Dryer S air caps were placed in the first two dryer groups. The goal behind installing the four gas heated Air Dryers was to increase the drying capacity of the pre dryer section. To ensure a stable web run at 1,100 m/min the open draw was rebuilt to become a closed web run system at the beginning of the 2nd dryer group.

In February this year APP and Voith started up the BM 6 again. After one day BM 6 was producing top quality board at 930 m/min. In April APP reached the world record mark of 1,103 m/min for a 24-hour period of uninterrupted production.

The good cooperation between the onsite teams of APP and Voith, the experience in board making of the APP production team and Voith’s concept for the rebuild made this new benchmark in board making possible.

Catalyst Paper and Pacifica Deep Sea Terminals Inc. reach agreement on sale of Elk Falls site

Catalyst Paper today announced that it has reached agreement with Pacifica Deep Sea Terminals Incorporated on the sale of its Elk Falls site in Campbell River. The $8.6 million sale of the 400-acre industrial site and adjacent properties is expected to close September 5, 2012. It completes Catalyst’s comprehensive bid review process which began earlier this year.

“We are very pleased to have attracted an experienced developer with the capacity and an industrial concept that will fully utilize the site’s infrastructure and bring new business and jobs to the region,” said Kevin J. Clarke, Catalyst President and Chief Executive Officer.

The former pulp and paper site was indefinitely curtailed in 2009 and closed permanently in 2010. Since then, equipment has been decommissioned and demolition work has been completed to prepare the site for sale and redevelopment to other industrial uses. The Elk Falls mill began operation in 1952, and at its peak, produced 784,000 tonnes of pulp, paper and kraft paper annually.

“The site is strategically located to serve a variety of marine, light manufacturing, clean energy and distribution uses,” said Pacifica Owner and Director Harold Jahn, “and we intend to transform it into a dynamic industrial park and port facility with the goal of creating 400 full time jobs in the Campbell River region over the next three years.”

Mr. Jahn is the director and owner of numerous Canadian private firms launched in a range of industries over the past 20 years. He is currently developing three industrial parks in northern Alberta.Within the new Pacifica Industrial Park, Mr. Jahn plans to base his companies that are presently developing algae based solar cells, a lithium battery manufacturing facility, ocean wave energy equipment fabrication and an electric vehicle assembly plant.

PEFC Supports Six New Projects Advancing Responsible Forestry

As part its assistance to projects and activities intended to promote sustainable forest management, mainstream forest certification, improve market conditions for certified products, and advance knowledge and collaboration, PEFC is has selected six projects to benefit from its Collaboration Fund this year.

The PEFC Collaboration Fundseeks to support efforts to advance sustainable forest management and forest certification around the world by members and partner  organizations. Through the competitive small grants programme, PEFC encourages locally relevant advancements in the sustainable management of forests.

organizations. Through the competitive small grants programme, PEFC encourages locally relevant advancements in the sustainable management of forests.

The six projects selected this year will receive a total of more than CHF 127.000 over the course of the next 12-18 month. In total, PEFC awarded close to a quarter of a million Swiss Francs to eleven projects through the Collaboration Fund in 2011 and 2012. This year's grantees include CESEFOR-Mediterranean Model Forest Network(Spain), the Estonian Forest Certification Council (Estonia), the Forest Certification Center (Russia), NymE Erfaret (Hungary) and PEFC Italy (Italy and the Balkans, two projects) and a total of about 20 project partners.

"We are thrilled to start working with these organisations and develop new partnerships with them to bring forward sustainable forest management and forest certification in new areas," said Sarah Price, Head of Projects and Development at PEFC International. "Our experiences from last years have demonstrated that the PEFC Collaboration Fund has the potential to make a real difference on the ground, and we hope that the 2012 projects will be equally successful."

The call for entries for the 2013 PEFC Collaboration Fund is expected to be issued in late 2012 (subject to funding availability).

Projects supported in 2012 include:

Sustainable Forest Management & PEFC Certification in Bosnia and Herzegovina Private Forests

Project objectives

- Expand forest certification in the Balkans;

- Raise awareness of the need for certification among private forest owners;

- Secure the participation and involvement of interested stakeholders in the national standard setting process and creation of a National Governing Body;

- Support preparations for the development of national PEFC systems .

Implementing organization

PEFC Italy was established to encourage and improve the sustainable development of forests through the promotion of the PEFC certification system and according to established standards. It joined PEFC in 2001.

Further information about the project

Fostering Partnerships to Promote PEFC Certification in Hungary

Project objectives

- Develop a national PEFC system and promote PEFC Chain of Custody certification;

- Build capacity among private forest owners and managers and the forest industry;

- Develop a national PEFC certification system in Hungary;

- Promote PEFC certification.

Implementing organization

ERFARET Non-profit Ltd. (ERFARET) is a research and development organization founded by the University of West-Hungary. Its primary mission is to foster cooperation between the University and its partners.

Further information about the project

Building Capacity for the Development of PEFC Certification in Russia and the Russian Far East

Project objectives

- Build capacity for the development of PEFC certification in Russia and the Russian Far East;

- Provide training to forest owners and forest certification auditors;

- Promote uptake of PEFC Chain of Custody certification in the market place.

Implementing organization

The Forest Certification Center (FCC), a not-for-profit partnership of leading organizations, and acknowledged experts and scientists working on issues related to the conservation of forest biodiversity and the sustainable use of forest resources.

Further information about the project

Estonia Market Outreach

Project objectives

- Raise awareness of PEFC in Estonia;

- Increase the certified forest area, especially of privately owned forests;

- Promote PEFC certification and label use among companies.

Implementing organization

The Estonian Forest Certification Council (EFCC) was set up as a non-profit organization on 29 October 2001 on the initiative of private forest owners and with the participation of other interest groups and stakeholders. The overall objective of the Estonian Forest Certification Scheme is to support the implementation of sustainable forestry in Estonia. EFCC currently has 12 institutional non-governmental members.

Further information about the project

Forest Traceability: Marketing Mushrooms in the Spanish Urbion Model Forest

Project objectives

- Investigate marketing synergies between certification and traceability;

- Develop a web-based platform;

- Pilot traceability of PEFC-certified mushrooms.

Implementing organization

CeseFOR is the Castilla y León regional wood and forestry industry centre; it works along the entire forest sector value chain at regional, national and international levels. The organization also acts as the main technical advisor to the Environment Department of the regional government of Castilla y León.

Further information about the project

E-Learning 4 PEFC

Project objectives

- Develop an e-learning platform to address current and future capacity building needs of PEFC members and stakeholders;

- Increase the availability of information about PEFC concepts, tools and objectives at national and international level;

- Prepare pilot courses on a variety of topics.

Implementing organization

PEFC Italy was established to encourage and improve the sustainable development of forests through the promotion of the PEFC certification system and according to established standards. It joined PEFC in 2001.

BASF expands center of competence for adhesive coatings

BASF expanded its coating center recently by adding a tailor-made and flexible laboratory coating and laminating facility. The new coater facilitates the development of adhesive systems for flexible packaging, labels, tapes and functional film coatings. It increases the capacity for customer tests and speeds up the development of new products as well as the adaption of existing adhesive formulations to new carrier materials.

BASF expanded its coating center recently by adding a tailor-made and flexible laboratory coating and laminating facility. The new coater facilitates the development of adhesive systems for flexible packaging, labels, tapes and functional film coatings. It increases the capacity for customer tests and speeds up the development of new products as well as the adaption of existing adhesive formulations to new carrier materials.

Leadership in adhesive coatings

“By expanding our coating center, we are able to further strengthen our technical leadership and innovation power when it comes to water-based adhesive systems and UV acrylic hotmelts. Our mission is the long-term success of our customers,” explains Dr. Jürgen Pfister, head of Dispersions for Adhesives and Fiber Bonding Europe. The universal laboratory coater produces exact, reproducible coatings of water-based and UV acrylate hotmelt systems, only requiring a minimum quantity of one kilo of adhesive. The pre-treatment and lamination of a variety of film combinations is possible without any problems.

The center of competence for adhesive coatings is located in Ludwigshafen, the global headquarters of BASF. The coating experts closely cooperate with all relevant BASF R&D centers for adhesive raw materials and the respective regional business units. The competences and experiences of those who work in technical service, development, research and laboratory are assembled here. The centerpiece of the competence center is the existing pilot coater for dispersions. With a coating speed of 1,800 meters per minute the coating team holds the world record with this machine. Further the new universal laboratory coater adds to BASF’s competences.

To further drive innovation, BASF invests every year more than €800,000 in the modernization and maintenance of its adhesive coating facilities. “Together with our customers we are working today on solutions to tomorrow’s problems,” says Andree Dragon, Technical Manager of the coating center.

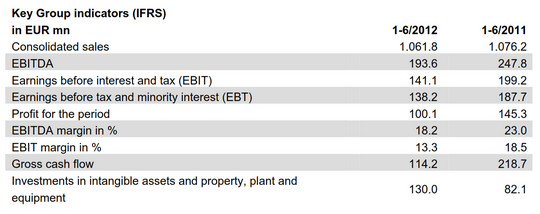

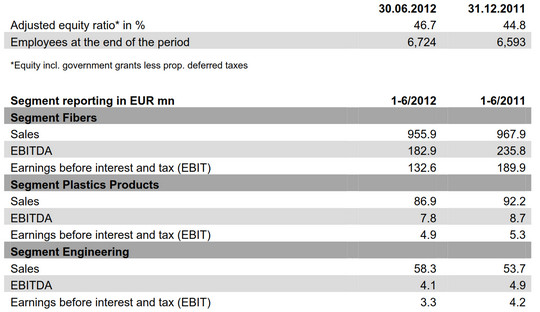

Lenzing Group: Good Half-Year Results in a Difficult Market Environment

NewPage, L.L.Bean & WWOA Join Forces

NewPage has announced that it has teamed with L.L.Bean and the Wisconsin Woodland Owners Association (WWOA) in an effort to increase sustainably managed woodlands in six Central Wisconsin counties. The project partners will provide forest management assistance and third-party certification using certification standards of the American Tree Farm System to woodland owners at no cost.

The initial pilot program is targeted at WWOA-member woodland owners in the Central Sands Chapter, which includes: Wood, Portage, Waushara, Adams, Juneau and Marquette counties. To date, 42 landowners owning more than 6,000 acres of forest have committed to the program.

According to Brian Kozlowski, director of Sustainable Development at NewPage, "This groundbreaking project reflects a shared commitment to forest stewardship. At the same time it helps increase the availability of locally certified wood to support the growing demand from our customers, including L.L.Bean, seeking paper sourced from certified timberlands."

In 2011, 48 percent of the fiber purchased by NewPage came from certified sources. NewPage is the largest buyer of pulpwood in the Great Lake States. This program is designed to increase the level of certification and provide forest management resources to WWOA members.

Certification has a number of benefits for woodland owners, according to Gordy Mouw, NewPage Certification and Resource manager. "For owners who intend to sell portions of their timber, certification gives them access to important wood markets. In addition, certification provides a guarantee that their woodlands will be managed sustainably," Mouw said.

Certification is also of value to woodland owners who have dedicated their properties for recreation and hunting. It provides assurance that they are doing everything possible to manage their natural resources and financial investments for future generations.

According to Bill Horvath, member and coordinator of the project for WWOA, "This project helps bring together our members to foster and encourage wise use and management of Wisconsin's woodland for timber production, wildlife habitat and recreation. We hope to use this project as a model to further advance certification of small private landowners in Wisconsin."

"The L.L.Bean catalog has been and continues to be an important marketing tool for L.L.Bean and is a significant means for customers to view our products," said Doug Darby, Marketing manager for L.L.Bean. "Since many of our customers work and recreate in the same forests from which the fiber for our catalogs originates, we want to ensure these forests are being sustainably managed. Certification is one of the tools that provide this assurance. We look forward to increasing the participation in this project," said Darby.

SOURCE NewPage Corporation

Ashland Inc. to host analyst day December 4 in New York City

Ashland Inc. (NYSE: ASH), a global leader in specialty chemical solutions for consumer and industrial markets, today announced it will hold an analyst day on Tuesday, December 4, 2012 in New York City. James J. O'Brien, chairman and chief executive officer, along with other members of the company's management team, will present an update on key business strategies and growth initiatives, with a focus on the Ashland Specialty Ingredients commercial unit. Topics will include long-term growth drivers, market trends, technical differentiation, and new product innovation.

Further event details will be posted on Ashland's investor website at http://investor.ashland.com closer to the date.

An audio webcast of the conference will be available live and can be accessed, along with supporting materials, through the Ashland website. A replay will be available within 24 hours of the live event and will be archived, along with supporting materials, on Ashland's website for 90 days. Supporting materials will be available for 12 months.