Ianadmin

Buckeye Announces Executive Restructuring and Promotions

Buckeye Technologies Inc. has announced that it will restructure its executive management team in support of its previously announced decisions to close or sell several underperforming or non-core assets and in conjunction with the departure of its chief operating officer, which was announced separately.

The Company’s Board of Directors has approved the following promotions effective July 24, 2012. Mr. Steven G. Dean, Senior Vice President and Chief Financial Officer has been promoted to Executive Vice President, Chief Financial Officer. Mr. Douglas L. Dowdell, Senior Vice President, Specialty Fibers has been promoted to Executive Vice President, Specialty Fibers. Mr. Terrence M. Reed, Vice President, Human Resources has been promoted to Senior Vice President, Human Resources.

Mr. Dean joined Buckeye in 1999, and since that time he has held positions of increasing responsibility in the area of finance and accounting. He has served as the Company’s Chief Financial Officer since 2006. In connection with his promotion, Mr. Dean will assume increased responsibilities in the area of information technology.

Mr. Dowdell joined Buckeye in 1988 and has played leadership roles in the Company’s Nonwovens division and in the Specialty Fibers division. He has led the Specialty Fibers division since 2006 and will assume increased operational responsibilities.

Mr. Reed joined Buckeye in 1995 and has held key leadership positions in Manufacturing and Human Resources. He has served as Vice President, Human Resources since 2006 and will assume increased responsibilities in the area of human resource development.

Buckeye, a leading manufacturer and marketer of specialty fibers and nonwoven materials, is headquartered in Memphis, Tennessee, USA. The Company currently operates facilities in the United States, Germany and Canada. Its products are sold worldwide to makers of consumer and industrial goods.

Certain matters discussed in this press release may constitute forward-looking statements within the meaning of the federal securities laws that involve risks and uncertainties, including but not limited to economic, competitive, governmental, and technological factors affecting the Company's operations, financing, markets, products, services and prices, and other factors. For further information on factors which could impact the Company and the statements contained herein, please refer to public filings with the Securities and Exchange Commission.

Source: Buckeye Technologies Inc.

Buckeye Announces Resignation

OMNOVA Solutions Recognizes Employee Innovations with 2011 Technology Awards

OMNOVA Solutions has announced its 2011 Technology Award recipients. This annual award program recognizes exemplary technological contributions by associates in OMNOVA's research and development, sales and marketing, technical service, operations, product management and LEAN SixSigma organizations.

These innovations in product development and process improvement are positively impacting customers in many of OMNOVA's served markets including performance chemicals for oil and natural gas drilling, paper and tape applications, as well as laminates for the kitchen and bath cabinetry, RV/manufactured housing and store fixture markets.

Recipients hail from across OMNOVA's global operations, including its Performance Chemicals business segment facilities in Akron, Ohio; Mogadore, Ohio; Chester, South Carolina; and Green Bay, Wisconsin, as well as Villejust, France and Shanghai, China. OMNOVA's Decorative Products business segment is also well-represented with Technology Award winners from its facilities in Fairlawn, Ohio; Auburn, Pennsylvania and Monroe, North Carolina.

"As a global company, we are continually taking actions that will enhance the value we deliver to our customers and allow us to pursue new and adjacent markets," said Kevin McMullen, OMNOVA Solutions' Chairman and Chief Executive Officer. "The cornerstone of these efforts is the enhancement of our existing competencies, as well as the development of new, sustainable products and processes for the future. These outstanding innovation teams have clearly focused on delivering value to our customers, enhancing our operations and reducing our environmental footprint, positioning OMNOVA for sustained profitable growth as we move forward."

Innovation titles, summaries and recipients are as follows:

Global High Performance Release Coating

Category: New Product Development/Commercialization

Doug Harper – Chester, South Carolina

Bobbi Varnadore – Chester, South Carolina

Tom Walsh – Akron, Ohio Global Technology Center

Haiping Fu – Shanghai, China

The strength of OMNOVA's global Performance Chemicals team was highlighted through the development of new release coating technology for the Chinese tape market. The release coating provides enhanced runnability on the customer's production line and delivers improved overall tape performance including overlap/release properties.

Elimination of Print Voids in Laminates

Category: LEAN SixSigma Excellence

Hrishikesh Bhide – Auburn, Pennsylvania

Mike Weremedic – Auburn, Pennsylvania

Don Scarnulis – Auburn, Pennsylvania

Eric Johnson – Fairlawn, Ohio World Headquarters

This Decorative Products team identified and implemented "Print Assist Technology" to eliminate the occurrence of print voids, which were small blemishes that would not receive ink during the printing process of vinyl laminates. The new technology ensures that ink will adhere to these voids, improving overall product quality at OMNOVA's Auburn plant. It also reduces the amount of printing ink consumed due to reprints and decreases scrap.

Extreme Condition Fluid Loss Resins for Oil/Gas Drilling Muds

Category: Continuous Innovation

Bertrand Guichard – Villejust, France Global Technology Center

Patrick Vongphouthone – Villejust, France Global Technology Center

Cecile Mazard – Villejust, France Global Technology Center

Bill Brown – Mogadore, Ohio Pilot Plant

This global team built on OMNOVA's already robust oil/gas drilling chemical portfolio by developing new fluid loss control polymeric particles for extreme condition drilling muds. These products are designed to provide excellent fluid loss control and low formation damage in oil and synthetic based fluids (drilling and drill-in fluids, completion fluids, etc.) under extreme heat and pressure conditions that intensify as wells are drilled deeper.

Extending Pot Life of Coatings for Laminates (Monroe, NC)

Category: LEAN SixSigma Excellence

Milton Johnson – Monroe, North Carolina

Tim Van Allen – Monroe, North Carolina

William Nick Gusler, Jr. – Monroe, North Carolina

Ron Collette – Monroe, North Carolina

This team developed a unique coating technology with a longer shelf life that could be reused for multiple production runs without compromising performance. This has enabled the Monroe plant to reduce its raw material costs and significantly decrease waste – a goal for the facility as part of OMNOVA's Vision 2014 sustainability program.

GenCryl Pt® 9525 Paper Coating Latex

Category: New Product Development/Commercialization

Scott Sabourin – Field Technical Sales

Rick Ellenberg – Field Technical Sales

Mark Pomush – Green Bay, Wisconsin

John Westerman – Akron, Ohio Global Technology Center

This cross-functional team developed a unique paper coating latex to meet specific customer needs for production and performance. GenCryl Pt 9525 provides exceptional paper coating strength attributes while maintaining other key requirements, such as high-speed coater runnability, ideal surface properties and high print fidelity for digital printing applications.

OMNOVA Solutions is a technology-based company with 2011 sales of $1.2 billion and a global workforce of approximately 2,300. OMNOVA is an innovator of emulsion polymers, specialty chemicals, and decorative and functional surfaces for a variety of commercial, industrial and residential end uses. Visit OMNOVA Solutions on the internet at www.omnova.com.

GENCRYL PT is a registered trademark of OMNOVA Solutions.

SOURCE OMNOVA Solutions

Kemira announces global restructuring program "Fit for Growth" within the context of a new organization

Kemira Oyj announces a global restructuring program "Fit for Growth" to improve the company's profitability, internal efficiency and to accelerate growth in the emerging markets. The cost savings target with the planned program is EUR 60 million on an annualized basis once the program is fully implemented. The goal of the planned program is to reach Kemira Group's financial targets for revenue growth and EBIT margin. The growth target for Kemira is above 3% in the mature markets and above 7% in the emerging markets. Kemira's EBIT margin target is at least 10%. Non-recurring charges related to the "Fit for Growth" program are estimated to be around EUR 85 million. These charges are expected to be accounted for within the next four quarters.

The planned group-wide restructuring program is based on the following key measures:

- Reducing internal complexity by renewing and simplifying the organizational structure in order to foster accelerated growth, innovation and application focus

- Improving internal efficiency by reducing organizational layers and by placing substantial responsibility into the regions by implementing regional business units reporting to the segment heads with full profit and loss responsibility

- Optimizing and rebalancing the manufacturing network

The implementation of these measures may ultimately lead to the reduction of up to 600 positions globally, from which approximately 250 could be reductions in Finland. Kemira will initiate the co-determination negotiations according to each country's local legislation. Kemira had 5,181 employees worldwide at the end of June 2012.

Kemira will also consolidate its management structure. As of October 1, 2012, there will be one Management Board lead by the CEO. This Board will replace the previous Strategic Management and Business Management Boards. The Management Board is responsible for securing the long-term strategic development of the company. The members of the Management Board as of October 1, 2012 are listed in the attached chart.

"Since I assumed responsibility as the CEO of Kemira, my most evident key priorities for Kemira going forward are: improving profitability, accelerating growth in Asia and South America without sacrificing business opportunities in the mature markets and sharpening the strategy. We have started to work in all three areas. The second quarter results underlined the fact that these restructuring plans are needed in order to ensure sustainable profitability and competitive strength for Kemira," says Wolfgang Büchele, CEO of Kemira.

"I understand that these plans may affect people and their families, and we will support our people during these changes," says Wolfgang Büchele.

BASF confirms outlook for 2012 despite growing economic risks

- 2nd quarter 2012:

-

Sales up 6% and EBIT before special items up 11%

compared with previous year’s quarter - Strong business in Agricultural Solutions

- Significant decrease in growth in China

-

Sales up 6% and EBIT before special items up 11%

- Outlook full year 2012: increase in sales and earnings targeted

BASF’s business performed solidly in the second quarter. The company improved sales by 6% to €19.5 billion and income from operations (EBIT) before special items increased by €253 million to €2.5 billion. While sales volumes declined in the chemicals business, which comprises the Chemicals, Plastics, Performance Products and Functional Solutions segments, the main contribution came from the strong performance of the Agricultural Solutions and Oil & Gas segments. In the first half of 2012, sales were €40.1 billion, 6% more than in the same period of the previous year. At over €5 billion, EBIT before special items matched the level of the first half of 2011.

At the presentation of the company’s second-quarter results, Dr. Kurt Bock, Chairman of the Board of Executive Directors, commented on the growing economic risks: “Our customers are continuing to act cautiously and are reducing their inventories, also in expectation of falling prices due to declining raw material costs.” In addition, the Chinese growth engine has started to stall leading to a decrease in BASF’s sales in local-currency terms in Asia in the second quarter, as they also did in the first quarter of 2012, explained Bock.

BASF confirms outlook for full year 2012

A look at the economic developments in the past months and at the order books have led BASF to become more cautious about its expectations for the global economy in 2012 than originally expected at the beginning of the year (previous forecast in parenthesis):

- Growth of gross domestic product: 2.3% (2.7%)

- Growth in industrial production: 3.4% (4.1%)

- Growth in chemical production: 3.5% (4.1%)

- An average euro/dollar exchange rate of $1.30 per euro

- An average oil price of $110/barrel in 2012

BASF does not expect an upturn in demand in the second half of 2012 compared with the first six months of the year. Pressure on margins will continue, although it may be somewhat lessened due to slightly lower raw material costs.

Bock said: “It remains our goal to increase sales and earnings compared with the second half of 2011. Our forecast is especially supported by the resumption of our crude oil production in Libya. It is unlikely that the earnings from our chemicals business will match the level of the previous year. We still aim to exceed the 2011 record levels in sales and EBIT before special items.”

To counter the challenges of the markets and the great political and macroeconomic uncertainties, BASF wants to protect its margins and create value. The excellence program, STEP, announced in November 2011, which is expected to contribute around €1 billion to earnings each year as of the end of 2015, is fully on track. Measures will be accelerated and spending carefully analyzed. BASF is continuing to optimize its working capital, as is demonstrated by the good cash flow development in the second quarter. Although the company had planned a slight increase in its workforce in 2012, especially in emerging markets, it will slow this down due to the lack of visibility as to when business in Asia will pick up again.

Second-quarter business development in the segments

In the Chemicals segment, sales were slightly below the level of the previous second quarter, primarily due to lower sales volumes. Along with weaker demand, the optimization of the supply chain for steam cracker products, carried out in the third quarter of 2011, contributed to this decline in volumes. Sales to Styrolution Group companies had a positive impact on sales development for the segment. Earnings decreased significantly as a result of falling margins and the scheduled maintenance shutdown of several plants.

Sales in the Plastics segment surpassed the level of the second quarter of 2011. While sales volumes were weaker, positive currency effects in particular boosted sales growth. Lower margins for some basic products led to a significant decline in earnings.

Sales in the Performance Products segment grew slightly compared with the previous second quarter, largely as a result of positive currency effects. Sales volumes were lower. Increased raw material costs could not be fully passed on through higher sales prices. Earnings therefore declined due to lower margins and volumes.

Sales in the Functional Solutions segment increased. In addition to the inclusion of 50% of the Korean joint venture Heesung Catalysts Corporation, positive currency effects were particularly responsible for sales growth. This was partially offset by lower prices, especially in precious metals. Earnings did not match the level of the previous second quarter, primarily as a result of higher raw material costs.

Business was very successful in the Agricultural Solutions segment. Sales volumes increased in all indications and regions. Furthermore, higher sales prices and positive exchange rate effects contributed to significant sales growth. Earnings were also considerably above the level of the previous second quarter. At €833 million, EBIT before special items in the first six months of 2012 already exceeded the amount for the full year 2011 (€810 million).

Increased volumes as well as higher gas prices led to significant sales growth in the Oil & Gas segment. Volumes grew in natural gas trading due to greater demand on spot trading markets. After the suspension of production in Libya from February to October of the previous year, it was possible to continuously produce crude oil there throughout the second quarter of 2012. Earnings before tax therefore considerably exceeded the level of the previous second quarter. Net income in

Oil & Gas declined.

Other posted a decline in sales, largely as a result of the divestiture of the styrenic plastics business, which was contributed to the Styrolution joint venture as of October 1, 2011. Earnings in Other improved as a result of lower provisions for the long-term incentive program, while an expense had been incurred in the previous second quarter.

Business development in the regions

In Europe, sales increased by 9% in the second quarter of 2012. Volumes in the Agricultural Solutions and Oil & Gas segments grew significantly. Sales rose considerably in the Chemicals segment due to portfolio effects. EBIT before special items grew by €467 million to €1.9 billion, thanks to the higher contribution from the Oil & Gas and Agricultural Solutions segments.

In North America, sales in the second quarter fell by 15% in U.S. dollars and by 5% in euro terms. This was mainly the result of lower volumes due to plant shutdowns and the optimization of the supply chain for steam cracker products in the third quarter of 2011. Sales in the Agricultural Solutions segment grew in all indications thanks to high demand. Lower margins in the Petrochemicals division as well as higher fixed costs resulting from plant shutdowns led to a €127 million decline in earnings to €330 million.

Compared with the same period of 2011, sales in the Asia Pacific region were down 1% in local-currency terms and up 9% in euro terms. Positive currency effects more than offset reduced sales prices. Sales rose significantly in the Catalysts division, mainly due to higher sales volumes. Weaker margins, especially in the Petrochemicals division, led to a €57 million decline in earnings to €229 million.

Sales in the South America, Africa, Middle East region rose by almost 1% in local-currency terms and in euro terms. While the business with crop protection products was very successful, sales in the Catalysts division declined due to lower volumes. Earnings in the region decreased by €30 million to €54 million.

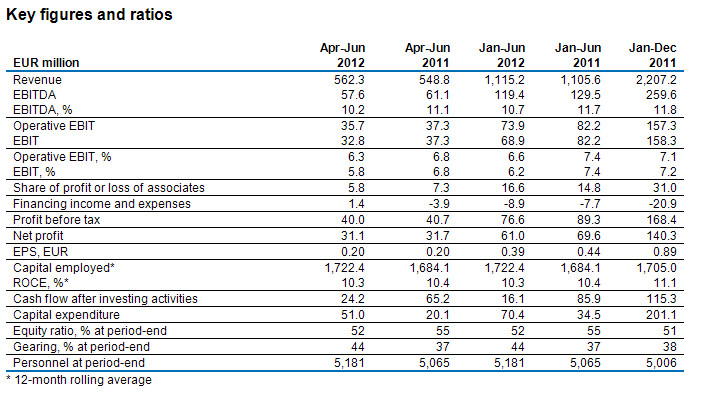

Kemira Oyj's Interim Report January-June 2012

Sales volumes and prices improved from Q1, fixed cost pressure continued

Second quarter:

- Revenue grew 2% to EUR 562.3 million (548.8) supported by favourable currency exchange.

- Operative EBIT decreased 4% to EUR 35.7 million (37.3) with a margin of 6.3% (6.8%) mainly due to higher fixed costs.

- Earnings per share remained at EUR 0.20 (0.20).

January-June:

- Revenue increased 1% to EUR 1,115.2 million (1,105.6).

- Operative EBIT decreased 10% to EUR 73.9 million (82.2) with a margin of 6.6% (7.4%).

- Earnings per share decreased 11% to EUR 0.39 (0.44).

- Kemira outlook for 2012 remains unchanged with expected revenue and operative EBIT in 2012 to be approximately at the same level as in 2011.

- To accelerate growth and improve profitability, Kemira has launched a global restructuring program "Fit for Growth" aimed to save EUR 60 million on an annualized basis.

Kemira's President and CEO Wolfgang Büchele:

"In the second quarter Kemira once again was able to compensate the lower sales volumes and higher raw material prices with sales price increases. In Paper, as well as in Municipal & Industrial, sales volumes recovered slightly. Fixed costs, however, continued to increase in all segments and resulted in a decrease in the operative EBIT. ChemSolutions operative EBIT decreased substantially mainly due to an extended maintenance shutdown of ChemSolutions' Oulu plant in Finland as well as higher variable costs.

After the first half of 2012, Kemira's operative EBIT is below the comparable period of 2011.

Our profitability is the fundamental issue we need to improve in order to continue to be a relevant player within the water quality and quantity management business, and to meet our guidance for 2012.

Therefore, Kemira announced today its global restructuring program "Fit for Growth" to improve the company's profitability, internal efficiency and to accelerate growth in emerging markets. The cost savings target with the planned program is EUR 60 million on an annualized basis. The ultimate goal of the program is to reach Kemira's financial targets in an accelerated mode. Revenue growth target for Kemira is above 3% in the mature markets and 7% in the emerging markets. Kemira's EBIT margin target is at least 10%.

The "Fit for Growth" restructuring program is based on the following measures:

- Reducing internal complexity by renewing and simplifying the organizational structure in order to foster accelerated growth, innovation and application focus.

- Improving internal efficiency by reducing organizational layers and by placing substantial responsibility into the regions by implementing regional business units reporting to the segment heads with full profit and loss responsibility.

- Optimizing and rebalancing the manufacturing network.

The implementation of these measures may ultimately lead to a reduction of up to 600 positions globally, from which approximately 250 could be in Finland. Kemira will initiate the co-determination negotiations according to each country's local legislation. Kemira had 5,181 employees worldwide at the end of June 2012.

Definitions of key figures are available at www.kemira.com > Investors > Financial information. Comparative 2011 figures are provided in parentheses for some financial results, where appropriate. Operating profit, excluding non-recurring items, is referred to as Operative EBIT. Operating profit is referred to as EBIT.

Outlook and restructuring program

Kemira's vision is to be a leading water chemistry company. Kemira will continue to focus on improving profitability and reinforcing positive cash flow. The company will also continue to invest in order to secure the future growth in the water quality and quantity management business.

Kemira's financial targets remain as earlier communicated. The company's medium term financial targets are:

- revenue growth in mature markets > 3% per year, and in emerging markets > 7% per year

- EBIT, % of revenue > 10%

- positive cash flow after investments and dividends

- gearing level < 60%.

The basis for growth is the expanding water chemicals market and Kemira's strong know-how in the water quality and quantity management. Increasing water shortage, tightening legislation and customers' needs to increase operational efficiency create opportunities for Kemira to develop new water applications for both current and new customers. Investment in research and development is a central part of Kemira's strategy. The focus of Kemira's research and development activities is on the development and commercialization of the new innovative technologies for Kemira's customers globally and locally.

Today, Kemira Oyj announced a global restructuring program "Fit for Growth" to improve the company's profitability, its internal efficiency and to accelerate growth in emerging markets without sacrificing business opportunities in the mature markets. The cost savings target with the planned program is EUR 60 million on an annualized basis. The ultimate goal of the program is to reach Kemira Group's targets for revenue growth and EBIT margin.

The program is based on the following measures:

- Reducing internal complexity by renewing and simplifying the organizational structure in order to foster accelerated growth, innovation and application focus.

- Improving internal efficiency by reducing organizational layers and by placing substantial responsibility into the regions by implementing regional business units reporting to the segment heads with full profit and loss responsibility.

- Optimizing and rebalancing the manufacturing network.

The implementation of these measures may ultimately lead to a reduction of up to 600 positions globally, from which approximately 250 could be in Finland. Kemira will initiate the co-determination negotiations according to each country's local legislation. Kemira had 5,181 employees worldwide at the end of June 2012.

Non-recurring charges related to the restructuring program are estimated to be around EUR 85 million. These charges are expected to be accounted for within the next four quarters.

In 2012, Kemira expects the revenue and operative EBIT to be at approximately the same level as in 2011. In the near term, an uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products in the customer industries. This guidance assumes current currency exchange rates and oil price level.

Financial calendar 2012 and 2013

Interim Report January-September 2012 October 24, 2012

Financial results for the year 2012 February 6, 2013

Interim Report January-March 2013 April 23, 2013

Interim Report January-June 2013 July 23, 2013

Interim Report January-September 2013 October 22, 2013

Clearwater Paper Reports Strong Second Quarter 2012 Results

Clearwater Paper Corporation has reported financial results for the second quarter of 2012.

The company reported net earnings of $21.5 million, or $0.91 per diluted share, for the second quarter of 2012, compared to net earnings of $13.9 million, or $0.59 per diluted share, for the second quarter of 2011.

Second quarter 2012 earnings before interest, taxes, depreciation and amortization, or EBITDA, was $64.2 million, compared to $52.4 million in the second quarter of 2011. Second quarter 2012 Adjusted EBITDA, which excludes approximately $1.0 million of legal expenses related to the attempt to enjoin delivery of the TAD tissue machine to the company's Shelby, North Carolina facility and a $1.0 million loss associated with the sale of legacy Cellu Tissue foam manufacturing assets, was $66.2 million.

"Strong Consumer Products and Pulp and Paperboard results produced record quarterly EBITDA," said Gordon Jones, chairman and chief executive officer. "In addition, cost savings synergies from our Cellu Tissue acquisition came in ahead of our estimates in the first two quarters of 2012, and our new paper machine facility in Shelby remains on budget and on time, with production expected to begin by year end."

The company repurchased 238,482 shares at a total cost of $7.5 million during the second quarter pursuant to its previously announced $30 millionshare buyback program. Since announcing the program in July 2011, the company has repurchased 571,782 shares at a total cost of $18.8 million for an average share price of $32.91.

SECOND QUARTER 2012 SEGMENT PERFORMANCE

Consumer Products

Net sales in the Consumer Products segment increased 5.2% to $283.1 million for the second quarter of 2012, as compared to second quarter 2011 net sales of $269.1 million, as a result of higher net selling prices and an increase in volumes. The $25.7 million of operating income for the second quarter of 2012 was approximately 275% higher as compared with the second quarter of 2011, primarily due to higher net sales and lower external pulp costs. Operating income for the second quarter of 2012 included a $1.0 million loss on the sale of legacy Cellu Tissue foam manufacturing assets.

- Tissue sales volume increased 3.3% to 132,978 tons in the second quarter of 2012 compared to the second quarter of 2011 due to consistent retail sales and increased parent roll sales.

- Net selling prices increased 2.0% to $2,129 per ton in the second quarter of 2012 compared to the second quarter of 2011 due to the segment's retail price increase that was implemented in the fourth quarter of 2011 and the first quarter of 2012, as well as sales mix improvements.

- The company has increased its expected 2012 cost savings from synergies related to the Cellu Tissue acquisition from $20 million to $28 million, with $6.7 million realized in the second quarter of 2012, and still expects that its annual run rate of cost savings from these synergies will be in the range of $35 to $40 million by the end of 2012.

Pulp and Paperboard

Net sales of $190.5 million for the second quarter of 2012 were down 15.5%, compared to second quarter 2011 net sales of $225.5 million. The decrease in net sales was primarily due to the sale of the company's Lewiston, Idaho sawmill in November 2011. In addition, there was a reduction in the sale of external pulp due to increased internal usage and lower paperboard volumes relative to the second quarter of 2011. Operating income for the quarter declined 7.1% to $32.0 million, compared to $34.5 million for the second quarter of 2011, primarily due to the decline in sales volumes partially offset by lower pulp, energy and transportation costs.

- Paperboard volumes declined 4.3% to 193,285 tons versus a record second quarter of 2011.

- Pulp net sales of $2.1 million were down $5.9 million versus the second quarter of 2011 due primarily to the increased internal usage of pulp produced by the company and a 30% decline in pulp sales prices.

Taxes

The actual income tax rate for the second quarter of 2012 was 39.2%, compared to 38.3% in the second quarter of 2011. Excluding discrete items, the effective tax rate in the second quarter of 2012 was approximately 35.3%. The estimated annual effective tax rate for 2012, excluding discrete items, is expected to be approximately 35.1%.

Note Regarding Use of Non-GAAP Financial Measures

In this press release, the company presents its results for the second quarter of 2012 and 2011, including EBITDA and Adjusted EBITDA. The EBITDA and Adjusted EBITDA amounts are not in accordance with generally accepted accounting principles (GAAP) and accordingly reconciliations of EBITDA and Adjusted EBITDA to net earnings determined in accordance with GAAP are included at the end of this press release.

For the full release and table follow here

Source: Clearwater Paper Corporation

CONFERENCE CALL INFORMATION

A live audio webcast and conference call will be held today, Wednesday, July 25, 2012, at 2 p.m. Pacific time (5 p.m. Eastern time). Investors may access the conference call by dialing 877-303-9241 (for U.S./Canada investors) or 760-666-3575 (for international investors). The audio webcast may be accessed on the company's website at http://ir.clearwaterpaper.com/events.cfm. An accompanying presentation including supplemental information will be available for downloading at the same site at 1 p.m. Pacific time (4 p.m. Eastern time). The webcast will be audio only. Investors are recommended to download the accompanying presentation prior to the call.

For those unable to participate in the call, an archived recording will be available through the Clearwater Paper Corporation website www.clearwaterpaper.com under "Investor Relations" following the conference call.

Mondi presents its digital printing papers at Cross Media

Mondi presents its digital printing papers at Cross Media, 3rd-4th September, London, UK.

The Cross Media exhibition brings together printers, agencies and businesses interested in multi-media platforms for marketing campaigns and business opportunities. Mondi will showcase Color Copy, DNS®, and NAUTILUS® brands optimised for digital printing technologies and variable data printing applications.

Vienna, July 25th 2011 – The newly expanded digital printing portfolio from Mondi will be presented in the UK at the Cross Media exhibition in London from 3rd-4th September 2012 on stand 31. “Cross Media is an excellent opportunity for Mondi’s digital printing experts to speak directly with printers, marketers and agencies about their digital printing needs, the technologies they use, and types of print applications they require. In 2010, we began hosting Digital Specialists Forums across Europe to keep our customers informed about new developments in digital printing, and new applications using bridging technologies and cross-media marketing; therefore, we see Cross Media as a valuable initiative for businesses.”

This year Mondi launched a new professional printing campaign to highlight its papers tailored to specific digital printing technologies. Over the past two years the paper producer has further expanded its professional portfolio to include digital printing papers for digital dry toner, HP Indigo, high-speed inkjet, and hybrid printing technologies. At Cross Media, Mondi will be showcasing the well-known digital printing papers Color Copy, 100% recycled NAUTILUS® SuperWhite and DNS® high-speed inkjet — a more recent development by Mondi for the burgeoning high-speed inkjet market. Eco-conscious businesses at Cross Media will also be interested to know that Color Copy is a fully CO2 neutral paper and NAUTILUS® SuperWhite and DNS® high-speed inkjet are available with a CO2 neutral option.

This year Mondi launched a new professional printing campaign to highlight its papers tailored to specific digital printing technologies. Over the past two years the paper producer has further expanded its professional portfolio to include digital printing papers for digital dry toner, HP Indigo, high-speed inkjet, and hybrid printing technologies. At Cross Media, Mondi will be showcasing the well-known digital printing papers Color Copy, 100% recycled NAUTILUS® SuperWhite and DNS® high-speed inkjet — a more recent development by Mondi for the burgeoning high-speed inkjet market. Eco-conscious businesses at Cross Media will also be interested to know that Color Copy is a fully CO2 neutral paper and NAUTILUS® SuperWhite and DNS® high-speed inkjet are available with a CO2 neutral option.

All Mondi-branded papers are now part of the company’s Green Range of sustainably produced papers that FSC® or PEFC™ certified, or 100% recycled or TCF (Totally Chlorine Free bleached).

More information about Mondi’s complete digital printing paper portfolio is available at: www.mondigroup.com/printing

A drop in demand for woody biomass in the US

A drop in demand for woody biomass in the US reduced biomass prices in the South, Northeast and the West during the 2Q/12, reports the North American Wood Fiber Review

Prices for mill and forest biomass fell in most major consuming regions of the US in the 2Q/12, according to the North American Wood Fiber Review. The main reason for the declining prices is the continued fall of natural gas prices to levels not seen in ten years

The full article can be found in the attached PDF file Below....

Finch Paper and Omya Structure Long-Term Partnership to Drive Innovation

Finch and Omya to expand process capabilities in the Glens Falls mill; business agreement expected to expand grade lines well into the future

Finch Paper, a dynamic uncoated paper company, has announced a long-term supply agreement with Omya, a leading manufacturer Precipitated Calcium Carbonate (PCC).

The Finch mill, established in 1865, has a long history of manufacturing innovation. Its integrated infrastructure has allowed Finch to capitalize on integrated processes which in turn improves quality control and financial performance. Finch Paper was one of the first paper mills to construct its own PCC plant in 1984, and now looks to Omya’s technological advancements and process capabilities to accelerate their success in new markets.

Omya is a leading global producer of industrial minerals derived from calcium carbonate.

Paper being just one of their major markets, Omya operates nearly two dozen PCC plants in paper mills around the world. Finch Paper President and CEO Joseph Raccuia said “Omya has developed proprietary operating techniques that, combined with new investments we are making in our own plant, will take our operations to a whole new level.”

In a unique arrangement, the experienced team of Finch employees will continue to operate the PCC plant. Omya employees will be on-site on a regular basis, training the Finch Paper PCC team in these advanced operating practices. Omya Regional Sales Manager Tim Bradley said “Our organization is dedicated to finding solutions that increase the viability of the paper mills across the U.S.” The strategic partnership, built upon a mutual respect, is a key advancement within both companies’ business strategy.

“The Finch operators not only understand PCC, but also have an intimate knowledge of the papermaking process,” Tim Bradley said. “Their holistic approach is a definite advantage in terms of quality, speed and cost.”

Precipitated Calcium Carbonate is used to fill gaps between the fiber in a sheet of paper.

The “filler” contributes to important paper characteristics such as brightness, opacity, and bulk. PCC is formed by adding carbon dioxide gas to lime and water. Producing its own PCC is more economical for Finch than buying this ingredient, but also enables the company to capture and re-use 50 million pounds per year of carbon dioxide from its Power Plant rather than emitting the greenhouse gases into the air.

PCC can be formed in a variety of particle sizes with varying surface characteristics to produce specific paper properties. The collaborative effort of Omya and Finch will augment the mill’s ability to produce tailored solutions and further supports Finch’s growth in the emerging transactional-promotional and print-on-demand book segments.