Ianadmin

Sonoco "Delivering on the Promise" at Pack Expo International 2012

Through the years, Sonoco (NYSE: SON) has built its reputation on its ability to deliver innovative packaging and high-quality service to customers worldwide. While these objectives will always remain top priorities, the Company is working harder than ever to better understand customers' opportunities and respond to their needs in several key impact areas.

"The idea behind 'Delivering on the Promise' is that we work to better understand the needs of our customers beyond manufacturing expectations," said Jack Sanders, Sonoco president and chief operating officer. "We work very hard at customer engagement – talking with them about their needs for shelf presence, product protection, visibility and security, and even recycling. Overall, this concept provides impact to our customers and helps satisfy their needs in a way that our competition will be challenged to match."

At Pack Expo International 2012, Sonoco will showcase how it differentiates itself from its packaging peers by delivering expertise and solutions in 12 impact categories that customers have indicated are valued in their businesses. These categories include:

Interactive Package Development – Next-generation packaging, including products for dosing and dispensing, packages with easy-open and reclose features and promotional ink technologies for film and paper laminates.

Right-size Packaging – Optimized packaging solutions for specific customer needs, ensuring the right amount of packaging – no more, no less.

Product Protection – Ultimate in product protection and cost management using a full range of materials – paper, foam, molded and formed plastics, wood or steel.

Shelf Appeal – Packaging and displays that deliver a clear brand message and cause shoppers to stop and take notice.

Convenience – Convenience features across a variety of packaging platforms: easy open and reclose, trays for microwaving or steaming and formats for portion control.

Product Safety – A commitment to developing packaging that delivers products to consumers safely – without damage or contamination.

Retail Merchandising – Delivering comprehensive, scalable, turn-key program management from high-impact packaging and display design through retail execution.

Theft Deterrence – Innovative and reliable theft-deterrent solutions and damage protection though blister packaging, radio frequency clamshell packaging, fusion sealing and electronic security labeling.

Temperature Assurance – Packaging for safe and efficient transport of temperature-sensitive products.

Total Solutions – A proven approach setting the industry standard for innovative, consumer-preferred products and seamless, single-source service.

Recycled Content/Recycling – An integrated system focused on creating value through community curbside collection, material recovery facilities, recycled paperboard mills and a broad range of expertise in use of recycled materials.

Recycling and Landfill Diversion – Expert service and customized recycling solutions to help customers achieve sustainability goals.

Pack Expo attendees are invited to learn more about Sonoco by visiting the Sonoco exhibit at Booth #S–1562 in the South Hall of McCormick Place. For additional information about Sonoco or its daily Pack Expo activities, visit our website at www.sonoco.com/packexpo2012.

SOURCE Sonoco

Metso's automation to control a new biopower plant in Hämeenkyrö, Finland

Modern automation technology and sophisticated reporting applications contribute to higher energy efficiency and sustainability at a biopower plant.

The new biopower plant built by Pohjolan Voima, Leppäkosken Sähkö and Metsä Board in Hämeenkyrö, Finland, is extensively controlled with automation supplied by Metso. Inaugurated on October 9, 2012, it is Pohjolan Voima's 15th biopower plant.

Located on Metsä Board's Kyro board and paper mill site, the biopower plant has an electricity capacity of 12 MW and a thermal capacity of 55 MW. It produces electricity and heat for the Kyro mill and district heat for the customers of Leppäkosken Sähkö. The plant runs on wood residues and other wood fuels. Peat is used as a support fuel. The CO2 emissions will be reduced by approximately 100,000 metric tons annually due to the use of domestic fuels instead of natural gas.

Metso supplied a Metso DNA automation system as a complete turnkey package to the plant, including all the stages from engineering to commissioning. Automation is used to control the fluidized bed boiler and the related fuel reception and handling systems. The new boiler has replaced the old natural gas-fired power plant that was controlled with Metso's Damatic XD automation system.

Metso supplied a Metso DNA automation system as a complete turnkey package to the plant, including all the stages from engineering to commissioning. Automation is used to control the fluidized bed boiler and the related fuel reception and handling systems. The new boiler has replaced the old natural gas-fired power plant that was controlled with Metso's Damatic XD automation system.

The automation system features high user friendliness. For example, the Metso DNA Trend and Event Archive tool gives the operators access to trend and event history straight from the operator interface. The Metso DNA Information Management system, in turn, includes extensive data collection as well as process performance and emissions control. There are also efficient tools for analyzing disturbances.

Reporting plays a major role in ensuring high plant efficiency. For example, the Metso DNA Solid Fuel Data Management application allows an accurate follow-up of biomass quality and energy content. The shareholder reporting allots the plant's production, consumption and CO2 emissions among the shareholders. The planning of plant operation is supported by an application that calculates electricity production forecasts per shareholder.

The plant condition and operation monitoring has been integrated into the automation system. With the Metso DNA Machine Monitoring application and advanced analysis tools, the staff is able to monitor and analyze the mechanical condition of critical plant equipment, such as the most important pumps and blowers as well as the turbine generator. Thanks to the monitoring, it is possible to foresee and notice equipment damage in good time so that maintenance work can be carried out during planned shutdowns.

Pohjolan Voima produces electricity and heat for its 21 shareholders with hydropower, thermal power and nuclear power. Its shareholders include Finnish export industry companies, energy companies and cities. At the end of 2011, Pohjolan Voima's electricity production capacity totaled 3,510 MW, which represents about 20% of Finland's total electricity production. In 2011, the company's net sales amounted to EUR 1.3 billion, and it employed an average of 487 people.

Leppäkosken Sähkö Group is a versatile energy service company that provides its customers with electricity, district heat and natural gas services and solutions. The parent company, Leppäkosken Sähkö Oy, acts as a distribution network operator in the municipalities of Ikaalinen, Jämijärvi, Kihniö, Parkano, Hämeenkyrö and Ylöjärvi. The Group's subsidiary, Leppäkosken Energia Oy, provides district heat for Ikaalinen, Parkano, Hämeenkyrö, Äetsä in Sastamala and the Ylinen area in Ylöjärvi, as well as distributes natural gas in Ikaalinen. The Group also sells electricity to all parts of Finland. In 2011, its net sales amounted to EUR 36.8 million, and it employed 87 people.

Metsä Board is Europe's leading producer of folding boxboard, the world's leading manufacturer of coated white-top kraftliners, and a major paper supplier. It offers premium solutions for consumer and retail packaging, graphics and office end-uses. Its sales network serves brand owners, carton printers, corrugated packaging manufacturers, printers, merchants and office suppliers. Metsä Board is part of Metsä Group. In 2011, its annual sales totaled EUR 2.5 billion, and it had about 3,600 employees.

Charges laid in fatal explosion at Terrace Bay Pulp

Terrace Bay Pulp, a mechanical contractor, and three individuals are facing charges in connection with a fatal explosion at the pulp mill last October.

T.J. Berthelot was killed in the explosion.

According to CBC.ca, Terrace Bay Pulp and Venshore Mechanical are charged for failing to ensure a tank being worked on was free of an explosive or flammable substance

The three individuals face similar charges. All are charged under the Occupational Health and Safety Act.

A local news site, Chroniclejournal.com, reports that the charges specify the tank was being worked on without “adequate instructions (being) given to a worker performing welding-related work on a cracked tank that normally contains a hazardous substance.”

A few months after the explosion, Terrace Bay Pulp became insolvent. The mill was sold in 2012 to Aditya Birla Group, and restarted. The new owner has not been charged.

News source : http://www.pulpandpapercanada.com

Smart packaging – filled with baby food!

This was the winning entry in this year’s Billerud design competition SPICE: 12 at Berghs School of Communication in Stockholm.

This is the third year in succession that Billerud, the design agency NINE and Berghs School of Communication have organised the SPICE (Sustainable Packaging & Innovation Communication Event) design competition.

Over the course of six weeks, 12 teams of students of graphic design and project management have been working on this year’s challenge – to improve food company Semper’s existing baby food packaging and associated storage jars.

”It’s been a really exciting journey to follow the work of the students. And the results have exceeded all my expectations; to come up with such well thought-out and exciting design concepts in such a short time is impressive,” says Marina Eriksdotter, Group Brand Manager at Semper.

The proposal the jury liked best came from Emma Fällman, Jesper Olsson, Kajsa Jacobsen and Louise Persson. “This is a concept that went the whole way. A fresh approach to the development of packaging, really delightful illustrations and a presentation video on the contentment of baby food that went straight to the heart,” commented the jury.

The proposal the jury liked best came from Emma Fällman, Jesper Olsson, Kajsa Jacobsen and Louise Persson. “This is a concept that went the whole way. A fresh approach to the development of packaging, really delightful illustrations and a presentation video on the contentment of baby food that went straight to the heart,” commented the jury.

“We began with Semper’s symbols: the red colour, the child. The emotional expression. And then we built on them,” says Kajsa Jacobsen and Jesper Olsson.

For the students the presentation to the jury was the finale to a hectic period that included a visit to Gruvön, Billerud’s paper mill, and talks on Billerud’s fibre-based products.

“The importance of product packaging is growing all the time. SPICE fits in well with Billerud’s customer offer: to develop smart, sustainable, value adding packaging. It gives us a unique opportunity to build a close relationship between the designers of the future and our products,” says Jimmy Nyström, Business Development Director at Billerud.

First prize now awaits the winning quartet – an inspiring journey to Berlin. All the prototypes and presentations will be featured in an exhibition at Semper’s headquarters in Sundbyberg.

“Then we will sit down in peace and quiet and think about how to proceed with all the ideas we have gained from the SPICE project,” says Marina Eriksdotter.

Ahlstrom revises its organization

![]() Ahlstrom, a global high performance materials company, announced that it will revise its organization to accelerate growth. The current operating model will remain unchanged. The new organization will become effective as of January 1, 2013.

Ahlstrom, a global high performance materials company, announced that it will revise its organization to accelerate growth. The current operating model will remain unchanged. The new organization will become effective as of January 1, 2013.

Ahlstrom currently has four business areas: Building and Energy, Filtration, Food and Medical and Label and Processing. As announced earlier, the specialty paper business operated under the Label and Processing business area is planned to be combined with Munksjö AB and the transaction is scheduled to be completed in two steps during the first and second quarter of 2013.

To enable stronger focus on the filtration markets, the current filtration business area will be divided into two business areas: Transportation Filtration and Advanced Filtration.

Ahlstrom's new business areas as of January 1, 2013 will be the following:

Building and Energy: One of the leading players globally for materials used in wallcoverings, floorings and windmill blades.

Transportation Filtration: Global leader in transportation filtration materials.

Advanced Filtration: Global leader in life science and laboratory filtration materials.

Food and Medical: One of the leading players globally for materials used in teabags, food packaging, masking tape and medical gowns and drapes.

These four business areas will form the new reporting segments in Ahlstrom's financial reporting. Subject to the approval by the Extraordinary General Meeting of the demergers of Ahlstrom Corporation on November 27, 2012, the Label and Processing business area will be reported as part of discontinued operations.

Changes in the Executive Management Team

In connection with the change in the business area structure, the following changes will be made in Ahlstrom's Executive Management Team:

Tommi Björnman, Executive Vice President, Filtration, has decided to resign from Ahlstrom to pursue other career opportunities. He will continue in his current role until the end of the year.

Tommi Björnman joined Ahlstrom in 1996 and has been a member of the Executive Management Team since 2005. Ahlstrom thanks Tommi Björnman for his valuable contribution during his long career with the company.

Fulvio Capussotti (40), M.Sc. (Chem. Eng.) has been appointed Executive Vice President, Advanced Filtration, and a member of the Executive Management team. He will report to Jan Lång, President and CEO, as of January 1, 2013.

Fulvio Capussotti has been working with Ahlstrom since 2002 in various senior management roles. He currently leads the Advanced Filtration Business Unit.

The Executive Vice President, Transportation Filtration, also a member of the Ahlstrom Executive Management Team, will be appointed in the near future.

Vacon Plc Interim Report 1 January - 30 September 2012

In this stock exchange release Vacon is publishing information included in the interim report that has a significant impact on the value of securities. The full interim report is in the appendix to this release and can be downloaded from the company's website in Finnish at www.vacon.fi and in English at www.vacon.com.

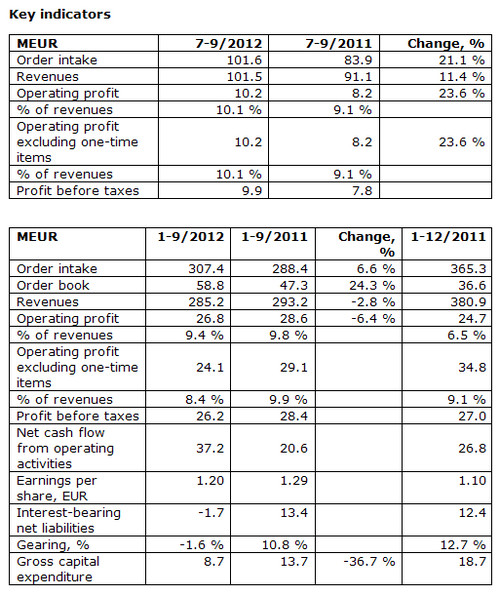

July-September summary:

- Order intake totalled MEUR 101.6 (MEUR 83.9), an increase of 21.1 % from the corresponding period in the previous year.

- Revenues totalled MEUR 101.5 (MEUR 91.1), an increase of 11.4 %.

- Operating profit was MEUR 10.2, or 10.1 % of revenues, (MEUR 8.2 and 9.1 %), growth of 23.6 %.

- Net cash flow from operating activities was MEUR 17.4 (MEUR 19.8).

- Earnings per share were EUR 0.45 (EUR 0.36), an increase of 25.8 %.

January-September summary:

- Order intake totalled MEUR 307.4 (MEUR 288.4), an increase of 6.6 % from the corresponding period in the previous year.

- Revenues totalled MEUR 285.2 (MEUR 293.2), a decline of 2.8 %.

- Operating profit was MEUR 26.8, or 9.4 % of revenues (MEUR 28.6 and 9.8 %), a decline of 6.4 %.

- Net cash flow from operating activities was MEUR 37.2 (MEUR 20.6).

- Earnings per share were EUR 1.20 (EUR 1.29), down 7.1 %.

General review

Vacon's business developed positively during the third quarter of 2012. Orders, revenues and operating profit increased considerably from the corresponding period in the previous year. The company's profitability, measured in terms of the operating profit percentage, also improved. During the year, Vacon has succeeded in increasing sales to several industrial sectors and consequently succeeded in compensating the sharp fall in the sales of products for renewable energy production.

Growth in Vacon's orders and revenues was strong in the third quarter and in the January - September period especially in China and North America.

Orders received in July - September totalled EUR 101.6 (83.9) million. Orders in the first nine months of the year totalled EUR 307.4 (288.4) million. The order book rose by EUR 22.3 million from the beginning of the year, standing at EUR 58.8 (47.3) million at the end of the period.

Vacon had revenues in the July - September period of EUR 101.5 (91.1) million. Revenues increased 11.4 % from the corresponding period in the previous year. Revenues in January - September were EUR 285.2 (293.2) million, a decline of 2.8 % from the corresponding period in the previous year.

Vacon's revenues rose during the third quarter in line with expectations. January - September revenues were lower than in the period for comparison, which was due to weak demand for products designed for the generation of renewable energy. During the year the company has however succeeded in raising its revenues in other industrial sectors, such as building automation and the marine industries.

Operating profit in July - September was EUR 10.2 million, or 10.1 % of revenues (EUR 8.2 million and 9.1 %). Factors contributing to the improvement in profitability were the increase in revenues in the third quarter, control of costs and savings in material costs. Growth in profitability was restricted however because sales focused on low power equipment.

The operating profit in January - September totalled EUR 26.8 million, or 9.4 % of revenues (EUR 28.6 million and 9.8 %).

The company's balance sheet remained strong and the net cash flow from operating activities was EUR 17.4 million in the third quarter, a decline of EUR 2.4 million from the corresponding period in the previous year. Net cash flow from operating activities in the January - September period totalled EUR 37.2 (20.6) million. Interest-bearing debt at the end of September totalled EUR 22.9 million, but the net debt was negative, EUR -1.7 million. Thanks to the strong net cash flow from operating activities the company's gearing was -1.6 % (10.8 %).

Prospects for 2012

In Vacon's estimation, there are still uncertainties relating to general growth prospects in the economy, and these may affect demand for AC drives in Europe and possibly globally as well. However, Vacon expects demand for products to control electric motors to remain at a good level in many industrial sectors in the final quarter of 2012. Vacon estimates that orders for products for wind power generation will improve slightly in the second half of 2012 from the first half of the year, but order volumes for the whole year will be clearly below their level in 2011.

Market guidelines for 2012

Vacon is retaining the market guidelines for 2012 that it published earlier. Vacon estimates that its revenues will increase and the operating profit percentage excluding one-time items will improve from 2011. In 2011 revenues were EUR 380.9 million and the operating profit percentage excluding one-time items was 9.1 %.

Vacon's target is to achieve revenues of EUR 500 million in 2014. The profitability targets for 2014 are an operating profit of 14 % and a return on equity of more than 30 %.

Formal statement

This release contains certain forward-looking statements that reflect the current views of the company's management. Due to the nature of these statements, they contain risks and uncertainties and are subject to changes in the general economic situation and in the company's business sector.

Stora Enso plans profitability improvement actions across all Business Areas

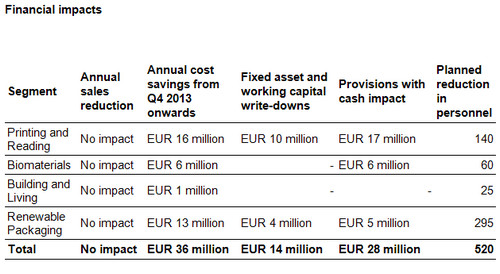

Stora Enso plans restructuring of its operations through the permanent shutdown of paper machine 1 at Hylte Mill in Sweden and the permanent closure of the corrugated packaging plant at Ruovesi in Finland. In addition, Stora Enso plans efficiency improvements at several other mills. The profitability improvement actions are planned to reduce annual costs by EUR 36 million and reduce the number of employees by approximately 520 altogether. Stora Enso will record a restructuring provision and a fixed asset and working capital write-down as non-recurring items totalling approximately EUR 42 million related to the restructuring plans in the fourth quarter 2012 operating profit.

Printing and Reading plans to close capacity in Sweden

Stora Enso plans the permanent shutdown of paper machine (PM) 1 at Hylte Mill in Sweden with annual capacity 180 000 tonnes of newsprint by the end of the fourth quarter of 2012 due to structural weakening of newsprint demand in Europe. The planned closure and other efficiency improvements would affect approximately 140 employees at Hylte Mill.

Renewable Packaging streamlines operations in Finland, Sweden and Poland

Stora Enso plans permanent closure of the corrugated packaging plant at Ruovesi in Finland in the second quarter of 2013 due to decreased demand for offset-printed corrugated packaging in Finland and poor financial performance of the plant. Stora Enso plans to serve Finnish offset customers through its other offset plants in Europe. The planned closure would affect approximately 60 employees at Ruovesi.

It is also planned to streamline operations at the Heinola, Ingerois and Pori board plants in Finland and corrugated packaging operations at all the Swedish units to ensure long-term competitiveness. The plans would reduce the number of employees in Sweden and Finland by up to 100 altogether mostly by the end of the third quarter of 2013.

In addition, Stora Enso plans the permanent shutdown of board machine (BM) 2 at Ostrołęka Mill in Poland as announced earlier. BM 2 is reaching the end of its technical lifetime. The shutdown of BM 2 and related technical functions is planned by the end of 2012. Including the effects of an overall review of Polish board and converting operations, the number of employees in Poland would decrease by up to 135 altogether.

Biomaterials efficiency improvement plans

Stora Enso plans to improve efficiency at Skutskär Pulp Mill in Sweden to reduce costs and improve the mill’s competitiveness in response to the challenging market environment. The plans would reduce the number of employees at Skutskär Mill by approximately 60 mostly by the end of Q3 quarter of 2013.

Building and Living plans to improve flexibility

Building and Living plans to improve flexibility and reduce costs at the Ala and Gruvön sawmills in Sweden and Varkaus Sawmill in Finland from the first quarter of 2013. The restructuring plans would affect approximately 25 employees at the Ala, Gruvön and Varkaus sawmills.

No decisions regarding closures and employee reductions will be taken until the local co-determination negotiations have concluded. Stora Enso would make every effort in co-operation with local communities to help the affected personnel find new employment opportunities, and all job openings in other Stora Enso units would be available to those affected.

Stora Enso CEO Jouko Karvinen and CFO Karl-Henrik Sundström comment on third quarter 2012 results

CEO Jouko Karvinen comments on the third quarter and company transformation:

“We finished the third quarter as we promised, and a little more. Markets overall varied from weak in Europe in printing and reading and wood products, to a mixed picture in renewable packaging. We finished the quarter at the upper end of our earnings expectations, and most important kept the cash generation rock solid as demonstrated by the improved quarter-end liquidity of EUR 1.7 billion,” says CEO Jouko Karvinen.

“This is a path we must continue to move on with accelerating speed. Today’s announcements of new profitability action plans across all businesses will be difficult for our people, but also a prerequisite for implementing our transformation in a responsible way. The weak performance of Building and Living is clear evidence that we have much more to do.

“The growth investments at Skoghall, Ostrołęka and Montes del Plata are reaching their final months and quarters of completion – living proof points of the transformation of Stora Enso into a value-creating renewable materials growth company. In parallel, we continue the planning for our China investment, as we do planning integration of our new joint venture in Pakistan.”

Stora Enso’s new CFO Karl-Henrik Sundström comments on continuous improvement, speed of execution and risk mitigation:

“We want to be masters of our own destiny and therefore plan to take capacity action in media-driven European paper markets with overcapacity and a structural and cyclical decline of around 6% annually right now, and 4–6% in the coming years. We cannot afford to wait for a transformation in our markets, we need to act as we have done previously.

“We have maintained strong cash generation and secured all of our short-term maturities through a number of bond transactions. We have today a robust liquidity position and have covered all of our maturities until the end of 2014. In addition, we have today announced plans to further reduce costs and improve productivity, partly in response to the weak and uncertain economic growth in Europe. This is prudent as well as responsible.

“The profitability improvement action plans will not be easy since they will affect a number of businesses that have been impacted before, and will intensify some of the issues in this very hard hit European industry. To transform our company, we must redirect the deep knowledge we have in production and development to products and markets that will offer value-creating growth. This will not be an overnight process but the essence of our ongoing journey.

“As a company we are fortunate to have created a stable cash generating business in Europe, which we will use to finance the transformation our business. The most important task for us is to ensure that for years to come we continue to have the best cash engines in Europe, which means de-risking our transformation by a cost-efficient and profitable Printing and Reading business in Europe, a very efficient balance sheet and ample liquidity.”

Stora Enso to examine the possibility of selling Corbehem Mill in France

Stora Enso will examine the possibility of selling Corbehem Paper Mill in France. The annual capacity of the mill is 330 000 tonnes of light-weight coated magazine paper. Employee organisations and other stakeholders will be fully involved in any process in compliance with the French regulations.

Weak economy and strong krona have negative impact on Södra's results

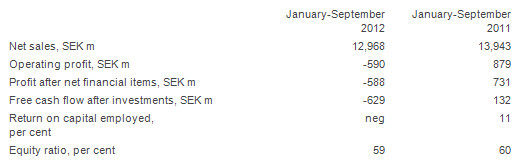

A weak international economic situation and massive fluctuations in currency exchange rates have adversely affected the markets for Södra's primary products and contributed to a negative result for the first three quarters of the year.

However, price levels have stabilised on the pulp market and a price increase was implemented in October.

Södra's operating profit for the first nine months of the year amounted to SEK -590 million, compared with SEK 879 million for the same period last year. Profit after net financial items amounted to SEK -588 million. The corresponding figure last year was SEK 731 million. Net sales over the first three quarters of the year amounted to SEK 12,968 million, SEK 975 million lower than for the same period last year.

The weak economic situation and concern about the euro have led to continued weak demand in Europe. As a result, 2012 has been characterised by weak development on the markets for Södra's products. Production in Södra's mills has also fallen as a result of stoppages at the start of the year. Reported results also include non-recurring items.

"We have decided to implement a number of measures to strengthen our earning capacity. These measures, combined with Södra's strong financial position, place us in a favourable position from which to deal with the challenges we face on our markets. We are also seeing signs of gradual improvement in the pulp market in particular," said Gunilla Saltin, acting Group President and CEO of Södra Cell.

A decision was made in August to liquidate Södra's holding in the Follafoss pulp mill, Norway. This mill produces CTMP (chemi-thermomechanical pulp) which has a variety of uses including paperboard and tissue production. The mill will be closed down on 1 November unless a new owner is found.

In September, a decision was made to make 260 people redundant at the company's Swedish operations. This measure will affect all business areas, and staff at all levels. Negotiations with the trade unions have begun.

Södra is also continuing to seek out new market segments. One such example is the launch of a new brand, Move Home, by Trivselhus in October. This new concept, which the company is using to target a younger customer category, offers quality homes at lower prices.

Paper pulp

Falling pulp prices in USD are affecting profitability in the pulp business. However, price levels stabilised in September, with the price of softwood sulphate pulp being increased to USD 790 per tonne in October. Further price increases are to be expected. Production at Södra's pulp mills was down slightly on the same period last year.

"We can see that the pulp market has strengthened. A price increase has taken place in October, and world stocks are at a good level. Therefore, we are of the opinion that the outlook for market pulp will improve gradually," commented Saltin.

Timber products

European consumption of timber products remains low and the market is still weak. Production at Södra's sawmills was slightly lower over the first three quarters of the year compared with the same period last year.

"Profitability at the sawmills is characterised by a sawn timber product market that remains weak. At the same time, our competitiveness is being affected by the strengthening of the krona against the euro, and by high raw material costs in relation to the price of finished products," said Saltin.

Interior products

The market for interior products is also being affected by the poor economic situation. Södra Interiör's main markets are characterised by reduced volumes and prices that are being forced down.

"The general economic decline and concern about the Eurozone's stability are contributing to reduced consumption in Europe. This is affecting us because Europe is our most important market," Saltin added.