Ian Melin-Jones

Clariant launches two new products to supplement its Deposit Control range

Clariant offers papermakers new deposit control solutions with the addition of Cartaspers® SCH and Cartabond® DST.01 to its range. The extended portfolio has been developed specifically to improve machine cleanliness and runnability when wastepaper is used as a raw material in the papermaking process.

Cartaspers® SCH makes use of nano-technology to introduce trillions of tiny polymer particles into the wet-end of a paper machine system. The emulsion particles, which are hydrophobic in nature, are derived from a very hard (high melting point) polymer. In a typical wet-end environment, the tiny polymer spheres associate themselves with other hydrophobic components in the pulp slurry.

Cartaspers® SCH works through a mechanism of passivation, combining with pressure sensitive adhesives, latex binders, pitch and all other potential “stickie” contaminants, to give them a hard protective shell, which prevents agglomeration and reduces the tendency of stickies to foul machine clothing. The increased softening point of the passivated stickies helps prevent “picking” in the drying section and the transfer of contaminant to the hot cylinders is significantly reduced. Addition levels of Cartaspers® SCH are aligned with the degree of stickie contamination and the product is applicable to mills using wastepaper but also virgin fiber as a raw material.

Cartabond® DST.01 is a low charge cationic polymer solution designed to reduce turbidity in the wet-end circuits, without impacting on backwater or fiber charge. Micro-stickies are transferred onto fibers without significantly increasing particle size, unlike the traditional high-charge polyamine coagulants which are known for creating agglomerated secondary stickies; much larger particles responsible for machine contamination and sheet quality problems. Primarily, but not exclusively, for Tissue grades, the Cartabond® DST.01 polymer is rich in hydrogen bonding groups and has been proven as a dry strength additive. The product therefore provides dual functionality and replaces both the coagulant and dry strength resin.

These new products join the patented and recently launched Cartaspers® PSM in Clariant’s Deposit Control range. Cartaspers® PSM provides protection for machine wires and felts, in the form of a hydrophilic coating, which prevents the adhesion of stickies. Added to the shower water, Cartaspers® PSM modifies the surface energy of the fabric monofilaments and ensures a continuous hydrophilic barrier, so that stickies are rinsed away before they can build up on machinery. With this new technology, solvent cleaning of machine clothing is hardly ever required.

The complementary additions to Clariant’s range of deposit control solutions, with the launch of Cartaspers® SCH and Cartabond® DST.01, address a key challenge facing Papermakers; the efficient use of wastepaper, in the papermaking process.

Noss to Supply Dissolving Pulp System to Lessebo Mill, Sweden

VIDA PAPER , Lessebo mill, Sweden, will commence production of dissolving pulp. Due to the need for improved pulp cleaning, the mill has chosen Noss AB, Sweden as supplier for cleaning equipment. The mill has decided to install a RADICLONE hydrocyclone system for cleaning and thickening. The NOSS RADICLONE is a well proven concept, which is used when the demands for cleanliness are in the high or very high range. Also included in the delivery is a RADISCREEN-C protection screen.

VIDA PAPER , Lessebo mill, Sweden, will commence production of dissolving pulp. Due to the need for improved pulp cleaning, the mill has chosen Noss AB, Sweden as supplier for cleaning equipment. The mill has decided to install a RADICLONE hydrocyclone system for cleaning and thickening. The NOSS RADICLONE is a well proven concept, which is used when the demands for cleanliness are in the high or very high range. Also included in the delivery is a RADISCREEN-C protection screen.

VIDA PAPER belongs to VIDA AB, which is Sweden´s largest privately owned sawmill company. VIDA PAPER is producing sulphite pulp as well as white and natural coloured uncoated premium paper. The company also produces coloured uncoated wood free paper and wood free digital paper. VIDA PAPER is a leading supplier of coloured paper within Europe. Pulp and paper is produced at Lessebo Mill in southern Sweden.

In connection with the new dissolving pulp production, the mill has also decided to invest in improved cleaning of the bleached sulphite pulp. The project implies possibilities for quality improvement of the paper produced at the mill as well. Furthermore, an increase in the overall production of pulp and paper will follow as a result of the investments.

The Noss cleaning system will be started up in early August, 2011.

There are special demands on dissolving pulp cleanliness. The highly efficient RADICLONE systems are particularly suitable for this application. The professional knowledge and long time experience have made Noss AB a leading company within the high end market with highest demands on pulp cleanliness.

ABB Wins Electrification Order for Pulp Mill in Uruguay

ABB, the leading power and automation technology group, has won an order to supply process electrification and power distribution infrastructure as well as equipment for a new pulp mill in southwestern Uruguay.

The Montes del Plata pulp mill is a joint project of Finnish pulp and paper manufacturer, Stora Enso, and the Chilean forestry company, Arauco. At an estimated cost of $1.9 billion, it is the largest private investment ever made in Uruguay..

The mill is scheduled to be begin production in the first quarter of 2013, and will have an annual capacity of 1.3 million metric tons of bleached eucalyptus kraft pulp sourced from Montes del Plata's own forestry plantations. The project includes the pulp mill, a deepwater port and a biomass-based power generation plant to convert waste from pulp production into electricity.

“ABB has delivered and managed large, complex electrification projects for the pulp and paper industry for more than 40 years," said Veli-Matti Reinikkala, head of ABB’s Process Automation division. “Our advanced technology can also help customers efficiently tap into local renewable energy sources, ensuring this state-of-the-art mill has a reliable, self-sufficient electrical supply.”

ABB will provide power distribution and process electrification for the pulp mill, including the main transformers, 33 kilovolt (kV) power distribution system and control system, smart motor control switchgear, all motors and frequency converters. ABB will also deliver the sectional drive systems for the two pulp dryer machines, including hardware and software engineering, as well as on-site services for customer training, start-up and commissioning.

ABB’s Process Automation division delivers industry specific solutions and services for industrial automation and plant electrification. These solutions help customers meet their critical business needs in the areas of energy efficiency, operational profitability, capital productivity, risk management and global responsibility. Available industry specific solutions include process control, instrumentation, analytics, safety, plant optimization, telecommunications, energy management and power distribution.

5th International Woodfibre Resource and Trade Conference in Singapore

Supply, demand, logistics and pricing of pulpwood and biomass will be the focus at the 5th International Woodfibre Resource and Trade Conference in Singapore

Global demand for wood fiber for both pulp manufacturing and renewable energy increased during 2010 and 2011.Worldwide trade of wood chips in 2010 was up 24 percent because of increased production of pulp and paper products worldwide; China showed the greatest growth in chip imports, with an increase over 400 percent in the past two years. Australia continues to be the major wood chip exporter, and shipped 11 percent more in 2010 than 2009.

Consumption and trade of biomass in the form of wood pellets has also gone up dramatically the past few years. In 2010, the estimated global consumption of wood pellets was 13 million tons, a doubling in four years.

These trends raise a number of questions about the future supply, trade and pricing of wood fiber:

How will demand for wood fiber for pulp manufacturing and energy generation develop in China and Japan?

What is the wood supply outlook in Australia, Southeast Asia, Latin America and Africa?

Which regions in the world have the most competitive wood fiber prices?

What are the latest developments in the supply/demand balance of woody biomass in Europe?

Will newly established energy plantations meet increases in demand for energy wood fiber?

What new woodfiber supply projects globally have recently started up, or are planned?

These questions, among others, will be answered by industry experts at the upcoming 5th International Woodfibre Resource and Trade Conference, which will be held in Singapore on October 30 - November 2, 2011. The conference is organized by DANA Ltd., Pike y Compania, and Wood Resources International LLC. As of June 30th, delegates from 26 countries have registered to attend the conference.

As always, the focus of these International Pulpwood Conferences will be to not only to educate, but to provide unique networking opportunities between wood fiber suppliers, consumers, traders and shipping companies from around the world.

For registration and for more information about this exciting opportunity to meet with participants in the global forest industry and biomass sectors and to hear about the latest developments in international trade of wood fiber please visit the official website, http://www.woodfibreconference.com

Temple-Inland Board of Directors Unanimously Rejects International Paper's Unsolicited Tender Offer

Board of Directors Unanimously Determines that IP's Offer Grossly Undervalues Temple-Inland and Urges Stockholders Not to Tender Shares Pursuant to IP's Offer

Temple-Inland Inc. today announced that its Board of Directors, after careful consideration with its independent financial and legal advisors, voted unanimously to reject the unsolicited tender offer from International Paper Company to acquire all outstanding common shares of Temple-Inland at a price of $30.60 per share in cash. The Board unanimously determined that the offer grossly undervalues Temple-Inland and is not in the best interests of Temple-Inland's stockholders.

The Board unanimously recommends that Temple-Inland stockholders not tender their shares into IP's offer.

The basis for the Board's recommendation with respect to IP's tender offer is set forth in Temple-Inland's Schedule 14D-9, filed today with the Securities and Exchange Commission ("SEC"), a copy of which is available at www.sec.gov and on Temple-Inland's website at www.templeinland.com.

"Since we launched the 'new' Temple-Inland in January 2008, we have delivered superior results to our stockholders compared with our corrugated packaging peers, building products peers, and the S&P 500. The Temple-Inland Board is unanimous in its belief that the offer grossly undervalues Temple-Inland and its prospects, including its position as the return on asset leader in the corrugated packaging industry, expected benefits from box plant transformation, its low-cost building products operation, and its strategic place within the industry as the third largest producer of corrugated packaging in North America," said Doyle R. Simons, Chairman and Chief Executive Officer of Temple-Inland.

As fully outlined in Temple-Inland's Schedule 14D-9, Temple-Inland's Board recommends that Temple-Inland stockholders not tender their shares into IP's offer because:

- International Paper's unsolicited offer grossly undervalues Temple-Inland and its future prospects:

- The Board believes Temple-Inland's accelerating growth of earnings and return on investment will result in superior value to Temple-Inland's stockholders as compared to the price being offered by IP.

- IP overstates Temple-Inland's net debt. The Company's net debt at the end of first quarter 2011 was $737 million, not $828 million as IP calculated for purposes of pricing its offer.

- IP wrongly characterizes Temple-Inland's timber financing transaction as a liability rather than an asset. IP appears to have considered only one aspect of the transaction, the present value of the settlement of the tax on the deferred gain, and ignored the remaining positive components (including alternative minimum tax credits) of the transaction, which together result in a net benefit.

- IP's offer fails to appropriately compensate Temple-Inland stockholders for the very significant synergies that IP would realize and the extraordinary level of earnings accretion that would result if an IP/Temple-Inland transaction were to occur.

- IP seeks to compare its offer price to valuation metrics from so-called "precedent" transactions that involved underperforming assets of other companies that are not comparable to Temple-Inland and its industry-leading returns, high-quality assets and low-cost structure.

- IP's offer does not appropriately reflect the fundamental changes and improved focus in the corrugated packaging industry. These fundamental changes and improved industry focus are expected to be beneficial to Temple-Inland, which, as a result of its strong position in the corrugated packaging industry and its low-cost operations, is well positioned to continue to achieve improving results.

- Temple-Inland is the largest remaining independent, publicly-held industry participant whose acquisition would fundamentally transform the industry, and IP's offer does not appropriately compensate Temple-Inland's stockholders for that strategic value.

- The timing of International Paper's unsolicited proposal is extremely opportunistic and disadvantageous to Temple-Inland stockholders:

- Housing markets are at historically low levels, temporarily depressing the value of our building products operations. IP is attempting to take advantage of our stockholders by moving to grab Temple-Inland at a bargain price at a time when there is little or no market value being ascribed to building products.

- As IP itself has consistently highlighted to the investment community, corrugated packaging demand remains below prerecession levels, but is expected to recover in the near future as the economy continues to improve. IP is attempting by its offer to acquire Temple-Inland before corrugated packaging demand returns to prerecession levels and pricing further improves.

- We estimate that $90 million of the annual cost savings from our Box Plant Transformation II project are still to be realized - our stockholders, not IP's, deserve to receive the benefit of the significant capital we have invested in this project.

- IP initially publicized its proposal to acquire Temple-Inland during a period of market weakness in order to claim an inflated "premium".

- The potential acquisition is subject to regulatory and other uncertainty:

- IP is proposing a combination of the largest and third largest producers of corrugated packaging in North America.

- Given the regulatory uncertainty and the significant conditionality of IP's offer, there is considerable uncertainty regarding the offer and the timing of Temple-Inland stockholders receiving the "certain" value that IP claims to be offering.

As noted above, the Company's Schedule 14D-9 is available on the SEC's website, www.sec.gov. In addition, the Schedule 14D-9 and other materials related to IP's unsolicited proposal are available in the "Investor Relations" section of the Company's website at www.templeinland.com. The Company urges stockholders to read the Schedule 14D-9 carefully and in its entirety.

Goldman, Sachs & Co. is acting as financial advisor to Temple-Inland, and Wachtell, Lipton, Rosen & Katz is acting as Temple-Inland's legal counsel.

SOURCE: Temple-Inland Inc.

ANDRITZ acquires Iggesund Tools, Sweden

International technology Group ANDRITZ has acquired Iggesund Tools International AB, headquartered in Iggesund, Sweden, including its subsidiaries in the USA, Canada, and other countries. The acquired companies have approximately 160 employees and generate annual sales of about 25 MEUR. It was agreed not to disclose the purchase price.

Iggesund Tools – now ANDRITZ Iggesund Tools – supplies wood chipping and debarking equipment (mainly chipper knife systems) for pulp and saw mills. The ANDRITZ PULP & PAPER business area is thus strengthening and complementing its service offerings in the wood processing area.

Treat & Add Value to your Effluents & Rejects

Register now to...

Register now to...

Effluent Treatment & Rejects Strategy: via LIVE e-Learning, 18-21 October 2011

Unique opportunity to learn how to reduce, treat and add value to your effluents & rejects, so that you can improve your runnability and productivity. The training is focused on Practical Solutions that can be directly implemented at your mill.

Live e-Learning is the best compromise to invest in knowledge and save money. Please, do not hesitate to ask us for a free test if you are not familiar with the concept.

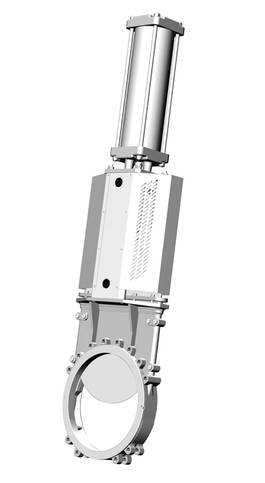

Stafsjö’s MP – the eighth knife gate valve generation

In 1928 our knife gate valve manufacturing started in close co-operation with nearby pulp and paper mills. Now it is time for the eighth knife gate valve generation, the MP, which is a result of market driven requirements and experienced engineering throughout the years. Stafsjö has introduced one new knife gate valve every year now the last three years. 2009 we introduced the slurry valve SLV, primarily for the mining business. 2010 we introduced our HL, a slim line version of our HG valve with through-going gate, and now 2011 the MP.

In 1928 our knife gate valve manufacturing started in close co-operation with nearby pulp and paper mills. Now it is time for the eighth knife gate valve generation, the MP, which is a result of market driven requirements and experienced engineering throughout the years. Stafsjö has introduced one new knife gate valve every year now the last three years. 2009 we introduced the slurry valve SLV, primarily for the mining business. 2010 we introduced our HL, a slim line version of our HG valve with through-going gate, and now 2011 the MP.

– We are proud to announce Stafsjö’s latest development for the Pulp & Paper Industry. The MP valve represents the new generation of shut-off valves which fully corresponds to today’s market demands such as bi-directionality, full bore and minimum maintenance, says Thomas Carlson, CEO of Stafsjö.

Product features

The MP is a bi-directional full bore valve which together with its special shut-off design makes it suitable for many different applications – it is a true Multi Purpose valve.

MP has a one piece body design in stainless steel. For operation reliability in applications with corrosive or clogging media the valve body comes with integrated purge ports as standard. The MP is also supplied with Stafsjö’s retainer ring system which can be combined with several seat materials and this makes it easy to optimize the valve to specific process conditions. It also offers smooth and cost-efficient maintenance. The valve has a gate support and casted bottom support cams to obtain bi-directional sealing. The gate support is available in different materials.

The top work consists of aluminium beams and stainless steel tie rods which gives good corrosion resistance and stability at maneuvering. Several actuator types are available to choose from as standard as well as accessories. All remote operated valves are supplied with gate guards in stainless steel.

Sealing principle

When the valve is operated from open to closed position, the gate effectively cuts through the media. This is facilitated by the inner cavity of the valve body and the bevel edged gate. In closed position the gate is pushed against the seat and the gate support ensure a bi-directional sealing together with the bottom support cams that stabilizes the gate.

The gland box is equipped with three layers of our TwinPackTM and a box bottom scraper, which gives high operation reliability and prevent the media from reaching surrounding environment.

Accessibility

Stafsjö is a recognised supplier of knife gate valves to process industries worldwide. Together with our sister company Ebro Armaturen and external sales partners we are able to provide fast deliveries, high quality service and support to local markets. We strive to be the most accessible, reliable and cost-effective supplier of knife gate valves.

Torraspapel Backs PRINT POWER Campaign

The efficiency and sustainability of print media are the pillars of this Europe-wide campaign.

PRINT POWER is a pan-European project which, backed by companies representing the entire print value chain, seeks to strengthen the position of print media within the multimedia world, highlighting it as an efficient and sustainable medium as well as a highly effective tool in the marketing media mix.

Print media establishes a direct personal relationship with the reader: it literally places the brand and the product in the consumer's hands. Quality, reliability, prestige, creativity, emotion…all of these are attributes associated with paper.

Print media establishes a direct personal relationship with the reader: it literally places the brand and the product in the consumer's hands. Quality, reliability, prestige, creativity, emotion…all of these are attributes associated with paper.

With a central organization and working group in Brussels to define strategy and global content, PRINT POWER has also established national organizations for developing the campaign in each of the 11 participating European countries, including Spain.

Torraspapel, part of the Lecta Group, has been involved in the initiative from the start, taking an active role in its development and launch both at the European level and within the working group for Spain.

During 2011, PRINT POWER has carried out numerous actions in the Spanish market, including advertising and direct marketing campaigns, publishing a magazine, creating a Spanish version of the European website, and participating in key marketing and communications events.

For more information on the power of print media visit www.printpower.eu and the Sustainability section on this website.

Avilon shuts down temporarily

Avilon Ltd, part of Neo Industrial's Viscose Fibers business, is temporarily shutting down production in its Valkeakoski-based factory. The shutdown is due to viscose fiber's globally poor market situation.

Viscose fiber market's weakening that started late spring is not only normal seasonal fluctuation, but also consequence of overheating. The market suffers from a surplus, and stock levels are high especially on the largest market, China, while factory utilization is low. Due to the surplus, the price of fiber has sunk nearly 30 percent in two months.

- It is difficult to estimate when the standard fiber market will make a turn to positive. We have better visibility with fire retardant fiber, but the market is also sluggish. According to its strategy, Avilon has however reached its previous, good market position in the United States fire retardant fiber market, which is important in the long-term, reminds Neo Industrial's Managing Director Markku Rentto.

Commercializing of the pulp converting technology that Avilon has developed is also proceeding according to plan.

Avilon will now postpone the startup of a second main production line, planned for August, but continues to prepare for it.

During the shutdown, Avilon will generate revenues from its current stock, including both standard and fire retardant fiber. The shutdown will not compromise the delivery accuracy of fire retardant fiber. Avilon maintains its good service availability with a fire retardant fiber stock estimated to last through the third quarter.

Due to the shutdown, Avilon has today given its entire staff notice of temporary layoffs of less than 90 days. There will be no redundancies.