Ian Melin-Jones

China Paper attracts many returning exhibitors

This year’s edition of China Paper/China Forest, held in Beijing on September 19-21, is drawing closer. Some 300 companies from 20 countries are expected to exhibit at the premier pulp and paper show for the Chinese and Asian markets. Many international companies exhibit regularly at the China Paper event.

- We have many returning exhibitors, who are loyal to the show and participate to keep up the good relations with customers in this very important market, says Patrik Löwstedt, Exhibition Manager. We are also pleased to welcome some new exhibitors to Beijing this year. Many companies have realised that if you are or want to become active in this exciting market, China Paper is an excellent stepping stone.

Allimand S.A. is one of the companies that is a recurrent exhibitor. Allimand is a paper machine manufacturer based in France, whose exports have now reached 85% of its sales. The company has been active in Asia for a long time and it aims to maintain its top position on the Asian market in the coming years.

- The Chinese and Asian markets represent a major part of the worldwide growth in paper and board production and consumption, says Franck Rettmeyer, Chairman & CEO of Allmand.

- The China Paper exhibition is primarily a global meeting point for all Chinese buyers, and this sole reason puts this event on the top priority list for our business activities in Asia. Increasingly, papermakers from other Asian countries are also attending the event, and we expect from this year’s show to create fruitful contacts with most of our established customers in the Asian area as well as with new ones, Mr Rettmeyer continues.

With the first event in 1987, China Paper/China Forest is today the premier event for China's and Asia's pulp, paper making and paper product industries. Since the year 2000 the event alternates between Beijing and Shanghai. The 19th edition of China Paper/China Forest is held on September 19-21, 2011, at the China International Exhibition Center (CIEC) in Beijing. China Paper is organised by Adforum in co-operation with E.J. Krause & Associates, Inc.

Out of the blue, Clariant launches the ultimate white

Clariant gives papermakers the unique opportunity to use up to 30% less optical brightening agent (OBA), reduce tinting colorant levels, and reach a truer, more neutral white, with the launch of its breakthrough whitening system Leucophor® XL.

The globally-available Leucophor® XL range offers a new approach to controlling and optimizing whiteness. Its innovative technology improves whiteness build-up without destroying brightness for coated and uncoated papers and board. This provides a step-change in the whiteness and brightness of paper compared to conventional whitening methods where the colorant can make paper appear duller and grayer.

Papermakers can achieve significant improvements in their manufacturing efficiency with Leucophor® XL. By replacing traditional brighteners with an OBA from the Leucophor® XL range, significantly less OBA is required in order to achieve equal whiteness levels. At the same time, lower levels of shading colorants are required in the wet-end, leading to higher brightness at less cost. By moving away from the OBA saturation limit, previously unattainable whiteness levels are made possible.

The Leucophor® XL range comprises products to cover all variations in application and potential end-use requirements.

“We see our new Leucophor® XL range as a toolkit which helps papermakers to reduce their consumption of optical brighteners and tinting colorants while continuing to produce papers to the same or even higher whiteness standards as before,” comments Andrew Jackson, Head of Global Product Management Optical Brightening Agents. “As well as bringing cost savings, this innovative approach to whiteness also reduces the carbon footprint of printing and writing papers, a move very much in line with Clariant’s sustainability concept."

Global Timber and Wood Products Market Update

Pulpwood prices in Western US were up almost 50 percent in 2Q/11 compared to 2Q/10, while wood prices were unchanged in the US South, reports the North American Wood Fiber Review.

Wood costs for pulp mills in Western US have increased over the past 12 months, reaching their highest level since early 2008 in the 2Q/11, reports the American Wood Fiber Review. Pulp mills in the US South have slightly lower wood costs than they did in 2010, and continue to have the lowest fiber costs in North America.

Seattle, USA. Pulp mills in the Western US have seen their wood costs go up for four consecutive quarters, and this region, together with Quebec, had the highest 2Q/11 wood fiber costs in North America, according to the North American Wood Fiber Review (NAWFR).

Douglas-fir and hemlock residual chip prices in the US Northwest were up 42 percent between 2Q/10 and 2Q/11, reaching their highest levels since early 2008. Pulplog prices have increased more than for wood chips, reaching a 16-year high in the 2Q/11. Historically, the region’s pulp industry has relied on 70-80 percent sawmill residuals for its fiber furnish, but in 2011, softwood residuals accounted for approximately 55 percent of the softwood fiber receipts as reported by the Forest Products Association, with the remaining being chips manufactured from roundwood.

The current price surge in Western US has been the result of four primary factors: sawmill lumber production well below historical volumes, high pulpmill production due to strong product prices, a reopened pulpmill in the state of Washington, and strong Chinese demand for logs.

Violent storms in Mississippi and Alabama, flooding along the Mississippi River and wildfires primarily in Georgia and Texas interrupted the regular flow of wood fiber in the US South during the 2Q. The extreme conditions resulted in curtailments of a few pulpmills and chipping facilities and temporary reductions in fiber demand. To some extent, this balanced out the reduction in pulpwood production. While salvaging is difficult and more costly than ordinary timber harvesting, the sheer volume of wood that is under pressure to be brought in before it deteriorates will bring a surge of supply to the market.

Softwood and hardwood pulpwood prices in the 2Q were unchanged from the previous quarter, according to NAWFR, but can be expected to decline in the 3Q as a result of the large volume of damaged wood in the region. With other North American regions experiencing significant increases in wood costs in the 2Q, the South’s low, stable wood prices continue to make the region’s pulp industry very competitive.

Sonoco Acquires Assets of Robinson Paperboard Packaging

Sonoco UK Ltd., a wholly owned subsidiary of Sonoco (NYSE: SON), one of the largest diversified global packaging companies and the world's largest producer of paperboard cans, has completed the acquisition of the assets of Robinson Paperboard Packaging Ltd., a division of Robinson PLC (LSE: RBN).

The acquisition will add approximately $10 million in annual sales and includes customer contracts, as well as other business assets of Robinson Paperboard Packaging. As part of the transaction, Sonoco will assume operation of Robinson's Chesterfield paperboard can plant located on Goyt Side Road. Employees at the Chesterfield plant will be retained.

"The purchase of Robinson Paperboard Packaging is a good strategic fit with Sonoco's growing global rigid paper container operations," said Sean Cairns, general manager of Sonoco Rigid Paper and Closures, Europe. "We believe Robinson's proven expertise in innovative paper bottom technology and unique, patented processes provide a strong platform for our continued development and growth in the United Kingdom and Europe."

Cairns added, "This agreement is a win for Robinson, Sonoco and our packaging customers, who are increasingly recognizing the proven advantages that rigid paper containers bring in terms of reducing costs and minimizing the impact on the environment - without compromising quality. Packaging made from rigid paper reduces package weight, makes more efficient use of raw materials and conserves energy."

With origins dating back to 1839, Robinson Paperboard Packaging manufactures rigid paperboard tubes and boxes for the food, drink, toiletries, cosmetics and the gift/presentation markets. The Chesterfield plant is ISO 14001 environmentally accredited, and also has British Retail Consortium/IoP Food Hygiene and ISO 9001 accreditation. Sonoco will continue to work with other parts of Robinson, including its plastics packaging division for the supply of plastic overcaps.

Sonoco has been operating in the UK since 1923 and now has more than 600 employees engaged in consumer and industrial packaging operations at 10 locations. Sonoco operates 44 facilities throughout 15 European countries with annualized sales of more than $700 million and more than 5,000 employees. The Company is the world's largest manufacturer of rigid paperboard containers, producing a variety of round and shaped spiral-wound, recycled paperboard cans, fiber cartridges and single-wrap paperboard containers, serving a variety of food and non-food markets. Sonoco's rigid paperboard operations include operations in North America, South America, Europe, Asia and Australia.

PaperlinX Global Operations Restructure

PaperlinX advises that whilst the Company`s financial results for the 2011 financial year are still to be determined, the Company expects that its full year statutory loss after tax will be within previous guidance, but nearer the A$30M loss advised in that guidance. This includes a substantial non cash valuation loss for a foreign currency option but excludes any possible impairment, if necessary.

The Board has approved management undertaking a restructuring process across its global operations which is expected to result in an additional charge of approximately A$14M pre tax (A$10M post tax), which will be included in the 2011 financial result. This additional charge is not included in the guidance referred to above. The intended restructuring is expected to produce annual cost savings of approximately A$17M pre tax in a full year with benefits of approximately A$14M pre tax in the 2012 financial year.

The restructuring will be funded from existing cash reserves and working capital facilities. The Company's current forecasts indicate that relevant financing covenants will continue to be complied with.

The Company will announce its full year results on 25 August 2011.

Emerson density meter reduces costs at Cartiere del Garda Paper Mill

Accuracy of Micro Motion® density meter removes need for expensive coating additives, enabling significant annual savings

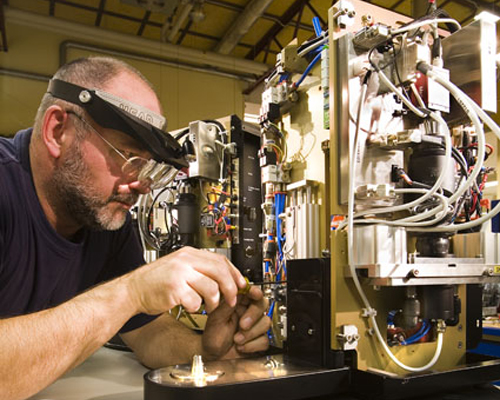

Cartiere del Garda is using a Micro Motion® density meter from Emerson Process Management to accurately measure the concentration of kaolin and other additives in the coating process at its paper mill on the banks of Lake Garda in Italy. The Micro Motion 7845 Density and Concentration Meter provides highly accurate density measurements under entrained gas conditions.

"The highly accurate measurement of the coating mixture concentration provided by Emerson's Micro Motion density meter means we have been able to discontinue the use of expensive additives,” said Fulvio Prati, Instrument Manager at Cartiere del Garda. “This has enabled significant annual savings and paper quality is improved."

Cartiere del Garda operates one of the most modern paper mills in Italy, specialising in high quality coated papers. For many years, a Micro Motion Coriolis flowmeter was used to monitor the concentration of the paper coating mixture and this provided reliable and accurate results. However, because the recirculation system on the feeding tank generated entrained air, it was necessary to add expensive additives to the coating mixture to prevent quality problems.

Removing the additives would reduce production costs but would cause up to 20 per cent air to be entrained in the coating mixture. The existing Coriolis flowmeter was not designed to provide the same degree of density measurement accuracy under these conditions, so Cartiere del Garda sought an alternative solution. The company needed an on-line, solids concentration measurement of the coating solution, made directly at the film coater machine feed. A minimum accuracy of +/-1 per cent of solids was required to guarantee the high quality of the paper being produced and avoid waste caused by out-of-specification batches.

Cartiere del Garda chose a Micro Motion 7845 Density and Concentration Meter for this challenging application. The company specified the advanced electronics, entrained gas version, which is designed to accurately measure density in aerated liquids − providing a final accuracy of better than +/- 0.5 per cent with very high stability and repeatability. The 7845 provides a 4-20 mA signal to the control system, related to line density. Density is converted into percentage solids using a formula embedded into the control system.

The Micro Motion 7845 is a straight tube, liquid density meter that uses a vibrating tube to measure density. As the liquid density changes, it affects the vibrating mass of the density meter. The change in vibrating mass then affects the resonant frequency, which is inversely proportional to the density of the process fluid. By monitoring the resonant frequency and applying well-known conversions, the 7845 provides highly accurate in-line density data.

The Micro Motion 7845 Density and Concentration Meter is rugged, reliable, and requires minimum maintenance. The meter is calibrated in an ISO17025 accredited laboratory, traceable to international standards, and requires no field calibration.

ABB to buy Lorentzen & Wettre to strengthen pulp and paper business

ABB to acquire Swedish manufacturer of quality control and process optimization solutions

ABB, the leading power and automation technology group, has agreed to acquire Lorentzen & Wettre from ASSA ABLOY AB (publ) for a price of about $119 million (SEK 750 million), to strengthen its business in the pulp and paper area.

Based in the Kista district of Stockholm, Sweden, Lorentzen & Wettre manufactures equipment for quality control, process optimization and test instrumentation for the pulp and paper industry. It has production facilities in Kista and Kajaani, Finland, and sales and service offices across Europe and in Canada, China, Japan, Singapore and the US. The company has approximately 190 employees, and will be incorporated into ABB’s Process Automation division.

“This acquisition will nicely complement our existing portfolio of pulp and paper industry offerings,” said Veli-Matti Reinikkala, head of ABB’s Process Automation division. “This is an excellent strategic fit as Lorentzen & Wettre’s products and services will enable us to address the broad spectrum of pulp and paper production challenges.”

Founded in 1895, Lorentzen & Wettre has technology that contributes to improving paper quality, reducing manufacturing costs, and cutting the consumption of raw materials and energy. The company’s offering includes automated fiber and pulp analysis devices, consistency transmitters, moisture sensors, laboratory paper testing instruments, automated paper testing systems, and industry specific services.

"We are very excited to continue to develop our business as part of the global Process Automation business of ABB,” said Patrik Stolpe, CEO of Lorentzen & Wettre.

Lorentzen & Wettre reported revenues of SEK 307 million ($49 million) in 2010 and expects an increase to SEK 335 million ($53 million) in 2011.

The transaction is subject to customary regulatory approvals. ABB expects the acquisition to be completed during the second half of the year.

AbitibiBowater Announces Debt Reduction Initiatives

AbitibiBowater has announced that, with the proceeds from the sale of its 75% indirect interest in ACH Limited Partnership, the Company recently redeemed approximately $270 million of its debt. With these disbursements, AbitibiBowater's total debt has been reduced to a face amount of approximately $670 million.

"These recent actions are an important milestone in AbitibiBowater's focus on reducing its debt and associated interest burden," stated Richard Garneau, President and Chief Executive Officer. "Debt reduction is a fundamental part of our strategy to reduce fixed costs and improve the Company's financial position and competitiveness."

The following three debt repayments were made during June 2011:

- $94 million principal at a redemption price of 105%, together with accrued interest, of the $850 million, 10.25% senior secured notes due 2018;

- $85 million principal at a redemption price of 103%, together with accrued interest, of the $850 million, 10.25% senior secured notes due 2018; and

- $90 million principal at par, together with accrued interest, of the Augusta Newsprint Company promissory note - repaid in full.

AbitibiBowater is a global leader in the forest products industry, producing a diverse range of products, including newsprint, commercial printing papers, market pulp and wood products. The Company owns or operates 18 pulp and paper mills and 24 wood products facilities located in the United States, Canada and South Korea. Marketing its products in close to 90 countries, AbitibiBowater is also among the largest recyclers of old newspapers and magazines in North America, and has third-party certified 100% of its managed woodlands to sustainable forest management standards. AbitibiBowater's shares trade under the stock symbol ABH on both the New York Stock Exchange and the Toronto Stock Exchange.

Buckman Announces Global Price Increase

Buckman is announcing a global price increase on all products and programs of up to 20%. Pricing adjustments will depend on the specific product or program and region of the world. Increases will be effective July 1, 2011.

This price increase, which is driven by mounting raw material, transportation, and energy costs, will enable Buckman to continue to provide the high quality service and support that our customers expect. Buckman will work closely with customers to leverage our innovative practices and unique application expertise in an effort to defray the impact of these increases.

source: Buckman

Five Years of Raising the Bar in Paper Recycling

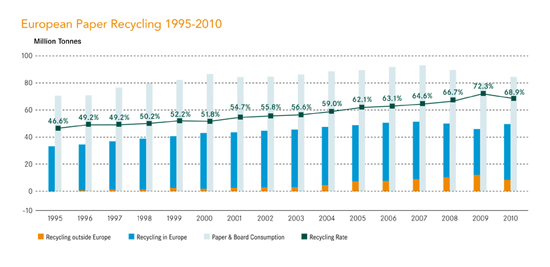

European Paper Recycling in 2010 at 68.9%

The European paper recycling rate reached an impressive 68.9% as announced today by the ERPC (European Recovered Paper Council) in their final monitoring report. The report shows that since 2004 the recycling rate has increased by 10% points due in part to the excellent work of the ERPC.

The 2010 European paper recycling rate of 68.9% is higher than the target set by the European paper industry for the ERPC commitment period of the 2nd European Paper Recycling Declaration 2006-2010. The council is proud to report on impressive work completed, following the pledge it first made in 2000 to increase paper recycling in Europe. In the mean time, a new ambitious commitment for 2011-2015 is being prepared, keeping the industry on its path to meet ambitious targets of recycling paper at a steadily increasing rate in Europe.

For the commitment period of 2006 to 2010, PricewaterhouseCoopers has independently verified the calculation of the recycling rate using the International Standard on assurance Engagements ISAE 3000.

In addition to the quantitative progress, a lot of qualitative work was done to establish an eco-design towards improved recyclability and in the area of waste prevention. The past five years gave the ERPC an opportunity to learn how to work better together, growing stronger as a value chain.

The results include pioneering work to give recycling a solid and scientific support, such as the adoption of the deinkability scorecard. The efforts of the ERPC also complement EU policy, for instance the new Waste Directive adopted in 2008.