Ian Melin-Jones

BTG launches an upgrade of its Kappa Number Analyzer, the KNA-5300.

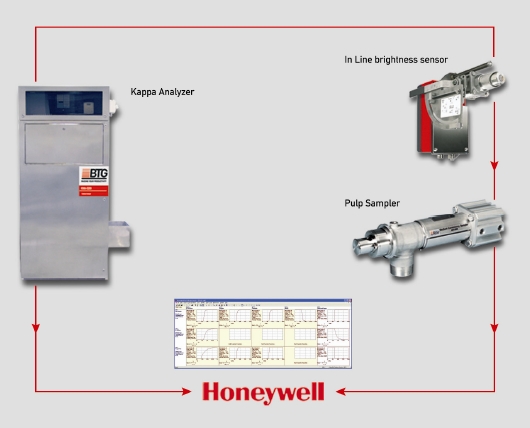

An enhanced Pulp mill solution, which reduces chemical consumption and quality variations and increases operator effectiveness, also requires modern communication with the instrumentation. BTG’s field sensors and analyzers are the window to your process and enable Honeywell’s Profit Controller® to provide best-in-class Advanced Process Control performance.

Therefore, BTG releases a new PLC and computer interface for new and existing KNA kappa analyzers. The new PLC utilizes connection to today’s most common field bus systems and allows four bus modules at one time. These include: Profibus DP, DeviceNet, CANopen, MODBUS, CS31, RCOM, Ethernet TCP/IP, PROFINET and EtherCAT. An OPC server is also provided.

Enhanced user-designated screens, graphics and diagnostics make this the most easily accessible kappa analyzer on the market. The computer interface for mill operators, instrument technicians and process engineers is Windows 7 based.

As of January, 2011 all new BTG kappa analyzers are delivered with this enhanced performance. Upgrade kits for mills, owners of the KNA-5200, will be available to take advantage of today’s new connection and communication technology.

Paper machine in Spain to close 31 March 2011

Holmen has decided on the date for closure of the smaller paper machine, PM 61, at the mill in Madrid. Production will cease on 31 March. The closure was announced in conjunction with the year-end report.

PM 61 has a capacity of 170 000 tonnes per year. This equates to almost 10 per cent of the business area’s production capacity. The paper machine produces coated magazine paper (LWC) as well as improved newsprint to a lesser extent. Approximately 170 employees will be affected.

The financial consequences of the closure are outlined in the year-end report for 2010.

Amazon Papyrus Chemicals recent findings in Oil-free Release Aids

Conventional, oil-based release technology has served well to control sheet adhesion on the Yankee dryer, provide lubrication for creping and cleaning blades, and remove excess coating from the dryer surface. However, oil-free technology is now available that provides advantages over traditional release technology

There are two main directions in developing oil-free release aids: plasticization of the coating to improve crepe density and control hard edge buildup, and replacing oil-based release aids with a cost effective, oil-free alternative. This paper recounts recent findings in tailoring oil-free release aids for plasticizing and release properties.

Oil-based vs. oil-free release technology

Let’s start with a brief description of how traditional, oil-based release agents interact with adhesives. Yankee coatings are generally composed of two components: adhesives and release agents. A number of tissue manufacturers use a third component, a coating modifier; but for our purposes, we’ll restrict this discussion to two component systems. Adhesives (responsible for holding the sheet against the Yankee during creping) are polymers- natural or synthetic- that crosslink on the Yankee surface. Left to themselves, adhesives would hold the sheet so strongly against the Yankee that it would be difficult, if not impossible, to control creping without causing sheet holes and breaks. This is where release agents come in. Release agents interfere with the integrity of the polymer matrix on the Yankee surface. Oil-based release agents create pockets of “dead space” in the matrix by inserting droplets of oil in between adhesive molecules. These droplets help to prevent too much crosslinking of the adhesives, which is good. However, the droplets tend to weaken the matrix so much that the coating tends to be stripped off the dryer when the ratio of release to adhesive is slightly out of balance.

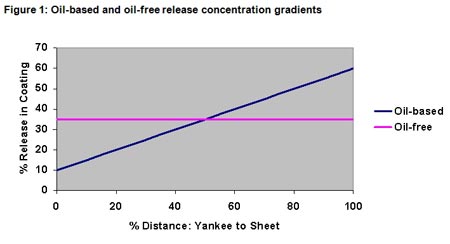

Typically, adhesives and release agents are applied to the Yankee surface by a low pressure shower. The concentration of the adhesive and release (taken together) is typically less than 1%. Before the coating matrix can form on the Yankee surface, the carrier water must be evaporated. As the carrier water is evaporated, the volume of coating on the dryer decreases and adhesive molecules come closer together and start to associate with each other. Consequently, the adhesive portion of the coating becomes more compact as the coating dehydrates. The release agent, on the other hand, is an emulsion of oil in water. The oil does not compact during coating dehydration. In fact, it expands on heating, migrating away from the dryer surface. Because the release oil expands while the adhesive compacts, a concentration gradient of release oil in the coating matrix develops. More release oil is present in the upper layer of the coating matrix; less is present in the harder layer near the dryer surface. Figure 1 shows a hypothetical concentration gradient of an oil-based release in the coating matrix between the dryer surface and the sheet. A potential problem with having a concentration gradient of release oil in the coating is the coating remaining on the dryer after creping can be quite hard. Under the right conditions, it can become quite difficult to control the buildup of hardened coating on the dryer, especially just outside the sheet edge. “Edge buildup” is a potentially serious problem, often associated with sheet breaks and/or heavy blade wear.

Oil-free release agents use a different approach to modifying the coating on the Yankee dryer. Instead of interfering with the ability of adhesive molecules to bond by inserting dead space in the coating matrix, oil-free plasticizers associate with adhesive molecules but do not crosslink with them the way another adhesive molecule would. Let’s first define the term “plasticizer”. A plasticizer acts to make something more pliable or flexible- more “plastic”. Since plasticizers associate intimately with the adhesive in the coating matrix, the net effect is to make the entire matrix more flexible. Creating a flexible coating matrix is the goal of any “soft” coating program.

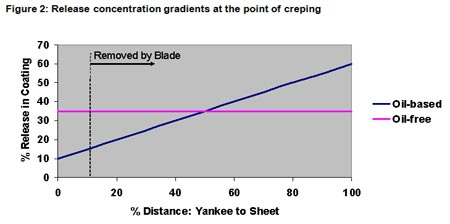

Looking again at Figure 1, we see that there is essentially no concentration gradient of oil-free release in the coating matrix. Both the oil-free release and the adhesive portions of the coating matrix compact during dehydration. That means the oil-free release has no “driving force” to concentrate in one portion of the coating, leaving a uniform amount of oil-free release throughout the Z-direction of the matrix. This lack of a concentration gradient is especially important when we consider what happens at the creping and cleaning blades. Sheet softness is built in the soft part of the coating matrix. It is here that the creping blade deforms both the coating and the sheet, which is the basis of creping. But what happens to the coating that is left on the dryer after the creping and cleaning blades have removed the softer part of the coating? It is here that Yankee protection is built. It is also here that an excessively hard residue can be developed which interferes with machine runnability and blade wear.

Figure 2 shows the hypothetical difference between the concentrations of oil-based and oil-free release agents in the harder portion of the Yankee coating matrix- the fraction that is not removed by the creping and cleaning blades. In this example, the average concentration of oil-based release in the cured portion of the coating is 15%, while that of the oil-free is 35%. The difference can lead to a dramatic difference in pliability of the coating left on the dryer.

Now that we have a basic understanding of how non-oil release agents work, it’s time to decide whether to focus on plasticizing or release

Plasticizing vs. release

Strictly speaking, when dealing with oil-free release agents the question is not “either/or” regarding plasticizing and release. It is rather a question of degree. The reason is there is an inverse relationship between plasticizing and release properties. There are four key factors in determining where a particular release fits on the curve of plasticizing vs. release:

- The type of base polymer used

- The molecular weight of the base polymer

- The type and degree of modification of the polymer

- The emulsification package

By working with these key properties, it is possible to create oil-free release agents that give strong release- much stronger than oil-based release agents on an actives basis- and some plasticization. It is also possible to create highly plasticizing release aids that have less aggressive release properties. However, even highly plasticizing release aids can be more efficient than oil-based release agents.

Advantages of plasticizing release

There are two essential characteristics of plasticizing release agents: they are “soft” polymers that associate intimately with creping adhesives and they compact along with creping adhesives during coating dehydration. These two aspects give the following benefits

A softer, thicker, more even coating. Because the plasticizer does not strip the adhesive off the dryer, the coating matrix actually gains in bulk. This is helpful in dealing with moisture streaks that interfere with proper coating buildup on the dryer.

More even creping. Unlike oil-based release agents that form discrete droplets in the coating matrix, the plasticizers associate intimately with the creping adhesive on the dryer. This leads to fewer “pockets” of coarser crepe in the sheet. Virtually all plasticizing release trials to date have shown a significant improvement in MD and CD creping uniformity.

Finer creping. Because plasticizing release aids don’t strip the adhesive from the dryer, the soft part of the Yankee coating (where creping takes place) tends to be softer, which usually gives an extra 10 crepe bars per cm in crepe density.

Less hard edge buildup. Having a relatively large fraction of release aid in the hard part of the Yankee coating helps to keep the coating left on the dryer flexible and easier to manage.

Case history 1: Removing edge buildup

A mill in the Middle East suffered from hard edge buildup, causing them to change creping blades every 1-2 hours due to edge blade wear. Figure 3 is a photograph of the tending side of the Yankee; the edge buildup was several centimeters wide, and could not be removed under normal operating conditions. A hard creping adhesive was chosen because of the machine’s operating speed (1750 m/minute) and the desire to protect the Yankee. Figure 4 is a photograph of the same area after introducing a plasticizing release; the edge buildup was brought under control. As is typical with plasticizing release applications, there was a significant reduction in creping adhesive use. In this case, the reduction was 37.5%. There was also an increase in creping density: the crepe bar count increased from 65 to 75 per cm.

Case history 2: Controlling blade wear

A mill in Southeast Asia suffered from severe edge wear of the creping blade and uneven roll building. Replacing the previous creping program with a hard, moisture tolerant coating and a plasticizing release gave significant improvements in blade wear, roll building, and creping. Figure 5 shows typical pre-trial blade wear of >5 mm at the edges. Figure 6 shows even blade wear at the same blade life. In addition, crepe density increased from 45 to 60 bars/cm. All this was achieved with a reduction of 24% in creping adhesive use.

Case history 3: Oil replacement

A mill in Southeast Asia was interested in reducing their creping program cost. Replacing the oil-based release aid with an oil-free plasticizer allowed the mill to enjoy a release aid program cost reduction of >20% while improving the evenness of the Yankee coating and maintaining handfeel, crepe density, roll building, and sheet specifications.

Conclusion:

Certainly, oil-based release agents have served tissuemakers well for decades. However, there are now alternate, oil-free release technologies that provide real advantages over conventional release agents. Plasticizing releases allow the tissuemaker to soften the Yankee coating without stripping it; improving creping, roll building, blade wear, and controlling problematic Yankee coating buildup. Oil replacement releases offer significant program savings over their oil-based counterparts.

SCA’s Annual Report for 2010 released

SCA’s Annual Report for 2010 has been published and is available at www.sca.com. SCA has also published its 2010 Sustainability Report, which can be downloaded from the same address.

The printed version of the Annual Report will be distributed by post to shareholders and other stakeholders on the week commencing 21 March.

FM Global Awards US$400,000 in Fire Prevention Grants in 2010 to Nearly 200 Organizations Worldwide.

FM Global, one of the world’s largest business property insurers, awarded US$400,000 in fire prevention grants during 2010 to help organizations worldwide more effectively prevent fire in their communities.

Fire departments, brigades and other related agencies in the United States, Canada, India and the United Kingdom benefited from FM Global fire prevention grants last year. On average, each grant recipient received US$2,400 to bolster loss prevention initiatives, like community education, prefire planning and arson prevention.

Because fire continues to be the leading cause of property damage worldwide, during the past 35 years FM Global has contributed millions of dollars in fire prevention grants to fire service organizations around the globe. Through its Fire Prevention Grant Program, FM Global awards grants that can have the most demonstrable impact on preventing fire, or mitigating the damage it can quickly cause.

“At FM Global, we’re passionate about the notion that the majority of property damage is preventable, not inevitable,” said Michael Spaziani, manager of the fire prevention grant program. “Far too often, inadequate budgets prevent those organizations working to prevent fire from being as proactive as they would like to be. With additional financial support, grant recipients are actively helping to improve property risk in the communities they serve.”

To learn more about FM Global’s Fire Prevention Grant Program, or to apply for a grant, please visit www.fmglobal.com/grants.

BASF increases European prices for methylamine and methylamine derivatives

With immediate effect or as existing contracts permit, BASF is increasing its European sales prices for methylamines and methylamine derivates as follows:

| Monomethylamin (MMA) | + 30 €/t |

| Dimethylamin (DMA) | + 40 €/t |

| Trimethylamin (TMA) | + 50 €/t |

| Dimethylaminopropylamin (DMAPA) | + 100 €/t |

| Dimethylethanolamin (DMEOA) | + 90 €/t |

| Methylethanolamin (MMEOA) | + 90 €/t |

| Methyldiethanolamin (MDEOA) | + 120 €/t |

| Dimethylformamid (DMF) | + 30 €/t |

| Dimethylacetamid (DMAC) | + 60 €/t |

or by the corresponding amount in local currency.

Methylamine and methylamine derivatives are versatile chemical intermediates with a wide range of applications, such as agrochemicals, water treatment and personal care. They also prove valuable in the production of feed additives and organic solvents. BASF produces methylamine and methylamine derivatives at its sites in Ludwigshafen (Germany), Geismar (Louisiana, USA), Nanjing (China) and Camaçari (Brazil).

Luc Rousselet appointed Executive Vice President, Supply Chain at Ahlstrom

Luc Rousselet, (born 1957) Master in Business Administration and Chemical Engineer, is appointed Executive Vice President, Supply Chain, and member of the Executive Management Team as of June 15, 2011, at Ahlstrom Corporation. Rousselet will report to Jan Lång, President and CEO.

Luc Rousselet will be responsible for developing the global supply management and processes of the Group, including manufacturing, sourcing and logistics.

Prior to joining Ahlstrom, Rousselet has been holding various senior positions at 3M Group since 1991, last as Supply Chain and Distribution Director, France. He has also worked for example as Site Manager in France, Lean Six Sigma Master Black Belt in Europe and Manufacturing Operations Manager in the US at the Medical Services Business Division.

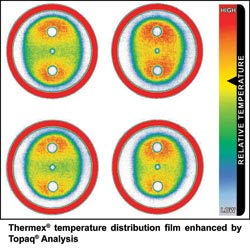

Thermex® Sensor Film Allows Engineers to Quickly Check and Correct Surface Temperature Variations

Maintaining heat within certain parameters between contacting platens and rollers is critical in several converting and printing applications. For that reason, Sensor Products Inc. has developed Thermex® surface temperature distribution film.

Thermex® is an economical thin film that can be used in virtually any application to monitor heated contacting rollers and presses from 200° to 300°F (93° to 149°C). Maintaining proper thermal contact across the interface of vacuum and flat web-type machines and lamination presses are among uses for this film.

Thermex® is an economical thin film that can be used in virtually any application to monitor heated contacting rollers and presses from 200° to 300°F (93° to 149°C). Maintaining proper thermal contact across the interface of vacuum and flat web-type machines and lamination presses are among uses for this film.

Upon exposure to heat, Thermex® changes color instantaneously and permanently to reveal temperature distribution between any two contacting surfaces. The intensity of this color change directly relates to the temperature it was exposed to enabling Thermex® to reveal spot high or low temperature zones and minute surface variations.

While the used Thermex® material may be saved for archival purposes, its low cost renders it inherently disposable. A sheet of Thermex® which is available in 14” by 17” (35.6 by 43.2 cm) format costs $25.00 or $299.99 for a pack of 25 sheets. It can be easily trimmed for smaller applications or custom cut to defined dimensions.

New applications for Thermex ®are being discovered daily. Common applications include heat sealing, lamination/press, converting, metallurgical welding, ultrasonic welding, heat sinking, and clutch/brake interfaces.

Post processing analysis of Thermex® is available for temperature fluctuations that need to be analyzed with great precision. For more information or to order Thermex®, call Sensor Products Inc. 1.973.884.1755 email, This email address is being protected from spambots. You need JavaScript enabled to view it. or view sensorprod.com/thermex. Many items from Sensor Products are available in their shopping cart online.

Acrowood Corporation announces three major orders received from China in 2010 and 2011.

Acrowood will deliver a DEAL Rotary Debarker to Shandong Sun Paper Industry Joint Stock Co. Ltd.'s Laos project. This order tops off 2010 and 2011 sales to some of China's largest mills, including the Guangxi Jingdaxing Group, and the Yunnan Yunjing Forestry & Paper Co. Ltd.

"We are pleased that these companies have invested in Acrowood technology as the industry moves to upgrade and expand existing as well as build new mills," said Acrowood Chairman and CEO Farhang Javid.

Sun Paper is China’s largest, privately owned paper company. The mill has purchased a DEAL RS4L330-60 Rotary Debarker -- key equipment for a new, 980 admt per day dissolving grade pulp mill located in Muang Phin, Laos. Mill start-up is scheduled for late 2012.

Acrowood has previously supplied equipment for Sun Paper. In 2006, Acrowood provided a complete woodyard system for their Chemical Mechanical Pulping Mill in China. That installation included an Acrowood debarker, chipper, and complete chip thickness screening system. Two dual drive suspended screens were also provided at the mill.

In August of 2010, Acrowood was awarded an order for a chipper (to produce pulp chips from both logs and bamboo) and a complete Chip Thickness Screening system from Guangxi Jingdaxing Group. The screening system includes an Acrowood Raised Roll Disc Thickness Screen, DiamondRoll VIRO Fines Screen, Air Density Separator System, and Chip Cracker. The order also included an Acrowood disc scalper to process their purchased chips. Start up for the woodyard system is scheduled for May of 2011.

Jingdaxing Group is one of the top 10 largest Pulp and Paper businesses in China and owns three companies; Jingdaxing Pulp Co. Ltd., Jingdaxing Paper Co. Ltd. and Jingdaxing Forest Co. Ltd.

In September of 2011, Acrowood received an order from Yunnan Yunjing Forestry & Paper Co. Ltd for a model 8425 Slant Disc Whole Log Chipper and a high capacity, three deck, four sort, Dual Drive Suspended Rotary Screen.

The mill is located in Jinggu County of Pu’er City in Yunnan Province and is one of the largest industries in Yunnan Province. The mill was established in the early ‘90s and has consistently upgraded its equipment to use the most advanced technologies. The current goal is to expand production capacity and erect a first-class, bleached sulfate plant. The line is expected to be commissioned in mid to late 2011.

“Acrowood debarkers, screens, chippers, and chip thickness systems have proven themselves.” said Mr. Javid, explaining the continued use of Acrowood’s equipment in China’s burgeoning woodyard industry. “The quality components in Acrowood machinery provide high performance and reduced maintenance cost, bringing the greatest return for customer’s investment. It’s all about performance value.”

Metso to supply tissue line to Jeesr Industries in Morocco

Metso will supply a complete tissue production line to the Moroccan Jeesr Industries for their mill in Berrechid, close to Casablanca. The line is scheduled to start up in the fourth quarter of 2012. The value of the order will not be disclosed. The market value of a tissue production line of this type is in the range of EUR 15–20 million depending on the scope of the delivery and the production output. The most part of the order is included in Paper and Fiber Technology’s Q1 orders received and the automation package in Energy and Environmental Technology’s Q1 orders received.

Metso’s delivery will include a complete production line with stock preparation equipment, a tissue machine, a rewinder and wrapping equipment. The production line will be optimized to produce top-quality tissue paper at low energy and water consumption levels. The delivery will also comprise an extensive automation package including machine, process and integrated drive controls, as well as a quality control system.

The new production line will produce around 30,000 tonnes a year of high-quality facial, toilet and towel grades. The raw material for the new line will be virgin pulp.

Jeesr Industries is a privately owned company, which is part of the Novatis Group, a producer and supplier of various consumer goods, among others baby diapers, for the Moroccon market.