Ianadmin

BlackRock's shareholding in UPM has gone below the threshold of 5 per cent

UPM-Kymmene Corporation has on 12 May 2016 received a notification under Chapter 9, Section 5 of the Securities Markets Act, according to which BlackRock, Inc.'s holding of UPM shares and voting rights has gone below the threshold of 5 per cent on 11 May 2016.

UPM-Kymmene Corporation has on 12 May 2016 received a notification under Chapter 9, Section 5 of the Securities Markets Act, according to which BlackRock, Inc.'s holding of UPM shares and voting rights has gone below the threshold of 5 per cent on 11 May 2016.

According to the notification, BlackRock, Inc.'s indirect shareholding in UPM has decreased to 26,407,100 shares, corresponding to 4.94 per cent of UPM shares and voting rights. The total number of UPM shares and voting rights owned directly or through financial instruments by BlackRock, Inc. and its funds was 5.54 per cent on 11 May 2016. UPM's registered total number of shares and voting rights amounting to 533,735,699 has been used in the calculation of percentages for the announcement.

Total positions of BlackRock, Inc. and its funds subject to the notification obligation:

| % of shares and voting rights (total of A) | % of shares and voting rights through financial instruments (total of B) |

Total of both in % (A + B) |

|

| Resulting situation on the date on which threshold was crossed or reached | 4.94% | 0.59% | 5.54% |

| Position of previous notification (if applicable) | 5.09% | 0.41% | 5.50% |

Notified details of the resulting situation on the date on which the threshold was crossed or reached:

A: Shares and voting rights

| Class/type of shares | Number of shares and voting rights | Number of shares and voting rights | % of shares and voting rights | % of shares and voting rights |

| ISIN code (if possible) | Direct (SMA 9:5) | Indirect (SMA 9:6 and 9:7) | Direct (SMA 9:5) | Indirect (SMA 9:6 and 9:7) |

| FI0009005987 | 26,407,100 | 4.94% | ||

| SUBTOTAL A | 26,407,100 | 4.94% |

B: Financial Instruments according to SMA 9:6a

| Type of financial instrument | Expiration date | Exercise/Conversion period | Physical or cash settlement | Number of shares and voting rights | % of shares and voting rights |

| Securities Lent | N/A | N/A | Physical | 2,028,098 | 0.37% |

| CFD | N/A | N/A | Cash | 1,170,810 | 0.21% |

| SUBTOTAL B | 3,198,908 | 0.59% |

Full chain of controlled undertakings through which the voting rights and financial instruments are effectively held starting with the ultimate controlling natural person or legal entity is presented in the enclosed Annex.

UPM

Through the renewing of the bio and forest industries, UPM is building a sustainable future across six business areas: UPM Biorefining, UPM Energy, UPM Raflatac, UPM Paper Asia, UPM Paper ENA and UPM Plywood. Our products are made of renewable raw materials and are recyclable. We serve our customers worldwide. The group employs around 19,600 people and its annual sales are approximately EUR 10 billion. UPM shares are listed on NASDAQ OMX Helsinki. UPM - The Biofore Company - www.upm.com

PMP received repeated order from Jiangsu Changfeng Paper, China

PMP received repeated order from Jiangsu Changfeng Paper, China for PM#2 Press Section Rebuild including a new Intelli-Nip® Shoe Press

PMP (Paper Machinery Producer) is continuing an active support of the Jiangsu Changfeng Paper’s development by implementing State-of-the-Art technology. After a successful PM#3 rebuild including (3) new Intelli-Jet V® hydraulic headboxes, an Intelli-Press® with an Intelli-Nip® Shoe Press and a new Intelli-Sizer® Metering Size Press in 2014, PMP has been awarded the contract again. This time the project is to complete a PM#2 Press Section rebuild including another new Intelli-Nip® Shoe Press.

Intelli-Nip® Shoe Press technology is great hybrid of energy saving solution & impressive paper properties and is recently a desired solution worldwide. At present, PMP is executing 4 projects that include its shoe press solution: in USA, Mexico, Columbia and China.

This time project goals for JCP are focused on increasing the PMs capacity, by increasing the operating speed from 700 to 850 mpm. Another target is to significantly improve quality parameters of the final product as well as machine runnability.

PM#2 of reel trim 4860 mm produces 2-ply fluting grades. The shoe press technology is going to play a key role in the final success, bringing ultra-high dryness (expected dryness after press 50%). It is important to mention that 1% more dryness after press brings 4% steam saving in the dryer section. The shoe press technology enables significant improvement of paper properties (especially bulk & bursting strength) and significantly supports runnability bringing extra production days.

PMP’s scope of delivery includes the Intelli-Nip® Shoe Module (design nip load 1050 kN/m), a plain mating roll of dia 1460 mm, PM auxiliaries systems such as hydraulic unit for the Shoe Press, PM controls & panels and mechanical drives. Structural machine components will be designed for a design speed of 900 m/min. PMP will also be responsible for on-site services, including on-site erection, start-up supervision and training services.

The delivery is scheduled for the beginning of 2017, followed by erection at site and start-up.

About Jiangsu Changfeng Paper:

Jiangsu Changfeng Paper Co., Ltd - producer of high strength corrugated base paper and testliner (3-ply, 90 – 220 gsm). Jiangsu Changfeng Paper Co., Ltd is specialized in paper making industry invested by Jiangsu Changfeng Group with the employee of over 650, the main product of the company is fluting paper with different specification which can reach the requirement of different customers. As highly starting point of the company, they own the high efficiency equipment and technology, their product exported to southeast Asia, middle east and African countries.

About PMP:

PMP – Paper Machinery Producer - a global provider of tissue, paper & board technology, has been supporting pulp and paper industry for over 160 years, executing projects on 6 continents. Company owns 6 facilities in 4 countries (Poland, USA, China, Italy). PMP – the only paper machinery manufacturer in Poland - is a recognized international player in both paper & tissue industry. At the end of December 2015, PMP introduced new branding initiative including launching new logo & visual identity. (learn more: www.pmpgroup.com)

Income and diversification appeals to northern UK farmers

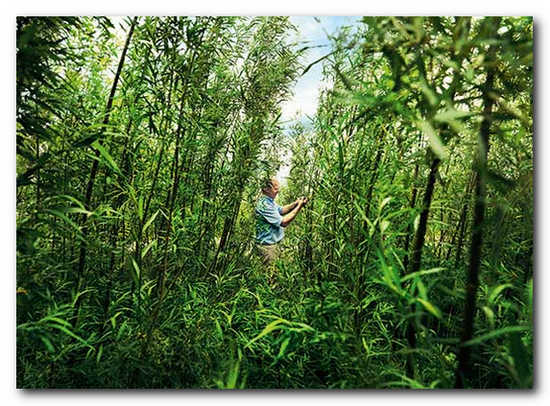

When Iggesund Paperboard’s Workington Mill in Cumbria, UK, took the decision to invest in a bio mass boiler in order to switch its energy sourcing from fossil fuels to biomass, they immediately started to plan for the future needs of fuel. One project, Grow Your Income, was to engage and interest local farmers to start growing willow to be delivered as biomass to the mill. The programme has been well received and is growing.

Some of the benefits for local farmers in Cumbria & the borders include a secure, long term regular income, increased farm biodiversity and provides land protection, e.g. soil erosion and management of environmental pollution such as excess run-off. SRC willow crop can even give bees a good source of pollen early on in the season. SRC willow crop can help farmers realise diversification by providing an additional good and reliable source of income on part of their land, thereby improving profitability and enabling sustainable supply of food when world market affects food income.

Working with farmers and land owners is the task of Neil Watkins, Alternative Fuels Manager at Iggesund Paperboard’s mill in Workington, England. The mill produces Incada, a high quality folding box board, FBB.

“We have to appreciate that this takes time and involves major decisions,” he explains, summing up the four years he has worked with the project so far. “Investing in energy crops is a twenty-year commitment so of course people want to feel they are doing the right thing. Interest is growing and the number of farmers planting new SRC Willow crops is increasing each year, especially since SRC Willow energy crops offer the farmer a way to diversify without taking on much risk.”

So far the mill received over 26 000 Tonnes of Willow chip added in to the fuel mix, which is much more willow than was expected early on in the project. It also has a growing list of farmers and landowners who are planning to plant willow within the Grow Your Income programme this year and in 2017.

“And that only involves a small fraction of the planted areas we’ve helped to create, because it takes three years to reach the first harvest,” says Managing Director Ulf Löfgren, who helped to initiate the whole project. “From 2016 onwards we’re expecting more volumes but we’ve already received more biomass from energy crops than we expected.”

The project was launched due to a dramatic shift in the energy supply of Iggesund’s paperboard mill in Workington. The company invested 108 million pounds to build a new biomass-fuelled CHP plant, which went online March 2013. Overnight the mill’s fossil carbon emissions were reduced to zero. At the same time the mill’s need for pure biomass went up by 500,000 tonnes a year.

The mill had already secured a sufficient biomass supply for the next several years but wanted to plan for the long term. Iggesund saw the opportunity to develop a new source of biomass in SRC energy crops. In its structure plan for Cumbria the UK environment department, DEFRA, has singled out parts of the county as being highly suitable for growing such crops. “The willow plants that we recommend are also very suitable to wetter unproductive ground, so they do not compete with food production,” Neil Watkins says.

Learn more at biofuel.iggesund.co.uk

Previous energy crop projects in Cumbria have failed due to their unpredictable harvesting costs. Biomass prices have been good but the costs of harvesting and transporting the crop to the customer have more or less erased farmers’ profits.

This was where Iggesund Workington saw new possibilities. The company already has its own forestry harvesting service plus an extensive timber transport network throughout northern England and southern Scotland. Iggesund is also part of the Holmen Group, one of Sweden’s biggest forest owners. So both the knowledge and resources for the harvesting of forest raw materials were readily available.

On this basis the company developed an offer to farmers. Iggesund takes responsibility both for the harvesting costs and for transporting the crop, while also guaranteeing farmers a return on their investment, which is index linked during the contract period, currently 22 years.

“We provide advice, financial support for the change-over, and a harvesting and transport service – all based on long-term contracts,” Watkins explains. “Our offer – which we’ve named ‘Grow Your Income’ – is a particularly attractive solution for older farmers interested in less work-intensive crops.”

Iggesund Paperboard has been one of Workington’s biggest employers since the end of the 1980s. Since the turn of the millennium the company has invested almost 200 million pounds to develop its paperboard manufacturing process. Three years ago Iggesund made one of its smaller investments over the years – it planted an energy crop on the ten hectares of land surrounding the mill. The crop will be harvested for the first time in the winter of 2016.

“We’re keen to show people that we believe in growing energy crops and we also want a demonstration facility so we can show visitors exactly how it’s done,” Watkins concludes. “And we’re counting on making a profit from it, too.”

Stora Enso strengthens bio-based chemicals development and signs a joint technology development and license agreement with Rennovia

Renewable materials company Stora Enso and specialty chemicals company Rennovia Inc have announced a joint development and license agreement to cooperate on bio-based chemicals development.

Under the terms of the agreement, the two companies will cooperate to develop processes for bio-based chemicals of interest to Stora Enso, employing Rennovia’s high-throughput catalyst discovery infrastructure and process development expertise. Rennovia focuses on the technology development of novel catalysts and processes for the cost advantaged production of chemicals from renewable feedstocks.

As Stora Enso is targeting new markets and developing novel products as it transforms into a renewable materials company, the agreement is a logical step for the company.

As Stora Enso is targeting new markets and developing novel products as it transforms into a renewable materials company, the agreement is a logical step for the company.

“The joint development and technology agreement will accelerate some of the developments Stora Enso is working on and gives us a solid platform to move further in building a portfolio of sustainable bio-based solutions for our customers. We are looking forward to collaborating with Rennovia,” said Juan Carlos Bueno, Executive Vice President, Biomaterials division at Stora Enso.

“This agreement underscores the broad applicability of Rennovia’s catalytic technologies to the production of a wide range of bio-based chemical products,” said Robert Wedinger, President and CEO of Rennovia. “We are delighted that Stora Enso recognizes our catalyst and process technologies as an efficient, cost-effective platform for producing bio-based chemicals.”

About Stora Enso Biomaterials division

Stora Enso Biomaterials division is a provider of pulp grades to meet the demands of various paper, board and tissue producers. The offering also includes fluff for hygiene applications and dissolving pulp for the textile industry. The mission of Stora Enso Biomaterials division is to find new, innovative ways to maximise the value extractable from wood, as well as other kind of ligno-cellulosic biomasses.

About Rennovia

Rennovia is a chemical process technology development company focused on the creation of novel processes for the cost advantaged production of commodity and specialty chemicals from renewable feedstocks. For further information, visit www.rennovia.com or e-mail This email address is being protected from spambots. You need JavaScript enabled to view it..

Juan Carlos Bueno, EVP, Stora Enso Biomaterials division, tel. +55 11 3065 5223

Stora Enso is a leading provider of renewable solutions in packaging, biomaterials, wooden constructions and paper on global markets. Our aim is to replace fossil based materials by innovating and developing new products and services based on wood and other renewable materials. We employ some 26 000 people in more than 35 countries, and our sales in 2015 were EUR 10.0 billion. Stora Enso shares are listed on Nasdaq Helsinki (STEAV, STERV) and Nasdaq Stockholm (STE A, STE R). In addition, the shares are traded in the USA as ADRs (SEOAY) on the International OTCQX over-the-counter market. storaenso.com

Sun and wind instead of gas

Fossil fuels will become increasing scarce in the future. So we are investigating the possibility of using all kinds of alternatives to gas as an energy source, such as biomass, solar energy and wind energy for producing green electricity. Ideally, we wish to install solar panels on the factory roof above our Converting section in the foreseeable future and we may participate in a wind turbine farm that is likely to be built locally.

Company Buyer Frank Bosmans: “Last year, we arranged a brainstorming session on satisfying our future energy needs. We have now seriously looked into a number of possibilities that match our sustainability vision, but have not yet taken concrete action. Solar panels and wind turbines are ideal methods for generating green electricity. We are investigating whether the roof and roof support structure above the Converting section are suitable for installing solar panels.”

As a leader in CSR, we want to make a statement, says Bosmans. “The most sustainable scenario is that we will be able to operate independently of fossil fuels at our production site. We are looking at the feasibility and financial viability of introducing power to heat as a method of exclusively using sustainably generated electricity in our production process. However, this is still very much a future scenario as our investigation has just started.

We consume 13.5 million cubic metres of gas annually. Most of this gas, 11 million m3 in fact, is used in our combined heat and power plant to produce the steam required to dry our paper. This plant also gives us the capability of generating approximately 25 to 30 million kilowatt hours (kWh) of electricity as a source of power for our machines. That is still insufficient however, and we have to purchase a further 12 million kWh elsewhere.

We are also interested in wind turbines. Plans for building an energy park on the Roerstreek industrial estate in Roermond are currently being drawn up and reviewed. Frank Bosmans: “We are investigating the possibilities for participating in this project. However, among other factors, that will depend on whether the government is prepared to invest in the project.”

Five wind turbines are already operating at the Neer wind farm in central Limburg. The fifth unit was installed by Windmolencoörperatie Zuidenwind in September. Private individuals and companies can still invest in this last wind turbine. Frank Bosmans: “Investing in a wind turbine delivers a better return than putting money in a savings account. In addition, your investment contributes to producing more sustainable energy in Limburg in the future. So we actively give our employees information about this investment opportunity.”

Verso Introduces Move the Message

New Promotion Features Sterling® Ultra Web Caliper Covers

Verso Corporation (OTCPink: VRSZQ), the leading North American producer of coated papers, has just introduced Move the Message, a new printed promotion for its Sterling® Ultra web caliper covers.

"Move the Message demonstrates the versatility of Verso's broad offering of Sterling® Ultra web caliper covers and provides a wealth of money-saving and performance-maximizing tips, techniques and technical information to help creative and print professionals put the print medium to work for a wide variety of applications," said Verso Senior Vice President of Sales, Marketing and Product Development Mike Weinhold.

In conjunction with the promotion, Verso expanded its line of Sterling® Ultra web caliper covers to include a dull finish offering available in 7 pt., 8 pt. and 9 pt. This addition complements the line's gloss and matte finish offerings, which range from 6 pt. to 10 pt. web covers. The 7 pt. and 9 pt. gloss, dull and matte web covers meet United States Postal Service minimum requirements for direct mail postcards and reply mail.

"Sterling® Ultra web caliper covers are manufactured to caliper specifications at a reduced weight, which means a thicker paper at a lower basis weight, resulting in savings on paper costs and postage," said Verso Brand Manager Jeffrey Pfister. "In other words, printers can produce the same number of impressions with less paper, and when the end product goes through the mail, less weight can translate into lower postal costs."

Sterling® Ultra is one of the broadest offerings on the coated paper market with gloss, dull and matte finishes; text and cover basis weights plus web caliper covers; matte reply card for business reply mail; and a specialized line of digital papers for production inkjet presses.

"Verso's Sterling® brand sets the standard for coated papers made in the USA - and it has for more than 100 years," said Pfister. "If you can imagine it, you can create it with Sterling®. Sterling® Ultra web caliper covers are the go-to-product for a wide variety of print applications such as direct mail and postcards; magazine, catalog or book covers; posters; specialty packaging; menus; and much more."

Contact a Verso sales or merchant representative to get a copy of Move the Message. To learn more about Sterling® Ultra web caliper covers, please visit our website versoco.com.

About Verso

Verso Corporation is the turn-to company for those looking to successfully navigate the complexities of paper sourcing and performance. The leading North American producer of printing and specialty papers and pulp, Verso provides insightful solutions that help drive improved customer efficiency, productivity, brand awareness and business results. Verso's long-standing reputation for quality and reliability is directly tied to our vision to be a company with passion that is respected and trusted by all. Verso's passion is rooted in ethical business practices that demand safe workplaces for our employees and sustainable wood sourcing for our products. This passion, combined with our flexible manufacturing capabilities and an unmatched commitment to product performance, delivery and service, make Verso a preferred choice among commercial printers, paper merchants and brokers, converters, publishers and other end users. For more information, visit us online at versoco.com.

Xerium to Acquire J.J. Plank Corporation, Maker of Spencer Johnston Spreader Rolls, Advancing Strategy in High-Growth Market Segments

Xerium Technologies, Inc. (NYSE:XRM), a leading global provider of industrial consumable products and services, has just announced that it has acquired the business of J.J. Plank Corporation, including its Spencer Johnston brand spreader roll line and related family of product lines for $18 million, comprised of $16.25 million in cash at closing, and the rest in future obligations. Spencer Johnston and the other J.J. Plank divisions supply equipment used in the production of paper, nonwoven fabrics, flexible packaging, tissue converting, and food packaging. The addition of these product lines will add strength and diversity to Xerium’s products, customers, and markets served. The combined company will have one of the broadest sets of capabilities with respect to spreader rolls, dandy rolls, and tissue embossing rolls in the world.

- Expands rolls product offering and service capabilities

- Diversifies customer base into tissue embossing, flexible packaging and nonwoven production

- Positions Xerium to be one of the leading global suppliers for spreader rolls, tissue embossing rolls, and dandy rolls

- Post synergy, pro-forma EBITDA contribution of $6 million

- Immediately de-leverages the company, on a pro-forma basis

The transaction furthers Xerium’s strategic plan to expand into product categories with the strongest growth opportunities. Through the acquisition, Xerium will expand its current product offerings and service capabilities, its markets served, and strengthen its financial profile and grow its customer base.

Harold Bevis, President and CEO of Xerium Technologies, Inc., said, “Incorporating Spencer Johnston’s and the other divisions' strengths in spreader rolls, dandy rolls, and tissue embossing rolls with our existing portfolio of products is a strategically and financially compelling advancement opportunity. These product lines will strengthen our product and service offerings, add new customers to our roster, and accelerate revenue diversification. Importantly, this acquisition furthers the Company’s strategy of realigning its market presence and future sales opportunities by onboarding existing customer references and special-purpose manufacturing assets.”

Harold Bevis, President and CEO of Xerium Technologies, Inc., said, “Incorporating Spencer Johnston’s and the other divisions' strengths in spreader rolls, dandy rolls, and tissue embossing rolls with our existing portfolio of products is a strategically and financially compelling advancement opportunity. These product lines will strengthen our product and service offerings, add new customers to our roster, and accelerate revenue diversification. Importantly, this acquisition furthers the Company’s strategy of realigning its market presence and future sales opportunities by onboarding existing customer references and special-purpose manufacturing assets.”

Bevis continued, “The acquisition is expected to produce post-synergy Adjusted EBITDA of $6 million, which will bolster the company’s de-leveraging efforts and immediately improve Xerium’s leverage ratios on a pro-forma basis.”

Spencer Johnston and the other J.J. Plank divisions generated 2015 revenue of $18.5 million, and are expected to be immediately accretive. Including integration and synergies, Xerium expects the acquisition to provide an Adjusted EBITDA contribution in 2016 of $2 to $3 million, excluding transaction related costs. When fully integrated, EBITDA contribution is expected to be $6 million annually, assuming no unexpected changes to market conditions.

ABOUT XERIUM TECHNOLOGIES

Xerium Technologies, Inc. (NYSE:XRM) is a leading global provider of industrial consumable products and services. Xerium, which operates around the world under a variety of brand names, utilizes a broad portfolio of patented and proprietary technologies to provide customers with tailored solutions and products integral to production, all designed to optimize performance and reduce operational costs. With 30 manufacturing facilities in 13 countries around the world, Xerium has approximately 3,000 employees.

New Valmet-delivered pulp drying lines started up at Klabin in Brazil

Two new pulp drying lines, delivered by Valmet, have been started at Klabin's new pulp mill located in Ortigueira city, Paraná state in Brazil. The first pulp bale was produced according to schedule on March 4th, 2016.

Two new pulp drying lines, delivered by Valmet, have been started at Klabin's new pulp mill located in Ortigueira city, Paraná state in Brazil. The first pulp bale was produced according to schedule on March 4th, 2016.

Klabin's new pulp mill will have the capacity to produce 1.5 million tons of pulp per year, with 1.1 million tons of bleached hardwood pulp (BEK) made of eucalyptus and 400,000 tons of bleached softwood pulp (BSK) made of pine. Part of the softwood will be converted into fluff pulp, making the mill the world's only pulp mill designed to produce the three fibers.

"The hardwood pulp drying machine that we delivered to Klabin produced the first bale according to the contract schedule. This is a great achievement to our team who has worked hard to build one of the biggest drying machines in the world, with 9.5 meters width. Now the two biggest drying machines in the world are running in Brazil, both supplied by Valmet," says Norbert Schwarz, Project Manager at Valmet.

"Klabin thanks its financers, suppliers, partners and employees for their effort in ensuring the feasibility and realization of this project, which is the largest investment in its history," the company stated in a notice to the market after the first pulp bales had been produced.

About the customer Klabin S.A.

Klabin, Brazil's largest paper producer and exporter, is the leading manufacturer of paper and board for packaging, corrugated board packaging, industrial sacks and timber in logs.Founded in 1899, it has 15 industrial units in Brazil and one in Argentina.Klabin is organized into four business units:Forestry, Pulp, Paper (paperboard, kraft paper and recycled) and Packaging (corrugated board and industrial sacks).

For further information, please contact:

- Norbert Schwarz, Project Manager, South America, Valmet, tel. +55 41 9971 1625

- Paulo Aguiar, Sr. Sales and Marketing Manager, South America, Valmet tel. +55 41 9989 0426

Valmet is the leading global developer and supplier of process technologies, automation and services for the pulp, paper and energy industries. We aim to become the global champion in serving our customers.

Valmet's strong technology offering includes pulp mills, tissue, board and paper production lines, as well as power plants for bioenergy production. Our advanced services and automation solutions improve the reliability and performance of our customers' processes and enhance the effective utilization of raw materials and energy.

Valmet's net sales in 2015 were approximately EUR 2.9 billion. Our 12,000 professionals around the world work close to our customers and are committed to moving our customers' performance forward - every day. Valmet's head office is in Espoo, Finland and its shares are listed on the Nasdaq Helsinki.

Valmet and Biochemtex to collaborate in developing technology for lignin derived biochemicals

Valmet and Biochemtex will start to cooperate in the field of conversion of lignin into biochemicals. The development project will combine and adapt LignoBoost and Moghi technologies. LignoBoost is Valmet's proprietary technology for the extraction of purified lignin from black liquor produced by pulp mills. Moghi in turn is Biochemtex's proprietary technology for the conversion of lignin into biofuels and biochemicals.

Valmet and Biochemtex will start to cooperate in the field of conversion of lignin into biochemicals. The development project will combine and adapt LignoBoost and Moghi technologies. LignoBoost is Valmet's proprietary technology for the extraction of purified lignin from black liquor produced by pulp mills. Moghi in turn is Biochemtex's proprietary technology for the conversion of lignin into biofuels and biochemicals.

This collaboration will create a high value market for lignin while providing the biochemical industry a consistent lignin stream to be used as a sustainable feedstock for the production of bioPET (bio based thermoplastic polymer).

"Valmet's industrially proven LignoBoost technology for lignin extraction plays an important role in this project. We are continuously developing new sustainable technologies for increasing the value of lignin. Combining LignoBoost and Moghi technologies is one of the very promising solutions we are looking into when developing biochemical technologies," says Rickard Andersson, Vice President for Valmet's Biotech and Environmental Systems.

"For us this partnership is an additional opportunity to provide the market with second generation biochemicals. We are already working with our own and Beta Renewables technologies. The cooperation with Valmet will allow to increase the feedstock available to produce bioPX, a key raw material for the production of PET made 100% from renewable sources. Existing pilot plant facilities, and the dedicated demo plant under construction in Italy, combined with the skills and know-how in both organizations, will provide a solid base to deliver fast and positive outcome for this exciting opportunity,"says Giovanni Bolcheni, CEO of Biochemtex.

About Biochemtex

Biochemtex is a leader in the technologies for the production of second generation biofuels and biochemicals. It is part of the Mossi Ghisolfi Group and a global leader in the development and engineering of technologies and bio-chemical processes based on the exclusive use of non-food biomass, as an alternative to oil.

VALMET

Corporate Communications

For further information, please contact:

Jussi Mäntyniemi, Director, Technology and R&D, Pulp and Energy, Valmet, tel. +358 40 769 8154

Alessandra Bogliano, R&D Director, Biochemtex, tel. +39 0131 88 28 11

ANDRITZ GROUP: Results for the first quarter of 2016

International technology Group ANDRITZ saw a solid development of profitability in the first quarter of 2016 despite slight declines in sales and order intake.

The situation on the markets served by ANDRITZ basically has not changed compared to 2015. While unchanged good project and investment activity prevails in the PULP & PAPER business area, several projects in HYDRO and METALS have been stopped temporarily or delayed due to uncertain demand.

The situation on the markets served by ANDRITZ basically has not changed compared to 2015. While unchanged good project and investment activity prevails in the PULP & PAPER business area, several projects in HYDRO and METALS have been stopped temporarily or delayed due to uncertain demand.

Based on the business results achieved in the first quarter of 2016, ANDRITZ expects Group sales for 2016 to decrease slightly compared to 2015. At the same time, however, profitability is expected to remain at a solid level.

The key financial figures developed as follows:

- Sales amounted to 1,285.6 million euros (MEUR) and were thus lower than the reference figure for the previous year (-8.5% versus Q1 2015: 1,404.3 MEUR). All business areas recorded a decline in sales.

- Order intake, at 1,247.4 MEUR, reached a satisfactory level, however, it was 12.8% below the reference figure of the previous year (Q1 2015: 1,430.6 MEUR). While the PULP & PAPER business area in particular and also SEPARATION were able to increase order intake compared to Q1 2015, HYDRO and METALS saw a significant decline in order intake.

- Order backlog as of March 31, 2016 amounted to 7,147.6 MEUR, thus decreasing slightly compared to the end of last year (December 31, 2015: 7,324.2 MEUR).

- Despite the decline in sales, EBITA increased to 83.9 MEUR (Q1 2015: 73.4 MEUR). This is due to the very positive development in the PULP & PAPER and HYDRO business areas. Thus, profitability of the Group (EBITA margin) increased to 6.5% (Q1 2015: 5.2%).

- Net income without non-controlling interests increased to 52.5 MEUR (Q1 2015: 44.0 MEUR).

ANDRITZ is a globally leading supplier of plants, equipment, and services for hydropower stations, the pulp and paper industry, the metalworking and steel industries, and for solid/liquid separation in the municipal and industrial sectors. The publicly listed technology Group is headquartered in Graz, Austria, and has a staff of approximately 24,200 employees. ANDRITZ operates over 250 sites worldwide.

Annual and financial reports

The annual reports and financial reports of the ANDRITZ GROUP are available as PDF for download at www.andritz.com Printed copies can be requested by e -mail to This email address is being protected from spambots. You need JavaScript enabled to view it.

Disclaimer

Certain statements contained in this press release constitute “forward -looking statements”. These statements, which contain the words “believe”, “intend”, “expect”, and words of a similar meaning, reflect the Executive Board’s beliefs and expectations and are subject to risks and uncertainties that may cause actual results to differ

materially. As a result, readers are cautioned not to p lace undue reliance on such forward-looking statements. The company disclaims any obligation to publicly announce the result of any revisions to the forward -looking statements made herein, except where it would be required to do so under applicable law.