Ianadmin

Mondi’s professional printing portfolio goes live at drupa

Mondi’s professional printing portfolio goes live at drupa with printing demonstrations by 17 press and finishing machine manufacturers

In cooperation with 17 original equipment manufacturers (OEMs) and finishing machine manufacturers, Mondi will showcase its new professional printing papers with live print runs at drupa. With the recent launch of the company’s professional printing campaign (www.mondigroup.com/printing), Mondi’s emphasis on paper optimisation for professional printing technologies reflects the latest trends in printing technology and the machines most widely used by professional printers.

Recent developments to Mondi’s professional printing portfolio have included new papers such as DNS® indigo, Color Copy indigo, DNS® high-speed inkjet as well as DNS® performance and BIO TOP 3® next, for hybrid print applications that require a combination of digital and offset print technologies.

Recent developments to Mondi’s professional printing portfolio have included new papers such as DNS® indigo, Color Copy indigo, DNS® high-speed inkjet as well as DNS® performance and BIO TOP 3® next, for hybrid print applications that require a combination of digital and offset print technologies.

“In the last year Mondi has launched several eco-conscious Green Range papers for high-speed inkjet, HP Indigo, digital dry toner and hybrid printing. Working together with OEMs and other digital printing specialists is an important step in bringing new papers to market. As printing technology advances, we feel that cooperation between the printers, printing machine manufacturers and specialists in all areas – paper, ink and machine technology – further stimulates new developments in the industry,” said Johannes Klumpp, Marketing and Sales Director for Mondi Uncoated Fine Paper.

According to Johannes Klumpp, sustainable production is a priority in the development of all Mondi products. The Green Range is Mondi’s umbrella brand for sustainably  produced products. As of 2012, all Mondi branded papers belong to the Green Range and are FSC® or PEFC™ certified, produced with pulp that is 100% recycled or bleached totally chlorine free (TCF).

produced products. As of 2012, all Mondi branded papers belong to the Green Range and are FSC® or PEFC™ certified, produced with pulp that is 100% recycled or bleached totally chlorine free (TCF).

Mondi’s professional printing portfolio is classified according to environmental accreditations, haptics, and optics, offering professional printers a full range of features, grammages and formats for diverse applications. Visitors can expect to see a broad spectrum of applications with Mondi’s smooth, high-white, white, off-white, recycled, tinted and coated papers, which reflect the latest trends in commercial, transpromotional or transactional printing.

Drupa visitors will find Mondi papers being printed and converted by the following manufacturers:

•Canon-Océ

•E.C.H. Will

•Formatwerk

•Horizon

•HP

•Hunkeler

•Impika

•KBA

•Komori

•Konica Minolta

•Kyocera

•Landa

•Polar Mohr

•Ricoh

•Sharp

•Xanté

•Xeikon

Upturn in market with positive outlook

“The order situation has improved in our packaging paper segments and is now at a normal level. However, our sales of SEK 2 291 million and operating margin of 6% reflect a low level of prices. In local currency, prices for packaging paper fell by around 2% in the first quarter, as a result of pressure on prices during the previous quarter. We are today announcing an increase of EUR 80 per tonne in the prices of our sack and kraft paper, with effect from 1 June.

As we disclosed earlier, we reached agreement with UPM-Kymmene on 1 February concerning the acquisition of its packaging paper operations in Pietarsaari and Tervasaari, at a cost of EUR 130 million. The acquisition will complement our current product offering and enable us to develop and strengthen our offering in renewable, smarter packaging.

Through the acquisition, we will also reduce our pulp exposure, in turn bringing down the volatility in our results. It also enables us to expand our EUR cost base. We are anticipating net annual synergies amounting to SEK 30 million, and that earnings per share will rise once the effects of the synergies are achieved. It is anticipated that the take-over of the acquired business will be completed in the second quarter.”

Metso's investment in QCS applications pays off with record-level orders

Metso IQ system deliveries have reached a record level. With proven successful installations over the years, Metso's market share has grown significantly to over 30%.

When Metso introduced its first advanced architecture PaperIQ quality control system in the mid-1990s, the company set in progress a resolute course to be a major contributor to the stability and profitability of its customers' papermaking operations. More than 15 years later and with over 1,000 QCS scanners delivered, the long-term investment in QCS technology, engineering skills and application development has paid off handsomely.

New Metso paper, board and tissue machines are equipped with Metso IQ systems. However, the substantial growth in Metso system deliveries is coming from replacing the so-called legacy systems, many of which were installed over the past twenty years. Just over 40% of the Metso IQ systems recently sold worldwide have replaced systems originally delivered by other vendors. In North America, that replacement rate was near 50%. Other growth areas for Metso include the replacement of CD profilers and CD controls.

Metso has introduced many new system enhancements in recent years to improve the return on investment from new system installations and therefore encourage customers to update their QCS technology. The now-standard MD and CD multivariable predictive controls have provided better machine stability and bottom-line results. New developments in sensor technology include Metso IQ Laser Caliper, which has a major market share in SC paper and many other grades, and Metso IQ Fiber non-nuclear fiber weight measurement for tissue machines. More than 50 Metso IQ Fiber sensors have been installed. New imaging-based sensors for formation, fiber orientation and surface topography, as well as a new pressure-based porosity sensor, are recent additions to the measurement capabilities.

Metso IQ systems have also become easier and less costly to service than previous generations with the addition of extensive predictive maintenance diagnostics. This makes the total cost of ownership over the system lifespan considerably lower.

Metso feels poised to achieve even better results in years to come. "In order to achieve the same success this year, we have to be even more competitive with our product performance, with our total quality, and naturally with product costs. Our total offering and industry specific concepts, such as Pulp, Paper, Tissue and Board, show our expertise and help differentiate us from our competitors. It is going to be a hard competition, but both our offering and the company are in good shape for it," concludes Juha Koistinen, Vice President, Control & Measurement Solutions.

Metso IQ quality control system including high-level intelligent control applications optimize the cross machine performance for papermaking processes. It integrates process quality management, measurements and profile controls resulting faster startups and grade changes, reduced dryer breaks and better runnability with stable short circulation improving uniformity of the wet sheet. (www.metso.com/metsoiq)

Metso IQ profilers provides effective profile management, improves production and runnability through to better paper quality and printing properties. Metso's profilers feature advanced self-diagnostics and compact designs for easy maintenance and installation. (www.metso.com/automation/pp_prod.nsf/WebWID/WTB-041026-2256F-5F91A)

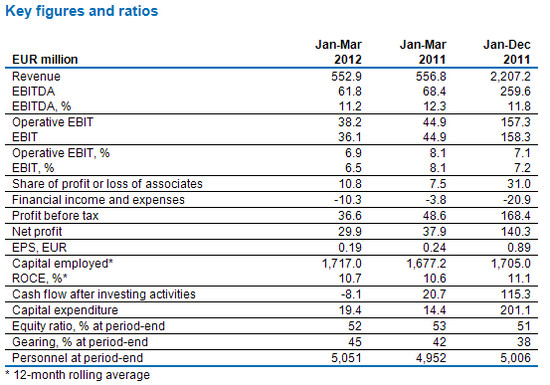

Kemira Oyj's Interim Report January-March 2012

Kemira Oyj's Interim Report January-March 2012: Stable revenue and sales margin offset by higher fixed costs

- Revenue remained stable at EUR 552.9 million (556.8).

- Operative EBIT decreased 15% to EUR 38.2 million (44.9) with a margin of 6.9% (8.1%) mainly due to higher fixed costs.

- Earnings per share decreased 21% to EUR 0.19 (0.24) mainly due to changes in fair values of electricity derivatives.

- Kemira outlook for 2012 is revised from the 2011 year-end report. Kemira expects revenue and operative EBIT in 2012 to be approximately at the same level than in 2011.

Kemira's President and CEO Wolfgang Büchele:

"Kemira's revenue and operative EBIT improved at the beginning of the year compared to the challenging fourth quarter of 2011. Compared to the first quarter of 2011, Kemira was able to compensate the lower sales volumes and higher raw material prices with the sales price increases. However, our fixed costs increased in all segments and resulted in a decrease in the operative EBIT.

Kemira will continue to focus on the water and more specifically on the water quality and quantity management. This is a unique aspect in the chemical industry. Now we are focusing on the following priorities:

First of all, we have to get into an accelerated mode in order to reach our EBIT financial target of 10% by improving our internal efficiency. This will be achieved by reducing the complexity of our business while growing profitably at the same time.

Secondly, as the fastest growth of water related business will be in Asia and South America, we have to substantially strengthen our position there.

Lastly, we need to sharpen our strategy and to make it more tangible for everyone.

I assumed the position of CEO on April 1, 2012 but already prior to that I have spent time meeting Kemira employees. What impressed me most was the energy and enthusiasm of our people. As one Kemira, we will together leverage our market potential and create value for the company and its stakeholders.

In the near term, uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products. Kemira expects revenue and operative EBIT in 2012 to be approximately at the same level than in 2011. This guidance assumes that no major macroeconomic disruption and/or further substantial increase in oil price would occur."

Definitions of key figures are available at www.kemira.com > Investors > Financial information. Comparative 2011 figures are provided in parentheses for some financial results, where appropriate. Operating profit, excluding non-recurring items, is referred to as Operative EBIT. Operating profit is referred to as EBIT.

Outlook (revised)

Kemira's vision is to be a leading water chemistry company. Kemira will continue to focus on improving profitability and reinforcing positive cash flow. The company will also continue to invest in order to secure the future growth in the water business.

Kemira's financial targets remain as communicated in connection with the Capital Markets Day in September 2010. The company's medium term financial targets are:

- revenue growth in mature markets > 3% per year, and in emerging markets > 7% per year

- EBIT, % of revenue > 10%

- positive cash flow after investments and dividends

- gearing level < 60%.

The basis for growth is the expanding water chemicals markets and Kemira's strong know-how in the water quality and quantity management. Increasing water shortage, tightening legislation and customers' needs to increase operational efficiency create opportunities for Kemira to develop new water applications for both current and new customers. Investment in research and development is a central part of Kemira's strategy. The focus of Kemira's research and development activities is on the development and commercialization of the new innovative technologies for Kemira's customers globally and locally.

In the near term, an uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products in the customer industries. In 2012, Kemira expects the revenue and operative EBIT to be approximately at the same level than in 2011. This guidance assumes that no major macroeconomic disruption and/or further substantial increase in oil price would occur.

Value of Pöyry's share-based incentive plan for the year 2012

On 24 April 2012 the Board of Directors of Pöyry PLC has resolved on the number of shares of the plan for key personnel for the year 2012.

The rewards to be paid on the basis of the earning period commencing in 2012 will correspond to a maximum total of 475,000 Pöyry PLC shares if the target performance set by the Board of Directors is met. If the Company's performance exceeds the target and reaches maximum performance, as defined by the Board of Directors, the rewards to be paid on the basis of the earning period commencing in 2012 will correspond to a maximum total of 950,000 Pöyry PLC shares.

The potential reward from the plan for the earning period commencing in 2012 will be based on the Group's Earnings per Share before restructuring costs (EPS) and Net Sales, as well as on the continuance of employment or service. The potential rewards earned on the basis of this earning period will be paid partly in the Company's shares and partly in cash in 2015.

PÖYRY PLC

Fortress adds to dissolving pulp management team

Fortress Paper Ltd. has announced changes to the management team of Fortress Specialty Cellulose Inc., a wholly-owned operating subsidiary which produces dissolving pulp at a mill in Thurso, Que. Marco Veilleux has been promoted to vice-president, business development and strategic projects, for Fortress Paper. Andre Boucher joins the company to replace Veilleux as chief operating officer of Fortress Specialty Cellulose.

Boucher has more than 30 years of industry experience in the specialty cellulose sector including 24 years at Tembec Inc. where he was the general manager of the Temiscaming dissolving pulp mill. Boucher was responsible for overall mill optimization and development of specialty products, including a full range of acetate and other specialty pulps. Most recently, Boucher was general manager of ethanol operations for Suncor Energy Inc.

Chadwick Wasilenkoff, chief executive officer of Fortress Paper, commented: "We feel [Andre’s] mill optimization and unique experience in transitioning a viscose-grade dissolving pulp mill to a specialty-grade dissolving pulp mill will further enhance our already strong specialty cellulose team. Andre's addition provides us with more flexibility as we balance our key personnel between Thurso and our other strategic projects."

Veilleux was a member of the executive team which managed the successful staffing, startup and conversion to dissolving pulp at the Thurso mill. In his new role, he will focus on special and strategic projects, manage risk and compliance matters, and will assume other key corporate responsibilities within Fortress Paper.

Fortress announced earlier this month that the closing date for its previously announced acquisition of the Lebel-sur-Quevillon pulp mill will be extended. The company states that it continues to work with the other parties to satisfy all the conditions prior to closing.

source: pulp and paper canada

AkzoNobel appoints Ton Büchner as new CEO

At the Annual General Meeting (AGM), shareholders of Akzo Nobel N.V. (AkzoNobel) approved the company’s 2011 financial statements and agreed that the 2011 financial year dividend would be €1.45 (2010: €1.40) per common share. An interim dividend of €0.33 was paid in November 2011, which means the final payment will be €1.12 per share.

The final dividend will be paid on May 24, 2012. Under the conditions to be published by the company and at the shareholder’s election, this dividend will be paid either in cash or in stock. The AkzoNobel shares will be traded ex-dividend on Euronext Amsterdam as of April 25, 2012. The record date is April 27, 2012.

Board of Management appointment and reappointments

Ton Büchner was appointed as member of the Board of Management by the shareholders and was duly appointed as CEO by the Supervisory Board. At the same time, Hans Wijers stepped down from his position as CEO and member of the Board of Management. The AGM thanked Mr. Wijers for his long and successful tenure at AkzoNobel, transforming the former conglomerate into the world’s largest coatings and specialty chemicals company.

Keith Nichols was reappointed to the Board of Management for another four-year term, and Leif Darner – who will reach the regular retirement age for Board of Management members in 2014 – was reappointed for a two-year term.

Rob Frohn stepped down from the Board of Management effective May 1, 2012. The AGM thanked Mr. Frohn for his extensive and successful 28-year career with AkzoNobel.

Supervisory Board appointments and reappointments

Dolf van den Brink and Peter Ellwood were reappointed to the Supervisory Board for further four-year terms. In addition, Sari Baldauf and Ben Verwaayen were appointed to the Supervisory Board for four-year terms.

Having reached the maximum 12-year tenure as member of the Supervisory Board, Virginia Bottomley stepped down. The AGM thanked Baroness Bottomley for her contributions to the company.

Amendments to the Articles of Association

The proposal to amend the Articles of Association to align them with changes in Dutch legislation was approved.

Further information about the amendments is available here.

Advanced lightweight material from forestry

Promising research findings with carbon fibre from lignin are presented in a new doctoral thesis by Ida Norberg

On 20 April, Ida Norberg defended her doctoral thesis “Carbon fibres from kraft lignin” at Innventia in Stockholm.

Her thesis shows that lignin, a substance that is found in wood but is removed during kraft pulp production, has great potential for use as a raw material for manufacturing carbon fibre. Carbon fibre is strong and light, with many applications. Today, demand is mainly limited by the high cost of production, with the petroleum-based raw material and fibre spinning accounting for around 50 percent of the cost. Thanks to LignoBoost technology*, the pulp mill can extract extremely pure lignin which could be used for carbon fibre, thus increasing access to a raw material for carbon fibre. According to studies reported on in Ida’s thesis, the cost of production could also be lowered by using lignin.

Her thesis shows that lignin, a substance that is found in wood but is removed during kraft pulp production, has great potential for use as a raw material for manufacturing carbon fibre. Carbon fibre is strong and light, with many applications. Today, demand is mainly limited by the high cost of production, with the petroleum-based raw material and fibre spinning accounting for around 50 percent of the cost. Thanks to LignoBoost technology*, the pulp mill can extract extremely pure lignin which could be used for carbon fibre, thus increasing access to a raw material for carbon fibre. According to studies reported on in Ida’s thesis, the cost of production could also be lowered by using lignin.

Ida carried out much of her doctoral work within the framework of the LigniCarb research project, with the aim of examining and demonstrating the possibilities of making carbon fibre from kraft lignin. One of the outcomes of this work was a brand new research environment at Innventia, where carbon fibre is now prepared on a laboratory scale.

“When I started this work six years ago, there was nothing except for a literature study by Elisabeth Sjöholm at Innventia,” explains Ida. “At that time, there were only three of us working on this project: Göran Gellerstedt from the Royal Institute of Technology, Elisabeth Sjöholm and me. Now there are lots of us involved, and there’s a great deal of interest from industry. It’s been exciting going from having nothing at all to now having lab equipment where we can actually produce carbon fibre. Hopefully, this work can lead to the full potential being realised and investment in larger scale, more advanced equipment.”

“There’s a lot to be gained from better equipment, such as the possibility of spinning a large number of fibres at the same time,” adds Elisabeth Sjöholm, who was Ida’s supervisor and is the project manager for LigniCarb. “But despite only having simple equipment, we can still show that kraft lignin has great potential as a raw material for carbon fibre. Building up knowledge is also extremely important in order to obtain expertise within what is a new area for us.”

In her studies, Ida has compared lignin from hardwood (birch and eucalyptus) and softwood (a mixture of spruce and pine). One important conclusion is that the differences in the lignin are reflected in the carbon fibre process. Softwood lignin has proven to be harder to liquefy and spin, but once lignin fibres have been produced they are easier to use later on in the process. The opposite is true with hardwood. A major breakthrough came when the team succeeded in spinning fibres from softwood lignin. This had previously been thought impossible, but is of particular interest to the forest industry in the northern hemisphere, such as the Nordic region and North America.

“This thesis is extremely interesting, and can be seen as another step towards the biorefineries of the future, where every component part of the wood is used based on its own unique properties, becoming raw materials for many different applications,” says Peter Axegård, Director of Business Area Biorefining at Innventia.

SCA has accepted DS Smith´s formal offer

SCA has accepted DS Smith´s formal offer to acquire the packaging operations in France following consultations with appropriate works councils. As a result, a sale and purchase agreement has been signed by both parties.

On 17 January 2012, SCA announced that its packaging operations – excluding the two kraftliner mills in Sweden – will be sold to DS Smith. The agreed purchase price amounts to EUR 1.7bn on a debt free basis.

As for the French part of the packaging operations, the price for which is included in the announced purchase price, DS Smith had made a formal offer to acquire also those operations. This acquisition was subject to consultation with the French works councils and has been managed separately.

After the consultation with the French works councils has been completed, SCA has accepted DS Smith's formal offer, and as a result, a sale and purchase agreement for the French operations has now been signed.

Following the signing of the sale and purchase agreement, the process will continue towards completing the entire transaction, which includes review of relevant competition authorities. Closing of the transaction is expected to take place in the second quarter 2012.

HIMA recorded turnover growth of 15% for the 2011 business year.

HIMA recorded turnover growth of 15% for the 2011 business year. The number of employees increased by 10% compared to the previous year. The annual result for 2011 and the success in the Q1 2012 indicate that HIMA is still on the path to growth.

In the 2010 business year HIMA had overall turnover of €75.7 million, which increased by 15% to €87.2 million in 2011. In 2012 turnover is expected to increase even further. In the first quarter of 2012 a record number of new orders were made, 23% higher than the amount for the previous year.

The more than 60 new jobs created in 2011 increased the number of employees by 10%. HIMA now has 720 employees globally as of Q1 2012 thanks to the new hires. Further hiring is planned for the current business year.

The world-wide expansion is moving forward continuously. Already more than 30,000 HIMA systems are now installed around the world. In the past business year, 72% of total turnover came from outside of Germany and more than 46% came from outside Europe thanks to the global positioning with group companies and representatives in over 50 countries. In 2011 new group companies were established in Oman and Columbia. A group company is being set up in Brazil. Expansion of distribution and engineering services are now being planned globally, with a focus on the Middle East. However, the products are still developed, produced and tested exclusively in Germany.

One of success factors in the company's growth is the multiple development activities and product innovations for the process industry, railway industry as well as machine safety. At the headquarters in Bruehl near Mannheim, Germany; one-third of employees work solely in research and development.

But also the development of holistic solutions, which include complete hardware and software (including certified function blocks) as well as lifecycle services (services throughout the complete safety lifecycle), have contributed to the success of the company. The HIMax safety system, launched in 2008, provides such solutions for turbo machines and compressors (FlexSILon TMC), burner control and boiler protection (FlexSILon BCS) as well as the management of gas and liquid fuel pipelines (FlexSILon PMC).

Other success factors behind the high growth rates include the efficient autonomy and economic independence of the family-owned and operated company.