Ianadmin

Dow Completes Strategic Ownership Restructuring of Dow Corning Corporation

Becomes 100 percent owner of Dow Corning’s silicones business, at post-synergy transaction multiple of less than 6x EBITDA

- Highly synergistic transaction unlocks significant value for Dow shareholders – expected to be accretive to operating EPS, cash flow from operations and free cash flow in the first full year after transaction close

- Dow targets a minimum of $400 million in annual cost and growth synergies from the restructured ownership; anticipates securing more than $1 billion in additional annual EBITDA at full run-rate synergies

- Strategic realignment provides powerful new set of material science capabilities, enabling Dow to go narrower and deeper into high-growth, high value market sectors such as building and construction, consumer care, transportation, packaging, electronics, and more

The Dow Chemical Company (NYSE: DOW) has just announced the successful completion of the transaction to restructure the ownership of Dow Corning. Dow is now 100 percent owner of Dow Corning’s silicones business, which had 2015 revenues of greater than $4.5 billion and is expected to generate more than $1 billion of annual EBITDA for Dow at full run-rate synergies. The transaction represents a post-synergy multiple of less than 6x EBITDA, highlighting the unique value creation to Dow shareholders from acquiring 50 percent of the silicones business while benefiting from 100 percent of the synergies.

The Dow Chemical Company (NYSE: DOW) has just announced the successful completion of the transaction to restructure the ownership of Dow Corning. Dow is now 100 percent owner of Dow Corning’s silicones business, which had 2015 revenues of greater than $4.5 billion and is expected to generate more than $1 billion of annual EBITDA for Dow at full run-rate synergies. The transaction represents a post-synergy multiple of less than 6x EBITDA, highlighting the unique value creation to Dow shareholders from acquiring 50 percent of the silicones business while benefiting from 100 percent of the synergies.

“Dow Corning’s world-leading silicone position brings a complementary new chemistry and technology to Dow, with it being a hand-in-glove, strategic fit for our material sciences portfolio and based on the additional $1 billion of EBITDA to Dow’s bottom line at full run-rate synergies, which at $400 million is the minimum we expect to achieve, this transaction is highly accretive for our shareholders. As an owner of Dow Corning for more than seven decades, our deep understanding of common and adjacent markets we serve will enable us to go narrower and deeper into high growth businesses where innovation is rewarded with value,” said Andrew N. Liveris, Dow’s chairman and chief executive officer. “By linking our two robust innovation engines, we will bring greater value to our shareholders and a wider range of differentiated, high value solutions to our customers.”

A pioneer, and current day leader in silicones, silicon-based technology and innovation, Dow Corning was previously a 73-year 50:50 joint venture between Dow and Corning Incorporated. Dow and Corning will maintain their equal proportional equity interests in Hemlock Semiconductor Group, a polysilicon producer in which Dow Corning was the majority shareholder.

The highly synergistic transaction extends Dow’s participation in its Consumer Solutions and Infrastructure Solutions segments, providing immediate integration into Dow’s monomer and polymer value chains. It also enables Dow to provide complementary technology offerings in attractive industry segments where Dow is already a leader today, such as building and construction, consumer care, transportation, packaging, and electronics. Dow is positioned to capture a minimum of $400 million in annual cost and growth synergies from the restructured ownership.

Business Structure and Governance

Dow Corning will operate as a wholly owned subsidiary of Dow, and will be headquartered with Dow in Midland, Michigan.

As previously announced, Dow Vice Chairman and Chief Financial Officer Howard Ungerleider will serve as chairman of Dow Corning in addition to his current responsibilities. Dow Vice President Mauro Gregorio, who leads the Dow Corning integration team for Dow, will serve as chief executive officer of Dow Corning. Andy Tometich, a 27-year Dow Corning veteran, has been named business president of the silicones business.

“We are excited to welcome the Dow Corning team to the Dow family, and to deliver the tremendous growth potential of the combined company,” said Ungerleider. “Dow Corning is a new element for growth for Dow. Bringing together these two industry-leading companies will drive exciting opportunities for our customers worldwide via more comprehensive product offerings, access to new technologies, and expanded R&D power to help quickly commercialize innovations.”

Next Steps

Dow’s immediate focus is on seamlessly integrating Dow Corning into its existing operations and quickly capturing full growth and cost synergies. Already, leadership from both companies have worked together to define the organizational design for rapid post-close implementation. Dow expects the transaction to be accretive to operating earnings per share (EPS), cash flow from operations and free cash flow in the first full year after transaction close.

“Dow Corning’s silicones technology platform is a natural fit within Dow. Together we share 73 years as joint venture partners,” said Gregorio. “And we also share a promising future of bringing new technologies and innovation to customers worldwide.”

About Dow

Dow (NYSE: DOW) combines the power of science and technology to passionately innovate what is essential to human progress. The Company is driving innovations that extract value from material, polymer, chemical and biological science to help address many of the world's most challenging problems such as the need for clean water, clean energy generation and conservation, and increasing agricultural productivity. Dow's integrated, market-driven, industry-leading portfolio of specialty chemical, advanced materials, agrosciences and plastics businesses delivers a broad range of technology-based products and solutions to customers in approximately 180 countries and in high-growth sectors such as packaging, electronics, water, coatings and agriculture. In 2015, Dow had annual sales of nearly $49 billion and employed approximately 49,500 people worldwide. The Company's more than 6,000 product families are manufactured at 179 sites in 35 countries across the globe. References to "Dow" or the "Company" mean The Dow Chemical Company and its consolidated subsidiaries unless otherwise expressly noted. More information about Dow can be found at www.dow.com.

The Dow Chemical Company

Rachelle Schikorra

This email address is being protected from spambots. You need JavaScript enabled to view it.

+1 (989) 638-4090

Verso Introduces a Guide to Paper Selection for Election Direct Mail

New Promotion Provides Tips for Winning Political Campaigns

Verso Corporation, the leading North American producer of coated papers, has just introduced a promotion with tips for creating a successful election direct mail campaign featuring Verso's entire offering of 7 pt. and 9 pt. products that meet the United States Postal Service (USPS) minimum requirements for direct mail. The promotion, titled A Guide to Paper Selection: Election Direct Mail: Verso Tips for Winning Political Campaigns, is printed on Sterling® Premium 100 lb. (9 pt.) dull cover and 100 lb. text.

"This promotion provides practical advice for selecting the right paper, design elements, color scheme, printing process and target data when producing election direct mail and offers useful checklists and resources for creating winning political campaigns at the local, state or national level," said Verso Senior Vice President of Sales, Marketing and Product Development Mike Weinhold. "Direct mail is a smart and effective way to reach voters."

"This promotion provides practical advice for selecting the right paper, design elements, color scheme, printing process and target data when producing election direct mail and offers useful checklists and resources for creating winning political campaigns at the local, state or national level," said Verso Senior Vice President of Sales, Marketing and Product Development Mike Weinhold. "Direct mail is a smart and effective way to reach voters."

Verso offers a breadth of direct mail paper for any print technology and run length – from premium to economy sheets; digital and inkjet papers; and web offset papers. Products are readily available across the country in Verso and merchant distribution centers.

"Unlike most forms of political mass communication, direct mail lets you reach the right voters with the right message," said Verso Brand Manager Tanya Pipo. "Verso has the knowledge, services and products to help create a successful election direct mail campaign – including a broad offering of 7 pt. and 9 pt. USPS-guaranteed papers to ensure a smooth process from the printing press to finishing equipment, through the post office and into voters' hands."

"We strongly encourage U.S. candidates using direct mail for their campaigns to use paper made by a company owned and operated in the U.S., like Verso," said Weinhold. "It sends a message to voters that they are mindful of the importance of supporting U.S. manufacturing jobs. And because paper is both renewable and recyclable, using direct mail demonstrates a candidate's commitment to environmental sustainability, too."

Contact a Verso sales or merchant representative to get a copy of A Guide to Paper Selection: Election Direct Mail. Verso Tips for Winning Political Campaigns. To learn more about Verso's line of direct mail papers, please visit our website versoco.com.

About Verso

Verso Corporation is the turn-to company for those looking to successfully navigate the complexities of paper sourcing and performance. The leading North American producer of printing and specialty papers and pulp, Verso provides insightful solutions that help drive improved customer efficiency, productivity, brand awareness and business results. Verso's long-standing reputation for quality and reliability is directly tied to our vision to be a company with passion that is respected and trusted by all. Verso's passion is rooted in ethical business practices that demand safe workplaces for our employees and sustainable wood sourcing for our products. This passion, combined with our flexible manufacturing capabilities and an unmatched commitment to product performance, delivery and service, make Verso a preferred choice among commercial printers, paper merchants and brokers, converters, publishers and other end users. For more information, visit us online at versoco.com.

SOURCE Verso Corporation

UPM celebrates 25 years of operations in Uruguay with a photo exhibition

UPM opens a photo exhibition on the 2 June at Bioforum, UPM's showroom at the UPM Biofore House, to celebrate company's special relationship with Uruguay. The Natural Commitment photo exhibition provides a cross-sectional overview of company's 25 years in Uruguay. The exhibition shows Andrés Bartet's photographs from the UPM's plantation operations and community engagement activities of the UPM Foundation. In addition, the exhibition offers glimpses into the Uruguayan countryside, its people, and their passionate relationship with the country's most popular sport football. The exhibition is staged in cooperation with the Embassy of Uruguay.

UPM has played a major role in the development of the Uruguayan forest industry since the early 1990s. In addition to certified eucalyptus plantation operations the company produces pulp and energy in one of the world's most modern pulp mills in Fray Bentos.

The UPM Foundation was established 10 years ago to promote education and entrepreneurship through joint work with social organisations and local representatives in Uruguay. The foundation's mission is to bring together local stakeholders, communities and authorities, especially in the fields of education and training in the rural interior of the country.

"UPM has been privileged to play a substantial role in the development of a successful and sustainable forest industry in Uruguay. Through our forestry, pulp production and related logistics chain we are deeply engaged with the Uruguayan society and will remain highly committed to supporting the positive development of the industry", says Anssi Klinga, Senior Vice President, UPM Pulp

"The establishment and operation of UPM in Uruguay has been a significant milestone in the development of the forestry industry in our country. It was the first major greenfield undertaking in the pulp sector, vertically integrated, environmentally sustainable, socially responsible and technologically advanced. I believe that UPM has found in Uruguay a country well suited for its business with the right natural conditions, a solid institutional framework, good governance and also a qualified and motivated working force", states Pablo Sader, Ambassador of Uruguay.

"Natural Commitment photo exhibition offers a unique and rare glimpse into a distant and beautiful country that UPM has a special relationship with. The photographs are more than documentation of UPM's 25 years of operations in Uruguay. They show the beauty of rural Uruguay and its people, celebrating the positive developments we have achieved working together in the local communities", says Elisa Nilsson, Vice President, Brand and Communications, UPM.

Visit biofore.upm.fi (in Finnish) to see opening dates and hours for the Uruguay photo exhibition.

For further information please contact:

Elisa Nilsson, Vice President, UPM Brand and Communication, tel. +358 40 500 3150.

UPM

Through the renewing of the bio and forest industries, UPM is building a sustainable future across six business areas: UPM Biorefining, UPM Energy, UPM Raflatac, UPM Paper Asia, UPM Paper ENA and UPM Plywood. Our products are made of renewable raw materials and are recyclable. We serve our customers worldwide. The group employs around 19,600 people and its annual sales are approximately EUR 10 billion. UPM shares are listed on NASDAQ OMX Helsinki. UPM - The Biofore Company - www.upm.com

UPM Pulp

UPM is one of the world's leading producers of northern softwood, birch and eucalyptus pulp supplying global customers in many end use segments such as tissue, specialty papers, board, and printing and writing papers through its own sales and technical service network close to the customers. UPM Pulp operates four modern pulp mills, three in Finland and one in Uruguay as well as eucalyptus plantations in Uruguay. UPM Pulp employs approximately 1,500 people. The annual pulp production capacity is 3.5 million tonnes. Pulp Business is part of the UPM Biorefining Business Area. To learn more, visit: www.upmpulp.com

UPM in Uruguay

UPM's operations in Uruguay include the Fray Bentos pulp mill, the UPM Forestal Oriental forestry and wood sourcing company with its two nurseries, as well as the UPM Foundation.

UPM Forestal Oriental owns about 230,000 hectares of land, of which about 60% is planted with eucalyptus. The rest of the land is protected or used for forestry-related infrastructure, cattle grazing and other non-plantation operations. All of UPM's forest plantations are certified to FSC® and PEFCTM standards.

The Fray Bentos pulp mill started operations in 2007 and remains one of the world's most modern and efficient pulp mills. Its annual production capacity is 1.3 million tonnes of chemical eucalyptus pulp. Besides pulp, the Fray Bentos mill is a significant biomass-based energy producer, its electricity production accounting 8% of Uruguay's total energy production. The mill's wood raw material comes from sustainably managed local plantations.

Founded in 2006, the UPM Foundation works in coordination with local stakeholders to promote the development of rural communities through education, training and entrepreneurship, fostering a culture of safety and healthy living.

UPM employs directly and indirectly altogether 7,000 in Uruguay jobs and its contribution to Uruguay's GDP is1.4%.

New owners for Hagen-Kabel paper mill as of 1 July 2016

The management of Hagen-Kabel Pulp & Paper GmbH announced today the acquisition of the Kabel Mill from Stora Enso. The virgin fibre-based coated mechanical paper of the Hagen-Kabel paper mill is well-positioned at the top of the industry.

Hagen-Kabel Pulp & Paper GmbH has been founded by a group of renowned experts in the paper industry, including Dr. Hubertus Burkhart, CEO, and Dr. Günther Niethammer, of the founding-family of Kübler & Niethammer Papierfabrik Kriebstein AG, and Harm Bouma, who has held various senior management positions in the paper industry, including as CEO of Voith Escher Wyss. The group further consists of two experienced financial managers: Rüdiger Thieke, CEO of the Thieke Group, and Klaus Weber, former managing director of various international financial services providers.

Hagen-Kabel Pulp & Paper GmbH has been founded by a group of renowned experts in the paper industry, including Dr. Hubertus Burkhart, CEO, and Dr. Günther Niethammer, of the founding-family of Kübler & Niethammer Papierfabrik Kriebstein AG, and Harm Bouma, who has held various senior management positions in the paper industry, including as CEO of Voith Escher Wyss. The group further consists of two experienced financial managers: Rüdiger Thieke, CEO of the Thieke Group, and Klaus Weber, former managing director of various international financial services providers.

The acquisition of the Kabel Mill is a significant step towards the fulfilment of a long-term strategic plan devised by the new owners. Dr. Günther Niethammer, whose family has 160 years of experience in paper manufacturing, explains, “Hagen-Kabel is a factory with excellent credentials and a qualified and motivated team. We have identified lots of potential for the future and will focus primarily on client centricity and service.” Dr. Hubertus Burkhart will assume the role of CEO temporarily.

Dr. Hubertus Burkhart, formerly Senior Vice President at Stora Enso Group and Managing Director of LEIPA said: “Hagen-Kabel is strategically well positioned for the production of graphical papers. We will introduce new fiber-concepts including recycled fibers and thermomechanical pulp, offering a broader product range to the market. Furthermore, we will increase the converted volumes.”

The paper mill Hagen cable employs approx. 540 professionals and produces an annual turnover of approx. € 300 million respectively more than 485,000 tons of high quality coated graphical paper in the segments rotogravure and offset.

Fibria announces increase in production capacity at Horizonte 2 Project to 1.95 million tons/year

New production line at Três Lagoas, Mato Grosso do Sul, should be able to produce 200,000 tons of pulp per year above the initial forecast, for the same investment

Fibria, a Brazilian forestry company and the world's leading eucalyptus pulp producer, announces an increase in the production capacity of its new plant in Três Lagoas, Mato Grosso do Sul, from 1.75 million tons/year to 1.95 million tons/year. This new expansion in the project does not change the total planned investment of R$8.7 billion, equivalent to around US$2.4 billion.

Fibria, a Brazilian forestry company and the world's leading eucalyptus pulp producer, announces an increase in the production capacity of its new plant in Três Lagoas, Mato Grosso do Sul, from 1.75 million tons/year to 1.95 million tons/year. This new expansion in the project does not change the total planned investment of R$8.7 billion, equivalent to around US$2.4 billion.

The announcement of the new production capacity comes at a time when the company celebrates one year of the Horizonte 2 Project, 32.5% of which has already been completed. On May 31st, Fibria CEO Marcelo Castelli and the governor of Mato Grosso do Sul, Reinaldo Azambuja, announced the increase in production capacity at the company's construction site.

Combining the new line with the plant currently in operation, the Três Lagoas unit will expand its production capacity by 150%, exceeding the total capacity of 3.2 million tons of pulp/year. With this, Fibria's total production capacity, considering all its units in Brazil, will increase from the current 5.3 million tons of pulp/year to 7.25 million tons of pulp/year.

Fibria has been investing in the development of its forest base in the region to supply the new production line. The wood supply required to operate Fibria’s new plant will come from forests grown in Mato Grosso do Sul. A total of 187,000 hectares of forests planted on own, leased and partners’ areas will be used. Including the 120,000 hectares used to supply the current unit, the forest base that will supply the Três Lagoas unit will span 307,000 hectares. The average radius of the forests to the company's two production lines will be less than 100 kilometers, one of the most competitive in the market.

Fibria's Três Lagoas unit follows the most modern concepts in ecodesign, with cleaner and more efficient production processes. In addition, all the energy consumed is generated by the unit itself using biomass in the form of eucalyptus bark and the liquid biomass resulting from the industrial process. With the increase in production capacity, the industrial unit will generate and consume its own energy and will still have a surplus of 130 MWH, which will positively contribute to Brazil's energy grid and benefit the energy matrix by using renewable sources.

"The expansion of production capacity of the Horizonte 2 Project shows that the fundamentals that guided the expansion of our Três Lagoas unit are solid and supported by a financial structure that maximizes gains for Fibria. We are announcing a bigger capacity without having to invest more. We are proud to see this work in progress, bringing jobs, better quality of life and development to Três Lagoas, Mato Grosso do Sul and Brazil,” said Fibria CEO Marcelo Castelli.

Horizonte 2 Project Financing Structure

In May this year, Fibria signed financing agreements with the Brazilian Development Bank (BNDES), the Midwest Development Fund (FDCO) of the Midwest Development Superintendent’s Office (SUDECO) and the Finnish export credit agency Finnvera. With this, all of the funds required for Fibria's new production line are formally contracted and guaranteed.

The average cost of financing of the Horizonte 2 Project will be around 2.1% per year in U.S. dollar. The financial solution for the project will improve the company's credit quality by reducing the current average interest rate in U.S. dollar from 3.4% to 2.9% and by lengthening the repayment terms.

To obtain the remaining funds required for the project, Fibria will complement the credit lines with the working capital resulting from the agreement signed in 2015 with Klabin for the sale of pulp produced by the PUMA project.

BNDES approved a R$2.3 billion loan for Fibria. The project includes the acquisition of railway cars, locomotives, domestically manufactured machinery and equipment, as well as social investments in the company's areas of influence. As part of project funding, Fibria issued Agribusiness Receivables Certificates (CRA) totaling R$ 675 million in October 2015. With this, the company could benefit from the Fixed Income Market Incentive Program, launched by BNDES in 2015 to stimulate the capital markets in Brazil.

SUDECO granted Fibria a loan of R$ 831.5 million. The company comes under SUDECO’s priority sector category as it belongs to a sector with a long operating history and since the project includes a pulp unit integrated to a reforestation project. It also comes under the priority location category as it is situated in the city of Três Lagoas in Mato Grosso do Sul and is classified in the typology of the Nacional Policy on Regional Development (PNDR), which establishes preference in the disbursement of FDCO funds.

In the international market, Fibria gained access to two financing facilities: a US$400 million syndicated export prepayment facility with an average cost of Libor + 1.43% and average term of 5 years; and a US$400 million facility from the Finnish export credit agency Finnvera, which finances equipment acquisitions in the country.

Commitment to the community

With the Horizonte 2 Project, Fibria reaffirms its commitment to operating in a responsible manner in stimulating the continuous development of surrounding communities. For this, it has also announced the Basic Environmental Program, which will invest another R$ 6.2 million in Três Lagoas to acquire equipment for the municipal departments and in repairs to four municipal schools, a dental clinic and an orthopedic clinic. Other entities such as the Fire Department, the local police, Salesian Center and APAE are also included.

The cities of Brasilândia and Selvíria will receive investments of over R$ 1.9 million to renovate the municipal school and hospital. The Mato Grosso do Sul government received R$ 34 million through environmental compensation, with investments in the state and in local communities totaling R$ 41.5 million.

During the two years of project execution, 40,000 direct and indirect jobs will be created. At the height of construction, the project will employ around 10,000 workers. When the new pulp line goes operational, it will employ 3,000 direct and indirect workers. During project construction, Fibria will have around 60 suppliers from Três Lagoas, whose contribution will encourage the economic development of the city, thereby improving the quality of life of its people. The project work will also have a positive impact on public finance, with an estimated tax collection of R$ 450 million during the construction.

The Três Lagoas unit expansion project entails another R$ 11.7 million in social investments in partnership with BNDES. Apart from health and education, social investments will go towards projects focused on income generation, including the expansion of the Territorial Rural Development Program (PDRT), which helps surrounding rural communities to develop ways and means for income generation and social inclusion. A total of 43 projects will receive investments, benefiting 43,000 people.

About Fibria

The world leader in eucalyptus pulp production, Fibria strives to meet the growing global demand for forestry products in a sustainable manner. With production capacity of 5.3 million tons of pulp a year, it has industrial units in Aracruz (Espírito Santo), Jacareí (São Paulo) and Três Lagoas (Mato Grosso do Sul), as well as in Eunápolis (Bahia), where it operates Veracel in a joint operation with Stora Enso. Fibria has 969,000 hectares of forests, with 568,000 hectares of planted forests and 338,000 hectares of environmental preservation and conservation areas. The pulp produced by Fibria is exported to more than 40 countries. In May 2015, Fibria announced the expansion of its Três Lagoas unit, which will receive a new line with annual pulp production capacity of 1.95 million tons and is slated for startup in the fourth quarter of 2017. Learn more at www.fibria.com.br

A new steel Yankee in Turkey at ESSEL®

A.Celli Paper, specialised supplier of high-technology turnkey tissue plants, has recently finalised an important rebuilding order with Essel Selüloz ve Kâğıt Sanayi Tic. A.ş., a Turkish company that already in 2005, for the inauguration of the first of its two facilities, recognised in the Lucca company a provider of excellence capable of fostering its growth.

Indeed, thanks to the A.Celli plant at the Caycuma production site, Essel Kagit produces almost thirty thousand tonnes of paper per year. And dozens and dozens of tonnes of optimal quality paper is each day converted into over 600 different types of tissue products designated for the Turkish market and not only.

The rebuilding on the tissue machine, aimed at improving formation and energy consumption on the line, entails the supply of a 12-foot steel Yankee and a new headbox. All this offers Essel the chance to plan its growth anew and to set new business goals for itself in terms of production quality and efficiency.

A.Celli Paper once again confirms itself a loyal supplier, a partner capable of building long-term business relations founded on respect, continuous growth and mutual sharing of goals in terms of technology and performance.

Essel Cellulose and Paper Industry Trade Co.

The Company was founded in 2005 in Zonguldak Çaycuma, the current location of the A.Celli Paper plant producing 70 tonnes of paper per day. The second plant was supplied in 2015 in Osmaniye. Essel produces many types of tissue products, roll and folded, exclusively in pure cellulose in different grammages. Quality of the raw material in order to manufacture optimal products at competitive prices capable of meeting market demands has always been a founding principle at Essel.

Stora Enso to divest its Kabel Mill in Germany

Stora Enso has signed an agreement to divest its Kabel coated mechanical paper mill in Germany to Hagen-Kabel Pulp & Paper GmbH, owned by a German based investor group. The transaction is in line with Stora Enso’s strategic transformation into a renewable materials growth company. The transaction is expected to be completed in the third quarter of 2016.

Stora Enso has signed an agreement to divest its Kabel coated mechanical paper mill in Germany to Hagen-Kabel Pulp & Paper GmbH, owned by a German based investor group. The transaction is in line with Stora Enso’s strategic transformation into a renewable materials growth company. The transaction is expected to be completed in the third quarter of 2016.

The cash consideration for the divestment of the assets is approximately EUR 23 million, subject to customary closing day adjustments. The loss on disposal amounts in total to EUR 15 million. The effect on operating profit is approximately EUR 5 million, and negative tax impact is approximately EUR 10 million. These will be recorded as a non-recurring item in Stora Enso’s second quarter 2016 results. Approximately EUR 17 million of pension liabilities will be transferred to the new owner with the transaction.

“Kabel Mill has an excellent reputation and an established customer base in the grades it produces. We believe that Kabel Mill will be able to further develop its business under the new ownership,” says Kati ter Horst, EVP Paper division at Stora Enso.

Based on 2015 annual figures, the divestment is expected to reduce Stora Enso’s annual sales by approximately EUR 300 million. It will also reduce Stora Enso’s annual paper production capacity by around 485 000 tonnes. Kabel Mill employs approximately 540 people, who will be transferred to the new owner with the divestment. The transaction will not have a material impact on Stora Enso’s operational EBIT going forward.

Stora Enso will continue to produce coated mechanical paper under the NovaPress brand at its Veitsiluoto Mill in Finland.

About Hagen-Kabel Pulp & Paper GmbH

Hagen-Kabel Pulp & Paper GmbH is a newly-established company owned by a German investor group with experience in the paper industry. One of the investors, Kübler & Niethammer Papierfabrik Kriebstein AG (“K&N”), produces graphical paper with a capacity of approximately 100 000 tonnes per year and recycled paper as raw material. The investor group has stated that it aims to develop the Kabel Mill and focus further on high quality customer service.

Stora Enso is a leading provider of renewable solutions in packaging, biomaterials, wooden constructions and paper on global markets. Our aim is to replace fossil based materials by innovating and developing new products and services based on wood and other renewable materials. We employ some 26 000 people in more than 35 countries, and our sales in 2015 were EUR 10.0 billion. Stora Enso shares are listed on Nasdaq Helsinki (STEAV, STERV) and Nasdaq Stockholm (STE A, STE R). In addition, the shares are traded in the USA as ADRs (SEOAY) on the International OTCQX over-the-counter market. www.storaenso.com

Russian JSC Syassky Pulp & Paper Mill starts up the 45,000 tonne/yr Toscotec AHEAD tissue machine at Syasstroy mill.

The Toscotec supplied AHEAD-1.5M tissue line came on stream on 29th April, 2016, well in advance to schedule at Syassky Pulp and Paper mill in Syasstroy, in the Leningrad region of Russia. The delivery agreement of the tissue machine was signed by Syassky PPM and Toscotec in December 2014.

After the PM3 start up the Syasstroy’s site is actually one of the most efficient Russian paper mills, employing over 2000 people to make 110.000 tons a year – almost twice the productivity of many competitor mills.

“The Toscotec AHEAD 1.5M tissue making line is designed to produce high quality tissue from dry and slush pulps, entailing a real reduction of the mill’s energy cost. That is important not only for us but also for our customers who realize the importance of sustainable industrial production. Toscotec has well understood our technological target as well as economical needs. Our partnership begun in 2009 with two new rewinders and continued in 2012 with an AHEAD line (PM2) until this new successful cooperation”, says Mrs. Irina Mozhaeva, the Chairman of the Board of Directors of Syassky PPM.

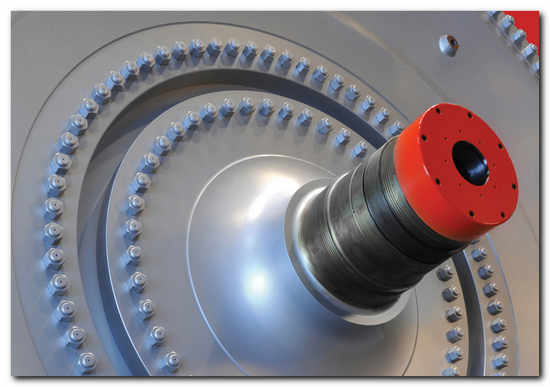

Toscotec scope of furniture for the new PM3 included AHEAD-1.5M crescent former tissue machine with a single layer headbox, single press configuration with suction pressure roll TT SPR1045, a 12 FT diameter Steel Yankee Dryer TT SYD-12FT and a reel section TT Reel-P. The delivery also included the stock preparation plant, gas heated hood and steam & condensate system as well as electrification & control system. Engineering and services (erection supervision, commissioning & start up assistance, training) completed the package.

JSC Syassky Pulp & Paper Mill

Toscotec is a turnkey supplier to the global paper industry. Since 1948, Toscotec offers complete production lines, plant retrofits, turnkey projects, and individual machineries. Headquartered in Lucca, Italy, the Group serves all the leading paper producers with customized solutions, leveraging on the experience gained in more than 60 years of activities. Since 2013 Toscotec has been the market leader in tissue machines sales. Toscotec currently employs approx. 180 people.

Valmet to supply an extensive board machine rebuild for ITC Bhadrachalam mill in India

Valmet will supply an extensive board machine rebuild and automation solution for machine and quality control to the ITC Bhadrachalam mill in India. The rebuilt production line (PM1) is planned to produce high-quality lightweight coated board with a wide range of produced grades. The start-up of the rebuilt machine is scheduled for the fourth quarter of 2017.

The order is included in Valmet's second quarter 2016 orders received. Typically, a project of this type and scope is valued at EUR 30 - 40 million.

"ITC has been the pioneer in Indian paper industry for introducing folding box board of international quality standards. Our investment in a state of the art paperboard machine PM 4 from Valmet way back in 1997 changed the experience of Indian printing industry. Selecting Valmet as partner for the new PM1 rebuild project is in line with our focus on enhancing the customer experience while aligning with the philosophy of "triple bottom line" i.e. for improved environmental, economic and social factors. With the support from Valmet, we will be introducing globally best available technology into this machine. I am sure that our customers are going to benefit immensely out of this project," says Sanjay Singh, CEO of ITC Paperboards and Specialty Papers Division.

"Long term relationship with the customer forms a solid base for this project - another machine PM 4 at the site is Valmet-delivered and Bhadrachalam values it as their flagship board machine. Energy and raw material savings were among the most important issues that were discussed in the negotiations of this new rebuild project. High quality furnish combined with our latest technology and automation and with the competence of ITC personnel give a good base for enabling an excellent end product. The rebuild will enable ITC to be among the best folding boxboard producers globally when it comes to lightweighing or improving bulk - leading directly to raw material savings," comments Petri Paukkunen, Vice President, Sales and Marketing from Valmet.

Technical information about the delivery

Valmet's delivery for the ITC Bhadrachalam PM1 board making machine rebuild includes all the key technologies from headbox to reel and automation for machine and quality control. The machine features number of leading technologies delivered exclusively by Valmet.

OptiFlo Fourdrinierheadbox,OptiFormer MultiFourdrinier forming section andOptiPress Linearshoe press with linear web run are important in high-quality board production. They enhance e.g. the end product surface and strength properties and productivity. Compared to other coated board machines in India, the machine is not equipped with Yankee cylinder, which often limits production. In the calendering section, a new type of a calender from Valmet OptiCalender Compact delivers reliable calendering results.

Valmet DNAmachine control andValmet IQquality control systems give accurate and reliable real-time data, which enables the optimizing of the entire production process and the end product quality.

The 4250-mm-wide (wire) PM 1 will produce mainly cup board, but also solid folding box board (FBB), bleached board (SBS) and art board grades with the basis weight range of 150 - 320 g/m2. The design speed for the rebuilt machine parts is 600 m/min.

Information about the customer ITC

ITC Paperboards and Specialty Papers Division is among the leaders in the paper and paperboard business with solutions to meet a diverse cross-section of packaging and communication needs. With emphasis on harnessing state-of-the-art technology, the company has emerged as the largest manufacturer of packaging and graphic boards in South Asia. Unit Bhadrachalam has seven machines with production annual capacity of 405,000 tons (TPA) of paperboard and 140,000 TPA of specialty boards.

Valmet is the leading global developer and supplier of process technologies, automation and services for the pulp, paper and energy industries. We aim to become the global champion in serving our customers.

Valmet's strong technology offering includes pulp mills, tissue, board and paper production lines, as well as power plants for bioenergy production. Our advanced services and automation solutions improve the reliability and performance of our customers' processes and enhance the effective utilization of raw materials and energy.

Valmet's net sales in 2015 were approximately EUR 2.9 billion. Our 12,000 professionals around the world work close to our customers and are committed to moving our customers' performance forward - every day. Valmet's head office is in Espoo, Finland and its shares are listed on the Nasdaq Helsinki.

Sonoco Products Company : Sonoco-Alcore to Increase Paperboard Prices in Italy

Sonoco-Alcore S.a.r.l. has just announced it will raise prices by €40 per tonne on all recycled paperboard grades sold in the Company's Italian region. The price change is effective with shipments on or after June 6th, 2016.

"This price increase is in response to rising raw material costs which have occurred and are now at the point where we need to pass this onto the market," said Phil Woolley, Director - Paper Europe. "We are also experiencing this effect in a number of other European countries and expect further announcements to follow if this trend continues," he added.

"This price increase is in response to rising raw material costs which have occurred and are now at the point where we need to pass this onto the market," said Phil Woolley, Director - Paper Europe. "We are also experiencing this effect in a number of other European countries and expect further announcements to follow if this trend continues," he added.

Sonoco Alcore S.a.r.l. is wholly-owned by Sonoco (NYSE:SON) and operates 29 tubes and cores plants and four paperboard mills in Europe, including the Company's largest European uncoated recycled paperboard mill in Cirie, Italy.

Contact:

Roger Schrum

+843/339-6018

This email address is being protected from spambots. You need JavaScript enabled to view it.

This announcement is distributed by NASDAQ OMX Corporate Solutions on behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Sonoco Products Company