Ianadmin

Mondi Launches a new campaign and website

Mondi, a leading global paper producer, has launched a new professional printing campaign for its professional printing portfolio. The campaign’s emphasis on digital printing technologies underscores Mondi’s approach to its portfolio development for the professional printing industry: to bring to market sustainably produced papers optimised for popular professional digital printing machines.

Mondi, a leading global paper producer, has launched a new professional printing campaign for its professional printing portfolio. The campaign’s emphasis on digital printing technologies underscores Mondi’s approach to its portfolio development for the professional printing industry: to bring to market sustainably produced papers optimised for popular professional digital printing machines.

“Our professional paper portfolio reflects the latest trends in printing technology and the machines most widely used by professional printers. In 2011, we launched a number of papers that focus on several key areas, namely high-speed inkjet, HP Indigo, digital colour laser and hybrid printing, which combines offset and digital printing. Moreover, all of our papers meet our Green Range environmental criteria and are FSC® or PEFC™ certified or produced with pulp that is 100% recycled or bleached totally chlorine free (TCF),” explains Johannes Klumpp, Marketing and Sales Director for Mondi Uncoated Fine Paper.

While Mondi’s professional printing portfolio offers several brands and sub-brands with various haptics, optics and environmental accreditations ─ smooth, high-white, white, off-white, recycled and coated papers ─ the new professional printing campaign, accompanying ads and new website (www.mondigroup.com/printing) focus on a central theme: the printer and his machine. By the end of March, in addition to English and German the website will be launched in French, Spanish, Italian, Dutch, Polish, Czech, Slovak, Romanian, Bulgarian, and Hungarian.

Globally, throughout 2012, Mondi will release five different ads that feature the full spectrum of the paper portfolio options as tailored to the printer’s technological focus: digital, hybrid, HP Indigo, and high-speed inkjet. The advent of new digital technologies has resulted in wider options for professional printers in terms of flexibility in applications. From personalised short runs and digital and offset hybrid jobs to mass mailings and transactional printing with high-speed inkjet machines, the options exist but successful results also depend on optimised paper technology. To ensure this, Mondi also works closely with Original Equipment Manufacturers (OEMs) in the development of its professional printing papers.

All of Mondi’s professional printing papers will be shown at this year’s drupa trade fair in Düsseldorf, Germany with an additional emphasis on the high-speed inkjet market. Mondi will be exhibiting at Hall 07.1, Booth B03/B05 at drupa from May 3-16.

Resolute Updates Status of Fibrek Offer

AbitibiBowater Inc., doing business as Resolute Forest Products has announced that it has received a favorable decision from the federal Minister of Industry, following his review of the Company's proposed acquisition of Fibrek Inc. under the Investment Canada Act.

The offer to acquire all of the issued and outstanding shares of Fibrek made by Resolute, together with RFP Acquisition Inc., a wholly-owned subsidiary, is more fully described in the offer circular and other ancillary documentation that Resolute filed on December 15, 2011, on the "SEDAR" website maintained by the Canadian Securities Administrators, as varied and extended. The offer will expire at 5:00 p.m. (Eastern Standard Time) on March 19, 2012, unless it is extended or withdrawn by Resolute.

Questions and requests for assistance or further information on how to tender Fibrek common shares to the offer should be directed to, and copies of the above referenced documents may be obtained by contacting, Georgeson at 1-866-598-0048 or by email at This email address is being protected from spambots. You need JavaScript enabled to view it.

Pallmann Group Completed China Regional Headquarters

Early in February, the China Ministry of Industry and Information Technology released a new industrial directory for renewable recycling resources and technology, aimed to push the comprehensive utilization technology of renewable resources and recycling industry development in order to meet the twelve-five-year plan’s goal of sustainable growth.

Sharing the same insights of sustainability, Pallmann group, the world-leading German company in size reduction technology, captured the great opportunity and completed its official establishment of China regional headquarters in Beijing.

Registered as Pallmann Technology (Beijing) Co,. Ltd, the company will function as the legal and functional managing office for mainland China, including customer service, business development, market expansion, legal, financial and HR.

Together with the Shanghai branch office, the Pallmann China team is now over ten experts covering size reduction, process of plastics and recycling industries. Pallmann also launched its Chinese language website providing product application manual download, technical consultancy, and online sales enquiry. Chinese visitors can also get up to date company news and tradeshow schedules. The new Chinese website has brought in many new business leads since the day it was launched.

Rolf Gren, Pallmann Group Senior Executive Vice President and President Pallmann Technology (Beijing), said: "We think China’s recycling industry is a vast emerging market. With the governments attention and policy support, innovation and new technology will become a health trend for further growth".

As a global leader in recycling technologies, Pallmann China has lots to offer and the China expert team is ready to support local customers and partners with the most cutting-edge recycling technologies and quality solutions whether in wood, paper, plastic, rubber and tire, metal, fabric etc.

NewPage Applauds Bill Passed to Apply Tariffs on Illegally Subsidized Goods From China

NewPage is pleased that President Obama signed the legislation passed by the U.S. House and Senate that will allow the Department of Commerce to continue to apply the countervailing duty law to non-market economy countries like China. This legislation will preserve intact the countervailing duty order in place covering coated paper, as well as other countervailing duty orders covering other products from China.

"We applaud the remarkable effort of Congress in passing this important legislation, and would like to especially thank Republican Senators Mitch McConnell (R-KY) and Susan Collins (R-ME) for their leadership roles," stated George Martin, president and chief executive officer for NewPage. "Keeping these duties in place helps to level the playing field and allow our world-class operations and workforce to continue to service our customers with high quality, competitive products," added Martin.

In 2009, Appleton Coated LLC, NewPage Corporation, Sappi Fine Paper North America and the United Steelworkers Union filed trade cases seeking to end dumping and subsidy practices, involving certain coated paper produced in China and Indonesia. In 2010, these efforts resulted in antidumping and countervailing duties being imposed on imports from both of these countries. Until the duties were put in place, imports from these countries were having a devastating effect on production and employment in the United States.

SOURCE NewPage

SCA launches new sustainability targets

SCA is one of the world’s most sustainable companies – environmentally, socially and financially. The company is now further raising its ambitions through the introduction of a number of new targets. According to a recent SCA survey, sustainability activities are significant for the business operation.

“Sustainability activities are business-critical for SCA and give us an edge over competitors. Our ambitious work makes us more attractive for customers, consumers and investors, while it also contributes to lower costs,” said Jan Johansson, SCA’s President and CEO, at a press meeting in Stockholm today where the new targets were presented.

SCA recently performed a survey which showed that sustainability activities play an important role in relationships with customers. As many as 41% of respondents said that they had participated in contract negotiations in which sustainability was the deciding factor for the outcome.

Measurability and access to relevant key performance indicators are crucial factors in ensuring successful sustainability programs. Systematic preparatory work has resulted in a number of specific new targets:

- Triple production of biofuels from SCA’s forests by 2020

- Increase wind power production on SCA forest land to 5 TWh by 2020

- Set aside at least 5% of SCA’s productive forestland from forestry in the ecological landscape plans and a further 5% for nature conservation purposes

- Decrease the accident frequency rate by 25% between 2011 and 2016

- Make SCA’s hygiene knowledge base available to customers and consumers and ensure access to affordable, sustainable hygiene solutions

- Deliver better, safe and environmentally sound solutions to customers through sustainable innovation

“The middle class is expected to grow by three billion consumers in the next 20 years, primarily in emerging markets. This represents a major opportunity for us to improve hygiene and health standards for millions of people at the same time as ensuring our commercial success,” said Kersti Strandqvist, SVP of Corporate Sustainability.

“Innovation and sustainability are strongly intertwined, and sustainable innovations are essential if we are to surpass customer and consumer expectations. In order for us to further emphasize the importance of this area, we are today proud to announce that we have decided to join the World Business Council for Sustainable Development, where global corporations go from words to action on sustainability matters,” she added.

Read more about SCA’s sustainability activities at www.sca.com/sustainability

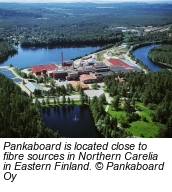

FSC Certification adds to Pankaboard's Green Credentials

Finland-based Pankaboard added to its environmental credentials after securing a certificate for complying with the latest version of FSC (Forest Stewardship Council) standard. Since the beginning of 2012, the company has held the FSC chain-of-custody certification.

The company, which focuses in the production of coated and uncoated specialty cartonboards, has been privately owned since 2006. Despite its young age, cartonboard production at the mill site began a century ago, which makes the company an experienced player in the field.

The company, which focuses in the production of coated and uncoated specialty cartonboards, has been privately owned since 2006. Despite its young age, cartonboard production at the mill site began a century ago, which makes the company an experienced player in the field.

Environmental sustainability is a key priority for Pankaboard. Already in December 2005, the company was granted a PEFC certificate. Now, in early 2012, Pankaboard pursued FSC certification to prove its commitment to sustainability. With the chain-of-custody credentials, the company can support its customers and end-users in the FSC chain-of-custody process.

Pankaboard continuously seeks to reduce the environmental impact of its production through local wood sourcing and efficient steam production with its own bio fuel steam plant. Such measures help in maintaining the company’s carbon footprint strongly negative.

The company produces high-thickness folding boxboards, with grammages extending up to even 560 g/m2, as well as the smoothest uncoated cartonboard available in the market. It also supplies solid bleached board and groundwood boards for special end uses and applications, such as picture frames and other laminated products.

All the board grades produced by the company are manufactured solely from virgin fibres and are naturally approved for food contact.

Talks continue in sale of Terrace Bay and NewPage mills

Prospective buyers have been touring the Terrace Bay mill in Northern Ontario, while in Nova Scotia, the bidder on the NewPage pulp and paper mill is ironing out details with the provincial utility and the employees’ union.

The Chronicle Journal reported in early March that eight companies with an interest in purchasing the insolvent Terrace Bay pulp mill had toured the facility.

The mill was closed in October 2011, following an explosion that killed one worker. The mill shut down for repairs, and then extended the shut down due to poor market conditions. In January, the company was put under creditor protection and the mill put up for sale.

Under the sales process approved by the courts, a new owner is to be in place by the end of April.

The Chronicle Journal also reports that the Ministry of Labour has concluded its investigation in the fatal explosion, but hasn’t yet decided whether there were any violations of the labour code.

For the NewPage Port Hawkesbury mill in Nova Scotia, the sales process is more advanced. The court appointed monitor is in negotiations with Pacific West Commercial Corp., an affiliate of Stern Partners Inc. of Vancouver, to finalize a going-concern sale of the mill.

In an update to the court presented in February, Ernst & Young said negotiations are proceeding on several fronts, according to the Chronicle Herald newspaper.

A plan of arrangement is being developed to determine how the company will handle its debt. In addition, Pacific West has contacted the Communications Energy and Paperworkers Union, Local 972, to schedule negotiations on a new labour agreement, the newspaper reports.

Talks between Pacific West and the province on fibre costs, and Nova Scotia Power Inc. on energy costs, are also ongoing.

Source: Pulp and Paper Canada

Pöyry awarded contract with Swedish national grid

Pöyry's Energy business group has been awarded a frame agreement by Svenska Kraftnät, the Swedish national grid, as Technical Consultants. The agreement is valid for 2012-2013 with separate options for two additional years.

Svenska Kraftnät has considerable investment needs and plan to invest SEK 18.8 billion over the next four years. Their investments for 2012 and 2013 are estimated to be SEK 7.8 billion.

"Counting the number of categories, we are very pleased to see Pöyry qualified as the largest supplier of consultancy services. We estimate that the agreement, for a period of 2+1+1 years, has a value of about SEK 200 million (22.6 MEUR)," says Magnus Hemmingsson, Managing Director, Pöyry SwedPower Ab.

PÖYRY PLC

BASF expands capacity for cyclohexane oxidation

BASF will increase its capacity for cyclohexane oxidation at its Antwerp Verbund site by about 50,000 tons per year. The total investment amounts to about €10 million. Cyclohexane oxidation products are important intermediates for caprolactam and adipic acid, starting materials for polyamide 6 (PA 6) and polyamide 6.6 (PA 6.6). PA 6 and PA 6.6 are used in lightweight components for cars, flexible food packaging, fishing lines and nets through to textile fibers for outdoor sportswear and carpets.

“ By expanding the cyclohexane oxidation capacity, we are further increasing backward integration of the polyamide value chain at the Antwerp Verbund site. This debottlenecking project will help us to reduce our dependency on external suppliers of cyclohexane oxidation products ,” says Hermann Althoff, Head of the Polyamide and Intermediates global business unit at BASF. The expansion will be implemented as part of two long-term planned turnarounds and is intended to be completed by the end of 2014 . BASF is one of the world’s leading manufacturers of polyamide and its intermediates and operates cyclohexane oxidation units at the Verbund sites in Ludwigshafen, Antwerp and Freeport.

Xerium Technologies Reports Fourth Quarter Results

Xerium Technologies, Inc., a leading global manufacturer of industrial textiles and roll covers used primarily in the paper production process, announced today the results of its operations for the quarter and year ended December 31, 2011. For the year ended December 31, 2011, net sales and income from operations increased approximately 7% and 35%, respectively, compared to the year ended December 31, 2010. In addition, net income (loss) per diluted share increased to$0.54 from $(7.29) for the year ended December 31, 2011 compared to 2010.

"During the fourth quarter, the negative headwinds affecting the global paper industry that we saw arise in the middle of the year were exacerbated by the worsening debt crisis in Europeand a return to higher oil prices after their brief respite," said Stephen R. Light, President, Chief Executive Officer and Chairman. "In response to our practice of closely monitoring our customers' behaviors and in particular their PMC and Rolls consumption rates and plans, we shut down much of our production late in the quarter in order not to build inventories above an acceptable level; this resulted in much lower fixed overhead cost absorption. These shutdowns enabled us to reduce inventories while at the same time reducing receivable days outstanding, both of which served to improve our cash position. Pricing and customer ordering patterns for our new products remained in control in spite of the overall demand decline. During the fourth quarter, we completed the Brazilian capacity investment and Australian ramp up we've planned to serve our customers increasing demand for our new press felts. In addition, we received our 200th order for our patented SmartRoll product, bringing SmartRoll revenue to approximately 7% of our roll cover revenue globally."

FOURTH QUARTER FINANCIAL HIGHLIGHTS

- Net sales for the 2011 fourth quarter were $145.2 million, a 0.4% increase from net sales for the 2010 fourth quarter of $144.6 million. Excluding currency effects of $(0.5) million, fourth quarter 2011 net sales increased 0.8% from the fourth quarter of 2010, with an increase of 4.2% in the clothing business unit and a decrease of (5.1)% in the roll covers business unit. See "Reporting Unit Information" and "Non-GAAP Financial Measures" below for further discussion.

- Gross margins decreased 13.9% to $50.2 million for the fourth quarter of 2011 from$58.3 million for the fourth quarter of 2010. As a percentage of net sales, gross margins declined to 34.6% of net sales for the fourth quarter of 2011 as compared to 40.3% of net sales for the fourth quarter of 2010. These decreases were primarily the result of (1) the unfavorable absorption of production costs in the fourth quarter of 2011 due to our concerted effort to decrease production and reduce inventories, necessitated by a slowdown in customer demand, most dramatically in paper production, where demand in the last eight months of 2011 was lower than 2010; (2) a favorable recovery of inventory reserves in the fourth quarter of 2010 that did not occur in 2011; (3) our inability to offset increased raw material costs, particularly in our roll covers business with productivity or price increases; and (4) strong sales growth in regions and products with lower gross margins.

- The Company's operating expenses (selling, general and administrative, restructuring and impairments and research and development expenses) of $37.5 million for the fourth quarter of 2011 declined by $1.4 million, or 3.6%, from operating expenses of$38.9 million in the fourth quarter of 2010. The decrease in operating expenses during the fourth quarter of 2011 is primarily the net result of the following:

- A decrease of $3.5 million in general and administrative expense due to a decrease in management incentive compensation and stock compensation from 2010 to 2011; and

- A decrease in restructuring and impairment expenses of $2.3 million in the fourth quarter of 2011 as compared to the fourth quarter of 2010 as a result of reduced restructuring activity.

Partially offsetting these items were:

- An increase of $2.5 million in general and administrative expenses, due to higher bank and legal fees, higher bad debt reserves and an unfavorable property tax assessment in Germany;

- An increase of $1.3 million in general and administrative expenses due to the absence of a non-recurring gain recognized in 2010 as a result of the sale of land in Brazil; and

- An increase of $0.6 million in selling expenses, primarily as a result of inflation and additional headcount.

- Interest expense decreased $2.8 million from the fourth quarter of 2010 to the current quarter due to $2.2 million of interest rate swaps amortized in the prior year and $1.2 million lower net interest expense as a result of lower debt balances and interest rates from 2010 to 2011. These decreases were partially offset by $0.5 million higher amortization of deferred financing costs in 2011. The decrease in interest expense and the increase in deferred financing costs were primarily a result of the refinancing in May of 2011.

- The decrease in income tax expense in the fourth quarter of 2011 as compared with the fourth quarter of 2010 was principally due to the impairment of the German deferred tax asset recorded in the fourth quarter of 2010 combined with other changes in tax reserves.

- Net income for the fourth quarter of 2011 was $2.4 million or $0.16 per diluted share, compared to net income of $0.7 million or $0.05 per diluted share for the fourth quarter of 2010. The increase is primarily a result of the items noted above.

- Adjusted EBITDA (as defined by the Company's credit facility) decreased 35.7%, or$12.6 million, to $22.7 million in the current quarter from $35.3 million in the fourth quarter of 2010. See "Non-GAAP Financial Measures" below for further discussion.

- Unrestricted and restricted cash at December 31, 2011 was $43.6 million, compared to $43.0 million at September 30, 2011 and $52.4 million at December 31, 2010. The increase in the cash balances from September 30, 2011 is primarily due to cash provided by operating activities of $14.4 million, offset by an increase of $11.2 millionin capital expenditures related to our additional press felt capacity and an increase of$2.4 million in payments on long-term debt. The decrease in the cash balances fromDecember 31, 2010 is primarily due to capital expenditures of $30.2 million, the payment of $17.3 million in debt financing fees in connection with the debt refinancing in May of 2011 and net debt payments of $14.0 million. These decreases were partially offset by cash flow from operations of $45.2 million and proceeds from the disposal of property and equipment of $7.8 million.

- Total debt at December 31, 2011 was $469.1 million, compared to $475.4 million atSeptember 30, 2011 and $481.4 million at December 31, 2010. The decrease of $12.3 million from December 31, 2010 is primarily due to net debt payments of $14.0 millionin 2011, partially offset by unfavorable currency effects of $1.7 million. The decrease of$6.3 million from September 30, 2011 is primarily due to favorable currency effects of$3.9 million and debt payments of $2.4 million in the fourth quarter of 2011.

- Capital expenditures for the year ended December 31, 2011 were $30.2 million, consisting of $12.2 million in growth capex and $18.0 million in maintenance capex. That compares to the same period in 2010 when we reported $27.9 million of capital spending, consisting of $15.3 million in growth capex and $12.6 million of maintenance capex. We are currently targeting total capital expenditures for 2012 at approximately $30 million.