Ian Melin-Jones

Perlen Papier counts on Voith as its service partner

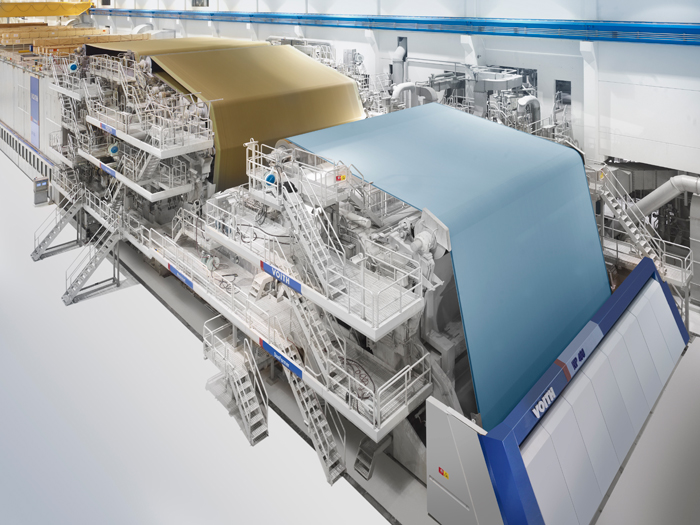

Swiss-based papermaker Perlen Papier AG signed a service agreement with Voith Paper Automation for the automation components of its PM 4 and PM 7 in Perlen. Voith has already had a service agreement with Perlen Papier AG for the PM 4 quality control system since 2004. The new PM 7 went on line in September 2010. The machine, which is working at full capacity, is expected to produce 300,000 metric tons of newsprint this year. Following the final acceptance inspection of the PM 7, the two companies are now going one step further in signing the service agreement effective since September 2011.

The PM 7 will benefit from a complete Voith automation package which covers the recovered paper preparation, the paper machine and winder as well as the packing and transport. With the new service agreement Voith ensures high availability in the long term and provides clearly defined performance guarantees for the specified system components.

Dirk Breuer, Technical Director at Perlen Papier AG, explains why Perlen is relying on external service support when it has a very experienced and well-trained maintenance team on site: "The automation in a paper machine is becoming increasingly complex. This is why we need experts to provide us with professional support. And in Voith we have found the perfect partner to rely on".

The agreement includes a remote diagnostic service of the automation system. A Voith service technician logs into the Perlen system via an online connection to check the current status and if necessary eliminate malfunctions or carry out optimizations.

In addition, the Emergency on Call service module provides a 24-hour/7-day standby service by Voith's service team with a contractually guaranteed response time. This ensures that Perlen Papier's maintenance team gets fast, direct support.

The service agreement also stipulates preventive maintenance schedules. Thus, the automation components MCS and DCS including system technology, and the quality control system with scanners, actuators and controls are checked. The downstream processes at the winder or packaging system are also monitored and constantly improved by the Voith service technicians.

Perlen Papier AG was founded in 1873 and is one of the key manufacturers of magazine paper and newsprint in Switzerland. In 2010 the family-owned company had a workforce of 381 and posted a net turnover of 182 million euros.

Technical concept convinces Stora Enso Sachsen

Stora Enso Sachsen, Germany, placed the order for the rebuild of Eilenburg PM 1 with Voith Paper. In this case, Voith's technical concept for the rebuild was convincing. The rebuild comprises former, press, dryer section as well as calender and air system. The installation of a NipcoFlex press and the rebuild of the existing calender to a Janus calender by reusing some of the existing components must be mentioned in particular.

Stora Enso Sachsen would like to improve paper quality as well as runability by the rebuild of PM 1. Furthermore, the operating speed of the production line is to be increased to 2,000 m/min. The rebuild is scheduled for May 2012.

PM 1 produces newsprint and telephone directory paper in a basis-weight range of 34-48.8 g/m2 from 100% recovered paper.

EA Permit Brings Waste Energy Plant Closer

One of the country's largest recycling facilities has been given the green light to power its operations with a new Sustainable Energy Plant.

One of the country's largest recycling facilities has been given the green light to power its operations with a new Sustainable Energy Plant.

The permit from the Environment Agency will enable Kemsley Mill to reduce its reliance on fossil fuels and to generate heat and electricity from up to 550,000 tonnes of pre-treated waste a year that might otherwise go to landfill.

Kemsley Mill, which is owned by DS Smith Paper, is the largest waste paper recycler in the UK, producing more than 850,000 tonnes of 100 per cent recycled paper and pulp a year.

The Environment Agency decision to grant the permit follows the unanimous backing of the application for the proposed plant, received when it went before Kent County Council's planning committee in April.

"Using waste that can't practicably be recycled to help fuel the recycling of nearly a quarter of the paper recycled in the UK fits well with our long-term strategy to develop an environmentally sustainable business," said DS Smith Paper Commercial Director Will Faure-Walker.

"As the country's largest recycler of waste paper, Kemsley Mill already has strong environmental credentials, with every tonne of paper recycled rather than sent to landfill saving the emission of 900kg (0.9 tonnes) of carbon dioxide.

"The proposed Sustainable Energy Plant will strengthen the recycling loop, further enhance our environmental performance and result in a 200,000-tonne net reduction in carbon dioxide emissions a year, equivalent to taking more than 90,000 cars off the road."

It is hoped that construction of the new Sustainable Energy Plant will begin in spring 2013, with completion scheduled for 2016. The plant will be developed and operated by E.ON and Wheelabrator Technologies.

Stora Enso will record a negative non-recurring item related to NewPage Stevens Point Mill paper machine lease

Stora Enso will record a provision with a cash impact of approximately USD 180 million (about EUR 128 million) as a negative non-recurring item (NRI) in its third quarter 2011 results due to NewPage Corporation’s Chapter 11 filing in the USA. On 7 September 2011 NewPage voluntarily filed for Chapter 11 protection under the US Bankruptcy Code to reorganise its debt.

Stora Enso will record a provision with a cash impact of approximately USD 180 million (about EUR 128 million) as a negative non-recurring item (NRI) in its third quarter 2011 results due to NewPage Corporation’s Chapter 11 filing in the USA. On 7 September 2011 NewPage voluntarily filed for Chapter 11 protection under the US Bankruptcy Code to reorganise its debt.

When Stora Enso North America, Inc (SENA) was divested to NewPage, the Stevens Point Mill Paper Machine (PM) 35 lease obligation was transferred from Stora Enso to NewPage. However, as explained in the Group’s Financial Statements since 2007, Stora Enso remained as guarantor of the lease. Stora Enso intends to recover a portion of the recorded cost related to the lease obligation in NewPage’s restructuring.

In the second quarter of 2009 Stora Enso wrote down to zero value its 19.9% shareholding in NewPage and the vendor note it holds.

NewPage Corporation Launches Process to Restructure Debt

Corporate Parent and Certain U.S. Subsidiaries Commence Voluntary Cases Under Chapter 11 of the United States Bankruptcy Code, Securing Commitment for Up to $600 million in DIP Financing To Continue Normal Business Operations

NewPage Port Hawkesbury Corp. Commences Proceedings Under the Companies' Creditors Arrangement Act of Canada

NewPage Corporation announced today that, to facilitate an orderly debt restructuring and position the overall business for long-term success, its corporate parent, NewPage Group Inc., and certain of its U.S. subsidiaries (collectively, "NewPage" or the "Company") have commenced voluntary cases under Chapter 11 of the United States Bankruptcy Code ("Chapter 11"). The cases are pending in the United States Bankruptcy Court for the District of Delaware. The company's Consolidated Water Power Company subsidiary is not part of the filing.

Separately, the company's Canadian subsidiary, NewPage Port Hawkesbury Corp., has brought proceedings before the Supreme Court of Nova Scotia under the Companies' Creditors Arrangement Act of Canada ("CCAA"). In order to maximize efficiency in both the U.S. and Canadian Court processes, NewPage Corporation and NewPage Port Hawkesbury Corp. have executed a Settlement and Transition Agreement, subject to approval by the Canadian Court.

Chapter 11 Restructuring for U.S. Entities

Through the Chapter 11 process, NewPage expects to work closely with its creditors and other stakeholders in the U.S. to formulate a Chapter 11 plan that details how it intends to satisfy its liabilities and restructure its balance sheet to emerge as a financially stronger company. The company expects to continue operating its U.S. businesses as usual throughout this process with an undiminished focus on providing customers with high-quality paper and employees with a stable and safe working environment. To help ensure it has adequate liquidity to achieve these objectives and continue to operate and compete successfully throughout the restructuring, NewPage has obtained a commitment led by J.P. Morgan for up to $600 million in Debtor in Possession (DIP) financing.

Additionally, NewPage has filed a series of customary First Day Motions in the United States Bankruptcy Court that, subject to court approval, would allow it to continue its U.S. employee wages and benefits programs, honor obligations for customers served by its U.S. businesses and provide additional protection to various other stakeholders. These motions are typical of the Chapter 11 process and are generally granted in the days immediately after a filing.

"We strongly believe that the court-supervised restructuring we began today is the most effective means of strengthening our financial position and enhancing our standing as the leading producer of printing and specialty paper in North America," said George F. Martin, president and chief executive officer for NewPage. "We expect to continue to provide our customers with the exceptional service and high-quality products they have come to expect. We recognize customers have choices, and NewPage needs to continue to earn their trust and loyalty every day. We expect to continue to run safe and efficient operations, be candid with all of our stakeholders and act as a responsible community member both during and after our financial restructuring."

Jay A. Epstein, senior vice president and chief financial officer for NewPage, added, "A successful restructuring will allow NewPage to emerge as a financially stronger company that is even better positioned to compete and succeed in this dynamic industry environment. To this end, we fully expect to work productively with our lenders and other creditors to develop our Chapter 11 plan as efficiently as possible. We are confident that the DIP financing we have secured will allow us to maintain continuity in our U.S. businesses as we complete this process."

Intention to Commence CCAA Proceedings for NewPage Port Hawkesbury Corp.

NewPage Port Hawkesbury Corp. has brought proceedings before the Supreme Court of Nova Scotia in Halifax, Nova Scotia. The Canadian entity is in discussions with potential buyers and hopes to complete a successful sale of the mill while under the anticipated court protection.

On August 22, NewPage announced that it would take downtime at NewPage Port Hawkesbury Corp. due to market and economic conditions that had prevented it from profitably operating the mill for more than a year. NewPage Port Hawkesbury Corp. plans to use funds arising from its Settlement and Transition Agreement to continue a "hot idle" at the mill and preserve the value of its assets while it continues discussions with potential buyers.

SOURCE NewPage Corporation

Leading high performance materials company Ahlstrom joins the WBCSD

Ahlstrom Corporation, a global high performance materials company, has become a member of the World Business Council for Sustainable Development (WBCSD). Sustainability forms a key pillar of the Helsinki, Finland based company's business activities and centers around environmental, social and economic responsibility within its global operations.

Björn Stigson, President, WBCSD said: "Ahlstrom has a long history as a company and also in social responsibility. Corporate responsibility has been an integral part of Ahlstrom's business and way of thinking already for 160 years. I am delighted that they have decided to join the WBCSD."

"Ahlstrom's clear commitment to sustainable development is impressive: they take care of integrating sustainable practices into product development from cradle to gate, and across all aspects of their business operations. Ahlstrom brings a valuable wealth of expertise and knowledge to our organization," Björn Stigson continued.

Ahlstrom is a member of WBCSD's Sustainable Forest Products Industry (SFPI) work program, which provides a platform for members to address issues associated with sustainable forest management, wood sourcing, energy, carbon emissions and sequestration.

As part of the SFPI work program, Ahlstrom will concentrate on two areas. It will further develop its expertise to provide business leadership in expanding sustainable forest-based solutions. Ahlstrom will also help develop policy frameworks that are responsive to business needs. By improving UNFCCC's and climate negotiators' understanding of the carbon benefits of forests and forest products, those can be better reflected in relevant policy frameworks.

"Last year, 82 % of Ahlstrom's fiber raw material came from renewable sources. Going forward, we aim to further increase our renewable and responsible sourcing," said Anna Maija Wessman, Vice President, Sustainability, Ahlstrom Corporation.

Kemira announces price increases for hydrogen peroxide in EMEA

Kemira increases prices for hydrogen peroxide products in EMEA by 15-25%. The increase will be effective immediately or as specific contract terms allow.

While Kemira continues to take actions to minimize the impact of escalating raw material costs, it is necessary to adjust pricing in order to compensate for the increased costs of raw materials, energy costs as well as freight costs.

International Paper Announces Definitive Agreement to Acquire Temple-Inland for $32.00 Per Share in Cash

International Paper (NYSE: IP) and Temple-Inland Inc. (NYSE: TIN) have announced that they have entered into a definitive merger agreement under which International Paper will acquire all of the outstanding common stock of Temple-Inland for $32.00 per share in cash, plus the assumption of $600 million in Temple-Inland's year end debt. The total transaction value is approximately $4.3 billion.

The combination, which has been approved by the Boards of both companies, brings together two strong North American corrugated packaging businesses to create an even stronger company. It offers numerous benefits for the shareholders and customers of both companies, and is consistent with International Paper's focus on achieving and sustaining cost of capital returns throughout the cycle. The transaction is expected to be accretive to International Paper's shareholders in year one after closing. It is expected to close in the first quarter of 2012.

International Paper Chairman and CEO John Faraci said, "The strategic benefits of this combination are clear and we are pleased to be able to move forward on terms that are financially attractive for both sets of shareholders. Acquiring Temple-Inland enhances our ability to generate additional cash flow while maintaining our strong balance sheet. We look forward to working with the employees of Temple-Inland as we integrate our businesses and create an even stronger company with substantial benefits for our customers, employees and shareholders."

Temple-Inland Chairman and Chief Executive Officer Doyle R. Simons said, "This transaction creates value for both Temple-Inland and International Paper shareholders. The combined company will be positioned to be a leader in providing high quality products for its customers."

The combination is expected to yield synergies of approximately $300 million annually within 24 months of closing, derived primarily from the areas of operations, freight, logistics, selling expense and overhead. The companies have a shared focus on low-cost mills, complementary converting systems and high levels of box integration - Temple-Inland's products and manufacturing facilities are an excellent strategic fit with International Paper's current offerings and facilities.

As contemplated by the merger agreement, International Paper will terminate its existing tender offer to acquire all of the outstanding common shares of Temple-Inland for $30.60 per share, and Temple-Inland will hold a special meeting of its stockholders to vote on the transaction. In addition to the approval of Temple-Inland's stockholders, the transaction is subject to customary closing conditions, including antitrust approvals.

Evercore Partners and UBS Investment Bank served as financial advisors to International Paper and Goldman, Sachs & Co. served as financial advisor to Temple-Inland. Debevoise & Plimpton LLP served as International Paper's legal counsel and Temple-Inland was advised by Wachtell, Lipton, Rosen & Katz.

SOURCE International Paper

AbitibiBowater Increases FSC® Forest Management Certification in Northern Ontario

AbitibiBowater has announced that it has received Forest Stewardship Council® (FSC) certification for the Black Spruce and Dog River-Matawin Forest areas, north of Thunder Bay, Ontario. This area covers approximately 2.5 million hectares of forest stretching from Lake Nipigon to Quetico Provincial Park.

"This certification represents a major increase in the amount of forest AbitibiBowater now manages under FSC," said Richard Garneau, President and Chief Executive Officer. "This effort is part of our ongoing strategy to meet market expectations as well as ensuring our commitment to sustainable forest management."

The FSC certification process took more than a year to complete and the certification audit entailed four auditors interviewing stakeholders including local citizens committees, community leaders, First Nations communities and various forest contractors working in the region. The two forest regions were certified by the SmartWood Program of the Rainforest Alliance using the National Boreal Standard of FSC. The certificate (FSC-C107523) is valid for five years subject to the annual Surveillance audits.

AbitibiBowater and other member companies of the Forest Products Association of Canada, as well as a number of environmental organizations, are partners in the Canadian Boreal Forest Agreement. The group works to identify solutions to conservation issues that meet the goal of balancing the three pillars of sustainability linked to human activities: economic, social and environmental.

High attendance forecasted for Mondi-hosted Green Event at WWT Wetland Centre in Barnes, UK. Registration limited but still possible.

Mondi Uncoated Fine Paper UK invites key sustainability managers to the Green Event, which will cover a variety of topics including green procurement, current climate issues, and active environmental projects.

Mondi Uncoated Fine Paper UK invites key sustainability managers to the Green Event, which will cover a variety of topics including green procurement, current climate issues, and active environmental projects.

Mondi Uncoated Fine Paper UK is holding the Green Event at the WWT Wetland Centre in Barnes, London, UK, on the 29th September 2011. Guest speakers include representatives from WWF, FSC®, Action Sustainability, World Resources Institute, Two Sides Campaign, Mondi’s Sustainable Development team as well as Dr. James Pryke, a specialist on ecological networks.

The event is free to attend but places are limited and offered on a first come first served basis. All attendees will be entered into a prize draw that will take place at the Green Event. The 1st prize is an eco-holiday. To reserve a place at Mondi’s Green Event, please register at www.mondigroup.com/GreenEventUK

Green Event guests will also have an opportunity to explore Mondi’s recycled digital printing brand, NAUTILUS®. The range consists of three 100% recycled papers, NAUTILUS® SuperWhite (with CO2 neutral option), NAUTILUS® Classic and NAUTILUS® Universal, and the recently launched NAUTILUS® ReFresh TRIOTEC made with unique TRIOTEC sandwich technology, which combines outer layers made from TCF (Totally Chlorine Free) virgin fibre with an inner layer made from 30% recycled fibre.

For more information about Mondi’s recycled paper portfolio, please visit: www.mondigroup.com/nautilus