Norske Skog’s gross operating earnings were NOK 248 million in the second quarter of 2011. This is somewhat weaker than in the first quarter, mainly affected by the magazine segment. Newsprint shows an increase in revenues, while the gross operating earnings in this segment were little changed from the first quarter.

“This has been a mixed quarter for Norske Skog. We have completed a refinancing process and reduced the debt, but we still do not achieve acceptable margins in our operations,” says CEO Sven Ombudstvedt of Norske Skog.

“We expect gradual price increases for our products, but we cannot expect the market to do the job for us. Going forward, we will also evaluate all options for further internal efficiencies”, Mr. Ombudstvedt says.

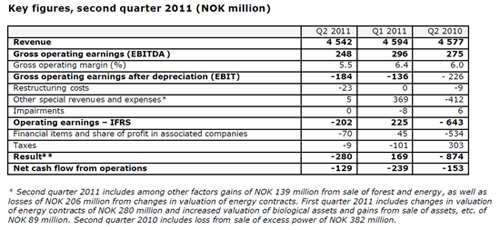

Operating earnings (IFRS) were minus NOK 202 million in the second quarter, compared to a positive NOK 225 million for the first quarter of 2011 and negative NOK 643 million for the second quarter of 2010. Financial items contributed negatively with NOK 70 million. In the first quarter the financial items were plus NOK 45 million. The result was a net loss of NOK 280 million, compared to net earnings of NOK 169 million in the first quarter of 2011 and a loss of NOK 874 million in the second quarter of 2010.

The gearing ratio was 0.85 at the end of the second quarter, compared to 0.90 at the end of the first quarter.

Segment information

Revenues from the segment newsprint in Europe increased compared to both the first quarter of 2011 and the second quarter of 2010. Gross operating earnings for the segment were somewhat weaker than in the first quarter of 2011 but better than in the second quarter of 2010. Prices have increased, but earnings were negatively affected by high input prices and a strong Norwegian krone.

The segment newsprint outside of Europe shows an increase in revenues compared to both the first quarter of 2011 and the second quarter of 2010. Gross operating earnings are marginally higher than in the first quarter of 2011 and somewhat lower than in the second quarter of 2010. The production volumes have increased in the second quarter.

The magazine paper segment experiences a reduction of both revenues and gross operating earnings compared to the first quarter of 2011 and the second quarter of 2010. The weaker results are due to lower sales volumes, currency changes and a higher export share. Production volumes are lower, especially when compared to the second quarter of 2010. This is strongly influenced by the fire at Norske Skog Saugbrugs in Halden, Norway, on 2 February. Normal production was resumed at the end of June.

Divestments in Brazil

Norske Skog in the second quarter entered into an agreement to sell all its shares in the energy company Enerpar in Brazil to SN Power Invest for BRL 120 million, about NOK 410 million.

A forest area of 21 500 hectares in Brazil was also sold in the second quarter for USD 63.5 million, about NOK 335 million.

From these two transactions the company could book a profit of NOK 139 million before tax in the second quarter, which contributed to the company being able to reduce net interest-bearing debt from NOK 9.0 billion at the end of the first quarter to NOK 8.4 billion at the end of the second quarter.

Refinancing

Norske Skog in the second quarter refinanced the company’s debt in two steps. First, a threeyear bank facility of EUR 140 million was arranged. Subsequently, a bond issue of EUR 150 million was completed. An existing bank facility of EUR 400 million was cancelled and repaid. Norske Skog continues to work on the financing situation, for instance through further asset sales.

“We now have sufficient funds through cash, asset sales and new financing to cover the maturities in 2011 and 2012. Our next big maturities will be in 2017 and later,” says the CEO, Mr. Sven Ombudstvedt. Following the refinancing, Standard & Poor’s adjusted the outlook for Norske Skog’s debt from “Negative” to “Stable”. The long-term rating is upheld at “B-“.

Outlook for 2011

Newsprint prices are expected to increase somewhat in the second half of the year. Within magazine, volumes are expected to increase in the second half. The volume increase is partly due to normal operations at Norske Skog Saugbrugs. The cost of most input factors will remain high, but the prices of energy and recovered paper show signs of moderating. Underlying gross operating earnings for all of 2011 are expected to improve somewhat from 2010.

Organisational change

Mr. Trond Stangeby has been engaged as Senior Vice President for Organisational Development from 15 August. He has extensive experience from the chemical industry through several leading positions in Norsk Hydro, Yara and INEOS. He currently works as an independent consultant. Mr. Stangeby will be a member of Norske Skog's Corporate Management team, and will be responsible for development of leadership and working processes in the company.