Displaying items by tag: Wood Resource Quarterly

Eucalyptus pulplog prices in Brazil have fallen over the past year and in the 2Q/19 reached their lowest levels in three years, reports the Wood Resource Quarterly

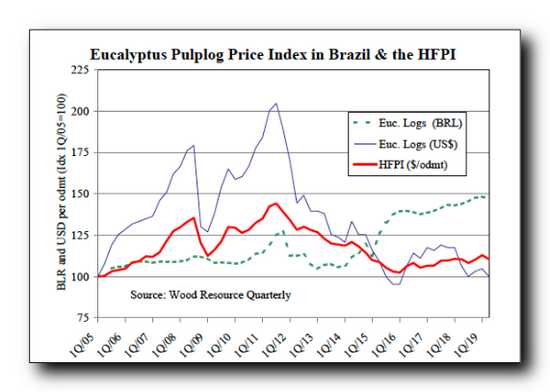

Pulpmills in Brazil had some of the lowest wood fiber costs in the world in the 2Q/19, according to the WRQ. Over the past three years Eucalyptus pulplog prices have fallen while the global Hardwood Fiber Price Index (HFPI) has trended upward to reach its highest level in four years.

Lower operating rates at the major pulp mills in Brazil and healthy inventory levels of wood fiber took pressure off prices of Eucalyptus pulplogs in the 2Q/19. Eucalyptus pulplog prices have been on a roller-coaster ride ever since the Wood Resource Quarterly began tracking wood fiber prices in Brazil in 1988, mostly due to fluctuations in the exchange rates and changes in the fiber demand/supply balance.

Following a 15-year period from 1988 to 2003 when prices fluctuated between US$20-50/odmt, prices took off and trended upward for almost eight years to reach an all-time- high in the 3Q/11. From 2011 to 2015, prices fell substantially to reach an 11-year low in the 4Q/15, which was followed by a period with slightly higher prices. In the 2Q/19, the average price reached its lowest level in over three years as the value of the US dollar strengthened.

It is interesting to compare the price developments for Eucalyptus in US dollar and Brazilian Real terms, as the exchange rate between the two currencies has fluctuated quite substantially over the years. Pulplog prices in Brazilian Real terms have generally trended upward over the past 15 years and reached a 25-year high in early 2019 when the average price was 50% higher than in 2005 (see chart). During the same period, prices in US dollar terms doubled before taking a plunge to 2005 levels. Pulpmills in Brazil now have some of the lowest wood fiber costs in the world.

For the past eight years, the Eucalyptus pulplog prices in Brazil have consistently been lower than the global Hardwood Fiber Price Index (HFPI), a weighted average of delivered wood fiber prices for 15 key hardwood pulp-producing regions of the world. The discrepancy between the average Brazilian pulplog prices and the HFPI actually reached a 15-year record in the 2Q/19 when Brazil’s price fell to 70% of the HFPI price index. Wood fiber costs as a percentage of market pulp prices have been at record lows over the past year, leading to healthy profit margins for the industry.

Global lumber, sawlog, and pulpwood market reporting are included in the 56-page quarterly publication, the Wood Resource Quarterly (WRQ). The report, which was established in 1988 and has subscribers in over 30 countries, tracks sawlog, pulpwood, wood chip, lumber and pellet prices, and trade and market developments in most key regions around the world. Please visit our website WoodPrices.com to learn more about our subscription services.

Contact Information

Wood Resources International LLC Hakan Ekstrom, Seattle, USA

This email address is being protected from spambots. You need JavaScript enabled to view it.

Hardwood fiber costs for the Swedish pulp industry moved up in late 2017 after a six-year period of declining pulplog prices

Wood fiber costs for hardwood pulp manufacturers in Sweden are among the lowest in Europe after having been on a downward trajectory since 2011, according to the Wood Resource Quarterly. However, in late 2017 this trend reversed because of tighter log supply resulting from unfavorable logging and transportation conditions.

![]() Hardwood pulp manufacturers in Europe have some of the highest wood fiber costs in the world despite prices for hardwood pulplogs having trended downward in most key markets on the continent over the past five years. In the second half of 2017, that trend reversed, with fiber prices going up in both the local currencies and in US dollar terms.

Hardwood pulp manufacturers in Europe have some of the highest wood fiber costs in the world despite prices for hardwood pulplogs having trended downward in most key markets on the continent over the past five years. In the second half of 2017, that trend reversed, with fiber prices going up in both the local currencies and in US dollar terms.

In the 4Q/17, prices for hardwood logs in Spain were the highest on the continent, while Swedish prices were on the lower end of the hardwood cost spectrum, according to the Wood Resource Quarterly.

Hardwood fiber supply in Sweden tightened in late 2017 because of an unusually wet and mild early winter season. Tight supply in central Sweden resulted in an odd importation of Eucalyptus chips from Brazil during the 4Q/17 at a reported price that was substantially higher than the domestic hardwood prices. Prices for hardwood pulplogs trended upward during most of 2017 after they reached an 11-year low in the 4Q/16. Despite the recent price rise, birch pulplog costs were in the 4Q/17 about 15% lower than their 10-year average in US dollar terms.

Prices for softwood chips and pulplogs were also up in Sweden during 2017 because of an imbalance between domestic supply and demand. The higher domestic fiber prices resulted an increase in importation of softwood chip to Sweden in 2017, reaching almost double the volume imported five years ago. The imports in the 4Q/17 were the second highest quarterly volume on record.

Historically, most imported chips have been destined for the country’s pulpmills, but over the past two years there has been an increase in imported chips to be used for energy. Latvia, Norway, Estonia and Finland, in ranking order, are the major suppliers of softwood chips,

accounting for 95% of the total import volume in 2017. With a higher percentage of lower- cost energy chips over the past few years (predominantly from Norway), the average value for imported chips has declined by about 40% 2013 to 2017, reports the WRQ in its latest issue. Of the four major supplying countries, Finland supplied the highest cost chips, while Norway was the lowest cost supplier in 2017.

Global lumber, sawlog and pulpwood market reporting is included in the 56-page quarterly publication Wood Resource Quarterly (WRQ). The report, which was established in 1988 and has subscribers in over 30 countries, tracks sawlog, pulpwood, wood chip, lumber and pellet prices, trade and market developments in most key regions around the world. To subscribe to the WRQ, please go to www.woodprices.com

Wood raw-material costs for European pulpmills continued to slide in early 2017

Wood raw-material costs for European pulpmills continued to slide in early 2017 to reach their lowest levels in over five years, reports the Wood Resource Quarterly

The European pulp industry has become much more competitive in the international pulp and paper market the past five years with wood fiber costs, which account for 55-65% of the production costs, having fallen more than in most other regions of the world, reports the Wood Resource Quarterly. Some of the biggest price declines have been for hardwood pulplogs in the Nordic countries.

The European pulp industry has become much more competitive in the international pulp and paper market the past five years with wood fiber costs, which account for 55-65% of the production costs, having fallen more than in most other regions of the world, reports the Wood Resource Quarterly. Some of the biggest price declines have been for hardwood pulplogs in the Nordic countries.

Wood costs for the pulp industry in Europe were generally lower in the 1Q/17 than in the previous quarter, continuing a downward trend that, depending on the country, has lasted for 4-6 years. The biggest price declines for pulplogs and sawmill residues in early 2017 occurred in Germany and France, according to the Wood Resource Quarterly (WRQ). The price reductions occurred mainly because of an oversupply of pulplogs, unchanged demand for wood fiber from the pulp industry, and reduced usage of raw-material by the competing wood pellet sector.

In neighboring Austria, conifer pulplog prices have been very stable during most of 2015 and 2016 (in Euro terms) and prices did not change much in the 1Q/17. However, the weakening of the Euro against the US dollar has resulted in Austrian pulplog prices falling seven percent in two years.

In the Nordic countries, wood fiber costs in the 1Q/17 were at their lowest levels since 2006 (in US dollars). This was mostly thanks to the weakening of the local currencies in both Sweden and Finland. The wood fiber costs currently account for about 60% of the manufacturing cost when manufacturing pulp in the region, according to Fisher International, so a reduction in prices for pulplogs and wood chips has a major impact in improving the competitiveness of the pulp and paper industry when competing in the global market place.

The pulp sectors in Portugal and Spain, which are the third and fourth largest consumers of hardwood logs in Europe, have also enjoyed a period of declining wood costs with the price levels in early 2017 being 20-25% below the fiber costs five years ago.

Hardwood fiber costs for pulpmill in Europe have fallen more rapidly than in other parts of the world from 2012 to 2017, and the industry has become much more competitive with competitors in North America, Latin America and Asia, according to the WRQ. For example, the price discrepancy for hardwood pulplogs between Sweden and the US South has fallen from US$62/odmt in the 1Q/12 to only US$9/odmt in the 1Q/17.

Global pulpwood prices were up in the 2Q/16 after having declined for seven consecutive quarters

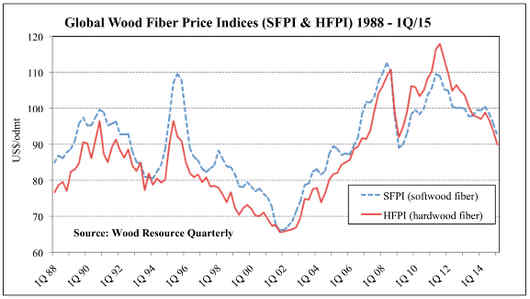

Wood fiber costs currently account for almost 60% of the cash costs when manufacturing wood pulp. Prices for both wood chips and pulplogs have trended downward for a long time, but this came to an abrupt halt in the 2Q/16 when the softwood price index rose 2.3% and the hardwood price index increased 3.7% from the 1Q/16, according to the latest Wood Resource Quarterly.

The wood fiber costs for the world’s pulp industry had trended downward for almost five years until this year when both the softwood and hardwood fiber price indices jumped in the 2Q/16. The two indices rose because price increases were seen for wood chips and pulplogs in practically every major market around the world.

The wood fiber costs for the world’s pulp industry had trended downward for almost five years until this year when both the softwood and hardwood fiber price indices jumped in the 2Q/16. The two indices rose because price increases were seen for wood chips and pulplogs in practically every major market around the world.

The Softwood Wood Fiber Price Index (SFPI) was up 2.3% from the 1Q/16 to US$89.63/odmt in the 2Q/16, as reported in the Wood Resource Quarterly (WRQ). This was the first quarter-over-quarter increase since early 2014. A combination of a weaker US dollar and higher wood fiber prices in the local currencies in Western Canada, France, Brazil and Germany, were the main reasons for the higher SFPI this quarter.

The Hardwood Wood Fiber Price Index (HFPI) was up 3.7% from the 1Q/16 to US$86.86/odmt, which was also the first increase in almost two years. The biggest price increases (in US dollars) occurred in Russia, Brazil, Chile, Australia and Eastern Canada.

Despite the recent price increase, current price levels for wood fiber are close to the lowest they have been in almost ten years in nominal terms. Wood fiber costs currently account for approximately 58% of the cash costs when manufacturing pulp on a global basis, according to Fisher International. Of the 16 major pulp-producing regions around the world tracked by the WRQ, pulpmills in Japan have the highest wood fiber cost percentage of close to 70%, while Russian mills have the lowest wood cost share of just below 40%.

The historically low wood fiber costs are, of course, very good news for the world’s pulp and paper industry. With market pulp prices currently being slightly below their ten-year averages, the wood costs as a percentage of the market pulp price (NBSK and EBK) are close to their lowest levels in almost 15 years.

Note. The Global Wood Fiber Price Index is a weighted average of delivered wood fiber prices for the pulp industry in all regions tracked by the publication Wood Resource Quarterly. These regions together account for 85-90% of the world’s wood-based pulp production capacity. The price is based on current quarter average prices, and country/regional wood fiber consumption data. The global average price for softwood and hardwood is calculated in nominal US$ per oven-dried metric ton (odmt) of wood fiber.

Global lumber, sawlog and pulpwood market reporting is included in the 52-page quarterly publication Wood Resource Quarterly (WRQ). The report, which was established in 1988 and has subscribers in over 30 countries, tracks sawlog, pulpwood, wood chip, lumber and pellet prices, trade and market developments in most key regions around the world. To subscribe to the WRQ, please go to www.woodprices.com

Global pulpwood prices were up in the 2Q/16 after having declined for seven consecutive quarters

Wood fiber costs currently account for almost 60% of the cash costs when manufacturing wood pulp. Prices for both wood chips and pulplogs have trended downward for a long time, but this came to an abrupt halt in the 2Q/16 when the softwood price index rose 2.3% and the hardwood price index increased 3.7% from the 1Q/16, according to the latest Wood Resource Quarterly.

The wood fiber costs for the world’s pulp industry had trended downward for almost five years until this year when both the softwood and hardwood fiber price indices jumped in the 2Q/16. The two indices rose because price increases were seen for wood chips and pulplogs in practically every major market around the world.

The wood fiber costs for the world’s pulp industry had trended downward for almost five years until this year when both the softwood and hardwood fiber price indices jumped in the 2Q/16. The two indices rose because price increases were seen for wood chips and pulplogs in practically every major market around the world.

The Softwood Wood Fiber Price Index (SFPI) was up 2.3% from the 1Q/16 to US$89.63/odmt in the 2Q/16, as reported in the Wood Resource Quarterly (WRQ). This was the first quarter-over-quarter increase since early 2014. A combination of a weaker US dollar and higher wood fiber prices in the local currencies in Western Canada, France, Brazil and Germany, were the main reasons for the higher SFPI this quarter.

The Hardwood Wood Fiber Price Index (HFPI) was up 3.7% from the 1Q/16 to US$86.86/odmt, which was also the first increase in almost two years. The biggest price increases (in US dollars) occurred in Russia, Brazil, Chile, Australia and Eastern Canada.

Despite the recent price increase, current price levels for wood fiber are close to the lowest they have been in almost ten years in nominal terms. Wood fiber costs currently account for approximately 58% of the cash costs when manufacturing pulp on a global basis, according to Fisher International. Of the 16 major pulp-producing regions around the world tracked by the WRQ, pulpmills in Japan have the highest wood fiber cost percentage of close to 70%, while Russian mills have the lowest wood cost share of just below 40%.

The historically low wood fiber costs are, of course, very good news for the world’s pulp and paper industry. With market pulp prices currently being slightly below their ten-year averages, the wood costs as a percentage of the market pulp price (NBSK and EBK) are close to their lowest levels in almost 15 years.

Note. The Global Wood Fiber Price Index is a weighted average of delivered wood fiber prices for the pulp industry in all regions tracked by the publication Wood Resource Quarterly. These regions together account for 85-90% of the world’s wood-based pulp production capacity. The price is based on current quarter average prices, and country/regional wood fiber consumption data. The global average price for softwood and hardwood is calculated in nominal US$ per oven-dried metric ton (odmt) of wood fiber.

Global lumber, sawlog and pulpwood market reporting is included in the 52-page quarterly publication Wood Resource Quarterly (WRQ). The report, which was established in 1988 and has subscribers in over 30 countries, tracks sawlog, pulpwood, wood chip, lumber and pellet prices, trade and market developments in most key regions around the world. To subscribe to the WRQ, please go to www.woodprices.com

Pulpmills in Eastern Canada have become more competitive following sharply declining wood costs the past four years.

In fact, wood costs reached their lowest levels in 15 years in the 1Q/16, according to the North American Wood Fiber Review

Wood costs for pulp mills in Eastern Canada have fallen dramatically the past four years, and the region has some of the lowest wood fiber costs in North America, according to

Wood costs for pulp mills in Eastern Canada have fallen dramatically the past four years, and the region has some of the lowest wood fiber costs in North America, according to

the North American Wood Fiber Review. In 2012, pulp mills in Ontario and Quebec had some of the highest wood fiber costs on the continent.

Softwood fiber prices in Eastern Canada have been in steady decline for over four years, and in the 1Q/16 were at their lowest levels in almost 15 years. The shrinking pulp industry in Ontario and Quebec has become more competitive with fiber costs matching many other regions of North America in early 2016, as reported in the North American Wood Fiber Review (NAWFR). In US dollar terms, softwood chips and pulplogs costs were down 37% and 27%, respectively in the 1Q/16 as compared to the 1Q/12.

Although much of the decline can be contributed to a stronger US dollar, wood chip prices have also fallen substantially in Canadian dollar terms. Softwood chip prices in Canadian dollars were 16% below 2012 levels, and they are actually at their lowest levelssince NAWFR started tracking wood fiber prices in Eastern Canada in 1988.

Chip prices in Quebec and Eastern Ontario are currently on par with prices in Western Canada and the US South, and they are substantially lower than in the US Northwest, the Lake States and the US Northeast. This has been quite a remarkable turn-around from four years ago when the region’s pulp mills had some of the highest wood fiber costs in North America.

Pulpwood prices (in Canadian dollar terms) in the Maritime Provinces fell in the 1Q/16 for the second consecutive quarter, according to the NAWFR (www.woodprices.com). The primary reasons for the recent price declines were full fiber inventories at the region’s pulp mills, and good access to the forests which resulted in a healthy flow of logs to the manufacturing plants. The collapse of the softwood log market in neighboring Maine has also had an impact on fiber prices in Eastern Canada over the past six months.

The hardwood pulplog price eased modestly in early 2016 due to healthy fiber inventories. Despite the fact that there has been a plentiful supply of logs over the past winter, hardwood log prices have not come down as much as have softwood logs, and are still near their highest levels in 20 years (in Canadian dollar terms).

Pulpwood costs have fallen substantially worldwide

Pulpwood costs have fallen substantially worldwide with the softwood and hardwood pulpwood price indices in the 4Q/15 being at their lowest levels in over ten years, reports the Wood Resource Quarterly

The largest cost component when manufacturing wood pulp is the cost of wood fiber. This cost has declined substantially in US dollar terms the past few years with the Global Price Indices being down almost ten percent in 12 months, according to the Wood Resource Quarterly.

The largest cost component when manufacturing wood pulp is the cost of wood fiber. This cost has declined substantially in US dollar terms the past few years with the Global Price Indices being down almost ten percent in 12 months, according to the Wood Resource Quarterly.

Wood cost is the factor that often determines the competitiveness of a pulp manufacturing plant or region, because it is the largest cost component when producing wood pulp. During the past few years, this cost has varied between 45% and 70% of the total cash cost, depending on product grade and the costs of other components such as chemicals, energy and labor.

Hardwood fiber prices continued to fall in most of the major pulp-producing countries in the world in the 4Q/15. The biggest declines were seen in Brazil, Chile, Russia, France, Germany and Indonesia. In most regions, the price adjustments occurred in both in the local currencies and in US dollar terms. The hardwood price index (HFPI) fell over two percent from the 3Q/15 to a level that was almost 10% lower than in the 4Q/14.

Russian pulp mills have substantially lower wood fiber costs than most competitors around the world thanks to the weak Ruble. Prices for hardwood pulplogs were less than half of the average prices in Brazil and Chile in the 4Q/15, according to the latest issue of the Wood Resource Quarterly. In US dollar terms, current price levels are also half of what they were two years ago. Pulplog prices throughout Europe have also fallen quite substantially the past few years but remain among the highest in the world.

With the exception of the US South and New Zealand, softwood fiber prices were also down throughout the world in the 4Q/15. The declines ranged between two to ten percent from the previous quarter. The softwood price index (SFPI) was US$88.46/odmt, a reduction of 1.4% from the previous quarter and 7.5% lower than the same quarter in 2014. Both the SFPI and HFPI are currently at the lowest levels in over ten years.

Note. The Global Wood Fiber Price Index is a weighted average of delivered wood fiber prices for the pulp industry in all regions tracked by the publication Wood Resource Quarterly. These regions together account for 85-90% of the world’s wood-based pulp production capacity. The price is based on current quarter average prices, and country/regional wood fiber consumption data. The global average price for softwood and hardwood is calculated in nominal US$ per oven-dried metric ton of wood fiber.

Global pulpwood and timber market reporting is included in the 52-page quarterly publication Wood Resource Quarterly (WRQ). The report, which was established in 1988 and has subscribers in over 30 countries, tracks sawlog, pulpwood, lumber and pellet prices, trade and market developments in most key regions around the world. To subscribe to the WRQ, please go to www.woodprices.com

FOEX WRI Wood Chip Prices Indices for Overseas Trade in July 2015

In July 2015, prices for overseas traded hardwood chip were 14% below their peak four years ago, according to the latest FOEX Chip Price Indexes

Prices for hardwood chips traded overseas have been in steady decline since November 2011. In less than four years, the FOEX hardwood chip price index (PIX-HCG) has fallen almost 14% to reach US$178.34 per oven-dry metric ton (odmt) in July 2015. The downward trend of the index has partly been the result of lower prices for hardwood chips, in US dollar terms, imported to Japan from Australia, Chile and South Africa.

Prices for hardwood chips traded overseas have been in steady decline since November 2011. In less than four years, the FOEX hardwood chip price index (PIX-HCG) has fallen almost 14% to reach US$178.34 per oven-dry metric ton (odmt) in July 2015. The downward trend of the index has partly been the result of lower prices for hardwood chips, in US dollar terms, imported to Japan from Australia, Chile and South Africa.

Global overseas trade of hardwood chips has slowed down in 2015 with the total trade for the first six months of the year being almost 14% lower than the same period in 2014.

The FOEX softwood chip price index (PIX-SCG) has fluctuated more than the PIX-HCG the past two years and has been on an upswing for the past three months after having declined since last summer. In July, the Index was up almost four percent month-over-month to US$173.20/odmt, the highest level since December of 2014. The increase in the price index was due in part to higher import prices in Japan and Turkey.

About the PIX wood chip prices indices

FOEX and Wood Resources International (WRI) have cooperatively launched two wood chip price indices, the Softwood Chip Global (SCG) and Hardwood Chip Global (HCG), both part of the PIX index family of FOEX. The Indices represent prices (CIF) for wood chips that are traded globally overseas for the manufacturing of wood pulp and wood-based panels. The Indices are reported monthly the third Tuesday of the month on the FOEX web site (www.foex.fi). If you are interested in participating as a data provider, subscribing to the index histories (data available from January 2010), or are considering using the Indices commercially, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

About FOEX Indexes Ltd

FOEX Indexes Ltd is a private, independent company which specializes in providing audited, trade-mark registered price indices for pulp, paper, recovered paper, biomass and wood chips. Financial institutions use the FOEX Indices as benchmarks when setting prices for SWAP-deals and other financial instruments hedging against product price risks.

The PIX Indices are trademark registered by FOEX Indexes Ltd. Any commercial use of the indices is subject to permission from FOEX and the terms outlined in the License Agreement between the user/-s and FOEX. If you are considering commercial use of PIX-SCG or PIX-HCG, please do not hesitate to contact FOEX for further guidance.

About Wood Resources International LLC

Wood Resources International LLC, an internationally recognized forest industry-consulting firm established in 1987, publishes two quarterly timber and pulpwood price reports and has subscribers in over 30 countries. The Wood Resource Quarterly, established in 1988, is a 50-page quarterly market report which includes global prices for sawlogs, pulpwood, wood chips, lumber and pellets, as well as market commentary about developments in the global timber, biomass and forest industry. If you have any questions, please contact Hakan Ekstrom (This email address is being protected from spambots. You need JavaScript enabled to view it.).

The Global Timber and Forest Industry This Quarter - Wood Resource Quarterly

Excerpts from the Wood Resource Quarterly (www.woodprices.com)

Global Timber Markets

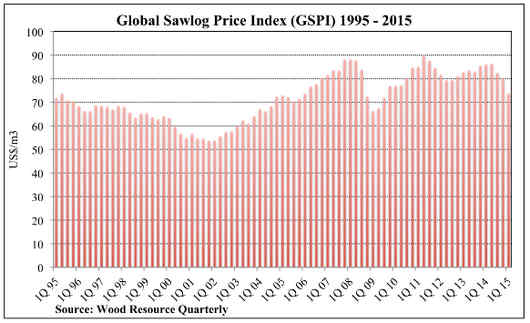

- Sawlog prices fell again in the 2Q/15 in most of the 19 regions worldwide that are part of the Global Sawlog Price Index (GSPI). The Index is at its lowest level since 2009, and is down 20% from its all-time high four years go.

- The only regions where prices increased in the 2Q were in Northwest Russia and the Interior of British Columbia.

- Global trade of softwood roundwood slowed down towards the end of 2014 and log shipments have continued to be slow during the first half of 2015, with the biggest reduction in imports being in Japan, South Korea and Sweden.

Global Pulpwood Prices

- Wood fiber costs for the global pulp industry continued their downward trend in the 2Q/15. The Softwood Fiber Price Index (SFPI) was $91.98/odmt, which was slightly lower than in the previous quarter.

- The SFPI index has fallen for four consecutive quarters and was in the 2Q/15 8.4% lower than 2Q/14. The biggest price declines from the 1Q/15 occurred in Brazil, Central Europe and New Zealand.

- The Hardwood Fiber Price Index (HFPI) fell one percent from the 1Q/15 to $88.95/odmt in the 2Q/15. The HFPI has declined for four years and is currently 25% below its all-time high in 2011. Fiber prices fell the most in France, Brazil, Indonesia and Australia.

Global Pulp Markets

- Despite the recent slowdown, global market pulp production during the first five months of the years was up 3.7% as compared to the same period last year.

- Prices for NBSK have fallen much of the first eight months of 2015, while BHKP prices have gone up. The price premium for NBSK in Europe has shrunk from over $200/ton last fall to only about $35/ton this summer.

Global Lumber Markets

- There have been mixed signals in the global lumber market during the 1H/15. Of the major lumber-importing countries in the world, China, the US and the United Kingdom have increased importation the most during the first half of 2015.

- Japan and most countries in Europe have imported less lumber this year as compared to 2014.

- Exporting countries that have taken advantage of the scattered bright lights in the international lumber market have included Canada, Finland, Russia and Sweden.

- Although the good news for lumber producers in the Nordic countries has been higher export volumes in 2015, the bad news has been that the average export price has declined by over 20% this year.

- Import volumes to China were 2.4% higher during the first seven months of 2015, with Russian shipments to China having increased 18% and supply from North America and Chile having declined over 10%.

- Both domestic and import prices for softwood lumber in Japan moved slightly lower during the summer months, and were close to their lowest levels in over seven years.

- Despite substantially lower export prices in Russia, total export volumes have not seen a dramatic increase. Shipments in April and May were practically the same in 2014 and 2015.

Global Biomass Markets

- British Columbia’s overseas pellet exports in the 1Q/15 fell by over 6% q-o-q. Pellet exports from the US South also fell back, breaking a four-year continuous increase in overseas shipments.

- Unusually warm weather, low costs for fossil fuels, and plenty of pellet supply drove the pellet prices in Europe downward during the spring and summer to their lowest levels in over three years.

Global timber and wood market reporting is included in the 52-page quarterly publication Wood Resource Quarterly. The report, established in 1988 and with subscribers in over 30 countries, tracks sawlog, pulpwood, lumber and pellet prices, and market developments in most key regions around the world. To subscribe to the WRQ, please go to www.woodprices.com

Contact Information

Wood Resources International LLC

Hakan Ekstrom

Seattle, USA

This email address is being protected from spambots. You need JavaScript enabled to view it.

Lack of domestic forest resources has forced the pulp industry in India to increasingly rely on hardwood chips from overseas

Lack of domestic forest resources has forced the pulp industry in India to increasingly rely on hardwood chips from overseas for its wood fiber needs, report the Wood Resource Quarterly

Growing consumption of pulp and paper in India has increased the demand for wood fiber for the domestic pulp industry in the country, reports the Wood Resource Quarterly. With the lack of domestic pulpwood plantations, pulp manufacturers have for the past few years increasingly been looking overseas to South Africa, Brazil, Australia and Southeast Asia for much needed hardwood chips.

India has limited domestic forest resources to supply its forest industry, and with growing domestic demand for forest products, the country’s pulp mills and sawmills have found it necessary to increase importation of wood raw-material both in the form of wood chips and logs.

Over the next five years, demand for paper is expected to increase by between 2-12% annually, depending on paper grade. Over the past decade, the domestic pulp industry has steadily increased its usage of pulpwood because of higher pulp production, less usage of bamboo and because several pulp mills switched from recycled fiber to wood fiber.

Over the next five years, demand for paper is expected to increase by between 2-12% annually, depending on paper grade. Over the past decade, the domestic pulp industry has steadily increased its usage of pulpwood because of higher pulp production, less usage of bamboo and because several pulp mills switched from recycled fiber to wood fiber.

The share of imported wood fiber for the pulp industry accounted for almost ten percent of total consumption of wood fiber in 2014, and this share is expected to increase in the coming years.

The shortage and high cost of local pulpwood in India has resulted in increased interest in sourcing wood chips from overseas despite logistical difficulties both at the ports and when transporting the chips from the ports to the pulp mills long.

Importation of chips is fairly new and Indian pulpmills did not import any wood chips until 2013 when the first shipments of hardwood chips from South Africa, Australia and Thailand arrived. The total imports reached just over 200,000 odmt in 2013, then rose to approximately 370,000 odmt in 2014, according to the Wood Resource Quarterly. South Africa has been the major supplier of chips, with shipped volumes accounting for about 70% of the total import volume in 2015.

During the first six months of 2015, India imported an estimated 180,000 m3, or about 30% more than in the same period in 2014. So far in 2015, three countries have exported wood chips to India, South Africa, Brazil and Vietnam. South Africa has been the dominant supplier to date, and is likely to continue to be the major supplier for the foreseeable future.

Global lumber, sawlog and pulpwood market reporting is included in the 52-page quarterly publication Wood Resource Quarterly (WRQ). The report, which was established in 1988 and has subscribers in over 30 countries, tracks sawlog, pulpwood, lumber and pellet prices, trade and market developments in most key regions around the world. To subscribe to the WRQ, please go to www.woodprices.com

Contact Information

Wood Resources International LLC

Hakan Ekstrom

Seattle, USA

This email address is being protected from spambots. You need JavaScript enabled to view it.