Displaying items by tag: catalyst paper

Catalyst Paper Announces Principal Securityholder Support for Recapitalization

Catalyst Paper Corporation have just announced that it has received an alternative recapitalization proposal to be implemented if the previously announced acquisition proposal by Kejriwal Group International ("KGI") is not completed. The Board of Directors believes that the availability of such an alternative is in the interest of the Company and all of its stakeholders, and had requested that holders representing about 79% of the Company's outstanding common shares and 87% of its 11% PIK Toggle Senior Secured Notes (the "Principal Securityholders") consider making or supporting an alternative proposal.

As a result of the Board of Director's request, each individual Principal Securityholder has separately, following its own independent evaluation, indicated that it would support an alternative recapitalization plan, the terms of which have been communicated to the Company. These terms include converting the US$260 million 11.00% PIK Toggle Senior Secured Notes due October 2017 into (i) a new term loan in the principal amount of US$135 million with a maturity 5 years from the issuance date, and 12% interest to be paid-in-kind during year one, with the possibility thereafter of partial payment-in-kind at the Company's option, and (ii) common shares of the Company representing 95% of the outstanding number thereof after giving effect to such conversion.

The implementation of the alternative recapitalization plan would not affect any of Catalyst's contractual relationships with its trade vendors or any amounts owing to them.

The implementation of the alternative recapitalization plan would not affect any of Catalyst's contractual relationships with its trade vendors or any amounts owing to them.

In addition, the Principal Securityholders have each agreed to defer the interest that is scheduled to be paid to them on November 1, 2016 in respect of the Company's PIK Toggle Notes. The alternative recapitalization plan also contemplates the conversion of the amount of such deferred interest into equity. Together with the significant debt reduction and the terms of the new term loan described above, this deferral and conversion would provide the Company with enhanced liquidity.

"We are pleased that each of our Principal Securityholders is willing to support an alternative recapitalization plan which would significantly reduce debt and provide enhanced liquidity without affecting trade vendors," said Joe Nemeth, President & Chief Executive Officer of Catalyst.

The alternative recapitalization plan also contemplates a transaction under which common shares not held by three of the Principal Securityholders would be exchanged for cash consideration, subject to certain conditions, including so as to permit the Company to cease to be a reporting issuer under applicable securities laws. The completion of any such transaction is not a condition to the implementation of the alternative recapitalization plan. There can be no assurance that such an exchange transaction will be proposed and if so at what price.

KGI Acquisition Proposal

The support agreement among KGI and each of the Principal Securityholders in respect of the KGI acquisition proposal contemplated that an arrangement agreement in connection thereof would be entered into by October 25, 2016. No such arrangement agreement has been entered into. As a result, the parties to the support agreement are permitted to terminate it, although they have not yet taken any such action. There can be no assurance that the support agreement will not be terminated and that the KGI transaction will be completed.

Information regarding process and conditions

Catalyst and its Board of Directors are reviewing and evaluating the alternative recapitalization plan with the assistance of legal and financial advisors and will be providing an update as to such review in due course. The alternative recapitalization plan would be proposed under the arrangement provisions of the Canada Business Corporations Act and submitted for court and securityholder approvals in order to be binding on all affected securityholders.

The alternative recapitalization plan contemplates certain conditions and other provisions including the maturity extension of the existing credit facilities of Catalyst, and securityholder, regulatory, stock exchange and court approvals. There can be no assurance that definitive agreements to implement the proposed alternative recapitalization will be entered into by Catalyst, that any of the conditions to the recapitalization will be satisfied, or that these or any other proposed transaction or plan will be approved or consummated, and if so on what additional or amended terms to those described herein.

The Company does not undertake any obligation to provide any updates with respect to the KGI acquisition or the alternative recapitalization plan or the processes relating thereto, except as required under applicable law. The Company notes that Schedule 13D filings are made from time to time by certain of its stockholders with the U.S. Securities and Exchange Commission and can be consulted by visiting EDGAR on the SEC website at www.sec.gov/edgar.shtml.

About Catalyst Paper

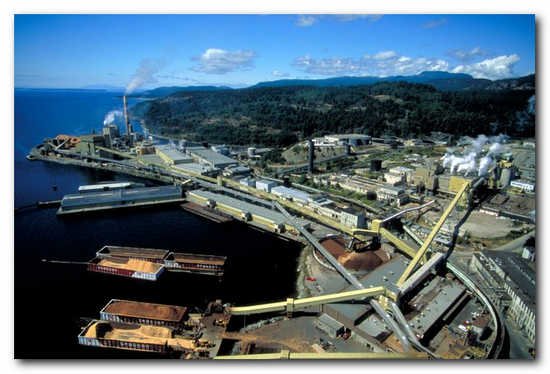

Catalyst Paper manufactures diverse papers such as coated freesheet, coated one side (C1S), flexible and industrial packaging, coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers, commercial printers, and converters of specialty applications in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and has been ranked by Corporate Knights magazine for the 10th consecutive year as one of the 50 Best Corporate Citizens in Canada.

Lawsuit Filed by Sunvault Energy Inc. and Aboriginal Power Corp. Against Catalyst Paper Discontinued

Catalyst Paper Corporation (TSX:CYT) is pleased to announce that Sunvault Energy Inc. and Aboriginal Power Corp. have discontinued the lawsuit previously commenced against Catalyst. The commencement of the lawsuit was previously announced and described in the company's news release of January 25, 2016.

This discontinuance filed by Sunvault Energy Inc. and Aboriginal Power Corp. brings this litigation to an end. Another party to the lawsuit, the Halalt First Nation, had previously filed a discontinuance, which was previously announced and described in the company's news release of September 6, 2016.

This discontinuance filed by Sunvault Energy Inc. and Aboriginal Power Corp. brings this litigation to an end. Another party to the lawsuit, the Halalt First Nation, had previously filed a discontinuance, which was previously announced and described in the company's news release of September 6, 2016.

The discontinuances filed by the Plaintiffs in this lawsuit does not preclude them from re-instituting litigation against Catalyst in the future for the claims made in the actions described in this release provided that any new filing are made within the prescribed limitation period.

"We are pleased that this litigation against Catalyst is now at an end," said Joe Nemeth, President & Chief Executive Officer.

About Catalyst Paper

Catalyst Paper manufactures diverse papers such as coated freesheet, coated one side (C1S), flexible and industrial packaging, coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers, commercial printers, and converters of specialty applications in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and has been ranked by Corporate Knights magazine for the 10th consecutive year as one of the 50 Best Corporate Citizens in Canada.

Discontinuance of Two Lawsuits Filed By the Halalt First Nation Against Catalyst Paper

Catalyst Paper Corporation is pleased to announce that the Halalt First Nation has discontinued two lawsuits previously commenced against Catalyst. The commencement of the two lawsuits was previously announced and described in the company's news release of January 25, 2016.

"We are pleased Halalt has chosen to discontinue its participation in the litigation against Catalyst," said Joe Nemeth, President & Chief Executive Officer. "Catalyst is focused on improving its long-term relationship with the Halalt First Nation and working collaboratively to safeguard the environment along with developing mutually beneficial economic opportunities."

"We are pleased Halalt has chosen to discontinue its participation in the litigation against Catalyst," said Joe Nemeth, President & Chief Executive Officer. "Catalyst is focused on improving its long-term relationship with the Halalt First Nation and working collaboratively to safeguard the environment along with developing mutually beneficial economic opportunities."

The first claim was filed by Halalt against Catalyst alleging that Catalyst has illegally trespassed on, and caused damages to, Halalt's asserted territories and fisheries resources through the operation of Catalyst's Crofton Mill since 1957. The Notice of Discontinuance filed by Halalt in this lawsuit brings this piece of litigation to an end.

The second claim was filed jointly by Halalt, Sunvault Energy Inc. and Aboriginal Power Corp. alleging Catalyst disclosed certain confidential information pertaining to a proposed anaerobic digester facility in breach of a confidentiality agreement. The Notice of Discontinuance filed by Halalt in this lawsuit removes Halalt as a plaintiff. Sunvault Energy Inc. and Aboriginal Power Corp. remain as plaintiffs in the lawsuit. Catalyst denies the remaining allegations contained in this claim and intends to continue to vigorously defend itself.

The discontinuances filed by Halalt from re-instituting litigation against Catalyst in the future for the claims made in the actions described in this release, but Catalyst is hopeful such issues will be permanently resolved through working with the Halalt.

About Catalyst Paper

Catalyst Paper manufactures diverse printing papers such as coated freesheet, coated one side (C1S), coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and has been ranked by Corporate Knights magazine for the 10th consecutive year as one of the 50 Best Corporate Citizens in Canada.

Catalyst Paper Corporation's Principal Securityholders and KGI Amend Support Agreement for a Potential Acquisition of Catalyst Paper; KGI Begins Due Diligence Process

Catalyst Paper Corporation (TSX:CYT) ("Catalyst" or the "Company") have just announced that its four largest shareholders holding or controlling approximately 79% of its outstanding common shares, including accounts or funds managed by Mudrick Capital Management, L.P., Cyrus Capital Partners, LP, Oaktree Capital Management, L.P. and Stonehill Capital Management LLC (collectively, the "Principal Securityholders"), have amended the previously announced support agreement with Kejriwal Group International ("KGI") and accordingly filed amended Schedule 13Ds with the United States Securities and Exchange Commission.

Catalyst is not a party to the amended support agreement but has entered into a confidentiality and non-disclosure agreement with KGI, which allows KGI to initiate its due diligence process in connection with the proposed transaction.

Catalyst is not a party to the amended support agreement but has entered into a confidentiality and non-disclosure agreement with KGI, which allows KGI to initiate its due diligence process in connection with the proposed transaction.

The amended support agreement provides in particular for the extension of the deadline to sign a definitive agreement (now October 25, 2016) but maintains December 15, 2016 as the deadline to complete a transaction, and for KGI to provide regular and satisfactory updates to the Principal Securityholders confirming the status and progress of the transaction.

The Board of Directors will continue to review and evaluate the proposed transaction and the process contemplated by the support agreement with the assistance of legal and financial advisors. Neither the support agreement, nor the confidentiality and non-disclosure agreement preclude discussions among the Principal Securityholders, the Company or the Board of Directors or management of the Company regarding modifications, amendments, extensions, replacements, refinancings, or any similar actions with respect to any securities of the Company held by the Principal Securityholders.

There can be no assurance that any definitive agreement to implement the proposed transaction with KGI will be entered into, and on what terms, that any of the material conditions to the proposed transaction will be satisfied, or that this or any other proposed transaction will be approved or consummated.

The Company does not undertake any obligation to provide any updates with respect to this or any other transaction or the process relating thereto, except as required under applicable law. Interested stakeholders may access the Principal Stakeholders' filings, including the amended support agreement, from time to time with the U.S. Securities and Exchange Commission by visiting EDGAR on the SEC website at www.sec.gov/edgar.shtml.

About Catalyst Paper

Catalyst Paper manufactures diverse printing papers such as coated freesheet, coated one side (C1S), coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and has been ranked by Corporate Knights magazine for the 10th consecutive year as one of the 50 Best Corporate Citizens in Canada.

Catalyst Paper Corporation's Principal Securityholders and KGI Enter Into a Support Agreement for a Potential Acquisition of Catalyst Paper

Catalyst Paper Corporation (TSX:CYT) ("Catalyst" or the "Company") has just announced that it has been advised that the four largest shareholders of the Company holding or controlling approximately 79% of the Company's outstanding common shares, that include Mudrick Capital Management, L.P., Cyrus Capital Partners, LP, Oaktree Capital Management, LP and Stonehill Capital Management LLC (collectively, the "Principal Securityholders") have entered into a support agreement with Kejriwal Group International ("KGI"). The Principal Securityholders have filed Schedule 13D with the United States Securities and Exchange Commission setting out the details of the support agreement.

The support agreement has been entered into between KGI and the Principal Securityholders following previously disclosed discussions. The Company is not a party to the support agreement, nor has it been a party to the discussions that led to it.

The support agreement has been entered into between KGI and the Principal Securityholders following previously disclosed discussions. The Company is not a party to the support agreement, nor has it been a party to the discussions that led to it.

The Principal Securityholders have committed to support and vote in favour of a transaction to be implemented by way of a plan of arrangement under the Canada Business Corporations Act, the terms of which would include:

- common shares held by minority shareholders would be acquired for C$6.00 per share, subject to a maximum aggregate payment of C$18 million;

- common shares held by the Principal Securityholders would be exchanged for interests in a new junior convertible term loan;

- existing PIK toggle senior secured notes due 2017 would be exchanged for interests in a new 5-year US$260.5 million term loan;

- existing credit facilities, including the Company's ABL Facility, would have their maturities extended, or be refinanced; and

- trade and other obligations remaining unaffected.

The support agreement among KGI and the Principal Securityholders includes material conditions and other provisions including satisfactory due diligence by KGI to occur over a period of up to 75 days, the refinancing or maturity extensions of the existing credit facilities of Catalyst, securityholder, regulatory and court approvals, and funding at closing. The support agreement contemplates an outside date to complete the transaction of November 30, 2016, subject to extension.

The Board of Directors has not yet entered into any discussions regarding the potential transaction with KGI or agreed to the contemplated process and timeline set forth in the support agreement. The Board of Directors is encouraged by KGI's proposal and will be pleased to review and evaluate the proposed transaction and the process contemplated by the support agreement with the assistance of legal and financial advisors.

There can be no assurance that any agreement to implement the transaction will be entered into between KGI and Catalyst, and on what terms, that any of the material conditions to the transaction will be satisfied, or that this or any other transaction will be approved or consummated.

The Company does not undertake any obligation to provide any updates with respect to this or any other transaction, except as required under applicable law. Interested stakeholders may access the Principal Stakeholders' filings, including the support agreement, from time to time with the U.S. Securities and Exchange Commission by visiting EDGAR on the SEC website at www.sec.gov/edgar.shtml.

About Catalyst Paper

Catalyst Paper manufactures diverse printing papers such as coated freesheet, C1S, coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and has been ranked by Corporate Knights magazine for 10 consecutive years as one of the 50 Best Corporate Citizens in Canada.

Catalyst Paper Named One of Canada's Top Corporate Citizens, 10th Year in a Row

Catalyst Paper has just announced that it has been named for the 10th consecutive year as one of the Best 50 Corporate Citizens in Canada by Corporate Knights Magazine, which reports on corporate sustainability and transparency.

"We are proud to be acknowledged for the 10th consecutive year as one of Canada's Best Corporate Citizens," said Joe Nemeth, President & Chief Executive Officer. "This designation acknowledges the investments we have made to put our sustainability values and commitment into practice."

"We are proud to be acknowledged for the 10th consecutive year as one of Canada's Best Corporate Citizens," said Joe Nemeth, President & Chief Executive Officer. "This designation acknowledges the investments we have made to put our sustainability values and commitment into practice."

The Best 50 Corporate Citizens in Canada are selected by Corporate Knights Magazine on the basis of their performance against 12 key sustainability indicators, including greenhouse gas production, percentage of taxes paid, health and safety performance, and pension fund quality.

The award recognizes Catalyst's ongoing focus on strengthening its leadership role in sustainable business practices and its commitment to building respectful and constructive relationships with stakeholders. In 2015, Catalyst demonstrated its environmental sustainability commitment through ongoing achievements, including maintaining certified fibre sourcing and chain of custody transparency, supporting the Great Bear Rainforest Land Use Objectives Order, investing in green-energy generation and implementing carbon reduction policies and practices.

Catalyst is proud of its performance and track record, and its commitment to transparently sharing information in its annual Sustainability Reports. The company's 2015 Sustainability Report, which is presented according to the Global Reporting Index, provides a transparent record of Catalyst's performance across multiple dimensions, including environmental results, as well as the social and economic contribution of its operations in the communities where the company's employees live and work.

About Catalyst Paper

Catalyst Paper manufactures diverse printing papers such as coated freesheet, C1S, coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and is ranked by Corporate Knights magazine as one of the 50 Best Corporate Citizens in Canada.

Powell River G13 Turbine Project Wins National Energy Conservation Leadership Award

Catalyst Paper have just announced that its Powell River mill has won the prestigious Canadian Industry Program for Energy Conservation (CIPEC) Leadership Award. Powell River was recognized in the category of Energy Performance Management in recognition of its successful installation of the G13 Turbine.

The G13 Turbine, which was installed in 2015, converts waste steam to electricity, increasing the mill's power output by 8 megawatts, enough to power almost 7,000 homes. The $24 million project was developed in partnership with BC Hydro and was completed in the fall of 2015.

The G13 Turbine, which was installed in 2015, converts waste steam to electricity, increasing the mill's power output by 8 megawatts, enough to power almost 7,000 homes. The $24 million project was developed in partnership with BC Hydro and was completed in the fall of 2015.

"This award recognizes the tremendous efforts of our team to reduce costs, create efficiency and support our commitment to environmental sustainability," said Fred Chinn, Vice President & General Manager, Powell River Mill. "It's a critical part of our effort to revitalize the mill for the future to ensure our long-term sustainability."

Award recipients were selected by the Industry Division of Natural Resources Canada's Office of Energy Efficiency. G13 was selected because it demonstrates achievements in energy efficiency and environmental stewardship, and is well aligned with the Government of Canada's commitment to advancing its clean growth agenda.

"I would like to commend Catalyst Paper on their CIPEC Leadership Award. Their innovative Powell River Mill project demonstrates how new technologies help reduce the environmental impacts of energy production and output," said Kim Rudd, Parliamentary Secretary to the Minister of Natural Resources. "Their commitment to improving environmental sustainability and energy efficiency is impressive and a great example to other manufacturers."

The award was presented on May 17 at an awards dinner in Niagara Falls, Ontario as part of the Energy Summit 2016 conference.

About Catalyst Paper

Catalyst Paper manufactures diverse printing papers such as coated freesheet, C1S, coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and is ranked by Corporate Knights magazine as one of the 50 Best Corporate Citizens in Canada.

Catalyst Paper's Three Major Shareholders Complete Schedule 13D Filings

Catalyst Paper Corporation (TSX:CYT) have just announced that it has been informed that three of its major shareholders, Mudrick Capital Management, L.P., Cyrus Capital Partners, L.P. and OCM Luxembourg VOF Sarl, a fund indirectly managed by Oaktree Capital (the "Reporting Persons"), have on an individual basis completed Schedule 13D filings with the United States Securities and Exchange Commission disclosing that they are currently engaged in discussions with a third party concerning a potential material strategic transaction involving Catalyst Paper. The Reporting Persons have also reported that there can be no assurance that such discussions will result in the consummation of any such transaction.

Catalyst Paper Corporation (TSX:CYT) have just announced that it has been informed that three of its major shareholders, Mudrick Capital Management, L.P., Cyrus Capital Partners, L.P. and OCM Luxembourg VOF Sarl, a fund indirectly managed by Oaktree Capital (the "Reporting Persons"), have on an individual basis completed Schedule 13D filings with the United States Securities and Exchange Commission disclosing that they are currently engaged in discussions with a third party concerning a potential material strategic transaction involving Catalyst Paper. The Reporting Persons have also reported that there can be no assurance that such discussions will result in the consummation of any such transaction.

Neither the Board of Directors nor management have been contacted by or received a proposal from such third party regarding a potential transaction. Catalyst will only further comment if and when required by applicable securities laws.

About Catalyst Paper

Catalyst Paper manufactures diverse printing papers such as coated freesheet, C1S, coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and is ranked by Corporate Knights magazine as one of the 50 Best Corporate Citizens in Canada.

Catalyst Paper Announces Voting Results for the Election of Directors

Catalyst Paper (TSX:CYT) has just announced the voting results of the Annual General Meeting which was held on May 10, 2016 in Richmond, BC.

Catalyst Paper (TSX:CYT) has just announced the voting results of the Annual General Meeting which was held on May 10, 2016 in Richmond, BC.

Shareholders voted in favour of all the items of business before the meeting including the election of all director nominees as follows:

| Votes by Ballot | ||||||||

| Outcome of Vote | Votes For | Votes Withheld | % of Votes Cast For |

|||||

| The election of the following nominees as directors of the Issuer for the ensuing year or until their successors are elected or appointed | Carried | |||||||

| (a) John Brecker | 11,859,104 | 6,626 | 99.94 | |||||

| (b) Todd Dillabough | 11,859,104 | 6,626 | 99.94 | |||||

| (c) Walter A. Jones | 11,859,104 | 6,626 | 99.94 | |||||

| (d) Leslie T. Lederer | 11,859,104 | 6,626 | 99.94 | |||||

| (e) Jill Leversage | 11,859,104 | 6,626 | 99.94 | |||||

| (f) Joe Nemeth | 11,859,104 | 6,626 | 99.94 | |||||

| (g) Pierre Raymond | 11,859,104 | 6,626 | 99.94 | |||||

Detailed voting results for the meeting are available on SEDAR at www.sedar.com.

About Catalyst Paper

Catalyst Paper manufactures diverse printing papers such as coated freesheet, C1S, coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and is ranked by Corporate Knights magazine as one of the 50 Best Corporate Citizens in Canada.

Catalyst Paper

Frank De Costanzo

Senior Vice President & Chief Financial Officer

(604) 247-4014

Catalyst Paper Reports Fatality at its Crofton Mill

Catalyst Paper (TSX: CYT) regrets to report the occurrence of a fatal incident involving an employee at its Crofton mill. The incident resulted from an industrial vehicle roll-over which occurred yesterday evening at the mill.

Catalyst Paper (TSX: CYT) regrets to report the occurrence of a fatal incident involving an employee at its Crofton mill. The incident resulted from an industrial vehicle roll-over which occurred yesterday evening at the mill.

The Coroner, RCMP and WorkSafeBC have been contacted and an investigation is underway.

"We are saddened by this tragic incident," says Joe Nemeth, President and Chief Executive Officer. "We are doing everything possible to support the investigation. We extend our deepest sympathies to the family of the deceased."

WorkSafeBC will lead the investigation, fully supported by mill personnel.

About Catalyst Paper

Catalyst Paper manufactures diverse printing papers such as coated freesheet, C1S, coated and uncoated groundwood, newsprint, directory, as well as market pulp. Customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada, and is ranked by Corporate Knights magazine as one of the 50 Best Corporate Citizens in Canada.

SOURCE Catalyst Paper Corporation

For further information:

Investor Contact: Frank De Costanzo, Senior Vice President & Chief Financial Officer, (604) 247-4014, This email address is being protected from spambots. You need JavaScript enabled to view it.; Media Contact: Eduarda Hodgins, Director, Organization Development & Communications, (604) 247-4369, This email address is being protected from spambots. You need JavaScript enabled to view it.

This information is being distributed to you by / Cette information vous est transmise par : Catalyst Paper Corporation