When the economy fell off the cliff in the autumn of 2008, both domestic and export recovered fiber markets quickly followed. In fact, traded volumes and prices of all fiber grades fell so fast and far that processing plants hung placards on their doors telling all who approached: “No paper wanted.”

Before the 2008 collapse, general business in the industry was strong; the market was highly competitive, pushing prices steadily upward. All the good done by an increasing fiber recovery rate in the US was quickly undone in the fall of 2008. Tons were diverted to the landfill. Companies that were being paid for fiber were forced to give it away. Some even had to pay to have recovered fiber hauled away. It was a scary time, made even more scary by the sheer magnitude of the decline and the absence of sufficient warning.

What if, through the summer of 2008, there had been a better market indicator available than a single published regional commodity price for each fiber grade? Would prices have plummeted in the same dramatic way? Could a better indicator have softened our industry’s landing? To what degree did the widely used, subjective market price reports available to us at the time amplify the price decline? Did their tendency to reflect building negative sentiment and anxiety about the future market impact developing events? Would the market have played out differently—with less volatility and a softer landing—if we had known the actual current market price and had insight into more robust market trend information?

While we can’t know the answer to these questions for sure, we may have an opportunity to find out. Recovered fiber markets are once again softening, a result of lackluster overseas economic performance and a still recovering US economy. We may need to brace ourselves, as survey-based price reporting mechanisms are likely to repeat their previous actions, magnifying anxiety, pushing prices lower than is rational and causing some in the industry to overreact in response.

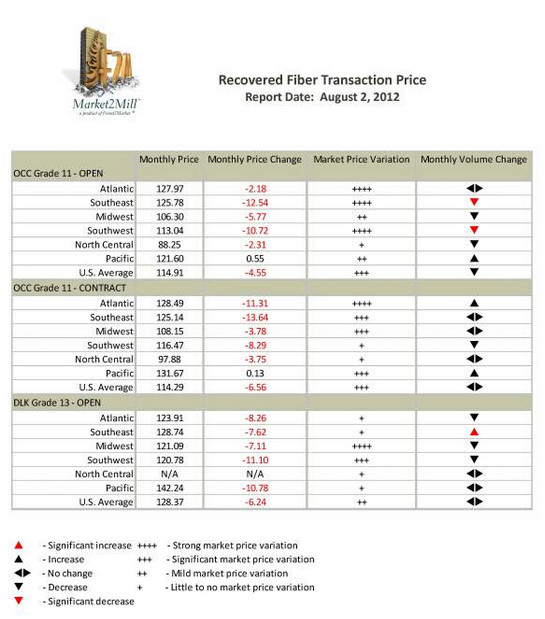

Compare our last report (below) to what survey-based mechanisms reported for the same period, and you will see that this anxiety is already creeping in.

Fortunately, there is an alternative this time, a transaction-based market snapshot that will allow informed businesses to review and analyze their buys and sells against an more accurate description of market performance. With better data and market trend information, an overreaction followed by an overcorrection might be avoided. The fall of 2008 didn’t kill the recovered fiber market; this time, the availability of more accurate market information might even make it stronger.

source: forest2market