Global Timber Markets

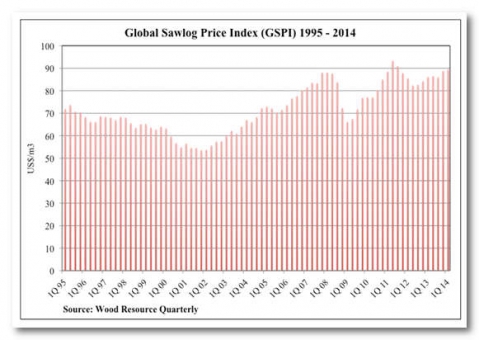

- With improved lumber markets in many regions around the world in early 2014, sawlog consumption was higher and sawlog prices were moving upward in a majority of the 20 regions covered by WRQ. The Global Sawlog Price Index (GSPI) rose by 0.8% from the 4Q/13 to US$89.45/m3 in the 1Q/14.

- During the 1Q/14, trade of logs was up in all major markets of the world as compared to the 1Q/13. For the four largest exporting countries, the increase was 17%, with the biggest rise in shipments coming out of Russia.

Global Pulpwood Prices

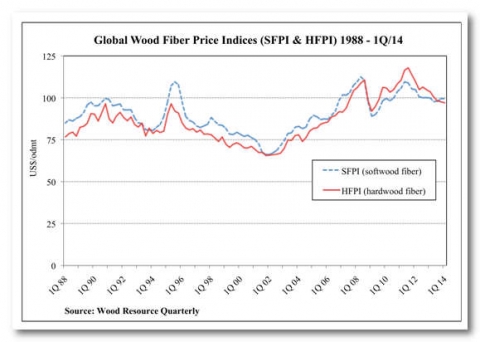

- Lower wood fiber prices in local currencies and a strengthening US dollar resulted in declines in both the Softwood and Hardwood Fiber Price Indices (SFPI and HFPI), which are the price indices that track wood costs for the global pulp industry.

- The SFPI fell from $99.51/odmt in the 4Q/13 to $99.43/odmt in the 1Q/14, with the biggest price reductions occurring in Canada, Russia, Australia and Brazil.

- The prices for hardwood pulplogs have trended downward in many markets for more than two years, which is reflected in an HFPI Index that has constantly fallen each quarter since its peak in the 3Q/11. In the 1Q/14, the HFPI was $97.01/odmt, down from $97.59/odmt in the previous quarter. Prices fell the most in Russia, Eastern Canada, Western US and Brazil.

Global Pulp Markets

- Production of market pulp fell in two of the three major pulp-producing regions in the world in early 2014. Production was down 5.2% in N. America and 4.2% in Europe. In Latin America, production was up 2.6% mainly because of higher exports to China and Europe.

- Prices for NBSK pulp have been holding up better than those for HBKP this year. With the recent opposing price trends for softwood and hardwood pulp, the price discrepancy between the two major pulp grades has widened to a two-year record.

Global Lumber Markets

- Lumber imports to Japan slowed down in the 1Q/14, with volumes being four percent lower than the first quarter of 2013 and, in fact, representing the lowest 1Q import levels since 2010.

- A slowdown in the Chinese economy has impacted the construction sector, resulting in a decline in lumber imports during the first four months of 2014. The biggest drop has been in lumber shipments from Canada, while Russian sawmills have kept up deliveries fairly well.

- The sawmilling sector in the US has been in a steady comeback mode ever since the global financial crisis struck in 2008. From 2009 to 2013, production has gone up every year, and the total production increased 28 % over this four-year period. In early 2014, production fell slightly.

- Lumber exports from Canada in the 1Q/14 fell to all markets except the US. The biggest decline from the previous quarter was in lumber headed to China (-22%) and to Japan (-32%).

- The Finnish sawmilling industry had a good year last year with total production reaching over ten million m3, the highest level in five years. This positive trend continued in 2014, with production in the 1Q being up 5% thanks to higher shipments to France, Germany and Algeria.

Global Biomass Markets

- With no slowdown in sight, North American wood pellet exporting companies keep building new facilities to manufacture pellets for the European market. Export volumes hit a new record high in the 4Q/13 and the total shipments for 2013 were up almost 50% from the previous year.

- South Korea has increased importation of pellets dramatically the past two years with Vietnam and Canada being the major suppliers