Ianadmin

Valmet to acquire tissue rewinder business from Massimiliano Corsini srl. Italy to strengthen its product portfolio

Valmet and Massimiliano Corsini srl. have signed a Sale and Purchase Agreement of MC Paper Machinery and Focus Rewinding business to Valmet on July 31, 2015. The acquisition is estimated to be completed by August 6, 2015.

Valmet and Massimiliano Corsini srl. have signed a Sale and Purchase Agreement of MC Paper Machinery and Focus Rewinding business to Valmet on July 31, 2015. The acquisition is estimated to be completed by August 6, 2015.

The acquired operations mainly supply rewinders for tissue and non-woven machines. In the past years the net sales of the acquired business has been around EUR 10 million. The operations employ 33 people and are located in Pescia, close to Lucca, Italy.

Combination of Valmet and MC Paper Machinery creates complete customer offering

As a result of the acquisition, Valmet will have a more extensive product portfolio and becomes a stronger technology and services company in its field. The acquisition strengthens Valmet's competitiveness by combining tissue making equipment from stock preparation to rewinding, process know-how, automation and services into one customer value-adding entity.

Valmet and MC Paper Machinery have had a long-term partnership and a large amount of MC Paper rewinders have been installed in connection to Valmet tissue machines.

The company being acquired is a strong business, with established customer relations and a high level of technology and know-how, including the successful Focus technology. During the last 20 years MC Paper Machinery has become world leading in designing and manufacturing rewinding plants specifically devoted to the field of non-woven and tissue paper.

Through the acquisition, Valmet strengthens its offering and continues to develop its business.

Strengthened tissue market position

"Valmet and MC Paper Machinery share the same determination to offer leading technologies, with highest customer satisfaction. Through the acquisition, Valmet will become a technology and service company with a wider offering of high technology equipment for tissue production. By combining tissue paper and re-winding machinery with process know-how, automation and services and global presence from both companies, we can serve the tissue producers even better than before and move our customers' performance forward," says Anders Björn, Vice President of Valmet's Tissue Mills Business Unit.

Asylum – an installation created in an industrial setting

In an industrial workshop in Strömsbruk in northern Sweden, multimedia artist Nils Olof Hedenskog is working up a sweat. Within six months he will create an installation that it is hoped will attract interest from many art institutions around the world. The raw material is paperboard and he is working with Invercote from Iggesund Paperboard.

Artist Nils Olof Hedenskog is the artist in residence at Iggesund Paperboard and is working on an installation called “Asylum”. Over a six-month period in the industrial setting he is building six paperboard towers that will enclose a space which viewers cannot enter but only look into.

“For me there exists a tension between the limitlessness of art and the fact that I am in a strict, production-oriented environment where everything is based on rationality,” he says during a break from his work. “I have six months to create something that represents this tension.”

Iggesund Paperboard, which offered him the opportunity to be an artist in residence, has a long tradition of working with artists. When the company celebrated its 300th anniversary at the end of the last century, it asked the well-known Swedish painter Mårten Andersson to depict various aspects of its production process. For the past 15 years Inger Drougge Carlberg, a textile artist who has increasingly been working with paper pulp, has had a studio on site at the mill. And five years ago Iggesund challenged packaging designers with its Black Box Project, in which seven international designers had to fill a box of specific dimensions with contents that challenged the performance abilities of the company’s most successful project, Invercote.

“We manufacture the basic material paperboard so we are a very long way back in the processing chain,” explains Staffan Sjöberg, who works at Iggesund’s Market Communications department. “Our own success is very dependent on all the creative people around the world who make fantastic things from Invercote. So of course we want to foster creativity both on the artistic level but also in the form of the innovations that our customers in the packaging segment put their heart and soul into.”

He readily admits that the end goal of Iggesund’s creative joint projects is to sell more paperboard. But to attract attention in the creative world a company must step outside the traditional commercial pathways, dare to hand over control and see where external creative forces can take it.

“It’s a balancing act,” he says. “In traditional business communications the aim is to control everything. In projects like this one you have to dare to give up control so that your efforts to communicate will hopefully reach further than those based on traditional methods.”

In the industrial workshop Nils Olof Hedenskog is working on models of an installation that will be built of paperboard with a special structure. The aim is to present the installation at an exhibition in the summer of 2015.

“I’ve worked with paper-based materials for several periods during my artistic career,” he says. “Now it feels terrific to be able to work with material from Iggesund, which has such strong environmental documentation.”

His installation has the working name of “Asylum” and consists of six paperboard towers enclosing a space. Viewers can look into the space but not enter it. On the outside the towers are not coloured; their structure together with the lighting will create various nuances of grey. On the inside they are painted in fluorescent colours, which will create light that will radiate out between the towers and through peepholes.

“I’m creating a reflection of the current situation in Europe – with hundreds of thousands of refugees who want to get inside but who most often only get a glimpse of what is inside Europe’s walls,” Hedenskog explains.

Diogo Rezende appointed as Inapa CEO

The Board of Directors coopted Mr. Diogo Mendes Bastos Rezende as member of the Board for the current three-year term, appointing him also as Chief Executive Officer of INAPA.

The Board of Directors coopted Mr. Diogo Mendes Bastos Rezende as member of the Board for the current three-year term, appointing him also as Chief Executive Officer of INAPA.

Graduated in Economics from Nova University in Lisbon, completed in 1992 an MBA in INSEAD (Fontainebleau, France). Between 2004 and 2014, Diogo Rezende was the CEO of Ford Lusitana (Portugal), where he led its transformation on a rapidly changing environment.

Currently, he is an Assistant Professor Adjunct of Applied Entrepreneurship in the Masters Program at the New School of Business Economics, and a member of its Advisory Board, advising additionally several companies in their developing, growth and restructuring phases.

About Inapa Group

Inapa is one of the leading paper merchants in Europe, with annual sales above 900 million Euros. Established in 1965, Inapa is the only listed company in the paper distribution sector in Europe.

With a team of 1500 employees, Inapa Group operates in 9 countries – Germany, France, Spain, Portugal, Switzerland, Belgium, Luxembourg, Turkey and Angola – holding a leading position in all these markets.

Diogo Rezende

Graduated in economics from Nova University in Lisbon, Portugal, and in 1992 completed an MBA in INSEAD (Fontainebleau, France).

He began his career in 1989 in MDM Sociedade de Investimentos, working in the departments of mergers and acquisitions and corporate finance. Later he worked as a strategic consultant in ESFI – Estratégia e Finança.

Between 1992 and 1998, he worked for Ford Lusitana (Portugal), where he was marketing director and sales director. Between 1996 and 1998 he was Assistance Professor Adjunct of Marketing in the Undergraduate Program at the Nova School of Business and Economics.

Between 1998 and 2003, he was the CEO of Chrysler Jeep in Portugal, a company with Spanish and Mexican shareholders, having started from scratch the operation. During this period he had on- going business relationships with Spain, USA and Belgium.

Between 2004 and 2014, he was the CEO of Ford Lusitana (Portugal), where he led its transformation on a rapidly changing environment.

Since 2013, he is an Assistant Professor Adjunct of Applied Entrepreneurship in the Masters Program at the New School of Business Economics, and a member of its Advisory Board, since 2011.

Foradditional information: InapaIPG

FernandoRente This email address is being protected from spambots. You need JavaScript enabled to view it.

+351213 823007 www.inapa.pt

Valmet's Interim Review January 1 - June 30, 2015: Strong start for Automation as part of Valmet - profitability reached the targeted range in Q2/2015

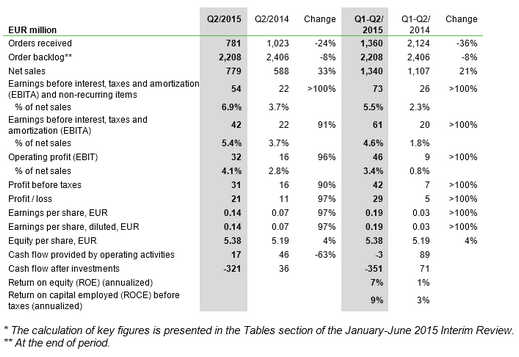

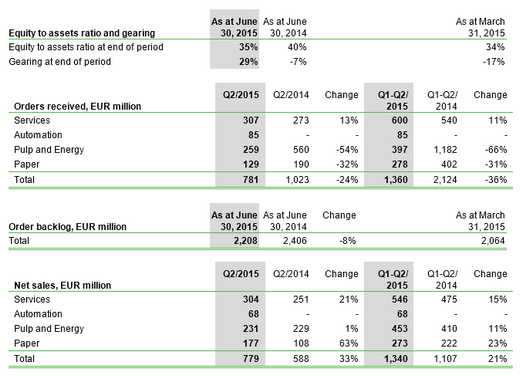

Figures in brackets, unless otherwise stated, refer to the comparison period, i.e. the same period of the previous year. Automation has been consolidated into Valmet's financials since April 1, 2015, when the acquisition of Automation was completed.

April-June 2015: Strong start for Automation - Valmet's EBITA more than doubled

- Orders received decreased to EUR 781 million (EUR 1,023 million).

- Orders received increased in the Services business line and decreased in the Pulp and Energy, and Paper business lines.

- Net sales increased to EUR 779 million (EUR 588 million).

- Net sales increased in the Paper, and Services business lines and remained at the previous year's level in the Pulp and Energy business line.

- Automation contributed to net sales by EUR 68 million.

- Earnings before interest, taxes and amortization (EBITA) and non-recurring items were EUR 54 million (EUR 22 million), and the corresponding EBITA margin was 6.9 percent (3.7%).

- Profitability improved due to the higher level of net sales, improved gross profit, and the acquisition of Automation.

- Earnings per share were EUR 0.14 (EUR 0.07).

- Non-recurring items amounted to EUR -12 million (EUR 0 million), of which costs related to acquisition of Automation amounted to approximately EUR 10 million.

- Cash flow provided by operating activities was EUR 17 million (EUR 46 million).

January-June 2015: EBITA more than doubled - continued good development in Services

- Orders received decreased to EUR 1,360 million (EUR 2,124 million).

- Orders received increased in the Services business line and declined from the high levels in H1/2014 in the Pulp and Energy, and Paper business lines.

- Net sales increased to EUR 1,340 million (EUR 1,107 million).

- Net sales increased in Services, Pulp and Energy, and Paper business lines.

- Automation contributed to net sales by EUR 68 million.

- Earnings before interest, taxes and amortization (EBITA) and non-recurring items were EUR 73 million (EUR 26 million), and the corresponding EBITA margin was 5.5 percent (2.3%).

- Profitability improved due to the higher level of net sales, improved gross profit, and the acquisition of Automation.

- Earnings per share were EUR 0.19 (EUR 0.03).

- Non-recurring items amounted to EUR -12 million (EUR -6 million), of which costs related to acquisition of Automation amounted to approximately EUR 10 million.

- Cash flow provided by operating activities was EUR -3 million (EUR 89 million).

Valmet reiterates its guidance for 2015

Valmet is reiterating its guidance presented on February 6, 2015 in which Valmet estimates that, including the acquisition of Process Automation Systems, net sales in 2015 will increase in comparison with 2014 (EUR 2,473 million) and EBITA before non-recurring items in 2015 will increase in comparison with 2014 (EUR 106 million).

Short-term outlook

General economic outlook

Global growth is projected at 3.3 percent in 2015, marginally lower than in 2014, with a gradual pickup in advanced economies and a slowdown in emerging market and developing economies. In 2016, growth is expected to strengthen to 3.8 percent. The distribution of risks to global economic activity is still tilted to the downside. Near-term risks include increased financial market volatility and disruptive asset price shifts, while lower potential output. (International Monetary Fund, July 9, 2015)

Short-term market outlook

Valmet is reiterating its short-term market outlook presented on April 29, 2015. Valmet estimates that activity in pulp, and board and paper markets will remain on a good level. The activity in the services, tissue, and automation markets is estimated to remain satisfactory. The activity in the energy markets is expected to remain weak.

President and CEO Pasi Laine: Together with Automation, Valmet becomes a stronger company

When the acquisition of Process Automation Systems was completed on April 1, 2015, Valmet got its fourth business line, called Automation. Our customers appreciate that we have reunited the automation expertise with paper, pulp, and power plant technology and process know-how, within the same company. This change has energized and motivated our employees too.

Automation had a strong start as a part of Valmet, and over time I believe that we can achieve even greater benefits through good internal cooperation. With an integrated sales process, harmonized project execution, wider offering and enhanced product development, we will be able to serve our customers even better than before. All in all, Valmet will become a stronger company.

Valmet's performance in the second quarter of 2015 was solid: net sales increased, profitability improved and the EBITA margin reached our targeted range. Good development continued in the Services business line. Additionally we are continuing our focus on cost control and successful project execution.

In addition to expanding Valmet's offering, the automation business somewhat decreases cyclicality of Valmet's businesses. On annual level the automation business is typically fairly stable, thus increasing the stability and visibility of Valmet's business.

Key figures*

Valmet is the leading global developer and supplier of technologies, automation and services for the pulp, paper and energy industries. Valmet's vision is to become the global champion in serving its customers.

Valmet's services cover everything from maintenance outsourcing to mill and plant improvements and spare parts. The strong technology offering includes pulp mills, tissue, board and paper production lines, as well as power plants for bio-energy production. Valmet's advanced automation solutions range from single measurements to mill wide turnkey automation projects.

Valmet's net sales in 2014 were approximately EUR 2.5 billion. Our 12,000 professionals around the world work close to our customers and are committed to moving our customers' performance forward - every day. Valmet's head office is in Espoo, Finland and its shares are listed on the NASDAQ OMX Helsinki Ltd.

Valmet's Interim Review January 1 - June 30, 2015

Clearwater Paper Reports Second Quarter 2015 Results

Clearwater Paper Corporation has reported financial results for the second quarter of 2015.

The company reported net sales of $444.6 million for the second quarter of 2015, down 10.9% compared to net sales of $498.8 million for the second quarter of 2014 primarily due to the sale of the company's specialty mills in December 2014. Net earnings determined in accordance with generally accepted accounting principles, or GAAP, for the second quarter of 2015 were $15.6 million, or $0.81 per diluted share, compared to $12.5 million, or $0.61 per diluted share, for the second quarter of 2014. The 2015 second quarter GAAP net earnings included $1.0 million of after-tax benefit associated with the mark-to-market impact of directors' equity-based compensation, $0.9 million of net after-tax gain associated with the settlement of a working capital escrow account established in connection with the sale of the company's specialty mills, and $0.5 million of after-tax expense associated with the closure of the company's Long Island, New York, converting and distribution facility. Excluding those items, second quarter 2015 adjusted net earnings were $14.2 million, or $0.74 per diluted share, compared to second quarter 2014 adjusted net earnings of $15.3 million, or $0.74 per diluted share.

The company reported net sales of $444.6 million for the second quarter of 2015, down 10.9% compared to net sales of $498.8 million for the second quarter of 2014 primarily due to the sale of the company's specialty mills in December 2014. Net earnings determined in accordance with generally accepted accounting principles, or GAAP, for the second quarter of 2015 were $15.6 million, or $0.81 per diluted share, compared to $12.5 million, or $0.61 per diluted share, for the second quarter of 2014. The 2015 second quarter GAAP net earnings included $1.0 million of after-tax benefit associated with the mark-to-market impact of directors' equity-based compensation, $0.9 million of net after-tax gain associated with the settlement of a working capital escrow account established in connection with the sale of the company's specialty mills, and $0.5 million of after-tax expense associated with the closure of the company's Long Island, New York, converting and distribution facility. Excluding those items, second quarter 2015 adjusted net earnings were $14.2 million, or $0.74 per diluted share, compared to second quarter 2014 adjusted net earnings of $15.3 million, or $0.74 per diluted share.

Earnings before interest, taxes, depreciation and amortization, or EBITDA, was $52.7 million for the second quarter of 2015. Adjusted EBITDA for the quarter was $50.7 million, down 11.6% compared to second quarter 2014 Adjusted EBITDA of $57.3 million. The decrease in EBITDA and Adjusted EBITDA was due primarily to costs associated with scheduled major maintenance at the company's Arkansas pulp and paperboard mill and the sale of the company's specialty tissue mills, partially offset by lower input costs for pulp, chemicals and natural gas.

"Clearwater Paper delivered strong results that exceeded the high end of our outlook for the second quarter of 2015," said Linda K. Massman, president and chief executive officer. "Our consumer products business has continued to demonstrate the ability to increase operating leverage, execute on its plan to improve efficiencies throughout the organization and expand its customer base. During the first half of the year, pulp and paperboard successfully completed major maintenance at both facilities within budget and brought these operations to a higher performance level, in addition to reaching record paperboard shipments in the second quarter."

Through July 29, 2015, the company has repurchased approximately 600,000 shares at an average price of $61.97 under the $100 million stock repurchase program authorized in December 2014.

SECOND QUARTER 2015 SEGMENT PERFORMANCE

Consumer Products

Net sales in the Consumer Products segment were $239.4 million for the second quarter of 2015, down 20% compared to second quarter 2014 net sales of $299.1 million. This decrease was due to the sale of the specialty tissue mills.

On a GAAP basis, the segment had operating income of $17.0 million, compared to operating income of $12.7 million in the second quarter of 2014. Adjusted operating income of $16.4 million for the second quarter of 2015 was up $1.5 million compared to the same period in 2014, after adjusting for $0.7 million and $2.2 million of costs in the second quarters of 2015 and 2014, respectively, related to previously announced facility closures. Also included in adjusted operating income for the second quarter of 2015 was the recognition of a $1.3 million net gain due to the settlement of the working capital escrow account associated with the sale of the specialty tissue mills. The improved results in the most recent period were driven primarily by a richer product mix, lower pricing for external pulp and increased usage of internally produced pulp, reduced energy costs, and lower planned maintenance expense, partially offset by the absence of operating income from the company's former specialty mills.

- Total tissue sales volumes of 96,220 tons in the second quarter of 2015 declined by 28.6% and converted product cases shipped were 13.1 million, down 6.9%, each compared to the second quarter of 2014, largely due to the sale of the specialty mills.

- Average tissue net selling prices increased 12.0% to $2,482 per ton in the second quarter of 2015, compared to the second quarter of 2014, due to improved product mix after the sale of the specialty mills.

Pulp and Paperboard

Net sales in the Pulp and Paperboard segment were $205.2 million for the second quarter of 2015, up 2.8% compared to second quarter 2014 net sales of $199.6 million. The increase was primarily due to stronger seasonal shipments. Operating income for the quarter decreased $5.9 million to $27.8 million, compared to $33.6 million for the second quarter of 2014, primarily due to approximately $7 million of scheduled major maintenance costs at the Arkansas pulp and paperboard mill, weaker pricing, and higher volumes of purchased pulp due to the major maintenance outage in Arkansas. These factors were partially offset by lower polyethylene prices and reduced chemical usage due to capital improvements at the Arkansas recovery boiler, lower natural gas prices and slightly lower transportation costs.

- Paperboard sales volumes increased 4.6% to a record 204,983 tons in the second quarter of 2015, compared to 195,924 tons in the second quarter of 2014.

- Paperboard net selling prices decreased 2.0% to $997 per ton compared to the second quarter of 2014 as a result of a product mix shift toward non-extruded products and quality related rebates that were limited in volume and scope.

Taxes

The company's GAAP tax rate for the second quarter of 2015 was a provision of 35.8% compared to 44.4% in the second quarter of 2014. The higher rate in 2014 was a result of the net impact of changes related to amendments to state tax returns and state tax rate changes. On an adjusted basis, the second quarter 2015 tax rate was 36.2%. The company expects its annual GAAP and adjusted tax rates to be approximately 36% for 2015.

Note Regarding Use of Non-GAAP Financial Measures

In this press release, the company presents certain non-GAAP financial information for the second quarters of 2015 and 2014, including EBITDA, Adjusted EBITDA, adjusted net earnings, adjusted net earnings per diluted share, and adjusted operating income. Because these amounts are not in accordance with GAAP, reconciliations to net earnings and net earnings per diluted share as determined in accordance with GAAP are included at the end of this press release. The company presents these non-GAAP amounts because management believes they assist investors and analysts in comparing the company's performance across reporting periods on a consistent basis by excluding items that the company does not believe are indicative of its core operating performance.

ABOUT CLEARWATER PAPER

Clearwater Paper manufactures quality consumer tissue, away-from-home tissue, parent roll tissue, bleached paperboard and pulp at manufacturing facilities across the nation. The company is a premier supplier of private label tissue to major retailers and wholesale distributors, including grocery, drug, mass merchants and discount stores. In addition, the company produces bleached paperboard used by quality-conscious printers and packaging converters. Clearwater Paper's employees build shareholder value by developing strong customer partnerships through quality and service.

Please follow this link to get the full release with figure tables

Resolute Reports Preliminary Second Quarter 2015 Results

Resolute Forest Products Inc. has reported net income of $7 million (excluding special items), or $0.07 per share, for the quarter ended June 30, 2015, compared to net income of $17 million (excluding special items), or $0.18 per share, in the same period in 2014. Sales were $926 million in the quarter, down $165 million, or 15%, from the second quarter of 2014. GAAP net loss was $4 million, or $0.04 per share, compared to a net loss of $2 million, or $0.02 per share, in the second quarter of 2014.

Resolute Forest Products Inc. has reported net income of $7 million (excluding special items), or $0.07 per share, for the quarter ended June 30, 2015, compared to net income of $17 million (excluding special items), or $0.18 per share, in the same period in 2014. Sales were $926 million in the quarter, down $165 million, or 15%, from the second quarter of 2014. GAAP net loss was $4 million, or $0.04 per share, compared to a net loss of $2 million, or $0.02 per share, in the second quarter of 2014.

US $

- Q2 adjusted EBITDA of $89 million, up from $64 million in Q1

- Significantly lower costs and favorable FX overcame effect of price declines

- Q2 earnings of $0.07 per share (excl. special items) / GAAP net loss of $0.04 per share

"Our continued focus on costs helped to deliver solid results considering the challenges that continue to pressure our industry," said Richard Garneau, president and chief executive officer. "Our competitive and diversified platform allowed us to weather the tough conditions, including the cyclical headwinds we faced in our growth businesses – market pulp and wood products – as well as increasing difficulty in paper grades, especially newsprint. We are working to maintain our competitive edge by focusing on the proven Resolute operating model in everything we do and pushing to optimize our asset base in order to maximize the utilization of our most cost-effective mills."

Non-GAAP financial measures, such as adjustments for special items and adjusted EBITDA, are explained and reconciled below.

Operating Income Variance Against Prior Quarter

Consolidated

The company reported operating income of $16 million in the quarter, compared to an operating loss of $15 million in the first quarter. The $31 million improvement reflects lower costs ($38 million) due to the effect of spring temperatures, natural gas pricing and better mill productivity, as well as higher volume ($12 million) and the favorable effect of the weaker Canadian dollar ($9 million), despite lower realized prices across all grades ($31 million), particularly wood products and newsprint. There were no closure costs in the quarter, compared to $6 million of closure costs associated with the permanent newsprint capacity closures at Iroquois Falls, Ontario, and Clermont, Quebec, in the first quarter.

Adjusted EBITDA was $89 million in the quarter, $25 million higher than the $64 million reported in the first quarter. As more fully described below, in the quarter the company changed its presentation of pension and other postretirement benefit (or "OPEB") costs to present the net financing and remeasurement components as a special item adjustment used in its non-GAAP performance measures, including adjusted EBITDA. Adjusted EBITDA in the second quarter would have been $77 million without this adjustment, compared to the $50 million previously disclosed for the first quarter. The net financing and remeasurement components of pension and OPEB costs are now allocated solely to "corporate and other" in its segment presentation of operating income.

Market Pulp

Operating income in the market pulp segment was $26 million in the second quarter, $15 million higher than the first. The increase reflects a 7%, or $46 per metric ton, drop in the operating cost per unit (the "delivered cost"), due to better operating efficiency and seasonal factors, as well as a 23,000 metric ton increase in shipments, or 7%, mostly bleached softwood kraft. But the overall average transaction price slipped by $8 per metric ton, or 1%, due to significantly lower realized prices for softwood, which was only partly offset by higher realizations for fluff and bleached hardwood kraft. Adjusted EBITDA improved to $108 per metric ton, for a 16% margin, compared to $76 in the previous quarter and a trailing twelve month average of $88 per metric ton. Finished goods inventory at the end of the quarter was 14,000 metric tons lower, or 14%, which represents almost four days of supply.

Wood Products

The wood products segment generated an operating loss of $4 million in the quarter, compared to operating income of $5 million in the first quarter. The drop reflects a $33 per thousand board feet reduction in average transaction price, or 9%, because of a lower average market price in the quarter. Shipments, however, rose by 25 million board feet, or 6%, to 418 million board feet, and the delivered cost dropped by $15 per thousand board feet, or 4%, to $327 per thousand board feet. The lower delivered cost is mostly because of the first quarter weakness in the Canadian dollar and its lag effect on inventory costs, as well as better fiber recovery overall and higher production efficiency. Finished goods inventory fell by 16 million board feet, or 12%. With the average transaction price in the quarter at multi-year lows, adjusted EBITDA was just $12 per thousand board feet, reflecting a 4% margin, compared to $33 in the previous quarter and a trailing twelve month average of $47 per thousand board feet.

Newsprint

Operating income in the newsprint segment was $3 million in the quarter, compared to an operating loss of $3 million in the first quarter. The improvement reflects a $31 per metric ton, or 6%, drop in the delivered cost, largely as a result of seasonally lower steam and power costs as well as lower prices for natural gas. Newsprint shipments were 14,000 metric tons higher, or 3%, but the overall average transaction price fell by a further $17 per metric ton, or 3%. Pricing conditions since late 2014 have reflected the increasing challenges for North American producers in the global newsprint business, who face an accelerating pace of global structural decline, a currency disadvantage in export markets because of the strong U.S. dollar, and very low operating rates outside of North America. The company reduced finished goods inventory by 8%, to 97,000 metric tons. Despite the challenging environment, adjusted EBITDA was $35 per metric ton in the quarter, for a 7% margin, compared to $24 in the previous quarter and a trailing twelve month average of $38 per metric ton.

Specialty Papers

Operating income in the specialty papers segment was $17 million in the second quarter, $12 million higher than the first quarter. As with the other segments, the improvement is the result of significantly lower costs, down by $40 per short ton, or 6%, which reflects seasonally lower steam costs, as well as better mill efficiencies and productivity compared to the first quarter. Shipments were 6,000 short tons higher, or 2%, but the average transaction price slipped by $10 per short ton, or 1%, as a result of decreases in supercalender and white paper pricing. Finished goods inventory rose by 22,000 short tons. Overall, adjusted EBITDA per short ton was $93, reflecting a 13% margin, compared to $58 in the previous quarter and a trailing twelve month average of $63 per short ton.

Consolidated Quarterly Operating Income Variance Against Year-Ago Quarter

The company reported operating income of $16 million in the quarter, compared to an operating loss of $8 million in the year-ago period, despite an $88 million drop in overall pricing, reflecting 17% lower average transaction prices for wood products, 11% for newsprint, 9% for market pulp and 2% for specialty papers. Newsprint and specialty paper shipments were also lower due to the impact of the company's 2014 capacity rationalization initiatives to, among other things, adapt to changing market dynamics. Excluding the $14 million increase in total pension and OPEB expenses, costs were $46 million lower in the quarter compared to the year-ago period, because of asset optimization initiatives, better mill efficiencies and productivity, lower prices for commodities and reduced maintenance costs. The increase in pension and OPEB expenses related to the $330 million increase in balance sheet net pension and OPEB liability in 2014. The weaker Canadian dollar favorably affected operating income by $41 million in the quarter. There were no closure costs in the quarter compared to the second quarter of last year when the company incurred $52 million of accelerated depreciation and other closure-related costs, most of which related to the permanent closure of an idled paper machine at our Catawba, South Carolina, mill.

Corporate & Finance

The company repurchased 3,195,127 shares of common stock in the quarter, or 3.4% of the outstanding amount, for aggregate consideration of $37 million. With $61 million of cash provided by operations and $39 million in capital expenditures, cash was $303 million at the end of the quarter. This provides the company with $771 million of liquidity, and net debt at $294 million.

"We took advantage of the recent stock price underperformance to buy back a significant portion of our stock under the recently-renewed share repurchase program," said Jo-Ann Longworth, senior vice president and chief financial officer. "This was an opportunistic move that does not compromise our ongoing value-creating initiatives to build capacity in markets with future growth opportunities as we continue to execute on our growth strategy, including the expansion into tissue and the pulp digester project in Calhoun, as well as the two new sawmills in Northern Ontario."

In the second quarter, the company changed its presentation of pension and OPEB costs to isolate the net financing and remeasurement components previously allocated to the operating segments and reallocate them to "corporate and other" in the segment presentation of operating income. Current service costs and amortization of prior service credits will continue to be allocated to the operating segments.

The company now also treats net financing and remeasurement components of pension and OPEB costs as a special item to be adjusted for purposes of establishing its non-GAAP performance measures, such as adjusted EBITDA and adjustments to earnings for special items. The change was applied retroactively by adjusting comparative financial information, including the information presented in this earnings release.

The company believes that isolating the net financing and remeasurement components of pension and OPEB costs, which are non-operating in nature, outside the operating segments and removing them from non-GAAP performance measures better reflects its ongoing operating results and improves their comparability between periods, and will therefore be more useful to investors. This approach is consistent with the indicators management uses internally to measure performance and also consistent with a number of industry peers.

Outlook

Mr. Garneau added: "Lower North American exports to Asia and softer than expected demand pulled lumber prices down to multi-year lows during the quarter. But in light of pricing momentum of late and the recent encouraging data on U.S. housing starts, our near-term outlook for lumber is more positive. For pulp, the slowing pace of growth in China, the strong U.S. dollar and lower demand for printing and writing grades dragged our average market pulp price down $67 per metric ton since its peak in the second quarter of last year. Accordingly, our near-term outlook for pulp is unclear. But we continue to believe that the underlying fundamentals for pulp and lumber will support stronger performance in the medium and long-term. Our quarterly results show that our platform of quality assets is very well positioned to capitalize on the recovery once this downturn has run its course."

He continued: "Even as conditions in the newsprint business continue to deteriorate, we expect to run our network to capacity, as we believe that our asset base gives us a competitive edge to weather the accelerating pace of global structural decline, the currency disadvantage in export markets because of the strong U.S. dollar, and very low operating rates outside North America. We expect a modest seasonal uptick in specialty paper shipments, but the weak euro and the accelerating pace of demand decline in North America could put pressure on selling prices. We will continue to focus on maximizing our competitive edge as we execute our growth strategy that will build the Resolute of the future with projects like the tissue manufacturing and converting facility scheduled for ramp-up in 2017 and our ongoing capacity-building initiatives in pulp and lumber."

About Resolute Forest Products

Resolute Forest Products is a global leader in the forest products industry with a diverse range of products, including newsprint, specialty papers, market pulp and wood products. The company owns or operates some 40 pulp and paper mills and wood products facilities in the United States, Canada and South Korea, and power generation assets in Canada. Marketing its products in close to 80 countries, Resolute has third-party certified 100% of its managed woodlands to at least one of three internationally recognized sustainable forest management standards. The shares of Resolute Forest Products trade under the stock symbol RFP on both the New York Stock Exchange and the Toronto Stock Exchange.

Resolute and other member companies of the Forest Products Association of Canada, as well as a number of environmental organizations, are partners in the Canadian Boreal Forest Agreement. The group works to identify solutions to conservation issues that meet the goal of balancing equally the three pillars of sustainability linked to human activities: environmental, social and economic.

Resolute is proud to be ranked by Corporate Knights as one of Canada's Best 50 Corporate Citizens for 2014. The company and Richard Garneau, president and chief executive officer, have been named to Canada's 2015 Clean50, and Resolute was also awarded The New Economy magazine's global Clean Tech Award for best forestry and paper solutions.

For the full release with tables please follow this link

Kemira Oyj appoints Kim Poulsen as President, Paper segment and APAC region

Kim Poulsen, (Master of Science, Economics) has been appointed President of Kemira's Paper segment and APAC region and member of the Management Board. He will start in the position on November 1, 2015. He joins Kemira from UPM, one of the world's leading fibre-based businesses. Poulsen has held various management positions at UPM and other leading companies in the forest and paper industry. He has a vast international experience, primarily from Asia and Europe.

Kim Poulsen, (Master of Science, Economics) has been appointed President of Kemira's Paper segment and APAC region and member of the Management Board. He will start in the position on November 1, 2015. He joins Kemira from UPM, one of the world's leading fibre-based businesses. Poulsen has held various management positions at UPM and other leading companies in the forest and paper industry. He has a vast international experience, primarily from Asia and Europe.

"Kim has an extensive experience in the global paper industry. In his current position as the head of Asian operations at UPM, Kim has gained valuable insight into the fastest growing paper market in the world. This is important, as APAC is one of Kemira's key growth regions in the paper chemicals business. Kim's energetic and people focused approach will be a great asset, driving forward our global leadership position in the pulp and paper chemicals market", says Jari Rosendal, Kemira's President and CEO.

For more information, please contact

Kemira Oyj

Jari Rosendal, President and CEO

+358 10 862 1801

Tero Huovinen, VP, Investor Relations

+358 10 862 1980

Kemira is a global chemicals company serving customers in water-intensive industries. We provide expertise, application know-how and chemicals that improve our customers' water, energy and raw material efficiency. Our focus is on pulp & paper, oil & gas, mining and water treatment.

In 2014, Kemira's revenue was EUR 2.1 billion and we employed approximately 4,250 people. Kemira shares are listed on the NASDAQ OMX Helsinki Ltd.

www.kemira.com

ANDRITZ to supply equipment for Fibria’s Horizonte 2 pulp mill

International technology Group ANDRITZ and Fibria, the world’s leading eucalyptus pulp producer, signed a letter of intent for supply of all production technologies and equipment for Fibria’s Horizonte 2 pulp mill at its Três Lagoas unit in the state of Mato Grosso do Sul. The new production line will have an annual pulp production capacity of 1.75 million tons. Combined with its existing capacity, already in operation, the Três Lagoas unit will reach a total annual production capacity of 3 million tons, making it one of the world’s largest eucalyptus pulp production sites. It was agreed not to disclose the order value; however typical order values of comparable reference projects are in the magnitude of approximately 600 million Euros. The contract is expected to be put into force during the third quarter of 2015.

International technology Group ANDRITZ and Fibria, the world’s leading eucalyptus pulp producer, signed a letter of intent for supply of all production technologies and equipment for Fibria’s Horizonte 2 pulp mill at its Três Lagoas unit in the state of Mato Grosso do Sul. The new production line will have an annual pulp production capacity of 1.75 million tons. Combined with its existing capacity, already in operation, the Três Lagoas unit will reach a total annual production capacity of 3 million tons, making it one of the world’s largest eucalyptus pulp production sites. It was agreed not to disclose the order value; however typical order values of comparable reference projects are in the magnitude of approximately 600 million Euros. The contract is expected to be put into force during the third quarter of 2015.

The scope of supply of the ANDRITZ PULP & PAPER business area covers the EPC delivery of the complete fiberline as well as the recovery island, including all relevant process steps. Start-up of production is scheduled for fourth quarter of 2017.

The Horizonte 2 project is one of the largest private investments in Brazil and will create 40,000 direct and indirect jobs over the two years of construction. During the peak of construction, the site will have around 10,000 workers. Once commissioned, Fibria’s new pulp line will have 3,000 direct and indirect jobs.

For further information, please contact:

ANDRITZ GROUP

Michael Buchbauer

Head of Group Treasury, Corporate Communications & Investor Relations

This email address is being protected from spambots. You need JavaScript enabled to view it.

The ANDRITZ GROUP

ANDRITZ is a globally leading supplier of plants, equipment, and services for hydropower stations, the pulp and paper industry, the metalworking and steel industries, and for solid/liquid separation in the municipal and industrial sectors. The publicly listed technology Group is headquartered in Graz, Austria, and has a staff of almost 25,000 employees. ANDRITZ operates over 250 sites worldwide.

Metsä Board Corporation's financial reporting and Annual General Meeting in 2016

In 2016, Metsä Board Corporation will publish the following financial reports:

Financial statements for 2015 on 3 February

Interim report for January–March 2016 on 3 May

Interim report for January–June 2016 on 4 August

Interim report for January–September 2016 on 2 November

Metsä Board will hold its Annual General Meeting on 23 March 2016.

METSÄ BOARD CORPORATION

Further information:

Markus Holm, CFO, Metsä Board, tel. +358 (0)10 465 4913

Arctic Paper: Appointment of Auditors

The Management Board of Arctic Paper S.A. (STO:ARP) (“Company”) herewith informs that on the 28th of July 2015 the Company received a resolution adopted by circulation by the Supervisory Board dated 22nd July 2015 appointing Ernst & Young Audyt Polska sp. z o.o. sp.k., as Company’s auditors authorized to audit the Company’s financial statements. The Supervisory Board is the eligible body to adopt such resolution pursuant to article 15, clause 15.2, item e of the Company’s Articles of Association.

The Management Board of Arctic Paper S.A. (STO:ARP) (“Company”) herewith informs that on the 28th of July 2015 the Company received a resolution adopted by circulation by the Supervisory Board dated 22nd July 2015 appointing Ernst & Young Audyt Polska sp. z o.o. sp.k., as Company’s auditors authorized to audit the Company’s financial statements. The Supervisory Board is the eligible body to adopt such resolution pursuant to article 15, clause 15.2, item e of the Company’s Articles of Association.

The appointment has been made according to generally applicable provisions and professional standards.

Ernst & Young Audyt Polska sp. z o.o. sp.k., seated in Warsaw (00-124), Rondo ONZ 1, has been entered on the list of chartered auditors of financial statements maintained by the National Chamber of Chartered Auditors with the number 130.

Ernst & Young Audyt Polska sp. z o.o. sp.k. shall:

1) review mid-year standalone financial statements of the Company and mid-year consolidated statements of the Arctic Paper S.A. Capital Group, as of June 30, 2015;

2) audit of annual standalone financial statements of the Company and annual consolidated statements of the Arctic Paper S.A. Capital Group for the trading year from 01 January 2015 through 31 December 2015 prepared according to MSR/MSSF principles.

The contract with the auditor will be concluded for the period necessary for the performance of the services.

The Company has already used services of the auditors to obtain audits of financial statements of Arctic Paper S.A. for years 2008-2014.

This information is disclosed pursuant to the Minister of Finance directive of February 19, 2009 on current and periodic information provided by issuers of securities, and on conditions of equivalence of information required to be provided under non-Member State law, §5, clause 1, item 19, and was submitted for publication on 29 July 2015 at 10:30 am CET, in reference to Arctic Paper’s current report no. 11/2015 filed with the Warsaw Stock Exchange

Arctic Paper

Wolfgang Lübbert

President of the Management Board of Arctic Paper

tel. +49 405 148 5310