Ian Melin-Jones

West Fraser Announces $37 Million Hinton Pulp Upgrade

West Fraser will proceed with an energy efficiency upgrade of its Hinton Pulp pulp machine. The project, which is expected to cost approximately $37 million, will be funded with credits earned under the Canadian federal government’s “Pulp and Paper Green Transformation Program”.

The pulp machine upgrade will allow Hinton Pulp to produce more pulp with greater energy efficiency and produce additional energy. The additional energy will be enough to power approximately 720 average homes. The mill’s natural gas consumption is expected to be reduced by more than 55,000 gigajoules per year and greenhouse gas emissions are expected to be reduced by more than 2,750 tonnes annually. As a result of this project and other initiatives, pulp production is expected to increase to 420,000 tonnes, returning the mill to levels achieved when the mill ran two production lines. The successful completion of this project is expected to be an important step for Hinton Pulp in improving its overall competitiveness and long-term outlook.

This News Release contains certain forward-looking statements about potential future developments, in particular those relating to the anticipated benefits from the Hinton Pulp machine energy efficiency project. These are presented to provide reasonable guidance to the reader. Their accuracy and the actual achievements of such benefits depend on and are subject to a number of assumptions, risks, and uncertainties and other factors. Accordingly, readers should exercise caution in relying upon forward-looking statements and West Fraser undertakes no obligation to publicly revise them to reflect subsequent events or circumstances except as required by applicable securities laws.

West Fraser is an integrated wood products company producing lumber, wood chips, LVL, MDF, plywood, pulp and newsprint. The Company has operations in western Canada and the southern United States.

AbitibiBowater Making a Difference on the Ground through Stakeholder Engagement

Based in Montreal, Quebec, AbitibiBowater Inc. is the third largest pulp and paper company in Canada and the eighth largest publicly traded pulp and paper manufacturer in the world. It manages the largest area of publicly-owned forest land in Canada, a total of some 19.5 million hectares.

Through its 21 pulp and paper mills and 24 wood products facilities in the Canada, the US and South Korea it produces a range of newsprint, commercial printing and packaging papers, pulp and wood products. It is one of most important recyclers of old newspapers and magazines in the world.

The company is committed to ensuring sustainability – ecological, economic and social – in all its operations. In particular it is keen to protect the wildlife, fish, plants, soils and water resources on the land under its management. It also makes efforts to conserve biological diversity and to protect the area under its management for other land uses including recreational purposes and cultural heritage.

As part of this, AbitibiBowater works with a wide range of stakeholders such as customers, suppliers, employees, shareholders, communities – indigenous groups like First Nation and Native American groups – governments and NGOs in all areas of its activities including the cooperative management of sustainable forest licenses, engineering, production, forestation, road access, harvesting, silviculture and transportation.

The company is a firm believer in the value of Sustainable Forest Management (SFM) principles and certification and supports mandatory certification on public land. Adherence to SFM standards provides assurances that wood and fibre products are sourced from responsibly-managed forests. Of the 10% of global forests that have been certified, 40% are in Canada.

AbitibiBowater recognizes several certification standards. These include the Canadian Standards Association (CSA), the Sustainable Forests Initiative (SFI), and the American Tree Farm Systems (ATFS), all fully endorsed by the Programme for the Endorsement of Forest Certification schemes (PEFC). In addition, it recognises the Forest Stewardship Council (FSC). As of end 2008, all the woodland under the company's management had been certified to independent, third-party audited standards, mainly CSA and SFI which are fully endorsed by PEFC. In addition, 12 of the company's pulp and paper mills have achieved Chain-of-Custody (CoC) to internationally-recognized CoC standards including PEFC. Plans are afoot to obtain CoC certification for more of its plants.

As part of its commitment to stakeholder engagement for SFM, in 2003 the company created the Lac St. Jean CSA Public Advisory Group, a voluntary initiative comprised of 27 local stakeholders drawn from companies, clubs and associations, workers' groups, environmental groups, fauna and flora reserve protection associations, indigenous peoples' organizations, and representatives of municipal authorities. This group of stakeholders was formed originally as part of efforts to secure CSA certification for 4.3 million hectares of forest land in two parts of the Lac St. Jean area, namely Lac St. Jean and Peribonka. Both areas include sites of exceptional biodiversity, cultural and spiritual value; the protection of all three values has been identified as a key indicator of SFM. In 2008, the area was modified to include new tenures covering 3.2 million hectares in the Lac St-Jean area.

Since its creation, the Lac St. Jean CSA Public Advisory Group has made significant and sustained contributions to identifying improvements in SFM practices resulting in a number of measurable successes.

One of these successful outcomes has been the inclusion of the White Mountain Valley area in the network of protected areas in the province. In June 2006, Nature Québec lodged a request with the Public Advisory Group to consider special conservation measures for the White Mountains Valley area, a region of particular scenic beauty popular for recreation activities. In particular, Nature Québec was keen to see this area included in the network of protected areas of the province so as to ensure that wood exploitation would not negatively impact on the area in any way. The Advisory Group requested that the Quebec Ministry of Sustainable Development, Environment & Parks include the site in its proposals for extending the province's network of protected areas.

The successful outcome of this initiative resulted in a request being submitted by the Regional Government to the Advisory Group for the conservation of three other special sites. These sites included La Chute Blanche (or White Falls), a place with a unique scenic value; the River Micosas' streamsides, tributaries rich in Landlocked Salmon (a species of freshwater salmon); and the area home to the largest Yellow Birch in Québec. The Advisory Group took on board the requests, examined the sites and their natural features, and analysed the impacts of commercial forestry activities at all three sites. Following on from this, special conservation measures have now been integrated into the 5-year forest management plan (2008-2013).

In the coming years, the Québec Ministry of Natural Resources and Wildlife plans to propose new sites for special consideration. And thanks to the Lac St. Jean Advisory Group's conservation successes, the Ministry has requested the Group's cooperation for analyses of new proposals as well as their possible integration in forest management planning.

Another very important aspect of SFM is minimising contamination of water sources around forestry operations. In this vein, the Lac St. Jean Advisory Group has also been solicited to consider ways to minimise sedimentation in water courses on the land managed by AbitibiBowater. The Group's work in this area began in February 2005 with the adoption of an indicator as part of efforts to reduce sedimentation from the road network on the land under AbitibiBowater's management.

As a first step in these efforts, the Group began by conducting an assessment of the magnitude of the problem represented by run-off and sedimentation of the water courses running through the region, particularly in those areas where culverts had been installed to direct the flow of water through the water courses. It then drew up an action plan with a series of measures aiming at reducing the occurrence of sediments in the water courses and in a 20-metre buffer zone along the stream one year after the installation of culverts.

Following this, a series of recommendations was made and a sampling assessment method developed and implemented. This allowed major sources of sedimentation to be identified. Subsequently, recommendations were made to improve water flow and reduce sedimentation from the surrounding areas.

These recommendations were implemented on the ground by forestry operators. They have yielded considerable positive results. In the first place, assessments carried out in 2007, two years after this initiative was first implemented, showed that the number of streams without any sediment within the 20m buffer on both sides of the culvert, increased from 58% to 91% (see graph, below). There is every reason to believe that improvements in sedimentation will continue to be seen year-on-year. Remarking on the success of this forest-management initiative, one commentator noted "Maintaining water quality is an important element of sustainable forest management. This new approach has clearly allowed achieving significant improvements while involving on the ground operators."

Clearly, in the years since its creation, the Lac St. Jean CSA Public Advisory Group has played an important role in identifying improvements in SFM practices in the Lac St. Jean forests and contributed to the health of the forest areas under the management of AbitibiBowater. For Abitibibowater too, the creation of the multi-stakeholder Public Advisory Group has yielded several benefits. It has helped the company to better define some of its operational practices, contributed to the protection of the sites under its management, improved the social acceptability of the company, facilitated sales of its products, and improved exchanges of information and dialogue among all stakeholders. Overall, the creation of the Public Advisory Group and the successful outcomes of its initiatives have resulted in a win-win situation for all concerned stakeholders as well as for the forests.

Further Information

Pöyry in Finland - operational excellence programme continues

The first major implementation milestone has been reached relating to the operational excellence programme aiming at improving the efficiency and quality of operations and serving Pöyry's clientele in a cost-efficient way.

Pöyry has made decisions to adapt capacity and to improve its operational model to be aligned with the current and future demand in Finland. These measures will lead to an annual operating profit improvement of about EUR 15 million. The majority of the impact will start from the beginning of 2011 onwards and the rest gradually after that. Restructuring costs of EUR 7.5 million will be recorded in the fourth quarter of 2010.

The statutory employee negotiations initiated in October 2010 in Pöyry's Finnish operations resulted in the decision to reduce capacity of the currently active workforce by about 270 persons. In addition, the capacity of the workforce that has been temporarily laid off will be reduced by about 130 persons. The implementation of these reductions will start immediately. Adaptation measures also include pension arrangements, possible relocations, and to a smaller extent also temporary lay-offs to adjust capacity.

Improvement of business support for Finnish operations will continue. In addition to personnel cost the cost-savings relate to facilities and other fixed costs. Including the above mentioned reductions, the current estimate for the total capacity reduction in Finland is 450-500 persons and includes both operative and non-operative personnel. The improved operational model is expected to be implemented by the end of the second quarter of 2011.

The process to consolidate detail engineering services to engineering centres in cost competitive locations was started in 2009. The ramp-up of engineering centres (Finland, Poland, Brazil, China) serving especially larger projects for industrial clients has resulted in the consolidation of the Finnish engineering centre operations in Kouvola. At the same time, the process to consolidate core competence areas that build on Pöyry's strong process know-how and project management capabilities has continued. The organisation in Finland plays a major role in offering clients effective integrated services, combining technology and process know-how with cost-efficient project implementation serving the industrial sector globally.

Office network in Finland has now been clustered under a regional model with wider scope of services and improved cost efficiency benefiting Pöyry's clients in the regions. Regional centres in Vantaa, Tampere, Turku, Oulu, Kuopio and Lappeenranta offer Pöyry's services across sectors. The regional centres will be supported by local offices concentrating on engagements requiring local presence. Finland will continue to constitute one of Pöyry's core markets with strong service capabilities employing around 2000 persons. This change in operational model does not impact Pöyry's external reporting structure.

Heikki Malinen, President and CEO:

"Cutting-edge engineering and project management is Pöyry's strength and future. Our employees are undoubtedly some of the best in the industry. By working as one Pöyry we can offer our customers the same broad scope of services everywhere. We have an excellent track record and current key projects demonstrate our continued strong presence as the market leader in Finland."

The group-wide operational excellence programme will continue during 2011-2012. The programme includes efficiency improvement measures and investing in core processes and competence development.

See also stock exchange releases of 14 and 28 October 2010 regarding the Operational Excellence Programme.

PÖYRY PLC

Additional information by:

Heikki Malinen, President and CEO, Pöyry PLC, Finland

Camilla Grönholm, Executive Vice President, Human Resources, Pöyry PLC, Finland

Contacts: Heli Uusnäkki, tel. +358 10 33 21158

Press outside the capital area:

Tapio Aalto, President, Pöyry Finland Oy

Contacts: Heli Uusnäkki, tel. +358 10 33 21158

Investors and analysts:

Sanna Päiväniemi, Director, Investor Relations, Pöyry PLC, Finland

tel. +358 10 33 23002

Pöyry is a global consulting and engineering company dedicated to balanced sustainability and responsible business. With quality and integrity at our core, we deliver best-in-class management consulting, total solutions, and design and supervision. Our in-depth expertise extends to the fields of energy, industry, urban & mobility and water & environment. Pöyry has 7000 experts and the local office network in about 50 countries. Pöyry's net sales in 2009 were EUR 674 million and the company's shares are quoted on NASDAQ OMX Helsinki. (Pöyry PLC: POY1V).

DISTRIBUTION:

NASDAQ OMX Helsinki

Major media

Billerud wins NASDAQ OMX prize for "Best 2009 Report"

During Finforum 2010, a seminar about communication between listed companies and the market, Billerud received the award for "Best 2009 Report" in the MidCap Company class.

This competition has been held since 1966 with the purpose of developing and improving the quality of external information provided by listed companies. Billerud's annual report won the prize for its logical organisation and good balance of text, photo and graphics, as well as some interesting and unique approaches. The jury also considered the description of sustainability initiatives that provides a common theme for the entire annual report to be a positive feature.

Moreover, the jury feels that Billerud is highly deserving of its award in the "Mid cap" class and that the annual report, with its high ambitions and exemplary clarity, could even hold its own among the "large cap" companies on the stock exchange.

Finforum is an event arranged jointly by FAR (the industry organisation for auditors and advisers), the Swedish Society of Financial Analysts (SFF), NASDAQ OMX, the Swedish Public Relations Association and Far Academy.

Billerud's annual report also won second place in the Swedish Shareholders' Association annual assessment of annual reports from all listed companies.

For more information, please contact:

Elisabet Olin, Head of Corporate Communication Billerud AB, +46 (0)8-553 335 18

Sophie Arnius, IR-manager Billerud AB +46 (0)8-553 335 24

Clearwater Paper Corporation Announces Extension of Expiration Date Relating to Offer for Cellu Tissue Holdings Inc.

Clearwater Paper Corporation ("Clearwater Paper") has announced the extension of the Expiration Date, as well as the results to date, relating to the cash tender offer (the "Tender Offer") to purchase any and all of Cellu Tissue Holdings, Inc.'s ("Cellu Tissue") outstanding 11½% Senior Secured Notes due 2014 (the "Cellu Notes").

The Tender Offer is being made upon the terms and subject to the conditions set forth in Clearwater Paper's Offer to Purchase dated November 5, 2010 (the "Offer to Purchase"), and in connection with the Agreement and Plan of Merger, dated as of September 15, 2010 (the "Merger Agreement"), among Clearwater Paper, Cellu Tissue, and Sand Dollar Acquisition Corporation, a Delaware corporation and a wholly owned subsidiary of Clearwater Paper ("Merger Sub"), pursuant to which, subject to the satisfaction of certain conditions, Merger Sub will merge with and into Cellu Tissue (the "Merger"). As a result of the Merger, Cellu Tissue will become a wholly owned subsidiary of Clearwater Paper.

The Expiration Date for the Tender Offer has been extended to 11:00 a.m., New York City time, on December 27, 2010, unless further extended by Clearwater Paper pursuant to the terms of the Offer to Purchase.

As of 5:00 p.m., New York City time, on December 6, 2010, tenders had been received from holders of $234.357 million (99.95%) in aggregate principal amount of the Cellu Notes. Holders who validly tendered their Cellu Notes on or before November 30, 2010, and have such Cellu Notes accepted for payment by Clearwater Paper will receive the Total Consideration (as defined in the Offer to Purchase) per $1,000 principal amount of Cellu Notes and accrued and unpaid interest up to, but not including, the payment date (the "Payment Date"). Holders who tender their Cellu Notes after November 30, 2010, but on or prior to the Expiration Date will receive the Total Consideration per $1,000 principal amount of Cellu Notes validly tendered, less the early tender payment of $30.00 per $1,000 principal amount of Cellu Notes.

The Total Consideration per $1,000 principal amount of Cellu Notes validly tendered on or before November 30, 2010, will be calculated based on the present value on the Payment Date of the sum of the Redemption Price on the Redemption Date plus interest payments through the Redemption Date, determined using a discount factor equal to the yield on the Price Determination Date (as defined in the Offer to Purchase) of the Reference Security plus a fixed spread of 50 basis points. Clearwater Paper expects that the Price Determination Date will be 2:00 p.m., New York City time, on December 13, 2010.

The Withdrawal Time relating to the Tender Offer expired at 5:00 p.m., New York City time, on Friday, November 19, 2010. As a result, all Cellu Notes previously tendered and any Cellu Notes that are properly tendered after the date hereof may not be withdrawn unless Clearwater Paper makes a material change to the terms of the Tender Offer or is otherwise required by law to permit withdrawal.

The Tender Offer is conditioned upon the satisfaction of, or, where applicable, Clearwater Paper's waiver of, certain conditions, including that all of the conditions precedent to the closing of the Merger as set forth in the Merger Agreement shall have been satisfied or waived, and certain other customary conditions.

The complete terms and conditions of the Tender Offer are described in the Offer to Purchase, a copy of which may be obtained by contacting D. F. King & Co., Inc., the information agent for the Tender Offer, at 001-800-431-9643 (U.S. toll-free). BofA Merrill Lynch is the exclusive dealer manager for the Tender Offer. Additional information concerning the Tender Offer may be obtained by contacting BofA Merrill Lynch, Debt Advisory Services, at 001-980-388-9217 (collect) or 001-888-292-0070 (U.S. toll-free).

This press release does not constitute an offer to purchase the Cellu Notes. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such an offer, solicitation, or sale would be unlawful. The Tender Offer is being made solely pursuant to the Offer to Purchase and related transmittal documents.

FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking statements that involve risks and uncertainties, including, but not limited to, statements regarding the Tender Offer. These forward-looking statements are based on Clearwater Paper's current expectations, estimates and assumptions that are subject to change, and actual results may differ materially from the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the risk that the conditions to the Tender Offer may be delayed or not occur. For a discussion of additional factors that may cause results to differ, see Clearwater Paper's public filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date thereof. Clearwater Paper does not undertake to update any forward-looking statements.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

On December 1, 2010, Cellu Tissue filed with the SEC a definitive proxy statement and other relevant material in connection with the Merger. The definitive proxy statement has been sent or given to the stockholders of Cellu Tissue. Before making any voting or investment decision with respect to the Merger, investors and stockholders of Cellu Tissue are urged to read the proxy statement and the other relevant material because they contain important information about the Merger. The proxy statement and other relevant materials, and any other documents filed by Cellu Tissue with the SEC, may be obtained free of charge at the SEC's website at www.sec.gov, at Cellu Tissue's Investor Relations website at cellutissue.com/investor (click "SEC filings") or from Cellu Tissue by contacting Investor Relations by mail at 1855 Lockeway Drive, Suite 501, Alpharetta, Georgia 30004, Attention: Investor Relations, or by telephone at 001-678-393-2651.

PARTICIPANTS IN THE SOLICITATION

Clearwater Paper and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Cellu Tissue stockholders in connection with the proposed Merger. Information about Clearwater Paper's directors and executive officers is set forth in Clearwater Paper's proxy statement on Schedule 14A filed with the SEC on March 29, 2010, and its Annual Report on Form 10-K for the year ended December 31, 2009, filed with the SEC on February 26, 2010. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Merger is included in the definitive proxy statement that Cellu Tissue filed with the SEC on December 1, 2010.

ABOUT CLEARWATER PAPER

Clearwater Paper manufactures quality consumer tissue, bleached paperboard and wood products at six facilities across the country. The company is a premier supplier of private label tissue to major retail grocery chains, and also produces bleached paperboard used by quality-conscious printers and packaging converters. Clearwater Paper's 2,500 employees build shareholder value by developing strong customer partnerships through quality and service.

For more info contact:

Clearwater Paper Corporation

Matt Van Vleet, 001-509-344-5912

Source: Clearwater Paper Corporation Clearwater Paper Corporation

SCA wins prestigious award for Best Sustainability Report

SCA has been awarded the Institute for the Accounting Profession in Sweden’s (FAR) prestigious prize for the Best Sustainability Report 2009 in the category Large companies. The award was presented today at Finforum 2010, an international conference in Stockholm, Sweden, focusing on market communications in listed companies.

The FAR jury’s citation:

“The SCA Board of Directors discloses relevant sustainability information in the Annual Report as well as in a separate Sustainability Report for 2009, and by this demonstrates that sustainability issues are well established and highly integrated in the company’s business model.”

“A systematic account with clear sustainability targets enables open and transparent dialogue with our stakeholders. SCA’s sustainability programmes constitute a strategically important and integrated part of the operations that we conduct to generate growth and value. Also, our sustainability activities enhance our competitiveness, reduce our costs and lower our risk level”, says Jan Johansson, President and CEO of SCA.

In addition, SCA recently received a citation for the Best Corporate Governance Report within the framework of a competition organised by PwC to highlight leading examples in the application of the Swedish Code of Corporate Governance. SCA received the citation for “a precise and coherent presentation with the theme of ‘Governance’ as the common thread throughout the report.”

For additional information, please contact:

Jörgen Olsson, Press and Media Officer, +46 8 788 51 29

SCA is a global hygiene and paper company that develops and produces personal care products, tissue, packaging solutions, publication papers and solid-wood products. Sales are conducted in some 100 countries. SCA has many well-known brands, including the global brands Tena and Tork. Sales in 2009 amounted to SEK 111 billion (EUR 10.5 billion). SCA has approximately 45,000 employees. More information at www.sca.com

Borregaard Opens High-Tech Control Centre

Minister of Trade and Industry, Trond Giske, has opened Borregaard’s new control centre, which will ensure innovative, knowledge based and eco-friendly industry in the years to come.

“This modern control centre demonstrates the focus on Norwegian process industry. The government is a team player with industries that focus on innovative, knowledge based and forward looking solutions. This new control centre is something Borregaard and the company’s employees have every reason to be proud of,” says Minister of Trade and Industry, Trond Giske.

Borregaard has invested more than NOK 80 million in the centre, which combines the control of 15 of the plants in the factory area into one joint control centre. New technology and a new organisation make the control centre the most technically advanced of its type in Norway.

“Borregaard’s plant in Sarpsborg is the world’s most advanced biorefinery. With a 3 kilometre long factory area, in which 22 factories are integrated, Borregaard is a complex activity. The operations centre will ensure increased productivity and safeguard control by means of process stability and optimising the production processes,” says Per A. Sørlie, President and CEO of Borregaard.

Borregaard’s new operations centre is the result of a major change process, the aim of which is to increase competitiveness and the focus on health, safety and the environment and, not least, interesting jobs. The project has set out to incorporate a dynamic performance culture by using increased competence and new technology to the maximum. The success criteria have been employee involvement, competence building and a new organisation.

“With the new operations centre, we can offer high-tech and interesting jobs using advanced control systems that will increase the attractiveness of jobs in this industry in the years to come,” says Sørlie.

Borregaard is the world’s most advanced biorefinery. By using natural, sustainable raw materials, Borregaard produces advanced and eco-friendly biochemicals, biomaterials and bioethanol that replace oil-based products. Borregaard has been the biggest employer in Sarpsborg ever since it began in 1889, and still is, with almost 800 employees. The company is part of the Orkla group and has altogether 1,300 employees in factories and sales offices in 20 countries in Europe, the USA, Asia and Africa. The head office and the company’s largest plants are in Sarpsborg.

For more information, contact:

Communications Manager Tone Horvei Bredal, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

PETRONAS and BASF sign MoU to explore new joint investment

BASF and PETRONAS today signed a Memorandum of Understanding to undertake a joint feasibility study to produce specialty chemicals in Malaysia, a move that would extend the two parties’ existing business collaboration in the country. T he partners are considering a potential joint investment sum of approximately MYR 4.0 billion / € 1.0 billion.

Under the terms of the MoU, the two parties will evaluate the technical, commercial and economic viability of jointly owning and operating world-scale facilities for the production of specialty chemicals including non-ionic surfactants, methanesulfonic acid, iso-nonanol as well as other C4-based specialty chemical products. The final scope of the investments will be determined following the outcome of the joint feasibility study which is targeted to be completed in 2011.

The MoU was signed at the PETRONAS headquarters in Kuala Lumpur. Signing on behalf of PETRONAS were Datuk Wan Zulkiflee Wan Ariffin, Executive Vice President of Downstream Business, and Encik Kamaruddin Zakaria, Vice President of Downstream Operations. Dr. Martin Brudermüller, member of the Board of Executive Directors of BASF SE, responsible for Asia Pacific, and Ms. Saori Dubourg, President, Asia Pacific, BASF, signed on behalf of BASF.

Datuk Wan Zulkiflee Wan Ariffin said, “The development of a new specialty chemical products portfolio is an important component of PETRONAS' plan to further grow the downstream petrochemical business as part of its integrated plan to be a key player in the region as well as to spur domestic investment in the oil, gas and petrochemical industries.”

Dr. Martin Brudermüller said, "With the rapid growth of chemical markets in Asia Pacific, we are further expanding our specialty chemical business. Our joint venture with PETRONAS, based on a long-standing and successful partnership, is an excellent, well-established and competitive production platform in Asia. By expanding our local production base in Malaysia, we can further improve our ability to supply our customers in Asia, from Asia." According to its Asia Pacific Strategy 2020, BASF intends to produce 70% of Asia Pacific sales in the region, with investments of € 2.0 billion between 2009 and 2013.

The proposed move by PETRONAS and BASF will build on their successful strategic partnership in the country, established in 1997. The partnership, via BASF PETRONAS Chemicals Sdn Bhd (of which BASF owns 60% shares) , currently own and operate an integrated complex in Gebeng, Pahang, Kuantan that produces acrylic monomers, oxo products and butanediol. As for the subsequent phase of the collaboration, PETRONAS Chemicals Group and BASF will jointly evaluate the outcome of the joint feasibility study and will adopt it as part of their strategic growth plans, if technically and commercially viable.

About PETRONAS

PETRONAS is a Global Fortune 500 company wholly owned by the Government of Malaysia, principally involved in all spectrum of integrated oil, gas and petrochemical industries. For the year ended 31 March 2010, PETRONAS recorded a group revenue of US$62.5 billion. More information on PETRONAS is available on www.petronas.com.

About BASF

BASF is the world’s leading chemical company: The Chemical Company. Its portfolio ranges from chemicals, plastics and performance products to agricultural products, fine chemicals and oil and gas. As a reliable partner BASF creates chemistry to help its customers in virtually all industries to be more successful. With its high-value products and intelligent solutions, BASF plays an important role in finding answers to global challenges such as climate protection, energy efficiency, nutrition and mobility. BASF posted sales of more than €50 billion in 2009 and had approximately 105,000 employees as of the end of the year. Further information on BASF is available on the Internet at www.basf.com.

Media Contacts:

BASF SE

Jennifer Moore-Braun

Phone : +(49) 621 60-9 9123

Fax: +(49) 621 60-9 2693

This email address is being protected from spambots. You need JavaScript enabled to view it.

Genevieve Hilton

Phone: +(852) 2731 0197

Mobile: +(852) 9025 9857

This email address is being protected from spambots. You need JavaScript enabled to view it.

PETRONAS

Azman Ibrahim

Phone: +(603) 2331 2140

Mobile: +(6019) 223 0199

This email address is being protected from spambots. You need JavaScript enabled to view it.

Södra Timber to invest in Unnefors sawmill

The Board of Directors at Södra Timber has approved an investment in an automatic sorting facility at the company's sawmill in Unnefors, outside Jönköping, Sweden. This sawmill produces 110,000 cubic metres of pine annually. The investment amounts to approximately SEK 12 million ($1.7 million).

"We are seeing positive development in pine sawing in Unnefors. This investment will further enhance our competitiveness in that it will allow us to use our raw materials more effectively. It will also improve our quality sorting, which will be a major plus for our customers," said Peter Nilsson, CEO of Södra Timber.

For further information, please contact:

Peter Nilsson, CEO of Södra Timber, tel.: +46 70 315 09 27

ABB to deliver automation and electrical systems for paper mill in Philippines

Complete automation and electrification package will optimize productivity and energy efficiency for Schweitzer – Mauduit’s new paper machine

ABB announced that it recently won an order from Schweitzer – Mauduit International Inc., to provide automation and electrification systems for its greenfield specialty paper mill in Batangas, in the Philippines.

ABB announced that it recently won an order from Schweitzer – Mauduit International Inc., to provide automation and electrification systems for its greenfield specialty paper mill in Batangas, in the Philippines.

Schweitzer-Mauduit International, Inc. is a diversified producer of premium specialty papers to the tobacco sector; it also manufactures specialty papers for other applications. The Batangas mill will produce Reconstituted Tobacco Leaf (RTL), a specialty product that helps cigarette manufacturers to recycle their by-products while also providing a tool that facilitates them to meet regulatory requirements.

The new paper machine to be installed will have a capacity of 30,000 tons per year and is scheduled to be operational by November 2011.

ABB was awarded the contract for its knowledge, expertise and experience in the Pulp and Paper Industry and the latest Product and System offerings which provide seamless integration of mill operations and optimized energy efficiencies.

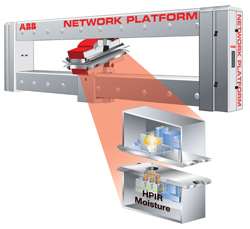

The electrification delivery includes air insulated switchgear, Onan Transformers, and low voltage Motor Control Centers with drives, Softstarters and low voltage motors. The automation scope of supply includes a comprehensive DCS (distributed control system) based on extended automation System 800xAwith AC800M Controllers , Process Portal Operator Stations with complete Profibus integration for the mill. The QCS (Quality Control Systems) delivery includes the popular NP700 Network platform with Moisture, Basis Weight and Infrared measurements.

ABB’s local operations in Singapore and Philippines will execute the project. Installation and commissioning is scheduled for the second quarter of 2011.

Schweitzer-Mauduit and its subsidiaries conduct business in over 90 countries and employ 2,900 people worldwide, with operations in the United States, France, Brazil, Philippines, Indonesia, Canada and China.

For more information please contact:

ABB Process Automation Media Relations:

Laura Patrick

Office: +1.585.889.7146

Mobile: +1.585.733.4958

email:This email address is being protected from spambots. You need JavaScript enabled to view it.

ABB Process Pulp and Paper Business Unit:

Sai Prakash

Office: +65 6773 8750

Mobile: +65 91193417

email: This email address is being protected from spambots. You need JavaScript enabled to view it.