Ian Melin-Jones

Jussi Pesonen of UPM wins RISI's European CEO of the year

Jussi Pesonen, President and CEO of UPM, has been selected as the RISI European CEO of the Year for the pulp and paper industry for 2011.

Jussi Pesonen, President and CEO of UPM, has been selected as the RISI European CEO of the Year for the pulp and paper industry for 2011.

European analysts and portfolio managers covering the forest products industry choose the European CEO of the Year annually through a survey organized by RISI, the leading information provider for the industry. The criteria for nomination include leadership, vision and strategic accomplishment. This is the second time that Mr. Pesonen has won this prestigious award, having received the title in 2007 as well.

Describing the reason behind Mr. Pesonen's nomination, one analyst commented, "UPM's recent entering into the agreement to acquire the Myllykoski Corporation and Rhein Papier signals that under Pesonen's leadership the company is proving itself to be the ultimate trailblazer of consolidation in European industry, something that is vital as the industry goes forward out of recession and back into profitability."

Another analyst pointed to Mr. Pesonen's track record of implementation, saying "Pesonen is showing clear vision in a number of ways, strategic acquisitions in paper, CAPEX spending in low cost pulp production in Latin America, and investment in C02 free energy production in Finland. What impresses me is that he is not talking about all these opportunities, he is actually doing them."

"Above all, the award is a recognition to UPM's organization which has shown strong commitment to renewal and ability to implement even the most demanding initiatives", says Jussi Pesonen.

Hairy fibres important for paper strength

"Invention to measure crill can enhance quality and save energy"

Crill are particles that are too small to be visible under an ordinary microscope but that are of great importance for fibre bonding in paper. A method for measuring crill, which was developed thirty years ago, is now being made available for industrial use.

“It’s only during the past three years, while working in one of our research projects, that we realized how important crill really is. The content of crill was found to be the variable that showed the strongest covariation with strength,” says Lars Wallbäcks at Innventia, a research company in Sweden.

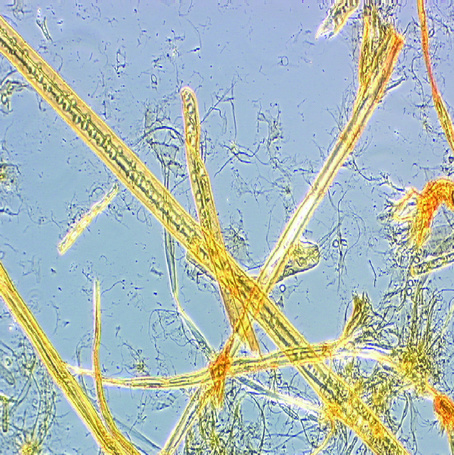

Micrograph (1.2 x 1.2 mm). Crill are the thin black threads on and around the fibres.

When measuring crill, you measure how "hairy" the fibres are. The more crill found on and around the fibres, the better binding ability they have, which in turn results in a stronger paper. In order to improve paper strength, it is therefore very useful to be able to measure the amount of crill in a pulp. With the aid of a crill sensor, it is possible to determine the amount refining required for optimizing the amount of crill in the pulp. This is also important from an economic point of view, since fibre refining is a very energy intensive process in paper production.

With the support of Forska & Väx (Research & Growth), a VINNOVA Programme, Innventia and Eurocon Analyzer, a measurement technology company, are developing a crill sensor for on-line application in pulp and paper mills. The aim is to make it possible to produce improved paper and pulp quality at lower energy costs.

The basic method for measuring crill was developed in the early 1980s by Thorulf Pettersson at Innventia. However, at that time, no importance was given to the small threads that surround the fibres. The crill sensor has been used in laboratory and pilot environments over the years, but it is only in the last three years, during the Advanced Fibre Management Project, that there has been a realization of how important crill is, when it comes to paper strength properties.

The crill measurement technique has been significantly improved since it was first invented. Jointly with Eurocon, it is now being further developed, since it is being integrated with their analysis platform, called PulpEye. Unlike sensors based on conventional image analyses, the crill sensor makes measurements of crill rapidly and frequently, which means that it is very suitable for online measurements in paper production.

“It's great that this invention can be utilized on a larger scale and that pulp and paper producers can now use this measurement technique to improve their processes and products,” says Thorulf Pettersson at Innventia.

Södra's Pulp price remains $950 per tonne for February 2011

The pulp market remains well balanced. Södra Cell’s price in Europe for softwood pulp will therefore remain unchanged from January levels at USD 950 per tonne.

For further information, please contact:

Ulf Edman, President of Södra Cell International, +46 70 677 8769

Per Braconier, Director of Corporate Communications, Södra, +46 70 534 5166

Sari Pajari appointed SVP, Business Development of M-real

Sari Pajari (42) has been appointed SVP, Business Development and a member of the Corporate Management Team of M-real Corporation, part of Metsäliitto Group. Her main responsibilities are business development and Total Quality Management. Pajari starts in the new position on 1 April 2011 and reports to CEO Mikko Helander.

Pajari is moving to M-real from the position of SVP, CIO of Metsäliitto Group which she held since 2009. Prior to joining Metsäliitto Group in 2007 Pajari has worked as a managing strategy consultant in Pöyry, PwC Consulting and IBM. Her education is Master of Science, Engineering.

RockTenn to Acquire Smurfit-Stone Container Corp.

Creating a $9 Billion Leader in the North American Paperboard Packaging Market

RockTenn and Smurfit-Stone Container Corporation today announced that the Boards of Directors of both companies have approved a definitive agreement under which Smurfit-Stone will become a wholly owned subsidiary of RockTenn. The aggregate consideration, consisting of 50% cash and 50% RockTenn stock, is valued at $35 per-share of Smurfit-Stone common stock, and represents a 27% premium to Smurfit-Stone's closing stock price on January 21, 2011. The aggregate equity value of the transaction, based on the closing price of RockTenn's common stock on January 21, 2011, is approximately $3.5 billion.

This strategic transaction, unanimously approved by the Boards of Directors of both companies, will create a $9 billion leader in the North American paperboard packaging market. Upon closing, RockTenn will maintain its headquarters in Norcross, GA.

Smurfit-Stone is one of the industry's leading integrated containerboard and corrugated packaging producers and one of the world's largest paper recyclers. Smurfit-Stone has manufacturing mill capacity of 7.0 million tons, and when combined, RockTenn will have 9.4 million tons of total production capacity, including 7.5 million tons of mill production in the attractive containerboard market.

RockTenn's Chairman and Chief Executive Officer, James A. Rubright said, "RockTenn's acquisition of Smurfit-Stone is another major step in our transformation of RockTenn to be the most respected company in our business with a laser focus on exceeding our customers' expectations and creating long term shareholder value. The containerboard and corrugated packaging industry is a very good business and U.S. virgin containerboard is a highly strategic global asset. With this acquisition, RockTenn's fiber input ratio will be 55% virgin and 45% recycled. We believe this transaction provides the greatest possible career opportunities for our co-workers from both companies."

Smurfit-Stone's Chief Executive Officer Patrick J. Moore said, "The Smurfit-Stone management team and the board of directors are sharply focused on creating value for shareholders. This transaction immediately achieves this objective, creating a stronger combined company that is well positioned to deliver long-term value to shareholders and high-quality, innovative packaging solutions to its valued customers."

Combined RockTenn and Smurfit-Stone

- #2 producer of North American containerboard

- #2 producer of coated recycled board

- Management team with strong record of shareholder value creation and excellent record of integrating acquisitions

- Balanced fiber input mix with 55% virgin fiber and 45% recycled fiber

- Expands Rock-Tenn's geographic footprint to the Midwest and West Coast

- Opportunity to recognize benefits from approximately $500 million of NOLs at Smurfit-Stone

- Conservative capital structure with significant liquidity

- Opportunity to improve results through cost reduction and capital investment

Transaction Summary

Smurfit-Stone will become a wholly owned subsidiary of RockTenn. For each share of Smurfit-Stone common stock, Smurfit-Stone stockholders will be entitled to receive 0.30605 shares of RockTenn common stock and $17.50 in cash, representing 50% cash and 50% stock. The aggregate consideration is $35 per Smurfit-Stone common share. The consideration represents a 27% premium to Smurfit-Stone's closing stock price on January 21, 2011.

The aggregate purchase price being paid for Smurfit-Stone's equity in the transaction is approximately $3.5 billion, consisting of approximately $1.8 billion of cash and the issuance of 30.9 million shares of RockTenn common stock. Following the acquisition, RockTenn shareholders will own approximately 56% and Smurfit-Stone shareholders will own 44% of the combined company.

In addition to the equity consideration, RockTenn will assume Smurfit-Stone's net debt and pension liabilities. As of December 31, 2010 Smurfit-Stone's net debt was $0.7 billion and its pension liabilities were $1.1 billion ($0.7 billion after-tax). RockTenn has received $3.7 billion in committed bank financing from Wells Fargo Bank N.A., Rabobank and SunTrust Bank to finance the cash portion of the transaction, to refinance existing debt and to provide liquidity for the combined operations.

The purchase price, including Smurfit-Stone's net debt and after-tax pension liability as of December 31, 2010, represents a multiple of 6.1x Smurfit-Stone's annualized adjusted EBITDA of $820 million for the three months ended December 31, 2010.

The transaction is expected to close in the second calendar quarter of 2011 and is subject to customary closing conditions, regulatory approvals, as well as approval by both RockTenn and Smurfit-Stone stockholders.

Advisors

Wells Fargo Securities acted as exclusive financial advisor to RockTenn and King & Spalding LLP acted as legal counsel. Smurfit-Stone's financial advisor was Lazard and its legal advisor was Wachtell, Lipton, Rosen & Katz.

Conference Call and Webcast

RockTenn will host a conference call to discuss our results of operations for the first quarter of fiscal 2011, our acquisition of Smurfit-Stone Container Corporation and other topics that may be raised during the discussion at 8:30 a.m., Eastern Time, on Monday, January 24, 2011. The conference call will be webcast live with an accompanying slide presentation, along with a copy of this press release, at www.rocktenn.com.

Conference Call and Webcast

Monday, Jan. 24, 2011 - 8:30 a.m. Eastern Time

- Conference call number: U.S. (888) 790-4710

- Passcode: ROCKTENN (Please dial in 10 minutes before conference call start time)

- The call will also be webcast and available at: www.rocktenn.com

Replays

- A replay of the conference call will be available through March 15, 2011 at U.S. (866) 351-2785

- Passcode: ROCKTENN

- A replay of the webcast will be available at www.rocktenn.com

Forest Products Market Update

Global sawlog prices in the 3Q 2010 were almost back up to pre-crisis levels, reports the Wood Resource Quarterly

Sawlog costs for many sawmills around the world went up during 2010, and the Global Sawlog Price Index reached the highest level in over two years in the 3Q/10, according to the Wood Resource Quarterly. The biggest wood price increases occurred in Western US, Germany, Sweden and Northwest Russia.

Seattle, USA. Sawlog prices have trended upward in almost all regions of the world for the past two years. The Global Sawlog Price Index (GSPI) reached $80.88/m3 in the 3Q/10, which was the highest level since the beginning of the financial crisis in late 2008, according to the Wood Resource Quarterly. The Index, which is based on prices for logs being processed into construction and better-grade lumber, is a weighted average of sawlogs traded in the open market in 19 key regions worldwide.

The GSPI for the 3Q/10 was up 4.8 percent from the previous quarter, which is actually one of the largest quarter-to-quarter increases in 15 years. Compared to a year earlier, the GSPI was 12.8 percent higher. The price increases are partly the result of a weakening US dollar, but log prices have also gone up in the local currencies in most regions. Western and Eastern Canada are the only two regions that currently have lower log costs in the local currency than a year ago. The biggest increases occurred in the US Northwest (+43%), Germany (+28%), Sweden (+24%) and Northwest Russia (22%).

Sawmills in North America, Latin America and Oceania generally have lower costs for wood raw-material than do sawmills in Europe and Japan. The lowest sawlog costs in 2010 were found in Western Canada, Chile and Northwest Russia, while Austria, Germany, Japan and China stand out as the high-cost countries of the world. These regions have been on the high-end of the price spectrum ever since WRQ started tracking sawlog prices in 1995.

The biggest change over the past decade has occurred in Brazil. Ten years ago, sawmills in Brazil had by far the lowest log costs in the world, according to Wood Resource Quarterly. This has changed in recent years, with prices rising closer to the global average. Just in the past two years, log prices have gone up 23 percent in the country. Not all of the increase has been the result of the higher costs in the local Brazilian Real; some is due to the strengthening of the Brazilian currency against the US dollar.

Global timber market reporting is included in the 52-page quarterly publication Wood Resource Quarterly. The report, established in 1988 and with subscribers in over 25 countries, tracks sawlog, pulpwood, lumber and pellet prices and market developments in most key regions around the world.

AkzoNobel invests €90m in growth strategy to supply world’s largest pulp mill

AkzoNobel has signaled its strategic intent to accelerate growth by investing close to €90 million in a new facility being built in Brazil. The plant, operated by the company’s Pulp and Paper Chemicals business, Eka Chemicals, will supply the world’s largest pulp mill.

The agreement – with Eldorado Celulose e Papel – emphasizes the importance of high growth markets to AkzoNobel and will help drive the medium-term strategy of doubling revenue in Brazil to €1.5 billion. It also underlines the value the company attaches to securing long-terms partnerships with customers.

The investment – AkzoNobel’s biggest ever in Latin America – is centered on further expanding Eka Chemicals’ sustainability focused Chemical Island concept. It will involve supplying, storing and handling all chemicals for the 1.5 million tons per year green field mill, which is being constructed in the northern part of Três Lagoas City. The mill is expected to come on stream in September 2012.

“This 15-year agreement confirms our intention to accelerate growth and expand our activities in the world’s high growth regions,” said Rob Frohn, the AkzoNobel Board member responsible for Specialty Chemicals. “We are about to make one of the biggest investments in our history, which emphasizes both the importance of Latin America to our growth ambitions and our commitment to the pulp and paper industry.”

Added Pulp and Paper Chemicals General Manager Jan Svärd: “Future demand for pulp and paper chemicals in Latin America is projected to increase substantially over the next 15 years. This agreement therefore represents an exciting opportunity for us to expand our operations in the region and further underlines the value our customers attach to our Chemical Island concept.”

He went on to explain that Eka Chemicals will be building a world scale sodium chlorate production unit to supply the projected demands of the Eldorado mill, which has been designed to accommodate three pulp lines. The new Eka Chemicals facility will also supply other key customers in Brazil. Work on the new pulp mill site started in June last year.

Commenting on the agreement, Eldorado President Rogerio D’Alcantara Peres, said: “Building the world’s largest pulp mill requires working with reliable partners who can provide the best technology. AkzoNobel’s proven Chemical Island concept, together with the company’s world class expertise and strong commitment to sustainability, meant that they were a natural choice for this major project.”

The new facility will expand Eka Chemicals’ well established pulp and paper activities in Brazil, where the business already operates its Chemical Island concept at several mills, as well as running production units in Jacareí, Eunapolis, Três Lagoas, Rio de Janeiro and Jundiaí.

Smurfit-Stone Reports 4th Qtr 2010 Results

Smurfit-Stone Container Corporation (NYSE: SSCC) today reported net income of $49 million, or $0.49 per diluted share, for the fourth quarter ended Dec. 31, 2010, compared with net income of $65 million, or $0.65 per diluted share, for the third quarter of 2010, and a net loss attributable to common stockholders of ($6) million, or ($0.02) per share, for the fourth quarter of 2009.

Smurfit-Stone's fourth quarter 2010 adjusted net income was $62 million, or $0.62 per diluted share, down seasonally from adjusted net income of $76 million, or $0.76 per diluted share, in the third quarter of 2010, and an adjusted net loss of ($16) million, or ($0.06) per diluted share, in the fourth quarter of 2009. The adjustments in the third and fourth quarter of 2010 were primarily the exclusion of costs related to reorganization and restructuring.

|

Diluted Earnings Per Share Attributable to Common Stockholders |

||||

|

Fourth |

Third |

Fourth |

||

|

Quarter |

Quarter |

Quarter |

||

|

2010 |

2010 |

2009 |

||

|

Net Income (Loss) Attributable to |

||||

|

Common Stockholders |

$0.49 |

$0.65 |

($0.02) |

|

|

Adjustments |

$0.13 |

$0.11 |

($0.04) |

|

|

Adjusted Net Income (loss) |

$0.62 |

$0.76 |

($0.06) |

|

|

Weighted Average Shares (MM) |

100 |

100 |

257 |

|

Patrick J. Moore, Smurfit-Stone's Chief Executive Officer, commented, "Fourth quarter performance was strong, meeting our expectations, and demonstrating that our initiatives to improve productivity and lower costs are enabling us to deliver improvement in earnings, margins and cash flow."

Adjusted EBITDA for the fourth quarter of 2010 was $205 million, down from $239 million in the third quarter of 2010, and up from $67 million in the fourth quarter of 2009. The sequential decline in adjusted EBITDA reflects seasonally lower volumes, cost inflation, the impact of a work stoppage at the Company's La Tuque, Quebec, mill, and market-related downtime taken in December in order to balance supply and demand in the Company's system.

Net sales for the fourth quarter of 2010 were $1.63 billion, unchanged from the third quarter of 2010 and up 18 percent compared with sales of $1.38 billion in the fourth quarter of 2009. The stable sales in fourth quarter 2010 reflect modestly higher selling prices, offset by seasonally lower volumes.

Fourth Quarter Highlights

- The Company achieved strong financial results despite higher reclaimed fiber costs, a work stoppage at its La Tuque facility and market-related downtime in the quarter.

- Initial SG&A cost reductions were completed in the fourth quarter that will produce net savings of $50 million in 2011.

- The Company ended the quarter with cash of $449 million, down only $15 million from the end of the third quarter, despite capital expenditures of $67 million and a voluntary $105 million pension contribution in the quarter.

- The Company's underfunded pension position improved to $1.13 billion at year end from $1.45 billion at June 30, 2010, reflecting strong asset returns and contributions totaling $199 million in 2010.

- The Company ended 2010 with net debt of $745 million and liquidity of nearly $1 billion.

Outlook

Smurfit-Stone expects lower sequential earnings in the first quarter of 2011 compared with the fourth quarter of 2010. Moderate improvement in pricing will be more than offset by seasonally higher energy usage, cost inflation in fiber and energy, and the impact of employee benefit cost timing.

Conference Call and Webcast

The previously scheduled conference call and webcast will not be held.

Heidelberg Optimizes Financing Structure and Pays off KfW Loan

At the end of 2010, Heidelberger Druckmaschinen AG (Heidelberg) repaid in full the loan from the Special Program of the KfW (Reconstruction Loan Corporation) for large companies ahead of schedule. The KfW loan was reduced by just under EUR 190 million immediately after the capital increase last year, and now the remaining sum of around EUR 100 million has been repaid following some reallocation within the financing structure.

"We would like to thank the KfW for supporting us during the financial and economic crisis and helping us to bridge this difficult period. It was, however, always understood that we would revert to capital market financing as soon as possible. As announced, we therefore used all the net proceeds from the capital increase in September 2010 to reduce our financial liabilities. We then repaid the outstanding sum of approximately EUR 102 million due under the KfW loan ahead of schedule on December 30, 2010. This has simplified our financing structure and will also facilitate our future refinancing," said Heidelberg CFO Dirk Kaliebe.

The proceeds from the capital increase and the positive free cash flow in the first half of the current financial year enabled Heidelberg to significantly lower its financial liabilities from some EUR 816 million at the end of March 2010 to around EUR 377 million by the end of September 2010.

The capital increase has given Heidelberg a more stable capital structure overall, with a much lower net debt of EUR 243 million and a solid equity basis of around EUR 830 million as at September 30, 2010. This has also resulted in a change to the Group's financing requirements. Financing has fallen from the previous level of EUR 1.4 billion to just under EUR 900 million. It is now made up of the credit line supported by guarantee pledges from the State and the syndicated credit line from a consortium of banks. These two credit lines have each been reduced to around EUR 445 million.

In summer 2009, Heidelberg concluded a financing package for the period up to the middle of 2012. It comprised a loan for an original sum of EUR 300 million from the KfW, a loan originally totaling EUR 550 million, supported by guarantee pledges from the Federal Government and the States of Baden-Württemberg and Brandenburg, and an existing syndicated credit line from a consortium of banks, also for an original amount of EUR 550 million.

BASF gets Certification for first compostable adhesive

Epotal Eco contributes to the development of biodegradable packaging materials

As producer of Epotal ® Eco, BASF shall forthwith be able to offer the first compostable water-based adhesive certified by the German Technical Inspection Agency TÜV. “Biologically degradable adhesives will play a decisive role in the future when it comes to developing compostable packaging materials,” says Cornelis Beyers from Marketing Industrial Adhesives. Epotal Eco is particularly suitable for the production of multi-layer films for flexible packaging materials based on biodegradable plastics. Possible applications are bags for potato chips or chocolate bar wrappings.

Trend towards biodegradable packaging

There is growing demand for efficient and at the same time sustainable raw materials in the packaging industry. “In the past, we received, again and again, inquiries for biodegradable adhesives but were unable to satisfy them,” confirms Merle Dardat, Product Manager at DIN Certco, a certification company of the TÜV Rhineland Group and of the German Standard Institute (Deutsches Institut für Normung e. V. / DIN). DIN Certco has now issued the registration notice for Epotal P100 Eco certifying the product as a biodegradable additive.

Feed for microorganisms

According to the European EN 13432 standard, substances are considered as fully biodegradable if at least 90 percent of the organic carbon contained in them is converted into CO2 within a testing period of no more than 180 days. The rotting test in composted earth showed that after 70 days only, 90 percent of Epotal Eco is broken down. The molecule structure of the product resembles the one of naturally occurring polymers. Microorganisms are able to convert them into carbon dioxide, water and biomass with the help of enzymes. The best results are achieved in industrial composting facilities since they offer ideal conditions for microorganisms. After the decomposition process, Epotal Eco leaves no toxic residuals und shows no negative impact on the environment.

Water-based adhesives – environmentally friendly and efficient Apart from its compostability, Epotal Eco offers all benefits of water-based adhesives, which are an environmentally friendly and efficient alternative to solvent-based and solvent-free products. They are free from toxic components and are suitable for food packaging. In addition, multi-layer films, which are produced with the help of water-based plastics, can be processed immediately. This helps the packaging industry to save time and money.