Ianadmin

Clearwater Paper to Present at the Vertical Research Partners Paper & Packaging Conference

Clearwater Paper Corporation has announced that Gordon Jones, chairman and CEO, andLinda Massman, president, COO, and CFO will present at the Vertical Research Partners Paper & Packaging Conference on Thursday, March 8, at10:45 AM EST. A live audio webcast of the presentation and accompanying slide materials will be accessible via Clearwater Paper's investor relations section of the company's website at http://ir.clearwaterpaper.com/events.cfm. An audio replay of the webcast will be available at the site for 90 days.

ABOUT CLEARWATER PAPER

Clearwater Paper manufactures quality consumer tissue, away-from-home tissue, hard roll tissue, machine glazed tissue, bleached paperboard and pulp at 15 manufacturing locations in the U.S. and Canada. The company is a premier supplier of private label tissue to major retailers and wholesale distributors. This includes grocery, drug, mass merchants and discount stores. The company also produces bleached paperboard used by quality-conscious printers and packaging converters. Clearwater Paper's employees build shareholder value by developing strong customer partnerships through quality and service.

For additional information on Clearwater Paper, please visit our website at www.clearwaterpaper.com.

Metso's Nomination Board proposes seven members to the Board of Directors

The Nomination Board established by Metso's Annual General Meeting proposes to the next Annual General Meeting, which is planned to be held on March 29, 2012, that the number of Board of Directors members is seven.

Proposal on the composition of Board of Directors

The Nomination Board proposes to the Annual General Meeting that Jukka Viinanen, Mikael von Frenckell, Christer Gardell, Ozey K. Horton, Jr., Erkki Pehu-Lehtonen and Pia Rudengren would be re-elected of the present members of the Board of Directors. In addition, it is proposed to elect Eeva Sipilä as a new member of the Board of Directors. It is proposed to elect Jukka Viinanen as Chairman of the Board of Directors and Mikael von Frenckell as Vice-Chairman of the Board of Directors.

Ms. Eeva Sipilä, M.Sc. (Econ), CEFA, b. 1973, has served as Chief Financial Officer (CFO) of Cargotec Corporation since 2008. She is a Board member of Basware Corporation since 2010. Eeva Sipilä has worked for Cargotec since 2005, prior to her current role she was Senior Vice President, Investor Relations and Communications during 2005-2008. During 2002-2005 she worked for Metso Corporation as Vice President, Investor Relations. Before Metso, Eeva Sipilä worked as an equity analyst at Mandatum Stockbrokers, Sampo-Leonia and Leonia Bank during 1999-2002. During 1997-1998 she worked as an associate consultant at Arkwright AB in Sweden.

Proposal on Board of Directors’ remuneration

The Nomination Board proposes to the Annual General Meeting that the members of the Board of Directors to be elected for a term of office ending at the end of the Annual General Meeting of 2013 would be paid the following annual remuneration: to the Chairman of the Board of Directors EUR 100,000; to the Vice-Chairman of the Board of Directors and the Chairman of the Audit Committee EUR 60,000; and to the other members of the Board of Directors EUR 48,000 each. The Nomination Board furthermore proposes that for each meeting of the Board of Directors or the committees of the Board of Directors a fee of EUR 700 would be paid to the members of the Board that reside in the Nordic countries, a fee of EUR 1,400 would be paid to the members of the Board that reside in other European countries and a fee of EUR 2,800 would be paid to the members of the Board that reside outside Europe. The Nomination Board proposes that as a condition for the annual remuneration the members of the Board of Directors are obliged, directly based on the General Meeting’s decision, to use 40% of the fixed annual remuneration for purchasing Metso Corporation shares from the market at a price formed in public trading and that the purchase will be carried out within two weeks from the publication of the interim review for the period 1 January 2012 to 31 March 2012.

Metso’s Board of Directors will include these proposals into the notice of the Annual General Meeting, which will be published later.

Personnel participation

The Nomination Board notes that a personnel representative will participate as an external expert in the Metso Board meetings also in the next Board term within the limitations imposed by the Finnish law. The new Board of Directors will invite the personnel representative as its external expert in its organizing meeting after the Annual General Meeting.

The Nomination Board

Kari Järvinen (Managing director, Solidium Oy) acted as the Chairman of the Nomination Board established by Metso's Annual General Meeting. The members the Nomination Board were Lars Förberg (Managing Partner, Cevian Capital), Harri Sailas (President and CEO, Ilmarinen Mutual Pension Insurance Company) and Matti Vuoria (President and CEO, Varma Mutual Pension Insurance Company). The Chairman of Metso Corporation’s Board of Directors, Jukka Viinanen, served as the Nomination Board's expert member.

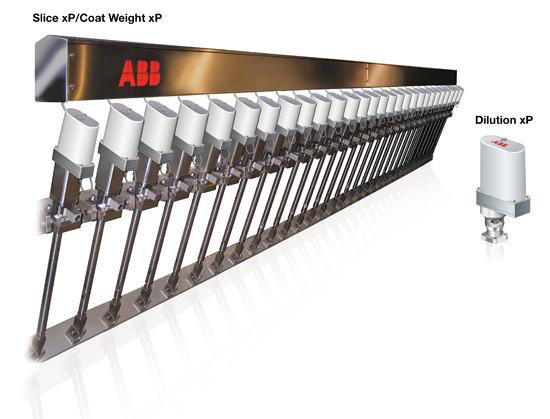

ABB Launches Next Generation Weight xP Actuators

High-speed positioning gives papermakers faster grade changes and faster recovery from process upset

ABB, the leading power and automation technology group, recently introduced the new Weight xP extended profiling actuators. These state-of-the-art actuators help customers to achieve the lowest possible Cross Direction variability and to reduce cost.

The new Weight xP actuators, the latest generation of ABB’s popular xP profilers, help papermakers meet even the most exacting product specifications. With robust design, proven components and unique technologies, Weight xP delivers precision and reliability.

“With the new Weight xP’s technology, mills can achieve faster recovery from grade changes and process upsets that they need to keep productivity at high levels,” says Steven St. Jarre, Head of Sales & Marketing for ABB Quality Control Systems.

The Weight xP family of actuators includes the Slice xP, Dilution xP and Coat Weight xP systems which are designed based on ABB’s experience in applying actuators on more than 25 different manufacturers of headboxes and coaters.

The actuators feature patented and patent-pending technology that eliminate the dependence on a physical position sensor, and allow the actuators to achieve their new position in one continuous and fast movement, reducing the time needed to make control actions.

In addition, the patented power management scheme allows simultaneous movement of actuators at all times even during flush cycles, global setpoint changes, or even if one power supply has failed, providing papermakers with the ultimate in reliability.

Slice xP, Coat Weight xP and Dilution xP each offer advanced diagnostics for easy troubleshooting and increased system availability, as well as built-in monitoring of over 60 different parameters, to predict an impending actuator failure long before it occurs.

International Paper, Temple-Inland Extend DOJ Review Period

International Paper Company (NYSE: IP) and Temple-Inland Inc. (NYSE: TIN) has announced that they have agreed to extend the U.S. Department of Justice's ("DOJ") review period with respect to International Paper's acquisition of Temple-Inland until February 13, 2012 to provide the parties with time to enter into binding documentation to resolve the DOJ's concerns with respect to the pending transaction.

International Paper Chairman and CEO John Faraci said, "We have been working constructively with the DOJ to address their concerns and anticipate entering into a definitive agreement on terms that are acceptable to all parties. The acquisition of Temple-Inland is a compelling value proposition for International Paper shareholders, and will create numerous benefits for our customers and employees."

SOURCE International Paper

Mercer International Inc. Announces Director's Resignation

Mercer International Inc. has announced that Ken Shields has resigned as a director of the Company.

Mr. Shields stated: "It has been a great pleasure to serve as a director and vice-chairman of Mercer but, due to demands from my other business interests, including the potential for increasing overlap between them and the Company in the energy segment, I felt it was appropriate to resign at this time. I wish the Company every success in the future."

Jimmy Lee, President and CEO, stated: "We regretfully accepted Ken's resignation as a director and, on behalf of the whole board and myself, wish to thank him for his invaluable service and contribution to the Company over the past eight years. We will miss his guidance and contribution and wish Ken all the best in all his future endeavours."

Mercer International Inc. is a global pulp manufacturing company. To obtain further information on the company, please visit its web site at http://www.mercerint.com.

Metso-supplied containerboard line starts up at Saica Containerboard in the UK

The Metso-supplied complete containerboard production line, PM 11, for Saica Containerboard UK Ltd., successfully came on stream on January 15, 2012 at Partington, near Manchester in the United Kingdom. The record-breaking start-up speed was 1,105 m/min with a basis weight of 95 g/m2.

Three days later, on January 18, the first sellable paper reels were produced and tested, leaving the mill and reaching the first customers shortly afterwards.

Francisco Carilla, Industrial Projects Director, Saica, and Federico Asensio, Deputy Managing Director, Saica Paper, are both very satisfied with the Metso teams of all project stages:“In commercial proposals, design, construction, start-up and maintenance activities the Metso teams’ efforts responded to our requirements, taking into consideration our papermakers’ technical advice and previous projects experiences.”

“We are sure the high level of cooperation achieved between Saica and Metso will create significant added value for the further optimization of the production line. This will allow Saica to deliver high-quality lightweight containerboard paper to our customers setting the standard for these grades in the UK and in Europe.”

The new 8.2-m-wide PM 11 has an annual production capacity of approximately 400,000tonnes of lightweight testliner and fluting grades in the basis weight range of 75 to 125 g/m2, out of 100% recycled raw material. The design speed is 1,700 m/min.

Metso’s delivery included a complete OptiConcept board making line from headbox to reel with an approach flow system, pulpers, air systems, press section clothing as well as a high-capacity WinDrum Pro winder.

A comprehensive Metso DNA automation package comprised process, machine and quality controls as well as machine condition monitoring. A Metso DNA process control system was also supplied for the mill’s new heat and power station and effluent treatment plant.

Metso Mill Service will have full responsibility for the mill maintenance operations as well as for maintenance management of continuous improvement programs for the OCC stock preparation system, board production line, power stations and wastewater treatment plant at the Partington mill.

Saica Containerboard UK Ltd., is a subsidiary of SAICA, a privately owned Spanish company and a world leader in the production of corrugated containerboard from recovered paper. The company currently employs over 8,000 people in Spain, France, Portugal, Italy, Ireland and the UK. SAICA has an annual turnover of EUR 1.8 billion.

Product release: SOLVED expert service aims to be the world’s leading cleantech community – Kemira is in!

SOLVED expert service aims to be the world’s leading cleantech community – Kemira is in!

All over the world people are struggling with environmental challenges. Cleantech Finland‟s new SOLVED expert service at www.solved.fi harnesses the Finnish problem solving ability and world-class technology expertise to solve them.

Cleantech Finland, operated by Finpro, is a network of Finnish environmental technology companies that has a goal to profile Finland as a top country in the field. Cleantech Finland‟s SOLVED expert service brings together cleantech companies, clients and other interest groups, the problems and their solutions on an online platform that enables new ways to be active and cooperate.

“SOLVED aims to be the world‟s leading cleantech community. Now we can be even more effective in channelling Finnish expertise to match global demand. Through the service companies get boost and visibility,” promises Santtu Hulkkonen, Cleantech Finland‟s Executive Director.

Meeting place for top experts and challenges

The experts from Cleantech Finland's member companies play a key role in SOLVED. In the service anyone can ask questions, engage in discussion and do networking. The top experts from the respective field then provide the factual information, perspectives and practical experience to solve a problem or take part in the discussion. About one hundred experts have already signed in the service. Also Kemira has experts among them.

”Problem solving ability is a known part of the Finnish heritage. We have the competence, the cooperational abilities and the natural willingness to do things as efficiently and well as possible. In SOLVED this way of doing things and Finnish expertise come together in a fascinating and easily approachable whole,” Santtu Hulkkonen says.

Södra textile pulp production in progress

Under full operation, annual production is expected to amount to 170 000 tonnes, and the investment in Mörrum will give Södra competitive textile pulp production based on hardwood.

Production of textile pulp at Södra Cell Mörrum has now begun. Under full operation, annual production is expected to amount to 170 000 tonnes, and the investment in Mörrum will give Södra competitive textile pulp production based on hardwood.

Södra made a decision to invest in the production of textile pulp back in December 2010. The Group is anticipating strong market development for textile pulp as it is renewable and timber-based, and it will replace oil-based and cotton fibres. Since this decision was made, implementation of the investment and development of a new market organisation for the new customer segment have been taking place in parallel.

"We are focusing on textile pulp as this is a growing market to which we can supply a certified, renewable forest raw material," says Gunilla Saltin, president of Södra Cell.

"For Södra Cell Mörrum, this is an important step in the reinforcement of the profitability and competitiveness of the mill," says Magnus Olsson, Site Manager for Södra Cell Mörrum.

Södra's executive committee has also made a decision in principle about an appropriation limit for production of textile pulp on a further pulp line at one of the company's pulp mills. A definitive decision on a second textile pulp line at Södra will be made in 2012.

Rottneros: Year-end Report January-December 2011

2011 was a year of two quite different halves. Demand for sulphate pulp was good during the first six months of the year, which resulted in prices increasing to a new record level of USD 1,025 per tonne by midsummer. However, the price of mechanical pulp remained virtually static despite the good momentum for chemical pulp. Global stock levels for pulp increased, which was probably due to purchasers worrying about further price rises. The market psychology changed during the summer; demand for printing and writing paper was weak, the financial crisis worsened in Member States in the Eurosystem and high levels of pulp stock suddenly became a good reason to push pulp prices down. This price correction did not cease during the third quarter but accelerated instead during the autumn, and the final months of the year were noticeably weak. Purchasers of pulp were very inclined to postpone any buying as pulp would soon be cheaper, and the risk of running out of pulp was considered to be worth taking in spite of consumer stocks being at a record low. The price of NBSK (bleached long fibre sulphate pulp) fell to approximately USD 830 per tonne by the end of the year. Stocks continued to rise despite global pulp producers taking significant production curtailments. These price fluctuations occurred against the background of the US dollar weakening during the first half of the year and then strengthening again during the autumn. For the Swedish pulp industry this means that the average pulp price for the year was almost SEK 500 per tonne lower than in 2010, despite record high USD pulp prices. This obviously had an adverse effect on the result. Before the one-off items charged to Quarter 3, the full-year result for Rottneros before depreciation fell from SEK 224 to 98 million.

We completed extensive improvements and investments at Vallvik Mill during the last quarter of the year; this satisfied the requirements imposed on us by the authorities, but also boosted production capacity at the factory by almost 20%. These investments constituted an important reason for our financial reconstruction and rights issue which took place at the end of 2009. Weak demand during the third quarter meant that no costly measures were approved to minimise production losses during the shutdown and start up, which resulted in volume losses being slightly higher than estimated. These have been included under the item ‘negative effect on result from annual maintenance shutdown’; they were previously forecast at SEK 15-20 million, but ended up as SEK 25 million. So far the results of these investments appear to be very promising. A full evaluation cannot be made until the operation has been running for a longer period and it has been possible to see the impact of both winter and summer climates on the process and biological water purification plant.

Negotiations have been concluded in respect of the improvement programme at Rottneros Mill, which was announced in September, and notices of termination given and early retirements arranged. The programme will be fully implemented during the summer. The mill restricted production quite significantly during the last quarter – approximately one week per month – in order to balance stocks while avoiding unnecessary price compression through focussing on volumes.

- Profit after net financial items amounted to SEK 28 (138) million for the full year 2011 before write-downs and one-off costs. Profit after net financial items amounted to SEK -44 (13) million for the fourth quarter of 2011. Costs of SEK 25 million for the normal maintenance shutdown at Vallvik Mill have been charged to this quarter.

- The result for the third quarter of 2011 was charged with write-downs of SEK -118 million and one-off costs of SEK -30 million (SEK -148 million in total). Loss after net financial items amounted to SEK -120 million for the full year 2011 after these write-downs and one-off costs.

- As a consequence of the weak market for mechanical pulp, Rottneros Mill is implementing an improvement programme involving changes to the product range as well as staff reductions and cutting other production costs.

- The board proposes a dividend of 0.10 (0.20) Swedish kronor per share for the financial year 2011.

There was certainly a high level of macroeconomic uncertainty at the start of 2012, at least in those Member States in the Eurosystem and, as regards the export industry, a disadvantageous relationship between the value of the Euro and the Swedish krona. On the other hand, our customers’ stock levels are low, activity is good in China – a country that is becoming increasingly important – Swedish timber prices are falling and electricity has been at its lowest winter level for some time. The official pulp price index (PIX) experienced a slight upturn in January after having continuously fallen since the end of June, so there are signs that the pulp price has bottomed out this time round.

The prospects for 2012 are unusually uncertain although they appear to be brighter. The situation seems more promising on leaving the gloomy fourth quarter behind us at a time when timber and electricity prices are falling and also as the fall in PIX prices of pulp in Europe tailed off in December and started to rise slightly in January.

Ole Terland

President and CEO

ACCOUNTING PRINCIPLES

This interim report has been prepared in accordance with IAS 34 ‘Interim Financial Reporting’, which complies with Swedish law through the application of the Swedish Financial Reporting Board’s Recommendation RFR 1 ‘Supplementary Accounting Rules for Groups’ together with RFR 2 ‘Accounting for Legal Entities’, in respect of the parent company.

The accounting principles, definitions of key ratios and calculation methods are the same as those applied in the last Annual Report, except as regards the following:

- Amendments to the existing standard IAS 24, which entered into force on 1 January 2011. Revised IAS 24 ‘Related Party Disclosures’ clarifies and simplifies the definition of ‘related party’. Rottneros has applied the revised standard with effect from 1 January 2011. The amended accounting principle has not yet had any effect on recognised amounts, though requires further information in the company’s financial reports.

- The parent company’s comparative figures have been amended as a consequence of the Swedish Financial Accounting Board having withdrawn UFR 2 . Group contributions are reported for the financial year commencing on 1 January 2011 or later in accordance with RFR 2[IAS27]p2 and also RFR 2[IAS18]p3. This amendment applies retroactively. The amended reporting had a positive effect of SEK 114 million on the net income of the parent company for the full year 2010. The amendment had no effect on the company’s equity.

FORECAST for 2012

The company is not providing an earnings forecast for 2012.

FORTHCOMING FINANCIAL INFORMATION

|

19 April 2012 |

Interim Report January-March 2012 |

|

18 July 2012 |

Interim Report January-June 2012 |

|

19 October 2012 |

Interim Report January-September 2012 |

|

24 January 2013 |

Year-end Report for 2012 |

The AGM for Rottneros AB will be held in Stockholm on Thursday 19 April 2012.

The Annual Report for 2011 will be available from the company’s website during Week 11 of 2012.

For more information, please visit Rottneros’ updated website, www.rottneros.com.

Stockholm, 27 January 2012

Mercer International Inc. Announces NAFTA Claim

Mercer International Inc. has served a Notice of Intent to Submit a Claim to Arbitration (the "Notice") on the Government of Canada for breaches by it of its obligations under the North American Free Trade Agreement ("NAFTA"). Under NAFTA, Mercer's investments in Canada are to be treated on a basis that is no less favorable than the most favorable treatment afforded to Canadian investors. Mercer's NAFTA claim (the "Claim") relates to its investments in its Castlegar pulp mill (the "Mill").

Mercer's Claim arises from the treatment of the Mill's energy generation assets and operations by the Province of British Columbia, primarily through the actions of British Columbia Hydro and PowerAuthority ("BC Hydro"), a Provincially owned and controlled enterprise, and the British Columbia Utilities Commission (the "Commission"), a Provincial Government regulatory agency. Mercer's Claim is against Canada, rather than the Province of British Columbia as, under NAFTA, Canada is responsible for the actions of its Provinces.

"We have been forced to commence the NAFTA Claim following years of attempts to resolve our issues through dialogue with the Province and proceedings before the Commission because of NAFTA time period limitations relating to the expiry of our claim," said Jimmy Lee, President and CEO. He continued: "We are bringing the Claim as, under Provincial policy, the Mill's ability to effectively utilize its own generation assets and to sell and purchase energy is severely and unfairly restricted. All other competing pulp mills in British Columbia receive more favorable treatment with respect to their ability to purchase and sell energy. This puts the Mill at an unfair competitive disadvantage. In our various attempts to resolve the issue, we have sought fair treatment in order to put us on equal footing with other pulp mills within the Province that have electrical generation capacity. Unfortunately, we were not able to obtain a satisfactory resolution through these efforts."

Mr. Lee then stated that: "Mercer acquired the Mill in 2005 for an aggregate purchase price, including working capital of over Cdn. $250 million. Since then we have invested in excess of Cdn. $100 million in additional capital to upgrade the Mill and increase its electricity generation capacity. We believe that maintaining and enhancing revenues from the production of green energy and other by-products at all of our mills is critical to Mercer's future success. Mercer must maintain its competitive position vis-à-vis other less efficient mills within the Province as well as at our other mill locations. Mercer simply cannot stand idly by and allow its competitive position to be unfairly eroded."

Mr. Lee continued: "The unfair and discriminating treatment of the Mill has resulted in it losing about Cdn. $19 million of incremental energy sales per annum."

Mr. Lee concluded: "Under the NAFTA Claim, we will be seeking damages in the amount of approximately Cdn. $250 million consisting of past losses of approximately Cdn. $19 million per year accruing since 2008 and the net present value of projected losses arising from the ongoing application of discriminatory Provincial policies."

About the Claim

As background to the Claim, the Province of British Columbia is served by two regulated utilities, BC Hydro, whose service area covers approximately 90% of the Province by area, and FortisBC Inc. ("FortisBC"), whose service area covers the remainder of the Province. In the Notice, Mercer describes how the Mill has received unfair and discriminatory treatment as compared to other pulp mills and entities that generate and sell electricity within the Province of British Columbia.

The primary factual bases for the Claim are that:

o In August, 2008, the Mill entered into an agreement with FortisBC (the "2008 PPA") to purchase all of its electricity needs from FortisBC, and filed the agreement for approval with the Commission. The 2008 PPA would have enabled the Mill to sell all of its self-generated electricity to third party purchasers. At the time that the Mill entered into the 2008 PPA, the agreement complied with all existing regulatory requirements.

o At such time, BC Hydro was obliged to supply a significant portion of FortisBC's energy requirements pursuant to an energy purchase agreement between BC Hydro and FortisBC (the "3808 Agreement") at lower embedded cost rates, the benefits of which were passed on to FortisBC's customers. The energy generated by BC Hydro's hydroelectric facilities is commonly referred to as "Heritage Power" and, as a matter of Provincial policy, is supposed to be made available to all BC Hydro ratepayers, including FortisBC for the benefit of its customers.

o In September, 2008, approximately three weeks after the Mill and FortisBC filed the 2008 PPA with the Commission, BC Hydro made application to the Commission to amend the 3808 Agreement for the purpose of restricting access by customers of FortisBC, such as the Mill, to energy (inclusive of Heritage Power) purchased under the 3808 Agreement, while such customers were selling their own self-generated electricity. The Province of British Columbia argued in favor of BC Hydro's application and the Commission ordered the requested amendment. The Mill was the only pulp mill in British Columbia operationally affected by the amendment.

o The 2008 Agreement was frustrated by the Commission's order. The Mill's ability to purchase energy from FortisBC, while selling its self-generated electricity, was blocked. As a result, the Mill became the only pulp mill in the Province of British Columbia that was required to service all of its internal electricity needs, from self-generation, before being entitled to sell any of its self-generated electricity.

o Other pulp mills throughout the Province have entered into agreements with BC Hydro that entitle them to purchase electricity from BC Hydro at the same time that they sell electricity. A similar arrangement between the Mill and FortisBC was prevented by the Commission order.

o As a result, competing pulp mills within the Province have been and continue to be provided an economic and competitive advantage over the Mill, in perpetuity, not because of technological innovation, greater investment or superior infrastructure, but because of government policy and regulatory intervention. In addition, such pulp mills have been the recipients from BC Hydro of direct subsidies or low interest rate loans, together with agreements to purchase power generated by such pulp mills, below their internal requirements, at favorable, market-based rates. Similar incentives, loans and below net of load purchase arrangements have not been made available to the Mill.

Mercer has engaged in dialogue with the Province and has undertaken subsequent applications and proceedings before the Commission, seeking a reconsideration of the Commission's initial decision, and seeking other alternative remedies. However, the Mill remains barred from purchasing any energy from FortisBC, and continues to be the only pulp mill in the Province of British Columbia that is denied access to any Heritage Power, while selling energy that is not in excess of its operational needs.