Displaying items by tag: Ashland Inc

Ashland Inc. elects Brendan Cummins to board of directors

Ashland Inc. has announced that Brendan Cummins, former chief executive officer of Ciba Specialty Chemicals, has been elected to the company's board of directors. With his election, the Ashland board now has 10 directors.

Cummins, 61, brings nearly 40 years of industry leadership experience to this new role. He spent 37 years with Ciba, holding a variety of international and senior management roles within the company. These roles included 20 years spent in the Asia Pacific region in finance and business unit leadership assignments. He served as chief operating officer from October 2005 through January 2008, when he was promoted to CEO. Ciba was acquired by BASF in late 2008. Since 2010, Mr. Cummins has served as a consultant to, and on the senior executive panel of, The Valence Group, a specialist mergers and acquisitions firm offering advisory services to companies and investors in the chemical, materials and related sectors.

About Ashland Inc.

In more than 100 countries, the people of Ashland Inc. (NYSE: ASH) provide the specialty chemicals, technologies and insights to help customers create new and improved products for today and sustainable solutions for tomorrow. Our chemistry is at work every day in a wide variety of markets and applications, including architectural coatings, automotive, construction, energy, food and beverage, personal care, pharmaceutical, tissue and towel, and water treatment. Visit ashland.com to see the innovations we offer through our four commercial units - Ashland Specialty Ingredients, Ashland Water Technologies, Ashland Performance Materials and Ashland Consumer Markets.

Source: Ashland Inc.

Ashland Inc. board increases annual dividend 29 percent

The board of directors of Ashland Inc. (NYSE: ASH) has declared a quarterly cash dividend of 22.5 cents per share on the company's common stock. This represents a 29 percent increase from the previous quarterly dividend and is equivalent to an annual dividend of 90 cents per share. The dividend is payable June 15, 2012, to shareholders of record at the close of business on June 1, 2012. As of March 31, 2012, there were 78,467,329 shares of Ashland common stock outstanding.

"This dividend increase reflects the board's continued confidence in the strategic direction of the company, as well our ability to generate cash and deliver strong financial performance for shareholders," said James J. O'Brien, Ashland chairman and chief executive officer. "Since 2009, we have tripled our annual dividend, a clear sign that Ashland's transformation into a specialty chemical company has yielded tangible benefits for our shareholders and provided a strong platform for continued growth in the years ahead."

In more than 100 countries, the people of Ashland Inc. (NYSE: ASH) provide the specialty chemicals, technologies and insights to help customers create new and improved products for today and sustainable solutions for tomorrow. Our chemistry is at work every day in a wide variety of markets and applications, including architectural coatings, automotive, construction, energy, food and beverage, personal care, pharmaceutical, tissue and towel, and water treatment. Visit ashland.com to see the innovations we offer through our four commercial units - Ashland Specialty Ingredients, Ashland Water Technologies, Ashland Performance Materials and Ashland Consumer Markets.

Source: Ashland Inc.

Ashland Inc. reports preliminary financial results for second quarter of fiscal 2012

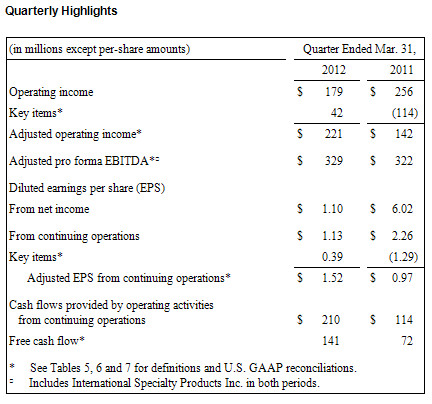

Ashland Inc., a global leader in specialty chemical solutions for consumer and industrial markets, today announced preliminary(1) financial results for the quarter ended Mar. 31, 2012, the second quarter of its 2012 fiscal year.

Earnings from continuing operations equal $1.13 per diluted share; adjusted earnings, excluding key items, increased 57 percent to $1.52 per diluted share

For the second quarter of fiscal 2012, Ashland reported income from continuing operations of $90 million, or $1.13 per diluted share, on sales of $2.1 billion. These results included three key items that together reduced income from continuing operations by approximately $31 million, net of tax, or 39 cents per diluted share. The after-tax charges related to adjustments to stepped-up inventory values from the acquisition of International Specialty Products Inc. (ISP) last August; expenses related to Ashland's integration and cost-reduction program; and a write-off related to pre-construction costs for a previously planned greenfield manufacturing facility in northern China. Excluding these three key items, Ashland's adjusted income from continuing operations was $121 million, or $1.52 per diluted share, an increase of 57 percent versus the year-ago quarter.

For the year-ago quarter, income from continuing operations was $182 million, or $2.26 per diluted share, on sales of $1.6 billion. The year-ago results included four key items that had a combined positive impact of $103 million, net of tax, or $1.29 per diluted share. Excluding these items, adjusted income from continuing operations was 97 cents per diluted share. The March 2011 results do not include ISP or related financing costs associated with that acquisition. (Please refer to Table 5 of the accompanying financial statements for details of key items in both periods.)

Adjusting for the impact of key items in both the current and prior-year quarters and for the acquisition of ISP on a pro forma basis, Ashland's results for the March 2012 quarter as compared with the March 2011 quarter were as follows:

- Sales grew 2 percent to $2.1 billion;

- Operating income rose 4 percent to $221 million;

- Earnings before interest, taxes, depreciation and amortization (EBITDA) increased 2 percent to $329 million; and

- EBITDA as a percent of sales held steady at 15.8 percent.

"I am pleased with Ashland's solid financial performance in the second quarter. Our overall business continues to perform well, with increased sales, stable margins and improved cash flow during the quarter despite some market weakness in certain commercial units," said James J. O'Brien, Ashland chairman and chief executive officer. "Ashland Specialty Ingredients achieved another strong quarter with double-digit sales and earnings increases, and good sales growth in all regions of the world. With last year's acquisition of International Specialty Products, we have strengthened our position in higher-margin growth markets and we are seeing the benefit to our bottom-line results. Also during the quarter, Ashland Performance Materials had improved pricing and stronger demand in the North American market. Although Ashland Consumer Markets was down versus the prior year due to softness in the domestic market, its performance improved when compared to the first quarter. Ashland Water Technologies continues to face a challenging demand environment, with lower volumes more than offsetting the benefit from improved pricing in the quarter."

Business Segment Performance

In order to aid understanding of Ashland's ongoing business performance, the results of Ashland's business segments are presented on an adjusted or pro forma adjusted basis, and EBITDA is reconciled to operating income in Tables 7 and 8 of this news release.

Ashland Specialty Ingredients reported sales of $723 million for the March 2012 quarter, an increase of 11 percent when compared to a year ago on a pro forma basis. EBITDA rose 12 percent, to $186 million, while EBITDA as a percent of sales was 25.7 percent, an increase of 10 basis points versus the year-ago quarter. Each of Specialty Ingredients' businesses performed well during the quarter, with particularly impressive performance from the Energy, Construction and Specialty Performance businesses. Specialty Ingredients represents the largest commercial unit within Ashland, comprising 56 percent of the company's consolidated EBITDA on a trailing 12-month basis.

Ashland Performance Materials reported sales of $408 million, a 4-percent decrease from the March 2011 quarter on the same pro forma basis, which includes the results of ISP's elastomers business. Excluding effects associated with our Casting Solutions joint venture and the recently divested PVAc business, year-over-year sales for Performance Materials rose 4 percent. EBITDA increased 9 percent, to $35 million, while EBITDA as a percent of sales grew 110 basis points to 8.6 percent.

Sales at Ashland Consumer Markets rose 6 percent, to $520 million, when compared to a year ago. EBITDA totaled $66 million, a decline of 10 percent versus a year ago, while EBITDA as a percent of sales was 12.7 percent, a decline of 220 basis points from March 2011. However, EBITDA was higher on a sequential basis when compared to the December 2011 quarter due to seasonal volume increases, increased pricing and lower raw material costs.

Ashland Water Technologies' sales totaled $428 million in the March 2012 quarter, a decline of 9 percent from the year-ago quarter. EBITDA was $39 million, a 24-percent decline from March 2011. EBITDA as a percent of sales was 9.1 percent, down 170 basis points. Lower volumes remain the primary challenge within Water Technologies' business. Water Technologies has taken a number of steps over the past year to refocus its business on higher-margin, higher-growth opportunities, and these actions should lead to improved results over time.This includes the divestiture of our synlubes business and the repositioning of our middle-market commercial business through a well-established distributor. The latter decision, announced last week, will eliminate the high costs associated with servicing approximately 5,000 customer locations that together generated only $15 million in annualized sales.

After excluding the effects from key items, Ashland's effective tax rate for the March 2012 quarter was 27 percent. Given our ongoing work in this area and a refinement of some of our initial assumptions, we now expect Ashland's tax rate for the full year to be in the range of 28-30 percent.

Outlook

Looking ahead, O'Brien said he is confident about Ashland's growth opportunities and business performance.

"Our year-to-date financial performance provides clear evidence of the strategic benefits provided by the addition of ISP's higher-margin business portfolio. Specialty chemicals are now the core of our business, and we are beginning to see the improved earnings power that comes with this focus on higher-growth, less cyclical markets. At the same time, we have made great progress on our cost reduction program, which is targeting $90 million in annualized savings. Through the end of March, we had already achieved more than two-thirds of that goal and the integration with ISP is progressing largely as expected. While rising raw material costs are always a concern in our business, we have demonstrated a strong ability to effectively manage these challenges through pricing and efficiency improvements," he explained.

"We have good momentum going into the second half of fiscal 2012, with the June quarter typically being our seasonally strongest. We will continue to focus on driving earnings through organic volume growth, margin improvement, cost efficiencies and strategic capital investment. We are well on track for the year and remain confident in our ability to deliver our fiscal 2014 financial targets for sales and earnings growth," O'Brien said.

Conference Call Webcast

Ashland will host a live webcast of its second-quarter conference call with securities analysts at 9 a.m. EDT Tuesday, April 24, 2012. The webcast and supporting materials will be accessible through Ashland's website at http://investor.ashland.com. Following the live event, an archived version of the webcast and supporting materials will be available for 12 months.

Use of Non-GAAP Measures

This news release includes certain non-GAAP (Generally Accepted Accounting Principles) measures. Such measurements are not prepared in accordance with GAAP and should not be construed as an alternative to reported results determined in accordance with GAAP. Management believes the use of such non-GAAP measures assists investors in understanding the ongoing operating performance of the company and its segments. The non-GAAP information provided may not be consistent with the methodologies used by other companies. All non-GAAP amounts have been reconciled with reported GAAP results in Tables 5, 6 and 7 of the financial statements provided with this news release.

Q2 2012 Earnings Press Release Tables Final

Source: Ashland Inc.

Ashland Inc. to transfer a portion of its North American middle market commercial assets

Ashland Inc. to transfer a portion of its North American middle market commercial assets within its Water Technologies business to Rochester Midland Corporation

Ashland Inc. has announced that its subsidiary, Hercules Incorporated, conducting business as Ashland Water Technologies, has entered into a definitive agreement to transfer a portion of its middle market commercial business assets to Rochester Midland Corporation (RMC). The business to be transferred includes roughly 5,000 customer locations, with total annualized revenues of approximately $15 million. Financial terms of the transaction were not disclosed.

Under the agreement, RMC will have the right to make and sell Ashland water treatment products into the North American commercial market. Going forward, Ashland and RMC will be working together to provide high-quality, innovative products and services to this segment.

"The transfer of this portion of our North America commercial business to Rochester Midland is consistent with our decision to focus more on heavy industrial markets, while maintaining our long-standing commitments to our commercial customers," said Paul Raymond, president, Water Technologies. "We believe Rochester Midland is well positioned to serve these customers and grow this business to realize a greater return for both companies, and we look forward to working with them."

"We look forward to a long-term relationship with Ashland Water Technologies in multiple areas of mutual interest in our markets and geographies," added Harlan Calkins, Rochester Midland chief executive officer.

The transaction is expected to close by early May, subject to fulfillment of certain conditions. The parties have agreed to work together to ensure a seamless transition with no disruption in customer service.

Approximately 70 employees who currently work in the business are being transferred. RMC has committed to offering jobs to all of these employees.

Ashland Inc. first-quarter earnings webcast

Ashland Inc. has announced that on Tuesday, Jan. 24, 2012, at 9 a.m. EST, it will conduct a live webcast of its first-quarter earnings presentation to the investment community. The presentation will cover results for the quarter ended Dec. 31, 2011, the first quarter of Ashland's 2012 fiscal year. The company's results will be issued earlier in the day.

In attendance at the presentation will be: James J. O'Brien, chairman and chief executive officer; Lamar M. Chambers, senior vice president and chief financial officer; John E. Panichella, president, Ashland Specialty Ingredients; Paul C. Raymond, president, Ashland Water Technologies; and David A. Neuberger, director, Investor Relations.

The webcast, which will last approximately 60 minutes, will be accessible through Ashland's Investor Relations website, http://investor.ashland.com, along with supporting materials. Following the live event, an archived version of the webcast and supporting materials will be available on the Ashland website for 12 months. Minimum requirements to listen to the webcast include the free Windows MediaPlayer software and a 28.8 Kbps connection to the Internet.

Ashland to expand Polyplasdone(TM) and Polyclar(TM)

Ashland Inc. has announced plans to expand production of Polyplasdone(TM) and Polyclar(TM) crosslinked polyvinylpyrrolidone (PVPP) at its manufacturing facility in Texas City, Texas in response to strong demand. The company plans to complete the addition of a new PVPP production unit at the site by late 2013, reinforcing Ashland's leading position in the market and enabling the company to continue supporting the growing needs of its pharmaceutical and beverage customers.

Polyplasdone(TM) PVPP is a synthetic polymer used globally as a tablet disintegrant and drug dissolution aid in a wide variety of over-the-counter and prescription drug products. Beer and wine producers around the world use Polyclar(TM) PVPP as a filter aid during production to improve the clarity and stability of their products during shipping and storage. As a global leader, Ashland currently has two dedicated PVPP manufacturing units located in Calvert City, Ky. and one located in Texas City that enable Ashland to respond to changing market requirements and increase the security of supply to its customers.

"Ashland is committed to having sufficient manufacturing capacity available to help our customers capitalize on future growth opportunities," said John Panichella, president, Ashland Specialty Ingredients. "We acquired International Specialty Products Inc. because of its growth potential and this major capacity expansion demonstrates our positive outlook and our commitment to growing this business. I am extremely excited about the growth opportunities for the PVPP product line."

"This expansion reinforces our commitment to provide high-value ingredients backed with superior technical support," added Jeff Wolff, group vice president, Pharmaceutical and Nutrition Specialties, Ashland Specialty Ingredients. "Over the next few years, Ashland expects steady growth in PVPP driven by an industry need for formulation ingredients that improve the dissolution of poorly soluble drugs and growth in emerging markets generated by increased demand for generic drug products and consumer demographics. Combining its industry-leading position as a producer of PVPP with its multiple technical support labs around the world, Ashland is well-suited to meet this increasing market demand."

Ashland Specialty Ingredients offers industry-leading products, technologies and resources for solving formulation and product performance challenges in key markets including personal care, pharmaceutical, food and beverage, coatings and energy. Using natural, synthetic and semi-synthetic polymers derived from plant and seed extract, cellulose ethers and vinyl pyrrolidones, Ashland Specialty Ingredients offers comprehensive and innovative solutions for today's demanding consumer and industrial applications.

Ashland Inc. completes announced sale of synlubes business

Ashland Inc. has said that its subsidiary, Hercules Incorporated, has completed the previously announced sale of its aviation and refrigerant lubricants business, a polyol/ester-based synlubes business, to Calumet Missouri, LLC, an assignee of Monument Chemicals Inc. The purchase price was not disclosed. Under the asset purchase agreement, Calumet Missouri obtained a 22-acre parcel that includes the manufacturing facility in Louisiana, Mo., which it plans to continue operating.

Ashland Water Technologies is a leading global producer of papermaking chemicals and a leading specialty chemicals supplier to the pulp, paper, commercial and institutional, food and beverage, chemical processing, mining and municipal markets. Its process, utility and functional chemistries are used to improve operational efficiencies, enhance product quality, protect plant assets and help ensure environmental compliance.

In more than 100 countries, the people of Ashland Inc. (NYSE: ASH) provide the specialty chemicals, technologies and insights to help customers create new and improved products for today and sustainable solutions for tomorrow. Our chemistry is at work every day in a wide variety of markets and applications, including architectural coatings, automotive, construction, energy, food and beverage, personal care, pharmaceutical, tissue and towel, and water treatment. Visit www.ashland.com to see the innovations we offer through our four commercial units - Ashland Specialty Ingredients, Ashland Water Technologies, Ashland Performance Materials and Ashland Consumer Markets.

Ashland Inc. completes sale of PVAc business to Celanese Corp

Ashland Inc. has announced it has completed the previously announced sale of its polyvinyl acetate homopolymer and copolymer (PVAc) business to Celanese Corporation. The proposed transaction included the transfer of the PVAc business, inventory and related technology. The sale does not include any real estate or manufacturing facilities. No purchase price was disclosed.

Ashland's PVAc business includes two brands, Flexbond(TM) and Vinac(TM) emulsions. To better support the transition, the products will be temporarily toll manufactured for Celanese.

Ashland Performance Materials is the global leader in unsaturated polyester resins and vinyl ester resins. In addition, it provides customers with leading technologies in gelcoats, pressure-sensitive and structural adhesives.

In more than 100 countries, the people of Ashland Inc. (NYSE: ASH) provide the specialty chemicals, technologies and insights to help customers create new and improved products for today and sustainable solutions for tomorrow. Our chemistry is at work every day in a wide variety of markets and applications, including architectural coatings, automotive, construction, energy, food and beverage, personal care, pharmaceutical, tissue and towel, and water treatment. Visit www.ashland.com to see the innovations we offer through our four commercial units - Ashland Specialty Ingredients, Ashland Water Technologies, Ashland Performance Materials and Ashland Consumer Markets.

Boni Elected Vice President and Treasurer at Ashland Inc

Ashland Inc. has announced its board of directors has elected Eric Boni as vice president and treasurer of the company, effective December 1, 2011. In addition, John Goswell has been named vice president, internal audit.

Boni succeeds J. Kevin Willis, who in September was named vice president of finance for Ashland Inc. and controller for Ashland Specialty Ingredients. Goswell succeeds John Guldig, who is retiring.

As treasurer, Boni will have responsibility for global treasury operations, long-term finance, trust investments, and risk and insurance. In addition to this role, he will retain responsibility for business analysis until a replacement is named. Boni will continue to report to Lamar Chambers, senior vice president and chief financial officer.

A native of McMurray, Pa., Boni joined Ashland in 1994 and has held several positions of increasing responsibility in corporate and commercial roles. He served as director of investor relations from 2007 to 2010, prior to being named director of business analysis. Boni earned a bachelor's degree in finance from Miami University in Oxford, Ohio, and an M.B.A. in finance and information systems from Indiana University.

Goswell joined Ashland in August via the acquisition of International Specialty Products (ISP). In his role as vice president, internal audit, he will be responsible for Ashland's global internal audit function, including oversight of financial, operational, information technology and environmental, health and safety audits. He will report to Ashland's Audit Committee and administratively to Chambers.

A native of Sydney, Australia, Goswell previously held various senior management roles in audit, information technology, and finance at American Standard Companies, Inc., Bristol-Myers Squibb and Price Waterhouse. He is a certified Chartered Accountant and Information Systems Auditor and holds a bachelor's degree in accounting and computing from Macquarie University in Sydney, Australia.

In more than 100 countries, the people of Ashland Inc. (NYSE: ASH) provide the specialty chemicals, technologies and insights to help customers create new and improved products for today and sustainable solutions for tomorrow. Our chemistry is at work every day in a wide variety of markets and applications, including architectural coatings, automotive, construction, energy, food and beverage, personal care, pharmaceutical, tissue and towel, and water treatment. Visit www.ashland.com to see the innovations we offer through our four commercial units - Ashland Specialty Ingredients, Ashland Water Technologies, Ashland Performance Materials and Ashland Consumer Markets.