Ashland Inc., a global leader in specialty chemical solutions for consumer and industrial markets, today announced preliminary(1) financial results for the quarter ended Mar. 31, 2012, the second quarter of its 2012 fiscal year.

Earnings from continuing operations equal $1.13 per diluted share; adjusted earnings, excluding key items, increased 57 percent to $1.52 per diluted share

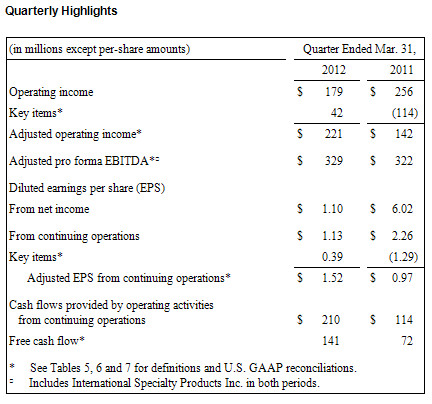

For the second quarter of fiscal 2012, Ashland reported income from continuing operations of $90 million, or $1.13 per diluted share, on sales of $2.1 billion. These results included three key items that together reduced income from continuing operations by approximately $31 million, net of tax, or 39 cents per diluted share. The after-tax charges related to adjustments to stepped-up inventory values from the acquisition of International Specialty Products Inc. (ISP) last August; expenses related to Ashland's integration and cost-reduction program; and a write-off related to pre-construction costs for a previously planned greenfield manufacturing facility in northern China. Excluding these three key items, Ashland's adjusted income from continuing operations was $121 million, or $1.52 per diluted share, an increase of 57 percent versus the year-ago quarter.

For the year-ago quarter, income from continuing operations was $182 million, or $2.26 per diluted share, on sales of $1.6 billion. The year-ago results included four key items that had a combined positive impact of $103 million, net of tax, or $1.29 per diluted share. Excluding these items, adjusted income from continuing operations was 97 cents per diluted share. The March 2011 results do not include ISP or related financing costs associated with that acquisition. (Please refer to Table 5 of the accompanying financial statements for details of key items in both periods.)

Adjusting for the impact of key items in both the current and prior-year quarters and for the acquisition of ISP on a pro forma basis, Ashland's results for the March 2012 quarter as compared with the March 2011 quarter were as follows:

- Sales grew 2 percent to $2.1 billion;

- Operating income rose 4 percent to $221 million;

- Earnings before interest, taxes, depreciation and amortization (EBITDA) increased 2 percent to $329 million; and

- EBITDA as a percent of sales held steady at 15.8 percent.

"I am pleased with Ashland's solid financial performance in the second quarter. Our overall business continues to perform well, with increased sales, stable margins and improved cash flow during the quarter despite some market weakness in certain commercial units," said James J. O'Brien, Ashland chairman and chief executive officer. "Ashland Specialty Ingredients achieved another strong quarter with double-digit sales and earnings increases, and good sales growth in all regions of the world. With last year's acquisition of International Specialty Products, we have strengthened our position in higher-margin growth markets and we are seeing the benefit to our bottom-line results. Also during the quarter, Ashland Performance Materials had improved pricing and stronger demand in the North American market. Although Ashland Consumer Markets was down versus the prior year due to softness in the domestic market, its performance improved when compared to the first quarter. Ashland Water Technologies continues to face a challenging demand environment, with lower volumes more than offsetting the benefit from improved pricing in the quarter."

Business Segment Performance

In order to aid understanding of Ashland's ongoing business performance, the results of Ashland's business segments are presented on an adjusted or pro forma adjusted basis, and EBITDA is reconciled to operating income in Tables 7 and 8 of this news release.

Ashland Specialty Ingredients reported sales of $723 million for the March 2012 quarter, an increase of 11 percent when compared to a year ago on a pro forma basis. EBITDA rose 12 percent, to $186 million, while EBITDA as a percent of sales was 25.7 percent, an increase of 10 basis points versus the year-ago quarter. Each of Specialty Ingredients' businesses performed well during the quarter, with particularly impressive performance from the Energy, Construction and Specialty Performance businesses. Specialty Ingredients represents the largest commercial unit within Ashland, comprising 56 percent of the company's consolidated EBITDA on a trailing 12-month basis.

Ashland Performance Materials reported sales of $408 million, a 4-percent decrease from the March 2011 quarter on the same pro forma basis, which includes the results of ISP's elastomers business. Excluding effects associated with our Casting Solutions joint venture and the recently divested PVAc business, year-over-year sales for Performance Materials rose 4 percent. EBITDA increased 9 percent, to $35 million, while EBITDA as a percent of sales grew 110 basis points to 8.6 percent.

Sales at Ashland Consumer Markets rose 6 percent, to $520 million, when compared to a year ago. EBITDA totaled $66 million, a decline of 10 percent versus a year ago, while EBITDA as a percent of sales was 12.7 percent, a decline of 220 basis points from March 2011. However, EBITDA was higher on a sequential basis when compared to the December 2011 quarter due to seasonal volume increases, increased pricing and lower raw material costs.

Ashland Water Technologies' sales totaled $428 million in the March 2012 quarter, a decline of 9 percent from the year-ago quarter. EBITDA was $39 million, a 24-percent decline from March 2011. EBITDA as a percent of sales was 9.1 percent, down 170 basis points. Lower volumes remain the primary challenge within Water Technologies' business. Water Technologies has taken a number of steps over the past year to refocus its business on higher-margin, higher-growth opportunities, and these actions should lead to improved results over time.This includes the divestiture of our synlubes business and the repositioning of our middle-market commercial business through a well-established distributor. The latter decision, announced last week, will eliminate the high costs associated with servicing approximately 5,000 customer locations that together generated only $15 million in annualized sales.

After excluding the effects from key items, Ashland's effective tax rate for the March 2012 quarter was 27 percent. Given our ongoing work in this area and a refinement of some of our initial assumptions, we now expect Ashland's tax rate for the full year to be in the range of 28-30 percent.

Outlook

Looking ahead, O'Brien said he is confident about Ashland's growth opportunities and business performance.

"Our year-to-date financial performance provides clear evidence of the strategic benefits provided by the addition of ISP's higher-margin business portfolio. Specialty chemicals are now the core of our business, and we are beginning to see the improved earnings power that comes with this focus on higher-growth, less cyclical markets. At the same time, we have made great progress on our cost reduction program, which is targeting $90 million in annualized savings. Through the end of March, we had already achieved more than two-thirds of that goal and the integration with ISP is progressing largely as expected. While rising raw material costs are always a concern in our business, we have demonstrated a strong ability to effectively manage these challenges through pricing and efficiency improvements," he explained.

"We have good momentum going into the second half of fiscal 2012, with the June quarter typically being our seasonally strongest. We will continue to focus on driving earnings through organic volume growth, margin improvement, cost efficiencies and strategic capital investment. We are well on track for the year and remain confident in our ability to deliver our fiscal 2014 financial targets for sales and earnings growth," O'Brien said.

Conference Call Webcast

Ashland will host a live webcast of its second-quarter conference call with securities analysts at 9 a.m. EDT Tuesday, April 24, 2012. The webcast and supporting materials will be accessible through Ashland's website at http://investor.ashland.com. Following the live event, an archived version of the webcast and supporting materials will be available for 12 months.

Use of Non-GAAP Measures

This news release includes certain non-GAAP (Generally Accepted Accounting Principles) measures. Such measurements are not prepared in accordance with GAAP and should not be construed as an alternative to reported results determined in accordance with GAAP. Management believes the use of such non-GAAP measures assists investors in understanding the ongoing operating performance of the company and its segments. The non-GAAP information provided may not be consistent with the methodologies used by other companies. All non-GAAP amounts have been reconciled with reported GAAP results in Tables 5, 6 and 7 of the financial statements provided with this news release.

Q2 2012 Earnings Press Release Tables Final

Source: Ashland Inc.