Displaying items by tag: Kemira

Paper mills compete on the Kemira sponsored Water Efficiency Award

The annual PPI Awards recognize the achievements of companies, mills and individuals in the pulp and paper sector. The awards provide an opportunity for pulp and papermakers worldwide to show off their strategic accomplishment as well as achievements in leadership, vision, and innovation on a global platform.

Kemira participates in PPI Awards 2012 by sponsoring the Water Efficiency Award. “Water is a vital resource for the pulp and paper sector and the topic is becoming even more important as the global spotlight falls on the possible shortage in the future”, says Kenneth Nysten, Senior Vice President, Printing & Writing, Paper. “The worsening imbalance between water demand and supply will require new water treatment solutions, especially such that can increase water reuse and enable utilization of poor-quality raw water sources. The winner of this award will be the mill that has clearly reduced the need for raw water while at the same time demonstrating that it is maximizing water reuse by filtering and circulation.”

The finalists in the Water Efficiency Award category are:

- Bignardi Papeis, Brazil

- BILT Graphic Paper Products Limited, Bhigwan Unit, India

- Cascades Candiac Mill, Canada

- Klabin Monte Alegre, Brazil

- Shandong Sun Paper Industry Joint Stock Co, Ltd, China

- Tamil Nadu Newsprint and Papers Ltd, India

The PPI Awards 2012 will be held in Brussels, Belgium on November 12, 2012 alongside the CEPI European Paper Week event. The finalists of each category have been chosen by an international panel of independent judges made up of industry experts. The finalists are invited to attend a gala dinner where the winners are revealed. Winners are presented with their trophies by the sponsor of each category and a celebrity host. More information at www.ppiawards.com.

Kemira to start co-determination negotiations in Finland

Kemira announced on July 26, 2012 that it will start a global restructuring program "Fit for Growth" to improve the company's profitability, internal efficiency and to accelerate growth in the emerging markets. Kemira also announced that the implementation of the measures related to the program may ultimately lead to the reduction of up to 600 positions globally, from which approximately 250 could be reductions in Finland.

Kemira will start co-determination negotiations in Finland which will affect all employees working at the following group's Finnish sites: Helsinki, Espoo, Oulu, Sastamala, Kuusankoski, Joutseno, Vaasa and Harjavalta. The invitation to the negotiations was given to the employee representatives today, on August 6, 2012. At the end of June 2012, Kemira had 5,181 employees from which 1,259 were located in Finland.

"The number of employees affected by the possible personnel reduction has now been specified and the measures related to the program may affect approximately 260 employees' work in Finland. During the negotiations we will examine e.g. internal transfers, retirement arrangements and outsourcing. Although we are not planning to close our sites in Finland, the possibility of some direct layoffs cannot unfortunately be ruled out. The number of possible direct layoffs will be defined during the negotiations. Our aim is to complete the negotiations within the 6 weeks negotiation period," says Jukka Oinonen, Vice President, Human Resources, Finland.

The cost savings target with the planned "Fit for Growth" program is EUR 60 million on an annualized basis once the program is fully implemented. Non-recurring charges related to the "Fit for Growth" program are estimated to be around EUR 85 million. These charges are expected to be accounted for within the next four quarters.

Organizational restructuring also affects Kemira's sites outside Finland and the negotiations in the sites affected by the possible personnel reductions will proceed in each country according to the local legislation. Kemira has operations in around 40 countries.

Kemira announces global restructuring program "Fit for Growth" within the context of a new organization

Kemira Oyj announces a global restructuring program "Fit for Growth" to improve the company's profitability, internal efficiency and to accelerate growth in the emerging markets. The cost savings target with the planned program is EUR 60 million on an annualized basis once the program is fully implemented. The goal of the planned program is to reach Kemira Group's financial targets for revenue growth and EBIT margin. The growth target for Kemira is above 3% in the mature markets and above 7% in the emerging markets. Kemira's EBIT margin target is at least 10%. Non-recurring charges related to the "Fit for Growth" program are estimated to be around EUR 85 million. These charges are expected to be accounted for within the next four quarters.

The planned group-wide restructuring program is based on the following key measures:

- Reducing internal complexity by renewing and simplifying the organizational structure in order to foster accelerated growth, innovation and application focus

- Improving internal efficiency by reducing organizational layers and by placing substantial responsibility into the regions by implementing regional business units reporting to the segment heads with full profit and loss responsibility

- Optimizing and rebalancing the manufacturing network

The implementation of these measures may ultimately lead to the reduction of up to 600 positions globally, from which approximately 250 could be reductions in Finland. Kemira will initiate the co-determination negotiations according to each country's local legislation. Kemira had 5,181 employees worldwide at the end of June 2012.

Kemira will also consolidate its management structure. As of October 1, 2012, there will be one Management Board lead by the CEO. This Board will replace the previous Strategic Management and Business Management Boards. The Management Board is responsible for securing the long-term strategic development of the company. The members of the Management Board as of October 1, 2012 are listed in the attached chart.

"Since I assumed responsibility as the CEO of Kemira, my most evident key priorities for Kemira going forward are: improving profitability, accelerating growth in Asia and South America without sacrificing business opportunities in the mature markets and sharpening the strategy. We have started to work in all three areas. The second quarter results underlined the fact that these restructuring plans are needed in order to ensure sustainable profitability and competitive strength for Kemira," says Wolfgang Büchele, CEO of Kemira.

"I understand that these plans may affect people and their families, and we will support our people during these changes," says Wolfgang Büchele.

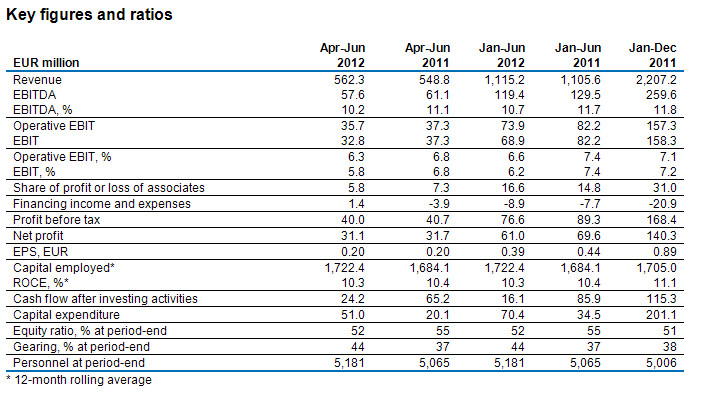

Kemira Oyj's Interim Report January-June 2012

Sales volumes and prices improved from Q1, fixed cost pressure continued

Second quarter:

- Revenue grew 2% to EUR 562.3 million (548.8) supported by favourable currency exchange.

- Operative EBIT decreased 4% to EUR 35.7 million (37.3) with a margin of 6.3% (6.8%) mainly due to higher fixed costs.

- Earnings per share remained at EUR 0.20 (0.20).

January-June:

- Revenue increased 1% to EUR 1,115.2 million (1,105.6).

- Operative EBIT decreased 10% to EUR 73.9 million (82.2) with a margin of 6.6% (7.4%).

- Earnings per share decreased 11% to EUR 0.39 (0.44).

- Kemira outlook for 2012 remains unchanged with expected revenue and operative EBIT in 2012 to be approximately at the same level as in 2011.

- To accelerate growth and improve profitability, Kemira has launched a global restructuring program "Fit for Growth" aimed to save EUR 60 million on an annualized basis.

Kemira's President and CEO Wolfgang Büchele:

"In the second quarter Kemira once again was able to compensate the lower sales volumes and higher raw material prices with sales price increases. In Paper, as well as in Municipal & Industrial, sales volumes recovered slightly. Fixed costs, however, continued to increase in all segments and resulted in a decrease in the operative EBIT. ChemSolutions operative EBIT decreased substantially mainly due to an extended maintenance shutdown of ChemSolutions' Oulu plant in Finland as well as higher variable costs.

After the first half of 2012, Kemira's operative EBIT is below the comparable period of 2011.

Our profitability is the fundamental issue we need to improve in order to continue to be a relevant player within the water quality and quantity management business, and to meet our guidance for 2012.

Therefore, Kemira announced today its global restructuring program "Fit for Growth" to improve the company's profitability, internal efficiency and to accelerate growth in emerging markets. The cost savings target with the planned program is EUR 60 million on an annualized basis. The ultimate goal of the program is to reach Kemira's financial targets in an accelerated mode. Revenue growth target for Kemira is above 3% in the mature markets and 7% in the emerging markets. Kemira's EBIT margin target is at least 10%.

The "Fit for Growth" restructuring program is based on the following measures:

- Reducing internal complexity by renewing and simplifying the organizational structure in order to foster accelerated growth, innovation and application focus.

- Improving internal efficiency by reducing organizational layers and by placing substantial responsibility into the regions by implementing regional business units reporting to the segment heads with full profit and loss responsibility.

- Optimizing and rebalancing the manufacturing network.

The implementation of these measures may ultimately lead to a reduction of up to 600 positions globally, from which approximately 250 could be in Finland. Kemira will initiate the co-determination negotiations according to each country's local legislation. Kemira had 5,181 employees worldwide at the end of June 2012.

Definitions of key figures are available at www.kemira.com > Investors > Financial information. Comparative 2011 figures are provided in parentheses for some financial results, where appropriate. Operating profit, excluding non-recurring items, is referred to as Operative EBIT. Operating profit is referred to as EBIT.

Outlook and restructuring program

Kemira's vision is to be a leading water chemistry company. Kemira will continue to focus on improving profitability and reinforcing positive cash flow. The company will also continue to invest in order to secure the future growth in the water quality and quantity management business.

Kemira's financial targets remain as earlier communicated. The company's medium term financial targets are:

- revenue growth in mature markets > 3% per year, and in emerging markets > 7% per year

- EBIT, % of revenue > 10%

- positive cash flow after investments and dividends

- gearing level < 60%.

The basis for growth is the expanding water chemicals market and Kemira's strong know-how in the water quality and quantity management. Increasing water shortage, tightening legislation and customers' needs to increase operational efficiency create opportunities for Kemira to develop new water applications for both current and new customers. Investment in research and development is a central part of Kemira's strategy. The focus of Kemira's research and development activities is on the development and commercialization of the new innovative technologies for Kemira's customers globally and locally.

Today, Kemira Oyj announced a global restructuring program "Fit for Growth" to improve the company's profitability, its internal efficiency and to accelerate growth in emerging markets without sacrificing business opportunities in the mature markets. The cost savings target with the planned program is EUR 60 million on an annualized basis. The ultimate goal of the program is to reach Kemira Group's targets for revenue growth and EBIT margin.

The program is based on the following measures:

- Reducing internal complexity by renewing and simplifying the organizational structure in order to foster accelerated growth, innovation and application focus.

- Improving internal efficiency by reducing organizational layers and by placing substantial responsibility into the regions by implementing regional business units reporting to the segment heads with full profit and loss responsibility.

- Optimizing and rebalancing the manufacturing network.

The implementation of these measures may ultimately lead to a reduction of up to 600 positions globally, from which approximately 250 could be in Finland. Kemira will initiate the co-determination negotiations according to each country's local legislation. Kemira had 5,181 employees worldwide at the end of June 2012.

Non-recurring charges related to the restructuring program are estimated to be around EUR 85 million. These charges are expected to be accounted for within the next four quarters.

In 2012, Kemira expects the revenue and operative EBIT to be at approximately the same level as in 2011. In the near term, an uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products in the customer industries. This guidance assumes current currency exchange rates and oil price level.

Financial calendar 2012 and 2013

Interim Report January-September 2012 October 24, 2012

Financial results for the year 2012 February 6, 2013

Interim Report January-March 2013 April 23, 2013

Interim Report January-June 2013 July 23, 2013

Interim Report January-September 2013 October 22, 2013

Kemira to publish January-June 2012 results on July 26, 2012

Kemira Oyj will publish its second quarter 2012 results on Thursday, July 26 around 8.30 am Finnish time (6.30 am UK time).

Kemira will arrange a press conference for analysts and the media starting at 10.00 am (8.00 am UK time) at Kemira House, Porkkalankatu 3, Helsinki. In the conference, Kemira's President and CEO Wolfgang Büchele and Chief Financial Officer Jyrki Mäki-Kala will present the results. The press conference will be held in English and will be webcasted at www.kemira.com. Presentation material will be available on Kemira's website at www.kemira.com under Investors in English and at www.kemira.fi in Finnish at about 10.00 am.

Conference call in connection to the press and analyst conference

You can also listen to the conference live over the phone and attend the Q&A session via a conference call. In order to participate in the call, please dial +44 (0)20 7162 0025, code 920266 ten minutes before the conference begins. A recording of the conference call will be available on Kemira's website later the same day.

Kemira launches KemFlite™ to eliminate paper machine deposition

Kemira is introducing KemFlite™, a new concept to reduce paper and board machine problems that are caused by deposits due to the agglomeration of hydrophobic particles. These particles typically originate from wood pitch, stickies or binders in coated broke and have previously been difficult to detect and control. Under certain conditions the particles agglomerate to a larger size and eventually deposit on paper machine wet-end surfaces, wires, felts and dryer cans.

KemFlite is designed to manage the hydrophobic substances, particularly their size, before they form deposits. The concept combines Kemira’s deep papermaking process know-how, with its broad deposit control product portfolio and powerful new analysis and monitoring tools.

These tools include Kemira Flyto™, a unique laboratory analysis to measure the particle size, quantity and hydrophobicity in samples taken from key points in the process, and Kemira AutoFlite™, a new on-line device that continuously provides similar information.

Following a complete mill survey by Kemira’s application experts, a tailor-made deposit control program can be implemented to manage the hydrophobic substances found in the mill process waters and eliminate machine deposition. The KemFlite concept has been proven in numerous mill cases where it has improved machine runnability and reduced defects like holes, spots, specks and hickeys in the final paper or board product.

“KemFlite is a concept that pools together a range of Kemira products and our process know-how in a consolidated package, directly addressing the problems customers have with deposit control on paper machines,” explains Chris Lewis, Regional Applications Manager, Paper.

The result for papermakers is smoother operation, decreased downtime, better cost efficiency, reduced chemical consumption and improved finished paper and board quality.

To learn more about how KemFlite can help you solve deposit problems due to pitch, stickies and binder particles go to www.kemira.com/kemflite

Kemira's associated company Sachtleben to acquire crenox titanium dioxide production assets and inventory

Kemira Oyj's and Rockwood Holdings Inc.'s titanium dioxide (TiO2) joint venture Sachtleben GmbH has reached an agreement to acquire the TiO2 production assets and inventory of crenox GmbH, based in Krefeld, Germany, from the insolvency administrator. The acquisition is expected to close by mid-July, subject to completion of due diligence, government approvals and other conditions.

Sachtleben will acquire the crenox Krefeld-Uerdingen plant and all inventory of the facility. The acquisition will add over 100,000 metric tons of TiO2 production, increasing total capacity to approximately 340,000 metric tons, further enhancing Sachtleben's position as a leading global supplier of high quality TiO2 pigments.

The joint venture Sachtleben (Kemira ownership 39% in the joint venture), which was formed in August 2008 by combining Kemira Oyj's and Rockwood's TiO2 businesses, is a leading producer of specialty TiO2 pigments for the synthetic fiber, packaging inks, cosmetics, pharmaceutical and food industries.

Kemira's associated company Sachtleben signed EUR 430 million credit facility

Kemira Oyj and Rockwood Holdings Inc. titanium dioxide joint venture Sachtleben Gmbh completed the financing of a new facility agreement in the aggregate amount of EUR 430 million. The proceeds of the facility will be used to repay the outstanding balance of the existing facility agreement, pay a dividend to the joint venture partners and other corporate purposes. The facility has a maturity of five years.

The joint venture Sachtleben, which was formed in August 2008 by combining Kemira Oyj's (Kemira ownership 39% in the joint venture) and Rockwood's TiO2 businesses, is a leading producer of specialty TiO2 pigments for the synthetic fiber, packaging inks, cosmetics, pharmaceutical and food industries.

Kemira is a global over two billion euro water chemistry company that is focused on serving customers in water-intensive industries. The company offers water quality and quantity management that improves customers' energy, water, and raw material efficiency. Kemira's vision is to be a leading water chemistry company.

Kemira establishes local R&D in Alberta, Canada

Kemira has opened a Research & Development projects laboratory in Alberta, Canada on May 1, 2012. The laboratory, located on the campus of the University of Alberta, will be an extension of Kemira's North American R&D, headquartered in Atlanta.

"This facility demonstrates Kemira's commitment to Alberta and to the research work in the area of water quality and quantity management addressing water consumption, reuse and recycling by the in situ oil sands extraction industry. In addition, this facility establishes a local Kemira presence within the academic and technical center of oil sands related research and innovation", says Mohan Nair, Senior Manager Oil & Gas R&D.

The new laboratory also provides a technology stage to showcase and demonstrate Kemira's novel solutions to targeted audiences such as the various oil sands producers. In addition, the new site supports Kemira's regional growth in the conventional oil and gas marketplace, e.g. stimulation, drilling and cementing.

Kemira Oil & Mining offers a large selection of innovative chemical extraction and process solutions for the oil and mining industries, where water plays a central role. Utilizing our expertise, we enable our customers to improve efficiency and productivity.

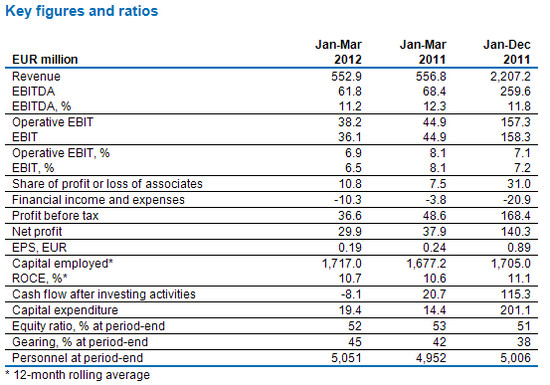

Kemira Oyj's Interim Report January-March 2012

Kemira Oyj's Interim Report January-March 2012: Stable revenue and sales margin offset by higher fixed costs

- Revenue remained stable at EUR 552.9 million (556.8).

- Operative EBIT decreased 15% to EUR 38.2 million (44.9) with a margin of 6.9% (8.1%) mainly due to higher fixed costs.

- Earnings per share decreased 21% to EUR 0.19 (0.24) mainly due to changes in fair values of electricity derivatives.

- Kemira outlook for 2012 is revised from the 2011 year-end report. Kemira expects revenue and operative EBIT in 2012 to be approximately at the same level than in 2011.

Kemira's President and CEO Wolfgang Büchele:

"Kemira's revenue and operative EBIT improved at the beginning of the year compared to the challenging fourth quarter of 2011. Compared to the first quarter of 2011, Kemira was able to compensate the lower sales volumes and higher raw material prices with the sales price increases. However, our fixed costs increased in all segments and resulted in a decrease in the operative EBIT.

Kemira will continue to focus on the water and more specifically on the water quality and quantity management. This is a unique aspect in the chemical industry. Now we are focusing on the following priorities:

First of all, we have to get into an accelerated mode in order to reach our EBIT financial target of 10% by improving our internal efficiency. This will be achieved by reducing the complexity of our business while growing profitably at the same time.

Secondly, as the fastest growth of water related business will be in Asia and South America, we have to substantially strengthen our position there.

Lastly, we need to sharpen our strategy and to make it more tangible for everyone.

I assumed the position of CEO on April 1, 2012 but already prior to that I have spent time meeting Kemira employees. What impressed me most was the energy and enthusiasm of our people. As one Kemira, we will together leverage our market potential and create value for the company and its stakeholders.

In the near term, uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products. Kemira expects revenue and operative EBIT in 2012 to be approximately at the same level than in 2011. This guidance assumes that no major macroeconomic disruption and/or further substantial increase in oil price would occur."

Definitions of key figures are available at www.kemira.com > Investors > Financial information. Comparative 2011 figures are provided in parentheses for some financial results, where appropriate. Operating profit, excluding non-recurring items, is referred to as Operative EBIT. Operating profit is referred to as EBIT.

Outlook (revised)

Kemira's vision is to be a leading water chemistry company. Kemira will continue to focus on improving profitability and reinforcing positive cash flow. The company will also continue to invest in order to secure the future growth in the water business.

Kemira's financial targets remain as communicated in connection with the Capital Markets Day in September 2010. The company's medium term financial targets are:

- revenue growth in mature markets > 3% per year, and in emerging markets > 7% per year

- EBIT, % of revenue > 10%

- positive cash flow after investments and dividends

- gearing level < 60%.

The basis for growth is the expanding water chemicals markets and Kemira's strong know-how in the water quality and quantity management. Increasing water shortage, tightening legislation and customers' needs to increase operational efficiency create opportunities for Kemira to develop new water applications for both current and new customers. Investment in research and development is a central part of Kemira's strategy. The focus of Kemira's research and development activities is on the development and commercialization of the new innovative technologies for Kemira's customers globally and locally.

In the near term, an uncertainty in Europe and a slowdown in global economic growth may affect the demand for our products in the customer industries. In 2012, Kemira expects the revenue and operative EBIT to be approximately at the same level than in 2011. This guidance assumes that no major macroeconomic disruption and/or further substantial increase in oil price would occur.