Ianadmin

Valmet and Orora's Botany Mill renewed the services agreement

Valmet and Orora Limited have signed a multi-year agreement to continue the supply of maintenance and technology services for board making line 'B9' at Orora's Botany Mill in New South Wales, Australia.

The value of the agreement will not be disclosed. The agreement will be effective as of July 1, 2017.

Continuation of good cooperation

Valmet supplied the complete B9 containerboard line in 2012 and took full responsibility for establishing the maintenance operations, mill maintenance services, management of several improvement projects and the mill utilities since start-up.

Valmet and Orora signed an agreement to continue the journey forward

Valmet and Orora signed an agreement to continue the journey forward

"Valmet is one of our key partners and supports B9's operation as a world class paper mill. Orora and Valmet have worked closely together over the past five years and we have renewed the maintenance agreement to continue our cooperative relationship. The new agreement offers our business many benefits and we look forward to working with Valmet to maintain and enhance the high performance of the B9 facility," says Scott Beckett, Maintenance & Engineering Manager, Botany Mill, Orora Limited.

"We are fully engaged and integrated into one B9 team and have been working side by side to deliver steady results in all areas since the machine's start-up. The renewal of this maintenance agreement is the best acknowledgement of what we have achieved over the years together with Orora. We're happy to share the journey forward with the B9 team to continuously improve the performance of the equipment and process, and keep B9 as a safe and stimulating place to work," says Pierre De Villiers, General Manager for Valmet in Australia and New Zealand.

Information about Valmet's delivery

Extended scope in the renewed maintenance outsourcing agreement includes a 'Booster Package' targeting clear and systematic development of planned and unplanned downtime to best in class levels. The maintenance agreement also includes comprehensive automation services, enabling the maintenance team to monitor the process, perform troubleshooting and corrections remotely, and utilize the acquired data to optimize the process operation through the Valmet Industrial Internet.

Other complementary agreements with Orora and its B9 facility include a Cooperation Agreement in which Valmet process experts and board makers work together to optimize various processes.

About Orora Limited

Orora Limited is a AUD 3.8 billion public company, offering a range of tailored packaging and visual communication solutions. The company employs more than 6,500 people across 131 sites in seven countries. Orora is headquartered in Melbourne, Australia and is listed on the Australian Securities Exchange.

Located in Botany, New South Wales, Orora's Botany Mill produces high quality recycled packaging paper, which is then primarily converted into corrugated board by Orora's Fibre Packaging business in Australia and New Zealand.

Valmet is the leading global developer and supplier of process technologies, automation and services for the pulp, paper and energy industries. We aim to become the global champion in serving our customers.

Valmet's strong technology offering includes pulp mills, tissue, board and paper production lines, as well as power plants for bioenergy production. Our advanced services and automation solutions improve the reliability and performance of our customers' processes and enhance the effective utilization of raw materials and energy.

Valmet's net sales in 2016 were approximately EUR 2.9 billion. Our 12,000 professionals around the world work close to our customers and are committed to moving our customers' performance forward - every day. Valmet's head office is in Espoo, Finland and its shares are listed on the Nasdaq Helsinki.

ANDRITZ AG to supply five circulating fluidized bed boilers to Nine Dragons Paper, China

International Technology Group ANDRITZ has received an order from Nine Dragons Paper (Holdings) Ltd. to supply a total of five circulating fluidized bed boilers (Powerfluid) for utilization of in-house residual materials. The boilers will be installed at the company‘s locations in Taicang, Quanzhou, Yongxin, Chongqing, and Dongguan. Start-up is scheduled for the second half of 2018.

ANDRITZ circulating fluidized bed boiler for Nine Dragons Paper, China “Photo: ANDRITZ”.Only waste from recycling of waste paper (rejects, sludges) undergoes thermal utilization, and the high-pressure steam produced is used to generate electricity and supply the Nine Dragons paper mills with process steam.

ANDRITZ circulating fluidized bed boiler for Nine Dragons Paper, China “Photo: ANDRITZ”.Only waste from recycling of waste paper (rejects, sludges) undergoes thermal utilization, and the high-pressure steam produced is used to generate electricity and supply the Nine Dragons paper mills with process steam.

Rejects and sludge are a considerable challenge in boiler operations due to the corrosive substances and impurities they contain, and they require a special design in this regard. As global market leader in this field, ANDRITZ has extensive know-how with numerous references worldwide and offers fluidized bed boilers for these special fuels.

Nine Dragons Paper is the largest paper producer in Asia and leads the field in resource-saving paper production, observing the most stringent environmental standards. The five plants ordered from ANDRITZ are also designed for significantly lower flue gas emissions than those required by European legislation. The order from Nine Dragons Paper confirms ANDRITZ’s leading position in circulating fluidized bed technology and is also ANDRITZ’s return to the Chinese power boiler market after an absence of almost 20 years.

The ANDRITZ GROUP

ANDRITZ is a globally leading supplier of plants, equipment, and services for hydropower stations, the pulp and paper industry, the metalworking and steel industries, and for solid/liquid separation in the municipal and industrial sectors as well as for animal feed and biomass pelleting. Other important business segments include automation and service business. In addition, the international Group is also active in the power generating sector (steam boiler plants, biomass boilers, recovery boilers, and gasification plants) and in environmental technology (flue gas cleaning plants) and offers equipment for the production of nonwovens, dissolving pulp, and panelboard as well as recycling plants. The publicly listed technology Group is headquartered in Graz, Austria, and has a staff of approximately 25,200 employees. ANDRITZ operates more than 250 sites in over 40 countries.

Metsä Board launches its unified offering of products and services

The Better with Less initiative highlights the company’s aims to improve consumer experience and make packaging even more sustainable

Metsä Board launches its clarified product and service portfolio on May 4th at Interpack in Düsseldorf. The company presents its offering of premium paperboards and related services, with focus on contributing to even more sustainable, safe and efficient packaging, now found under one Metsä Board family.

The Better with Less initiative showcases Metsä Board’s aim to create, together with its customers, considered and innovative, renewable contemporary packaging solutions fitting brands and demands of the future world.

“Consumers expect better experiences with less environmental impact. Brand owners are looking at how to optimise packaging to be more sustainable, safer and lighter in weight. We are known for our pioneering expertise in high-quality, lightweight paperboards and are committed to improving further. Now with our unified product portfolio and targeted services we can provide even stronger support to our customers to jointly improve sustainability and efficiency of packaging throughout the value chain,” says Mika Joukio, CEO of Metsä Board.

As part of the launch Metsä Board renews the product names of its premium quality lightweight paperboards to bring the offering to customers in a clearer way that makes product selection even easier. The three service areas – Packaging Analysis & Design, Availability Services and Technical Expertise and R&D – complement the products and provide collaboration initiatives for joint development with customers to develop better and lighter packaging.

While the company’s offering and product names will be harmonised, the products and their specifications will remain unchanged. All Metsä Board mills hold PEFC™ and FSC® Chain-of-Custody certificates, as well as the highest environmental and manufacturing quality standards. Metsä Board’s paperboards use fresh forest fibres from sustainably managed northern European forests.

The new brand imagery was created with a Stockholm based photographer and image maker Carl Kleiner. Kleiner is known for creating playful, high quality and eye-catching visuals for global companies such as Calvin Klein, Google, Hermès, H&M and Nike. The new brand visuals utilise the Metsä Group Moose symbol’s angular forms to design a striking category colour coded visual. All the images were crafted by hand, through precise printing, cutting, layering of Metsä Board’s board materials.

Metsä Board

www.metsaboard.com

Metsä Board is a leading European producer of premium fresh fibre paperboards including folding boxboards, food service boards and white kraftliners. Our lightweight paperboards are developed to provide better, safer and more sustainable solutions for consumer goods as well as retail-ready and food service applications. We work together with our customers on a global scale to innovate solutions for better consumer experiences with less environmental impact. The pure fresh fibres Metsä Board uses are a renewable resource, traceable to origin in sustainably managed northern forests.

The global sales network of Metsä Board supports customers worldwide, including brand owners, retailers, converters and merchants. In 2016, the company’s sales totalled EUR 1.7 billion, and it has approximately 2,500 employees. Metsä Board, part of Metsä Group, is listed on the Nasdaq Helsinki.

Metsä Group

www.metsagroup.com

Metsä Group is a forerunner in bioeconomy utilising renewable wood from sustainably managed northern forests. Metsä Group focuses on wood supply and forest services, wood products, pulp, fresh fibre paperboards and tissue and cooking papers.

Metsä Group’s sales totalled EUR 4.7 billion in 2016, and it employs approximately 9,300 people. The Group operates in some 30 countries. Metsäliitto Cooperative is the parent company of Metsä Group and owned by approximately 104,000 Finnish forest owners.

U.S. Paper Recovery Rate Reaches Record 67.2 Percent in 2016

The American Forest & Paper Association (AF&PA) has just announced that a record 67.2 percent of paper consumed in the U.S. was recovered for recycling in 2016.

U.S. paper recovery rate statistics are available at www.paperrecycles.org/statistics.

U.S. paper recovery rate statistics are available at www.paperrecycles.org/statistics.

“The voluntary, market-driven recovery system, the millions of Americans who recycle every day, and industry efforts to inform consumers about the importance of paper recycling continue to enable a high U.S. paper recovery rate,” said AF&PA President and CEO Donna Harman.

“Paper recovery for recycling helps extend the useful life of paper and paper-based packaging products, making it an integral part of our industry’s sustainability story,” said AF&PA Board Chair and Clearwater Paper Corporation President and CEO Linda Massman.

The annual paper recovery rate has doubled since 1990 and U.S. paper recovery has met or exceeded 63 percent for the past eight years. The industry has a goal to exceed 70 percent paper recovery for recycling by 2020 as part of its Better Practices, Better Planet 2020 sustainability initiative.

For more information about paper recycling, including statistics and other resources, visit paperrecycles.org.

The American Forest & Paper Association (AF&PA) serves to advance a sustainable U.S. pulp, paper, packaging, tissue and wood products manufacturing industry through fact-based public policy and marketplace advocacy. AF&PA member companies make products essential for everyday life from renewable and recyclable resources and are committed to continuous improvement through the industry’s sustainability initiative - Better Practices, Better Planet 2020. The forest products industry accounts for approximately 4 percent of the total U.S. manufacturing GDP, manufactures over $200 billion in products annually, and employs approximately 900,000 men and women. The industry meets a payroll of approximately $50 billion annually and is among the top 10 manufacturing sector employers in 45 states. Visit AF&PA online at www.afandpa.org

How is M&A activity shaping the European tissue industry?

Pirkko Petäjä, Principal at Pöyry Management Consulting, and Mikko Helin, Senior Consultant

Since 2000, the European tissue volume has grown from 5.7 million tons to almost 8.5 million tons. A clear trend connected to this growth has been consolidation of the largest players.

Consolidation is a clear trend in the European tissue industry

The large producers have been growing through sizeable acquisitions, as well as by organic growth. The most active acquirers have been SCA, Sofidel and WEPA, while all of the mentioned, and in addition ICTTronchetti, have also been active builders of new capacity. The capacity share of the three largest players has grown from approximately 40% to 50%.

The large producers have been growing through sizeable acquisitions, as well as by organic growth. The most active acquirers have been SCA, Sofidel and WEPA, while all of the mentioned, and in addition ICTTronchetti, have also been active builders of new capacity. The capacity share of the three largest players has grown from approximately 40% to 50%.

The business environment is better in a consolidated market. The impact of consolidation is also reflected in the performance of individual companies; after the consolidation steps in Europe, SCA’s tissue business experienced evidently higher and more stable margins. While large companies have been becoming even larger, there has been a continuous stream of new entrants to the tissue business, as barriers to entry are relatively low. The Eastern European industry especially is still fairly fragmented, and consolidation could significantly improve this business environment.

European tissue M&A over the last 15 years

The leading European tissue companies have targeted major strategic acquisitions, such as SCA’s acquisition of P&G and G-P, Sofidel’s acquisition of LPC and WEPA’s of Kartogroup. These deals have resulted in significant synergy benefits and positively impacted the business environment. There is, however, a limited number of opportunities for large acquisitions. Finding one buyer for all, or the majority of, assets has become difficult. This has led K-C to actively divest its less profitable units and locations, where it does not have ‘number 1 brand position’. Since 2000, K-C has divested some 300,000 t/a tissue capacity as individual mills to different buyers.

In the same time period, most of the largest companies in the industry have made a clear transformation through acquisitions. SCA, the clear leader in the M&A activity, has more than doubled its size in the last 15 years. Sofidel first expanded throughout Europe with new mills, and then through acquisitions. Sofidel has grown into a million ton company, and has recently started to expand outside of Europe. WEPA made one of the biggest leaps by first acquiring Kartogroup, and more recently through active organic growth and complementary smaller acquisitions. Kimberly Clark has been a clear exception - its capacity in Europe has reduced over 30%. Metsä Tissue has been stagnant. The last acquisition they made was ten years ago, and the company’s organic growth has been cautious, mainly replacing outdated capacity. Companies on the smaller end of this spectrum have grown steadily and have doubled their capacity since 2000. Lucart has made acquisitions and built mills in France and Italy, and Carrara in Italy.

Recent M&A ac tivities focused on small companies and individuals mills

In the last five years, since SCA’s G-P acquisition in 2012, European tissue acquisitions have been relatively small. Deals have included re-arrangements related to the aftermath of the G-P exit: Sofidel’s completion of its portfolio through purchase of selected targets, and WEPA’s strategic acquisitions in the UK and France, and divestment of two Italian mills. In addition, recent deals have involved acquisitions of individual single mills, or small companies, where the buyer is often a private equity fund and in many cases, the seller is K-C.

In some cases, there is distinct strategic benefit to the smaller deals. These are often concentrated to the CEE, currently a ‘hot’ area in European tissue. The Paloma deal, whereby the Slovenian company finally ended up with the Slovakian SHP, is one step towards Eastern European consolidation. Also, the Abris Capital acquisition of the Romanian Pehart Tec forms a future platform for further consolidation. In the Iberian Peninsula, strategic investments include Cominter acquiring Cellulosas de Hernani, and Portucel acquiring AMS. The acquisition by Portucel (now the Navigator Company) of AMS-Paper in Portugal anticipates a future significant move into the tissue sector. Other strategic acquisitions include purchase of independent converters or independent converters acquiring base paper mills.

Industrial buyers complement their portfolios with acquisitions and target stronger position, consolidation and synergy benefits. Financial investors have become more interested in tissue acquisitions than before. In many cases, there is a clear strategic intent behind these deals as well.

Characteristics of organic growth and new builds

A large share of the new tissue capacity in Europe has been built by larger companies that have renewed their assets or grown organically.

- Tronchetti has built 350,000 t/a new capacity in the last some fifteen years

- SCA has closed down 180,000 t/a obsolete capacity and built 275,000 t/a new

- Sofidel has grown outside Italian markets with 250,000 t/a new capacity WEPA has soon built 190,000 t/a new capacity, speeding up in the last few years

New capacity has also been built by small and medium size established players and by newcomers. The Iberian Peninsula specifically has seen many investments (AMS, Suavecel, Paper Prime, Renova) and more capacity increases are planned. Eastern Europe has also seen an increase of new investments. Part of these has been made by established large groups such as SCA and ICT. Russian companies such as Syassky and Syktyvkar Tissue Group have also grown to sizable players in a relatively short time. Pehart Tec investments have been supported by the new owner, Abris Capital.

There are various players adding single width machines to replace old capacity, or just to grow or start producing tissue. Only the largest industrial companies have added double width machines.

New Generation of Tissue Entry

Tissue capacity increase is not only by expansion of existing producers but there is versatile motivation for new entrants. This can be push or decline of their current businesses - for example, smaller pulp mills losing competitiveness and integrating to tissue or graphic paper sites, looking for new opportunity due to their declining market. There are also cost benefits for this type of entry in terms of both manufacturing and investment costs. For a newcomer the entry is often much easier to an existing site.

Entry into the tissue market often starts from converting. When capacity is high enough for a paper machine, many independent converters start to consider their own paper production. Margins are normally higher for an integrated player as the concept has many cost benefits, while the producer is also stronger and less vulnerable with its own base paper. Consequently, adding base paper production is attractive to sizable independent tissue converters.

Investors are currently active in the tissue sector making base paper additions possible, and enabling consolidation moves. Therefore, even investors can be considered a new entrant group.

Large family companies and financial owners increasing their share of the industry

In the 1990s large multinational paper or hygiene companies accounted for a large share of tissue companies in Europe. Family companies were small and more locally based. A significant share of tissue companies were private, local single mill companies. The number of large listed and multinational companies has reduced from those days. Current major ones include SCA, K-C and Metsä Group (Metsä Tissue). The exit of North American companies from Europe has reduced the presence of multinationals and non-European companies significantly.

Family-owned companies have grown significantly, spreading across and even outside of European regions. New family companies have also become more visible. In addition, the industry has seen the reincarnation of family companies, such as Carrara Group carrying the family name of former Cartoinvest owners and the independent converter Leicester Tissue Company owned by the Tejani family (former owner of LPC).

Financial owners are also becoming more common in tissue, especially in growth areas such as Iberia and Eastern Europe. Local funds have been common participants in smaller deals, while large international funds have always shown interest when anything significant has been for sale, as now related to the recent split of SCA into two companies.

There are investors behind several tissue companies, either full or partial. In addition, there are various small privately or even state owned companies. For many small companies the ownership structure is not known.

The European top 100 tissue base paper producers’ capacity is broken down into different ownership categories. Family and private companies account for approximately 40% of capacity. Listed, large, and often multinational companies are the second biggest group.

Investor ownership of tissue base paper producers accounts for approximately 7% of ownerships. This analysis does not include independent converters, which are mostly private companies, but can also be owned by investor funds (e.g. Accrol Paper). Minority ownerships, such as the case of Syktyvkar Tissue Group (30% Venture Investments & Yield Management), are also excluded from this estimate. Considering all of this, it is fair to say that some 10% of the European tissue business is in the hands of financial owners. There are no large groups involved in this type of ownership at the moment, although in Eastern Europe this kind of players are developing.

Forest2Market Publishes First Transaction-Based Wood Price Report for Sweden, Finland, the Baltic States and Northwest Russia

1Q2017 Baltic Rim Index brings transparency about wood raw material prices to region’s forest products, forestry and bioenergy industries.

Forest2Market has published the first installment of its Baltic Rim Wood Price Index, a transaction-based wood raw material price benchmark for the forest products, forestry and bioenergy industries in Scandinavia (Sweden and Finland), the Baltic States (Estonia, Latvia and Lithuania) and Northwest Russia.

The results for 1Q2017 show that, among other trends, there are significant differences in delivered wood costs (roadside wood costs plus transportation costs to mill) for both pulp producers and sawmills in Sweden.

- Pulp producers: the highest-cost mill paid 26 per cent more for conifer pulpwood than the lowest-cost mill. Annualized, the cost savings potential for the highest-cost mill exceeds 250 million SEK (26 million EUR). If a mill consuming 2.5 million cubic meters (m3) of pulpwood annually could reduce its costs to the market average of 43 SEK/m³ (4.5 EUR/m³), the savings would exceed 100 million SEK (10.4 million EUR).

- Sawmills consuming pine sawlogs: the highest-cost mill paid 20 per cent more for conifer sawlogs than the lowest-cost mill. Annualized, the cost savings potential for the highest-cost mill exceeds 65 million SEK (6.8 million EUR). If a mill consuming 500,000 m3 of logs annually could reduce its costs to the market average of 67 SEK/m³ (7 EUR/m³), the savings would exceed 33 million SEK (3.4 million EUR).

- Sawmills consuming spruce sawlogs: the highest-cost mill paid 34 per cent more for conifer sawlogs than the lowest-cost mill. Annualized, the cost savings potential for the highest-cost mill exceeds 125 million SEK (13 million EUR). If a mill consuming 500,000 m3 of logs annually could reduce its costs to the market average of 151 SEK/m³ (15.7 EUR/ m³), the savings would exceed 75 million SEK (7.8 million EUR).

With this newest addition to its product line, Forest2Market now provides market price reports, performance benchmarks and custom analytics to major wood markets across North America, Brazil, Scandinavia, the Baltic States and Russia.

With this newest addition to its product line, Forest2Market now provides market price reports, performance benchmarks and custom analytics to major wood markets across North America, Brazil, Scandinavia, the Baltic States and Russia.

With the Baltic Rim Wood Price Index, timber buyers and sellers will be able to clearly and confidently compare their performance to market, accurately assess market prices and build strong partner relationships, as well as define, measure and adjust strategic decisions based on actual and actionable data. While high-cost mills can use the Index to lower their costs, low-cost mills can use the data to demonstrate to stakeholders that they are extracting as much value as possible from the supply chain.

This level of market transparency comes at a critical time for the region’s industry. “Now that the United States has instituted tariffs on softwood lumber coming from Canada,” said Pete Stewart, President and founder of Forest2Market, “Sweden’s sawmills will have an opportunity to export more softwood lumber to the US. But they’ll only have that opportunity if they are cost-competitive. Using the Index to manage costs provides a strategic advantage in this environment.”

Antti Kämäräinen, Director of Fores2Market’s Scandinavian business, sees a similar utility for the Index in Finland: “Currently, container freight in Finland is painfully high. The Index will allow sawmills to reduce their costs at the front of the value chain as they are buying wood. This will mitigate the overall effect of high freight costs on profitability. With the new demand that will come on line in Finland in 3Q2017, this will be especially important.”

Russian mills also have a reason to manage their costs. “Over the last few years, domestic wood raw material costs have increased annually over 10 per cent in local currency,” said Vasylysa Hänninen, Director of Forest2Market’s Baltic States and Russia business. “The weak ruble has masked the effect of rapidly increasing wood costs, making mills seem more competitive and profitable on the global market than they really are. Over the last year, however, the ruble has been strengthening. As the exchange rate stabilizes, the mask will be removed and profitability will drop. With the Index, mills can pay less for wood raw materials, securing their competitive advantage in the international market.

About Forest2Market

With solid data, industry experience and third-party independence, Forest2Market provides participants in the wood, sawnwood, paper, bioenergy and biochemicals supply chains with business solutions that support fact-based decision making and planning. Headquartered in Charlotte, North Carolina, USA, with offices in Kennewick, Washington, USA; Curitiba, Brazil; and Helsinki, Finland, Forest2Market is the global wood and fiber supply chain expert. www.forest2market.com

PCMC announces Let’s Roll 2017 show to reveal the Omnia

This new tissue embosser-laminator will offer customers flexibility and safety in a small footprint

Paper Converting Machine Company (PCMC), a division of Barry-Wehmiller, has announced that registration is now open for Let’s Roll 2017, a one-day show that will feature the unveiling of the new Omnia tissue embosser-laminator, along with a live demonstration. The event will take place on June 13, 2017, at PCMC’s Cormier location in Green Bay.

The Omnia, which in Latin means “all, everything,” marks a new era for PCMC in the embossing and laminating market. This full-featured machine will deliver safety, flexibility, fast changeovers and productivity for customers, all in a compact footprint. Other highlights include an open design for accessibility and ergonomics, the elimination of hydraulics, modularity for easy upgrades and automatic roll changes.

The Omnia, which in Latin means “all, everything,” marks a new era for PCMC in the embossing and laminating market. This full-featured machine will deliver safety, flexibility, fast changeovers and productivity for customers, all in a compact footprint. Other highlights include an open design for accessibility and ergonomics, the elimination of hydraulics, modularity for easy upgrades and automatic roll changes.

At Let’s Roll 2017, the Omnia will be showcased with PCMC’s Forte Genius line, making it possible for attendees to see all the latest packaging equipment from PCMC. In addition, Northern Engraving’s state-of-the-art Forte Pilot line will be showcased, running NTT base sheet from Valmet and producing laminated tissue rolls.

“We’re thrilled that our customers have the opportunity to view our first Omnia,” said Jason Hilsberg, Tissue Sales Director at PCMC. “The fact that we are able to showcase a variety of our equipment for our customers at one time is very exciting.”

To learn more about Let’s Roll 2017 and to register, please visit pcmcletsroll.com. This event is made possible in part thanks to the following sponsors:

- American Roller Company

- Clarke Roller & Rubber Ltd.

- Convermat Corporation

- Goldenrod Corporation

- Henkel

- InterFlex

- Pamarco

- Rockwell Automation

- Sonoco

Valmet

Mondi launches new swatch book for BIO TOP 3® portfolio

A strikingly original new swatch book for Mondi’s BIO TOP 3®, designed with the needs of creative industries in mind, is now available in Europe. A well-known brand in its 28th year on the market, BIO TOP 3® is already widely recognised as a premium uncoated off-white paper with a best-in-class environmental profile. The new swatch book, with the theme ‘by Nature’, shows off the quality and versatility of the BIO TOP 3® portfolio while highlighting its pure and authentic appeal.

‘It’s not a shade, it’s an attitude’ is the tagline of BIO TOP 3® -- and the new swatch book has plenty of attitude. The offset printed book provides beautiful examples of colour printing and blind embossing in a section entitled ‘inspired by Nature’. Another section called ‘versatile by Nature’, which is stitched to the cover of the swatch book, clearly explains the versatile applications and benefits of BIO TOP 3® in areas such as corporate communication, book printing, packaging and others.

Jutta Wacht, Art Director at the Austrian creative agency Say Say Say, Inc., which designed the swatch book, explained the two-part concept: “BIO TOP 3®’s versatility and its natural shade inspired us to create a multidimensional swatch book that consists of a practical part showing the versatility of applications in a visual approachable way, and an emotional part – a detachable book – featuring the most fascinating landscapes on earth and its sublime colour shades that pay tribute to BIO TOP 3®’s natural shade.”

In touch with the needs of eco-conscious designers and printers

Professional designers, printers and publishers who seek an authentic, natural, sustainable look and feel for their projects will find what they need in the BIO TOP 3® portfolio. Mondi offers BIO TOP 3® next in folio and reels for professionals in digital, preprint and offset printing; BIO TOP 3® high-speed inkjet in reels for full colour high-speed inkjet applications with special surface treatment for dye and pigment ink; BIO TOP 3® extra for all sustainable office printing needs; and matching BIO TOP 3® envelopes.

The swatch book was printed in Austria by Holzhausen Druck GmbH. Hannes Fauland Jr., Customer Service at Holzhausen, was impressed by the paper’s printability and results: “The BIO TOP 3® book turned out to be exceptionally beautiful. The paper is really outstanding to print on – we used normal offset printing. I had left a sample of the swatch book in a meeting room and a regular customer of mine looked through it. He has already decided to use BIO TOP 3® for his next book.”

Luděk Lorenc, Chief Technical Officer at the Czech printing house PB tisk, also believes in the paper’s advantages: “We used BIO TOP 3® next for printing the book Kmeny, as this paper fully met requirements given by the publisher. BIO TOP 3® next was the ideal choice for this project due to its natural shade, high bulk and trouble-free runnability. Based on our good experience with this paper, we have decided to include BIO TOP 3® next in our sample book of materials for book printing.”

Sustainable. Every day.

In addition to its unique off-white shade and high bulk, BIO TOP 3® also has an impeccable environmental profile that will appeal to those seeking credibility and authenticity in communication. It is totally chlorine free (TCF) bleached and made without optical brightening agents (OBAs) to retain its natural off-white shade and pleasant uncoated feel. The paper is produced exclusively at the ISO 14001 certified Mondi Neusiedler mill in Austria from FSC™ certified resources. BIO TOP 3® is part of Mondi’s Green Range and carries the EU Ecolabel as well as the Austrian Ecolabel and is available with a CO2 neutral option.

BIO TOP 3® is a premium uncoated off-white paper that is inspired by nature and conveys a natural, sustainable attitude in whatever printed materials it is used for.

We are Mondi: IN TOUCH EVERY DAY

Mondi is an international packaging and paper Group, employing around 25,000 people across more than 30 countries. Our key operations are located in central Europe, Russia, North America and South Africa. In 2016, Mondi had revenues of €6.7 billion and a return on capital employed of 20.3%.

We are fully integrated across the packaging and paper value chain - from managing forests and producing pulp, paper and compound plastics, to developing effective and innovative industrial and consumer packaging solutions. With over 100 products customised into more than 100,000 solutions, we offer more than you may expect. Leading brands around the world rely on our innovative technologies and products across a variety of industries such as agriculture; automotive; building and construction; chemicals and dangerous goods; food and beverages; graphic and photographic; home and personal care; medical and pharmaceutical; office and professional printing; packaging and paper converting; pet care; retail and e-commerce; and shipping and transport.

We believe sustainable development makes good business sense. It's integral to our responsible and profitable growth, and embedded in everything we do, every day. We continue to look for ways to do more with less, promote the responsible management of ecosystems, develop and inspire our people, and enhance the value that our sustainable product solutions create.

Mondi has a dual listed company structure, with a primary listing on the JSE Limited for Mondi Limited under the ticker code MND and a premium listing on the London Stock Exchange for Mondi plc, under the ticker code MNDI. We have been included in the FTSE4Good Index Series since 2008 and the JSE's Socially Responsible Investment (SRI) Index since 2007.

About Mondi Uncoated Fine Paper

Mondi Uncoated Fine Paper is part of Mondi Group. In 4 paper mills in Austria, Slovakia, and Russia Mondi Uncoated Fine Paper produces environmentally sound office and professional printing papers tailored to the latest professional digital print technology. The company complies with the strictest international certification standards to support sustainable production processes through the responsible management of forest, water and air resources. All Mondi uncoated fine papers belong to the Green Range of papers that are FSC® or PEFC™ certified, 100% recycled or bleached entirely without chlorine.

Its renowned brands such as Color Copy, DNS®, IQ, MAESTRO®, NAUTILUS®, BIO TOP 3®, PERGRAPHICA® or Snegurochka are used in office environments on laser or inkjet printers and by professional printers on digital or offset presses to create brochures, transactional material, folders, invitations, business cards, letterheads or other high-impact communication.

Toscotec finalizes a drying section rebuilding project including a new drive system and tail feeding for Smurfit Kappa Italia - at Ponte all’Ania, Lucca.

Smurfit Kappa Italia has successfully started up its PM3 at Ponte dell’Ania mill, after a dryer section rebuild supplied by Toscotec.

The scope of the delivery was an advanced mechanical transmission section in “silent drive” with a new frame on the drive side for the whole machine, the installation of uni-run vacuum rolls in the first drying battery and an automatic air paper threading system in the first two drying sections and on the size press. The modification has completely changed the dryer section layout with the relocation of fabric rolls, improving machine runnability and reducing noise and vibration.

![]() Toscotec service specialists have provided the complete mechanical erection and supervision of the project and the commissioning and start up assistance for the fine-tuning of the new equipment.

Toscotec service specialists have provided the complete mechanical erection and supervision of the project and the commissioning and start up assistance for the fine-tuning of the new equipment.

“The project was completed before the date agreed upon with SK and the performance was achieved immediately after start-up. The new drive technology exceeds all our expectations with regard to downtime improvements and it allowed a considerable reduction of noise and vibration that will reduce maintenance cost” - says Massimiliano Listi, Mill Manager of Smurfit Kappa Ania.

“This project contributes to strengthening the partnership between Smurfit Kappa and Toscotec” - says Enrico Fazio, Toscotec Sales Manager – P&B division.

“It is worth mentioning that, in addition to this project, which consolidates the long-standing collaboration with Lucca-based SK Ania, in the last two years Toscotec has taken part in almost all the projects developed by Smurfit in South America (Colombia, Mexico and Argentina) and it has just begun an important cooperation with the group in France. With this important rebuild project, Toscotec consolidates its leadership in the dryer section best available technology.”.

About Smurfit Kappa Ania

Smurfit Kappa Ania is one of the main producers of recycled paper jumbo rolls in Italy.

The mill occupies an area of 100,000 sqm and employs 120 people.

The annual production is over 200,000 tpy, with 100% recycled fibers.

The mill operates two paper machines, which produce corrugated cardboard packaging in a wide range of paper grades out of recycled fibers.

About Toscotec - The flexibility and intense activity of research and development enable Toscotec to supply equipment and machinery for all the paper industry and to meet customer requirements.

Since 1948, Toscotec is a leader supplier offering proprietary solution from complete production lines to rebuilds, modernization projects and even single components.

ANDRITZ to supply tissue machine with steel Yankee and shoe press to PMI, Algeria

International technology Group ANDRITZ has received an order from Paper Mill Investment (PMI) to supply a tissue machine with steel Yankee and shoe press to Algeria. The new plant will produce high-quality facial wipes as well as toilet and towel papers. Start-up is scheduled for the first quarter of 2018.

The new ANDRITZ PrimeLineCOMPACT tissue machine has a design speed of 2,000 meters per minute and a paper width of 2.85 meters. The order includes a complete ANDRITZ stock preparation for virgin pulp with a capacity of 135 bdmt/day.

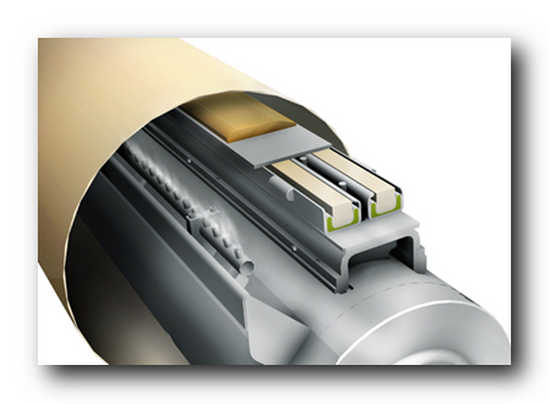

The ANDRITZ tissue machine for PMI, Algeria, is fitted with PrimePress XT Evo, the latest shoe press technology. “Photo: ANDRITZ”.

The ANDRITZ tissue machine for PMI, Algeria, is fitted with PrimePress XT Evo, the latest shoe press technology. “Photo: ANDRITZ”.

The tissue machine is equipped with the latest ANDRITZ shoe press technology (PrimePress XT Evo). Thanks to the energy-efficient design, improved dewatering, and reduced need for thermal drying, the shoe press minimizes energy consumption. The 16 ft. PrimeDry Yankee is made entirely of steel and enables a high drying capacity.

Paper Mill Investment (PMI) is a new innovative paper manufacturing company founded by people with longtime and profound experience in the paper making industry. Its expansion plans include paper mills in several countries of the MENA region.

ANDRITZ PULP & PAPER is a leading global supplier of complete plants, systems, equipment, and comprehensive services for the production and processing of all types of pulp, paper, tissue, and cardboard. The technologies cover the processing of logs, annual fibers, and waste paper; the production of chemical pulp, mechanical pulp, and recycled fibers; the recovery and reuse of chemicals; the preparation of paper machine furnish; the production of paper, tissue, and cardboard; the calendering and coating of paper; as well as the treatment of reject materials and sludge. The service offering includes system and machine modernization, rebuilds, spare and wear parts, on-site and workshop services, optimization of process performance, maintenance and automation solutions, as well as machine relocation and second-hand equipment. Biomass, steam, and recovery boilers, as well as gasification plants for power generation, flue gas cleaning plants, plants for the production of nonwovens, dissolving pulp, and panelboard (MDF), as well as recycling plants are also part of this business area.