Ian Melin-Jones

Resolute Updates Status of its Offer for Fibrek

Resolute also announced that the U.S. Securities and Exchange Commission declared effective Resolute's registration statement relating to the proposed transaction on January 13, 2012, and that U.S. antitrust authorities granted early termination of the statutory waiting period under the U.S. Hart-Scott-Rodino Act with respect to the proposed transaction.

"The tactical poison pill has outlived its usefulness," said Richard Garneau, President and Chief Executive Officer. "Since we announced our offer late in November, Fibrek has found time to adopt the tactical poison pill and enhance compensation packages for senior management, but has yet to provide its shareholders with a competitive alternative to our offer. Shareholders must now be given the opportunity to decide for themselves whether or not to accept our offer."

Mr. Garneau continued: "Fibrek's repeated suggestions that we are somehow not following the letter and spirit of the law does not make it so. The fact is we have no knowledge of any material information regarding Fibrek that has not been disclosed to the public and there is no legal requirement for a formal valuation. Their decision to pursue such a valuation is nothing more than a diversion on behalf of Fibrek's management. The value of our offer is sufficiently compelling for three of Fibrek's largest shareholders, representing approximately 46% of the outstanding shares, to have agreed to irrevocable lock-up agreements, with no ability to tender their shares to a competing bid."

Fibrek shareholders should consider the following factors in making their decision to accept the offer:

- The offer represents a substantial premium to Fibrek's pre-announcement trading price;

- The offer is not subject to any financing condition;

- Fibrek shareholders have the opportunity to exchange their shares of Fibrek, which had been thinly traded through to the date the offer was announced;

- Resolute is uniquely positioned to integrate Fibrek into its existing operations;

- Fibrek shareholders who become Resolute shareholders will own shares in a company that:

- is financially stronger;

- has a diversified asset and product base;

- is determined to continue improving the competitive position of its mills by focusing on cost optimization;

- maintains a prudent capital structure, with a ratio of long-term debt to last twelve months adjusted EBITDA of 1.3x as of the end of the third quarter of 2011.

The offer is subject to certain conditions including, among others, a 66⅔% minimum tender condition, waiver or termination of all rights under the shareholder rights plan, receipt of all regulatory, governmental and third-party approvals, consents and waivers, Fibrek not having implemented or approved any issuance of shares or other securities or any other transaction, acquisition, disposition, capital expenditure or distribution to its shareholders outside the ordinary course of business, and the absence of occurrence or existence of any material adverse effect or material adverse change. Subject to applicable laws, Resolute reserves the right to withdraw or extend the offer and to not take up and pay for any Fibrek common shares deposited under the offer unless each of the conditions of the offer is satisfied or waived (at its sole discretion). The offer is not subject to any financing condition.

Questions and requests for assistance or further information on how to tender Fibrek common shares to the offer should be directed to, and copies of the above referenced documents may be obtained by contacting, Georgeson at 1-866-598-0048 or by email at This email address is being protected from spambots. You need JavaScript enabled to view it.">This email address is being protected from spambots. You need JavaScript enabled to view it..

Important Notice

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Resolute has filed with the SEC a registration statement on Form S-4, as amended, in connection with the proposed transaction with Fibrek. INVESTORS AND SECURITY HOLDERS OF RESOLUTE AND FIBREK ARE URGED TO READ THESE DOCUMENTS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Such documents are available free of charge through the web site maintained by the SEC at www.sec.gov, by calling the SEC at telephone number 800-SEC-0330, on SEDAR at www.sedar.com or on Resolute's website at www.resolutefp.com.

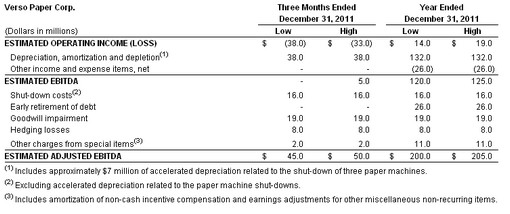

Verso Paper Corp. Prelim Results for 4th Quarter and Year End

- For the three-month period ended December 31, 2011, we expect Adjusted EBITDA to be within the range of $45 million to $50 million, and for the year ended December 31, 2011, we expect Adjusted EBITDA to be within the range of $200 million to $205 million.

- Adjusted EBITDA for the three-month period ended December 31, 2011, excludes charges from special items of approximately $45 million primarily related to the shut-down of three paper machines, goodwill impairment, and hedging transactions. Adjusted EBITDA for the year ended December 31, 2011, excludes charges from special items of approximately $80 million primarily related to net losses on debt refinancing, the shut-down of three paper machines, goodwill impairment, and hedging transactions.

- For the three-month period ended December 31, 2011, we expect operating income before items to be within the range of $14 million to $19 million. Including approximately $52 million of charges primarily related to the paper machine shut-downs, goodwill impairment and hedging transactions we expect operating losses within the range of $38 million to $33 million for the quarter. For the year ended December 31, 2011, we expect operating income before items to be within the range of $74 million to $79 million. Including approximately $60 million of charges primarily related to the paper machine shut-downs, goodwill impairment and hedging transactions we expect operating income within the range of $14 million to $19 million for 2011.

- Cash and total debt at December 31, 2011 were approximately $95 million and $1.2 billion, respectively. At December 31, 2011, our existing $200 million revolving credit facility had no amounts outstanding, approximately $41 million in letters of credit issued, and approximately $159 million available for future borrowing.

- Capital expenditures for the three-month period ended December 31, 2011, are expected to be approximately $23 million.

Verso intends to release its financial results for the fourth quarter and the year ended December 31, 2011, in a news release to be issued before the market opens on Wednesday, March 7, 2012. Management will host a conference call at 9 a.m. (Eastern Time) on Wednesday, March 7, 2012, to discuss the fourth quarter and year-end results. Analysts and investors may participate in the live conference call by dialing 719-325-4795 or, within the U.S. and Canada only, 877-591-4959, access code 5749765. To register, please dial in 10 minutes before the conference call begins. The conference call and presentation materials will be made available on Verso's website at www.versopaper.com/investorrelations by navigating to the Events page, or at http://investor.versopaper.com/eventdetail.cfm?EventID=108162. The earnings release and Verso's annual report on Form 10-K for the year ended December 31, 2011, will be made available on Verso's website at www.versopaper.com/investorrelations by navigating to the Financial Information page. A telephonic replay of the conference will be accessible at 719-457-0820 or, within the U.S. and Canada only, 888-203-1112, access code 5749765. This replay will be available starting on March 7, 2012, at 12:00 p.m. (Eastern Time) and will remain available for 14 days.

Reconciliation of Estimated Operating Income to Estimated Adjusted EBITDA

The agreements governing our debt contain financial and other restrictive covenants that limit our ability to take certain actions, such as incurring additional debt or making acquisitions. Although we do not expect to violate any of the provisions in the agreements governing our outstanding indebtedness, these covenants can result in limiting our long-term growth prospects by hindering our ability to incur future indebtedness or grow through acquisitions.

EBITDA consists of earnings before interest, taxes, depreciation, and amortization. EBITDA is a measure commonly used in our industry, and we present EBITDA to enhance your understanding of our operating performance. We use EBITDA as one criterion for evaluating our performance relative to that of our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets among otherwise comparable companies. Adjusted EBITDA is EBITDA further adjusted to exclude unusual items and other pro forma adjustments permitted in calculating covenant compliance in the indentures governing our notes to test the permissibility of certain types of transactions. We believe that the inclusion of the supplemental adjustments applied in calculating Adjusted EBITDA are reasonable and appropriate in providing additional information to investors to demonstrate our compliance with our financial covenants. We also believe that Adjusted EBITDA is a useful liquidity measurement tool for assessing our ability to meet our future debt service, capital expenditures, and working capital requirements.

However, EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDA or Adjusted EBITDA as an alternative to operating or net income, determined in accordance with U.S. GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as an indicator of our cash flows or as a measure of liquidity.

The following table reconciles estimated operating income (loss) to estimated EBITDA and estimated Adjusted EBITDA for the periods presented.

Source: Verso Paper Corp.

Resolute to Present at the CIBC 2012

A live audio webcast of the presentation will be available at http://webcasts.welcome2theshow.com/whistler2012/forest. A replay of the presentation will be available for six months.

About Resolute Forest Products

Resolute is a global leader in the forest products industry with a diverse range of products, including newsprint, commercial printing papers, market pulp and wood products. Resolute owns or operates 18 pulp and paper mills and 23 wood product facilities in the United States, Canada and South Korea. Marketing its products in close to 90 countries, Resolute has third-party certified 100% of its managed woodlands to sustainable forest management standards. The shares of Resolute trade under the stock symbol ABH on both the New York Stock Exchange and the Toronto Stock Exchange.

Resolute and other member companies of the Forest Products Association of Canada, as well as a number of environmental organizations, are partners in the Canadian Boreal Forest Agreement. The group works to identify solutions to conservation issues that meet the goal of balancing equally the three pillars of sustainability linked to human activities: economic, social and environmental. Resolute is also a member of the World Wildlife Fund's Climate Savers program, in which businesses establish ambitious targets to voluntarily reduce greenhouse gas emissions and work aggressively toward achieving them.

Clariant successfully issues EUR 500 million Eurobond

The fixed rate notes with a minimum denomination of EUR 100,000 and a final coupon of 5 ⅝ % p.a. are maturing on January 24, 2017. The orderbook was significantly oversubscribed on the back of strong investor demand. Clariant has applied for listing of the notes with the London Stock Exchange. BNP Paribas, Citigroup and UniCredit acted as Joint Book Runners on this transaction.

The proceeds are to be used for general corporate purposes so optimizing Clariant's debt maturity profile. After two CHF-Bond issuances (total of CHF 300 million) in May and July 2011 and the placement of a total of four German Certificates of Indebtedness (total of EUR 390 million) in October 2011 including an increase in early January 2012, this bond issuance is the third successful financing step in the debt capital markets over the last nine months.

Stora Enso increases flexibility and competitiveness

The Company will have four Business Areas and Reporting Segments:

Biomaterials, headed by EVP Juan Bueno

Printing and Reading, headed by EVP Juha Vanhainen

Renewable Packaging, headed by EVP Mats Nordlander

Building and Living, headed by EVP Hannu Kasurinen

The changes in the Business Areas and management will take place as of 17 January 2012.

“We are organising our businesses based on the different markets and customers they serve. The aim is to increase our organisation’s competitiveness, flexibility, speed and accountability, and to minimise interdependences between the businesses to ensure that we have the ability and agility to seize opportunities arising from the changes in the global economy,” says CEO Jouko Karvinen.

The first financial report according to the new reporting segment structure will be the first quarter 2012 Interim Review to be released on 24 April 2012. Historical figures according to the new reporting structure will be published on Stora Enso’s Capital Markets Day on 22 March 2012.

Change in outlook formulation

Stora Enso will change the formulation of how it gives its forward-looking guidance with effect from the fourth quarter of 2011 results onwards. The Group will cease to give future grade-specific price and demand guidance, and instead will give forward-looking guidance for quarterly sales and operational EBIT for the ongoing quarter to improve the capital markets service.

BASF to build TDI plant in Ludwigshafen

“We are constantly developing the Ludwigshafen site further to remain competitive internationally. In addition to such important investments in production, this involves modernization and targeted development of the whole infrastructure,” said Dr. Bernhard Nick, Site Manager of the BASF Ludwigshafen Verbund site. “The new TDI plant and the related facilities strengthen the competitiveness of BASF’s largest Verbund site.” Associated investments in precursors and infrastructure will support additional growth in other BASF value chains.

At Schwarzheide, BASF will develop its site structures according to the future needs over the next years to focus more on specialties. With the investment BASF will have two strong sites in Europe for polyurethane basic products: Ludwigshafen for the production of TDI and Antwerp for the production of MDI (diphenylmethane diisocyanate) and propylene oxide.

TDI is a core component for polyurethanes. TDI t o a large extent is used in the automotive industry (e.g. seating cushions and interior applications) as well in the furniture segment (e.g. flexible foams for mattresses, cushions or wood coating).

BASF is a leading supplier of basic products for polyurethanes and is currently operating TDI plants in Geismar, Louisiana; Yeosu, Korea; Caojing, China and Schwarzheide, Germany.

SCA divests its packaging operations

“The reason for the divestment is primarily to enable increased growth in the hygiene business”, says Jan Johansson, President and CEO of SCA.

The packaging operations, excluding the two kraftliner mills, had net sales in 2010 of approximately SEK 24.2bn (EUR 2.5bn) and an operating profit, excluding restructuring costs, of approximately SEK 1.1bn (EUR 117million). The operations have approximately 12,000 employees.

The purchase price is equivalent to an EBITDA multiple of 6.3 based on the 12 month period Q4 2010 – Q3 2011.

In connection with the transaction a write-down of goodwill of approximately SEK 4bn will be made, which will have the result that the remaining kraftliner operations will not have any goodwill. The write-down will impact the result for the fourth quarter of 2011 and will be treated as an item affecting comparability.

The debt/equity ratio will decrease to approximately 0.5 provided that the divestment of the packaging operations and the previously announced binding offer for Georgia-Pacific´s European tissue operations are completed according to plan.

Earnings per share will decrease by SEK 0.75 based on net profit for the 12 month period Q4 2010 – Q3 2011.

Regarding the French part of the packaging operations, the price for which is included in the announced purchase price, DS Smith has made a formal offer to acquire this business. This process is subject to consultation with relevant works councils and will be treated separately.

SCA’s two kraftliner mills in Sweden are not included in the transaction as they are well integrated with SCA´s forest products operations.

“Over the years we have developed our packaging business and we are divesting a competitive operation to an industrial buyer who can continue to develop it”, says Jan Johansson, President and CEO of SCA.

The transaction is subject to approval from DS Smith´s shareholders and antitrust clearance from the European Commission. Closing is expected during the second quarter of 2012. DS Smith will publish a prospectus regarding the transaction. DS Smith´s financing of the transaction is committed.

Södra tallies the winter's storms

"This tally includes the effects of the advent storm, including storms Emil and Dagmar and other days of heavy wind that resulted in wind-felled trees," says Håkan Svensson, Director of Forestry at Södra.

While the severity of the storms in southern Sweden varied from area to area, at most the regional tally adds up to approximately one-tenth of an annual felling. Södra's Southern Region was the hardest hit with around 350,000 cubic metres, followed by Western Region with around 300,000 cubic metres. The forest areas on Sweden's west coast, in northern Skåne and western Blekinge were the most severely affected areas. Although locally some individual forest owners were particularly hard hit, so far the volumes of fallen timber have been modest when compared with storms Per and Gudrun which blew down 16 million and 75 million cubic metres respectively.

Södra expects to accommodate the harvesting of these volumes within its normal operations, but it has also advised all forest owners to perform an inventory and ensure that all storm-felled timber is taken care of as quickly as possible. Wind-felled trees are spread over large areas and the ground is very wet, which makes rational and efficient harvesting difficult.

"When spring comes, these storm-felled trees will be a veritable feast for the spruce bark beetle," says Håkan Svensson. "So even with the risk of more storms it is vital that forest owners take stock of their property and begin harvesting as soon as possible."

Södra has extended a storm-related offer to its members making it simpler for forest owners to sell all their storm-felled timber. Södra advises forest owners to be very careful when taking care of wind-felled timber as the work is a lot more hazardous than regular felling.

Ashland Inc. first-quarter earnings webcast

Ashland Inc. has announced that on Tuesday, Jan. 24, 2012, at 9 a.m. EST, it will conduct a live webcast of its first-quarter earnings presentation to the investment community. The presentation will cover results for the quarter ended Dec. 31, 2011, the first quarter of Ashland's 2012 fiscal year. The company's results will be issued earlier in the day.

In attendance at the presentation will be: James J. O'Brien, chairman and chief executive officer; Lamar M. Chambers, senior vice president and chief financial officer; John E. Panichella, president, Ashland Specialty Ingredients; Paul C. Raymond, president, Ashland Water Technologies; and David A. Neuberger, director, Investor Relations.

The webcast, which will last approximately 60 minutes, will be accessible through Ashland's Investor Relations website, http://investor.ashland.com, along with supporting materials. Following the live event, an archived version of the webcast and supporting materials will be available on the Ashland website for 12 months. Minimum requirements to listen to the webcast include the free Windows MediaPlayer software and a 28.8 Kbps connection to the Internet.