Ian Melin-Jones

Outotec launches new cooling towers

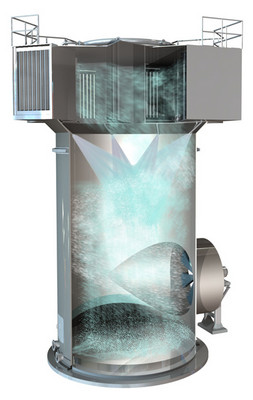

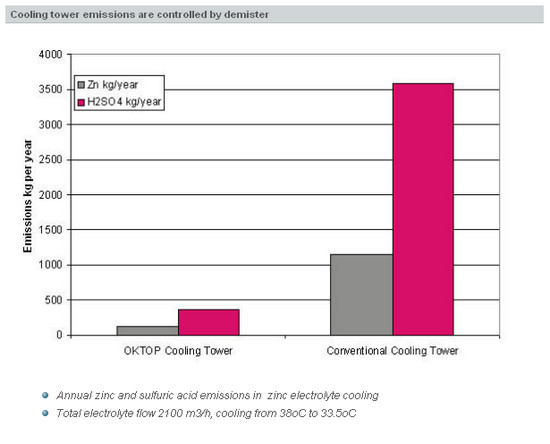

Outotec OKTOP® Cooling Towers enable lower emissions and larger cooling capacity than conventional cooling towers.

Outotec launches a new series of cooling towers for process solutions. The major benefits are increased cooling capacity as well as lower emissions to air.

The towers are a result of several years of product development which have resulted in radically new structural geometry. The most important change is that the air flows out of demisters horizontally, not vertically like in conventional cooling towers. The speed in the demister is higher and there is more cooling air. In addition, drops are separated more efficiently. Consequently, the amount of harmful solution emissions is brought down to a completely new level.

The new structure also improves the cooling air flow distribution inside the tower. This minimizes the dead spots where the drops are not cooling.

Furthermore, the inflow of the air can be adjusted dynamically so that the out-flowing solution temperature can be controlled regardless the outside weather conditions.

More capacity in one tower

“Our technology is way superior to our competitors,” Process metallurgist Tuomas Hirsi says. “We can offer a better overall solution based on the customer’s process conditions and meet even the strictest environmental legislative requirements. By using advanced CFD modelling and our own standardized models, we can determine the optimum solution for every customer.”

By optimising the process and using the more efficient cooling towers there is no need for as many towers as there would be when using conventional technology. Less towers equals to less space, less piping, less energy and less running costs. Lower emission levels meet the emission limits for a long time in the future. Thus, investing in an OKTOP Cooling Tower pays itself back very quickly.

Excellent availability and easy maintenance

Another benefit of the new cooling tower is its easy maintenance, which has been paid special attention to. All regular maintenance work can be carried out from the upper deck safely and while the tower is still running. There are maintenance hatches where the pieces of equipment can be serviced and the nozzles can be changed without going inside the tower. The demister boxes can be separated and they can be washed without shutting the tower off. This ensures maximum availability of the plant and makes working with the towers as safe as possible.

Province Will Keep NewPage Mill in Point Tupper Re-Sale Ready

Natural Resources Minister Charlie Parker announced today, Jan. 4, he is encouraged that the company selected by a court-appointed monitor to negotiate exclusively for the NewPage mill is committed to an ongoing sustainable operation, which will maintain hundreds of jobs in the area.

After consultations with the monitor responsible for the sale of the mill, Mr. Parker announced the province will continue to keep the mill re-sale ready through February and March during negotiations with successful bidder Pacific West Commercial Corporation.

"The premier committed to the workers, their families and the many affected communities that the province would do what it could to protect jobs and get the mill operating again," said Mr. Parker.

The province outlined a seven-point plan on Sept. 9, to keep hundreds of people working, provide specialized training and help maintain the contractor base to keep the mill an attractive asset. Today's investment will continue that plan and ensure the mill remains re-sale ready. It is expected to cost up to $5 million, but the province is recovering that cost through the sale of wood harvested as part of the seven-point plan.

"We commend all the parties that have taken part in the sales process," said Mr. Parker. "We look forward to continue working with the monitor during negotiations with exclusive bidder Pacific West Commercial Corporation."

NewPage Port Hawkesbury Corporation will appear in court Jan. 18 to request a sales process extension until March 30.

"This brings us another step closer to getting the mill back in operation to provide the employment and stability the workers and community want," said Port Hawkesbury Mayor Billy Joe MacLean.

Alfa Laval wins SEK 70 million energy-efficiency order in Russia

Alfa Laval – a world leader in heat transfer, centrifugal separation and fluid handling – has won an order for compact heat exchangers from a refinery in Russia. The order, worth approximately SEK 70 million, was booked late December 2011. Delivery is scheduled for 2012.

Alfa Laval’s compact heat exchangers will be used in the refinery distillation process where crude oil is preheated in different steps. They will reuse heat from the process for preheating the crude oil, resulting in a very energy-efficient solution.

”This is another example of our compact heat exchangers enabling big energy savings compared with the traditional shell-and-tube technology they are replacing”, says Lars Renström, President and CEO of the Alfa Laval Group.

Alfa Laval’s compact heat exchangers can recover up to 95 percent of the heat that otherwise would be wasted, representing an efficiency increase of slightly more than 40 percent compared with the competing shell-and-tube technology.

Did you know… that there are approximately 300 Alfa Laval compact heat exchangers installed in Russian refineries – and that all major refineries in the country are customers of Alfa Laval’s?

Catalyst Paper defers interest payment

Catalyst Paper Corporation in mid-December deferred a US$21-million interest payment and announced it is reviewing alternatives to address its capital structure. Debt reduction has been identified as a priority and discussions are ongoing with certain holders of its 2016 Notes and 2014 Notes.

The company has $840 million of debt. It has 30 days to pay the interest before triggering a default.

According to an article in the Globe and Mail on Dec. 15, failure to pay the interest amount would allow 2016 note holders to declare the $390-million (U.S.) principal amount and all accrued interest, due immediately.

One analyst quoted in the Globe story noted that the deferred payment is likely a tactic to pressure note holders to come to an agreement on restructuring outside of bankruptcy protection.

Catalyst Paper said operations are expected to continue as usual with obligations to customers, suppliers and employees being met in the ordinary course.

"We advised several months ago that we were actively pursuing a restructuring of our balance sheet. This is a very complex process and while we cannot prejudge outcomes, we are firmly committed to achieving a solution that puts Catalyst on stronger financial footing for the future," said president and CEO Kevin J. Clarke.

Catalyst Paper manufactures diverse specialty printing papers, newsprint, and pulp. It has four mills located in British Columbia and Arizona.

St. Mary's Paper pushed into receivership

St. Mary's Paper was forced into receivership on Dec. 30, after its insurer discontinued coverage. CEO Dennis Bunnell told the Sault Star newspaper that lack of insurance carrier caused the mill's first secured party, International Forest Products, to have St. Mary's put into receivership. Bunnell characterized the situation as unusual.

The mill in Sault Ste. Marie has been closed since March 2011, putting about 30 employees out of work, and had operated only sporadically in the past few years. It produces supercalender paper.

The Sault Star reports that the mill's unionized workers had agreed in October not to take any legal action regarding severance pay until January. With the receivership, those employees fall to the end of the list of creditors.

Ashland Inc. completes announced sale of synlubes business

Ashland Inc. has said that its subsidiary, Hercules Incorporated, has completed the previously announced sale of its aviation and refrigerant lubricants business, a polyol/ester-based synlubes business, to Calumet Missouri, LLC, an assignee of Monument Chemicals Inc. The purchase price was not disclosed. Under the asset purchase agreement, Calumet Missouri obtained a 22-acre parcel that includes the manufacturing facility in Louisiana, Mo., which it plans to continue operating.

Ashland Water Technologies is a leading global producer of papermaking chemicals and a leading specialty chemicals supplier to the pulp, paper, commercial and institutional, food and beverage, chemical processing, mining and municipal markets. Its process, utility and functional chemistries are used to improve operational efficiencies, enhance product quality, protect plant assets and help ensure environmental compliance.

In more than 100 countries, the people of Ashland Inc. (NYSE: ASH) provide the specialty chemicals, technologies and insights to help customers create new and improved products for today and sustainable solutions for tomorrow. Our chemistry is at work every day in a wide variety of markets and applications, including architectural coatings, automotive, construction, energy, food and beverage, personal care, pharmaceutical, tissue and towel, and water treatment. Visit www.ashland.com to see the innovations we offer through our four commercial units - Ashland Specialty Ingredients, Ashland Water Technologies, Ashland Performance Materials and Ashland Consumer Markets.

Vacon reorganizes Executive Management Team

Vacon Plc is reshaping its Executive Management Team and re-allocating responsibilities. The main objectives of the changes are to streamline the Group's management model, clarify the reporting hierarchy within the global organization, and raise efficiency.

In the new model for allocating responsibility, Vacon's operations are divided into three main areas, namely Market Operations, Product Operations and Support Functions. Market Operations include sales, marketing, product marketing and customer and maintenance services. Product Operations comprise research, product development and product management, as well as production, materials sourcing, logistics and product support. Support Functions include human resources, finance and legal, ICT, corporate communications and investor relations. Vacon will reorganize its global operations during the first quarter of 2012 to bring them in line with the new allocation of responsibilities within the Executive Management Team.

As from 5 January 2012, the members of the Vacon Executive Management Team are: President and CEO Vesa Laisi; Heikki Hiltunen, Executive Vice President, Market Operations; Jukka Kasi, Executive Vice President, Product Operations; Tuula Hautamäki, Senior Vice President, Human Resources; and Eriikka Söderström, Chief Financial Officer. President and CEO Vesa Laisi is chairman of the Executive Management Team and the secretary is Sebastian Linko, Director, Corporate Communications and Investor Relations. Heikki Hiltunen is deputy to the president and CEO.

- "It is time for Vacon to take the next step in developing its global presence. We are renewing our organization to bring it in line with the company's strategy. Our goal is to build an organization that is clear and coherent and with which we can achieve our targets for 2014", says President and CEO Vesa Laisi.

Jari Koskinen (Vice President, Global Production Operations) and Timo Kasi (Vice President, R&D), who were previously members of the Executive Management Team, continue in the company's service, working in Product Operations, headed up by Jukka Kasi, and remain in charge of their own areas of responsibility during the transition phase.Jari Koskinen will be on study leave to write his doctoral thesis as from 1 March 2012.

Invitation to a pre-silent Q&A session with Metso

Metso’s management will host a pre-silent Q&A session prior to stepping into silent period. The purpose of these sessions is to serve all financial community parties equally and increase understanding of the earlier stated information by giving an opportunity to set questions to our management. No new information will be disclosed but the aim is to clarify information on our operations and operating environment. Therefore, we don’t intend to publish separate releases in connection with these events.

Pre-silent Q&A session before 2011 Financial Statements Review publication

will be held on Thursday, January 12, 2012 at

3.00 p.m. EET (Helsinki),

1:00 p.m. GMT (London),

2:00 p.m. CET (Paris),

8:00 a.m. EDT (New York).

Metso’s CFO Harri Nikunen will be answering the questions.

The Q&A session can be participated through conference call (please see the details below). Questions can be presented during the call or by sending questions in advance via email to This email address is being protected from spambots. You need JavaScript enabled to view it. by Wednesday, January 11 by 12:00 p.m. EET (Helsinki).

Conference call participants are requested to dial in few minutes prior to the start of the teleconference

• US: +1 866 803 8344

• Other countries: +44 (0)207 1620 177

• Access code: Metso

A replay of the conference call will be available for 14 days until January 26, 2012 at:

• US: +1 954 334 0342

• Other countries: +44 (0)207 0314 064

• Access code: 909 214

A transcript of the event will be available on our website on Friday, January 13, 2012.

Welcome to our pre-silent Q&A session!

Metso Corporation

Juha Rouhiainen

VP, Investor Relations

Propapier PM2 mill site evaluated

The environmental sustainability of Progroup AG's Propapier´s PM2 mill site, located in Germany, has been successfully analysed with Pöyry´s Green Mill Index.

"We want to be forerunners concerning environmental sustainability issues. Pöyry's Green Mill Index gave us a complete overview of our production and mill site performance. Although our performance was excellent, there is always room for some improvement and we know now where to concentrate" says Mr. Resvanis from Propapier.

The Green Mill Index is a tool developed by Pöyry for pulp and paper mills. The index represents the relations of different indicators and overall environmental performance of a mill and helps to measure e.g. energy or water efficiency. Many of the indicators used in Pöyry´s Green Mill Index are based on European Commission standards for best available technology, known as BAT levels.

The Green Mill Index is a natural extension to Pöyry's services dedicated to balanced sustainability and continuous improvement. As a leading consulting and engineering company in the pulp and paper industry, Pöyry is committed to designing mills that are technologically advanced, operationally efficient and meet stringent environmental standards.

Progroup AG produces corrugated board formats as its core business. The Propapier PM2 produces high-quality corrugated board base papers exclusively on the basis of waste paper. The special technology of PM2 makes it possible to produce lightweight, fibre-saving new papers for lighter and at the same time more efficient corrugated boards of the "next generation".

Supplier must repay $1.8 million to Domtar

The B.C. Supreme Court has decided in favor of Domtar in a dispute between the papermaker and chemicals distributor Univar Canada over the application of force majeure in a caustic soda contract.

The contract between Domtar and Univar Canada in 2008 capped the price of caustic soda at $545/dry tonne.

During 2008 the global price of caustic soda rose dramatically, and Univar chose to apply force majeure.

In her judgement, delivered Dec. 23, Madam Justice Fisher stated:

"Accordingly, I have concluded that the increased price of caustic soda in 2008 did not constitute an event of force majeure within the terms of clause 15A of the contract. Univar was not entitled to be excused from performance and it remained obligated to supply caustic soda to Domtar at the contract price until the contract expired on December 31, 2008."

During the six-month period from the declaration of force majeure and the end of the contract on Dec. 31, 2008, Domtar paid the requested price, under protest, because the supply of caustic soda was vital to the operation of the mill. Prices charged by Univar during that period ranged from $730 to $860/dry tonne. The difference between the contractual maximum and the actual prices paid is $1.871 million plus GST, which Univar must repay to Domtar.

Domtar has since changed suppliers of caustic soda.