Super User

ABB launches latest digital solution for total control over wet end operations to maximize productivity and profit

ABB Wet End Control offers process stabilization, variability reduction and performance optimization for all paper, board and tissue manufacturers

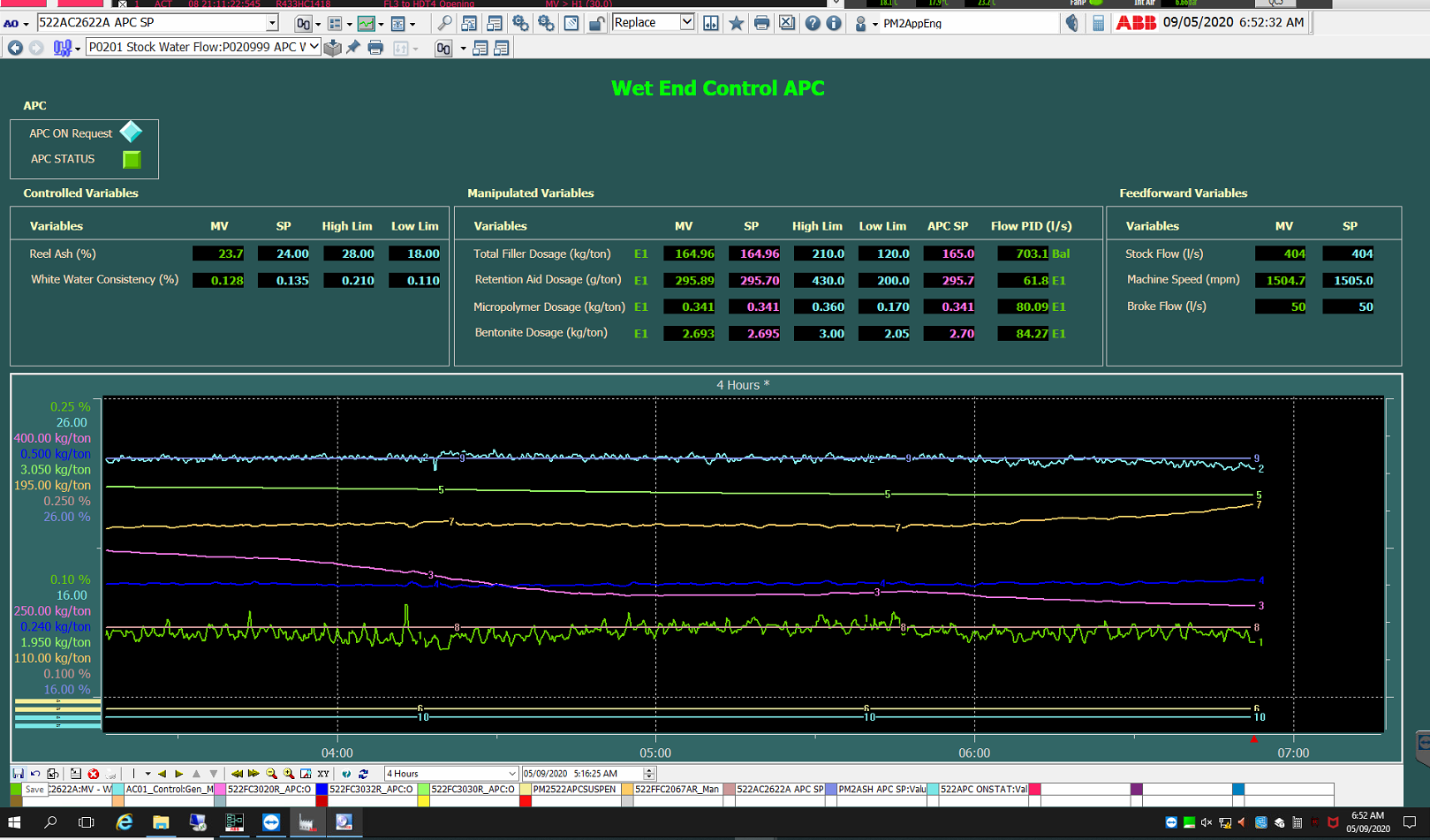

ABB has just launched the latest generation of its Advanced Process Control (APC) to provide complete digital control over wet end operations, optimizing productivity and profit for paper mills globally.

Wet End Control — an ABB Ability™ APC solution for paper mills — stabilizes the wet end process and reduces variability by controlling, monitoring and optimizing retention performance. It uses a multivariable model predictive control approach to predict future wet end process behavior, making automatic adjustments to stabilize ash levels, reduce white water consistency variability and minimize chemical and filler dosages.

Wet End Control — an ABB Ability™ APC solution for paper mills — stabilizes the wet end process and reduces variability by controlling, monitoring and optimizing retention performance. It uses a multivariable model predictive control approach to predict future wet end process behavior, making automatic adjustments to stabilize ash levels, reduce white water consistency variability and minimize chemical and filler dosages.

This results in improved machine runnability by helping to reduce sheet breaks, and accelerating grade changes and break recovery. Papermakers can then track performance from the wet end to the final sheet. It is available as a subscription-based service delivered via ABB Ability™ Collaborative Operations, with structured remote monitoring and expert analysis of control performance for sustainable results.

In addition to its impact on productivity, Wet End Control helps to minimize raw material, chemical costs and broke usage, ultimately reducing the environmental impact and leading to lower steam consumption and increased energy savings.

“We know that continuous monitoring of wet end operations is crucial to driving process improvements,” said Ramesh Satini, global product manager for Pulp & Paper Control Systems, ABB. “We developed our Wet End Control solution to address this need by automatically managing targets and implementing cost efficiencies within process constraints. By adopting this ABB service, mills will benefit from ongoing insight and collaboration to optimize stability for long-term gains and minimized operator interventions.”

Wet End Control is part of a fully integrated quality measurement, control and optimization solution that works seamlessly with ABB Ability 800xA control system or a third-party alternative (via OPC interface). ABB’s latest APC platform allows dynamic model adaption to capture varying process dynamics for tighter control, while optimally working within operational parameters to maximize the economic gain. The solution is suitable for all mills seeking a quality measurement, control and optimization solution that enables paper specifications to be met at the lowest possible cost.

How to measure tissue and nonwovens mill machinery performance with real time analytics

Tissue and nonwovens mills rely primarily on the performance of their machinery to ensure the manufacturing of a high-quality product in a reasonable time and at optimal productivity. If this machinery is not running at peak efficiency or if it breaks down, production can slow down or stop altogether.

Yet, the equipment and machinery in a mill is subjected to extreme conditions on a daily basis. Machines in the mill are exposed to things like significant temperature variations and ongoing wear and tear that can impact their performance over time.

In the past it was difficult, if not impossible, to detect small dips in machinery performance simply because the human eye can’t detect small changes in things like machine vibration or speed. By the time a lag in performance was noticeable, the machine was often already at a point of needing repair or would break down entirely. This is one of the biggest causes of lost productivity in the mill. Fortunately, with today’s technology, it is possible to perform real time analytics, allowing mill staff to know the performance level of their machinery at all times.

In the past it was difficult, if not impossible, to detect small dips in machinery performance simply because the human eye can’t detect small changes in things like machine vibration or speed. By the time a lag in performance was noticeable, the machine was often already at a point of needing repair or would break down entirely. This is one of the biggest causes of lost productivity in the mill. Fortunately, with today’s technology, it is possible to perform real time analytics, allowing mill staff to know the performance level of their machinery at all times.

Measures of Machine Performance

Improving the performance and productivity of fixed assets is the best way to improve shareholder returns. Over the years, a number of key performance indicators (KPIs) have been developed to measure machine performance. Of these KPIs, Overall Equipment Effectiveness (OEE) has become an industry standard for the tissue and nonwovens mill.

OEE measures three categories within the mill: equipment availability, equipment performance, and product quality. When it comes to machine performance in the tissue and nonwovens mill, the focus is specifically on equipment availability, the amount of time the machine is actually up and running, and equipment speed.

While it is easy to see when a machine is running or not, it isn’t always easy to understand why it has stopped running or to see this downtime coming. When it comes to machine speed, it is not possible to detect small changes in that speed simply by looking at it. In the past, we simply did the best we could and dealt with machine downtime. However, today we have new technology that makes real time analytics possible.

The Role of Industry 4.0

Industry 4.0 is the key to ensuring optimal performance of mill machinery. It offers a combination of the Industrial Internet of Things (IIoT), data management, and artificial intelligence (AI)/machine learning that make it possible to continuously monitor every machine in every plant, as well as overall plant operations.

Pivotal to the measurement of machine performance in real time is IIoT. IIoT requires the installation of thousands of sensors and cameras along the production line. Every single machine will have dozens or hundreds of sensors that are continuously measuring every single aspect of the machine during operation. These sensors can gather data in a digital format from parts of the machine that mill workers cannot monitor adequately. They can sense changes in the machine’s operation that the human eye can’t even detect, all in real time.

The sensors on each machine are part of a company-wide network of sensors and devices that are connected to the cloud. As the data are collected, they are gathered and fed into AI software that can provide real-time analytics. Machine learning allows the machinery to make adjustments in real time and the system can alert staff of anomalous readings and let them know when maintenance is required.

A Bird’s Eye View with Real Time Analytics

How does all this improve machine performance? Since data are constantly flowing in from sensors sensitive enough to detect the slightest changes in machine performance, real time analytics:

- provides a closeup view of the different variables affecting machine performance;

- determines the probability that the machine will break down;

- anticipates and schedules predictive maintenance.

In other words, when something isn’t working at peak efficiency and speed, the system will pick up on that. Maintenance can then be scheduled before those minor anomalies become big enough to cause the machine to slow down or break down entirely. In addition, with such detailed data from every part of every machine, a tissue and nonwovens mill can tweak environmental and machine settings to ensure the highest possible speed a machine can be run at without compromising product quality. This pushes machine performance to its optimal state, and when you can accomplish this, equipment availability and equipment speed scores increase and your overall OEE score goes up.

Final Word

The technology available today has made Industry 4.0 possible, and with that, real time analytics is also possible. With the ability to collect data continuously and while a machine is in operation, the chances of a machine going offline or slowing down are significantly reduced. This provides tissue and nonwovens mills with much tighter control over all aspects of their operations and allows them to automate their processes so they can increase operational efficiency and make better product with less waste and in less time. Since time is money, this is the ideal situation for any tissue and nonwovens company competing in the market today.

For more information about measuring machine performance in your tissue and nonwovens mill, please take a look at our eBook The Ultimate Industry 4.0 Guide for the Tissue and Nonwovens Market.

Valmet to supply world’s largest bleached chemi thermo mechanical pulp line to Sun Paper’s Beihai mill in China

Valmet will supply the world’s largest bleached chemi thermo mechanical pulp (BCTMP) line to Guangxi Sun Paper Co., Ltd’s new Beihai mill in China. The start-up is scheduled for the fourth quarter of 2021. The order was included in Valmet's orders received of the second quarter 2020. The value of the order will not be disclosed.

Valmet’s delivery is part of Sun Paper’s new greenfield mill in Beihai, which will eventually have a total pulp and paper capacity of 3.5 million tonnes annually. This order complements the fine paper machine, automation and recovery boiler order, which Valmet announced in April 2020 and the cooking and fiberline order announced at the beginning of June.

“We have been discussing BCTMP technology with Valmet over the years and have done a lot of research on Valmet installations. The selected solution meets our needs very well, especially in terms of energy saving, environmental impact and operation capacity,” says Yanjun Cao, Vice General Manager, Sun Paper.

“This BCTMP order from Sun Paper is a great breakthrough for our cooperation, especially in BCTMP technology. The state-of-the-art technology we offered will help the customer to reduce operation cost significantly. This order further extends Valmet’s scope of delivery to Sun Paper Beihai Mill,” says Xiangdong Zhu, Area President, China, Valmet.

The Beihai mill site, showing site activities in progress.

The Beihai mill site, showing site activities in progress.

Information about Valmet’s delivery

The Valmet delivered BCTMP line is integrated to a folding box board line which will have capacity of 1,800 airdried metric tonnes per day.

Valmet’s delivery includes the main equipment for the BCTMP line including the world leading refiner and wash press technology. The EPS delivery scope covers engineering, procurement and site supervision. Training, site services and corresponding spare parts are also a part of the scope.

Information about the customer Sun Paper

Sun Paper is one of the subsidiaries of Shandong Sun Holdings Group, which was founded in 1982. Currently Sun Paper has two mills in China’s Shandong province. The company also operates a mill in Laos. In July 2019, Sun Paper established a wholly owned subsidiary, Guangxi Sun Paper, to build an integrated pulp and paper mill in Beihai.

ANDRITZ completes the world’s largest P-RC APMP production system at Jiangsu Bohui Paper Industry, China

International technology Group ANDRITZ has received the Final Acceptance Certificate from Jiangsu Bohui Paper Industry Co., Ltd in Yancheng, Dafeng, China, for its chemi-thermo-mechanical pulping system. With a total capacity of 2,250 admt/d, this system is the largest worldwide.

ANDRITZ installed its well-proven P-RC APMP (Pre-Conditioning Refiner Chemical Alkaline Peroxide Mechanical Pulp) technology to ensure optimum pulp quality in terms of high bulk and low shive content at lowest energy consumption and highest availability. The system processes eucalyptus wood chips for the production of folding boxboard (specifically coated ivory board), and consists of the world’s largest single P-RC APMP fiberline with a capacity of 1,500 admt/d and a second fiberline with a capacity of 750 admt/d.

The ANDRITZ TX68 refiner with an advanced feeding system is the centerpiece of the process and the latest innovation in high-consistency (HC) refining. The new feeding system combines the proven concepts of ANDRITZ’s Side Entry Plug Feeder (SEPF) with a Constant Feeder (C-Feeder) on each side of the twin refiner. The “DoubleSEPF” feed system ensures constant chip feeding and excellent steam control thanks to the exact and adjustable split of incoming wood chips and thus by far exceeds the capacities so far achieved with a single HC refiner.

ANDRITZ TX68 refiner with newly developed feeding system. Photo: ANDRITZ

ANDRITZ TX68 refiner with newly developed feeding system. Photo: ANDRITZ

ANDRITZ also supplied basic engineering, supervision of mechanical installation, training, commissioning and start-up services. The latest ANDRITZ Metris IIoT technologies feature a connection to the ANDRITZ DCS system to collect and analyze statistical mill data for continuous optimization of both fiberlines.

Jin Xiaoshan, Production Manager at Jiangsu Bohui Paper Industry confirms: “The Final Acceptance Certificate was achieved in superior cooperation, even in the challenging situation of Covid-19. Our ANDRITZ key contacts in Europe provided professional and efficient remote support. At the same time, we were able to count on highly committed and experienced engineers from ANDRITZ China on site. We are very proud of our folding boxboard production line with its P-RC APMP fiberlines and the excellent performance already achieved.”

Jiangsu Bohui Paper Industry Co., Ltd. is a subsidiary of Shandong Bohui Paper Industrial Co., Ltd., a listed company established in 1994 that focuses on the production of ivory board, culture paper, linerboard, paper for gypsum plasterboard, and market pulp for the papermaking industry.

Siegwerk launches new Circular Economy website

Siegwerk, one of the leading suppliers of printing inks for packaging applications and labels, has launched their new Circular Economy website. The company strongly believes in the needs of a Circular Economy (CE) and is committed to contribute to creating a circular packaging industry. The new website provides information about the company’s CE approach.

Siegwerk is committed to the principle of sustainability: Achieving a sensible balance between ecological, social and economic needs without compromising the resources of future generations. The growing demand for environmentally friendly solutions and sustainable packaging has strongly influenced the packaging market. “It is time to rethink packaging and move from a linear to a Circular Economy model,

Siegwerk is committed to the principle of sustainability: Achieving a sensible balance between ecological, social and economic needs without compromising the resources of future generations. The growing demand for environmentally friendly solutions and sustainable packaging has strongly influenced the packaging market. “It is time to rethink packaging and move from a linear to a Circular Economy model,

“ said Alina Marm, Head of Circular Economy Hub at Siegwerk.

Inks and coatings play an important enabler role in a Circular Economy. In addition to the branding of the packaging, the technical functionalities of inks support all three levers of a Circular Economy in terms of reduction, re-use and recycling. To that end, Siegwerk is purposefully investing in additional resources to become a circular and digital packaging solutions company, driving the positive developments in the industry with its functional and technical understanding of inks and coatings that support innovative packaging solutions.

New website for comprehensive overview

The new Siegwerk Circular Economy website offers a comprehensive overview of the company’s commitment to drive the development of circular packaging solutions. One particular website chapter provides information on in-depth circular solutions from Siegwerk such as:

- Inks, varnishes and barrier coatings for creating packaging designed for the paper recycling stream

- Inks, varnishes and barrier coatings for recyclable mono-plastic packaging

- Driving deinking solutions with inks and primers and value chain collaborations for deinking process standards

Siegwerk believes that cooperation and sharing knowledge are key on the way to a Circular Economy. That is why website visitors can also learn about Siegwerk’s strong partnership network that helps drive the development of new circular packaging solutions.

For more information please visit https://www.siegwerk.com/en/circular-economy.html

From toilet paper to face masks

Fabio Perini patents technology to produce up to 10,000 biodegradable bamboo masks per minute

The upgrade is available for Fabio Perini converting lines, new and/or already installed

A technological innovation capable of producing up to 10 thousand face masks per minute, which can be adapted to all main "non-woven" materials, including a particular bamboo-based material that can be disposed of with other organic waste. This is the patent filed by Fabio Perini, a Lucca based company which is part of the Körber Tissue Business Area. The technology, which developed in just over a month during lockdown, can be quickly added to the company’s converting machines, new and/or already installed with customers all over the world.

Oswaldo Cruz Jr., CEO of Fabio Perini S.p.A. and the Körber Tissue Business Area, has this to say about the technology: “Opportunities for innovation are everywhere, even in the midst of a health crisis, and during the lockdown our team got to work to respond to two needs: on the one hand, the huge demand for face masks – the Polytechnic University of Turin , for example, estimates that Italian companies alone will need almost 1 billion a month -; on the other, the issue of their disposal. In just over a month, from ideation to production, we arrived at the solution: a technological update that would allow the production of up to 10,000 masks (in rolls) per minute, and the use of a bamboo-based non-woven fabric that is biodegradable and can be disposed of with other compostable waste”.

These single-layer masks are very useful for daily, collective, and community use in places such as airports, public transportation, shopping malls, supermarkets, groceries and of course in our workplaces.

“The solution makes our machines also capable of manufacturing certified masks; however, pairing these materials with plastic would make the masks non-biodegradable. Nevertheless, together with different raw materials suppliers in the industry we are testing specific material solutions and we are confident of finding a solution soon” continues O. Cruz.

Coronavirus has thus also diversified Fabio Perini's business. O. Cruz concludes: “On this innovation, all over the world, we have had excellent feedback from our customers and we expect a significant grow in our business. In fact, from our own privileged point of view - we work with toilet paper and paper towel manufacturers across the world, from China to the United States - we have seen an important change. Initially the request was to increase the production capacity of the machines, especially those for toilet paper, due to the "stock effect" of these products, and to cope with this we even introduced a service for the fast delivery of machines (and those who know our sector know very well that this is not easy!). As weeks went by, demand has focused more on folded tissue paper products, due to the increase in the number of disposable items being used to meet greater hygiene needs. I believe this will continue as a trend for a long time to come”.

Coronavirus has thus also diversified Fabio Perini's business. O. Cruz concludes: “On this innovation, all over the world, we have had excellent feedback from our customers and we expect a significant grow in our business. In fact, from our own privileged point of view - we work with toilet paper and paper towel manufacturers across the world, from China to the United States - we have seen an important change. Initially the request was to increase the production capacity of the machines, especially those for toilet paper, due to the "stock effect" of these products, and to cope with this we even introduced a service for the fast delivery of machines (and those who know our sector know very well that this is not easy!). As weeks went by, demand has focused more on folded tissue paper products, due to the increase in the number of disposable items being used to meet greater hygiene needs. I believe this will continue as a trend for a long time to come”.

New harvesting plan confirmed Increased harvesting level and higher cash flow

SCA has confirmed a new harvesting plan which shows that the harvesting level in the own forest will increase over the coming five years by an additional one million cubic meters per year more than the current level. The increased harvesting level gives an increased cash flow of 300-400 MSEK per year with full effect from 2025.

SCA has confirmed a new harvesting plan which shows that the harvesting level in the own forest will increase over the coming five years by an additional one million cubic meters per year more than the current level. The increased harvesting level gives an increased cash flow of 300-400 MSEK per year with full effect from 2025.

In 2019, SCA made a new forest survey which showed that the company’s forests had a higher standing volume and a higher growth rate than previously estimated. A higher growth rate gives higher long term harvesting potential.

The new harvesting plan is now confirmed and it is based on calculations of the development of the forest over more than one hundred years into the future. It shows that harvesting over the coming five year period can successively increase from todays level of 4.3 million cubics meter solid wood under bark (m3sub) to 5.4 million m3sub per year.

Paper industry’s recycling performance reaches highest level ever in 2019

|

Toscotec-rebuilt PM1 exceeds production targets at Papertech in Spain

Core board manufacturer Papertech exceeded the targets of production increase originally set for the rebuild of its PM1 at Tudela mill, Spain.

At the end of 2018, Toscotec carried out a turnkey rebuild of the dryer section, installing 20 new TT SteelDryers. The supply included TT AirTail, an advanced rope-less tail threading system, which features a simple air flow regulation that guarantees stable tail threading for any basis weight. PM1 came online at the beginning of 2019 and successively exceeded the production targets Papertech originally set for this rebuild.

Mr. David Rubio, General Manager of Papertech and Dr. Luis Miguel Calvo, Mill Manager, openly discussed what they achieved with their rebuild project.

Who is Papertech?

Mr. Rubio: Founded in 1952, Papertech is a core board specialist in Spain. The Group has four paper mills in Europe and Asia: Tudela mill in Northern Spain, two mills in Indonesia and one in China. A couple of years ago, Sonoco Corporation, the global packaging company, bought 100% of the company’s shares. The group manufactures paper tubes and cores and other industrial applications such as cones for the textile industry, laminates, composite cans and dividers.

Currently, Tudela mill has an annual capacity of 60,000 tonnes, and the group total production is approximately 300,000 t/y.

PM1’s rebuild was your first cooperation with Toscotec. Why did you select Toscotec?

Mr. Rubio & Dr. Calvo: Our goal was to increase production. Out of the various technical solutions we evaluated, Toscotec gave us the most advantages. Firstly, with TT SteelDryers you can customize the diameter, and they offered a larger diameter than that of the cast iron cans we had; secondly, TT SteelDryers feature a bigger drying surface than cast iron dryers of the same face length. Basically, maintaining unchanged the overall length of the dryer section of the paper machine, we significantly increased our drying capacity, due to the larger diameter and drying surface of the new steel dryers. As a result, we were also able to preserve our existing hood, which is still working well. Toscotec had many successful references of similar rebuild projects and we were rather impressed with their extensive experience.

Why did you choose a turnkey supply?

Mr. Rubio & Dr. Calvo: This has been a key part of our growth strategy and we wanted to have one single company in charge and responsible for every aspect of the supply, including the mechanical and electrical part and services. Toscotec supplied all of the equipment and provided erection, supervision, commissioning and start-up assistance. They did a great job, we are very satisfied with their management of this turnkey supply.

Let’s focus on the project implementation. Are you satisfied with time management?

Mr. Rubio & Dr. Calvo: We were very focused on the machine downtime, because any delay would have put us in the difficult position of handling unplanned downtime, which is very costly. Toscotec’s team managed the project schedule beautifully. Our machine downtime was executed exactly as planned. It was perfect!

Did you achieve your production targets?

Mr. Rubio & Dr. Calvo: Yes, we achieved our targets of production increase. Actually, we surpassed the targets we had originally set for this project. TT SteelDryer lived up to our expectations and delivered a high drying capacity, which allowed for this production increase.

Toscotec’s rope-less tail threading system has been another upgrade of our existing line. It was specifically designed for low speed and high basis weight, because we were to apply it also to our higher basis weight range. As we went along, the expertise of our operators increased, which contributed to improve its final efficiency. Now, we are happy with it.

How would you describe the cooperation with Toscotec?

Mr. Rubio & Dr. Calvo: The cooperation has been very profitable. Toscotec is a very professional and flexible supplier, who delivered and implemented a successful rebuild. Their team provided fast responses and assistance whenever needed, solved problems and coordinated all the involved parties in the best possible way.

Clearwater Paper Launches ReMagine™ Paperboard Solution

Clearwater Paper Corporation has just introduced ReMagine™, a folding carton paperboard brand with up to 30 percent post-consumer recycled fiber. Inspired by circular economy principles, ReMagine provides high definition print capability and superior converting performance. The new folding carton brand is now available to the company’s customers.

“We are excited to introduce ReMagine to our customers, with a quality standard that we believe stands apart from other folding carton options in the market,” said Steve Bowden, senior vice president and general manager of the pulp and paperboard division. “Our newly-branded ReMagine is an important part of Clearwater Paper’s value proposition, positioning our customers to address growing trends in sustainable packaging.”

ReMagine is distinct, offering up to 30 percent post-consumer recycled fiber that is Food and Drug Administration compliant for all types of food contact. This new brand of solid bleached sulphate (SBS) provides an optimized balance of post-consumer recycled fiber and renewable virgin fiber, converting speed, and high definition print capability. The brand also offers Forest Stewardship Council® FSC-C008402 chain of custody certification.

For ReMagine, the company uses Sustana Fiber’s Envirolife™ 100% recycled fiber. It has similar characteristics to non-recycled hardwood pulp.

ReMagine is a brand promise that Clearwater Paper will continually evolve to provide customers innovative choices for the circular economy.

Speciality paper & board production was stable in 2019, showing robust positioning on end-markets. Also, market pulp production grew (+6.1%) as a result of recent significant investments in new capacities. Market pulp exports grew by 48% in 2019.

Speciality paper & board production was stable in 2019, showing robust positioning on end-markets. Also, market pulp production grew (+6.1%) as a result of recent significant investments in new capacities. Market pulp exports grew by 48% in 2019.