Ianadmin

Michelle Goldberg to Join Plum Creek Board of Directors

Plum Creek Timber Company, Inc. (NYSE:PCL) has announced that Michelle J. Goldberg has joined the company’s board of directors. Goldberg is a Partner at the venture capital firm Ignition Partners in Bellevue, Washington. She serves as an advisor to many emerging growth companies and sits on several for-profit and not-for-profit boards. She was named both 40 Under 40 and one of the Top 100 Most Influential Women in Technology by the Puget Sound Business Journal, and is a Crown Fellow of The Aspen Institute.

Plum Creek Timber Company, Inc. (NYSE:PCL) has announced that Michelle J. Goldberg has joined the company’s board of directors. Goldberg is a Partner at the venture capital firm Ignition Partners in Bellevue, Washington. She serves as an advisor to many emerging growth companies and sits on several for-profit and not-for-profit boards. She was named both 40 Under 40 and one of the Top 100 Most Influential Women in Technology by the Puget Sound Business Journal, and is a Crown Fellow of The Aspen Institute.

“Michelle’s extensive background as a venture capital investor and business advisor makes her a valuable addition to the board”

“Michelle’s extensive background as a venture capital investor and business advisor makes her a valuable addition to the board,” said Rick Holley, chief executive officer. “With her wealth of investment experience and financial acumen, she will bring an important perspective and we are pleased to welcome her to our board.”

Goldberg earned a Bachelor of Arts degree in East Asian Studies from Columbia University and a Master of Arts and Sciences degree in Regional Studies – East Asia from Harvard University.

Plum Creek is among the largest and most geographically diverse private landowners in the nation with more than 6 million acres of timberlands in 19 states. We also operate wood products mills in the Northwest. We manage our working forests using sustainable practices to benefit Plum Creek’s many stakeholders. Our employees work together to create shareholder value, serve as stewards of the environment, make wood products for everyday use, and build strong communities. Please visit www.plumcreek.com for the latest information about Plum Creek.

Contacts

Plum Creek Timber Company, Inc.

Investors: John Hobbs, 1-800-858-5347

Wausau Paper Reports Second-Quarter 2015 Results

Wausau Paper (NYSE:WPP) has announced financial and operating results for the three- and six-month period ended June 30, 2015.

Wausau Paper (NYSE:WPP) has announced financial and operating results for the three- and six-month period ended June 30, 2015.

“Our teams remain focused on furthering the significant performance benefits we are realizing from MEI in the second half of the year. We are pleased with the market’s favorable response to our premium products and the resulting improvement in our strategic mix.”

Second-Quarter Highlights

Financial Results

- Second-quarter adjusted EBITDA from continuing operations in 2015 was $14.5 million compared with adjusted EBITDA of $9.9 million in 2014. Second quarter 2015 adjusted EBITDA exceeded the Company’s previous guidance range of $13 to $14 million.

- On a reported basis, net earnings from continuing operations were $2.5 million, or $0.05 per share, in the second quarter of 2015 compared with a prior-year second-quarter net loss from continuing operations of $3.7 million, or $0.07 per share.

Case Volume Growth

- Second-quarter case shipment volume increased 2 percent in 2015 compared with the same period in 2014, resulting in a second-quarter shipment record of approximately 4.4 million cases for the Company.

- Strategic product shipments - those products sold in conjunction with proprietary dispensing systems or produced from premium substrates - comprised slightly more than 49 percent of the Company’s sales for the second quarter of 2015 and similar to the strategic product shipment mix in the prior-year quarterly period. The improved margin quality of both strategic and support products shipped in 2015 contributed to a 5 percentage point improvement in adjusted EBITDA margin of 16 percent as compared with 11.1 percent for the second quarter of 2014.

Michael C. Burandt, CEO, commented, “Our second quarter results reflect the continuing above-market demand growth for our premium DublNature® and Artisan™ products lines, the positive market response to our differentiated product portfolio, and the benefits from the significant number of Margin Enhancement Initiative (MEI) projects that are evidenced by ongoing improvement in operating performance, as well as, increased cash generation. We are very pleased with the pace of growth of our premium products and the contributions of our entire team toward improving our operating platform.”

Third-Quarter 2015 Outlook

Commenting on the third quarter, Mr. Burandt, said, “Our teams remain focused on furthering the significant performance benefits we are realizing from MEI in the second half of the year. We are pleased with the market’s favorable response to our premium products and the resulting improvement in our strategic mix.

“Although costs of production have improved through the first half of 2015, we maintain our prior forecast for modest cost pressure related to wastepaper pricing through the balance of the year. As a result we currently expect third quarter adjusted EBITDA of $17 million to $18 million,” Mr. Burandt concluded.

2015 Second-Quarter and First-Half 2015 Results

Continuing Operations

The following second-quarter and six-month discussion, as well as the financial highlights and other information summarized in the preceding discussion, contain comparisons of financial elements including EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net earnings (loss) and adjusted net earnings (loss) per share. These financial elements are not measurements of our performance under generally accepted accounting principles (GAAP) and should not be considered an alternative to net earnings (loss) or any other performance measures derived in accordance with GAAP. Additionally, the non-GAAP measures presented may not be the same as similar measures used by other companies. The Company believes that the presentation of select non-GAAP measures provides a useful analysis of ongoing operating trends. Please refer to the attached Reconciliation of Non-GAAP Financial Measures.

Second-quarter net sales for 2015 were $90.9 million, an increase of approximately 2 percent compared to $89.2 million in the second quarter of 2014. On a year-to-date basis, net sales rose approximately 5 percent to $175.1 million compared to $166.7 million in 2014. Higher net sales in both the quarter and year-to-date periods, were driven primarily by case shipment volume growth of 2 percent and more than 4 percent, respectively. Average net selling price for the comparable quarterly and first-half periods was relatively flat as actual selling price improvement was largely offset by the unfavorable impact of the Canadian exchange rate.

|

The following table provides a reconciliation of EBITDA(1) to adjusted EBITDA for both the three- and six-month periods ended June 30: |

||||||||||||||||

|

Three Months |

Six Months |

|||||||||||||||

|

2015 |

2014 |

2015 |

2014 |

|||||||||||||

| EBITDA | $ | 18.0 | $ | 6.8 | $ | 32.0 | $ | 12.4 | ||||||||

| Expense related to change in control provisions | 1.4 | 1.4 | ||||||||||||||

| Expense related to severance benefit of former CEO | 1.6 | 1.6 | ||||||||||||||

| Credit for contract at former manufacturing facility | (3.5 | ) | (7.4 | ) | ||||||||||||

| Adjusted EBITDA | $ | 14.5 | $ | 9.9 | $ | 24.6 | $ | 15.5 | ||||||||

| Adjusted EBITDA margin | 16.0 | % | 11.1 | % | 14.1 | % | 9.3 | % | ||||||||

|

Note: Totals may not foot due to rounding differences |

||||||||||||||||

|

(1) See also the attached reconciliation of Non-GAAP Financial Measures to the most directly comparable GAAP measure. |

||||||||||||||||

Year-over-year improvements in adjusted EBITDA and adjusted EBITDA margins in both the second quarter and first half periods of 2015 were driven by the improved quality of mix and volume of products sold, as well as continued operational improvement. These positive factors were partially offset by pre-tax costs of approximately $1.2 million as a result of planned, routine maintenance outages that occurred at both our Kentucky and Ohio, facilities in the second quarter of 2015.

Excluding the after-tax impact of the special items previously mentioned, second quarter 2015 adjusted net earnings were $0.2 million, or $0.00 per share, compared to an adjusted net loss of $1.8 million, or $0.04 per share, in the second quarter of 2014. On a reported basis, second quarter net earnings were $2.5 million, or $0.05 per share, in 2015 compared to a net loss of $3.7 million, or $0.07 per share, in the year-ago period.

The first half of 2015 and 2014, excluding special items previously mentioned, resulted in adjusted net losses of $2.0 million, or $0.04 per share, and $6.2 million, or $0.12 per share, respectively. On a reported basis, net earnings for the first half of 2015 were $2.7 million, or $0.05 per share, compared to a net loss of $8.2 million, or $0.16 per share, for the first six months of 2014.

About Wausau Paper:

Wausau Paper produces and markets a complete line of away-from-home towel and tissue products, as well as soap and dispensing systems. The Company is listed on the NYSE under the symbol WPP. To learn more about Wausau Paper visit wausaupaper.com.

ANDRITZ GROUP: results for the first half of 2015

International technology Group ANDRITZ showed solid business development in the first half of 2015 in a still challenging overall economic environment.

International technology Group ANDRITZ showed solid business development in the first half of 2015 in a still challenging overall economic environment.

The key financial figures developed as follows:

- In the first half of 2015, sales amounted to 3,005.6 MEUR, which is an increase of 13.0% compared to the previous year’s reference period (H1 2014: 2,659.4 MEUR). In the second quarter of 2015, sales rose by 11.2% compared to last year’s reference figure, reaching 1,601.3 MEUR (Q2 2014: 1,439.9 MEUR).

- Order intake amounted to 2,580.0 MEUR in the first half of 2015 (-13.4% versus H1 2014: 2,980.2 MEUR). While the order intake in the HYDRO business area only dropped slightly (-2.5% versus H1 2014), order intake in the other business areas dropped – in some cases substantially: PULP & PAPER -14.0%, METALS -25.4%, SEPARATION -9.5%. In the second quarter of 2015, order intake amounted to 1,149.4 MEUR (-7.2% versus Q2 2014: 1,238.0 MEUR).

- The order backlog as of June 30, 2015, amounted to 7,349.0 MEUR (-2.2% versus December 31, 2014: 7,510.6 MEUR).

- Earnings and profitability developed favorably. In the first half of 2015, the EBITA rose by 38.6% to 184.9 MEUR (H1 2014: 133.4 MEUR) and the EBITA margin to 6.2% (H1 2014: 5.0%). In the second quarter of 2015, the EBITA amounted to 111.5 MEUR (+31.5% versus Q2 2014: 84.8 MEUR), and the EBITA margin increased to 7.0% (Q2 2014: 5.9%). This positive development is mainly due to the HYDRO and PULP & PAPER business areas, which achieved a substantial increase in profitability compared to the previous year’s reference period.

- Net income (without non-controlling interests) rose considerably in the first half of 2015 and amounted to 113.9 MEUR (+70.8% versus H1 2014: 66.7 MEUR).

Wolfgang Leitner, President and CEO of ANDRITZ: “In view of the unchanged difficult economic environment, we are satisfied with the business development in the first half of 2015. However, project and investment activity has slowed down in some of our end markets, in some cases substantially, and this activity has also become increasingly volatile. Hence, we shall continue the structural measures already implemented in the past few years in order to adapt our value chain to these changed market conditions and thus increase our flexibility.”

Based on the current project activity in the ANDRITZ business areas and on the order backlog as of the end of June 2015, ANDRITZ currently expects an increase in sales and net income for the 2015 business year compared to the previous year. If, however, the economic weakness in the emerging countries (particularly in China) continues in the coming months, the global economy suffers any severe setbacks, or there is major turmoil in the international foreign currency and financial markets, this could have a negative impact on ANDRITZ’s business development. This could necessitate organizational and capacity adjustments in individual business areas and thus result in financial provisions that could negatively impact the earnings of the ANDRITZ GROUP.

For further information, please contact:

Michael Buchbauer

Head of Group Treasury, Corporate Communications & Investor Relations

Phone: +43 (316) 6902 2979

f_to=This email address is being protected from spambots. You need JavaScript enabled to view it.&;g_cmsid=5222" title="Contact ANDRITZ about "ANDRITZ GROUP: results for the first half of 2015"">This email address is being protected from spambots. You need JavaScript enabled to view it.

The ANDRITZ GROUP

ANDRITZ is a globally leading supplier of plants, equipment, and services for hydropower stations, the pulp and paper industry, the metalworking and steel industries, and for solid/liquid separation in the municipal and industrial sectors. The publicly listed technology Group is headquartered in Graz, Austria, and has a staff of almost 25,000 employees. ANDRITZ operates over 250 sites worldwide.

Annual and financial reports

The annual reports and financial reports of the ANDRITZ GROUP are available as PDF for download at www.andritz.com. Printed copies can be requested by e-mail to f_to=This email address is being protected from spambots. You need JavaScript enabled to view it.&;g_cmsid=5222" title="Contact ANDRITZ about "ANDRITZ GROUP: results for the first half of 2015"">This email address is being protected from spambots. You need JavaScript enabled to view it..

Disclaimer

Certain statements contained in this press release constitute “forward-looking statements”. These statements, which contain the words “believe”, “intend”, “expect”, and words of a similar meaning, reflect the Executive Board’s beliefs and expectations and are subject to risks and uncertainties that may cause actual results to differ materially. As a result, readers are cautioned not to place undue reliance on such forward-looking statements. The company disclaims any obligation to publicly announce the result of any revisions to the forward-looking statements made herein, except where it would be required to do so under applicable law.

A table with figures can be downloaded below

Voith supplies complete process line for corrugated board base papers to Schoellershammer

In April, Heinrich August Schoeller Söhne GmbH & Co. KG commissioned Voith with the supply of a complete process line for the manufacture of corrugating medium and testliner for its Schoellershammer paper mill, based in Düren, Germany.

In April, Heinrich August Schoeller Söhne GmbH & Co. KG commissioned Voith with the supply of a complete process line for the manufacture of corrugating medium and testliner for its Schoellershammer paper mill, based in Düren, Germany.

On the new system, Schoellershammer will produce packaging papers in a basis weight range of 80 to 120 g/m². The annual capacity of the new PM 6 will come in at 250,000 metric tons. This will double the manufacturer’s current capacity and will also provide the option to produce a larger share of papers with low basis weights. Demand is driven by producers of corrugated packaging board, with particularly strong growth in lighter paper grades. One of the key drivers is ever-increasing Internet commerce with its direct shipping to end consumers.

The new PM 6 will be designed to a wire width of 6,300 mm and a speed of 1,200 m/min. Start-up is scheduled for the end of 2016. Voith’s scope of delivery includes the entire production line featuring state-of-the-art technology: The complete stock preparation to produce short and long fiber stock from 100% recovered paper, a DuoFormer Base with a MasterJet Pro G headbox including ModuleJet and a DuoCentri NipcoFlex press to increase surface quality on the face side, as well as a SpeedFlow sizing unit. The dryer section will be equipped with ProRelease+ and DuoStabilizers, ensuring stable web pickup. The scope of delivery further includes a MasterReel winder for master reels with a diameter of 3.8 m and a VariFlex winder.

Voith will also supply the entire automation and clothing package. The order is rounded out with a five-year contract comprising services, fabrics and screen baskets.

Key points for Schoellershammer in selecting its supplier were Voith’s reference projects in the field of sophisticated, light packaging papers, the supply of the entire manufacturing line and the overall concept, which takes the energy efficiency of the process into account.

The Schoellershammer paper mill, of Heinrich August Schoeller Söhne GmbH & Co. KG, was founded in 1784. Today, the mill produces approx. 230,000 metric tons/a corrugated board base papers on a paper machine with a width of 5,000 mm. The company employs 229 staff and has annual sales of some 100 million euros. The new PM 6 will provide employment for 85 staff in Düren, Germany.

Further information is available on the Voith website at www.voith.com/paper. Voith Paper is also on Twitter and YouTube.

Voith Paper is a division of the Voith Group and the leading partner to and pioneer in the paper industry. Through constant innovations, Voith Paper is optimizing the paper manufacturing process, focusing on developing resource-saving products to reduce the use of energy, water, and fibers. Furthermore, Voith Paper offers a broad service portfolio for all sections of the paper manufacturing process.

Voith sets standards in the markets of energy, oil & gas, paper, raw materials and transport & automotive. Founded in 1867, Voith today has more than 39,000 employees, sales of €5.3 billion and locations in more than 50 countries, making it one of the largest family-owned companies in Europe.

Martin à Porta appointed President and CEO of Pöyry

The Board of Directors of Pöyry PLC has appointed Martin à Porta (M. Sc. Eng.), 44, as the new President and CEO of Pöyry PLC. He will take up the position latest on 1 February, 2016. Alexis Fries will continue as President and CEO until Martin à Porta takes up his position.

The Board of Directors of Pöyry PLC has appointed Martin à Porta (M. Sc. Eng.), 44, as the new President and CEO of Pöyry PLC. He will take up the position latest on 1 February, 2016. Alexis Fries will continue as President and CEO until Martin à Porta takes up his position.

Martin à Porta joins Pöyry from Siemens Corporation where he is currently CEO of Siemens Building Technologies in Europe. Previously, Martin held leadership positions at Siemens spanning European, Asian, Middle Eastern and Latin American countries. Martin started his career at Electrowatt Engineering, acquired by Pöyry in 1997. His CV is available on Pöyry's website at www.poyry.com.

"Martin has a strong track record of leadership in professional organisations. He was selected especially due to his high level of energy and strong teamworking skills", says Henrik Ehrnrooth Chairman of the Board of Directors of Pöyry PLC.

"I am excited to be rejoining Pöyry. It is an honour to lead the company", says Martin à Porta. "Managing a knowledge organisation is challenging but very rewarding. Our society, markets and clients require ever more environmentally-friendly, cost efficient products and processes; our urban living environment is getting more dense and needs a compact, efficient as well as sustainable infrastructure. The demand for these future products and new forms of energy production will continue and many customers expect it to be based on renewable raw materials and sources. Furthermore, future 'smart infrastructure' is designed for economic recycling of materials and energy. Pöyry's know-how is uniquely relevant to address these new demands. It is our vision to work in even closer collaboration with our clients, developing new concepts that will address these future challenges. It is a privilege to rejoin Pöyry and to continue to build a new future based upon Pöyry's unique knowledge and strong corporate culture."

Alexis Fries has served Pöyry as a Member of the Board of Directors since 2008. He was appointed President and CEO in September 2012 to restructure and reposition the company. Having successfully completed his assignment, Alexis will continue as a member of the Board of Directors.

"I want to take this opportunity to thank Alexis Fries for his dedication and commitment to Pöyry during the past three years," says Henrik Ehrnrooth. "He has done an excellent job. While the company was facing various challenges in a difficult business environment, Alexis has refocused the company and established a solid foundation from which to continue."

"Over the past years we have introduced many changes and improvements", says Alexis Fries. "Today, Pöyry is back on track and looks to the future with confidence. I would like to warmly thank all my colleagues for their support in accomplishing this task. I look forward to continuing to contribute to the company's development and will support Martin during the transition. I am confident that Martin will continue to move the company to the next level."

"We are confident that Pöyry is in good hands and succeeds under Martin's leadership", comments Henrik Ehrnrooth.

PÖYRY PLC

Board of Directors

Additional information:

Henrik Ehrnrooth, Chairman of the Board of Directors, Pöyry PLC

Tel. +358 10 33 22629

Pöyry is an international consulting and engineering company. We serve clients globally across the energy and industrial sectors and provide local services in our core markets. We deliver management consulting and engineering services, underpinned by strong project implementation capability and expertise. Our focus sectors are power generation, transmission & distribution, forest industry, chemicals & biorefining, mining & metals, transportation and water. Pöyry has an extensive local office network employing about 6,000 experts. Pöyry's net sales in 2014 were EUR 571 million and the company's shares are quoted on NASDAQ OMX Helsinki (Pöyry PLC: POY1V).

Paperworld China: Oriental Culture zone features unique products from Anna Chennault Foundation

Top-notch stationery and gift items with Chinese attributes, as well as the most popular hobby & craft techniques and live demonstrations, will be staged at Paperworld China, held from 15 – 17 October 2015 at the Shanghai New International Expo Centre, Hall N1 – N2.

Top-notch stationery and gift items with Chinese attributes, as well as the most popular hobby & craft techniques and live demonstrations, will be staged at Paperworld China, held from 15 – 17 October 2015 at the Shanghai New International Expo Centre, Hall N1 – N2.

- Oriental Culture zone features unique products from Anna Chennault Foundation

- Creative Pavilion responds to the hobby & craft craze

- Esteemed lawyers share insights into intellectual property rights

Aside from a selection of high-quality traditional arts, fine crafts, calligraphy and painting showcased by a number of exhibitors, the Oriental Culture zone will collaborate with the Anna Chennault Foundation, which is committed to protecting intangible cultural heritage and advocating national culture. The foundation’s exclusive collection of stationery, desktop products and gift items characterised by a blend of modernity and Chinese tradition, will allow visitors to enjoy a prestigious sourcing experience as well as forge a commercial channel for the cultural industry.

The return of Oriental Culture zone maintains the momentum from the presentation, held in July in Suzhou, which was supported by hundreds of culture and arts professionals and related companies. The promotional efforts will expand to Northern and Southern China as well as Taiwan to draw more exhibitors from different provinces who will bring their local uniqueness to the show.

Stationery combining traditional oriental features and contemporary design has experienced growing popularity in recent years, particularly among middle range to high-end domestic and overseas consumer groups. It is regarded as a representation of individuality and personal taste and is often used as a corporate gift.

Creative Pavilion responds to the hobby & craft craze

Paperworld China envisions enormous potential for providing hobby & craft professionals a quality avenue for information exchange, network and trading. For this purpose, the hobby & crafts element was added to the show’s portfolio in 2013 and continues to receive overwhelmingly positive feedback from the exhibitors. In 2015, Paperworld China and the DIY Industry Promotion Council of Shanghai Creative Industry Association have joined forces again to launch the Creative Pavilion, which is expected to house more exhibitors and a larger exhibition space.

Hobby & craft has become a pop culture phenomenon in the Chinese consumer market, fuelling the rapid development of China's creative industry. In particular, the post-80s and 90s generation consumer groups pursue unique experience and original innovation, which propel the huge demand for hobby & craft products. To date, there are more than 1,000 websites in China dedicated to hobby & craft enthusiasts, which have almost 400 million members. Just in Taobao alone, the e-commerce giant in China, there are 130,350 individual shops solely for hobby & craft products, materials, tools and related items.

Esteemed lawyers share insights into intellectual property rights

Intellectual property rights play a growing significant role in international trade and it is particularly essential for China as it is one of the world’s top five largest patent application countries. While upgrading original design and innovation capability, Chinese enterprises must strengthen their intellectual property rights consciousness to protect their rights and interests when launching new products in overseas markets.

In response to the pressing issue, one of the show’s fringe events will be hosted by eminent intellectual property lawyers who will closely examine intellectual property rights and related issues, which are often encountered by Chinese enterprises. The seminar will encompass an introduction to intellectual property rights, case studies as well as the latest trends and overseas promotion channels.

Paperworld China is organised by Messe Frankfurt (Shanghai) Co Ltd, the China Chamber of Commerce for I/E of Light Industrial Products & Arts-Crafts and Guangzhou Foreign Trade South China Exhibition Corp Ltd.

For more information about the show, please visit www.paperworldchina.com or email: a href="malto:This email address is being protected from spambots. You need JavaScript enabled to view it." title="blocked::mailto:This email address is being protected from spambots. You need JavaScript enabled to view it..

Other shows under the Paperworld brand include:

- Hong Kong International Stationery Fair

11 – 14 January 2016, Hong Kong

- Paperworld

30 January – 2 February 2016, Frankfurt

- Paperworld Middle East & Playworld Middle East

1 – 3 March 2016, Dubai

For more details about these fairs, please visit

www.global.paperworld.messefrankfurt.com

Background information on Messe Frankfurt

Messe Frankfurt is one of the world’s leading trade fair organisers, generating around €554 million in sales and employing 2,130 people. The Messe Frankfurt Group has a global network of 29 subsidiaries and 57 international Sales Partners, allowing it to serve its customers on location in more than 160 countries. Messe Frankfurt events take place at more than 30 locations around the globe. In 2014, Messe Frankfurt organised a total of 121 trade fairs, of which more than half took place outside Germany. Comprising an area of 592,127 square metres, Messe Frankfurt’s exhibition grounds are home to ten exhibition halls. The company also operates two congress centres. The historic Festhalle, one of the most popular venues in Germany, plays host to events of all kinds. Messe Frankfurt is publicly owned, with the City of Frankfurt holding 60 percent and the State of Hesse 40 percent. For more information, please visit our website at www.messefrankfurt.com.

Unmatched mixing performance

Alfa Laval Rotary Jet Mixer effectively handles liquid and powder mixing, gas dispersion and Cleaning-in-Place (CIP) while reducing time, energy and costs.

Alfa Laval Rotary Jet Mixer effectively handles liquid and powder mixing, gas dispersion and Cleaning-in-Place (CIP) while reducing time, energy and costs.

In many applications the Alfa Laval Rotary Jet Mixer provides a faster and more efficient mixing than conventional methods. It combines high blending precision with minimized mixing times and up to 50% reduction in energy requirements. Based on rotary jet head technology, it can be used in tanks between 100 and 800,000 liters in size.

Equipped with two or four nozzles, the Rotary Jet Mixer is positioned below liquid level in the tank. Liquid is withdrawn from the tank outlet by a pump and circulated via an external loop to the mixer. It helps reduce operating expenses while achieving fast and efficient mixing. A single Rotary Jet Mixer can handle liquid mixing, gas dispersion and powder dispersion applications – plus tank cleaning – without requiring separate equipment for each process, thereby delivering significant savings.

About Alfa Laval

Alfa Laval is a leading global provider of specialized products and engineering solutions based on its key technologies of heat transfer, separation and fluid handling.

The company’s equipment, systems and services are dedicated to assisting customers in optimizing the performance of their processes. The solutions help them to heat, cool, separate and transport products in industries that produce food and beverages, chemicals and petrochemicals, pharmaceuticals, starch, sugar and ethanol.

Alfa Laval’s products are also used in power plants, aboard ships, oil and gas exploration, in the mechanical engineering industry, in the mining industry and for wastewater treatment, as well as for comfort climate and refrigeration applications.

Alfa Laval’s worldwide organization works closely with customers in nearly 100 countries to help them stay ahead in the global arena.

Alfa Laval is listed on Nasdaq OMX, and, in 2014, posted annual sales of about SEK 35.1 billion (approx. 3.85 billion Euros). The company has about 18 000 employees.

Quant wins large contract with Stora Enso in China

Quant and Stora Enso (Guangxi) Packaging Company Limited in China have signed a total maintenance outsourcing agreement, effective April 15, 2015. The deal represents a significant order for Quant both globally, and in the region.

Quant and Stora Enso (Guangxi) Packaging Company Limited in China have signed a total maintenance outsourcing agreement, effective April 15, 2015. The deal represents a significant order for Quant both globally, and in the region.

The site is a greenfield operation for Stora Enso and Quant, consisting of two main phases: phase one — board machine with mechanical pulping line and supporting utilities; phase two — chemical pulp line with expanded utilities.

Spanning a total duration of six years, the scope of the agreement demonstrates Quant’s expansive capabilities, covering all maintenance resources and materials across different stages and subcontractors, including warehouse, repair workshop operations, equipment and warranty management. The ongoing maintenance team size is estimated at 75 people for phase one.

Quant’s objective is to provide Stora Enso (Guangxi) Packaging Company Limited with sustainable, world-class industrial operations, while demonstrating the value of taking maintenance to the next level.

About Quant:

Quant www.quantservice.com is a global leader in industrial maintenance. For over 25 years, we have been realizing the full potential of maintenance for our customers. From embedding superior safety practices and building a true maintenance culture, to optimizing maintenance cost and improving plant performance, our people make the difference. We are passionate about maintenance and proud of ensuring we achieve our customers’ goals in the most professional way.

About Stora Enso:

Stora Enso is a leading provider of renewable solutions in packaging, biomaterials, wood and paper in global markets. Stora Enso’s aim is to replace non-renewable materials through innovation based on wood and other renewable materials. The Group has some 27 000 employees in more than 35 countries, and is publicly traded in Helsinki and Stockholm. www.storaenso.com

For more information, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.

Subscribe to our online magazine here

Watch what Quant is all about here

Zanders – the expert in high quality speciality papers and boards launches new appearance

Following its acquisition by mutares AG, Zanders GmbH, the expert in high quality speciality paper and board for labels, packaging and graphical applications, has launched a new corporate design and expressive logo. The company, based in Bergisch Gladbach, Germany, is also planning to promote its products and expertise more vigorously in the future to a wider global market.

Zanders' Gohrsmühle paper mill in Bergisch Gladbach, Germany, was founded in 1829

The new Zanders logo expresses the essence of the company: a white "Z" for Zanders is emblazoned on a dark circular background that symbolises a roll of paper, illustrating its focus on papermaking. Below this letter, three horizontal white lines, representing sheets of paper, emphasise the basis for the success of the company. "Zanders, the papermakers" is the new corporate slogan. It spells out that this paper factory, with its rich tradition, continues to be sustained by its employees - the "papermakers" - and their special form of expertise.

The Zanders paper mill remained in the hands of the Zanders family for around 150 years. Constantly growing, Zanders expanded its production at the Gohrsmühle mill into art paper in 1895 and introduced Chromolux in 1958. Following its listing on the stock exchange in 1980, Zanders AG was acquired by the Finnish fresh forest fibre paper and board manufacturer Metsä Board (formerly M-real) in 2001, and renamed Metsä Board Zanders GmbH in 2012. In May 2015, Munich-based holding company mutares AG acquired the company, which once again produces its high quality grades of paper under the name of Zanders GmbH.

The new look heralds Zanders’ move to expand in a wider global market, offering its expertise in high quality speciality paper and board for labels, packaging and graphical applications to brand owners, packaging manufacturers and printers.

Its range encompasses high-gloss finished label papers and premium board grades in the traditional Chromolux brand, as well as the Zanlabel brand added to its portfolio as a cost-effective solution in 2014. This includes Zanlabel gloss and Zanlabel touch label papers, with a particularly smooth and naturally uncoated surface respectively. Zanders also offers the flexible packaging paper Zanflex, and the Silver digital premium paper range designed for digital printing. Zanders exclusively uses raw materials from sustainably cultivated forestry operations and therefore fulfills the FSC requirements.

Zanders provides specialised solutions for a wide variety of segments while consistently maintaining the highest quality in terms of technical characteristics and finishing options, as well as product safety. It meets the requirements of manufacturers of beverages, including spirits, sparkling wine, wine, water and beer; grocery and luxury food products; tobacco products, as well as pharmaceuticals and cosmetics. Its potential end-uses range from high-end to standard products, including specialised segments such as individual craft beer breweries.

About Zanders GmbH

Zanders GmbH brings expertise and innovation to the manufacture of high quality speciality papers and boards, developed especially for applications that include labels, packaging and graphics. Founded by Johann Wilhelm Zanders in Bergisch Gladbach, Germany, in 1829, the company still operates the Gohrsmühle paper mill there today with around 500 employees. The premium Chromolux brand introduced in 1958 – one of the world's leading brands of paper – as well as Zanlabel brand label papers, introduced in 2014, form part of its range of products.

Finnish Forestry Expansion: Increased Demand Affects Supply and Price

The most densely forested countries in Europe, Finland and Sweden—with their ideal growing conditions for conifers, easily workable and valuable tree species, good harvesting conditions and infrastructure and accessibility to major European markets—have a robust and prosperous forest products industry. In 2014, the countries were the largest pulp producers in Europe, representing more than 60 per cent of total European pulp production (36.5 million tonnes) and 13 per cent of global pulp production (173 million tonnes). Sweden is the world’s fifth largest pulp producer, and Finland is the sixth. They follow just Brazil, Canada, the United States, Chile and Indonesia. Scandinavia also has a world-class sawn wood industry, which will be the focus of follow-on articles.

Global Competition

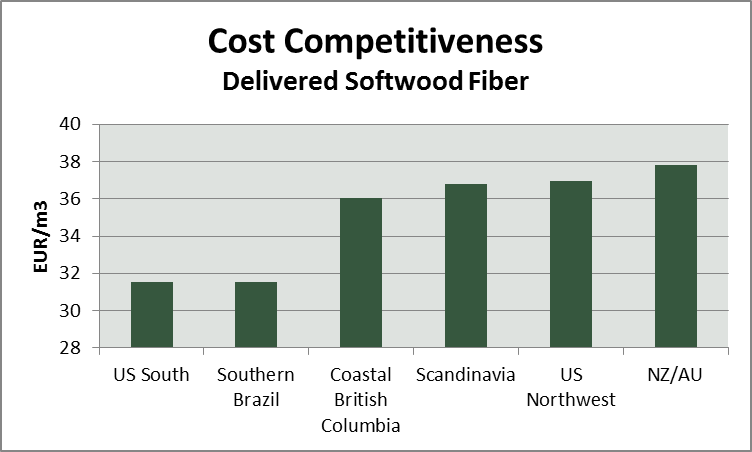

Despite being a high production region, Scandinavian countries are facing increasing pressure from global competitors with lower wood costs. The figure below illustrates the relative cost positions of the major pulp producing regions in the world. Coniferous fiber costs in Scandinavian countries are on the higher end of the scale, with both the US South and Southern Brazil being advantaged from this perspective.

Increased Demand Leads to Increased Production Capacity

As competition has grown, however, so has demand. The global increase in demand for conifer pulp has led to a series of announcements for new production capacity. The Metsä Fibre pulp/bioproduct mill scheduled to open in central Finland in 2017 will be the largest ever investment in the forest industry in Finland, at 1.1 billion EUR. With an annual pulp production capacity of 1.3 million tonnes, the mill will increase consumption by 4 million m3 of roundwood on a yearly basis. In addition, a number of other pulp/bioproduct mill projects have been announced, some for the construction of new capacity and others for expanding the capacity of current facilities.

The Effect of New Demand on Timber Supply

On the surface, it appears that Finland’s forests are capable of meeting this additional demand. Forest area has remained almost unchanged in Finland over the last 50 years, and the volume of growing stock has increased more than 40 per cent over the same period. In 2013, growing stock volume in Finnish forests was 2,357 million m3 (over bark), and the annual growth rate was approximately 100 million m3 (in 2013: 104 million m3). In addition, 10 million m3 of roundwood was imported in 2013, for a total of 110 million m3. At the same time, industrial roundwood consumption in the country was 64.5 million m3, and fuelwood consumption was 9.4 million m3. With just 74 million m3 of the available 114 million m3 being used in 2013, or 61 per cent, an additional 40 million m3 of over supply was available to the market.

Even though the forest is healthy and growing from an operational and economic perspective, the fact that consumers imported 10 million m3 of roundwood each year points to regional supply deficits, as imports flowing from the Baltics and Russia attest. Logistics are one explanation. Some of these forests are not economically harvestable from a logistics perspective, as individual harvest sizes are small or difficult to log because of swampy terrain. Others are far away from mills, and because of high fuel costs, transporting logs from the forest to the market is not economically feasible. These logistical issues incent forest products companies to import logs from nearby Russia to save on freight costs, and to import inexpensive logs from areas, like the Baltics, with minor pulpwood markets. Logs from these areas are readily available and relatively inexpensive, compensating for higher freight rates.

In this context, an additional 4 million m3 of demand should induce a certain amount of diligence in the industry. This additional capacity will add fiber constraints to the local market regardless of the state of the entire Finnish forest.

- 4 million m3 in a local market is a significant increase in demand.

- It is unlikely that all of the new demand can be sourced from the forest directly, so expect an increase in saw log production in conjunction with pulpwood production and a proportional increase in lumber and chips.

- 4 million m3 represents a 6 per cent increase in roundwood demand and a 10 per cent increase in pulpwood demand; at the same time, forests grow at an average rate of 3 per cent per year.

The Effect of New Demand on Timber Prices

To support this additional demand, markets in Scandinavia are likely to become more dynamic and complicated, and wood will flow more freely across borders. Because mills will need to source wood from further distances, logistics costs will increase, and they become a larger part of overall costs.

Forest2Market’s experience with similar situations in North and South American markets suggests that logistics costs go up first and then stumpage prices follow. Currently, real stumpage prices have been following a downward trend in Finland as a result of the oversupply, and prices are lower than they are in key competitor countries as a result. The addition of production capacity will bring supply and demand into greater parity, and—at least in some areas—prices should reverse trend.

Scandinavian forest products markets are approaching a liminal moment. Facing increased competition globally from markets with lower cost positions and the potential for the higher fiber costs associated with more dynamic markets, producers in Scandinavia will be under greater pressure to understand their markets and manage their cost positions not only in regards to other mills in their region, but to other mills across the globe.

Currently, the delivered price data required to evaluate a mill’s cost position relative to the market and to optimize the supply chain to reduce costs is unavailable in Europe. A credible benchmark, like the ones Forest2Market has developed in North and South American markets, would provide a level of transparency to the market that would be beneficial in the long term to both Scandinavian markets and support the health and sustainability of forests through better utilization.