Ianadmin

Domtar announces major investment at its Ashdown, AR mill

Domtar Corporation (NYSE: UFS) (TSX: UFS) has announced that its Board of Directors has approved a $160 million capital project to convert a paper machine at the Ashdown, Arkansas mill to a high quality fluff pulp line used in absorbent applications such as baby diapers, feminine hygiene and adult incontinence products. The planned conversion is expected to come online by the third quarter 2016 and will allow for the production of up to 516,000 metric tons of fluff pulp per year once the machine is in full operation. The project will also result in the permanent reduction of 364,000 short tons of annual uncoated freesheet production capacity in the second quarter of 2016.

Domtar Corporation (NYSE: UFS) (TSX: UFS) has announced that its Board of Directors has approved a $160 million capital project to convert a paper machine at the Ashdown, Arkansas mill to a high quality fluff pulp line used in absorbent applications such as baby diapers, feminine hygiene and adult incontinence products. The planned conversion is expected to come online by the third quarter 2016 and will allow for the production of up to 516,000 metric tons of fluff pulp per year once the machine is in full operation. The project will also result in the permanent reduction of 364,000 short tons of annual uncoated freesheet production capacity in the second quarter of 2016.

"The fluff pulp conversion project at the Ashdown mill is an important step in advancing our strategy to generate $300 to 500 million of EBITDA from growth businesses," said John D. Williams, Chief Executive Officer. "We are expanding our presence in a growing business that will allow us to support our top-tier supplier position with some of the world's largest producers of absorbent hygiene products. Once completed, Ashdown, together with our Plymouth mill will provide a platform to further strengthen our leading position as an effective producer of high quality fluff pulp with nearly one million tonnes of total production capacity."

Commenting on the reduction of papermaking capacity, Mr. Williams added, "The conversion of the paper machine in 2016 will further help balance our supply with our customers' demand. In the interim, the flexibility of the two remaining paper machines at the Ashdown mill allows us to take measured steps to adjust our paper production while selling papergrade pulp."

The conversion work is expected to commence during the second quarter of 2016 and the fluff pulp line is scheduled to start-up by the third quarter 2016. The cost of conversion will be approximately $160 million of which $40 million is expected to be invested in 2015 and $120 million in 2016. The Company will also invest in a pulp bale line that will provide flexibility to manufacture papergrade softwood pulp, contingent on market conditions.

The aggregate pre-tax earnings charge in connection with this conversion is estimated to be $117 million which includes an estimated $114 million in non-cash charges relating to accelerated depreciation of the carrying amounts of the manufacturing equipment as well as the write-off of related spare parts. Of the estimated pre-tax charge of $117 million, $3 million relates to estimated cash severance, employee benefits and training. Of the estimated total pre-tax charge of $117 million, $9 million is expected to be recognized in the fourth quarter of 2014 and $108 million is expected to be incurred during 2015 and 2016.

As a result of the fourth quarter decision to convert the nature and use of line A64 of the Ashdown Pulp and Paper mill, the carrying amount of the assets of the Ashdown mill is being tested for impairment and may result in a write-down during the fourth quarter of 2014. The carrying amount of such assets was approximately $813 million at November 30, 2014.

About Domtar

Domtar Corporation (NYSE: UFS) (TSX: UFS) designs, manufactures, markets and distributes a wide variety of fiber-based products including communication papers, specialty and packaging papers and absorbent hygiene products. The foundation of its business is a network of world class wood fiber converting assets that produce papergrade, fluff and specialty pulps. The majority of its pulp production is consumed internally to manufacture paper and consumer products. Domtar is the largest integrated marketer of uncoated freesheet paper in North America with recognized brands such as Cougar®, Lynx® Opaque Ultra, Husky® Opaque Offset, First Choice® and Domtar EarthChoice®. Domtar is also a leading marketer and producer of a broad line of absorbent hygiene products marketed primarily under the Attends®, IncoPack and Indasec® brand names. In 2013, Domtar had sales of $5.4 billion from some 50 countries. The Company employs approximately 10,000 people. To learn more, visit www.domtar.com .

Safe Harbor

The statements in this release regarding our conversion plans with respect to our Ashdown facility are forward-looking statements. Actual results could differ materially for a number of reasons, including demand and price for fluff products, the availability of the parts and equipment for the conversion of the mill, the cost and availability of raw materials, and the other factors that impact our business generally.

SOURCE Domtar Corporation

INVESTOR RELATIONS : Nicholas Estrela, Director, Investor Relations, Tel.: 514-848-5555 x 85979; MEDIA RELATIONS : David Struhs, Vice-President, Corporate Communications and Sustainability, Tel.: 803-802-8031

Metso's Board of Directors decides to implement a new long-term incentive plan for senior management

The Board of Directors of Metso has decided on a new long-term share-based incentive plan for the Group's senior management, with a Performance Share Plan (PSP) as the main structure. In addition, the Board decided to establish a Restricted Share Plan (RSP) as a complementary share-based incentive structure for specific situations. The aim of this long-term incentive plan is to align the interests of the management with those of the shareholders in order to increase the value of Metso and to commit the senior management to Metso by offering them a competitive long-term incentive plan in the company.

The Board of Directors of Metso has decided on a new long-term share-based incentive plan for the Group's senior management, with a Performance Share Plan (PSP) as the main structure. In addition, the Board decided to establish a Restricted Share Plan (RSP) as a complementary share-based incentive structure for specific situations. The aim of this long-term incentive plan is to align the interests of the management with those of the shareholders in order to increase the value of Metso and to commit the senior management to Metso by offering them a competitive long-term incentive plan in the company.

Performance Share Plan

The Performance Share Plan consists of annually commencing performance share plans, each with a three-year earning period. The commencement of each new plan will be subject to a separate approval by the Board. The first plan (PSP 2015) will commence at the beginning of 2015 and potential share rewards will be delivered in the spring 2018 if the performance targets set by the Board are achieved.

The potential share reward payable under the PSP 2015 is based on the total shareholder return of Metso's share during 2015-2017. The PSP 2015 may include a maximum of approximately 100 employees and will comprise a maximum of 400,000 reward shares (gross before the deduction of applicable payroll tax).

Restricted Share Plan

The complementary Restricted Share Plan (RSP) consists of annually commencing restricted share plans, each with a three-year vesting period after which the allocated share rewards will be delivered to the participants provided that their employment with Metso continues until the delivery date of the share rewards. The commencement of each new plan is subject to a separate approval by the Board. The first plan (RSP 2015) will commence at the beginning of 2015 and any potential share rewards will be delivered in the spring 2018.

The maximum number of shares that may be allocated and delivered within the RSP 2015 totals 40,000 shares (gross before the deduction of applicable payroll tax).

Other terms

Metso applies a share ownership recommendation policy for the members of Metso Executive Team. In accordance with this policy at least fifty per cent of the share rewards (net shares after the deduction of applicable payroll tax) received by these individuals under the above plans shall be retained until the share ownership of the individual participant in Metso amounts to his/her annual gross base salary.

The incentive plans will have no diluting effect as no new shares will be issued in connection with them.

Metso is a leading process performance provider, with customers in the mining, oil and gas, and aggregates industries. Metso's cutting-edge services and solutions improve availability and reliability in minerals processing and flow control, providing sustainable process and profit improvements. Metso is listed on the NASDAQ OMX Helsinki, Finland. In 2013, Metso's net sales totaled EUR 3.8 billion. Metso employs approximately 16,000 industry experts in 50 countries. Expect results.

www.metso.com, www.twitter.com/metsogroup

Further information, please contact:

Merja Kamppari, Senior Vice President, HR, Metso, tel. +358 20 484 3119

Harri Nikunen, Chief Financial Officer, Metso, tel. +358 20 484 3010

Metsä Board renews its management and reporting structure

Metsä Board Corporation, part of Metsä Group, renews its management and reporting structure to enable successful implementation of the company’s growth strategy.

Metsä Board Corporation, part of Metsä Group, renews its management and reporting structure to enable successful implementation of the company’s growth strategy.

“Our main target is profitable growth of our paperboard businesses. At the same time we plan to take an exit from underperforming paper businesses. We have developed our paperboard offering actively in recent years in order to better serve our customers. Now we also change our management structure in order to secure successful implementation of these new growth and restructuring steps. Function based organization fits Metsä Board the best from now on”, comments CEO Mika Joukio.

As of 1 January 2015 Metsä Board’s Corporate Management Team consists of the following persons:

- Mika Joukio, CEO

- Markus Holm, CFO

- Seppo Puotinen, SVP, Marketing and Sales

- Ari Kiviranta, SVP, Production and Technology

- Sari Pajari, SVP, Business Development

- Susanna Tainio, SVP, Human Resources

Tainio is a new member in the Metsä Board Management Team.

Metsä Board’s reporting segments from 1Q 2015 onwards are the following:

- Paperboard

- Non-core operations

Paperboard segment includes folding boxboard, fresh forest fibre linerboard, wallpaper base and market pulp businesses. Non-core operations include Husum’s standard paper business until the planned discontinuation latest by end 2017 and Gohrsmühle mill’s cast coated and label paper businesses. Reporting under Other operations will remain unchanged.

Accounting for the 24.9 per cent ownership in Metsä Fibre will remain unchanged. The associated company result of Metsä Fibre will be allocated to Paperboard segment.

Metsä Board will announce the 2014 financial statements on 5 February 2015 based on the old reporting segments including Cartonboard and Linerboard and Paper business areas. The restated historical figures will be released during February 2015.

For further information, please contact:

Markus Holm, CFO, tel. +358 10 465 4913

Metsä Board grows its paperboard business

Metsä Board grows its paperboard business, plans to fully exit paper production and considers a rights issue to partially finance the final steps of transformation

Metsä Board Corporation, part of Metsä Group, is introducing the final steps of transformation to a paperboard company and invests approximately EUR 170 million in a new folding boxboard machine at its Husum mill in Sweden. The production capacity of the new machine is approximately 400,000 tonnes per annum and it will start up in early 2016. Full production capacity is expected to be reached by the end of 2016. Husum mill’s paper production is planned to be discontinued mostly at the end of 2015 and fully by the end of 2017. These measures in Husum, including also the increasing fresh forest fibre linerboard sales volumes, are expected to improve Metsä Board’s operating result by approximately EUR 50 million per annum mostly in 2017 and fully from 2018 onwards compared to 1–3Q 2014 annualized performance.

Metsä Board Corporation, part of Metsä Group, is introducing the final steps of transformation to a paperboard company and invests approximately EUR 170 million in a new folding boxboard machine at its Husum mill in Sweden. The production capacity of the new machine is approximately 400,000 tonnes per annum and it will start up in early 2016. Full production capacity is expected to be reached by the end of 2016. Husum mill’s paper production is planned to be discontinued mostly at the end of 2015 and fully by the end of 2017. These measures in Husum, including also the increasing fresh forest fibre linerboard sales volumes, are expected to improve Metsä Board’s operating result by approximately EUR 50 million per annum mostly in 2017 and fully from 2018 onwards compared to 1–3Q 2014 annualized performance.

Metsä Board is also planning new measures to eliminate losses of its Gohrsmühle mill in Germany. The primary target is to divest the mill during the first half of 2015. If the divestment does not materialize in the set time frame, Metsä Board will introduce other measures to eliminate the unit’s heavy losses. Gohrsmühle mill has approximately 480 employees and its main products are cast coated and label papers. The mill’s annual sales amount to approximately EUR 85 million and annualized operating loss to EUR 20 million based on the 1–3Q 2014 performance.

Metsä Board’s associated company Metsä Fibre is planning to build a bioproduct mill with an investment cost of approximately EUR 1.1 billion to replace the current pulp mill in Äänekoski, Finland. The planned pulp capacity of the mill is 1.3 million tonnes leading to a net capacity increase of approximately 800,000 tonnes compared to the existing pulp production at the site. Metsä Fibre targets to make the final investment decision in spring 2015 and operations at the mill would commence during 2017. According to preliminary plans, the amount of capital invested by Metsä Board in the project would be maximum EUR 30 million. Metsä Board’s ownership share in Metsä Fibre remains at 24.9 per cent also after the planned Äänekoski investment.

These planned measures are expected to be financed by current liquidity, operating cash flow and potentially also by an approximately EUR 100 million rights issue, based on the Board of Directors’ authority granted by the AGM. The potential rights issue is targeted to be implemented in 1Q 2015. The company’s principal shareholder Metsäliitto Cooperative is committed to a pro rata investment of approximately EUR 43 million in the potential rights issue.

Metsä Board will renew its management and reporting structure tosupport successful implementation of the new growth and restructuring actions and to strengthen its position as the leading paperboard company. A separate stock exchange release related to this topic has been published today at the same time as this release.

“These final steps of our transformation to a paperboard company allow us to grow significantly our core business and exit the weak paper production. Our profitability will be raised to a new improved level without compromising the solid balance sheet,” comments CEO Mika Joukio.

Growth of paperboard business and planned exit from paper production

Metsä Board’s strategy is to grow profitably its fresh forest fibre paperboard business and reduce its exposure in the declining paper businesses. Measures announced today strengthen the company’s market leadership in fresh forest fibre paperboards and enable an exit from the weak paper operations. Thanks to these new measures Metsä Board’s total paperboard capacity will increase from 1.4 million to over 2 million annual tonnes by 2018.

“We have experienced good growth in our folding boxboard and linerboard businesses in recent years. Demand for our sustainable, safe and cost-competitive folding boxboards has recently increased especially in North America. In order to continue profitable growth, we must increase folding boxboard production capacity. After extensive planning work, we have decided to invest in the new folding boxboard machine at Husum, which is our biggest mill integrate including a large two line pulp mill, state of art coating technology, an efficient power plant, and own harbor. This is a very cost-competitive alternative to increase our capacity,” continues Joukio.

After the investment at Husum, Metsä Board’s total folding boxboard capacity will be approximately 1.3 million annual tonnes. The new folding boxboard capacity in Husum, approximately 400,000 tonnes per annum, is planned to be sold mainly to markets outside Europe, especially to North America, and also to the food service segment globally. Metsä Board entered the food service segment in early 2014. If the demand supply situation so requires in the coming years, Metsä Board has possibilities to adjust its production accordingly.

Metsä Board started to produce uncoated fully bleached fresh forest fibre linerboards at Husum mill in 2013 and expanded to coated grades in 2014. At the moment, the linerboard sales volume run rate is over 100,000 tonnes per annum. Husum’s linerboard annual production is planned to be increased to close to 300,000 tonnes by 2018. These volumes are expected to be sold both in Europe and North America increasingly also to new applications e.g. in food packaging.

Metsä Board plans to discontinue standard paper production at Husum mostly by the end of 2015. Total paper capacity planned to be ceased is approximately 600,000 tonnes annually. Personnel impacts will be clarified in the statutory negotiations that will be commenced immediately.

After the investment and the planned paper capacity closures, there will be two paperboard machines at Husum mill:

- Board Machine 1 with annual folding boxboard production capacity of about 400,000 tonnes.

- Board Machine 2 (current Paper Machine 8) with annual linerboard capacity of about 300,000 tonnes. Uncoated fine paper business reel production will be continued in the Board Machine 2 until the linerboard sales volumes have been grown to the full capacity of the machine.

The annual pulp production capacity at Husum is approximately 750,000 tonnes per annum including both softwood and hardwood grades. In addition to chemical pulp produced at the site, the new folding boxboard production at Husum will use majority of the BCTMP produced at Kaskinen mill in Finland from 2016 onwards.

Financial implications

Based on growth of the folding boxboard and linerboard businesses as well as the planned discontinuation of Husum’s paper production, Metsä Board’s annual sales is expected to remain rather stable. The positive impact of the new measures in Husum on Metsä Board’s annual operating result excluding non-recurring items is expected to be approximately EUR 50 million compared to 1–3Q 2014 annualized performance. Profitability improvement impact is expected to materialize mostly in 2017 and fully from 2018 onwards. Investment shutdown and accelerated depreciations of the paper capacity planned to be discontinued in Husum is forecast to impact operating result in 2015 negatively by roughly EUR 20 million.

Linerboard and Paper business area’s 4Q 2014 operating result will include approximately EUR 14 million in non-recurring costs related to planned discontinuation of paper production at Husum mill. Cartonboard business area’s 4Q 2014 operating result will include approximately EUR 27 million fixed asset impairments due to the weak performance of Gohrsmühle mill. A separate stock exchange release related to all non-recurring items in 4Q 2014 has been published today at the same time as this release.

METSÄ BOARD CORPORATION

For further information, please contact:

Mika Joukio, CEO, tel. +358 10 465 4300

Markus Holm, CFO, tel. +358 10 465 4913

Juha Laine, Vice President, Investor Relations and Communications, tel. +358 10 465 4335

Metsä Board organizes a conference call and webcast presentation for investors and analysts today 10 December at 4 p.m. (EET). Conference call participants are requested to dial in and register a few minutes earlier on the following numbers:

Europe: +44 (0)20 7162 0077

USA: +1 334 323 6201

The conference ID is 950178.

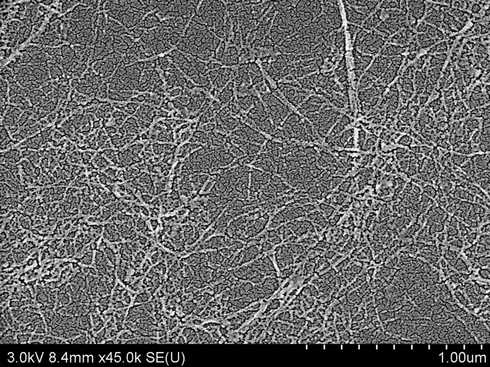

Sappi and Edinburgh Napier University discover new low-cost process to make nanocellulose.

Sappi and Edinburgh Napier University discover new low-cost process to make nanocellulose. Promises wonder material break-through.

- Sappi to build a pilot-scale plant for low-cost Cellulose NanoFibrils production

- Follows three year partnership between researchers from global pulp and paper producer Sappi and Edinburgh Napier University

- Nanocellulose has potential to be used in a huge range of applications – from packaging and touch screen displays to car panels and wound care

- Market could reach 35 million tonnes per year by 2020s

- Continues Sappi’s move into new and adjacent business fields based on renewable raw materials

Scientists from Edinburgh Napier University and Sappi have developed a low cost way to turn wood into a wonder material that could be used to build greener cars, thicken foods and even treat wounds.

It means Sappi will be able to produce the lightweight material on a commercially viable basis – and without producing large volumes of chemical waste water associated with existing techniques. The energy-saving process will be used in a new nanocellulose producing pilot plant to be erected by Sappi.

“Nanocellulose, extracted from wood fibres, has a number of unique optical, barrier and strength properties,” said project coordinator Math Jennekens, R&D Director at Sappi Europe. “Unlike other lightweight, high-strength materials based on fossil fuels it is completely sustainable, making it very desirable as a new material for various industrial and transport applications.”

The versatile material has previously been produced by intensively processing wood pulp to release ultra-small, or ‘nano’ cellulose fibers – each so small that 2,000 could fit inside the width of a single strand of human hair.

But the Edinburgh Napier research team say they have been able to drastically reduce the amount of energy needed to power the process, as well as the need for expensive chemicals.

“What is significant about our process is the use of unique chemistry which has allowed us to very easily break down the wood pulp fibers into nanocellulose,” said Professor Rob English, who led the research with his Edinburgh Napier colleague, Dr. Rhodri Williams.

“There is no expensive chemistry required and, most significantly, the chemicals used can be easily recycled and reused without generating large quantities of waste water.

“It produces a dry powder that can be readily redispersed in water and leaves the nanocellulose unmodified – effectively making its surface a chemical “blank canvas” and so more easily combined with other materials.

“The ability to bring all these attributes together have so far eluded materials scientists working in the field. It is very exciting.”

Nanocellulose produced at the proposed Sappi plant could be used in a wide range of industrial and everyday products and devices because of the way they can improve the properties of materials they are combined with, said Professor English.

“It could be used to thicken water-based products such as paints, foods and concrete,” he said. “Or when it’s used in plastics to make a composite it can replace glass fibers, which is very attractive in the production of the next generation of lighter, fuel-efficient vehicles.

“Because of its low oxygen permeability it could also be a possible replacement for plastic films in packaging. Then there are also applications for it in containing films in lithium batteries and touch screen displays. And as cellulose is inherently bio-compatible and bio-absorbable, there is considerable potential in biomedical applications such as wound dressings and regenerative medicine.”

Andrea Rossi, Group Head Technology, Sappi Limited, said a pilot production plant was being planned for “towards the end of 2015.This pilot plant” he continued “ will move Sappi into new adjacent business fields based on renewable raw materials to produce innovative performance materials and help in delivering on Sappi's strategy to seek growth opportunities in adjacent and new markets.”

Professor English added: “Commercial interest in nanocellulose is growing at a phenomenal rate following predictions of a possible 35 million tonnes per year market by the 2020s. And so the key challenge now is very much in business development and understanding the value offered by nanocellulose in our target markets.”

According to Andrea Rossi, the pilot plant will test the manufacturing of dry re-dispersible Cellulose NanoFibrils (CNF). Using this proprietary break-through technology, Sappi will ultimately be able to manufacture CNF with unique morphology, specifically modified for either hydrophobic or hydrophilic applications. Products produced will be optimally suitable for conversion in lighter and stronger fibre-reinforced composites and plastics, in food and pharmaceutical applications, and in rheology modifiers as well as in barrier and other paper and coating applications.

Andrea Rossi indicated that using the products manufactured in the pilot-scale plant, Sappi will seek co-development with multiple partners to incorporate CNF into a large variety of product applications to optimise performance and to create unique characteristics.

South African headquartered Sappi, a leading global producer of dissolving wood pulp and graphics, speciality and packaging papers, uses research and development to drive product innovation and to develop new uses for its renewable resource (woodfibre) as well as for the biomass and other residues from its production processes. One such area of investigation is nanocellulose; a new forest products material which Sappi believes will play a key role in its future suite of products, both as a product in itself and in its applications.

Edinburgh Napier University is home to forward-thinking people inspired by the world around them. We create and support personalised learning and research opportunities that develop talent and solutions that really work and matter in today’s and tomorrow’s world. With over 12,000 UK and EU students and more than 6,300 overseas students, Edinburgh Napier is a truly international University with students from 110 countries. We have over 3,000 students based in Hong Kong, where we are the largest UK provider of higher education. As a testament to our commitment to being connected with business and industry, we are in the top 20 in the UK for graduate employability, with 95.4% of our undergraduates in further work or study within six months of graduating (HESA 2013). It also means that our courses are accredited by over 100 Professional Bodies.

Edinburgh Napier University is home to forward-thinking people inspired by the world around them. We create and support personalised learning and research opportunities that develop talent and solutions that really work and matter in today’s and tomorrow’s world. With over 12,000 UK and EU students and more than 6,300 overseas students, Edinburgh Napier is a truly international University with students from 110 countries. We have over 3,000 students based in Hong Kong, where we are the largest UK provider of higher education. As a testament to our commitment to being connected with business and industry, we are in the top 20 in the UK for graduate employability, with 95.4% of our undergraduates in further work or study within six months of graduating (HESA 2013). It also means that our courses are accredited by over 100 Professional Bodies.

Universal Converting Equipment complete Phase 2 of their expansion strategy

In the last two years, Universal Converting Equipment has doubled its turnover. To support this turnover growth, Universal invested in additional manufacturing space, designers and assembly staff (Phase 1). However, Universal found that the business was being held back by the lack of capacity of its sub-contractors to meet their increased demands. In the last 12 months Universal undertook an ambitious plan to install its own machine shop so it could be self-sufficient in machined mechanical parts. This Phase 2 investment plan is now complete following the installation of £1m in CNC controlled machine tools. The investment has included a CNC mill for the manufacture of machine side-frames, a CNC lathe for production of rollers, PC controlled roller balancing equipment and a range of CNC machining centres for the manufacture of other parts. Special foundations were built for some of the equipment. For example, the large mill sits on a solid reinforced concrete base over 1000mm deep. Levelling the machine bed to the tolerances required took a specialist team over a week to achieve.

In the last two years, Universal Converting Equipment has doubled its turnover. To support this turnover growth, Universal invested in additional manufacturing space, designers and assembly staff (Phase 1). However, Universal found that the business was being held back by the lack of capacity of its sub-contractors to meet their increased demands. In the last 12 months Universal undertook an ambitious plan to install its own machine shop so it could be self-sufficient in machined mechanical parts. This Phase 2 investment plan is now complete following the installation of £1m in CNC controlled machine tools. The investment has included a CNC mill for the manufacture of machine side-frames, a CNC lathe for production of rollers, PC controlled roller balancing equipment and a range of CNC machining centres for the manufacture of other parts. Special foundations were built for some of the equipment. For example, the large mill sits on a solid reinforced concrete base over 1000mm deep. Levelling the machine bed to the tolerances required took a specialist team over a week to achieve.

Commenting on the investment, Alan Jones, Managing Director of Universal Converting Equipment said “We have been using 3D CAD systems to design our machines for the last 10 years. We have now invested in CAM software systems so that the part drawings can be converted into files that can be downloaded directly into the CNC machine tools. This prevents errors caused with manually controlled machines and eliminates data entry mistakes. The CAM system ensures we have consistently high quality components with the minimum of downtime when new designs are entered. Since installing this equipment, we have changed the design of some components so that the machining time can be reduced resulting in cost savings that can be passed onto our customers. We have used our own resources to fund this investment without the need for borrowings, increasing the financial strength and stability of the company. We are now commencing Phase 3 to increase our global sales and support infrastructure.”

Universal Converting Equipment are a manufacturer of slitter rewinders, rewinding machines, hot melt coating equipment, core cutters and other ancillary systems used in the converting industry. These machines are sold globally. The Universal X6 slitter rewinder is a machine with a compact footprint that has proved particularly successful as a high performance yet cost effective slitting machine for slitting flexible materials. It incorporates automatic knife setting, core alignment, closed loop tension control, additional tension zone through slitting and constant geometry contact rollers to allow high speed operation, minimising changeover time, with consistent high quality output.

For further information contact Alan Jones, (Managing Director) on +44 (0) 1473 403333, This email address is being protected from spambots. You need JavaScript enabled to view it. or online at www.universalconvertingequipment.com

Why “going paperless” is not the way to save North American forests

Link to the origional Two Sides North America article

Link to the origional Two Sides North America article

Here are 5 key reasons why going paperless will not save North American forests.

1 – Our forests are growing due to sustainable forestry practices

In North America we grow many more trees than we harvest. In the U.S., between 1953 and 2012, the net area occupied by forests increased from about 300 to 310 million ha and the net volume of growing stock (which takes into account the number of trees and their size) rose about 60%[1]. In Canada forest area remained stable over the last 2 decades at about 350 million ha and less than 0.5% of the resource is harvested annually and must be regenerated.[2]

In North America we grow many more trees than we harvest. In the U.S., between 1953 and 2012, the net area occupied by forests increased from about 300 to 310 million ha and the net volume of growing stock (which takes into account the number of trees and their size) rose about 60%[1]. In Canada forest area remained stable over the last 2 decades at about 350 million ha and less than 0.5% of the resource is harvested annually and must be regenerated.[2]

2 – Paper production is not a main cause of forest loss (deforestation)

Deforestation means the permanent or long-term conversion of forest lands to other land uses due to urban expansion, industrial development, resource extraction or agricultural development. Worldwide by far the most significant cause of deforestation is the expansion of agriculture.[3] In the U.S., the main causes are development of cropland, pasture and urban areas (particularly the southern regions) and in Canada it is the expansion of agriculture and the oil and gas industry.[4]

Although woodland roads are a cause of deforestation, they make up a small percentage of overall forest loss and they do offer many positive recreational benefits for thousands of outdoor enthusiasts across North America (ex: mountain biking, hiking, bird-watching, fishing, hunting).

3 – Most trees don’t go into pulp and paper

In North America, the majority of wood fiber for papermaking comes from sawmill residues and recycled paper products. Only 36% of the U.S. roundwood harvest (trees) is used each year in manufacturing paper and paperboard[5]. In Canada, 13% of the wood fiber to make paper comes from roundwood[6]. The main product made from trees harvested in the U.S. and Canada is lumber and it is the sawmill chips (by-products of the lumber process) that are a key raw material for pulp manufacture and eventually papermaking.

4 – Forest products provide an incentive for forest owners to keep land as forest

Most pulpwood harvested in the U.S. (89%) comes from private land[7]. Landowners receive income from the trees grown on their land which is an important incentive to maintain, sustainably manage and renew this valuable resource. This is especially important where landowners are facing economic pressure to convert forestland to non-forest uses such as residential housing[8]. Continued use of paper and other wood products may therefore be a key factor in maintaining a forested landscape for future generations.

5 – Paper is one of many products from sustainably managed forests

Due to its inherent sustainable features (renewability, recyclability, carbon uptake and storage), wood is a highly valued raw material for numerous products. In fact, the University of Kentucky - College of Agriculture has compiled a thorough list of hundreds of products made from wood.[9]

As paper use declines in mature markets such as North America, there may be temporary decreases in wood harvesting in some regions, until markets recover or new markets develop. These economic slow-downs are not necessarily good for privately owned forests since forest owners lose income and may sell their forest land (see item 4 above).

However, as our industry undergoes its transformation into innovative forest products and new markets, wood used for papermaking is being diverted to other uses such as dissolving pulp for textiles and consumer goods[10], biomass for energy use, and even biodiesel that you can put in your car gas tank.[11]

So, how do we protect forests? In my opinion there are a few priorities:

- Provide incentives to keep forestland and continually improve sustainable forest management since most forest across North America are not under conservation agreements or easements, and many are privately owned.

- Continue efforts to protect valuable forest areas. Today only about 10% of forests are under conservation.

- Try to minimize losses of growing stock from natural disasters such as fire, insects and disease. In 2011 in the U.S., over 8.7 million acres of forest burned and there were over 74,000 fires.[12] In 2012 in Canada, over 20 million acres were damaged by insects.[13] These statistics far exceed the amount of wood harvested for forest products.

I will leave you with this extract from “Tree-Free Paper: A Path to Saving Trees and Forests?” by Dovetail Partners[14]:

“While saving trees and protecting forests is a widely shared goal, avoiding the use of wood is not necessarily the way to get there. It is precisely the areas of the world that consume the least wood that continue to experience the greatest forest loss….It may well be, then, that the very foundation of the tree-free movement is flawed. Counter intuitively, continued use of paper and other wood products may be a key factor in maintaining a forested landscape for future generations.”

[1] USDA Forest Inventory Analysis, 2012 Forest Resource Tables

[2] http://www.conferenceboard.ca/hcp/details/environment/use-of-forest-resources.aspx

[3] Covington, P., 2013. Deforestation and the role of paper products.

[4] Two Sides Blog, 2014. Let's Get the Story Straight on the State of North American Forests and Deforestation.

[5] Dovetail Partners Inc., 2014. Tree-Free Paper: A Path to Saving Trees and Forests?

[6] Forest Products Association of Canada, 2012

[7] USDA Forest Inventory Analysis, 2012 Forest Resource Tables

[8] World Business Council for Sustainable Development and NCASI, 2007

[9] http://www.twosidesna.org/Products-Made-from-Wood---A-List-of-Hundreds-of-Items

[10] http://ppimagazine.com/mills/north-america/projects/conversion-boosts-sappi-cloquet-mill-growth-strategy

[11] http://www.upmbiofuels.com/Pages/default.aspx

[12] USDA Forest Inventory Analysis, 2012 Forest Resource Tables

[13] Natural Resources Canada, 2014. The State of Canada’s Forests – Annual Report 2014.

[14] Dovetail Partners Inc., 2014. Tree-Free Paper: A Path to Saving Trees and Forests?

Stora Enso opens new biomaterials innovation centre

Stora Enso will concentrate its new biomaterials business development in an Innovation Centre that will be located in the Stockholm area in Sweden. The centre, which will open during the second quarter of 2015, will host research, application, business development, and strategic marketing.

Stora Enso will concentrate its new biomaterials business development in an Innovation Centre that will be located in the Stockholm area in Sweden. The centre, which will open during the second quarter of 2015, will host research, application, business development, and strategic marketing.

The centre will boost innovation by identifying business opportunities in the renewable materials market and linking them with leading innovation and research centres in business and academia. The centre will be staffed with Stora Enso employees currently working in Sweden, Finland and Germany. It will initially employ a little less than 60 people and is estimated to employ around 75 people by year end 2015.

“We are convinced that our access to biomass, in combination with our expertise in forestry worldwide, will benefit our customers in new, innovative ways in the future. Our goal is to develop a competitive offering serving customers in multiple industries and markets, while adding value to our current cellulosic streams”, says Karl-Henrik Sundström, CEO of Stora Enso.

“We facilitate creative thinking and cross-functional interaction by consolidating R&D and business development under one roof. Additionally, it is important to create a close link to leading innovation and research centres in this field – both at academic and business levels”, says Dr. Antonio Batistini, Head of Innovation and Strategic Marketing, Stora Enso Biomaterials.

Stora Enso’s other R&D units are not affected by this change and will remain in their current locations.

About Stora Enso Biomaterials

Stora Enso Biomaterials is a provider of pulp grades to meet the demands of various paper, board and tissue producers. The offering also includes fluff for hygiene applications and dissolving pulp for the textile industry. The mission of Stora Enso Biomaterials is to find new, innovative ways to maximise the value extractable from wood, as well as other kind of ligno-cellulosic biomasses. Through innovation, the aim is to develop into a cost and performance differentiated renewable biochemical company offering drop-in and new materials into existing and new industries to Stora Enso.

For further information, please contact:

Ulrika Lilja, EVP Global Communications, Stora Enso, tel. +46 1046 71668

Kirsi Seppäläinen, Head of Communications, Stora Enso Biomaterials, tel. +358 50 598 9958

www.storaenso.com

biomaterials.storaenso.com

Stora Enso is the global rethinker of the paper, biomaterials, wood products and packaging industry. We always rethink the old and expand to the new to offer our customers innovative solutions based on renewable materials. Stora Enso employs some 29 000 people worldwide, and our sales in 2013 amounted to EUR 10.6 billion. Stora Enso shares are listed on NASDAQ OMX Helsinki (STEAV, STERV) and Stockholm (STE A, STE R). In addition, the shares are traded in the USA as ADRs (SEOAY) in the International OTCQX over-the-counter market.

Resolute Announces Permanent Closure of 465,000 Metric Tons of Newsprint Capacity

Iroquois Falls (Ontario) Mill and Two Paper Machines in Quebec to be Permanently Closed

Resolute Forest Products Inc. (NYSE: RFP) (TSX: RFP) has announced the permanent closure of 465,000 metric tons of newsprint production capacity in Canada. This capacity reduction will be achieved with the permanent closure of the Iroquois Falls (Ontario) newsprint mill, as well as paper machine #1 at Baie-Comeau (Quebec) and paper machine #4 at Clermont (Quebec).

Resolute Forest Products Inc. (NYSE: RFP) (TSX: RFP) has announced the permanent closure of 465,000 metric tons of newsprint production capacity in Canada. This capacity reduction will be achieved with the permanent closure of the Iroquois Falls (Ontario) newsprint mill, as well as paper machine #1 at Baie-Comeau (Quebec) and paper machine #4 at Clermont (Quebec).

Resolute's decision to reduce newsprint capacity is a result of the ongoing weakness in the global newsprint business, exacerbated by fiber-related issues, including both availability and costs, as well as transportation challenges. In Quebec, power costs played a role in these decisions, as well as the spruce budworm infestation.

"Market conditions have had a major impact on our newsprint operations in both Ontario and Quebec, and the cost position of these operations has made them vulnerable to the structural decline in newsprint," said Richard Garneau, president and chief executive officer.

"There is another issue that cannot be ignored in these decisions: the ill-founded attacks of environmental activist groups. Their inaccurate and deceptive campaigning, which misrepresents the company's forest management practices, was also a factor. These campaigns are based on malicious falsehoods regarding Resolute's overall compliance with the Crown Forest Sustainability Act in Ontario and the Loi sur l'aménagement durable du territoire forestier in Quebec, and overall sustainability leadership. The provinces of Ontario and Quebec have forest management regimes that are among the very best in the world, and both governments are ensuring compliance. These systems deserve to be respected and defended, and we call upon those provinces to stand up for their standards and to refute these unjustified and unwarranted attacks," said Garneau.

The Iroquois Falls mill employs approximately 180 people and has an annual production capacity of 210,000 metric tons of newsprint. It will permanently close on December 22, 2014, with closure-related activities running into January 2015. The currently idled paper machine #1 at Baie-Comeau will be permanently closed as of today, and paper machine #4 in Clermont will be permanently closed on or about January 30, 2015. The closures at Baie-Comeau and Clermont will result in the loss of approximately 120 positions and the permanent removal of approximately 255,000 metric tons of newsprint capacity. All statutory notice provisions of the two provinces will be respected.

Resolute understands the impact these decisions will have on employees, their families and local communities. The company will work with union representatives and government officials to respond to the needs of those affected. Local management will also ensure that employees receive support, that the relevant conditions in the collective agreements are respected, and that as many employees as possible are transferred to other company facilities.

"The decision to rationalize our newsprint capacity was difficult, as we are mindful of the impact it will have on affected employees," added Richard Garneau. "Resolute remains committed to customer service and to the delivery of high-quality products and will work closely with customers to continue to meet their needs."

About Resolute Forest Products

Resolute Forest Products is a global leader in the forest products industry with a diverse range of products, including newsprint, specialty papers, market pulp and wood products. The company owns or operates nearly 40 pulp and paper mills and wood products facilities in the United States, Canada and South Korea, and power generation assets in Canada. Marketing its products in close to 90 countries, Resolute has third-party certified 100% of its managed woodlands to at least one of three internationally recognized sustainable forest management standards. The shares of Resolute Forest Products trade under the stock symbol RFP on both the New York Stock Exchange and the Toronto Stock Exchange.

Resolute and other member companies of the Forest Products Association of Canada, as well as a number of environmental organizations, are partners in the Canadian Boreal Forest Agreement. The group works to identify solutions to conservation issues that meet the goal of balancing equally the three pillars of sustainability linked to human activities: environmental, social and economic.

Resolute is proud to be ranked by Corporate Knights as one of Canada's Best 50 Corporate Citizens for 2014. Corporate Knights is an organization recognized globally for its transparent and objective approach to measuring corporate sustainability performance. Resolute Forest Products and Richard Garneau, president and chief executive officer, have also been named to Canada's Clean50, recognizing leaders who have made the greatest contributions to sustainable development or clean capitalism in Canada.

SOURCE Resolute Forest Products Inc.

For further information: Contacts: Investors: Rémi G. Lalonde, Vice-President, Investor Relations, 514 394-2345, This email address is being protected from spambots. You need JavaScript enabled to view it.; Media and Others: Seth Kursman, Vice President, Corporate Communications, Sustainability and Government Affairs, 514 394-2398, This email address is being protected from spambots. You need JavaScript enabled to view it.

Imerys Ceramics Announces Price Increase for Ball Clay and Kaolin Products in North America

Imerys Ceramics North America announced today that it will increase prices up to 15% on all of its ball clay and kaolin products manufactured in the United States, effective January 1, 2015, subject to any provisions in individual contracts. The price increase supports investment in manufacturing, quality systems, maintenance, environmental compliance, and new product development.

Customers purchasing products on a delivery basis will also see a cost increase due to highly volatile and increasing truck and rail freight rates. Imerys continues to work with its freight partners to minimize this impact as much as possible.

Imerys Ceramics is a world leading supplier of industrial mineral solutions and full prepared bodies for all ceramic applications. Our portfolio includes: ball clay, kaolin, talc, feldspar, quartz, chamotte, halloysite, mica, and pegmatite. Imerys Ceramics has 50 production sites in 23 countries, supported by a global network of technical sales staff, agents and distributors.

About Imerys

The world leader in mineral-based specialty solutions for industry, with €3.7 billion revenue and 15,800 employees in 2013, Imerys transforms a unique range of minerals to deliver essential functions (heat resistance, mechanical strength, conductivity, coverage, barrier effect, etc.) that are essential to its customers' products and manufacturing processes.

Whether mineral components, functional additives, process enablers or finished products, Imerys’ solutions contribute to the quality of a great number of applications in consumer goods, industrial equipment or construction. Combining expertise, creativity and attentiveness to customers’ needs, the Group’s international teams constantly identify new applications and develop high value-added solutions under a determined approach to responsible development. These strengths enable Imerys to develop through a sound, profitable business model.

Contacts

Imerys Ceramics

Marketing Communications

Elena Atanasova, 770-645-3705

This email address is being protected from spambots. You need JavaScript enabled to view it.