Ianadmin

Resolute Reports Preliminary Third Quarter 2014 Results

- Q3 adjusted EBITDA of $112 million / net income of $0.18 per share, excluding special items

- Strong performances once again for wood products and pulp

- Thunder Bay pellet plant ramping up; Ignace sawmill about to start

- Closure costs and impairment contribute to GAAP net loss of $116 million / $1.23 per share

Resolute Forest Products Inc. (NYSE: RFP) (TSX: RFP) has reported net income for the quarter ended September 30, 2014, excluding special items, of $17 million, or $0.18 per share, down from net income, excluding special items, of $29 million, or $0.31 per share, in the third quarter of 2013. Sales were $1.1 billion in the quarter, down $34 million, or 3%, from the third quarter of 2013.

Resolute Forest Products Inc. (NYSE: RFP) (TSX: RFP) has reported net income for the quarter ended September 30, 2014, excluding special items, of $17 million, or $0.18 per share, down from net income, excluding special items, of $29 million, or $0.31 per share, in the third quarter of 2013. Sales were $1.1 billion in the quarter, down $34 million, or 3%, from the third quarter of 2013.

GAAP net loss was $116 million, or $1.23 per share, compared to a net loss of $588 million, or $6.22 per share, in the third quarter of 2013 as last year's results were significantly affected by a $619 million non-recurring, non-cash income tax charge.

"Our adjusted EBITDA improved sequentially thanks to the best lumber quarter in recent history and continued strength of market pulp," said Richard Garneau, president and chief executive officer. "We're building momentum in the wood products business: the Thunder Bay pellet plant is starting its ramp-up, our Ignace sawmill is about to begin its own ramp-up, and we're on schedule with the construction of our Atikokan sawmill. Year-to-date shipments of newsprint and specialty papers outperformed industry trends, demonstrating the strength of our position, but we took some newsprint downtime in the quarter to reduce finished goods inventory. More broadly, we met our commitment to reduce finished goods inventory levels in a disciplined manner across all segments, especially pulp."

Non-GAAP financial measures, such as adjustments for special items and adjusted EBITDA, are explained and reconciled below.

Segment Operating Income Variance Against Prior Quarter

Market Pulp

Operating income in the market pulp segment was $21 million, $3 million less than the second quarter. The average transaction price slipped by $24 per metric ton, or 3%, to $701, mostly because of lower average prices for hardwood grades, as the market absorbs major new eucalyptus capacity. Overall shipments significantly improved from the disappointing levels of the first two quarters, up by 29,000 metric tons, or 9%, compared to the second quarter. Finished goods inventory fell by 21,000 metric tons, or 18%. The operating cost per unit (the "delivered cost") dropped by $7 per metric ton, or 1%, despite higher maintenance costs.

Wood Products

The wood products segment generated operating income of $24 million in the quarter, a $9 million improvement over the second quarter, reaching its highest level since the 2007 start of the U.S. housing downturn. Shipments were unchanged, reflecting sustained demand despite the slow recovery in U.S. housing starts. Further to a 13% reduction in the second quarter, the company reduced finished goods inventory by an additional 19% this quarter. The average transaction price was $10 per thousand board feet higher, or 3%, reflecting an increase in market prices for both stud and random length lumber grades. The delivered cost fell by 4%, or $13 per thousand board feet, mostly because the company recognized additional tax credits in connection with infrastructure investments.

The company started the ramp-up process at its new wood pellet plant in Thunder Bay in October. The facility will produce 45,000 metric tons annually under a ten-year agreement to supply Ontario Power Generation's Atikokan Generating Station, the largest capacity, 100% biomass-fueled, power plant in North America.

Newsprint

Operating income was $5 million in the newsprint segment this quarter, $13 million less than the second quarter. Shipments fell by 27,000 metric tons, or 4%, mostly because of market downtime and wood shortages in domestic-focused mills. Accordingly, domestic shipments represented 58% of total shipment volume, compared to 60% in the previous quarter. The average transaction price slipped by less than 1% as a result of continued price deterioration in certain export markets. The delivered cost increased by $14 per metric ton, or 2%, from the second quarter, due primarily to lower contribution from the Thunder Bay cogeneration facility as a result of a longer than expected annual outage, as well as turbine damage and lost production caused by multiple power transmission disruptions to the mill. This was partially offset by the recognition of an energy savings incentive in the U.S. southeast. Finished goods inventory fell by 19,000 metric tons, or 13%.

Specialty Papers

The specialty papers segment generated operating income of $6 million, a $9 million improvement over the second quarter. The average transaction price slipped less than 1%, which is largely due to erosion in higher-end white papers. Shipments rose by 2%, or 11,000 short tons, in this seasonally stronger quarter, especially on the higher end of the grade spectrum. The delivered cost in the quarter was $700 per short ton, down by $23 per ton, or 3%, from the previous quarter, mostly because of maintenance timing. Finished goods inventory closed the quarter up by 7% to meet the expected continuation in seasonal demand. The closure of the Laurentide mill in Shawinigan, Québec, as of mid-October will reduce annual production capacity for supercalender grades by 210,000 short tons.

Consolidated Quarterly Operating Income Variance Against Year-Ago Period

The company recorded an operating loss of $40 million in the third quarter, compared to operating income of $36 million in the year-ago period. Overall pricing was higher as a result of a 13% increase in the average transaction price for wood products and 4% for market pulp, offset in part by 4% lower average pricing for specialty papers and 3% for newsprint. Shipments were 1% higher in both wood products and specialty papers, but they were 9% lower in market pulp, largely because of greater internal consumption of hardwood kraft pulp and market downtime in recycled bleach kraft pulp. Shipments were also 5% lower in newsprint, which reflects lower export volumes compared to the same period last year.

Overall manufacturing costs were essentially unchanged, due mainly to lower pension and other postretirement benefit expenses and the recognition of an energy savings incentive in the U.S. southeast, offset by higher natural gas prices, the write-off of stores in connection with the permanent closure of the Laurentide mill, higher wood costs and lower contribution from cogeneration facilities. The weaker Canadian dollar had a $15 million favorable effect on operating income.

The company incurred $85 million of accelerated depreciation and other closure-related costs, almost all of which are related to the Laurentide mill. It also recorded a $50 million write-down to the investment in Ponderay Newsprint Company, an unconsolidated partnership in which the company owns a 40% interest and acts as managing partner. Selling, general and administrative expenses were $3 million higher in the quarter, primarily because of allowances for doubtful accounts.

Outlook

Mr. Garneau added: "We expect our Ignace sawmill to begin ramp-up before year-end, to build its production and inventory gradually in the first quarter and to continue to improve production efficiency over the course of the year. The high capacity planer mill at our new Atikokan sawmill will start to dress Ignace's lumber in the first quarter, with the ramp-up of its own sawline scheduled to begin in the second quarter. We expect these sawmills to start generating positive earnings as early as the third quarter of next year. This is a great time to be building momentum in the wood products business, where we've seen sustained demand support in the market despite the slow recovery in U.S. housing starts.

The pulp market continues to adjust to major hardwood pulp capacity increases, but our outlook has turned to cautious optimism, based on the market's resilience this year. Turning to paper, the pace of price declines in coated mechanical and supercalender grades is leveling off; we're hopeful that recent industry capacity rationalization announcements will help to ease some of the pressure the industry experienced this year as a result of lower operating rates. In newsprint, recent demand trends are forcing us to respond with targeted market downtime initiatives, particularly at some of our Québec mills struggling with high wood costs and wood availability issues resulting from the implementation of the new forest tenure system. We remain confident that our operating platform has the scale, financial strength and cost advantage to withstand market challenges."

About Resolute Forest Products

Resolute Forest Products is a global leader in the forest products industry with a diverse range of products, including newsprint, specialty papers, market pulp and wood products. The Company owns or operates nearly 40 pulp and paper mills and wood products facilities in the United States, Canada and South Korea, and power generation assets in Canada. Marketing its products in close to 90 countries, Resolute has third-party certified 100% of its managed woodlands to at least one of three internationally recognized sustainable forest management standards. The shares of Resolute Forest Products trade under the stock symbol RFP on both the New York Stock Exchange and the Toronto Stock Exchange.

Resolute and other member companies of the Forest Products Association of Canada, as well as a number of environmental organizations, are partners in the Canadian Boreal Forest Agreement. The group works to identify solutions to conservation issues that meet the goal of balancing equally the three pillars of sustainability linked to human activities: environmental, social and economic.

Resolute is proud to be ranked by Corporate Knights as one of Canada's Best 50 Corporate Citizens for 2014. Corporate Knights is an organization recognized globally for its transparent and objective approach to measuring corporate sustainability performance. Resolute Forest Products and Richard Garneau, president and chief executive officer, have also been named to Canada's Clean50, recognizing leaders who have made the greatest contributions to sustainable development or clean capitalism in Canada.

SOURCE Resolute Forest Products Inc.

For further information:

Investors

Rémi G. Lalonde

Vice President, Investor Relations

514 394-2345

This email address is being protected from spambots. You need JavaScript enabled to view it.

Catalyst Paper Corporation to purchase paper mills in Maine and Wisconsin

Catalyst Paper Corporation (TSX: CYT) ("Catalyst" or the "Company") has announced that it has entered into an Asset Purchase Agreement (the "Agreement") with NewPage Corporation, NewPage Wisconsin System Inc. and Rumford Paper Company (the "Sellers") to purchase the Biron paper mill located in Wisconsin and the Rumford pulp and paper mill located in Maine, USA (the "Paper Mills") for consideration of US$74.0million, subject to certain adjustments (the "Transaction").

Catalyst Paper Corporation (TSX: CYT) ("Catalyst" or the "Company") has announced that it has entered into an Asset Purchase Agreement (the "Agreement") with NewPage Corporation, NewPage Wisconsin System Inc. and Rumford Paper Company (the "Sellers") to purchase the Biron paper mill located in Wisconsin and the Rumford pulp and paper mill located in Maine, USA (the "Paper Mills") for consideration of US$74.0million, subject to certain adjustments (the "Transaction").

Catalyst intends to finance the acquisition through a combination of advances under its revolving asset-based credit facility (the "ABL Credit Facility"), the maximum amount of which is to be increased in connection with the Transaction. To provide additional working capital following the consummation of the Transaction, Catalyst also intends to effect a US$25.0 million offering of additional PIK Toggle Senior Secured Notes ("Additional PIK Toggle Notes"), which would form part of the same series as Catalyst's outstanding PIK Toggle Senior Secured Notes (the "PIK Toggle Notes").

Completion of the Transaction is subject to customary closing conditions, including the completion of the previously announced acquisition by Verso Paper Corp. of NewPage Holdings Inc. (the "Verso Transaction"), the execution of a transition service agreement, materials and service supply agreements, and certain other ancillary agreements relating to the Transaction, and certain regulatory approvals. There is no financing condition to Catalyst's obligation to consummate the Transaction. The Agreement may be terminated by the Sellers and Catalyst in certain circumstances, including upon or at any time following the final uncontested termination of the Verso Transaction.

"With this Transaction, Catalyst will be better able to serve new and existing customers through operational synergies and a more diversified and higher value suite of products," said Joe Nemeth, President and CEO of Catalyst.

"Our acquisition of these U.S. pulp and paper mills, once complete, will support our efforts to improve our balance sheet and enhance the Company's long-term competitiveness," added Nemeth.

If the Transaction is completed, the addition of the Paper Mills is expected to increase Catalyst's production capacity by approximately 65 per cent or 995 thousand tonnes per year. The Biron Wisconsin mill has 355 thousand tonnes capacity for lightweight coated and ultra-lightweight coated paper. The Rumford Maine mill has 510 thousand tonnes paper capacity for coated specialty, coated freesheet and coated groundwood paper, and 130 thousand tonnes Kraft market pulp capacity to produce both hardwood and softwood pulp. Efficiencies are expected to be gained as overhead costs will be distributed over a larger production base. Access to new markets and business opportunities is anticipated.

Based on unaudited historical financial summaries prepared by the Sellers, the Paper Mills achieved total sales of US$782.2 million for the twelve months ended September 30, 2014 and US$787.1 million for the twelve months ended December 31, 2013. Total mill contribution was US$29.5 million and normalized mill contribution was US$45.6 million for the twelve months ended September 30, 2014, compared to US$72.4 million for mill contribution and normalized mill contribution for the twelve months ended December 31, 2013. Mill contribution is a non-U.S. GAAP measure of mill operating performance defined as total sales minus the cash cost of goods sold. Mill contribution was normalized for the twelve months ended September 30, 2014 for the adverse impact of extreme weather conditions and market curtailment. These figures do not include sales, general and administrative expenses which are estimated to be approximately US$10.0 million per year. Capital spending for the two mills is expected to be similar to that of our Canadian mills, approximately US$7.0 million per facility per year.

Transaction and Financing

Under the terms of the Agreement, Catalyst will acquire the Paper Mills for consideration of US$74.0 million, subject to certain adjustments, and assumption of certain ongoing obligations related to the Paper Mills. Pre-closing environmental and pension liabilities will be retained by the Sellers.

To assist in financing the acquisition and provide additional working capital, Catalyst has received a Letter of Commitment from Canadian Imperial Bank of Commerce and Wells Fargo Capital Finance Corporation Canada to increase the Company's ABL Credit Facility by $50.0 million, from $175.0 million to $225.0 million, the maximum amount of credit available under the ABL Credit Facility. Catalyst has received the requisite consent from holders of PIK Toggle Notes to give effect to the increase in the ABL Credit Facility. The availability of the proposed increase in the ABL Credit Facility is subject to the satisfaction of certain customary conditions, including the entering into by the relevant parties of required amendments to the credit agreement governing the ABL Credit Facility.

To provide additional working capital following the completion of the Transaction, Catalyst also intends to issue US$25.0 million of Additional PIK Toggle Notes. The Additional PIK Toggle Notes will be offered by Catalyst to eligible holders of PIK Toggle Notes, with eligible offerees being permitted to subscribe for their pro-rata share of Additional PIK Toggle Notes based on the aggregate principal amount of PIK Toggle Notes held by such holders relative to the total aggregate principal amount of outstanding PIK Toggle Notes. The Additional PIK Toggle Notes will be issued at a 20% discount to face value. When issued, the Additional PIK Toggle Notes are expected to form part of the same series of notes as the PIK Toggle Notes. Catalyst and certain holders of its PIK Toggle Notes have executed a definitive term sheet to backstop the issuance of Additional PIK Toggle Notes. The offering of Additional PIK Toggle Notes is expected to close concurrently with the consummation of the Acquisition or shortly thereafter. As the terms of the offering of Additional PIK Toggle Notes have not been finalized, there is no certainty that such a financing will be completed or completed on the terms described above. Completion of any such offering will be subject to receipt of any required third party, regulatory and exchange approvals.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction. None of the securities have been or will be registered under the United States Securities Act of 1933, as amended (the "1933 Act"). Such securities may not be offered or sold in the United States absent registration under the 1933 Act or an applicable exemption from the registration requirements of the 1933 Act.

Advisors

CIBC is acting as financial advisor to Catalyst and its Board of Directors. Catalyst's legal counsel is Sidley Austin LLP and Lawson Lundell LLP.

About Catalyst Paper Corporation

Catalyst manufactures diverse specialty mechanical printing papers, newsprint and pulp. Its customers include retailers, publishers and commercial printers in North America, Latin America, the Pacific Rim and Europe. With three mills in British Columbia, Catalyst has annual production capacity of 1.5 million tonnes. Catalyst is headquartered in Richmond, British Columbia, Canada and is ranked by Corporate Knights magazine as one of the 50 Best Corporate Citizens in Canada.

SOURCE: Catalyst Paper Corporation

For further information:

Brian Baarda

Vice-President, Finance and CFO

604-247-4710

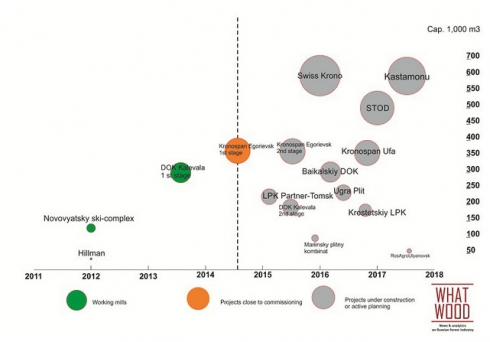

WhatWood study: Kronospan launched Russia’s fourth OSB production

Kronospan holding has launched Russia’s fourth OSB mill in in Egorievsk, Moscow region (after Hillman, Novovyatsky LK and DOK Kalevala) with a capacity of 350,000 m3, this is stated in the updated study by WhatWood agency “OSB market in Russia in 2013 – 1H2014”. Information about the launch of the mill and start of the product sales was confirmed to WhatWood in late September by the resin manufacturers and distributors of wood-based panels.

Meanwhile, the Austrian holding intends to expand production at this mill up to 700,000 m3 and currently solves the issue with the site for the construction of the second line.

Kronospan’s mill in Mogilev also started test production at the end of August, the rated capacity of this plant will be 300,000 m3. Its products will be sold on the markets of Western Europe and Russia. The company has recently published an advertisement about the search of exclusive regional distributors in Russia.

OSB imports into Russia in the first half of 2014, meanwhile, decreased just slightly – by 3.3% to 283,600 m3.

Prices for Romanian and Latvian OSB panels began to decline in the autumn of 2013 and stabilized only in May 2014, which is likely due to increased competition. According to market players, the suppliers “are fighting literally for 5 roubles per sheet”, which is less than 1.5% of the value.

The construction terms and conditions of many projects of OSB mills were revised this year. Projects with a high probability of implementation are listed in the infographics at the end of this article.

The second edition of the study “OSB market in Russia in 2013 – 1H2014” was published in October 2014 and is available for order at the WhatWood website:

- detailed list of investment projects of OSB capacities in Russia, split on the current status of the project;

- base import prices, distributors prices and detailed trade statistics;

- list of global manufacturers and review of the world industry;

- review of Russian economy, OSB market and competing panel sectors;

- outlook on consumption, imports and production.

Bold action to improve service

Iggesund Paperboard is now taking bold action to improve its service. The company offers its customers a wide range of services but most important is its delivery service. Like most other paperboard manufacturers, Iggesund – and not least its customers – has suffered from delivery times that have varied considerably.

“Having a capacity utilisation rate of almost 95 per cent makes you very sensitive to fluctuations in demand, especially when that demand increases,” explains Arvid Sundblad, Vice President Sales and Marketing for Iggesund. “In the past we’ve had a number of such experiences and we don’t want either ourselves or our customers to go through that again.”

“Having a capacity utilisation rate of almost 95 per cent makes you very sensitive to fluctuations in demand, especially when that demand increases,” explains Arvid Sundblad, Vice President Sales and Marketing for Iggesund. “In the past we’ve had a number of such experiences and we don’t want either ourselves or our customers to go through that again.”

A logistics team has been working for a couple of years to gradually improve the situation. Just over six months ago Iggesund launched the greatly modernised support system that forms the foundation for the improved delivery service.

“The change of systems was so radical that it was about the same as doing a heart-lung transplant plus a full body blood transfusion in a human being,” Sundblad adds. “This reorganisation has created the conditions for us to start moving towards constant delivery times but that will take time.”

Iggesund’s delivery service solution ranges from overnight service from dedicated customer stocks to regular deliveries from the mill, with several more options in between. Further development will occur over the next 12 months.

Iggesund’s service offering also encompasses everything linked to the products Invercote and Incada, from technical support in local markets to the paperboard expertise the company offers with its range of reference materials.

“We don’t just want customers to buy our paperboard,” Sundblad says. “It’s important to us that they also get the most out of it. All our documentation and our teams of locally based technicians with their experience of projects and processes similar to our customers’ exist to make sure that happens.

“We’ve offered some of this support for a long time but we haven’t made it clear enough to the majority of our customers that this service is available.”

Other features of the service offering, which is now being launched under the name “Care by Iggesund”, are the fast, easy ordering of samples and inspirational materials, the provision of product safety information and certificates, and access to the analytical services of Iggesund’s accredited Laboratory for Chemical and Sensory Analyses. Iggesund’s extensive environmental documentation is also part of the service, not least as a guarantee that customers will have no unpleasant surprises about the origin of their forest raw material.

Iggesund

Iggesund Paperboard is part of the Swedish forest industry group Holmen, one of the world’s 100 most sustainable companies listed on the United Nations Global Compact Index. Iggesund’s turnover is just over €500 million and its flagship product Invercote is sold in more than 100 countries. The company has two brand families, Invercote and Incada, both positioned at the high end of their respective segments. Since 2010 Iggesund has invested more than €380 million to increase its energy efficiency and reduce the fossil emissions from its production.

Iggesund and the Holmen Group report all their fossil carbon emissions to the Carbon Disclosure Project. The environmental data form an integral part of an annual report that complies with the Global Reporting Initiative’s highest level of sustainability reporting. Iggesund was founded as an iron mill in 1685, but has been making paperboard for more than 50 years. The two mills, in northern Sweden and northern England employ 1500 people.

Further information:

Staffan Sjöberg

Public Relations Manager

This email address is being protected from spambots. You need JavaScript enabled to view it.

Iggesund Paperboard

SE-825 80 Sweden

Tel: +4665028256

Mobile: +46703064800

www.iggesund.com

Domtar makes key updates to its Xerox® Paper and Specialty Media Line

Changes Include New Packaging Look, Product Line Reorganization and Product Enhancements

Domtar Corporation (NYSE: UFS) (TSX: UFS) is pleased to announce a whole new packaging look, a realignment of the product line, as well as a series of product enhancements to its Xerox® Paper and Specialty Media Line.

Domtar Corporation (NYSE: UFS) (TSX: UFS) is pleased to announce a whole new packaging look, a realignment of the product line, as well as a series of product enhancements to its Xerox® Paper and Specialty Media Line.

In June 2013, Domtar Corporation completed the acquisition of the Xerox® Paper and Specialty Media Line for the U.S. and Canada. With its strong foundation in serving businesses and corporations, the Xerox® Paper and Specialty Media Line was already a well-known brand within the marketplace, and the Domtar leadership team wanted to continue to build on that success.

"Although we wanted to continue to leverage the great foundational work that Xerox had established within the paper category, we also wanted to grow the paper business, and expanding beyond large and corporate customers was a key driver for us," said John D. Williams, President and Chief Executive Officer. "Our goal was to maintain the existing customer base, while still broadening the brand's appeal across new consumer targets, as well as increasing the presence of the Xerox® Paper and Specialty Media Line within new channels of business." Williams added.

The Xerox® Paper and Specialty Media Line has been reorganized into three product families, VitalityTM, BoldTM, and RevolutionTM to help customers make better paper choices based on their usage and project needs.

- VitalityTM includes versatile office papers that are great for a wide variety of uses and always provide great looking results.

- BoldTM is a line of professional office papers and digital printing papers designed to give users the highest quality results, so that their work always looks a step above the rest.

- RevolutionTM is a line of specialized paper, films and materials that allow customers to create professional looking marketing and business building tools.

New packaging was created not only to reflect these changes, but also to refresh and modernize the look to align with Xerox's strong positioning within the marketplace.

"We worked hard to create a package that's not only attractive, but also one that reflects the professional nature of the brand and gives customers just enough information to make informed choices about their paper purchases." said Katie Zorn, Marketing Director for Domtar Business Papers.

Additionally, many of the product features have been enhanced to meet market demands. One result is by optimizing the office papers to perform in a wide variety of print devices, Domtar has eliminated the need to choose paper by print device.

Domtar, also known for its leadership in sustainability practices and strong commitment to domestic production, made the decision to add the rigorous Forest Stewardship Council® (FSC®) certification to nearly all of its office papers and digital printing paper products. Many of the certified products will bear the well-known World Wildlife Fund panda logo, and the entire office papers line will be produced in either the United States or Canada.

FSC® C001844

About Domtar

Domtar Corporation (NYSE: UFS) (TSX: UFS) designs, manufactures, markets and distributes a wide variety of fiber-based products including communication papers, specialty and packaging papers and absorbent hygiene products. The foundation of its business is a network of world class wood fiber converting assets that produce papergrade, fluff and specialty pulps. The majority of its pulp production is consumed internally to manufacture paper and consumer products. Domtar is the largest integrated marketer of uncoated freesheet paper in North America with recognized brands such as Cougar®, Lynx® Opaque Ultra, Husky® Opaque Offset, First Choice® and Domtar EarthChoice®. Domtar is also a leading marketer and producer of a broad line of incontinence care products marketed primarily under the Attends®, IncoPack and Indasec® brand names as well as baby diapers. In 2013, Domtar had sales of US$5.4 billion from some 50 countries. The Company employs approximately 10,000 people. To learn more, visit www.domtar.com.

SOURCE Domtar Corporation

International Paper CEO-Elect to Speak at Vertical Research Partners Annual Paper and Packaging Conference on November 19, 2014

International Paper (NYSE: IP) Chief Executive Officer Elect Mark S. Sutton, will speak at the Vertical Research Partners Annual Paper and Packaging Conference on November 19, 2014, in New York City. The presentation is scheduled to begin at 12:30pm EST, followed by a question and answer session. All interested parties are invited to view the presentation and/or listen to the webcast live via International Paper's Internet site http://www.internationalpaper.com by clicking on the "Investors" tab and then clicking on the "Webcasts & Presentations" link. A replay of the webcast will be available on the website approximately three hours after the presentation.

International Paper (NYSE: IP) Chief Executive Officer Elect Mark S. Sutton, will speak at the Vertical Research Partners Annual Paper and Packaging Conference on November 19, 2014, in New York City. The presentation is scheduled to begin at 12:30pm EST, followed by a question and answer session. All interested parties are invited to view the presentation and/or listen to the webcast live via International Paper's Internet site http://www.internationalpaper.com by clicking on the "Investors" tab and then clicking on the "Webcasts & Presentations" link. A replay of the webcast will be available on the website approximately three hours after the presentation.

About International Paper

International Paper (NYSE: IP) is a global leader in packaging and paper with manufacturing operations in North America, Europe, Latin America, Russia, Asia and North Africa. Its businesses include industrial and consumer packaging and uncoated papers. Headquartered in Memphis, Tenn., the company employs approximately 65,000 people and is strategically located in more than 24 countries serving customers worldwide. International Paper net sales for 2013 were $29 billion. For more information about International Paper, its products and stewardship efforts, visit www.internationalpaper.com

SOURCE International Paper

Revealing the invisible to increase quality

Roll cover with integrated measurement system impresses paper manufacturer

Two innovative technologies are allowing Propapier in Eisenhüttenstadt, Germany, to optimize their sizer and roll covers and at the same time improve paper quality. As a result, the cost and effort for future maintenance work could also be substantially reduced.

For four years now, Propapier has been producing 70 – 115 g/m² corrugated base paper on their PM 2 at the Eisenhüttenstadt mill on the River Oder. The production and technology management team decided last year to upgrade their PM 2 sizer rolls, which were due to be re-covered. The rolls were fitted with an eVen rubber polymer cover and an integrated NipVision high-tech measuring system, both of which are Voith products. The papermaker wanted to achieve three goals through this investment: more uniform pressure conditions in the roll and rod nips, lower temperatures during size application and longer regrinding intervals for the roll covers. Achieving all these goals would allow the mill to improve the surface quality of the paper and at the same time significantly reduce maintenance costs for the rolls. Evaluating the first three months of operation confirms that all three goals have indeed been reached.

Real-time measuring system in the roll nip. NipVision consists of glass fibers inside the roll cover and an external electronic unit. The glass fibers function as sensors, recording dynamic pressure and temperature conditions in the roll cover. The measured data is transmitted offline to the electronic unit, allowing the machine crew to continuously check the actual conditions in the roll cover and nip in real time. If temperatures rise too steeply or pressure conditions deviate too much over the web width, operators can intervene and make the necessary corrections. This prevents damage to the roll cover from too high temperature and at the same time improves paper quality.

Real-time measuring system in the roll nip. NipVision consists of glass fibers inside the roll cover and an external electronic unit. The glass fibers function as sensors, recording dynamic pressure and temperature conditions in the roll cover. The measured data is transmitted offline to the electronic unit, allowing the machine crew to continuously check the actual conditions in the roll cover and nip in real time. If temperatures rise too steeply or pressure conditions deviate too much over the web width, operators can intervene and make the necessary corrections. This prevents damage to the roll cover from too high temperature and at the same time improves paper quality.

Even before Propapier opted to purchase the covers with built-in sensors, Voith had already acquired very good experience with NipVision in other paper mills and applications in the press, size press and calender. The opportunitiy in Eisenhüttenstadt was for NipVision to visualize not only the sizer nip but also the metering rod pressure on both rolls at the same time. The specialists from Propapier and Voith were therefore excited to see the initial results – and they were not disappointed: Right away, the new roll covers produced an impressive performance in operation.

The eVen covers consist of a rubber polymer matrix which is specially developed for use on size and film presses. Christian Schulze, Application Finishing, expressed his enthusiasm after the first 16 weeks of operation: “We have now been running the eVenSize roll covers for twice as long as before and there is still no need to change them. This means that we have so far already saved the expense of the special transport for regrinding, the costs for the regrinding itself and downtime for the unit.”

The upgraded rolls from Eisenhüttenstadt were brought to the Voith Service Center in Laakirchen for the first time after 20 weeks of continuous service. Measurements taken there confirmed that eVen is more rugged than conventional sizer covers. During the roll service, the cover roughness was measured and surface quality analyzed. Both values were excellent, given that the covers had been in use two and a half times longer than the previous product. In addition, the amount of material removed in the regrinding process could be kept to a minimum, so that from today’s perspective there are good grounds to be very optimistic about the expected total service life of the covers.

The NipVision measuring and sensor system also performed very well in Propapier’s coating unit. Production Manager Stefan Jürgen confirms that the benefits pay off: “The temperature monitoring in both the roll covers enable us to even out the normal fluctuations. This not only preserves the roll cover but also improves the application of the size. Using NipVision, we are able to keep the pressure conditions largely stable. For us as papermakers, NipVision has literally made a vision reality: It has made the invisible visible!”//

The company – Propapier PM 2 GmbH

Propapier PM 2 GmbH is a Progroup AG company. Questioning established methods, developing fundamentally new approaches and bringing pioneering concepts to market. That is what Progroup AG stands for. The successful evolution of the company is based on technology leadership, network management and supply chain strategy. With its two paper mills, seven corrugated sheetboard plants and several service companies, Progroup manufactures corrugated base paper and corrugated sheetboard. In 2014 the company with 880 employees achieved sales of approx. 650 million euros and is one of the industry’s top 5 companies in Central Europe. The Next Generation branded products offer lower raw material consumption with increased performance and have become the epitome of sustainable thinking and economic efficiency in the industry.

Forest Stewardship Council® recognizes Domtar as conservation champion

First-Ever FSC®Leadership Award Celebrates Company as a Leader Driving Progress in the Marketplace

Domtar Corporation was recognized for its longtime leadership in sustainability, as the company accepted the first-ever annual FSC® Leadership Award for the paper sector in a ceremony at the Greenbuild 2014 Conference in New Orleans. The award celebrates Domtar's innovative pursuit of FSC certification in North America, and highlights its commitment to maintaining forests for future generations.

Domtar Corporation was recognized for its longtime leadership in sustainability, as the company accepted the first-ever annual FSC® Leadership Award for the paper sector in a ceremony at the Greenbuild 2014 Conference in New Orleans. The award celebrates Domtar's innovative pursuit of FSC certification in North America, and highlights its commitment to maintaining forests for future generations.

At a time when many organizations are building strategies around environmental and social responsibility, the Forest Stewardship Council lauded Domtar as a standout leader and trailblazer in the forest products industry. In 2000, Domtar was the first forest products company in North America to achieve FSC certification of its lands, and in 2005, it launched the first FSC certified line of general use copy paper, called the EarthChoice® Product Line.

"Like salmon swimming upstream, the award winners have worked tirelessly to protect forests and create change in the marketplace," said Corey Brinkema, president of the Forest Stewardship Council US. "They are used to being told 'it can't be done' so they know that true leadership requires resolve and determination, usually in the face of strong currents protecting the status quo," he added.

Domtar's early adoption of FSC certification, history of industry-leading collaboration with Environmental Non-Governmental Organizations (ENGOs) and bold commitments to increasing the supply of certified fiber helped earn the company the honor.

"Domtar is honored to receive the first annual FSC Leadership Award for the paper sector, demonstrating what it takes to be a leader in responsible forest practices," said Paige Goff, vice president, Sustainability & Business Communications at Domtar. "We're proud to be recognized as an organization that has made a significant contribution to the longevity and health of the world's forests, and will continue to raise the bar for the pulp and paper industry for years to come."

The FSC Leadership Awards were presented at the 10th Annual Design & Build with FSC Awards, co-hosted with the World Wildlife Fund and Green Sports Alliance.

To learn more about FSC and the role it plays in Domtar's commitment to full circle responsibility, please visit www.domtar.com/earthchoice.

About Domtar

Domtar Corporation (NYSE: UFS) (TSX: UFS) designs, manufactures, markets and distributes a wide variety of fiber-based products including communication papers, specialty and packaging papers and absorbent hygiene products. The foundation of its business is a network of world class wood fiber converting assets that produce papergrade, fluff and specialty pulps. The majority of its pulp production is consumed internally to manufacture paper and consumer products. Domtar is the largest integrated marketer of uncoated freesheet paper in North America with recognized brands such as Cougar®, Lynx® Opaque Ultra, Husky® Opaque Offset, First Choice® and Domtar EarthChoice®. Domtar is also a leading marketer and producer of a broad line of absorbent hygiene products marketed primarily under the Attends®, IncoPack and Indasec® brand names. In 2013, Domtar had sales of $5.4 billion from some 50 countries. The Company employs approximately 10,000 people. To learn more, visit www.domtar.com.

About the Forest Stewardship Council

The Forest Stewardship Council is an independent nonprofit organization that promotes environmentally sound, socially beneficial, and economically prosperous management of the world's forests. FSC was created in 1993 to help consumers and businesses identify products from well-managed forests. FSC sets standards by which forests are certified, offering credible verification to people who are buying wood and wood products. 4,000 companies and 175 million acres of forestland are certified under FSC standards in the United States and Canada. For more information visit www.fsc.org.

SOURCE Domtar Corporation

Domtar Corporation elects Domenic Pilla to its Board of Directors

Domtar Corporation has announced the election of Domenic Pilla to its Board of Directors. Mr. Pilla currently serves as President of Shoppers Drug Mart, Canada's leading pharmacy and beauty retailer, with sales of over $11 billion, and more than 52,000 employees across 1,400 retail locations; he has held this position since 2011. Shoppers Drug Mart is a unique and independent operating division of Loblaw Companies Limited.

Domtar Corporation has announced the election of Domenic Pilla to its Board of Directors. Mr. Pilla currently serves as President of Shoppers Drug Mart, Canada's leading pharmacy and beauty retailer, with sales of over $11 billion, and more than 52,000 employees across 1,400 retail locations; he has held this position since 2011. Shoppers Drug Mart is a unique and independent operating division of Loblaw Companies Limited.

Under Mr. Pilla's leadership, Shoppers Drug Mart underwent a significant business transformation that led to impressive financial performance. Mr. Pilla attributes a customer-centric and results-driven approach to his successful track record of implementing business efficiencies. Prior to 2011, he served as President of McKesson Canada, a leading provider of health care services.

"We're extremely pleased to add Domenic to our Board," said Robert J. Steacy, Domtar's Chairman of the Board. "His experience and skills will be a valued addition to our Board as we continue to implement our key strategic initiatives."

"Domenic's extensive leadership experience in the retail and institutional health care markets will play an integral role in advancing our company's strategic growth in the personal care segment," said John D. Williams, Domtar's President and Chief Executive Officer.

Mr. Pilla is a graduate of McGill University with a degree in Chemical Engineering. He serves as Chairman of the Board of the Canadian Cancer Research Society and is a member of the Board and Chair of the HRCC for the Princess Margaret Cancer Center Foundation. He is a member of the Ivey Council for Health, Innovation, and Leadership; and also a Governor of the Marie-Clarac Hospital Foundation.

About Domtar Domtar Corporation (NYSE: UFS) (TSX: UFS) designs, manufactures, markets and distributes a wide variety of fiber-based products including communication papers, specialty and packaging papers and absorbent hygiene products. The foundation of its business is a network of world class wood fiber converting assets that produce papergrade, fluff and specialty pulps. The majority of its pulp production is consumed internally to manufacture paper and consumer products. Domtar is the largest integrated marketer of uncoated freesheet paper in North America with recognized brands such as Cougar(®), Lynx(®) Opaque Ultra, Husky(®) Opaque Offset, First Choice(®) and Domtar EarthChoice(®). Domtar is also a leading marketer and producer of a broad line of absorbent hygiene products marketed primarily under the Attends(®), IncoPack and Indasec(®) brand names. In 2013, Domtar had sales of $5.4 billion from some 50 countries. The Company employs approximately 10,000 people. To learn more, visit www.domtar.com.

SOURCE Domtar Corporation

The European Commission decides to close proceedings against Ahlstrom and Munksjö

![]() The European Commission has decided to close proceedings against Ahlstrom Corporation, Munksjö Oyj and Munksjö AB. The decision is taken following consideration of responses made by the companies to the Statement of Objections, presentations at the oral hearing and, in particular, the information provided in response to the Commission's request for information dated May 26, 2014.

The European Commission has decided to close proceedings against Ahlstrom Corporation, Munksjö Oyj and Munksjö AB. The decision is taken following consideration of responses made by the companies to the Statement of Objections, presentations at the oral hearing and, in particular, the information provided in response to the Commission's request for information dated May 26, 2014.

Ahlstrom Corporation, Munksjö Oyj and Munksjö AB received on February 25, 2014 a Statement of Objections (Article 14.1(a))from the European Commission with respect to alleged incorrect or misleading information provided in connection with the merger notification to the European Commission, submitted in 2012. The business combination of Ahlstrom's Label and Processing business and Munksjö AB was completed in two phases during 2013.

For more information, please contact:

Liisa Nyyssönen

Vice President, Communications

Tel. +358 10 888 4757

Ahlstrom in brief

Ahlstrom is a high performance fiber-based materials company, partnering with leading businesses around the world to help them stay ahead. We aim to grow with a product offering for clean and healthy environment. Our materials are used in everyday applications such as filters, medical fabrics, life science and diagnostics, wallcoverings and food packaging. In 2013, Ahlstrom's net sales from the continuing operations amounted to EUR 1 billion. Our 3,500 employees serve customers in 24 countries. Ahlstrom's share is quoted on the NASDAQ OMX Helsinki. More information available at www.ahlstrom.com.